|

市場調查報告書

商品編碼

1687918

行動裝置 MEMS -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)MEMS for Mobile Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

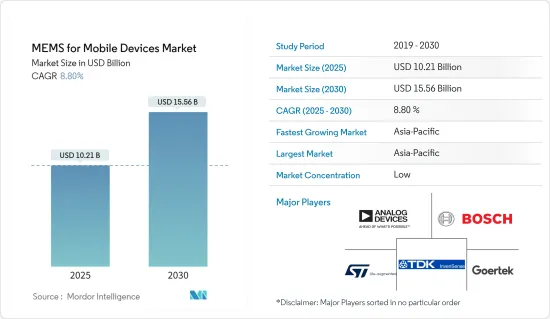

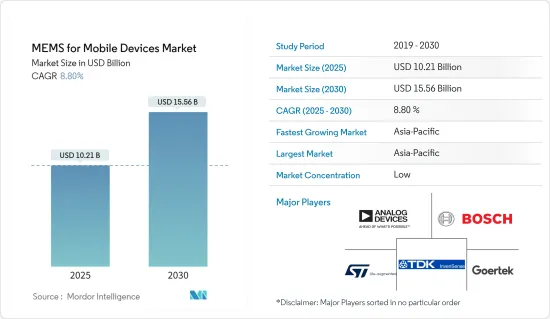

預計 2025 年行動裝置 MEMS 市值將達到 102.1 億美元,到 2030 年將達到 155.6 億美元,預測期內(2025-2030 年)的複合年成長率為 8.8%。

由於智慧型手機對加速計和陀螺儀的需求不斷增加,預計預測期內行動裝置的 MEMS 市場將大幅成長。例如,預計到2022年,全球行動用戶總數將達到約84億人。愛立信預測這一數字還將進一步成長。

關鍵亮點

- MEMS 設備的低耗電量。此外,更快的充電速度、更短的充電時間和最佳化的充電等消費者需求的變化正在推動智慧行動裝置對感測器的需求。這些設備消耗的電量更少,因此充電速度更快。

- 此外,隨著智慧型手機擴大用於成像應用,MEMS 感測器支援使用光學影像穩定 (OIS) 和電子影像穩定 (EIS)。如此廣泛的功能和創新能力將在預測期內進一步加速智慧行動裝置 MEMS 感測器的成長。

- 受訪市場的全球趨勢受到5G商業化的推動。例如,向5G的過渡將加速對先進行動裝置的需求。根據愛立信2022年11月發布的《行動報告》,預計到2028年底,5G行動用戶數將達到50億,5G人口覆蓋率預計將達到85%,5G網路預計將承載約70%的行動流量。由於5G需要增加頻寬數量,對RF MEMS的需求也預計將增加,這也將刺激對RF濾波器的需求。

- MEMS 公司很少有機會接觸到 MEMS 製造設施和代工廠進行原型設計和設備生產。此外,大多數有望從該技術中受益的組織目前並不具備支持 MEMS 製造所需的能力或競爭力,這直接影響了製造標準化。預計這將阻礙市場成長。

- COVID-19 對行動裝置市場的影響不大。此外,疫情改變了人們對當前全球製造業供應鏈的看法,這可能在不久的將來導致價值鏈更加本地化和進一步區域化,以最大限度地降低類似風險。

行動裝置MEMS市場趨勢

小型化趨勢日益普及推動市場

- 設備小型化是推動行動裝置對 MEMS 需求的主要因素之一。隨著終端設備變得越來越小,製造商不斷尋找升級技術的方法以獲得利益。隨著越來越多的感測器被整合到行動裝置中,對微型 MEMS 滿足設計因素的需求也日益成長。行動裝置包括接近感測器、加速計、陀螺儀、指紋感測器、環境光感測器、指南針、霍爾效應感測器和氣壓計等感測器。

- 此外,由於尺寸較小、聲學性能更好,MEMS 麥克風使得透過智慧型手機上的影片共用資訊變得更加容易。無論您是在遠距飛行中還是只想不受干擾地聽音樂,MEMS 麥克風還可以幫助實現主動降噪。

- 世界各地的供應商都致力於進一步小型化,以增加 MEMS 提供的成本效益。此外,MEMS 感測器製造商正在推動 MEMS 的進一步小型化,以滿足更小行動裝置的需求。例如,為了滿足對更小行動裝置的需求,SiT15xx 微機電振盪器採用 1.5 x 0.8 x 0.55 mm CSP(晶片級封裝),與標準 2.0 x 1.2 mm SMD XTAL 封裝相比,佔用空間減少了 85%。與 XTAL 不同,SiT15xx 系列具有自己的輸出,可直接驅動晶片組的 XTAL-IN 接腳。

- 傳統感測器無法有效運作的領域需要開發超小型、高靈敏度的下一代微加速計。此外,加速計的不斷小型化進程也帶來了更小的封裝,並最終降低了成本。

- 基於石墨烯的電子機械系統 (NEMS)加速計佔用的晶片晶粒比傳統的矽 MEMS加速計計小一個數量級,同時保持了具有競爭力的靈敏度。設備小型化的趨勢正在推動行動裝置中使用的 MEMS 市場的發展。增加更多功率並降低成本和空間的需求將繼續成為市場創新者的關鍵因素。市場創新者正在利用這些趨勢為高性能消費者的設備添加更多功能。

亞太地區預計將經歷強勁成長

- 亞太地區是智慧型手機最重要的市場之一,主要得益於其高度發展的通訊產業和龐大的基本客群。此外,該地區對先進行動網路的投資正在不斷增加。中國、印度、日本、澳洲、新加坡和韓國等國家正在加大對發展國內通訊市場的投資,也有望推動該地區市場的發展。

- 由於原料容易取得、設置和支付工人的成本低,企業也將生產基地設在該地區。

- 印度、中國、韓國和新加坡等國家對行動電話和其他家用電子電器產品的需求不斷成長,促使許多公司在亞太地區設立工廠。

- 根據中國政府發布的最新數據,中國用戶正在紛紛購買昂貴的新型 5G行動電話。預計2021年中國5G行動電話出貨量將超過2.66億部,與前一年同期比較增63.5%。根據中國資訊通訊研究院的資料,2019年,5G行動電話出貨量佔75.9%。

- 指紋認證技術使得智慧型手機解鎖變得更容易、更快捷,增加了對 MEMS 感應器的需求。指紋認證比依賴密碼或個人識別碼的傳統技術更安全。指紋認證技術在智慧型手機和平板電腦等家用電子電器產品中變得越來越普遍。這是因為它們很受歡迎,並且具有獨特的品質,例如能夠識別每個人的凸起、凹陷和小點。

行動裝置MEMS產業概況

行動 MEMS 市場擠滿了擁有後向整合和向前整合能力以及強大產生收入能力的大型供應商。市場競爭水平相當高,並且未來幾年可能會更加激烈。

2022 年 10 月,Bosch Sensortec 推出了 BMI323,這是其首款具有 I3C 介面以及 I2C 和 SPI 介面的 IMU 設備。 BMI323 是一款 6 軸加速計和陀螺儀,專為運動敏感消費品而設計。在高性能模式下,同時使用陀螺儀和加速計,BMI323 的電流消耗為 790A,而 BMI160 的電流消耗為 925A,減少了約 15%。

2022年5月,ADI公司(ADI)推出了3軸MEMS加速計。與上一代產品(ADXL362)相比,ADXL367加速計的功耗降低了 2 倍,雜訊效能提高了 30%。新型加速計還具有更長的現場使用時間,延長了電池壽命並降低了維護頻率和成本。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 小型化趨勢的接受度不斷提高

- 對高性能設備的需求不斷增加

- 市場限制

- 複雜的製造流程和週期時間

- 缺乏標準化的製造流程

第6章市場區隔

- 依感測器類型

- 指紋感應器

- 加速計感測器

- 陀螺儀

- 壓力感測器

- 體聲波感測器

- 麥克風

- 其他感測器

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Analog Devices Inc.

- Bosch Sensortec GmbH

- STMicroelectronics NV

- InvenSense Inc.(TDK)

- Goertek Inc.

- Knowles Corporation

- Murata Manufacturing

- AAC Technologies

- MEMSIC Inc.

- BSE Co. Ltd

第8章投資分析

第9章:市場的未來

The MEMS for Mobile Devices Market size is estimated at USD 10.21 billion in 2025, and is expected to reach USD 15.56 billion by 2030, at a CAGR of 8.8% during the forecast period (2025-2030).

With an increase in demand for accelerometers and gyroscopes in smartphones, the MEMS for mobile devices market is expected to grow significantly during the forecast period. For instance, in 2022, the total number of mobile subscriptions globally is expected to reach around 8.4 billion. It is poised to increase further, according to Ericsson forecasts.

Key Highlights

- The studied market has been marked by a trend toward lower power consumption of MEMS devices. Also, changing consumer needs, like faster charging speeds, shorter charging times, and better charging optimization, drive the need for sensors in smart mobile devices. These devices are made to use less power, which makes them charge much faster.

- Moreover, as smartphones are increasingly being used for image applications, the usage of optical image stabilization (OIS) and electronic image stabilization (EIS) is enabled by MEMS sensors. This broad set of features and innovative functions further augments MEMS sensor growth for smart mobile devices in the forecast period.

- Global trends in the market studied are boosted by the commercialization of 5G. For instance, the transition toward 5G accelerates the demand for advanced mobile devices. According to the Ericsson Mobility Report released in November 2022, 5G mobile subscriptions are anticipated to reach 5 billion by the end of 2028. Further, 5G population coverage is projected to reach 85%, while 5G networks are expected to carry around 70% of mobile traffic. Such events are also expected to drive the demand for RF MEMS, owing to the higher number of bands that 5G demands, triggering the demand for RF filters.

- MEMS companies have minimal access to MEMS fabrication facilities or foundries for prototypes and device manufacture. Also, most organizations expected to benefit from this technology do not currently have the required capabilities and competencies to support MEMS fabrication, directly impacting fabrication standardization. This is expected to hinder the market's growth.

- The effect of COVID-19 on the mobile device market has been moderate. Moreover, the pandemic changed the perception of the current global supply chain in manufacturing, potentially leading to more localized value chains and further regionalization to minimize similar risks in the near future.

MEMS for Mobile Devices Market Trends

Increasing Acceptance of Miniaturization Trend to Drive the Market

- The miniaturization of devices is one of the major factors driving the demand for MEMS in mobile devices. With the size of end devices shrinking, manufacturers continuously look for ways to upgrade their technology to reap benefits. As the number of sensors on a mobile device increases, the need for smaller MEMS is required to fulfill design factors. Mobile devices have sensors like proximity sensors, accelerometers, gyroscopes, fingerprint sensors, ambient light sensors, compasses, hall effect sensors, barometers, and others.

- Furthermore, miniaturization and improvements in their acoustic properties have enabled MEMS microphones to facilitate the sharing of information through smartphone videos. MEMS microphones are also useful for active noise cancellation, like on long-distance flights or when you want to listen to music without being disturbed.

- Vendors worldwide are focusing on reducing the size of MEMS further to enhance the cost benefits it reaps. Furthermore, the manufacturers of MEMS sensors are pushing to reduce the size of MEMS to meet the need for smaller mobile devices. For instance, in order to support the demand for even smaller mobile devices, the SiT15xx MEMS oscillators available in 1.5 x 0.8 x 0.55 mm CSPs (chip-scale packages) reduce footprint by as much as 85% compared to standard 2.0 x 1.2 mm SMD XTAL packages. Unlike XTALs, the SiT15xx family has a unique output that directly drives the chipset's XTAL-IN pin.

- In areas where traditional sensors cannot efficiently operate, developing next-generation micro-accelerometers with ultra-small dimensions and high sensitivity is required. Also, the constant process of making accelerometers smaller has led to smaller packages and, in the end, lower costs.

- Nano Electromechanical Systems (NEMS)-based accelerometers using graphene occupy orders of magnitude smaller die areas than conventional silicon MEMS accelerometers while retaining competitive sensitivities. Such trends in the miniaturization of devices drive the market for MEMS used in mobile devices. The need to add more power and reduce cost and space will remain a key factor for innovators in the market. Market innovators are banking on such trends to add more functionalities to their devices for high-performance-demanding consumers.

Asia Pacific is Expected to Witness Significant Growth

- The Asia-Pacific region has been one of the most significant markets for smartphones, primarily due to the highly developing telecom sector and large customer base. Furthermore, the region is increasingly investing in advanced mobile networks. Countries such as China, India, Japan, Australia, Singapore, and South Korea are increasingly investing in developing their domestic telecom markets, which are also expected to drive the market in the region.

- Also, companies set up their production centers in the area because raw materials are easy to get and there are low costs to set up and pay workers.

- Growing demand for mobile phones and other consumer electronics products from countries such as India, China, the Republic of Korea, and Singapore is encouraging many companies to set up factories in the Asia-Pacific region.

- According to the most recent figures given by the Chinese government, Chinese subscribers are flocking to buy pricey new 5G cellphones. China's 5G phone shipments surpassed 266 million units in 2021, an increase of 63.5 percent over the previous year. Data from the China Academy of Information and Communications Technology (CAICT) shows that 75.9% of all mobile phones shipped were 5G.

- There is a growing need for MEMS sensors because of the ease and speed with which fingerprint technology allows smartphones to be unlocked. Fingerprint authentication is more secure than traditional techniques, which rely on passwords and personal identification numbers. Fingerprint sensing technology is becoming more common in consumer electronics like smartphones and tablets. This is because it is popular and has unique qualities, like being able to recognize each person's ridges, valleys, and small points.

MEMS for Mobile Devices Industry Overview

The MEMS market is riddled with large-scale vendors that are capable of both backward and forward integration and command significant revenue generation capabilities. The level of competition in the market is moderately high, and it is likely to get worse in the years to come.

In October 2022, Bosch Sensortec announced its first IMU device, the BMI323, to include the I3C interface and the I2C and SPI interfaces. The BMI323 is a six-axis accelerometer and gyroscope designed for motion-sensitive applications in consumer goods. The BMI323 has a current consumption of 790 A in high-performance mode, using both the gyroscope and the accelerometer, compared to 925 A on the BMI160, representing a nearly 15% reduction.

In May 2022, Analog Devices, Inc. (ADI) released a three-axis MEMS accelerometer. The ADXL367 accelerometer reduces power consumption twice compared to the previous generation (ADXL362) while improving noise performance by up to 30%. The new accelerometer also has a longer field time, which increases battery life while decreasing maintenance frequency and cost.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Acceptance of Miniaturization Trend

- 5.1.2 Increasing Demand for High-Performance Devices

- 5.2 Market Restraints

- 5.2.1 Highly Complex Manufacturing Process and Demanding Cycle Time

- 5.2.2 Lack of Standardized Fabrication Process

6 MARKET SEGMENTATION

- 6.1 By Type of Sensor

- 6.1.1 Fingerprint Sensor

- 6.1.2 Accelerometer Sensor

- 6.1.3 Gyroscope

- 6.1.4 Pressure Sensor

- 6.1.5 BAW Sensor

- 6.1.6 Microphones

- 6.1.7 Other Types of Sensors

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Analog Devices Inc.

- 7.1.2 Bosch Sensortec GmbH

- 7.1.3 STMicroelectronics NV

- 7.1.4 InvenSense Inc. (TDK)

- 7.1.5 Goertek Inc.

- 7.1.6 Knowles Corporation

- 7.1.7 Murata Manufacturing

- 7.1.8 AAC Technologies

- 7.1.9 MEMSIC Inc.

- 7.1.10 BSE Co. Ltd