|

市場調查報告書

商品編碼

1686521

託管服務 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Managed Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

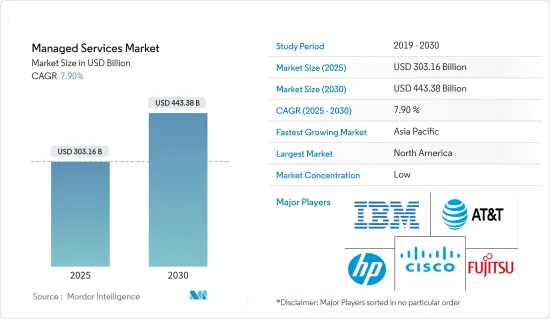

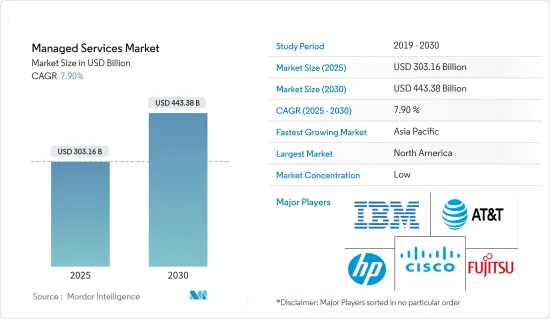

託管服務市場規模預計在 2025 年達到 3,031.6 億美元,預計到 2030 年將達到 4,433.8 億美元,預測期內(2025-2030 年)的複合年成長率為 7.9%。

隨著越來越多的中小型企業考慮外包非核心業務,中小型企業(SMB)有望成為對市場成長產生正面影響的驅動力。據 Datto 稱,平均每個 MSP 有 122 個客戶,大約 60% 的 MSP 客戶擁有 1 至 150 名員工。此外,只有 5% 的 MSP 擁有員工人數超過 500 人的客戶。

主要亮點

- 託管服務提供了一系列好處,並被證明可以透過讓組織專注於其核心專業知識對發展產生積極影響。據估計,成功實施託管服務可以降低25-45%的IT成本,並提高45-65%的業務效率。此外,根據智慧技術解決方案的調查,25% 的公司表示,停機平均每小時造成 301,000 美元至 40 萬美元的損失。

- 此外,預測到2022年,開發與發展速度相符的應用程式將變得非常重要。應用程式維護和支援服務是 IT 託管服務的重要組成部分。應用程式效能監控(APM)有望為開發人員提供快速回饋機制。前端監控(使用者行為調查)、ADTD(應用程式發現、追蹤和診斷)和 AIOps 分析(應用程式生命週期模式和異常檢測)都是 APM 的一部分。這些解決方案可協助 DevOps 團隊更好地分析業務問題。這減少了平均修復時間(MTTR)。

- 隨著行業要求、標準和消費者需求每天都在變化,企業要求以結果為導向的成果。這些公司要求預先定義或預期的標準能夠被清楚地記錄下來並即時交付。 MSP 將使用進階分析和彙報來描述部署技術的影響並提供基於事實的資料。

- 此外,區塊鏈和物聯網技術將為託管服務提供者創造更好的機會。為了抓住這些機會、保持相關性並跟上競爭的步伐,託管服務供應商正在擴大掌握這些技術所需的技能,以及 AR、VR 和 AI 等其他顛覆性技術。

- 自新冠疫情爆發以來,企業採用的遠距工作模式導致雲端基礎的解決方案的需求激增。隨著越來越多的 IT 決策者希望利用現代雲端環境,計劃耗時更長,所需的預算也更大。據 Wanclouds 稱,美國和英國近一半(48%)的 IT 決策者表示,成功遷移單一多重雲端應用程式的平均時間為一到兩個月。

託管服務市場趨勢

製造業預計將佔據較大的市場佔有率

- 在當今科技主導的商業環境中,巨量資料已成為提高製造業生產力和效率的關鍵驅動力之一。感測器和連網型設備的廣泛採用,實現了 M2M通訊,導致製造業產生的資料點數量顯著增加。

- 各行各業正在快速轉型為智慧產業,資料可以即時產生和視覺化。從說明到預測性的分析技術的進步使業界能夠從這些豐富的資料中獲得利益。製造業的座右銘正在轉向基於指標的領域,在該領域中,可以基於資料驅動的統計數據利用來改善決策。

- 隨著工業 4.0 概念影響製造生產設施,製造業產生的資料量正在滾雪球般成長,因為現在可以從各個製程點(例如溫度、壓力、濕度、應力、應變、品質等)建立資料。

- 一些應用範例是在半導體、消費性電子和汽車行業,這些行業製造商需要監控大量變數以確保最終產品的品質。巨量資料分析已成為傳統方法的有效解決方案。

- 許多中小型製造企業將這些巨量資料分析解決方案外包,因為他們專注於硬體設備,缺乏軟體解決方案的專業知識。外包軟體服務正在進一步減少開支。預計在預測期內,現場服務管理和 ERP 等其他軟體服務的外包將促進託管服務的發展。

亞太地區可望成為成長最快的市場

- 數位轉型已成為中國的首要任務,隨著越來越多的公司製定正式策略來支持這項工作,數位轉型正在迅速加速。 2021年1月,中國國務院發布了「十四五」規劃(2021-2025年)期間推動數位經濟蓬勃發展的建議。根據規劃,2025年,我國產業數位轉型將邁上新台階,數位公共服務更加完善,數位經濟管治結構明顯改善。

- 中國的託管服務供應商致力於跟上最新技術,以降低安全風險並最佳化最終用戶的業務。該國的電信業者主要服務託管服務市場。這些公司也策略性地收購託管服務公司,以佔領更多的市場佔有率。

- 此外,由於產業技術的快速發展,印度銀行業正經歷巨大的變化,導致各組織採用雲端處理服務來應對挑戰。此外,印度託管儲存供應商正在投資開發專門針對 BFSI 領域的整合式雲端儲存平台。

- 此外,印度政府繼續對智慧城市等實體基礎設施進行大量投資,預計這將為資料儲存、安全性和網路管理等託管服務的部署創造機會。目前,印度的智慧城市計畫專注於改造100座城市。

- 2022 年 1 月,畢馬威印度公司和 Qualys 宣佈建立合作夥伴關係,將 Qualys 解決方案加入畢馬威的託管安全服務。畢馬威在印度業界領先且全球認可的網路安全服務,與 Qualys 世界一流的網路安全創新相結合,將使企業能夠保護其網路、應用程式、端點和雲端工作負載免受安全漏洞的侵害,提供可見性並確保合規性。

- 而服務業在GDP中所佔比重最大的日本,在服務業管理方面也共用。日本一直是市場經濟,是世界第二已開發經濟體。目前,日本正專注於發展混合動力汽車、機器人、光學設備等製造業。

託管服務業概覽

全球託管服務市場競爭激烈,有幾家大型企業參與。市場的主要企業包括Cisco、IBM、微軟、富士通和 Wipro。隨著市場競爭不斷加劇,企業正在形成策略聯盟和夥伴關係。

2022 年 5 月,安永和 IBM Expand Alliance 宣布決定透過數位創新和更強的彈性來幫助全球企業。安永和 IBM 正在建立一個新的人才卓越中心 (COE),該中心將建立資料驅動的人工智慧和混合雲端解決方案,並提供全方位的人才、人力資源、流動性和薪資核算轉型服務,以幫助客戶轉變其人力資源職能,同時克服吸引、留住和提升員工技能的迫切需求。

2022 年 5 月,IBM 宣布與亞馬遜網路服務 (AWS) 達成策略合作協議 (SCA),透露計劃在 AWS 上廣泛提供其軟體目錄作為軟體即服務 (SaaS)。企業將能夠在 AWS 上將廣泛的 IBM 軟體組合作為雲端原生服務運行,使推出和運行以實現業務價值。

2022 年 1 月,Rackspace Technology 與 BT 宣布達成夥伴關係協議,為 BT 的跨國客戶轉型雲端服務。根據協議,英國電信的混合雲端服務將基於 Rackspace 技術解決方案,該公司將透過 Rackspace Fabric 管理層將其部署在英國電信的資料中心。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 轉向混合IT的轉變日益加劇

- 提高成本和業務效率

- 市場挑戰

- 整合和監管問題、可靠性問題

第6章市場區隔

- 擴張

- 本地

- 雲

- 類型

- 託管資料中心

- 託管安全

- 託管通訊

- 主機網路

- 託管基礎設施

- 託管行動性

- 公司規模

- 中小企業

- 大型企業

- 按最終用戶產業

- BFSI

- 資訊科技/通訊

- 衛生保健

- 娛樂和媒體

- 零售

- 製造業

- 政府

- 其他最終用戶產業

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第7章競爭格局

- 公司簡介

- Fujitsu Ltd

- Cisco Systems Inc.

- IBM Corporation

- AT&T Inc.

- HP Development Company LP

- Microsoft Corporation

- Verizon Communications Inc.

- Dell Technologies Inc.

- Nokia Solutions and Networks

- Deutsche Telekom AG

- Rackspace Inc.

- Tata Consultancy Services Limited

- Citrix Systems Inc.

- Wipro Ltd

- NSC Global Ltd

- Telefonaktiebolaget LM Ericsson

第8章投資分析

第9章 市場機會與未來趨勢

The Managed Services Market size is estimated at USD 303.16 billion in 2025, and is expected to reach USD 443.38 billion by 2030, at a CAGR of 7.9% during the forecast period (2025-2030).

Small and midsize Businesses (SMB) are expected to be the driving factors that positively impact the market's growth, as more and more SMBs are looking to outsource non-core activities. According to Datto, on average, MSPs report a client base of 122 clients, and about 60% of the MSP's clients have between 1-150 employees. Additionally, only 5% of the MSPs reported clients with over 500 employees.

Key Highlights

- Managed services offer various benefits that are proven to positively impact the development of the organization that adopts such services as they can focus on their core expertise. It is estimated that successfully deploying managed services will help reduce IT cost by 25-45% and increase operational efficiency by 45-65%. In addition, according to Intelligent Technical Solutions, 25% of organizations said downtime costs averaged between USD 301,000 and USD 400,000 per hour.

- Moreover, 2022 was expected to be all about application deployments matched to the development speed. The application maintenance and support services will be pivotal to the managed services in IT. Application performance monitoring (APM) will imbibe a quick feedback mechanism for developers. Front-end monitoring (for studying user behavior), ADTD (for application discovery, tracing, and diagnostics), and AIOps analytics (for detecting application lifecycle patterns and anomalies) will all be parts of APM. These solutions will help the DevOps team to analyze business problems better. It will cut down on their mean time to repair (MTTR).

- With industry requirements, standards, and consumer needs changing daily, businesses are seeking result-based outcomes. They require possession of pre-defined or expected criteria documented clearly, and in real time. The MSP will now be seen using advanced analytics and reporting to state the implemented technologies' impact and present factual data.

- Further, the Blockchain and IoT technologies are set to create better opportunities for managed services providers, as these organizations require expertise to implement these technologies. To get a hold of these opportunities, stay relevant, and keep up with the competition, managed services providers increasingly acquire essential skill sets for these, among other innovative technologies, like AR, VR, and AI.

- Since the outbreak of COVID-19, the demand for cloud-based solutions saw significant growth due to remote working models being adopted by enterprises. As more IT decision-makers look to take advantage of modern cloud environments, they are increasingly running into longer project runways and the need for bigger budgets. According to Wanclouds, nearly half (48%) of the US and the UK IT decision-makers say the average time it takes them to complete a single multi-cloud application migration successfully is 1-2 months.

Managed Services Market Trends

Manufacturing is Expected to Hold a Significant Market Share

- In the current technology-driven business environment, Big Data is one of the manufacturers' primary drivers of productivity and efficiency. With the high rate of adoption of sensors and connected devices and the enabling of M2M communication, there has been a massive increase in the data points that are generated in the manufacturing industry.

- Industries are pitching hard and fast to switch to a smart industry, where data generation and visualization can become real-time. From descriptive to predictive, the evolution of analytics has made the industry aware of the benefits it can reap from this volume of data. The motto of the manufacturing industry is moving toward a metrics-based sector, which can improve decision-making based on the data-driven use of statistics.

- With the concept of Industry 4.0 influencing production establishments in the manufacturing industry, the amount of data produced from the manufacturing industry has snowballed, as they have been able to create data from each process point, varying from temperature, pressure, humidity, stress, strain, and quality, among numerous others.

- There are several applications in the semiconductors, consumer electronics, and the automotive industry, where manufacturers have to monitor numerous variables to ensure the quality of end products. Big Data analytics has emerged as an effective solution to traditional methods.

- As most small and medium manufacturing industries are more concentrated on hardware equipment and lack expertise in software solutions, they are outsourcing these Big Data analytic solutions. Outsourcing software services are further reducing their expenditure. Outsourcing other software services, such as field service management and ERP, is expected to boost managed services during the forecast period.

Asia-Pacific is Expected to be the Fastest Growing Market

- Digital transformation has become a top priority in the country and is moving rapidly as more companies are implementing formal strategies to support their efforts. In January 2021, China's State Council released a proposal to help the digital economy flourish throughout the 14th Five-Year Plan period (2021-2025). According to the plan, China's digital transformation of industries will reach a new level by 2025, while digital public services will become more inclusive, and the digital economy governance structure will visibly improve.

- The managed service providers in China focus on reducing security risks and optimizing operations for the end users by keeping up with the latest technologies. The telecommunication companies in the country majorly offer the managed services market. These companies are also strategically acquiring companies offering managed services to gain more market share.

- Furthermore, the banking sector in India is experiencing a colossal change due to the rapid evolution of technology in its verticals, which led to the adoption of cloud computing services by organizations to address their issues. Additionally, the managed storage providers in the country are investing in developing an integrated cloud storage platform dedicated to the BFSI sector.

- Moreover, the ongoing extensive investments by the Indian government toward physical infrastructures, like smart cities, are expected to create more opportunities for deploying managed services, like data storage, security, and network management, in the country. Currently, the Indian smart cities program is focused on transforming 100 cities.

- In January 2022, KPMG India and Qualys announced a partnership to add Qualys solutions to KPMG's Managed Security service. KPMG's industry-leading and globally recognized cybersecurity services in India will be combined with Qualys' world-class cybersecurity innovations to enable enterprises to protect their network, applications, endpoints, and cloud workloads from security vulnerabilities, provide visibility, and ensure compliance.

- Whereas, with the service industry taking up the largest portion of its GDP, Japan has much to share in managing the service industry. Japan has always been a market-oriented economy and represents the second-most developed economy in the world. Currently, the country is focusing on the manufacturing sectors, including the production of hybrid vehicles, robotics, and optical instruments.

Managed Services Industry Overview

The global managed services market is very competitive because of the presence of several major players. Some major players in the market are Cisco Systems Inc., IBM Corporation, Microsoft Corporation, Fujitsu Ltd, and Wipro Ltd. The market players are forming strategic collaborations and partnerships to sustain the intense competition in the market.

In May 2022, EY and IBM Expand Alliance announced their decision to help businesses around the world through digital innovation and greater resilience.EY and IBM have established a new Talent Center of Excellence (COE) that will create data-driven AI and hybrid cloud solutions to provide broad talent, HR, mobility, and payroll transformation services helping clients in overcoming the urgent need to attract, retain and upskill their workforce while transforming their HR function.

In May 2022, IBM announced a Strategic Collaboration Agreement (SCA) with Amazon Web Services Inc. (AWS), with plans to offer a broad array of its software catalog as Software-as-a-Service (SaaS) on AWS that will help customers build and deploy modern, secure, and more intelligent workflows with IBM Software on AWS. Organizations will be able to run a broad array of the IBM Software catalog as cloud-native services on AWS so they can get up and running quickly to deliver business value.

In January 2022, Rackspace Technology and BT announced a partnership agreement to transform BT's multinational customers' cloud services. Under the terms of the agreement, BT's hybrid cloud services will be based on Rackspace Technology's solutions, which the company will deploy in BT data centers along with its Rackspace Fabric management layer.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Shift to Hybrid IT

- 5.1.2 Improved Cost and Operational Efficiency

- 5.2 Market Challenges

- 5.2.1 Integration and Regulatory Issues and Reliability Concerns

6 MARKET SEGMENTATION

- 6.1 Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 Type

- 6.2.1 Managed Data Center

- 6.2.2 Managed Security

- 6.2.3 Managed Communications

- 6.2.4 Managed Network

- 6.2.5 Managed Infrastructure

- 6.2.6 Managed Mobility

- 6.3 Enterprise Size

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 End-user Vertical

- 6.4.1 BFSI

- 6.4.2 IT and Telecommunication

- 6.4.3 Healthcare

- 6.4.4 Entertainment and Media

- 6.4.5 Retail

- 6.4.6 Manufacturing

- 6.4.7 Government

- 6.4.8 Other End-User Verticals

- 6.5 Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 Rest of Asia-Pacific

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Argentina

- 6.5.4.3 Mexico

- 6.5.4.4 Rest of Latin America

- 6.5.5 Middle East and Africa

- 6.5.5.1 United Arab Emirates

- 6.5.5.2 Saudi Arabia

- 6.5.5.3 South Africa

- 6.5.5.4 Rest of Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Ltd

- 7.1.2 Cisco Systems Inc.

- 7.1.3 IBM Corporation

- 7.1.4 AT&T Inc.

- 7.1.5 HP Development Company LP

- 7.1.6 Microsoft Corporation

- 7.1.7 Verizon Communications Inc.

- 7.1.8 Dell Technologies Inc.

- 7.1.9 Nokia Solutions and Networks

- 7.1.10 Deutsche Telekom AG

- 7.1.11 Rackspace Inc.

- 7.1.12 Tata Consultancy Services Limited

- 7.1.13 Citrix Systems Inc.

- 7.1.14 Wipro Ltd

- 7.1.15 NSC Global Ltd

- 7.1.16 Telefonaktiebolaget LM Ericsson