|

市場調查報告書

商品編碼

1683971

英國LED照明:市場佔有率分析、產業趨勢與成長預測(2025-2030年)UK LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

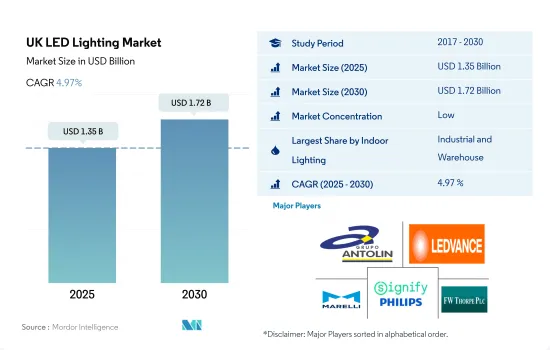

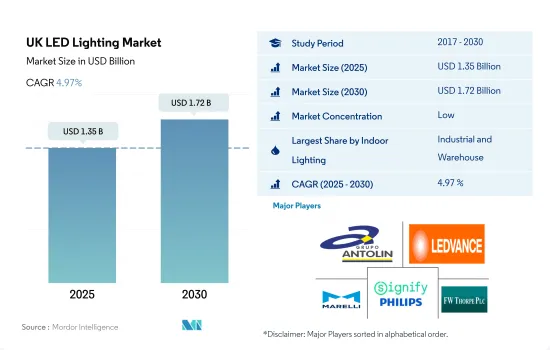

英國LED 照明市場規模預計在 2025 年為 13.5 億美元,預計到 2030 年將達到 17.2 億美元,預測期內(2025-2030 年)的複合年成長率為 4.97%。

工業生產的成長和對科技新興企業的投資推動了市場的成長

- 就金額佔有率而言,工業和倉儲(I&W)部門在 2023 年佔據最高市場佔有率(46.8%),其次是商業(33.8%)、住宅(19.2%)和農業。預計未來幾年 I&W 和住宅領域的市場佔有率將會成長。英國工業面臨許多內部和外部阻力,包括新冠疫情期間的晶片短缺、工廠關閉和供應鏈中斷。不過,該國 2021 年的工業生產保持穩定,產值達到 2,748.7 億美元,比 2020 年成長 16.57%。因此,工業生產的擴張可能會在未來幾年產生對室內照明的需求。

- 電動車、自動駕駛和網路連線技術等新技術得到了政府的支持,為該產業提供了巨大的推動力。預計這些因素將在預測期內推動室內 LED 的需求。 2023年4月,捷豹路虎宣布計劃在未來五年內向其英國製造工廠投資數十億美元,以增加電動車和軟性汽車的產量。

- 由於生活成本危機持續惡化,2023年5月英國零售下滑速度放緩。 2023年5月零售額成長0.3%,低於上個月0.5%的增幅。預計網路購物的激增將導致全國各地新倉庫的增加,從而增加對室內照明的需求。

- 英國的科技新興企業成長率令人矚目。光是 2021 年,英國科技新興企業就宣布了價值 241 億美元的股權交易。這些發展將會刺激商業領域的需求。預計這些因素將在未來幾年推動室內 LED 的需求。

英國LED照明市場趨勢

住宅房地產上漲可能推動LED市場成長

- 2021年,英格蘭人口為5650萬,出生兒童1.56萬。 2019 年至 2021 年下降了 0.1 個百分點。 2020 年,英國死亡率降至每 1,000 人 9.7 人,2021 年降至每 1,000 人 0.4 人(-3.96%)。在英國,人口成長和死亡率下降預計將推動對 LED 的需求。

- 英格蘭的住宅存量正在穩步成長,到 2021 年,住宅總數將達到約 2,500 萬套。截至 2022 年第二季度,在該國 71,400 套規劃住宅中,約有 44,500 套為待建出租住宅。英國住宅房地產市場在 2021 年蓬勃發展,但由於疫情,2022 年陷入低迷。 40,000 英鎊(50,475.20 美元)以上的交易數量從 2020 年的約 100 萬筆增加到 2021 年的 150 多萬筆,2022 年則增加到 130 多萬筆。隨著交易數量的預期增加,預計全國平均房價也將上漲。平均交易價格的上漲可能會鼓勵更多人在未來購買住宅,從而推動對 LED 的需求。

- 2021 年,英國擁有有效駕照的汽車數量為 32,889,462 輛。 2020年英國家庭平均擁有1.24輛。 2021年英國將擁有1,632,997輛電動車,比2014年增加6.9輛。截至年終,英國約有5%的汽車完全或部分由電力驅動。混合動力電動車是迄今為止最常見的,2021 年上路行駛的車輛數量為 932,335 輛。隨著汽車和電動車的增加,預計該國將使用更多的 LED。

人均收入的增加和政府推廣使用節能照明的政策可能會促進 LED 的使用。

- 2022年,英國家庭數量預計將達到1,940萬戶,比2012年的1,840萬戶增加5.7%。預計2022年英國家庭數將達2,820萬戶,較2012年(2,660萬戶)增加6.1%。因此,家庭數量和戶數的增加可能會增加該國對LED的需求。 2021年至2022年間,擁有房屋的家庭數量將達到1,560萬戶,佔全國所有家庭的64%。這一比例較 2016-2017 年的 63% 有所增加,但在 2020-2021 年保持不變。過去十年來,情況一直如此。英國的可支配收入很高,這導致個人消費能力上升,對新生活空間的支出增加。 2022 年 12 月,英國人均收入達到 33,138 美元,而 2021 年 12 月為 36,516.3 美元。與一些已開發國家相比,儘管英國人均收入較前一年有所下降,但 2021 年的購買力仍然較高。例如,截至 2021 年,巴西為 7,732.4 美元,法國為 25,337.7 美元。

- 住宅新屋開工量從 2022 年第三季的 43,140 套下降至 2022 年第四季的 39,220 套。儘管住宅計劃已經減少,但對 LED 的需求仍然存在。然而,住宅領域與上一季相比有所下降。政府宣布啟動節能照明新提案的諮詢。該提案將使用 LED 等低能耗照明取代老式鹵素燈泡,在燈泡的使用壽命內可節省 2,000 英鎊(2,523.76 美元)至 3,000 英鎊(3,785.64 美元)。預計此類案例將在未來提振該國對 LED 照明的需求。

英國LED照明產業概況

英國LED照明市場較為分散,前五大企業佔比為29.96%。市場的主要企業有:GRUPO ANTOLIN IRAUSA, SA、LEDVANCE GmbH(MLS)、Marelli Holdings、Signify(飛利浦)和Thorlux Lighting(FW Thorpe Plc)(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 汽車產量

- 人口

- 人均收入

- 汽車貸款利率

- 充電站數量

- 持有汽車數量

- LED進口總量

- 照明功耗

- #家庭數量

- 道路網路

- LED滲透率

- #體育場數量

- 園藝區

- 法律規範

- 室內照明

- 英國

- 戶外照明

- 英國

- 汽車照明

- 英國

- 室內照明

- 價值鏈與通路分析

第5章 市場區隔

- 室內照明

- 農業照明

- 商業照明

- 辦公室

- 零售

- 其他

- 工業/倉庫

- 住宅照明

- 戶外照明

- 公共設施

- 路

- 其他

- 汽車實用照明

- 日間行車燈 (DRL)

- 方向指示器

- 頭燈

- 倒車燈

- 紅綠燈

- 尾燈

- 其他

- 汽車照明

- 二輪車

- 商用車

- 搭乘用車

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ACUITY BRANDS, INC.

- Crompton Lamps Limited(GCH Corporation Limited)

- Dialight PLC

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA(FORVIA)

- LEDVANCE GmbH(MLS Co Ltd)

- Marelli Holdings Co., Ltd.

- OSRAM GmbH.

- Signify(Philips)

- Thorlux Lighting(FW Thorpe Plc)

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The UK LED Lighting Market size is estimated at 1.35 billion USD in 2025, and is expected to reach 1.72 billion USD by 2030, growing at a CAGR of 4.97% during the forecast period (2025-2030).

The growing industrial production and investments in technology startups driving the market's growth

- In terms of value share, in 2023, the industrial and warehouse (I&W) segment accounted for the highest market share (46.8%), followed by commercial (33.8%), residential (19.2 %), and agricultural. The market share of the I&W and residential segments is expected to grow in the coming years. UK industries faced several internal and external headwinds, such as chip crunch, plant closures, and supply chain disruptions during the COVID-19 pandemic. However, the country sustained its industrial production in 2021 and produced a total of USD 274.87 billion, a 16.57% increase over 2020. Thus, the growing industrial production will generate demand for indoor lighting in the coming years.

- New technologies such as EVs, as well as autonomous and connected technology, are supported by the government, which is a major boost to the industry. These will continue to boost the demand for indoor LEDs during the study period. In April 2023, Jaguar Land Rover announced plans to invest billions over the next five years in its UK manufacturing plants to ramp up EV and flexible production.

- As the cost-of-living crisis continued to worsen, UK retail sales declined at a slower pace in May 2023. Retail sales rose by 0.3% in May 2023 after growing by 0.5% in the previous month. The rapid increase in online shoppers is expected to boost new warehouses in the country, resulting in more demand for indoor lighting

- In the UK, technology startups have recorded a remarkable growth rate. In 2021 alone, USD 24.10 billion worth of announced equity deals were raised by UK technology startups, compared to USD 10.80 billion in 2020, a massive 123% surge. Such developments boost the demand in the commercial segment. These factors are expected to generate more demand for indoor LEDs over the coming years.

UK LED Lighting Market Trends

An increase in residential real estate may drive the growth of the LED market

- In 2021, there were 56.5 million people living in England, and 1.56 children were born in the country. There was a 0.1-point decrease from 2019 to 2021. In 2020, the death rate in the United Kingdom dropped to 9.7 fatalities per 1,000 people, which translated to a decrease of 0.4 fatalities per 1,000 people (-3.96%) in 2021. In the United Kingdom, the demand for LEDs is expected to increase due to population growth and a drop in the death rate.

- England's housing stock has steadily grown, reaching a total of about 25 million homes as of 2021. There were around 44,500 build-to-rent homes in the country's 71,400 planned residences as of the second quarter of 2022. The UK residential real estate market experienced a rise in activity in 2021 before seeing a dip in 2022 after stagnating due to the epidemic. The number of transactions with a value of at least GBP 40,000 (USD 50475.20) increased from about 1 million units in 2020 to over 1.5 million units in 2021 and 1.3 million units in 2022. The average property price is anticipated to rise across the country, along with the anticipated rise in transactions. As a result of the increase in average price transactions, more people will likely buy homes in the future, thus increasing the demand for LEDs.

- In the United Kingdom, there were 32,889,462 automobiles with valid licenses in 2021. English homes had an average of 1.24 vehicles in 2020. In the country, there were 1,632,997 electric vehicles in 2021, a 6.9 increase from 2014. About 5% of vehicles in the country were powered by electricity entirely or in part at the end of 2021. Hybrid electric vehicles are by far the most common, with 932,335 units on the road in 2021. More LEDs are expected to be used in the country as the number of vehicles and EVs increases.

Increasing per capita income and the government policy to roll out the use of energy-efficient lighting may boost the use of LEDs.

- In 2022, the number of UK families was projected to reach 19.4 million, an increase of 5.7% from 18.4 million in 2012. The expected number of households in the United Kingdom in 2022 was 28.2 million, 6.1% more than that in 2012 (26.6 million). Thus, the increasing number of families and households may create more demand for LEDs in the country. During 2021-2022, there were 15.6 million owner-occupied households, representing 64% of all households in the country. This percentage increased from 63% during 2016-2017 but remained constant during 2020-2021. It has been consistent throughout the past 10 years. The disposable income in the United Kingdom is high, resulting in rising spending power of individuals and more spending on new residential spaces. The country's per capita income reached USD 33,138.0 in December 2022 compared to USD 36,516.3 in December 2021. Compared to some developed nations, the United Kingdom had high purchasing power in 2021, even though per capita income decreased compared to the previous year. For instance, in Brazil, it was USD 7732.4, while in France, it was USD 25,337.7 as of 2021.

- Housing starts in the country decreased to 39,220 units in Q4 2022 from 43,140 units in Q3 2022. Even though housing projects declined, the demand for LEDs existed. However, it was less in the residential segment compared to previous quarters. The government announced the launch of a consultation on a new energy-efficient lighting proposal. Under this proposal, lighting such as low energy-use LEDs will be rolled out to replace old halogen bulbs, which could save households between GBP 2,000 (USD 2523.76) and GBP 3,000 (USD 3785.64) over the lifetime of the bulbs. Such instances are further expected to boost the demand for LED lighting in the country in the future.

UK LED Lighting Industry Overview

The UK LED Lighting Market is fragmented, with the top five companies occupying 29.96%. The major players in this market are GRUPO ANTOLIN IRAUSA, S.A., LEDVANCE GmbH (MLS Co Ltd), Marelli Holdings Co., Ltd., Signify (Philips) and Thorlux Lighting (FW Thorpe Plc) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 Lighting Electricity Consumption

- 4.9 # Of Households

- 4.10 Road Networks

- 4.11 Led Penetration

- 4.12 # Of Stadiums

- 4.13 Horticulture Area

- 4.14 Regulatory Framework

- 4.14.1 Indoor Lighting

- 4.14.1.1 United Kingdom

- 4.14.2 Outdoor Lighting

- 4.14.2.1 United Kingdom

- 4.14.3 Automotive Lighting

- 4.14.3.1 United Kingdom

- 4.14.1 Indoor Lighting

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Outdoor Lighting

- 5.2.1 Public Places

- 5.2.2 Streets and Roadways

- 5.2.3 Others

- 5.3 Automotive Utility Lighting

- 5.3.1 Daytime Running Lights (DRL)

- 5.3.2 Directional Signal Lights

- 5.3.3 Headlights

- 5.3.4 Reverse Light

- 5.3.5 Stop Light

- 5.3.6 Tail Light

- 5.3.7 Others

- 5.4 Automotive Vehicle Lighting

- 5.4.1 2 Wheelers

- 5.4.2 Commercial Vehicles

- 5.4.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 Crompton Lamps Limited (GCH Corporation Limited)

- 6.4.3 Dialight PLC

- 6.4.4 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.5 HELLA GmbH & Co. KGaA (FORVIA)

- 6.4.6 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.7 Marelli Holdings Co., Ltd.

- 6.4.8 OSRAM GmbH.

- 6.4.9 Signify (Philips)

- 6.4.10 Thorlux Lighting (FW Thorpe Plc)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms