|

市場調查報告書

商品編碼

1687812

外包半導體組裝和測試(OSAT) -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Outsourced Semiconductor Assembly and Test (OSAT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

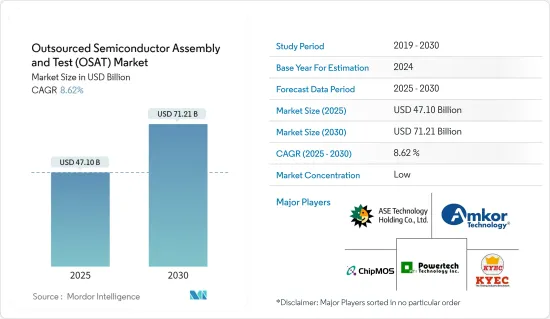

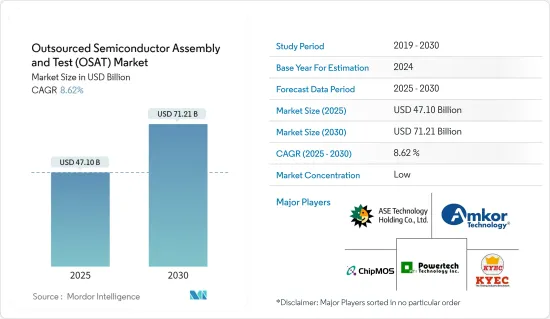

預計 2025 年半導體組裝和測試外包市場規模將達到 471 億美元,到 2030 年將達到 712.1 億美元,預測期內(2025-2030 年)的複合年成長率為 8.62%。

半導體產業繼續發展,重點是小型化和效率。半導體已成為所有現代技術的基石。該領域的進步和創新對所有下游技術產生直接影響。人工智慧(AI)和雲端運算等電子技術的快速發展,加上對高速、低功耗和高度積體電路(IC)的旺盛需求,帶來了巨大的銷售。

主要亮點

- 外包也是半導體產業的關鍵因素。除了設計之外,半導體產品開發的製造方面還依賴第三方供應商提供的服務。晶圓廠 (Fabs) 和 OSAT 是半導體外包的兩個突出例子。

- OSAT半導體公司提供第三方IC封裝和測試服務,在代工廠生產的半導體裝置推出市場之前對其進行封裝和測試。這些公司提供創新且經濟高效的解決方案,可提供更快的處理速度、更強大的性能和功能,同時佔用電子設備中更少的空間。

- 英特爾、AMD 和 Nvidia 等半導體設計公司與 OSAT 公司簽訂契約,以運行該公司的設計。例如,英特爾既是晶片設計公司,也是一家代工廠(晶圓供應商)。在將晶片發送給客戶之前,英特爾委託晶片封裝外包給另一家 OSAT 進行組裝和測試服務。

- 各大半導體製造商對封裝業務的垂直整合對全球OSAT市場構成了重大威脅。美國貿易戰等多種因素正造成半導體產業供應鏈出現缺口。

- OSAT供應商是提供半導體積體電路組裝、封裝和測試服務的第三方。疫情過後,隨著晶片製造商專注於生產更小、更快、更有效率的半導體,半導體產業正在呈現成長態勢。

半導體組裝測試外包(OSAT)市場趨勢

通訊成為最大的應用領域

- 由於封裝在通訊價值鏈中仍處於起步階段,半導體市場的成長對 OSAT 市場的發展有直接的影響。代工廠可以自行封裝,也可以外包。例如,半導體和通訊設備製造商高通 (Qualcomm) 與 OSAT 簽訂合約來處理其封裝需求。

- 通訊應用主要為通訊業的通訊晶片。功率放大器(PA)、前端模組(FEM)以及其他射頻(RF)和連接設備等設備是 OSAT 和OEM的主要需求來源。根據半導體產業協會的數據,所有製造的半導體中約有 31% 用於通訊,例如網路設備和智慧型手機無線電。

- 通訊應用通常部署在惡劣的環境條件下,需要可靠的封裝解決方案。特別是在大規模通訊應用中,系統級封裝(SiP)通常是各種通訊設備的首選。

- 過去幾年,智慧型手機市場在硬體和軟體方面都取得了顯著成長。儘管新冠疫情期間全球智慧型手機出貨量有所下降,但包括中國在內的許多市場仍保持著較高的滲透率。生物感測器、5G智慧型手機和人工智慧功能等趨勢預計將再次推動新智慧型手機的銷售。

- 根據GSMA預測,到2025年,亞太地區的智慧型手機普及率預計將上升至83%。同時,行動用戶普及率預計到同年將達到62%。此外,5G智慧型手機的廣泛應用預計將顯著提高連網型設備密度、無線資料通訊頻寬和延遲。

- 多家半導體廠商預計,矽含量更高的5G智慧型手機將在全球廣泛應用。 5G智慧型手機需要更高的功率效率、更快的通訊速度和更複雜的功能,這將增加每台裝置使用的半導體元件數量。因此,消費性電子產業對半導體封裝解決方案的需求預計將大幅增加。

- 根據GSMA報告,預計2025年,全球約三分之一的人口將能夠使用5G網路。報告也指出,屆時5G連線數將超過4億,約佔所有行動連線的14%。

- 預計到2023年底,5G普及率將達到17%,到2030年將成長到54%(相當於53億個連線)。預計這項技術進步將為全球經濟貢獻近1兆美元。因此,預計半導體需求將推動市場成長。

韓國:預計市場將顯著成長

- 韓國是全球OSAT供應商最有前景的市場之一。該國擁有三星和 SK 海力士等知名消費性電子晶片製造商,是半導體設備技術創新的蓬勃發展的中心。

- 韓國政府正專注於智慧製造,並計劃在 2025 年之前將全自動製造公司的數量增加到 30,000 家。政府旨在透過採用現代化自動化、資料交換和物聯網技術來實現這一目標,這些技術有望成為該國 OSAT 服務的主要驅動力。

- 隨著三星電子系統半導體業務的成長,韓國的半導體測試部門也取得了顯著成長。 NEPES Ark、LB Semicon、Tesna、Hana Micron 等國內半導體測試公司正在對必要的設施和設備進行大量投資,以應對系統半導體供應量的增加。

- SK海力士正在投資120兆韓元(約8億日圓),在龍仁市元山地區建造下一代記憶體生產基地。 SK Hynix計劃於2025年開始建造其記憶體製造廠。 SK Hynix也是HBM3的製造商。該公司計劃在其利川 DRAM 製造工廠建立一條 TSV 封裝生產線。為了提升HBM的競爭力,三星和SK海力士正在考慮增加更多的封裝生產線。

- 三星正在努力取代台積電提供的 2.5D內插器整合服務。我們正在努力降低TSV(矽穿孔電極)封裝方法的製造成本。與SK海力士相比,三星是HBM(高頻寬記憶體)市場的後來者。儘管如此,三星聲稱正在增加對 HBM 產能的投資,並表示打算在 2023 年之前推出新的 HBM 產品,這為擴大 HBM 封裝產能提供了可能性。

- 5G領域的發展也推動了晶片先進封裝的成長。據越南科學技術資訊通訊部稱,截至 2023 年 2 月,越南 5G用戶數量為 2,913 萬,比 2021 年 2 月的 1,366 萬成長 113%。

半導體組裝和測試外包(OSAT)市場概況

外包半導體組裝和測試 (OSAT) 市場較為分散,主要企業包括日月光科技控股、安靠科技公司、力成科技公司、南茂科技公司和京元電子等。該市場中的公司正在採用創新、夥伴關係和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2023 年 12 月 - 力成科技(PTI)股份有限公司在最近的公告中宣布與華邦電子股份有限公司建立合作夥伴關係。此次合作旨在共同推動2.5D(晶圓上晶片)/3D先進基板業務。 PTI 將指導客戶利用 WEC 的矽中介層、DRAM 和快閃記憶體來實現異質部署,並滿足市場對高頻寬和高效能運算服務的需求。

2023 年 10 月-ASE Technology Holding 推出協作設計工具集整合設計生態系統 (IDE)。該工具集旨在系統地增強整個 VIPack 平台的先進封裝架構。這種創新方法實現了從單晶粒SoC 到多晶片分解 IP 區塊(包括晶片和記憶體)的無縫過渡。這可以透過使用 2.5D 或先進的扇出結構進行整合來實現。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 半導體產業展望

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19疫情對市場的影響評估

第5章市場動態

- 市場促進因素

- 半導體在汽車領域的應用日益增多

- 5G等趨勢將推動半導體封裝的演進

- 市場限制

- 整合產業是 OSAT 公司關注的主要議題之一。

第6章市場區隔

- 按服務類型

- 包裝

- 測試

- 按包裝類型

- 球柵陣列 (BGA) 封裝

- 晶片級封裝(CSP)

- 堆疊晶片封裝

- 多晶片封裝

- 四方扁平和雙列直插式封裝

- 按應用

- 通訊設備

- 消費性電子產品

- 車

- 運算與網路

- 工業的

- 其他用途

- 按地區

- 美國

- 中國

- 台灣

- 韓國

- 馬來西亞

- 新加坡

- 日本

第7章競爭格局

- 公司簡介

- ASE Technology Holding Co. Ltd

- Amkor Technology Inc.

- Powertech Technology Inc.

- ChipMOS Technologies Inc.

- King Yuan Electronics Co. Ltd

- Formosa Advanced Technologies Co. Ltd

- Jiangsu Changjiang Electronics Technology Co. Ltd

- UTAC Holdings Ltd

- Lingsen Precision Industries Ltd

- Tongfu Microelectronics Co.

- Chipbond Technology Corporation

- Hana Micron Inc.

- Integrated Micro-electronics Inc.

- Tianshui Huatian Technology Co. Ltd

- Vendor Share Analysis

第8章投資分析

第9章 市場機會與未來趨勢

The Outsourced Semiconductor Assembly and Test Market size is estimated at USD 47.10 billion in 2025, and is expected to reach USD 71.21 billion by 2030, at a CAGR of 8.62% during the forecast period (2025-2030).

The semiconductor industry has been growing, focusing on miniaturization and efficiency. Semiconductors are emerging as building blocks of all modern technology. The advancements and innovations in this field directly impact all downstream technologies. The rapid development of electronics technology, including artificial intelligence (AI) and cloud computing, is complemented by a high demand for integrated circuits (ICs) with high speed, low power consumption, and high integration, leading to its significant sales.

Key Highlights

- Outsourcing is also a significant factor in the semiconductor industry. More than just design, the manufacturing aspect of semiconductor product development is dependent on the services provided by third-party vendors. Fabs (Pure-Play Foundries) and OSATs are two prominent examples of semiconductor outsourcing.

- OSAT semiconductor firms provide third-party IC packaging and testing services package and test semiconductor devices made by foundries before shipping them to the market. Such companies in the market provide innovative and cost-effective solutions that deliver faster processing speeds, higher performance, and functionality while taking up less space in an electronic device.

- Semiconductor design companies, such as Intel, AMD, and Nvidia, contract OSAT companies to execute the companies' designs. For instance, Intel is a chip designer and a foundry (wafer provider) because they own and operate their fabs or foundries. Before shipping the chips to customers, Intel outsources its chip packaging to different OSATs for assembly and test services.

- Vertical integration of key semiconductor manufacturers into packaging operations is a significant threat to the global OSAT market. Various factors, such as the US-China trade war, have caused a supply chain gap in the semiconductor industry.

- The suppliers of as OSAT are third parties that provide the assembly, packaging and testing services for a semiconductor integrated circuit. Post COVID, semiconductor industry has been witnessing the growth due to chipmakers are focused on producing smaller, faster and more efficient semiconductors and where which increased the growth of OSAT as its has playes an essential part in the by filling the gap between IC design and availability.

Outsourced Semiconductor Assembly and Test (OSAT) Market Trends

Communication to be the Largest Application Segment

- The semiconductor market's growth directly influences the OSAT market's development because the packaging is still at an early stage in the telecommunications value chain. The foundries can either handle the packaging themselves or contract it out. For instance, Qualcomm, a manufacturer of semiconductors and telecom equipment, contracts OSATs to handle its packaging needs.

- The communication applications primarily consist of communication chips in the telecommunication industry. Equipment such as power amplifiers (PAs), front-end modules (FEMs), and other RF and connectivity devices are major sources of demand for OSATs and OEMs. According to the Semiconductor Industry Association, about 31% of all semiconductors manufactured are used for communications, including networking equipment and smartphone radios.

- Communication applications require highly reliable packaging solutions as they are often deployed in harsh environmental conditions. In many cases, a system in package (SiP) is preferred for a large variety of communication equipment, especially in large-scale telecommunication applications.

- The smartphone market has grown significantly in hardware and software over the past few years. Despite declining global smartphone unit shipments during COVID-19, there was high penetration in many markets, including China. Sales of new smartphones are expected to regain momentum, driven by trends like biosensors, 5G smartphones, and AI features.

- The smartphone adoption rate in Asia-Pacific is expected to rise to 83% by 2025, according to GSMA. Concurrently, the mobile subscriber penetration rate is expected to reach 62% by the same year. The proliferation of 5G smartphones is also expected to significantly improve connected device density, wireless data communication bandwidth, and latency.

- Many semiconductor producers anticipate that 5G smartphones with higher silicon contents will be widely adopted worldwide. The use of semiconductor components per device will rise due to the need for 5G smartphones to have higher power efficiency, faster speeds, and more complex functionalities. In turn, the consumer electronics industry is anticipated to experience a significant increase in demand for semiconductor packaging solutions.

- According to the GSMA Report, around one-third of the global population is estimated to have access to 5G networks by 2025. The report also states that there will be more than 400 million 5G connections at that time, accounting for approximately 14% of all mobile connections.

- The adoption of 5G was projected to reach 17% by the end of 2023 and increase to 54% (equivalent to 5.3 billion connections) by 2030. This technological advancement is anticipated to contribute nearly USD 1 trillion to the global economy. As a result, the demand for semiconductors will enhance the market's growth.

South Korea Expected to Register Significant Growth in the Market

- South Korea is one of the promising markets for global OSAT vendors. The country is also home to some prominent chip makers for the consumer electronics segment, such as Samsung and SK Hynix, making it a lucrative hub for innovation in semiconductor devices.

- The South Korean government focuses on smart manufacturing and plans to have 30,000 fully automated manufacturing companies by 2025. The government aims to achieve this by incorporating the latest automation, data exchange, and IoT technologies, which are expected to be significant drivers for OSAT services in the country.

- The country's semiconductor testing sector has grown significantly with the growth of Samsung Electronics' system semiconductor business. The semiconductor testing companies in the country, such as NEPES Ark, LB Semicon, Tesna, and Hana Micron, have been dealing with increased supplies of system semiconductors by making significant investments in necessary facilities and equipment.

- SK Hynix is constructing a base for manufacturing next-generation memory in the Wonsam town region of Yongin by investing KRW 120 trillion ( USD 90 billion). The chipmaker anticipates breaking construction on the memory manufacturing facility in 2025. SK Hynix is also the manufacturer of HBM3. The company plans to install TSV packaging production lines at its Icheon DRAM manufacturing facility. To improve its HBM competitiveness, Samsung and SK Hynix are considering adding more packaging production lines.

- Samsung has been working on replacing the 2.5D interposer integration service offered by TSMC. It seeks to lower the cost of manufacturing the through-silicon via (TSV) packaging method. Compared to SK Hynix, Samsung is a latecomer to the HBM (high bandwidth memory) market. Still, the business claims it is increasing investments in its HBM capacity and declared intentions to introduce new HBM products by 2023, opening possibilities for expanding HBMs' packaging capacity.

- The developments in the 5G space have also led to the growth of advanced packaging of chips. According to the Ministry of Science and ICT, as of February 2023, the country had 29.13 million 5G Subscribers, an increase of 113% compared to 13.66 million 5G subscribers in February 2021.

Outsourced Semiconductor Assembly and Test (OSAT) Market Overview

The outsourced semiconductor assembly and test services (OSAT) market is fragmented, with the presence of major players like ASE Technology Holding Co. Ltd, Amkor Technology Inc., Powertech Technology Inc., ChipMOS Technologies Inc., and King Yuan Electronics Co. Ltd. Players in the market are adopting strategies such as innovations, partnerships, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

December 2023 - In a recent announcement, Powertech Technology (PTI) Inc. revealed its partnership with Winbond Electronics Corporation by signing a letter of intent. This collaboration aims to jointly advance the business of 2.5D (Chip on Wafer on Substrate)/3D advanced packaging. PTI will guide its customers to leverage WEC's silicon Interposer, DRAM, and Flash to enable heterogeneous integration and cater to the market's demand for high-bandwidth and high-performance computing services.

October 2023 - ASE Technology Holding Co. Ltd launched its Integrated Design Ecosystem (IDE), a collaborative design toolset. This toolset is designed to enhance advanced package architecture across the VIPack platform systematically. This innovative approach enables a seamless transition from single-die SoC to multi-die disaggregated IP blocks, including chiplets and memory. It can be achieved by integrating them using 2.5D or advanced fanout structures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Semiconductor Industry Outlook

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Assessment of the Impact of COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Applications of Semiconductors in Automotive

- 5.1.2 Advancement in Semiconductor Packaging Due to Trends like 5G

- 5.2 Market Restraints

- 5.2.1 Vertical Integration is One of the Significant Concerns of OSAT Players

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Packaging

- 6.1.2 Testing

- 6.2 By Type of Packaging

- 6.2.1 Ball Grid Array (BGA) Packaging

- 6.2.2 Chip Scale Packaging (CSP)

- 6.2.3 Stacked Die Packaging

- 6.2.4 Multi Chip Packaging

- 6.2.5 Quad Flat and Dual-inline Packaging

- 6.3 By Application

- 6.3.1 Communication

- 6.3.2 Consumer Electronics

- 6.3.3 Automotive

- 6.3.4 Computing and Networking

- 6.3.5 Industrial

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 United States

- 6.4.2 China

- 6.4.3 Taiwan

- 6.4.4 South Korea

- 6.4.5 Malaysia

- 6.4.6 Singapore

- 6.4.7 Japan

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ASE Technology Holding Co. Ltd

- 7.1.2 Amkor Technology Inc.

- 7.1.3 Powertech Technology Inc.

- 7.1.4 ChipMOS Technologies Inc.

- 7.1.5 King Yuan Electronics Co. Ltd

- 7.1.6 Formosa Advanced Technologies Co. Ltd

- 7.1.7 Jiangsu Changjiang Electronics Technology Co. Ltd

- 7.1.8 UTAC Holdings Ltd

- 7.1.9 Lingsen Precision Industries Ltd

- 7.1.10 Tongfu Microelectronics Co.

- 7.1.11 Chipbond Technology Corporation

- 7.1.12 Hana Micron Inc.

- 7.1.13 Integrated Micro-electronics Inc.

- 7.1.14 Tianshui Huatian Technology Co. Ltd

- 7.2 Vendor Share Analysis