|

市場調查報告書

商品編碼

1687958

歐洲自助倉儲:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)Europe Self-storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

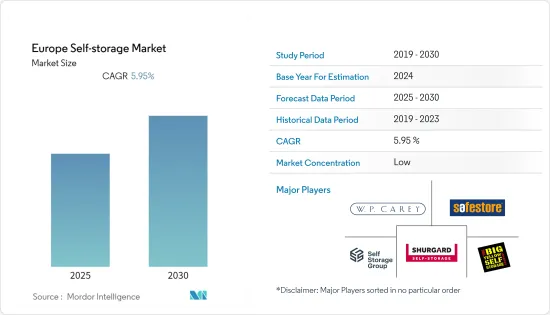

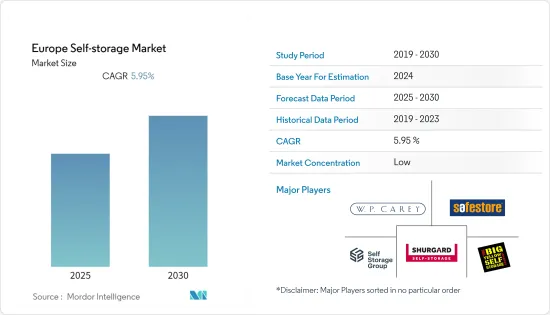

預計預測期內歐洲自助倉儲市場的複合年成長率將達到 5.95%。

自助倉儲市場是零售房地產的一個子行業。受都市化進程加快、各地區商業前景改善以及新業務不斷湧現的推動,該行業在預測期內預計將保持強勁成長。

關鍵亮點

- 歐洲自助倉儲市場在多個地區設施和空間供應正在增加。在歐洲,都市化、人口成長、經濟前景改善以及住宿設施,導致大量人出於個人和商業目的租用房間,這有助於所研究市場的擴張。

- 小型企業自助倉儲市場的成長受到電子商務領域開設零售店供取貨和送貨的整體趨勢的推動。隨著消費者對當日送達服務的需求以及企業擴大轉向價值物流,他們開始轉向自助倉儲。同樣,市場參與企業也積極主動。

- 與世界其他地區相比,歐洲消費者對自助倉儲市場的認知度相對較高。此外,近一半的消費者在第一次了解這個市場時可能會注意到一些關鍵優勢,例如獨家使用空間、靈活的租賃條款以及適合每個客戶需求的一系列單位尺寸。

- 當今的自助倉儲經理和業主面臨著多項法律挑戰,包括但不限於留置權銷售和拍賣、遺棄貨物和文件、有關租戶破產和死亡的州法律變化、收款、租賃協議的有效性、租戶資料保護和車輛儲存。

- 隨著城市生活方式的改善和消費者需求的不斷成長,歐洲自助倉儲市場經歷了溫和成長。預計預測期內市場成長將保持穩定。在新冠疫情期間,該地區的市場實現了穩定成長。但疫情導致產量減少,企業投入急遽萎縮。

歐洲自助倉儲市場的趨勢

商業儲存預計將在市場上受到歡迎

- 雖然自助倉儲最初是供個人使用,但企業也意識到個人儲存設施的重要性。對於小型企業來說,租用自助倉儲單位可以成為解決空間管理問題的經濟實惠的臨時或長期解決方案。

- 自助倉儲業務的客戶大多是新興企業。它們提供靈活的貨物儲存解決方案,無需佔用辦公空間、配送、倉儲和長期租賃。自助倉儲設施為商務客戶提供了越來越方便的服務,包括會議室、無線網路和貨運服務。

- 此外,歐洲二氧化碳排放的 40% 來自建築環境。為了減少這種影響並實現淨零碳排放,投資者和開發商正在探索維修現有建築和建造新建築的方法。歐洲只有 3% 的自助倉儲設施安裝了太陽能電池板,越來越多的房地產投資者開始關注建築的永續性。

- 此外,隨著小型企業尋找倉庫的替代位置,商業租賃(目前約佔租戶總數的五分之一)可能會增加。較小的空間、更實惠的成本和更短的租賃期限通常對小型企業有利。鑑於過去五年倉庫租金的成長速度(平均每年超過 6%),許多企業正在考慮將其需求轉移到自助倉儲設施。

德國:預計將出現顯著成長

- 儘管德國自助倉儲市場的滲透率低於英國和法國,但工業客戶的需求正在成長。在市場滲透率較低的國家,新進業者正在進入市場以獲取優勢。

- 此外,隨著越來越多的人意識到這些服務可用於個人目的和商業目的,該地區的市場正在擴大。現有的自助儲存設施和用於儲存大、小個人和商用物品的新設施也為該地區越來越多的市場供應商提供了支援。

- 由於需求過剩和租金不均導致住宅市場緊張,此類儲存設施在德國人口最多的城市中心越來越受歡迎。預計這些因素將在預測期內推動該地區對自助倉儲的需求。

- 由於德國大城市人口密度高,空間不足,成為建造自助倉儲場所的理想地點,因此有許多成長機會。此外,推動德國自助倉儲市場成長的主要因素是都市化加快和生活空間縮小。都市化增加了對空間的需求,並推高了每平方公尺的房地產價格。因此,市場成長受到這些因素的推動。

歐洲自助倉儲產業概況

歐洲自助倉儲市場是分散的,大多數設施由小型獨立業者擁有和營運。同時,這些業者正在歐洲各地不斷建造新的儲存設施。此外,合資企業和夥伴關係關係是公司直接投資自助倉儲物業的途徑。

2023 年 7 月,Shurgard 自助倉儲 SA 宣布將在荷蘭阿莫斯福特 (Randstad) 開設一座新的自助倉儲大樓。合併後的建築將擁有超過 1,100 個單元,並將滿足蘭斯塔德地區對安全且可存取的儲存選項日益成長的需求。

2022 年 10 月,由自主管理的綜合倉儲公司 SmartStop Self Storage REIT Inc. 被指定為 Arrow McLaren SP 車隊和 Felix Rosenqvist 駕駛的 6 號雪佛蘭克爾維特的官方贊助商,從 2023 年 NTT INDYCAR 系列賽的首輪比賽開始。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 都市化進程加快,生活空間縮小

- 商業實務與新冠疫情下的消費行為變化

- 市場問題

- 政府關於倉儲的規定

第6章市場區隔

- 依使用者類型

- 個人

- 商業

- 按國家

- 德國

- 英國

- 法國

- 荷蘭

- 義大利

- 西班牙

- 挪威

- 丹麥

- 瑞典

- 其他歐洲國家

第7章競爭格局

- 公司簡介

- Shurgard Self Storage SA

- Safestore Holdings PLC

- Self Storage Group ASA

- WP Carey Inc.

- SureStore Ltd

- Big Yellow Group PLC

- Access Self Storage

- Lok'nStore Limited

- Lagerboks

- Nettolager

- Pelican Self Storage

- 24Storage

- Casaforte(SMC Self-Storage Management)

- W Wiedmer AG

第8章投資分析

第9章:市場的未來

The Europe Self-storage Market is expected to register a CAGR of 5.95% during the forecast period.

The self-storage market is a sub-sector of retail real estate. Over the forecast period, driven by higher urbanization and a better business outlook across regions, growth in this industry is predicted to be robust as new businesses emerge.

Key Highlights

- Increased facilities and space offers in several regional countries have increased the European self-storage market. The European mass of renters of rooms for individuals and business purposes has helped increase the studied market due to urbanization, rising population, an improving economic outlook, and crowded accommodation.

- The growth of the SME self-storage market is driven by the prevailing trend to open retail outlets for pick-ups and deliveries in the e-commerce sector. Companies increasingly use value logistics as consumers demand more and more deliveries on the same day, so they're turning to self-storage. In the same vein, several market participants have acted positively.

- European consumers have a relatively high awareness of this self-storage market compared to other regions worldwide. Additionally, the key benefits, such as sole access to space, flexible rental periods, and a wide range of size units suitable for each customer's needs, could be understood by nearly half of consumers who initially understand the market.

- Several legal challenges exist for current Self Storage Managers and Owners, including but not limited to lien sale and auction, leaving of goods or documents, changes in State law on tenant bankruptcy or death, collections, rental agreement validity, protection of tenants' data, and the storage of vehicles.

- As a result of the increasing demands for consumers with improved city lifestyles, Europe's Self Storage Market was subject to moderate growth. The growth in the market is expected to be supported over the forecast period. The region experienced stable market growth due to the COVID-19 pandemic. However, the pandemic decreased production, resulting in an acute contraction of business inputs.

Europe Self Storage Market Trends

Business Storage Expected to Gain Market Popularity

- Although self-storage was initially aimed at personal usage, businesses are beginning to realize the importance of private storage facilities. For smaller businesses, to solve the management of space problems, renting a self-storage unit could be an affordable, temporary, or long-term solution.

- Most of the customers in self-storage businesses are startups; they offer a flexible solution for office space, distributing, warehousing, and holding goods without taking long leases. Self-storage facilities are becoming more and more helpful to business clients by providing meeting rooms, wireless Internet access, and freight forwarding services.

- In addition, 40 % of Europe's total CO2 emissions are attributable to the built environment. To reduce their impact and offer net zero carbon, investors and developers are looking at ways to retrofit existing buildings and build new ones. Solar panels are present in only 3% of Europe's self-storage facilities, and an increasing number of real estate investors have started to focus on the sustainability of buildings.

- Furthermore, as small companies look to alternative warehouse locations, commercial leases could increase, which now make up about one-fifth of the tenant base. The smaller space options, more affordable costs, and shorter lease terms often favorably align with smaller companies. Given the increase in warehouse rent over the past five years, which averaged more than 6 % per year, many companies are considering moving their needs to self-storage facilities.

Germany Expected to Register Significant Growth

- Germany's penetration of the Self Storage market is lower than in the United Kingdom or France, but demand from industry customers has been growing. In a country with limited market penetration, new entrants are entering the market to gain an advantage.

- In addition, as more and more people know that these services are available to them personally and for commercial purposes, the region's market is growing. Existing self-storage facilities and the opening of new ones for storing small and large private and commercial goods are also supported by the increasing number of market vendors in the area.

- Due to the strained housing demand caused by the excess demand and the uneven range of rents, the popularity of these storage facilities is increasing in central cities in Germany with a higher population. This type of factor in the region is projected to increase demand for self-storage during the forecast period.

- Germany offers several opportunities for growth because the large cities are characterized by strong population density, which makes it attractive to build self-storage sites due to lack of space. In addition, the main driver behind the German market growth for self-storage is rising urbanization and shrinking living space. Growing urbanization raises the demand for space, causing property prices per square meter to rise. Consequently, growth in the market is being driven by these factors.

Europe Self Storage Industry Overview

The European self-storage Market is fragmented, with most facilities owned and operated by smaller independent operators. At the same time, new storage facilities are constantly being built by these operators throughout Europe. In addition, joint ventures or partnerships are the means for companies directly investing in self-storage real estate.

In July 2023, Shurgard Self Storage SA announced the opening a new self-storage building in the Netherlands in Amersfoort (Randstad). The combined size of the building comprises over 1,100 units and will meet the growing demand for secure and accessible storage options in the Randstad area.

In October 2022, SmartStop Self Storage REIT Inc., starting with the start of the NTT INDYCAR SERIES season in 2023, a self-managing and complete integrated storage company, has been named an official sponsor of Arrow's McLaren SP Team and its No.6 Chevrolet Corvette driven by Felix Rosenqvist.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Greater Urbanization Coupled with Smaller Living Spaces

- 5.1.2 Changing Business Practices and COVID-19 Consumer Behavior

- 5.2 Market Challenges

- 5.2.1 Government Regulations on Storage

6 MARKET SEGMENTATION

- 6.1 By User Type

- 6.1.1 Personal

- 6.1.2 Business

- 6.2 By Country

- 6.2.1 Germany

- 6.2.2 United Kingdom

- 6.2.3 France

- 6.2.4 Netherlands

- 6.2.5 Italy

- 6.2.6 Spain

- 6.2.7 Norway

- 6.2.8 Denmark

- 6.2.9 Sweden

- 6.2.10 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Shurgard Self Storage SA

- 7.1.2 Safestore Holdings PLC

- 7.1.3 Self Storage Group ASA

- 7.1.4 W P Carey Inc.

- 7.1.5 SureStore Ltd

- 7.1.6 Big Yellow Group PLC

- 7.1.7 Access Self Storage

- 7.1.8 Lok'nStore Limited

- 7.1.9 Lagerboks

- 7.1.10 Nettolager

- 7.1.11 Pelican Self Storage

- 7.1.12 24Storage

- 7.1.13 Casaforte (SMC Self-Storage Management)

- 7.1.14 W Wiedmer AG