|

市場調查報告書

商品編碼

1686285

奢侈品包裝:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Luxury Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

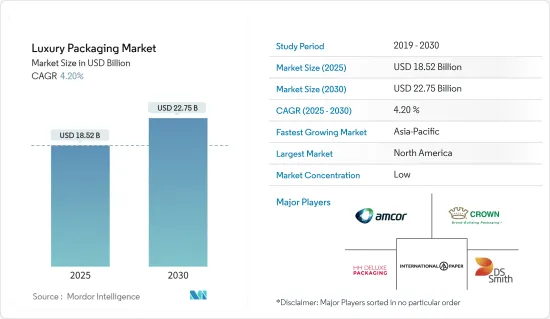

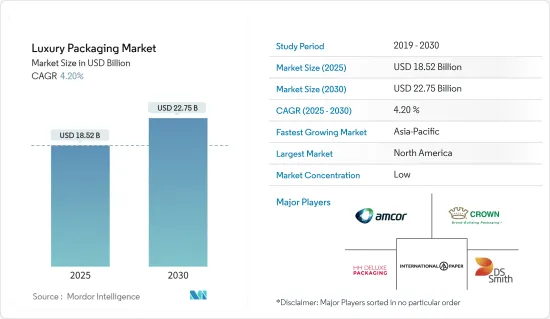

奢侈品包裝市場規模預計在 2025 年為 185.2 億美元,預計到 2030 年將達到 227.5 億美元,預測期內(2025-2030 年)的複合年成長率為 4.2%。

主要亮點

- 由於銷售奢侈品的公司擴大使用獨特且有吸引力的包裝,預計預測期內奢侈品包裝市場將會成長。由於人們對環保和永續奢侈品和產品的追求日益成長,奢侈品包裝市場可能會快速成長。

- 奢侈品擴大與永續性和再利用聯繫在一起,年輕的消費者也紛紛加入這一行列。尤其是在時尚領域,隨著特定族群採取更永續的消費方式,更廣大的消費者轉向奢侈品的轉變正在加速。

- 奢侈品包裝市場因其在包裝和裝飾奢侈品中的應用而正在經歷強勁成長。領先的供應商利用各種優質材料和先進的設計來增強購物體驗。消費者偏好的變化、消費習慣的增加以及公司對最佳化生產方法和產品開發的關注推動了對此類優質包裝的需求不斷成長。

- 生物分解性和永續包裝的使用是市場的主要驅動力。隨著消費者的環保意識增強並尋求更永續的生活方式,一些公司逐漸將永續放在首位。喬治阿瑪尼 (Giorgio Armani) 的環保化妝品盒旨在提高消費者對環境永續性的認知。

- 國際市場對優質包裝的需求日益成長。但存在著阻礙這一成長的挑戰。其中包括建立包裝製造設施所需的大量初始資本投資以及重型和笨重包裝的盛行,限制了全球奢侈品包裝市場的擴張。

- 與更廣泛的包裝市場一樣,奢侈品包裝市場也因 COVID-19 疫情而遭遇重大挫折。疫情使全球工商業格局陷入動盪,奢侈品包裝市場大幅放緩。時尚、消費品和個人護理等行業是推動奢侈品包裝需求的主要因素。疫情期間,製造業中斷、原料短缺和供應鏈中斷導致許多終端使用產業的產量暴跌,抑制了對高階包裝的需求。

奢侈品包裝市場的趨勢

化妝品和香水預計將推動需求

- 可支配收入的增加,尤其是在新興市場,正在推動奢侈品支出的增加。隨著對品牌形象和產品差異化需求的日益重視,這一趨勢得到了進一步放大,優質包裝成為創造理想品牌認知的關鍵要素。此外,社交媒體的影響以及消費者希望透過購買來展示自己的生活方式的願望,極大地促進了對具有視覺吸引力的高檔包裝的需求。

- 在中國,網路購物取代實體店成為消費者購買化妝品的方式。到2023年,中國化妝品零售額的45%以上將來自線上通路。根據中國國家統計局的數據,2023年中國化妝品零售額將達4,141.7億元人民幣(574.8億美元),較2022年成長5.23%。化妝品銷售的成長推動了對奢華包裝的需求。

- 生活方式和化妝品領域的銷售額持續成長。隨著中國二、三線城市化妝品需求持續成長,化妝品零售市場預計將保持上升動能。此外,男性護膚觀念的轉變正推動中國男性化妝品市場大幅成長,預計將進一步促進市場成長。

- 隨著全球銷售額的成長,對化妝品和香水永續包裝的需求也在成長。作為回應,供應商正在形成策略聯盟。例如,2023 年 1 月,陶氏化學與奢侈品集團 LVMH 旗下的 LVMH Beauty 合作,加速 LVMH 香水和化妝品系列採用永續包裝。此次合作將加速將生物基和循環塑膠融入 LVMH 美容產品的各種應用中,同時保持其包裝的品質和功能。

亞太地區可望推動經濟成長

- 由於可支配收入的增加和消費者對奢侈品的支出增加,預計亞太地區在預測期內將實現高成長。龐大的人口和大規模的都市化正在改變消費者的消費模式,增加對奢侈品的需求,導致人們越來越接受城市生活方式。

- 此外,永續包裝措施正在推動該地區的市場成長。奢侈品製造商擴大採用生物分解性材料作為包裝解決方案。知名的國際品牌正在優先考慮環保奢華包裝,以符合其永續性目標並增強其企業社會責任。

- 推動市場成長的關鍵因素是時尚和化妝品領域產品發布的增加。知名品牌正將注意力轉向中國和印度等新興經濟體,並在那裡開設商店,理由是這些國家具有多種成長前景。例如,2023年10月,陶氏個人護理產品在2023年亞洲化妝品原料展覽會上推出了三款新產品,擴大了其永續產品組合。新產品的推出,包括 Beauty Rebalanced 2.0 概念系列和可持續護髮系列,凸顯了該公司致力於在個人護理領域提供全面的永續、高性能解決方案。

- 該地區化妝品製造商的擴張舉措預計將產生對各種由塑膠和紙張製成的優質包裝解決方案的需求。 2024 年 3 月,包裝消費品製造商印度斯坦聯合利華 (HUL) 打算大幅擴展其高階美容業務。該公司計劃透過加速現有個人護理品牌(如 Tresemme 和 Lakme)的成長來加強其優質化策略。這項舉措是在推出一系列數位優先品牌三年後推出的,凸顯了 HUL 致力於搶佔高階美容市場更大佔有率的決心。

奢侈品包裝產業概況

奢侈品包裝市場較為分散,新參與企業正向新興地區擴張。企業間的國際和區域競爭企業間敵對情緒高漲,競爭日益激烈。主要公司包括 Amcor PLC、HH Deluxe Packaging、DS Smith PLC 等。

- 2023 年 12 月,創新美容集團 Fasten Packaging 推出了 Goodloop,這是一款可再填充、可回收的乳霜產品罐,旨在將奢侈品牌與永續發展相結合。由回收的 PP 和 PET 製成,完全可回收。包裝由一個透明的外瓶和一個彎曲的內瓶組成,設計給人一種「智慧」的外觀。

- 2023 年 10 月,總部位於倫敦、專注於設計的奢侈品包裝公司 Wrapology 被德國紙盒和盒子專家 Carton Group 收購,該公司與一系列知名的國際和新興品牌合作。透過此次收購,Carton Group 計畫提供不僅超越客戶功能要求和期望,還能引起最終消費者強烈情緒和促銷反應的包裝解決方案。

- 2023 年 8 月,費列羅巧克力時刻 (Ferrero Rocher Moments) 修改了在印度的包裝策略。該品牌推出了工廠包裝的懸掛式電池和貨架就緒的分配袋,可在現代和傳統零售店以及電子商務平台上銷售。此次推出的產品滿足了消費者自用、共用和贈送的需求。新包裝保留了經典費列羅巧克力的優質精髓和設計元素,但採用金色包裝和現代設計圖案。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 評估宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 增加使用永續和可生物分解的材料,例如紙板

- 遊客增加帶來旅遊和零售連鎖店的需求

- 市場限制

- 不願意包裝重型或大宗產品

- 機器的初始成本和營運成本高

第6章市場區隔

- 按材質

- 紙板

- 玻璃

- 金屬

- 其他材料

- 按最終用戶

- 化妝品和香水

- 糖果零食

- 手錶和珠寶飾品

- 優質飲料

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章競爭格局

- 公司簡介

- DS Smith PLC

- Crown Holdings Inc.

- Amcor PLC

- WestRock Company

- Owens-Illinois Inc.

- International Paper Company

- Ardagh Group

- Delta Global

- GPA Global

- HH Deluxe Packaging

- Prestige Packaging Industries

- Pendragon Presentation Packaging

- Stolzle Glass Group

- Keenpac

- Elegant Packaging

- Lucas Luxury Packaging

- Luxpac Ltd

- McLaren Packaging Ltd

- B Smith Packaging Ltd

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 51623

The Luxury Packaging Market size is estimated at USD 18.52 billion in 2025, and is expected to reach USD 22.75 billion by 2030, at a CAGR of 4.2% during the forecast period (2025-2030).

Key Highlights

- The market for luxury packaging is anticipated to grow during the forecast period due to the growing usage of distinctive and appealing packaging by businesses selling luxury goods. The market for luxury packaging is likely to grow rapidly due to the growing trend of eco-friendly and sustainable luxury goods and products.

- Luxury is becoming increasingly aligned with sustainability and re-use, driven by younger shoppers getting on board. The shift among a wider consumer base toward luxury, particularly in fashion, is accelerating by certain demographic groups adopting a more sustainable approach to consumerism, particularly in fashion.

- The luxury packaging market is witnessing significant growth, driven by its use in high-end product packaging and decoration. Leading suppliers are utilizing a variety of premium materials and advanced designs to enhance the shopping experience. This increased demand for luxury packaging is fueled by changing consumer preferences, a greater willingness to spend, and a growing focus from businesses on optimizing production methods and product development.

- The use of biodegradable and sustainable packaging is a significant market driver. As customers become more environmentally conscious and demand more sustainable lifestyle options, several businesses steadily emphasize sustainable development above everything else. Giorgio Armani's eco-friendly cosmetics box aims to raise consumer awareness of environmental sustainability.

- The international market is experiencing a growing demand for luxury packaging. However, certain challenges impede its growth. These include the substantial initial capital investment required to establish packaging manufacturing facilities and the widespread use of heavy and bulky packaging, which restricts the global expansion of the luxury packaging market.

- The luxury packaging market, like its broader packaging counterpart, faced significant setbacks due to the COVID-19 pandemic. The global industrial and commercial landscape was disrupted by this pandemic, leading to a notable slowdown in the luxury packaging market. Industries such as fashion, consumer goods, and personal care predominantly drive the demand for luxury packaging. With manufacturing disruptions, raw material scarcities, and supply chain interruptions, the output of many end-use sectors plummeted during the pandemic, subsequently dampening the appetite for luxury packaging.

Luxury Packaging Market Trends

Cosmetics and Fragrances are Expected to Drive Demand

- Increasing disposable incomes, particularly in emerging markets, are driving higher expenditures on premium products. This trend is further amplified by a growing emphasis on brand image and the necessity for product differentiation, making luxury packaging a crucial element in crafting the desired brand perception. Additionally, the influence of social media and consumers' desire to exhibit their lifestyles through their purchases are significantly contributing to the demand for visually appealing and high-end packaging.

- In China, online shopping has overtaken brick-and-mortar shops as the preferred method of purchasing cosmetics among consumers. In 2023, over 45% of China's cosmetic retail sales were made online. According to the National Bureau of Statistics of China, in 2023, the retail sales of cosmetics in China totaled about CNY 414.17 billion (USD 57.48 billion), registering an increase of 5.23% compared to sales in 2022. This growth in the sales of cosmetics is propelling demand for luxury packaging.

- The lifestyle and cosmetics sectors are experiencing a consistent increase in sales. As the demand for cosmetic products continues to grow in China's second and third-tier cities, the cosmetics retail market is expected to sustain its upward momentum. Additionally, the evolving perception among men regarding skincare is driving significant growth in the men's cosmetics market in China, which is further anticipated to support market growth.

- The demand for sustainable packaging for cosmetics and perfumes is growing with increased sales globally. In response, vendors are witnessing strategic collaborations. For instance, in January 2023, Dow and LVMH Beauty, a division of luxury conglomerate LVMH, partnered to expedite the implementation of sustainable packaging across LVMH's perfume and cosmetic products. This collaboration would facilitate the integration of both bio-based and circular plastics into various LVMH beauty applications, ensuring that packaging quality and functionality are maintained.

Asia-Pacific Expected to Witness Increasing Growth Rate

- Asia-Pacific is expected to register high growth during the forecast period, owing to the increase in disposable income and consumer spending on luxury products. Large populations and massive urbanization have led to a rise in the adoption of urban lifestyles due to changing consumer patterns and the rising demand for luxurious products.

- Furthermore, in the region, the market is experiencing growth driven by sustainable packaging initiatives. Manufacturers of premium products are increasingly adopting biodegradable materials for their packaging solutions. Prominent international brands are emphasizing eco-friendly luxury packaging to align with their sustainability goals and enhance their corporate social responsibility.

- The primary factors driving the market's growth include growth in product launches in the fashion and cosmetic sectors. The major international brands are eyeing emerging economies, such as China and India, to set up their stores in these countries, as they pose various growth prospects. For instance, in October 2023, Dow Personal Care expanded its sustainable portfolio with three new product launches at in-cosmetics Asia 2023. The launch of new products, including the Beauty Rebalanced 2.0 Concepts Collection and the Sustainable Hair Care Collection, underscores the company's dedication to providing a comprehensive portfolio of sustainable and high-performance solutions in the personal care sector.

- The expansion initiatives of cosmetics manufacturers in the region are projected to create demand for different luxury packaging solutions made of plastic and paper. In March 2024, packaged consumer goods company Hindustan Unilever Ltd (HUL) intended to significantly expand its premium beauty business. The company planned to enhance its premiumization strategy by accelerating growth across its existing personal care brands, such as Tresemme and Lakme. This initiative came three years after the introduction of a range of digital-first brands, underscoring HUL's commitment to capturing a larger share of the premium beauty market.

Luxury Packaging Industry Overview

The luxury packaging market is fragmented, and the new players are expanding their businesses into emerging regions. The high rate of competitive rivalry among international and regional players intensifies the competition. Key players include Amcor PLC, HH Deluxe Packaging, and DS Smith PLC.

- In December 2023, Innovative Beauty Group's FASTEN Packaging company introduced Goodloop, its refillable and recyclable jar for cream products intended to combine luxury branding with sustainable progress. It is made of recycled PP and PET so that it can be fully recyclable. The pack constitutes a transparent outer jar and a curved inner portion, designed to provide a 'sleek' appearance.

- In October 2023, Wrapology, a London-based luxury packaging company that works with various high-profile, international, and emerging brands with a focus on design, was acquired by German carton and boxes specialist Carton Group. Through this acquisition, Carton Group planned to provide packaging solutions that not only surpass the functional requirements and expectations of its customers but also spark a strong emotional and promotional response from end consumers.

- In August 2023, in India, Ferrero Rocher Moments revamped its packaging strategy. The brand introduced pouches available in factory-packed hangsells and shelf-ready dispensers that are accessible across modern and traditional retail outlets, as well as on e-commerce platforms. This launch addressed consumer demands for self-consumption, sharing, and gifting. The new packaging preserved the premium essence and design elements of the classic Ferrero Rocher, utilizing gold-colored packaging and contemporary design patterns.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard

- 5.1.2 Demand for Travel and Retail Chains Due to Increase in Tourism

- 5.2 Market Restraints

- 5.2.1 Reluctance in Packaging Heavy and Bulk Products

- 5.2.2 High Initial and Operating Costs of Machineries

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Paperboard

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Other Material Types

- 6.2 By End User

- 6.2.1 Cosmetics and Fragrances

- 6.2.2 Confectionery

- 6.2.3 Watches and Jewelry

- 6.2.4 Premium Beverages

- 6.2.5 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Russia

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DS Smith PLC

- 7.1.2 Crown Holdings Inc.

- 7.1.3 Amcor PLC

- 7.1.4 WestRock Company

- 7.1.5 Owens-Illinois Inc.

- 7.1.6 International Paper Company

- 7.1.7 Ardagh Group

- 7.1.8 Delta Global

- 7.1.9 GPA Global

- 7.1.10 HH Deluxe Packaging

- 7.1.11 Prestige Packaging Industries

- 7.1.12 Pendragon Presentation Packaging

- 7.1.13 Stolzle Glass Group

- 7.1.14 Keenpac

- 7.1.15 Elegant Packaging

- 7.1.16 Lucas Luxury Packaging

- 7.1.17 Luxpac Ltd

- 7.1.18 McLaren Packaging Ltd

- 7.1.19 B Smith Packaging Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219