|

市場調查報告書

商品編碼

1687204

聲學感測器-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Sound Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

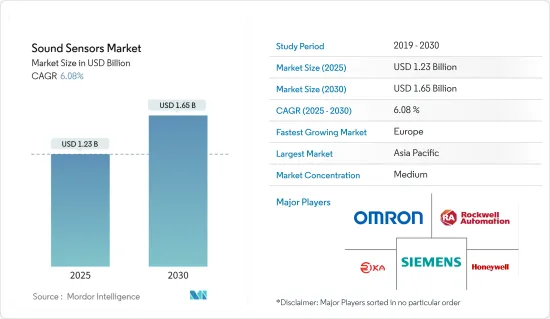

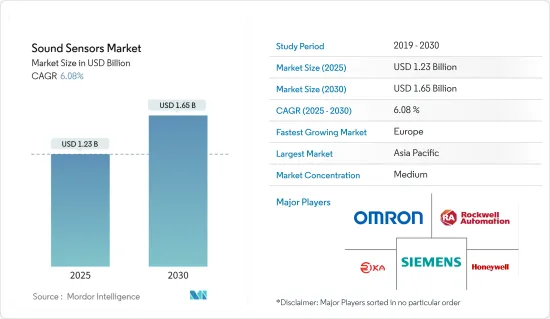

聲學感測器市場規模預計在 2025 年為 12.3 億美元,預計到 2030 年將達到 16.5 億美元,預測期內(2025-2030 年)的複合年成長率為 6.08%。

關鍵亮點

- 對可靠、高性能感測器的需求不斷成長是推動聲學感測器市場高速成長的關鍵因素。此外,市場上的多項技術進步和聲學感測器製造成本的下降也促進了這些感測器的普及。

- 例如,數位訊號處理在將類比音訊轉換為數位形式以供數位環境使用的過程中起著關鍵作用。數位訊號處理是一個持續改進的過程,它影響著專業安裝的音響系統的設計、安裝和使用。

- 現在,感測器技術可以讓自動化設備無需非常強大的智慧處理就能解釋聲音和其他資料。這使得緊湊、低功耗系統的開發成為可能,這些系統可以提高機器對機器互動的自主性,並在人機互動中提供自然感知的使用者介面。

- 聲學感測器技術的進步正在提高無線耳機和頭戴式耳機的音質和電池壽命。預計這些改進將推動市場成長。

- 然而,以其他技術(如麥克風、超音波感測器等)取代聲音感測器的可能性可能會抑制所研究市場的成長。

- 自新冠疫情爆發以來,對變革和創意解決方案的需求不斷增加。在新技術方面,研究人員正在開發一種響應特定聲波而振動的新型感測器。被動聲學感測器用於建築、地震和某些醫療設備監測,可以節省數百萬個電池。研究人員也對用於監測廢棄油井的無電池感測器感興趣。當氣體從井孔洩漏時,會產生獨特的嘶嘶聲。這種機械感測器可以檢測到這種嘶嘶聲並啟動警報,而無需持續消耗電力。

聲學感測器市場趨勢

工業領域是成長最快的終端用戶產業

- 聲學感測器廣泛應用於各種工業應用,例如監測機器振動和噪聲,以及分析高速運行過程中機器元件疲勞故障引起的聲波發射。這些設備為工業自動化系統提供資料輸入,使機器和機器人能夠根據透過所述感測部件獲得的相應參數按照特定規則執行任務,從而能夠更有效地控制不同環境條件下的操作,同時顯著改善安全通訊協定。

- 工業 4.0 的興起趨勢以及機器人在製造、庫存和其他部門的各種用途的應用預計將推動市場成長。德國正在發展成為專注於人工智慧及其應用(包括機器學習、深度學習、電腦視覺和預測分析)的新興企業的首選中心。根據歐盟Start-Ups的數據,柏林是繼倫敦之後歐洲第二大新Start-Ups中心。超過 65% 的德國公司最近採用了工業 4.0,其餘 25% 的公司正在嘗試遵循當前的工業 4.0 計劃。

- 根據 IFR 預測,全球工業機器人的採用率將大幅增加,到 2024 年,全球工廠將有 518,000 台工業機器人運作。工業機器人市場的顯著成長軌跡預計將推動所研究市場的需求。消息人士稱,預計未來幾年工業機器人出貨量將大幅成長,超過2022年的峰值,當時全球工業機器人出貨量約為45.3萬台。到2024年,亞洲/澳洲的工業機器人安裝量預計將達到37萬台。

- 為了加強本國製造業,許多國家正在大力投資並與其他國家合作創造製造業機會。中國正在將第四次工業革命(工業 4.0)的概念作為其十年計劃「中國製造 2025」的一部分,以趕上德國等製造業強國,並以更低的人事費用擊敗其他新興經濟體的競爭對手。這是中國全面實現工業現代化的努力。該計劃重點關注10個領域,包括高階電腦機械和機器人技術。此類工業 4.0 舉措可望在市場中創造機會。

- 強大的生態系統也為該市場提供了助力,支援各地區快速採用新技術。例如,物聯網和工廠自動化的採用正在幫助市場,因為已開發國家已經建立了最大限度發揮聲學感測器效用所需的基礎設施。預計「美國製造」等政府舉措將推動工業領域採用先進技術,從而在預測期內為市場創造機會。

歐洲正在經歷快速成長

- 聲學感測器廣泛應用於各種工業用途,例如監測機器振動和噪聲,以及分析高速運行過程中機器元件疲勞故障引起的聲波發射。根據Make UK的數據,截至2023年,英國年產值將達到1,830億英鎊(2,325億美元),是世界第九大製造業國家。近年來,人工智慧(AI)及相關數位和機器人技術的興起為英國製造業帶來了新的機會。它有望提高效率、生產力和盈利。

- 此外,國防系統的發展和創新也有望推動市場發展。例如,2023 年 6 月,以色列航太公司的子公司 Elta Systems 與德國聲納製造商 Atlas Elektronik 合作開發反潛戰系統。該公司還宣布與德國蒂森克虜伯海洋系統公司的子公司阿特拉斯建立新的合作夥伴關係,推出一款聯合產品,即名為「藍鯨」的反潛戰(ASW)型號。該系統基於 Elta Systems 自主水下航行器 (AUV),並整合了 Atlas 拖曳式被動聲納三重陣列。

- 聲學感測器廣泛應用於各種工業用途,例如監測機器的振動和噪聲,以及分析設備高速運作時機器元件疲勞失效引起的聲波發射。根據Make UK的數據,英國仍是全球第九大製造業國家,年產值達1,830億英鎊(2,319.8億美元)。近年來,人工智慧(AI)及相關數位和機器人技術的興起為該國的製造業帶來了新的機會。它有望提高效率、生產力和盈利。

- 該國製造業先進技術的引進也得到了政府大量資金的支持。例如,2022 年 10 月,英國研究與開發部門 (UKRI) 向 12 個智慧工廠計劃撥款 1,370 萬英鎊(1,737 萬美元),用於開發可提高製造業能源效率、生產力和成長的技術。這是英國政府耗資 1.47 億英鎊(1.8634 億美元)的「製造更智慧創新挑戰」計畫的一部分,旨在提高英國製造業的技術應用。

- 2022 年 5 月,英國政府公佈了透過新的智慧製造資料中心 (SMDH) 提高中小型製造企業生產力和競爭力的計畫。新的中心和試驗平台將由阿爾斯特大學主導,並獲得 5,000 萬英鎊(6,338 萬美元)的政府資助和企業共同投資。此外,在第二次疫情期間,法國為了維護國家主權和軍事獨立,開始研究第三代核彈彈道導彈潛艦的設計,並已建造了第一段。

聲學感測器市場概況

- 聲學感測器市場是一個分散的市場,有幾家主要企業,包括霍尼韋爾國際公司、通用電氣測量與控制解決方案、Maxbotix 公司、羅克韋爾自動化公司、西門子公司、意法半導體公司、羅伯特博世有限公司、松下公司、Bruel & Kjaer GmbH 和 Teledyne Technologies Incorporated。市場已經看到主要市場參與企業之間的多項創新、夥伴關係和協作,以增強技術力並更好地滿足消費者不斷變化的需求。

- 2023 年 6 月,霍尼韋爾推出了一項旨在提高低壓燃燒空氣和燃氣監測和管理的有效性和可靠性的解決方案:DG 智慧感測器。對於OEM) 、最終用戶和系統整合商而言,該解決方案代表著機會,即透過採用符合工業 4.0 的數位化趨勢來改善燃燒系統的性能並改變其運作動態。它還列出了精確的監控功能。

- 2023年2月,Polysense宣布推出面向智慧城市和工業環境的室內外聲學和噪音感測器集群,實現健康監測和城市管理。升級後的聲學/噪音感測器由 iEdge 4.0 OS 上的模組化和可配置的 WxS 產品平台提供支持,與帶有附加 PolySense PSS 感測器的 BYOD 結合使用時,可為用戶提供更強大的監測和採取行動應對噪音污染的能力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場動態

- 市場促進因素

- 由於市場技術進步而採用率提高

- 製造成本低

- 市場限制

- 替代技術的出現

第6章 技術簡介

- 透過水中聽音器

- 定向

- 定向

- 透過麥克風

- 駐極體麥克風

- 壓電麥克風

- 電容麥克風

- 動圈/磁性麥克風

- 其他麥克風

第7章市場區隔

- 按最終用戶產業

- 消費性電子產品

- 通訊

- 產業

- 防禦

- 醫療保健

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第8章競爭格局

- 公司簡介

- Honeywell International Inc.

- Omron Corporation

- Hunan Rika Electronic Tech Co. Ltd

- Rockwell Automation Inc.

- Siemens AG

- Stmicroelectronics NV

- Robert Bosch Gmbh

- Panasonic Corporation

- Bruel And Kjaer

- Teledyne Technologies Incorporated

第9章投資分析

第10章 市場機會與未來趨勢

簡介目錄

Product Code: 56504

The Sound Sensors Market size is estimated at USD 1.23 billion in 2025, and is expected to reach USD 1.65 billion by 2030, at a CAGR of 6.08% during the forecast period (2025-2030).

Key Highlights

- The rising demand for reliable and high-performance sensors is a primary driver responsible for the high growth rate of the sound sensors market. Several technology advancements in the market and decreasing manufacturing costs of sound sensors have also led to the increasing adoption of these sensors.

- For instance, digital signal processes play a crucial role in converting analog audio to digital format for use in a digital environment. They have undergone continual improvement, influencing the design, installation, and use of professionally installed sound systems.

- Sensor technology has enabled automated devices to interpret sounds and other data without extremely powerful intelligent processing. This has led to the development of compact, low-power systems that enable increased autonomy in machine-to-machine interactions and offer natural perceptual user interfaces for human-machine interactions.

- Advancements in sound sensor technology have led to improvements in sound quality and battery life for wireless earphones and headphones. These improvements are expected to lead to the market's growth.

- However, the possibility of substituting sound sensors with other technologies (like microphones, ultrasonic sensors, etc.) is likely to restrain the growth of the market studied.

- In the post-COVID-19, there is an increased demand for transformation and creative solutions. In terms of newer technology, researchers are developing a new type of sensor that reacts to certain sound waves, causing it to vibrate. This Passive sound-sensitive sensors could be used to monitor buildings, earthquakes or certain medical devices and save millions of batteries. There is also interest by researchers in battery-free sensors for monitoring decommissioned oil wells. Gas can escape from leaks in boreholes, producing a characteristic hissing sound. Such a mechanical sensor could detect this hissing and trigger an alarm without constantly consuming electricity - making it far cheaper and requiring much less maintenance.

Sound Sensors Market Trends

Industrial Sector to be the Fastest Growing End-user Industry

- Sound sensors are widely employed for various industrial purposes like monitoring machinery vibrations and noises and analyzing acoustic emissions generated due to fatigue failure on machine elements when equipment runs at high speeds. These devices provide data input into industrial automation systems, which allow machines or robots to execute tasks according to specific rules depending on corresponding parameters acquired through said detection components, leading toward more effective control over operations under different environmental conditions while increasing safety protocols significantly.

- The growing trend of Industry 4.0 and the use of robotics for various purposes in manufacturing, stock, and other units is expected to drive the market's growth. Germany is growing as a preferred hub for start-ups focusing on AI and its applications, such as machine learning, deep learning, computer vision, and predictive analytics. According to EU start-ups, Berlin is Europe's second-biggest start-up hub after London. Over 65% of German companies recently implemented Industry 4.0 practices, with the other 25% pitching to follow the ongoing suit.

- According to the IFR forecasts, the global adoption of industrial robots is expected to increase significantly to 518,000 industrial robots operational across factories worldwide by 2024. The significant growth trajectory of the industrial robot market is expected to drive the demand for the market studied. According to the same source, industrial robot shipments are expected to rise significantly in the coming years, surpassing the peak in 2022, when around 453,000 industrial robots were shipped worldwide. It is projected that by 2024, industrial robot installations in Asia/Australia are projected to reach 370,000 units.

- Many countries invest heavily and collaborate with other countries to create opportunities for manufacturers to strengthen their manufacturing industry. China is embracing the concept of the fourth industrial revolution (Industry 4.0) as part of its 10-year Made in China 2025 plan to catch up with manufacturing powerhouses like Germany and stand tall in competition with other developing countries with lower labor costs. It is an effort to modernize Chinese industry comprehensively. The plan focuses on ten areas: high-end computerized machinery, robotics, etc. Such initiatives in Industry 4.0 are anticipated to create opportunities in the market.

- The market has also been helped by a robust ecosystem sustaining the fast adoption of new technology in various regions. For instance, IIOT adoption and factory automation have aided the market, as the infrastructure required to maximize the utility of acoustic sensors is already in use in developed countries. Government initiatives such as "Made in America" are expected to drive the adoption of advanced technologies in the industrial domain, creating opportunities in the market during the forecast period.

Europe to Witness Significant Growth

- Sound sensors are widely employed for various industrial purposes like monitoring machinery vibrations and noises and analyzing acoustic emissions generated due to fatigue failure on machine elements when equipment runs at high speeds. As per 2023, with an annual output of GBP 183 (USD 232.5 Billion) billion, the United Kingdom remains the ninth-largest manufacturing nation in the world, according to Make UK. Moreover, in recent times, the rise of artificial intelligence (AI) and associated digital and robotic technologies has presented new opportunities for the country's manufacturers. It promises even greater levels of efficiency, productivity, and profitability.

- Moreover, developments and innovations in the defense system are also expected to boost the market. For instance, in June 2023, Elta Systems, a subsidiary of Israel Aerospace Industries, teamed up with German sonar manufacturer Atlas Elektronik to develop an anti-submarine warfare system. The firm announced its new partnership with Atlas, a subsidiary of Germany's Thyssenkrupp Marine Systems, aimed at launching a joint product, the BlueWhale anti-submarine warfare (ASW) variant. The system is based on Elta's autonomous underwater vehicle (AUV), integrated with Atlas's towed passive sonar triple array.

- Sound sensors are widely employed for various industrial purposes like monitoring machinery vibrations and noises and analyzing acoustic emissions generated due to fatigue failure on machine elements when equipment runs at high speeds. According to Make UK, with an annual output of GBP 183 billion (USD 231.98 billion), the United Kingdom remains the ninth-largest manufacturing nation in the world. Moreover, in recent times, the rise of artificial intelligence (AI) and associated digital and robotic technologies has presented new opportunities for the country's manufacturers. It promises even greater levels of efficiency, productivity, and profitability.

- The adoption of advanced technologies in the country's manufacturing industry is also aided by much government funding. For instance, in October 2022, UK Research and Innovation (UKRI) awarded 12 smart factory projects a share of GBP 13.7 million (USD 17.37 million) in funding to develop technologies that improve energy efficiency, productivity, and growth in manufacturing. It is a part of the government's wider GBP 147 million (USD 186.34 million) Made Smarter Innovation Challenge that seeks to increase the use of technology within UK manufacturing.

- In May 2022, the UK government revealed plans to boost manufacturing SMEs' productivity and competitiveness through a new Smart Manufacturing Data Hub (SMDH). The new hub and testbed were expected to be led by Ulster University and backed by GBP 50 million (USD 63.38 million) in government funds and business co-investment. Moreover, during the second pandemic, France launched design studies and built the first sections of a third-generation nuclear ballistic missile submarine to maintain national sovereignty and military independence.

Sound Sensors Market Overview

- The sound sensors market is a fragmented market with the presence of several significant players like Honeywell International Inc., GE Measurement & Control Solutions, Maxbotix Inc., Rockwell Automation Inc., Siemens Inc., ST Microelectronics Inc., Robert Bosch GmbH, Panasonic Corporation, Bruel & Kjaer GmbH, Teledyne Technologies Incorporated, etc. The market studied is witnessing several innovations, partnerships, and collaborations among significant market players to enhance their technical capabilities and better serve consumers' evolving requirements.

- In June 2023, Honeywell unveiled a solution to improve the effectiveness and dependability of monitoring and managing low-pressure combustion air and fuel gases as the DG Smart Sensor. For OEMs, end users, and system integrators, this solution presents an opportunity to enhance combustion system performance and change the operating dynamics by embracing digitalization trends in line with Industry 4.0. It also offers accurate monitoring capabilities.

- In February 2023, Polysense announced the launch of indoor and outdoor sound/noise sensor clusters for Smart City and Industrial environments, enabling health monitoring and city management. Empowered by the iEdge 4.0 OS modular and configurable WxS product platform, the upgraded sound/noise sensor is claimed to be BYODed with additional Polysense PSS sensors to equip users with more powerful capabilities to monitor and take action on noise pollution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technology Advancement in the Market, Leading to Increasing Adoption

- 5.1.2 Low Manufacturing Cost

- 5.2 Market Restraints

- 5.2.1 Emergence of Alternative Technologies

6 TECHNOLOGY SNAPSHOT

- 6.1 By Hydrophone

- 6.1.1 Omni-directional

- 6.1.2 Directional

- 6.2 By Microphone

- 6.2.1 Electret Microphones

- 6.2.2 Piezoelectric Microphones

- 6.2.3 Condenser Microphones

- 6.2.4 Dynamic/Magnetic Microphones

- 6.2.5 Other Microphones

7 MARKET SEGMENTATION

- 7.1 By End-user Industry

- 7.1.1 Consumer Electronics

- 7.1.2 Telecommunications

- 7.1.3 Industrial

- 7.1.4 Defense

- 7.1.5 Healthcare

- 7.1.6 Other End-user Industries

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia

- 7.2.4 Australia and New Zealand

- 7.2.5 Latin America

- 7.2.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Honeywell International Inc.

- 8.1.2 Omron Corporation

- 8.1.3 Hunan Rika Electronic Tech Co. Ltd

- 8.1.4 Rockwell Automation Inc.

- 8.1.5 Siemens AG

- 8.1.6 Stmicroelectronics NV

- 8.1.7 Robert Bosch Gmbh

- 8.1.8 Panasonic Corporation

- 8.1.9 Bruel And Kjaer

- 8.1.10 Teledyne Technologies Incorporated

9 INVESTMENT ANALYSIS

10 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219