|

市場調查報告書

商品編碼

1683852

船用聲學感測器-市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Marine Acoustic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

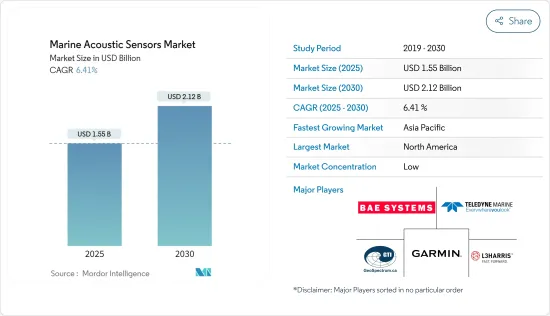

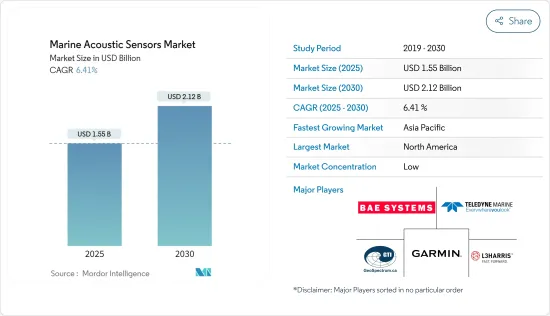

預計 2025 年海洋聲學感測器市場規模為 15.5 億美元,到 2030 年將達到 21.2 億美元,預測期內(2025-2030 年)的複合年成長率為 6.41%。

海洋聲學感測器用於各種船舶小型裝置,用於即時資料收集和環境監測。這些設備形式多樣,用途廣泛。海洋聲學感測器用於海洋生物檢測、監測等目的。

主要亮點

- 物聯網(IoT)技術被提出作為智慧工作技術革命的最新概念。由於聲波感測器技術應用的快速成長和低成本計算組件的強大功能,海洋產業將獲得廣泛的機會。

- 由於物聯網在全球海洋技術中的快速應用,該碼頭在全球透過單一網路支援其雲端基礎的物聯網。智慧化、智慧化港口可以說是完全自動化的,所有設備都透過物聯網智慧港口連接起來。它由智慧感測器網路組成,包括聲波感測器和無線設備,構成智慧港口的核心基礎設施。

- 用於保護軍艦、潛艇和船舶並提供即時情境察覺的技術型聲學感測器的興起正在推動預測期內的市場成長。

- 海洋聲學感測器可以在一個產品中整合訊號處理和感測器功能。然而,聲學感測器面臨穩定性和可靠性差等操作挑戰,這影響了其更廣泛的應用。

- 為了擴大全自動船舶的發展,全球各大造船商和系統開發商正在增加對研發活動的投資,從而增加了對海洋聲學感測器的需求。預計自主船舶將成為海洋產業永續、安全、高效的流程模式。

海洋聲學感測器市場趨勢

水下感測器佔據產品領域的主導地位

- 水下轉換器是一種在水下將一種形式的能量轉換成另一種形式的能量的裝置。在海洋技術中,它通常指將電訊號轉換為聲波(致動器)或將聲波轉換為電訊號(感測器)的設備。水中聽音器是一種用於檢測聲音的特定類型的水下換能器,但其他水下換能器可以用於不同的用途,例如發射聲納訊號或產生振動以用於各種應用。

- 目前,多項關於水下傳輸的實驗和計劃正在進行中,進一步推動了水下換能器領域的發展。例如,2022年11月,日本電報電話公司、NTT Docomo公司和NTT通訊公司進行了一項聯合實驗,以實現用於各種海上活動的寬頻無線通訊。在使用水下聲波通訊的現場實驗中,我們成功地在淺水域(深度約30公尺)實現了1Mbps/300m的水下傳輸。

- 此外,各種產品創新和發展以及與國防部門的合作也正在推動這一研究領域的發展。例如,2023年5月,Teledyne Marine與美國合作,首次成功從直升機部署水下滑翔機,並首次成功從飛機發射自主海底航行器(AUV)。 Teledyne Slocum 滑翔機是一款長航時 AUV,可執行多項持續作戰任務。海軍海洋局(NAVOCEANO)將操作 LBS 滑翔機並收集資料以支援海軍行動。

- 斯德哥爾摩國際和平研究所報告稱,2023年美國軍費開支將佔全球軍事開支的37%。

北美佔據主要市場佔有率

- 國防和安全領域水下通訊應用的不斷增加、自主水下航行器的興起以及科學探勘和資料收集需求的激增是推動北美水下通訊系統市場成長的主要因素,進一步推動了市場研究。

- 自主水下航行器正在成為軍事、海軍和海岸警衛隊行動,尤其是海底行動的中流砥柱。美國廣泛使用這些車輛用於各種應用,包括掃雷、監視、偵察、識別 (ID) 和反潛戰 (ASW)。美國海軍正在加快其收購策略,快速購買水下航行器,以應對來自中國的重大挑戰。

- 在尖峰時段,位於華盛頓的美國海上系統司令部向波音公司授予了一份價值 1,110 萬美元的契約,用於升級海軍作戰。該公司預計將為未來的海軍行動升級導引與控制、導航、情境察覺、任務感測器、人口和核心通訊。例如,同一時期,美國與波音公司簽訂了一份價值4300萬美元的契約,用於研發超大型無人水下載具(XLAUV)。

- 2022 年 8 月,國防部工業基礎政策辦公室與位於德克薩斯州的奧斯汀製造與創新中心 (ACMI) 聯合透過《國防生產法》(DPA) 第3章計畫啟動了一項開創性的製造業試點計畫。預計這個世界上首個試點計畫將專注於商業和軍事應用的先進製造技術,這些技術可以快速擴大生產規模。此類軍事應用發展也可能推動該地區的市場研究。

- 國防支出的增加也可能推動市場發展。例如,根據美國預算辦公室的數據,預計到 2033 年美國國防支出將逐年增加。預計2033年美國國防支出將增加至1.1兆美元。

海洋聲波感測器產業概況

所研究的市場高度分散,主要參與者包括 BAE Systems PLC、Garmin Ltd、Teledyne Marine Technologies(Teledyne Technologies Incorporated)、Ocean Sonics Ltd 和 Geospectrum Technologies Inc. 所研究的市場中的參與者正在採用聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2023 年 6 月 - 泰雷茲在拉斯佩齊亞海軍基地開設新的綜合服務中心,加強與義大利海軍的合作。該中心將作為海軍的獨家服務合作夥伴,負責維護掃雷艦上安裝的聲納系統,並為從那不勒斯和塔蘭託海軍基地出發的護衛艦提供沿海支援。

- 2023 年 1 月,該公司宣布荷蘭皇家海洋研究所 (NIOZ) 已收購了一艘新型 AUV,即 Gavia Osprey。 NIOZ 是荷蘭的國家海洋研究所,進行多學科應用海洋研究,以解決荷蘭海洋的關鍵科學問題。 NIOZ 研究海洋在氣候變遷中的作用,從赤道到兩極,從大陸棚到深海,從現在到過去。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場概況

第5章 市場動態

- 市場促進因素

- 擴大聲學導航在水下定位的應用

- 各國國防費用增加

- 市場挑戰

- 相容性與安裝問題、頻寬限制

- 關鍵績效指標分析

第6章 市場細分

- 按產品

- 水中聽音器

- 水下換能器

- 聲學拖曳陣列

- 側掃聲納

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

第7章 應用分析

- 按應用

- 水深及深度測量

- 海洋成像

- 海洋生物探測

- 軍隊

- 海洋調查與監測

第8章 競爭格局

- 公司簡介

- BAE Systems PLC

- Garmin Ltd

- Teledyne Marine Technologies(Teledyne Technologies Incorporated)

- Ocean Sonics Ltd

- Geospectrum Technologies Inc.

- L3harris Technologies Inc.

- Hottinger Bruel & Kjaer(Spectris PLC)

- Cobham Ultra Seniorco Sa Rl

- Thales Group

- CTS Corporation

第9章 市場展望

The Marine Acoustic Sensors Market size is estimated at USD 1.55 billion in 2025, and is expected to reach USD 2.12 billion by 2030, at a CAGR of 6.41% during the forecast period (2025-2030).

Marine acoustic sensors are used in small devices in various ship types for real-time data collection and environmental monitoring. These devices come in a broad variety of forms with numerous uses. Marine acoustic sensors are used for marine life detection, monitoring, and other purposes.

Key Highlights

- The Internet of Things (IoT) technology has been presented as a recent intelligent work technical revolution concept. The marine industry will have access to a broad range of opportunities due to the rapidly increasing rush of acoustic sensor technology applications and the capabilities of low-cost computing components.

- Docks are being supported globally in solitary networks to support their cloud-based IoT due to the rapid adoption of IoT in global marine technology. An intelligent and smart port can be described as fully automated, with all devices connected via an IoT smart port. It comprises a network of intelligent sensors, including acoustic sensors and wireless devices that make the central infrastructure of a smart port.

- The rising technological-based acoustic sensors for military ships, submarines, and vessels to guard and give them real-time situational awareness are boosting the market growth during the forecast period.

- The marine acoustic sensors allow the integration of signal processing and sensor functions within one product. However, acoustic sensors have faced operational challenges like inadequate stability and reliability, impacting their adoption growth.

- Increased investments in R&D activities by leading shipbuilders and system developers globally for expanding fully autonomous ships have increased the need for marine acoustic sensors. Autonomous ships are estimated to launch as sustainable, safe, and efficient modes of process for the marine industry.

Marine Acoustic Sensors Market Trends

Underwater Transducer to Hold Major Share in the Product Segment

- An underwater transducer is a device that converts one form of energy to another underwater. Marine technology often refers to devices that can convert electrical signals into sound waves (actuators) or sound waves into electrical signals (sensors). While hydrophones are a specific type of underwater transducers used for sound detection, other underwater transducers can serve different purposes, such as emitting sonar signals or generating vibrations for various applications.

- Several experiments and projects in underwater transmission are happening, further driving the underwater transducer segment. For instance, in November 2022, the NTT Corporation, NTT DOCOMO, INC, and NTT Communications Corporation performed a joint experiment on achieving broadband wireless communication for various marine activities. It succeeded at 1-Mbps/300-m underwater transmission in a shallow sea area (water depth of about 30 m) using underwater acoustic communication in field experiments.

- Various product innovations, developments, and collaborations with the defense sector are also driving the studied segment. For instance, in May 2023, In collaboration with the US Navy, Teledyne Marine completed the first-ever successful undersea glider deployment from a helicopter, marking the first time an autonomous underwater vehicle (AUV) was successfully launched from an aircraft. The Teledyne Slocum glider is a long-endurance AUV for multiple persistent operational missions. The Naval Oceanographic Office (NAVOCEANO) pilots the LBS gliders and includes collected data supporting Navy operations.

- In 2023, SIPRI reported that the United States' military expenditure made up 37 percent of global military expenditure.

North America Holds Significant Market Share

- An increase in the adoption of underwater communication in navel defense, an increase in autonomous underwater vehicles, and a surge in the need for scientific exploration and data collection are the key factors driving the growth of the underwater communication systems market in North America, further driving the market studied.

- Autonomous underwater vehicles have become mainstream for the military, navy, and coastal security forces, especially subsea operations. The US Navy extensively uses these vehicles for various applications, such as mine countermeasures (MCM), intelligence, surveillance and reconnaissance, identification (ID), and anti-submarine warfare (ASW). The Navy has accelerated acquisition strategies for the faster purchase of underwater vehicles to counter significant challenges from China.

- During the peak time of the pandemic, US Naval Sea Systems Command Washington signed a contract worth USD 11.1 million with Boeing to upgrade naval operations. The company was expected to upgrade for future naval operations such as guidance and control, navigation, situational awareness, mission sensors, population, and core communication. For instance, at the same time, the US Navy signed a contract worth USD 43 million with Boeing to develop an Orca Extra Large Unmanned Undersea Vehicle (XLAUV).

- In August 2022, the Department of Defense's Industrial Base Policy Office launched a pioneering manufacturing pilot program through the Defense Production Act (DPA) Title III Program with the Austin Center for Manufacturing and Innovation (ACMI) in Austin, Texas. The first-of-its-kind pilot program was expected to focus on advanced manufacturing technology for commercial and military applications that can be rapidly scaled to production. These developments in military applications may also drive the market studied for the region.

- The increase in defense expenses may also drive the market studied. For instance, according to the US Congressional Budget Office, defense spending in the United States is predicted to increase yearly until 2033. Defense outlays in the United States are expected to increase up to USD 1.1 trillion in 2033.

Marine Acoustic Sensors Industry Overview

The market studied is fragmented with the presence of major players like BAE Systems PLC, Garmin Ltd, Teledyne Marine Technologies (Teledyne Technologies Incorporated), Ocean Sonics Ltd, and Geospectrum Technologies Inc. Players in the market studied are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- June 2023 - Thales reinforced its collaboration with the Italian Navy by inaugurating a new integrated service center at the La Spezia naval base. This center will serve as the exclusive service partner of the Navy for the upkeep of sonar systems installed on minesweeper vessels and the waterfront support of frigate vessels operating in the Naval Bases of Naples and Taranto.

- In January 2023, the company announced the acquisition of a new GaviaOsprey AUV by the Royal Netherlands Institute for Sea Research (NIOZ). NIOZ is the Netherlands' national oceanographic institute conducting multidisciplinary applied marine research to address major scientific questions about the company's oceans and seas. NIOZ studies the ocean's role in changing climate from equator to pole, from the continental shelf to the deep ocean, and from present to past.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Deployment of Acoustic Navigation for Underwater Positioning

- 5.1.2 Rising Defense Spending in Several Countries

- 5.2 Market Challenges

- 5.2.1 Compatibility and Installation Issues and the Presence of a Limited Frequency Band

- 5.3 KPI Analysis

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Hydrophones

- 6.1.2 Underwater Transducer

- 6.1.3 Acoustic Towed Array

- 6.1.4 Side-scan Sonar

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

7 APPLICATION ANALYSIS

- 7.1 By Application

- 7.1.1 Water Depth and Bathymetry

- 7.1.2 Marine Imaging

- 7.1.3 Marine Life Detection

- 7.1.4 Military

- 7.1.5 Marine Research and Monitoring

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 BAE Systems PLC

- 8.1.2 Garmin Ltd

- 8.1.3 Teledyne Marine Technologies (Teledyne Technologies Incorporated)

- 8.1.4 Ocean Sonics Ltd

- 8.1.5 Geospectrum Technologies Inc.

- 8.1.6 L3harris Technologies Inc.

- 8.1.7 Hottinger Bruel & Kjaer (Spectris PLC)

- 8.1.8 Cobham Ultra Seniorco S.a R.l.

- 8.1.9 Thales Group

- 8.1.10 CTS Corporation