|

市場調查報告書

商品編碼

1910546

LED照明:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031年)LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

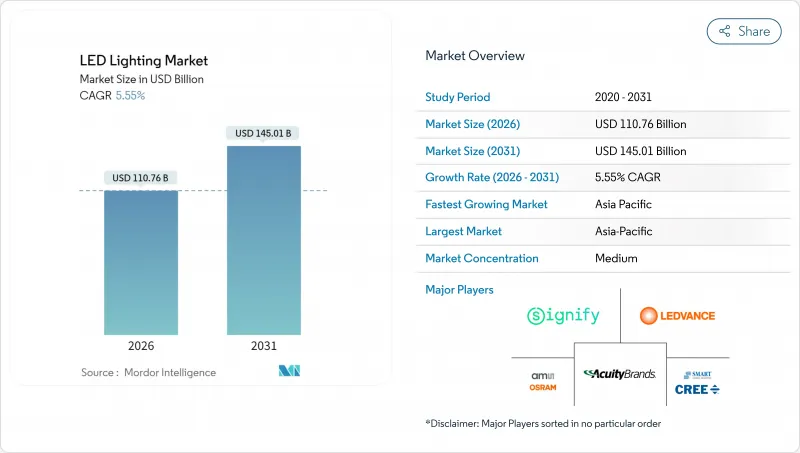

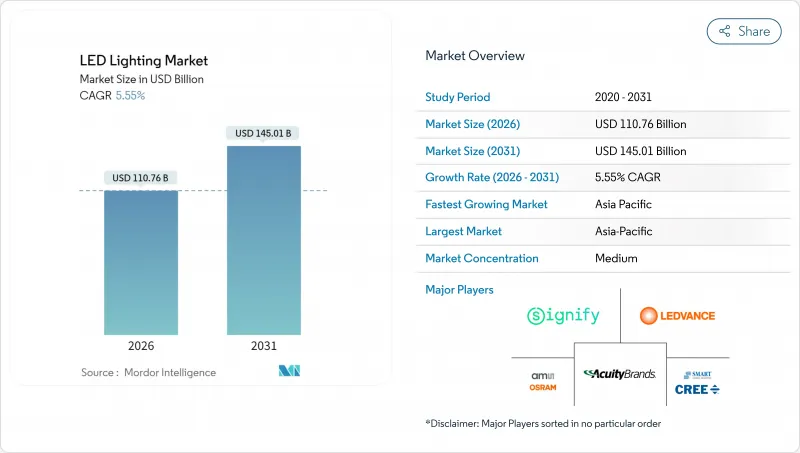

LED照明市場預計將從2025年的1,049.3億美元成長到2026年的1,107.6億美元,預計到2031年將達到1,450.1億美元,2026年至2031年的複合年成長率為5.55%。

這一轉變標誌著產業正從快速普及的早期階段過渡到穩定的、以替換為主導的階段,在這個階段,品質差異化和整合控制將決定競爭優勢。政府逐步淘汰低效率照明設備、2014年至2016年間安裝設備的二次更換需求以及智慧城市計畫的加速推進,都是關鍵的需求促進因素。將感測器、網路介面和附加價值服務與LED硬體整合的製造商,更有可能獲得大規模的合約和長期的客戶關係。同時,以三星計畫退出市場為代表的供應端整合,加劇了剩餘供應商之間的競爭,加速了爭奪銷售管道和維持利潤率的競賽。

全球LED照明市場趨勢與洞察

政府獎勵與逐步淘汰政策推動市場轉型

政策干預仍然是LED照明市場最強的驅動力。澳洲的《溫室氣體和能源最低標準條例》(2026年3月生效)提高了最低能源效率標準,並將白熾燈禁令延長至2030年,為製造商提供了明確的合規時間表,並降低了庫存積壓的風險。美國也呈現類似的趨勢,聯邦標準指導州和地方政府的採購,從而建立了可預測的大量採購管道。費城更換13.1萬個照明燈具(消費量降低50%,每年節省240萬美元)等城市規模的改造項目,已向其他城市證明了其合理性。這些政策確保只有符合標準的高品質燈具才能在市場上銷售,從而推高了平均售價,並使擁有強大認證組合的品牌受益。

智慧城市基礎建設加速LED普及

智慧城市投資正在將照明轉變為城市管理的數據基礎設施,從而提升每盞照明設備的戰略價值。米爾頓凱恩斯部署了2萬盞配備感測器的LED路燈,節能40%,並增加了交通和空氣品質監測功能。帕拉馬塔實現了65%的節能,並將照明節點整合到覆蓋全市的物聯網網路中,從而支援照明功能以外的產生收入服務。這些案例表明,LED照明市場正在從銷售商品產品轉向銷售具有長期服務合約和數據平台收入來源的多學科計劃。

高昂的初始成本限制了高階市場的擴張。

入門級和高階智慧燈具之間的價格差異依然顯著,這在對成本敏感的地區阻礙了其普及。雖然組件成本逐年下降,但可調頻譜、整合感測器和強大的溫度控管等先進功能仍然推高了組件成本。因此,LED照明市場呈現兩極化,基礎型號的競爭完全依賴價格,而高級產品則主打降低生命週期成本,但部分買家仍然低估了其價值。新興市場、中小企業以及資金有限的市政預算面臨著最為嚴峻的限制,減緩了高利潤率的智慧化和人性化產品的普及。

細分市場分析

2025年,燈具將佔LED照明銷售額的61.45%,這顯示消費者對整合光學元件、散熱器和控制系統的一體化設計需求旺盛。這項優勢使得能夠根據特定建築和工業規範開發產品的全套燈具供應商能夠獲得更大的LED照明市場佔有率。燈具品類平均售價高,更換週期長,有助於穩定製造商的現金流。同時,受住宅和輕型商業插座二次更換需求的推動,燈泡市場預計將以8.29%的複合年成長率成長。 Cree LED的XLamp XFL燈泡採用緊湊型機殼,亮度高達20,000流明,是燈泡技術創新的典範,為攜帶式照明提供了顯著的性能提升。

隨著二次更換趨勢的興起,對於那些希望快速提升照明性能而無需佈線或安裝天花板的業主來說,燈具變得更加重要。然而,在LED照明市場,那些整合網路控制功能並支援公用事業補貼申請流程的燈具製造商,透過增強客戶留存率,持續獲得競爭優勢。企業同時提供維修燈具和新型連網燈具的混合策略,能夠有效地滿足既注重預算又注重效能的客戶的需求。

到2025年,批發零售通路將佔據53.55%的市場佔有率,因為承包商和設施管理人員重視產品的即時可得性、技術指導和售後支援。該通路透過確保計劃進度並符合當地法規和規範,為LED照明市場奠定了基礎。然而,由於住宅消費者和小型企業擴大選擇直接送貨上門,預計到2031年,電子商務將以6.62%的複合年成長率實現最快成長。像哈維爾斯(Havells)這樣的製造商正在利用雙管道模式,在南卡羅來納州安德森開設庫存充足的倉庫,同時也與獨立的照明分銷商保持合作關係。

數位化購買流程利用標準化的產品目錄和豐富的多媒體內容,簡化了產品選擇流程。然而,對於複雜的商業維修,能夠提供光度佈局、返利協調和現場故障排除服務的批發商仍然具有優勢。因此,將線上配置器與本地取貨或快速配送相結合的全通路策略能夠觸及最廣泛的客戶群。

區域分析

亞太地區在2025年將以42.10%的收入佔有率引領LED照明市場,這主要得益於中國的大規模製造業和印度的基礎建設。印度政府的「UJALA」燈泡分發計畫和廣泛的智慧城市計畫等措施持續推動著市場需求,而本土製造商則利用其成本優勢為海外計劃供貨。預計到2031年,該地區將以7.58%的複合年成長率實現最高增速,這主要得益於加速的都市化、獎勵策略的建築需求以及人們對互聯照明生態系統日益成長的需求。來自韓國和日本元件製造商的高效晶片供應,使亞太地區的照明品牌能夠在性能和價格方面都具備全球競爭力。

北美地區仍保持強勁的市場地位,這得益於嚴格的節能標準、能源服務公司(ESCO)合約以及聯邦政府優先發展LED基礎設施的支出。各州政府的獎勵措施,加上市政永續性發展目標,正在推動路燈和公共設施中LED照明的快速普及。商業新建計劃正在部署智慧連網燈具以滿足居住者健康標準,而倉庫和物流設施也逐步採用高棚LED燈以降低營運成本。然而,供應鏈中斷在某些情況下導致計劃延期,迫使許多買家從多個供應商採購驅動器和晶片組。

在歐洲,《建築能源性能指令》和「維修浪潮」推動了成員國大規模的維修,並從中受益。公用事業收費和碳排放稅強化了LED升級的經濟合理性,而公共採購中的在地採購規則也有利於歐洲品牌。斯堪地那維亞的城市正在領先人性化的照明試點項目,並推廣可調光白光照明燈具的廣泛應用。同時,中東和非洲的進展並不均衡。雖然石油資源豐富的海灣國家正在投資建立智慧城市模式,但許多非洲國家仍專注於基礎電氣化,並依賴捐助者資助的LED部署。在拉丁美洲,公共照明專案的能源補貼和特許經營的減少,促進了基於績效的合約的採用,從而帶來了漸進式的進展。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 政府對白熾燈和節能燈的激勵措施和逐步淘汰計劃

- LED價格下降和效率提高

- 智慧城市基礎建設

- 商業建築和維修蓬勃發展

- 2014年至2016年間安裝的LED照明燈具的二次更換週期

- 人性化(晝夜節律)照明解決方案的興起

- 市場限制

- 高品質LED照明燈具的初始成本較高

- 在惡劣環境下對溫度和電壓敏感

- 大量劣質、低價進口商品湧入

- 關鍵供應商退出或併購導致供應鏈波動;

- 產業價值鏈分析

- 宏觀經濟因素的影響

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 燈

- 照明燈具/照明設備

- 透過分銷管道

- 直銷

- 批發/零售

- 電子商務

- 按安裝類型

- 新推出

- 維修工程

- 透過使用

- 銷售辦事處

- 零售店

- 飯店業

- 產業

- 高速公路和地方道路

- 建築學

- 公共場所

- 醫院

- 園藝花園

- 住宅

- 車

- 其他(化工、石油天然氣、農業)

- 最終用戶

- 室內的

- 戶外

- 車

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Signify NV

- ams OSRAM AG

- Acuity Brands Lighting Inc.

- Cree LED(SMART Global Holdings)

- LEDVANCE GmbH

- Zumtobel Group AG

- Nichia Corporation

- Seoul Semiconductor Co. Ltd.

- Everlight Electronics Co. Ltd.

- Dialight plc

- LSI Industries Inc.

- Havells India Ltd.

- Syska LED Lights Pvt. Ltd.

- Opple Lighting Co. Ltd.

- Yankon Group Co. Ltd.

- Fagerhult Group

- Current Lighting Solutions LLC

- Leedarson Lighting Co. Ltd.

- TOSPO Lighting Co. Ltd.

- MLS Co. Ltd.

- Hubbell Lighting Inc.

- Panasonic Corporation(Lighting)

- Bridgelux Inc.

- Valmont Industries(Lighting)

第7章 市場機會與未來展望

The LED lighting market is expected to grow from USD 104.93 billion in 2025 to USD 110.76 billion in 2026 and is forecast to reach USD 145.01 billion by 2031 at 5.55% CAGR over 2026-2031.

This trajectory illustrates the sector's transition from rapid early adoption to a stable, replacement-driven phase, where quality differentiation and integrated controls drive competitive success. Government phase-outs of inefficient lamps, a secondary replacement wave for installations completed between 2014 and 2016, and the acceleration of smart-city programs form the primary demand engines. Manufacturers that integrate LED hardware with sensors, network interfaces, and value-added services tend to secure larger contracts and longer customer relationships. Meanwhile, supply-side consolidation, illustrated by Samsung's planned exit, intensifies rivalry among remaining suppliers as they race to secure channel loyalty and defend margins.

Global LED Lighting Market Trends and Insights

Government Incentives and Phase-Outs Drive Market Transformation

Policy intervention remains the strongest accelerator for the LED lighting market. Australia's Greenhouse and Energy Minimum Standards regulation, effective March 2026, raises minimum efficacy thresholds and extends the incandescent ban through 2030, providing manufacturers with clear compliance schedules and mitigating the risk of stranded inventory. Similar dynamics in the United States, where federal standards guide state and municipal procurement, create predictable bulk-purchase pipelines. Citywide conversions such as Philadelphia's 131,000-fixture program, which delivered 50% energy savings and USD 2.4 million annual savings, prove the financial logic to other municipalities. These policies narrow the viable product spectrum to compliant, higher-quality lamps and luminaires, raising the average selling price and rewarding brands with strong certification portfolios.

Smart City Infrastructure Accelerates LED Adoption

Smart-city investments convert lighting into a data backbone for urban management, raising the strategic value of each luminaire. Milton Keynes' deployment of 20,000 sensor-enabled LED streetlights cut energy use by 40% while adding traffic and air-quality monitoring functions.Parramatta achieved 65% energy savings and integrated lighting nodes into city-wide IoT networks that support revenue-generating services beyond illumination. These examples illustrate how the LED lighting market is shifting from commodity product sales to multidisciplinary infrastructure projects that command long-term service contracts and data platform revenue streams.

High Upfront Costs Limit Premium Segment Penetration

Price differentials between entry-level lamps and premium connected luminaires remain sizeable, deterring adoption in cost-sensitive regions. Although component costs decline annually, advanced features such as tunable spectra, integrated sensors, and robust thermal management add to the bill-of-materials pressure. The result is a bifurcated LED lighting market where basic models compete purely on price, while premium offerings rely on lifecycle savings narratives that some buyers still discount. Emerging markets, small businesses, and municipal budgets with limited capital face the sharpest constraints, resulting in slower penetration of high-margin smart and human-centric products.

Other drivers and restraints analyzed in the detailed report include:

- Commercial Construction Boom Fuels Retrofit Demand

- Secondary Replacement Cycle Creates Sustained Demand

- Supply Chain Consolidation Creates Market Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Luminaires captured 61.45% of 2025 revenue, demonstrating how buyers prefer integrated form factors that combine optics, heat sinks, and controls. This dominance has increased the market share of full-fixture vendors in the LED lighting market, which can tailor products to meet specific architectural and industrial specifications. The luminaire category commands higher average selling prices and longer replacement intervals, stabilizing cash flows for manufacturers. Meanwhile, the lamp segment is expected to expand at an 8.29% CAGR, driven by the secondary replacement wave in residential and light-commercial sockets. Cree LED's XLamp XFL, delivering up to 20,000 lumens in compact footprints, exemplifies lamp innovation that supplies specific performance gains for portable lighting.

The secondary replacement trend elevates lamps as owners seek quick performance upgrades without the need for rewiring or ceiling work. Nonetheless, the LED lighting market continues to reward luminaire makers that integrate networked controls and support utility rebate paperwork, deepening customer lock-in. Hybrid strategies, in which firms offer retrofit lamps alongside new connected fixtures, help address both budget-driven and feature-seeking buyers.

Wholesale and retail outlets held a 53.55% share in 2025 because contractors and facility managers rely on immediate product availability, technical guidance, and after-sales support. This channel anchors the LED lighting market by safeguarding project timelines and ensuring compliance with local codes and specifications. E-commerce, however, is on track for the fastest 6.62% CAGR through 2031, as residential consumers and small businesses increasingly adopt direct-to-door fulfillment. Manufacturers such as Havells tapped a dual-channel model by opening a fully stocked warehouse in Anderson, South Carolina, while maintaining relationships with independent lighting agents.

Digital purchase journeys capitalize on catalog standardization and rich media content that demystify the product selection process. Yet complex commercial retrofits still favor wholesalers who provide photometric layouts, rebate coordination, and on-site troubleshooting. Consequently, omni-channel strategies that blend online configurators with local pickup or rapid delivery serve the broadest customer base.

The LED Lighting Market Report is Segmented by Product Type (Lamps, and Luminaires/Fixtures), Distribution Channel (Direct Sales, Wholesale/Retail, and More), Installation Type (New Installation, and Retrofit Installation), Application (Commercial Offices, Retail Stores, and More), End User (Indoor, Outdoor, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region led the LED lighting market, accounting for a 42.10% revenue share in 2025, driven by China's large-scale manufacturing and India's infrastructure development. Government schemes such as India's UJALA bulb distribution and widespread smart-city programs propel continuous demand, while domestic producers leverage cost advantages to supply foreign projects. The region is also expected to exhibit the fastest growth, with a 7.58% CAGR to 2031, underpinned by accelerating urbanization, stimulus-backed construction, and a growing preference for connected lighting ecosystems. Korean and Japanese component firms contribute high-efficacy chips, allowing regional fixture brands to compete globally on both performance and price.

North America maintains a robust position through stringent energy codes, ESCO contracting, and federal infrastructure spending that prioritizes LED conversions. State-level incentives combined with municipal sustainability targets drive high penetration in streetlights and public facilities. Commercial new-build projects integrate networked luminaires to meet occupant-wellness standards, while warehousing and logistics facilities migrate to high-bay LEDs for operational savings. Supply-chain disruptions, however, cause occasional project delays, prompting many buyers to dual-source drivers and chip packages.

Europe benefits from the Energy Performance of Buildings Directive and the Renovation Wave that compel deep retrofits across member states. Utility tariffs and carbon taxes strengthen the economic case for LED upgrades, and local content rules favor European brands for public tenders. Scandinavian cities are spearheading human-centric lighting pilots, advancing the adoption of tunable white fixtures. Conversely, the Middle East and Africa exhibit heterogeneous development; oil-rich Gulf states invest in smart-city showcase projects, while many African nations focus on basic electrification and rely on donor-funded LED rollouts. Latin America is experiencing gradual progress as energy subsidies decline and public lighting concessions encourage the adoption of performance-based contracting.

- Signify N.V.

- ams OSRAM AG

- Acuity Brands Lighting Inc.

- Cree LED (SMART Global Holdings)

- LEDVANCE GmbH

- Zumtobel Group AG

- Nichia Corporation

- Seoul Semiconductor Co. Ltd.

- Everlight Electronics Co. Ltd.

- Dialight plc

- LSI Industries Inc.

- Havells India Ltd.

- Syska LED Lights Pvt. Ltd.

- Opple Lighting Co. Ltd.

- Yankon Group Co. Ltd.

- Fagerhult Group

- Current Lighting Solutions LLC

- Leedarson Lighting Co. Ltd.

- TOSPO Lighting Co. Ltd.

- MLS Co. Ltd.

- Hubbell Lighting Inc.

- Panasonic Corporation (Lighting)

- Bridgelux Inc.

- Valmont Industries (Lighting)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government incentives and phase-outs of incandescent/CFL lighting

- 4.2.2 Falling LED prices and efficiency gains

- 4.2.3 Smart-city infrastructure roll-outs

- 4.2.4 Commercial construction and retrofit boom

- 4.2.5 Secondary replacement cycle for 2014-2016 LED installs

- 4.2.6 Rise of human-centric (circadian) lighting solutions

- 4.3 Market Restraints

- 4.3.1 High upfront cost of quality LED luminaires

- 4.3.2 Thermal/voltage sensitivity in harsh environments

- 4.3.3 Influx of sub-standard low-cost imports

- 4.3.4 Supply-chain volatility after major vendor exits and M&A

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Lamps

- 5.1.2 Luminaires / Fixtures

- 5.2 By Distribution Channel

- 5.2.1 Direct Sales

- 5.2.2 Wholesale / Retail

- 5.2.3 E-commerce

- 5.3 By Installation Type

- 5.3.1 New Installation

- 5.3.2 Retrofit Installation

- 5.4 By Application

- 5.4.1 Commercial Offices

- 5.4.2 Retail Stores

- 5.4.3 Hospitality

- 5.4.4 Industrial

- 5.4.5 Highway and Roadway

- 5.4.6 Architectural

- 5.4.7 Public Places

- 5.4.8 Hospitals

- 5.4.9 Horticulture Gardens

- 5.4.10 Residential

- 5.4.11 Automotive

- 5.4.12 Others (Chemicals, Oil and Gas, Agriculture)

- 5.5 By End User

- 5.5.1 Indoor

- 5.5.2 Outdoor

- 5.5.3 Automotive

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.4.1 UAE

- 5.6.4.5 South-East Asia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Signify N.V.

- 6.4.2 ams OSRAM AG

- 6.4.3 Acuity Brands Lighting Inc.

- 6.4.4 Cree LED (SMART Global Holdings)

- 6.4.5 LEDVANCE GmbH

- 6.4.6 Zumtobel Group AG

- 6.4.7 Nichia Corporation

- 6.4.8 Seoul Semiconductor Co. Ltd.

- 6.4.9 Everlight Electronics Co. Ltd.

- 6.4.10 Dialight plc

- 6.4.11 LSI Industries Inc.

- 6.4.12 Havells India Ltd.

- 6.4.13 Syska LED Lights Pvt. Ltd.

- 6.4.14 Opple Lighting Co. Ltd.

- 6.4.15 Yankon Group Co. Ltd.

- 6.4.16 Fagerhult Group

- 6.4.17 Current Lighting Solutions LLC

- 6.4.18 Leedarson Lighting Co. Ltd.

- 6.4.19 TOSPO Lighting Co. Ltd.

- 6.4.20 MLS Co. Ltd.

- 6.4.21 Hubbell Lighting Inc.

- 6.4.22 Panasonic Corporation (Lighting)

- 6.4.23 Bridgelux Inc.

- 6.4.24 Valmont Industries (Lighting)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment