|

市場調查報告書

商品編碼

1686211

表面聲波感測器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Surface Acoustic Wave Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

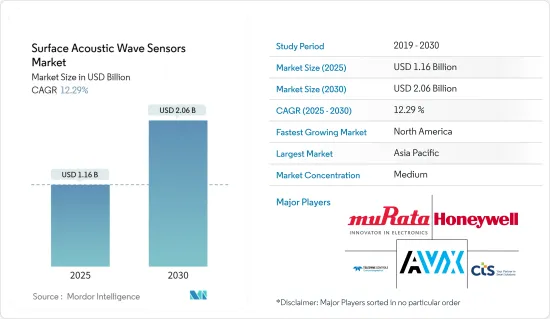

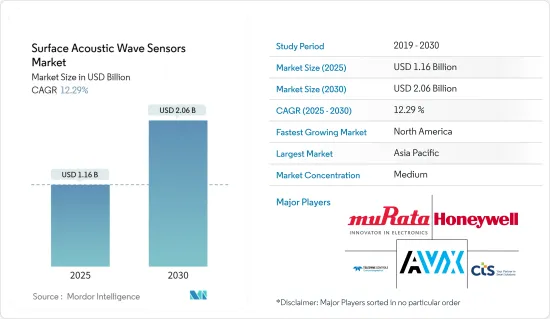

表面聲波感測器市場規模預計在 2025 年為 11.6 億美元,預計到 2030 年將達到 20.6 億美元,預測期內(2025-2030 年)的複合年成長率為 12.29%。

在預測期內,表面聲波感測器由於其體積小、堅固、經濟、生產率高、運行穩定以及在各種終端用戶行業的應用,將成為越來越被採用的感測器技術。

主要亮點

- 表面聲波(SAW)技術已廣泛應用於航太、通訊和汽車等多個工業應用領域。它最常見的用途是在稱為 SAW 濾波器的電子元件中,這是一種基本射頻 (RF) 電路元件。 SAW 設備也用於測量濕度、壓力、溫度和檢測某些化學物質。

- 隨著通訊領域的進步,SAW 和體聲波(BAW)共振器、濾波器、振盪器和延遲線越來越受歡迎。除了被動和無線的特點外,SAW 感測器還具有價格競爭力、固有堅固、響應速度快和固有可靠性高的特性。

- 近年來,汽車、國防和航太工業也在吸引市場研究領域的供應商。由於這些感測器對磁場不敏感,許多汽車應用需要在馬達和螺線管附近進行扭矩感應。對於其他類型的感測器技術來說,這是一個問題。

- 在新冠肺炎疫情爆發的初期,受調查的市場由於全國範圍內的封鎖和許多製造產能的關閉而出現了供應鏈中斷。但自2020年第二季起,市場開始出現需求和生產的復甦,半導體產業的趨勢也反映在研究市場。然而,電動車和汽車強制性安全功能等趨勢正在增加每輛汽車的半導體含量,這可能有助於 SAW 感測器需求在未來幾個月克服這種影響。

- SAW感測器專家研究人員正在積極尋找機會與無損檢測解決方案提供者合作,以驗證可行性並最終探索這些感測器的新應用領域。例如,X-Wave Innovations Inc. 是一家與紐約理工學院 (NYIT) 工程與電腦科學學院合作為航太和國防工業提供無損檢測解決方案的供應商,該公司宣布將與 NASA 合作開發一種嵌入式感測器系統,可以測量影響火箭推進引擎系統的溫度、壓力和其他刺激因素。該計劃還從美國宇航局獲得了超過125,000美元的資助。

表面聲波感測器市場趨勢

醫療保健產業預計將大幅成長

- 人們對使用軟式電路板並能實現無線監控的低成本感測器的需求日益成長,這推動了醫療保健產業對 SAW 感測器的需求。生物感測應用是 SAW 技術在醫療保健行業中最常見的應用之一,並且擴大應用於針對特定疾病的即時診斷(POC)測試和分析設備。

- 在醫療保健和生物醫學領域,對快速、緊湊、準確和可攜式診斷感測系統的需求不斷成長,推動了對生物感測器和 MEMS 的投資增加。 SAW 感測器可用於癌細胞檢測、心電圖 (ECG)、生物電位監測、心臟病監測、血糖監測等設備,以及開發穿戴式生物感測器。

- 另一個有前景的應用是監測新生兒護理室的胸音,微型 SAW 感測器可以最大限度地減少新生兒的不適。手持式監測設備的日益普及和發展也擴大了 SAW 感測器的採用範圍。

- 近年來,SAW感測器擴大用於檢測幾種備受關注的細菌病毒,包括伊波拉出血熱、愛滋病毒、非洲豬瘟病毒和炭疽菌。最近的 COVID-19 疫情也促使許多 SAW 製造商瞄準這項應用。

- 例如,2022 年 8 月,麻省理工學院 (MIT) 的工程師開發了一種用於健康監測的新型無線穿戴式類皮膚感測器。這種名為「電子皮膚」的新感測器是一種由壓電材料製成的極薄半導體薄膜,貼在皮膚上可以檢測身體的振動。預計各類組織的努力將有助於增加醫療保健市場對 SAW 感測器的需求。

- 同樣,由於 COVID-19 的蔓延,醫療保健市場對無線和遠端監控系統的需求增加,預計也將促進市場成長。

北美預計將大幅成長

- 美國是北美表面聲波感測器的主要市場之一,其次是加拿大。由於 SAW 感測器在北美汽車產業安全相關指令中的應用,預計北美市場對 SAW 感測器的需求將會增加。

- 隨著北美地區技術進步的不斷加快,預計許多行業都將使用這些感測器。此外,汽車、航太、醫療保健、家用電子電器和工業等各行業的多種應用也推動了這些感測器的需求激增。

- 此外,由於政府和研究機構所進行的各種創新研發活動,該區域市場也不斷成長。最近的 COVID-19 疫情等市場情況進一步刺激了對這些研究活動的支持和需求。

- 此外,北美地區也是這些感測器技術最先進的應用市場之一,擁有許多知名的系統供應商、感測器製造商和領先的半導體公司。該地區的規模、消費者的富裕程度以及醫療設備製造商之間的激烈競爭使其成為表面聲波感測器製造商的利潤豐厚的市場。

- 此外,半導體產業相關人員正在嘗試不同的方式來利用對 MEMS 的預期需求。預計該市場將由 IDM 和現有的無廠半導體公司組成,這些公司未來將把部分技術外包。為了在這個市場上保持競爭力,各個公司都在這個領域發展和擴張。

- 例如,2021 年 12 月,Microchip Technology Inc. 宣布大幅擴展其氮化鎵 (GaN) 射頻 (RF) 功率裝置產品組合,包括新的 MMIC 和分立電晶體,覆蓋頻率高達 20吉赫(GHz)。該公司的 SAW 感測器、電子機械系統 (MEMS) 振盪器和高度整合的模組結合了微控制器 (MCU) 和RF收發器(Wi-Fi MCU),支援所有主要的近距離無線通訊協定,從藍牙和 Wi-Fi 到 LoRa 設計。

表面聲波感測器產業概況

表面聲波感測器市場競爭適中,因為許多大大小小的參與者活躍於國內和國際市場。市場集中度呈現中等水平,主要企業採用產品創新及併購等策略。

- 2022 年 8 月 - 麥克拉倫應用公司的下一代尖端扭力系統採用 Transence 的 SAW(表面聲波)技術,已交付給一家主要馬達客戶。新型扭矩感測器是一種基於Transens SAW技術的非接觸式測量設備,它使用微型感測器實現輕量、堅固和準確的無線測量。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 無線和被動感測器

- 製造成本低

- 市場限制

- 相容性和安裝問題

- 液體感測的局限性

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 感測類型

- 壓力感測器

- 扭力感測器

- 溫度感測器

- 濕度感測器

- 化學感測器

- 其他感測器

- 最終用戶產業

- 車

- 航太和國防

- 消費性電子產品

- 衛生保健

- 工業

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭格局

- 公司簡介

- API Technologies Corp.

- Vectron International(Microchip Technology Inc.)

- AVX Corporation

- Boston Piezo-Optics Inc.

- Ceramtec

- CTS Corporation

- TDK Electronics AG

- Honeywell International Inc

- Teledyne Microwave Solutions

- Murata Manufacturing Co., Ltd.

第7章投資分析

第 8 章:市場的未來

The Surface Acoustic Wave Sensors Market size is estimated at USD 1.16 billion in 2025, and is expected to reach USD 2.06 billion by 2030, at a CAGR of 12.29% during the forecast period (2025-2030).

Due to their small size, rugged nature, economical production, stability in operation, and applications across various end-user industries, the surface acoustic wave sensors make them an increasingly adopted sensor technology during the forecast period.

Key Highlights

- Surface acoustic wave (SAW) technology has been significantly adopted across some industry applications, including aerospace, telecommunication, and automotive. The most common use is in electronic components known as SAW filters, a basic radio frequency (RF) circuit component. SAW devices have also been utilized to measure humidity, pressure, and temperature and detect certain chemicals.

- With advancements in the communication sector, SAW and bulk-acoustic-wave (BAW) resonators, filters, oscillators, and delay lines have gained traction. Apart from being passive and wirelessly interrogated, SAW sensors are competitively priced, intrinsically rugged, highly responsive, and intrinsically reliable.

- The automotive, defense, and aerospace industries are also attracting vendors in the market studied in recent years. As these sensors are insensitive to Magnetic Fields, many automotive applications require torque-sensing close to electric motors and solenoids. This is problematic for some other types of sensor technology.

- In the initial phase of COVID-19, the studied market witnessed a disruption in the supply chain owing to a nationwide lockdown and closure of many manufacturing capacities. However, after Q2 2020, the market started witnessing a recovery in demand and in production, the trend of the semiconductor industry was also reflected in the studied market. However, trends like electric vehicles and mandating safety features in automotive are increasing the per vehicle semiconductor content, which will help the SAW sensors demand to overcome the impact in the coming months.

- Researchers specializing in SAW sensors are actively seeking opportunities to partner with non-destructive testing solution providers in a bid to check the feasibility and ultimately open new application areas for these sensors. For instance, in partnership with NYIT's School of Engineering and Computing Sciences, the NDT solution provider for the aerospace and defense industry, X-Wave Innovations Inc., announced to work for NASA to develop an embedded sensor system capable of measuring temperature, pressure, and other stimuli affecting rocket propulsion engine systems. The project was also awarded funding of over USD 125,000 by NASA.

Surface Acoustic Wave Sensors Market Trends

Healthcare Segment is Expected to Grow at a Significant Rate

- The ongoing demands for low-cost sensor adaptability with flexible substrates, which are also capable of wireless monitoring, are driving the need for SAW sensors in the Healthcare industry. Biosensing application is one of the most common SAW technology applications in the healthcare industry, increasing its adoption in Point of Care (POC) testing and analysis devices for a particular disease.

- The healthcare and the biomedical sectors are increasingly investing in biosensors and MEMS due to the increasing requirement for rapid, compact, accurate, and portable diagnostic sensing systems. SAW sensors are useful for devices used for cancer cell detection, electrocardiogram (ECG), biopotential monitoring biosensors, heart attack monitoring, blood glucose monitoring, and the development of wearable biosensors.

- Another promising application is monitoring chest sounds in neonatal care units where the miniature SAW sensors minimize discomfort for newborns. The increasing adoption and development of hand-held monitoring devices are also expanding the scope of SAW sensor adoption.

- In recent years, SAW sensors have been increasingly used for detecting multiple high-profile bacteria viruses, including Ebola, HIV, Sin Nombre, and Anthrax. The recent COVID-19 pandemic has also motivated many SAW manufacturers to target this application.

- For instance, in August 2022, engineers at the Massachusetts Institute of Technology (MIT) developed a new category of wireless wearable skin-like sensors for health monitoring. The new sensor is an ultrathin semiconductor film made of a piezoelectric substance that adheres to the skin, sensing the vibrations of the body, and will be called 'e-skin.' Such initiatives by various organizations are expected to contribute to the increase in demand growth for SAW sensors in the healthcare market.

- Similarly, the increase in the demand for wireless and remote monitoring systems in the healthcare market owing to the spread of COVID-19 is also expected to contribute to the market growth.

North America Region is Expected to Witness Significant Growth

- The United States is one of the major markets for surface acoustic wave sensors in the North American region, followed by Canada. The North American market is expected to witness an increase in the demand for SAW sensors owing to the applications in the safety-related mandates for the automobile industry in the region.

- With the increasing technological advancements in the North American region, many industries are expected to take advantage of these sensors. The rapid surge in demand for these sensors is also due to multiple applications in various industries, including automotive, aerospace, healthcare, consumer electronics, and the industrial sector.

- Moreover, the regional market is also growing owing to the various innovative research and development activities undertaken by the government and research institutions. Market scenarios like the recent COVID-19 pandemic have further fueled the support and demand for these research activities.

- Moreover, the North American region is also one of the most technologically advanced application markets for these sensors owing to the presence of many prominent system suppliers, sensor manufacturers, and large semiconductor companies. The enormous size of the region, the affluence of its consumers, and the highly competitive nature of the medical equipment manufacturers make this region a lucrative market for surface acoustic wave sensor manufacturers.

- Further, semiconductor industry participants are also trying different ways to benefit from the anticipated MEMS demand. The market is expected to constitute IDMs and established fabless companies that would outsource some of their technologies in the future. The market has been witnessing several developments and expansion activities related to the field by various players to stay ahead of the competition.

- For instance, in December 2021, Microchip Technology Inc. announced a significant expansion of its Gallium Nitride (GaN) Radio Frequency (RF) power device portfolio with new MMICs and discrete transistors that cover frequencies up to 20 gigahertz (GHz). The company's SAW sensors and microelectromechanical systems (MEMS) oscillators and highly integrated modules combine microcontrollers (MCUs) with RF transceivers (Wi-Fi MCUs) that support major short-range wireless communications protocols from Bluetooth and Wi-Fi to LoRa design.

Surface Acoustic Wave Sensors Industry Overview

The Surface Acoustic Wave Sensors Market is moderately competitive owing to the presence of many small and large players operating in the domestic as well as the international markets. The market appears to be moderately concentrated, with the key players adopting strategies like product innovation and mergers and acquisitions.

- August 2022 - The next generation of McLaren Applied's cutting-edge torque system that uses Transense's SAW (Surface Acoustic Wave) technology has been successfully delivered to one of their leading motorsport clients, who will mandate the part across all entrants. The new torque sensor is a non-contact measurement device based on Transense's SAW technology which uses small sensors, is lightweight, robust, and provides accurate wireless measurement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Wireless and Passive Nature of Sensors

- 4.2.2 Low Manufacturing Cost

- 4.3 Market Restraints

- 4.3.1 Compatibility and Installation Issues

- 4.3.2 Limitations in Liquid Sensing

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sensing Type

- 5.1.1 Pressure Sensors

- 5.1.2 Torque Sensors

- 5.1.3 Temperature Sensors

- 5.1.4 Humidity Sensors

- 5.1.5 Chemical Sensors

- 5.1.6 Other Sensors

- 5.2 End-User Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Consumer Electronics

- 5.2.4 Healthcare

- 5.2.5 Industrial

- 5.2.6 Other End-User Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 API Technologies Corp.

- 6.1.2 Vectron International (Microchip Technology Inc.)

- 6.1.3 AVX Corporation

- 6.1.4 Boston Piezo-Optics Inc.

- 6.1.5 Ceramtec

- 6.1.6 CTS Corporation

- 6.1.7 TDK Electronics AG

- 6.1.8 Honeywell International Inc

- 6.1.9 Teledyne Microwave Solutions

- 6.1.10 Murata Manufacturing Co., Ltd.