|

市場調查報告書

商品編碼

1687408

產品資訊管理 (PIM) - 市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Product Information Management (PIM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

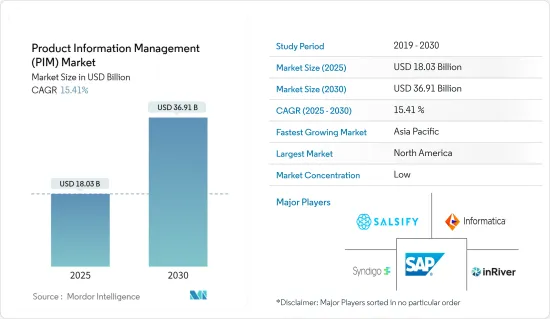

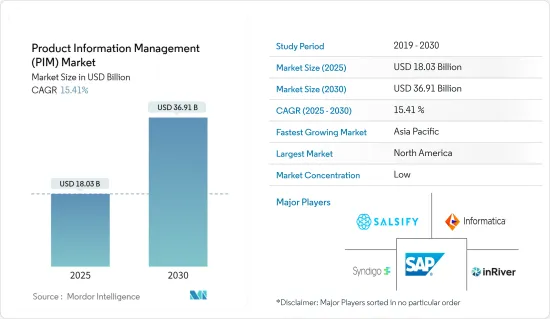

產品資訊管理市場規模預計在 2025 年為 180.3 億美元,預計到 2030 年將達到 369.1 億美元,在市場估計和預測期(2025-2030 年)內以 15.41% 的複合年成長率成長。

產品資訊管理 (PIM) 解決方案集中了您企業的產品訊息,確保您的產品資料具有單一、準確的視圖。 PIM 提供了一個集中式平台,可以經濟高效地管理公司產品和服務的資料。

主要亮點

- 集中產品管理增加了零售商、製造商和批發商對該解決方案的採用。 PIM 有助於維護來自不同來源的產品資料的一致性和質量,並將其整合到一個通用資料庫中。 PIM 軟體透過簡化內部和外部行銷流程,擴大被各行各業所採用,從而提高了客戶滿意度並提供了全通路體驗。

- 隨著資料產生的大量增加,資料和資訊已經成為組織和企業的支柱。除了儲存和傳輸產品資料之外,PIM 還可以提高整體資料品質、鼓勵資料審核並提高產品資訊的準確性。透過減少管理多個系統中的冗餘資訊的需要,資料品質和一致性自然會提高。政府法規正在幫助 PIM 市場成長,尤其是在醫療保健和線上業務解決方案領域。

- 由於 COVID-19 疫情的影響,電子商務大幅成長,顯示 PIM 解決方案的成長和採用。網路零售的持續成長對採用電子商務系統產生了巨大的需求。此電子商務系統提供企業資源規劃、供應鏈管理和客戶關係管理系統,以滿足客戶對即時產品資訊日益成長的需求。經營多種產品的公司在其產品目錄中使用進階分類。

- 數位商務的這種複雜性使得許多公司爭相簡化產品資訊的創建、維護和向下游管道的發布。 PIM 讓跨多種管道和媒體傳播訊息變得容易。因此,各種最終用戶採用該軟體來管理大量的產品內容。因此,電子商務導致的資料管理日益複雜,大大增加了對PIM軟體的需求。

- 資料外洩會損害公司的信譽和聲譽,進而降低客戶的信任和忠誠度。因此,如果組織認為像 PIM 這樣的新系統對資料安全和隱私構成潛在威脅,他們可能會猶豫是否要採用它。這種不情願在消費者信任至關重要的行業(例如醫療保健和金融)可能特別明顯。

- 然而,雖然資料外洩的增加可能不會直接抑制 PIM 市場,但它確實為考慮採用 PIM 解決方案的企業帶來了挑戰和考慮。解決資料安全和隱私問題對於在當今資料主導的商業環境中建立信任、確保合規性和增加 PIM 系統的採用至關重要。

產品資訊管理 (PIM) 市場趨勢

零售業成長

- 由於零售和電子商務行業越來越注重改善客戶體驗以及採用人工智慧 (AI) 和零售分析工具,預計產品資訊管理 (PIM) 在零售和電子商務行業的應用將會成長。

- 數位化使客戶能夠從各種資訊來源獲取產品資訊。此外,隨著電子商務的大規模成長,客戶偏好和行為也在發生巨大變化。此外,隨著行動和人工智慧領域與智慧資料分析的融合,世界各地的零售商可以體驗到有利於其業務的準確分析。

- 根據 Shopify 的調查,約 62% 的網路用戶表示,他們過去的客戶體驗或服務顯著影響了他們未來的購買決策。預計到 2026 年電子商務銷售額將超過 8.1 兆美元,目前全球有 1,200 萬至 2,400 萬家電子零售商店。

- 此外,根據IBEF的數據,印度電子商務市場規模預計將從2017年的385億美元增加到2026年底的2000億美元。該產業的快速成長主要得益於網路和智慧型手機普及率的提高。印度正在持續進行數位轉型,預計該國網路用戶總數將會增加。據印度網際網路和行動協會稱,印度有超過 8.2 億活躍網路用戶。其中超過一半(約4.42億)的用戶來自農村地區。 2023年,網路普及率將年與前一年同期比較8%。

- 客戶轉換是零售商面臨的關鍵挑戰,而這個挑戰在於透過提供獲取產品資訊的綜合解決方案來加強資訊供應鏈並吸引有權力的消費者。 PIM 解決方案管理這些資訊並為企業帶來競爭優勢。 PIM 也用於管理從各種來源產生的資料。

- 實體店面臨著管理新舊產品添加的挑戰。此外,各種實體店正在透過將產品轉移到線上銷售管道來擴大客戶範圍。這導致向客戶提供一致、完整和準確的產品資訊的需求不斷增加,從而推動了零售業採用 PIM 解決方案。

亞太地區可望大幅成長

- 預計亞太地區將出現最高成長,這得益於中小型組織的發展以及對雲端和 PIM 等資料管理技術的投資增加。

- 由於客戶期望不斷提高和競爭日益激烈,該地區的軟體公司面臨著透過數位轉型變得更加靈活和高效的巨大壓力。這為市場創造了機會。中國和印度等國家的電子商務行業的成長正在積極推動市場成長。國際銷售對於在線零售商來說變得越來越重要。

- 中國是成長最快的電子商務市場之一,這得益於消費者對網路購物的偏好日益成長、替代付款解決方案的普及、網路購物活動(例如提供豐厚折扣的一日宣傳活動)以及不斷改善的物流基礎設施。快速都市化是推動市場成長的主要因素之一。此外,網際網路普及率的提高以及使用智慧型手機、筆記型電腦和平板電腦等設備訪問電子商務網站正在推動市場成長。電子商務使公司無需維持實體存在即可開展業務,從而節省基礎設施、通訊和管理成本。

- 據投資印度 (Invest India) 稱,印度電子商務產業的成長得益於智慧型手機普及率上升、富裕程度增加和資料通訊資費下降等因素,這些因素推動了電子商務的成長。

- 印度是全球第二大網路市場,到2022年將擁有超過9億用戶和1259.4億筆UPI交易。到2025會計年度,印度的社會經濟規模可能達到160-200億美元,複合年成長率為55%-60%。預計到2024年和2026年,印度電子商務市場規模將分別達到1,110億美元和2,000億美元。印度在過去三年增加了 1.25 億網消費者,預計到 2025 年將再增加 8,000 萬人。

- 因此,該地區龐大的零售市場以及先進技術的採用預計將在預測期內進一步提高市場成長率。

產品資訊管理(PIM)市場概覽

產品資訊管理 (PIM) 市場競爭激烈,有多家全球和區域參與者。該市場對新參與企業的進入門檻較高,但有幾家新參與企業正在發揮主導作用。其中包括 Informatica LLC、SAP SE、Salsify Inc.、Syndigo LLC 和 InRiver AB。

- 2024 年 2 月,協助品牌製造商、經銷商和零售商在數位貨架上獲勝的產品體驗管理 (PXM) 平台 Salsify 宣布全面推出 Salsify PXM Advance,這是 Salsify 平台的新版本,可增強客戶從其產品體驗管理業務獲得的商業價值。

- 2024年1月,IBM宣布與SAP合作開發解決方案,協助消費品和零售業的客戶利用生成性AI來增強其供應鏈、財務業務、銷售和服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- COVID-19 疫情對產品資訊管理市場的影響評估

第5章市場動態

- 市場促進因素

- 對更好的客戶服務的需求不斷增加

- 對集中資料管理工具的需求不斷增加

- 市場限制

- 資料外洩案例增多

第6章市場區隔

- 按部署

- 雲

- 本地

- 按服務

- 解決方案

- 按服務

- 按最終用戶產業

- BFSI

- 媒體與娛樂

- 零售

- 能源與公共產業

- 衛生保健

- 資訊科技/通訊

- 運輸和物流

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- SAP SE

- Salsify Inc.

- Syndigo LLC

- Informatica LLC

- InRiver AB

- Stibo Systems Inc.

- Precisely Holdings LLC

- Insight Software

- IBM Corporation

- Pimcore GMBH

- Akeneo SAS

- Plytix Limited

- Acquia Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Product Information Management Market size is estimated at USD 18.03 billion in 2025, and is expected to reach USD 36.91 billion by 2030, at a CAGR of 15.41% during the forecast period (2025-2030).

Product information management (PIM) solutions unify and manage a business' product information to secure a single accurate view of product data. PIM offers a centralized platform to manage data on a business's products and services cost-effectively.

Key Highlights

- The management of products in a central space increases the use of solutions by retailers, manufacturers, and wholesalers. PIM contributes to maintaining the consistency and quality of product data obtained from a variety of sources and consolidating them into one common database. By streamlining internal and external marketing processes, the growing adoption of PIM software in various vertical industries delivers improved customer satisfaction and omnichannel experiences.

- With the massive growth in data generation, data and information have become the backbone of organizations and businesses. In addition to storing and transferring product data, PIMs bolster overall data quality, encourage data audits, and can improve the accuracy of the product information. Data quality and consistency are naturally improved by reducing the need to manage redundant information in multiple systems. Government regulations are instrumental in augmenting the PIM market, particularly across healthcare and online business solutions, owing to the need for a centralized system to hold the data and processes and manage the launch and update of products.

- With the impact of the COVID-19 pandemic, e-commerce has significantly grown, indicating growth and adoption of PIM solutions. A continuously growing number of internet sales generates huge demand for adopting an eCommerce system. This e-commerce system offers Enterprise Resource Planning systems, Supply Chain Management Systems, and Customer Relationship Management Systems to meet customers' growing demand for real-time product information. Companies with a wide range of products have sophisticated categorizations in their product catalogs.

- This complex nature of digital commerce engages many companies to streamline product information creation, maintenance, and publication to downstream channels. PIM makes it easy for many channels and media to disseminate information. Thus, various end users are adopting this software to manage a large amount of product content. Therefore, the demand for PIM software has shown a considerable rise because of the growing complexity of data management resulting from electronic commerce.

- Data breaches have the potential to undermine the trust and reputation of businesses, resulting in diminished customer confidence and loyalty. Consequently, organizations might be hesitant to adopt new systems like PIM if they perceive them as potential data security and privacy threats. This reluctance could be particularly pronounced in industries where consumer trust is paramount, such as healthcare or finance.

- However, while the rise in data breaches may not directly restrain the PIM market, it does introduce challenges and considerations for businesses contemplating the adoption of PIM solutions. It is crucial to address data security and privacy concerns to cultivate trust, ensure compliance, and promote the adoption of PIM systems in the contemporary data-driven business landscape.

Product Information Management (PIM) Market Trends

Retail Sector to Witness Growth

- The adoption of product information management (PIM) is expected to gain market in the retail and e-commerce industry due to the growing focus on enhancing customer experience and the adoption of artificial intelligence (AI) and retail analytics tools in the retail and e-commerce sector.

- Owing to digitization, customers have the power to access product information through various sources. Also, with the massive growth in e-commerce, customer preferences and behaviors have changed drastically. Moreover, as the world of mobility and artificial intelligence combines with smart data analytics, retailers across the world can experience accurate analytics that are useful for their business.

- According to Shopify, around 62% of internet users concur that past customer experience and service have significantly influenced their future purchase decisions. E-commerce sales are expected to surpass USD 8.1 trillion in 2026, and there are currently 12 to 24 million e-retail stores globally.

- Additionally, according to the IBEF, the Indian e-commerce market is set to reach USD 200 billion by the end of 2026, from USD 38.5 billion in 2017. This industry's rapid growth is primarily triggered by increasing internet and smartphone penetration. The continuing digital transformation in India is expected to increase the country's total internet user base. As per the Internet and Mobile Association of India, India has more than 820 million active Internet users. Over half of them, around 442 million, come from rural parts of the country. In 2023, internet penetration grew eight percent year-on-year.

- Customer conversion is a significant challenge for retailers, and they are competing to engage the empowered consumer by providing them with a comprehensive solution for accessing product information, thereby enhancing the information supply chain. PIM solutions maintain a tab on such information and offer enterprises a competitive advantage. PIM is also used to manage data generated from various sources.

- The brick-and-mortar stores are challenged with managing old and new product additions. Also, various brick-and-mortar stores are expanding their customer reach by moving their products to online sales channels. Hence, the need for consistent, complete, and accurate product information to customers has gained increased importance, which is instrumental in driving the adoption of PIM solutions in the retail industry.

Asia Pacific Expected to Register Major Growth

- Asia-Pacific is expected to witness the highest growth owing to the development of small and medium-sized organizations and increasing investment in cloud and data management technologies such as PIM.

- Software companies in the region are facing high pressure to increase agility and improve efficiency through digital transformation, owing to customers' rising expectations and high competition from other players. This creates an opportunity for the market. The growth of e-commerce industries in countries such as China and India positively drives the market's growth. International sales are becoming more important for each online retailer.

- China is one of the nations where the e-commerce market is growing rapidly due to the increasing consumer preference for online shopping, the proliferation of alternative payment solutions, online shopping events, such as single-day offers with lucrative discounts, and improved logistic infrastructure. One of the primary factors driving the market's growth is rapid urbanization. Additionally, rising internet penetration and devices such as smartphones, laptops, and tablets to access e-commerce websites boost the market's growth. E-commerce allows businesses to conduct business without maintaining a physical presence, saving money on infrastructure, communication, and overhead.

- According to Invest India, the e-commerce sector in India is growing based on factors such as increased smartphone penetration, increased affluence, and low data prices, which are driving e-commerce growth.

- India is the 2nd largest internet market globally, with over 900 million users and 125.94 billion UPI transactions in 2022. In FY 2025, India's social economy could reach USD 16 to USD 20 billion, growing at a compound annual growth rate of 55% to 60%. By 2024 and 2026, the Indian e-commerce market is expected to reach USD 111 billion and USD 200 billion, respectively. India has gained 125 million online shoppers in the last three years, with another 80 million expected by 2025.

- Therefore, the presence of a significant retail market in the region alongside the adoption of advanced technologies is set to bolster the market growth rate during the forecast period.

Product Information Management (PIM) Market Overview

The product information management market is highly competitive and fragemented as it comprises several global and regional players in the competitive market space. Although the market poses high barriers to entry for new players, several new entrants have gained traction. Some of the players include Informatica LLC, SAP SE, Salsify Inc., Syndigo LLC, and InRiver AB.

- In February 2024, Salsify, the Product Experience Management (PXM) platform empowering brand manufacturers, distributors, and retailers to win on the digital shelf, announced the general availability of Salsify PXM Advance, a new version of the Salsify platform that raises the business value customers can achieve from their product experience management operations.

- In January 2024, IBM announced a collaboration with SAP to develop solutions to help clients in the consumer-packaged goods and retail industries enhance their supply chain, finance operations, sales, and services using generative AI.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Assessment of the Impact of the COVID-19 Pandemic on the Product Information Management Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Better Customer Service

- 5.1.2 Growing Demand for Centralized Data Management Tools

- 5.2 Market Restraints

- 5.2.1 Increasing Data Breaching Cases

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By Offering

- 6.2.1 Solution

- 6.2.2 Services

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Media and Entertainment

- 6.3.3 Retail

- 6.3.4 Energy and Utilities

- 6.3.5 Healthcare

- 6.3.6 IT and Telecommunications

- 6.3.7 Transportation and Logistics

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 Salsify Inc.

- 7.1.3 Syndigo LLC

- 7.1.4 Informatica LLC

- 7.1.5 InRiver AB

- 7.1.6 Stibo Systems Inc.

- 7.1.7 Precisely Holdings LLC

- 7.1.8 Insight Software

- 7.1.9 IBM Corporation

- 7.1.10 Pimcore GMBH

- 7.1.11 Akeneo SAS

- 7.1.12 Plytix Limited

- 7.1.13 Acquia Inc.