|

市場調查報告書

商品編碼

1911807

歐洲LED照明:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031年)Europe LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

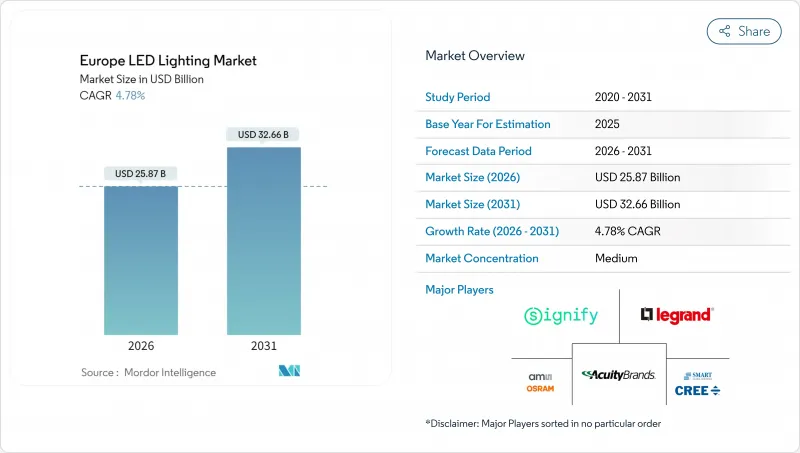

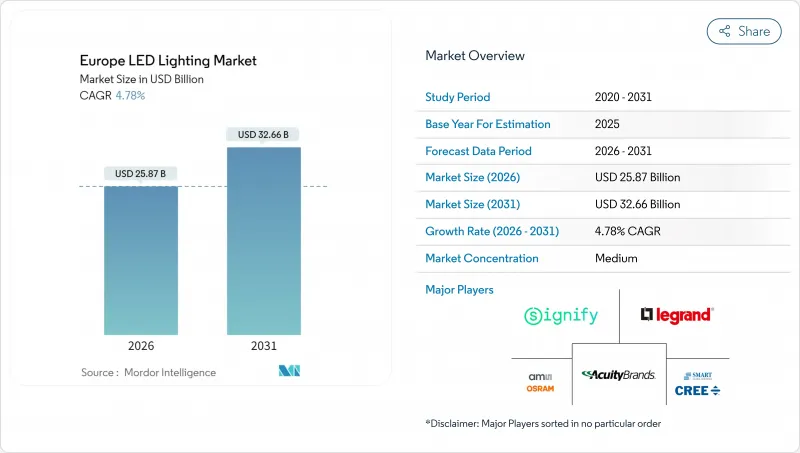

2025年歐洲LED照明市場價值為246.9億美元,預計到2031年將達到326.6億美元,高於2026年的258.7億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 4.78%。

這種成長反映了一個成熟的、以更新換代為主導的周期,在這個週期中,監管合規和永續性目標優先於純粹的技術創新。歐盟範圍內的能源效率強制令、鹵素燈和螢光的逐步淘汰以及企業的淨零排放藍圖將維持對維修的高需求,而每流明成本的下降和智慧城市競標將擴大新安裝的機會。現有供應商將利用安裝服務、互聯照明平台和循環經濟設計來保護其市場佔有率,而電子商務管道正在降低利基市場新進入者的進入門檻。與稀土元素磷光體相關的供應鏈風險以及生態設計和廢棄電子電氣設備指令(WEEE)義務帶來的行政負擔將限制短期成長潛力,同時阻礙潛在的新競爭者,並穩定大型企業的利潤率。

歐洲LED照明市場趨勢與分析

歐盟嚴格的能源效率法規

將於2024年7月生效的《永續產品生態設計法規》(ESPR)將重塑採購模式,優先選擇具備LED技術固有特性的產品,例如低能耗、長壽命和高可修復性。計劃於2027年實施的數位化產品護照將要求製造商記錄其環境足跡,這將加重傳統照明設備的合規負擔,並促使供應商更加青睞已公佈生命週期數據的成熟LED品牌。該法規還禁止從2026年起處置未售出的產品,迫使經銷商改善庫存管理並迅速清理不合規庫存。公共部門資金將透過諸如義大利國家復甦與韌性計畫等舉措,重點用於支持合規照明設備。該計畫撥款555.2億歐元(約627.4億美元)用於能源轉型計劃。

快速淘汰鹵素燈和螢光

歐盟和英國的法規正迫使傳統燈具退出市場,迫使各設施無論預算週期如何都必須過渡到LED照明。北歐國家製定了最嚴格的淘汰期限,引發了區域訂單激增,庫存充足的供應商從中受益。整合式LED燈具通常會取代整個機殼,儘管銷量穩定,但會推高單位成本,從而推高平均售價。提供承包安裝服務的製造商正利用監管合規的緊迫性,捆綁銷售維護契約,以提高客戶留存率。

中小企業價格敏感型維修的投資回收期

如果節能效果無法在兩年內收回資本支出,中小企業就會推遲升級改造,這導致儘管監管期限臨近,維修規模仍然不足。績效合約模式,例如丹麥的Lumega計劃,雖然免除了前期成本,但其設定的資格要求卻阻礙了申請,使得相當一部分已安裝照明設備的用戶仍然依賴過時的照明系統。

細分市場分析

預計到2025年,燈具類產品將佔據歐洲LED照明市場62.10%的佔有率,這主要得益於市場對整合了光引擎、光學元件和控制系統的全工程化燈具的需求。平均售價的上漲和企劃為基礎的安裝服務推動了該細分市場的收入成長。雖然燈泡絕對值小規模,但預計到2031年將以7.45%的複合年成長率成長,這主要得益於成本下降和智慧燈泡功能推動的維修需求。軌道燈和緊急照明燈具正被廣泛應用於商業辦公場所,以滿足保險法規對合規燈具的要求。循環經濟設計,例如LEDVANCE的EVERLOOP系列,展示了可更換模組如何延長產品壽命並滿足ESPR的可維修性要求。

就銷量而言,燈具出貨量成長更為迅速,因為更換燈具無需佈線,更符合中小企業的融資需求。同時,照明計劃通常與建築管理系統整合,產生資料流,設施管理人員可以透過入住率分析將其變現。這一服務層支援高價位,並降低了在日益同質化的硬體市場中利潤率下降的風險。

到2025年,批發和零售網路將保持在歐洲LED照明市場51.70%的佔有率,這主要得益於電氣承包商優先考慮物流整合和售前設計支援。同時,電子商務正以5.75%的複合年成長率快速成長,滿足了那些重視價格透明和快速交付的中小型企業的需求。製造商目前正在部署混合模式;例如,宜家將線上訂購其Jetstrom智慧面板與店內安裝支援相結合。由於大型計劃需要現場審核和客製化照明設計,直銷仍然十分重要。

數位平台上的價格透明化正在擠壓經銷商的利潤空間,同時為供應商提供即時需求數據並提高預測準確性。為了應對這項挑戰,經銷商正尋求透過增加多層附加價值服務來保障自身生存,例如現場試運行和保固管理。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟嚴格的能源效率法規

- 快速淘汰鹵素燈和螢光

- 企業淨零排放目標推動維修

- 降低LED每流明成本

- 現場可再生能源+直流微電網安裝

- 智慧城市競標項目,融合物聯網感測器

- 市場限制

- 中小企業價格敏感型維修的投資回收期

- 稀土元素磷光體供應鏈的可變性

- 歐盟生態設計/符合WEEE(廢棄電子電氣設備)指令的複雜性

- 互聯照明系統熟練安裝人員短缺

- 產業價值鏈分析

- 宏觀經濟因素的影響

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 燈

- 照明燈具/照明設備

- 透過分銷管道

- 直銷

- 批發/零售

- 電子商務

- 按安裝類型

- 新安裝

- 維修和安裝

- 透過使用

- 商業辦公

- 零售店

- 飯店業

- 產業

- 高速公路/普通道路

- 建築學

- 公共設施

- 醫院

- 園藝和花園

- 住宅

- 車

- 其他(化工、石油天然氣、農業)

- 最終用戶

- 室內的

- 戶外

- 車

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 瑞典

- 波蘭

- 俄羅斯

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Signify NV

- Zumtobel Group AG

- Osram Licht AG(ams-Osram)

- Schreder SA

- Fagerhult Group

- Acuity Brands Lighting Inc.

- Havells Sylvania Europe Ltd.

- Legrand SA

- Eaton Corporation plc(Cooper Lighting)

- TRILUX GmbH and Co. KG

- Thorn Lighting Ltd.

- FW Thorpe Plc

- LEDVANCE GmbH

- Helvar Oy Ab

- iGuzzini illuminazione SpA

- Glamox AS

- Cree Lighting Europe SpA

- ITECH LED Lighting

- Hella GmbH and Co. KGaA

- Nichia Europe GmbH

- Samsung Electronics Europe(LED business)

- LG Innotek Europe GmbH

- Valmont Industries(EU lighting poles)

- Opple Lighting Europe BV

第7章 市場機會與未來展望

The European LED lighting market was valued at USD 24.69 billion in 2025 and estimated to grow from USD 25.87 billion in 2026 to reach USD 32.66 billion by 2031, at a CAGR of 4.78% during the forecast period (2026-2031).

Growth reflects a mature, replacement-led cycle in which regulatory compliance and sustainability targets take precedence over the novelty of pure technology. EU-wide energy-efficiency mandates, phase-outs of halogen and fluorescent light bulbs, and corporate net-zero roadmaps keep retrofit momentum high, while falling costs per lumen and smart-city tenders expand new-installation opportunities. Incumbent suppliers capitalize on installation services, connected-lighting platforms, and circular-economy designs to defend share, though e-commerce channels lower barriers for niche entrants. Supply-chain risks surrounding rare-earth phosphors and the administrative burden of eco-design and WEEE obligations temper the near-term upside but also deter potential new competitors, keeping margins stable for scale players.

Europe LED Lighting Market Trends and Insights

Stringent EU Energy-Efficiency Regulations

The Ecodesign for Sustainable Products Regulation (ESPR), which took legal effect in July 2024, reshapes procurement by rewarding products with low energy use, long service life, and high repairability -attributes inherent to LED technology. Digital Product Passports, set for 2027, require manufacturers to document their environmental footprints, thereby increasing the compliance burden for legacy luminaires and strengthening supplier preference for established LED brands that already publish lifecycle data. The regulation also bans the destruction of unsold goods after 2026, compelling distributors to refine their inventory management and accelerate the clearance of non-compliant stock. Public-sector funding funnels into compliant lighting via instruments such as Italy's National Recovery and Resilience Plan, which allocated EUR 55.52 billion (USD 62.74 billion) for energy transition projects.

Rapid Phase-Out of Halogen and Fluorescent Lamps

EU and UK restrictions eliminate legacy lamps from circulation, obliging facilities to adopt LEDs regardless of budget cycles. Nordic countries enforce the shortest sunset dates and have triggered regional spikes in purchase orders that favor suppliers with well-stocked warehouses. Because integrated LED luminaires often replace entire housings, unit revenues rise even as unit counts remain stable, thereby lifting average selling prices. Manufacturers equipped with turnkey installation services capitalize on the urgency of compliance to bundle maintenance contracts, thereby deepening account lock-in.

Price-Sensitive Retrofit Payback Period in SMEs

Small enterprises defer upgrades when energy savings do not repay capital outlays within two years, thereby slowing retrofit volumes, even in the face of looming regulatory deadlines. Performance-contracting models, such as Denmark's Lumega scheme, remove upfront costs but impose qualification hurdles that discourage applicants, leaving a sizable portion of the installed base reliant on outdated lighting.

Other drivers and restraints analyzed in the detailed report include:

- Corporate Net-Zero Commitments Driving Retrofits

- Falling LED Cost per Lumen

- Supply-Chain Volatilities for Rare-Earth Phosphors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The luminaires category secured 62.10 of % European LED lighting market share in 2025 through demand for fully engineered fixtures that merge light engines, optics, and controls. Segment revenues benefit from higher average selling prices and project-based installation services. Lamps, although smaller in absolute terms, are forecast to grow at a 7.45% CAGR to 2031 as costs decline and smart bulb features unlock retrofit spending. Track lighting and emergency luminaires are adopted in commercial offices where insurance regulations mandate compliant fittings. Circular-economy designs, such as LEDVANCE's EVERLOOP series, highlight how replaceable modules extend life cycles and satisfy ESPR repairability requirements.

In volume terms, lamp shipments rise faster because replacement work requires no rewiring, fitting SME cash-flow constraints. However, luminaire projects often integrate with building management systems, yielding data streams that facility managers monetize through occupancy analytics. This services layer supports premium pricing, reducing the risk of margin compression in an otherwise commoditized hardware landscape.

The wholesale and retail network maintained a 51.70% market share of the European LED lighting market in 2025, driven by electrical contractors who prefer bundled logistics and pre-sale design assistance. Yet e-commerce is expanding at a 5.75% CAGR, serving SMEs that value transparent pricing and rapid delivery. Manufacturers now deploy hybrid models; for instance, IKEA pairs online ordering of its JETSTROM smart panels with in-store support for configuration. Direct sales remain essential for large projects requiring site audits and bespoke photometric design.

Price transparency on digital platforms compresses distributor spreads while also providing suppliers with real-time demand data, thereby improving forecasting accuracy. Distributors respond by layering value-added services, such as on-site commissioning and warranty management, to protect their relevance.

The Europe LED Lighting Market Report is Segmented by Product Type (Lamps, and Luminaires/Fixtures), Distribution Channel (Direct Sales, Wholesale/Retail, and More), Installation Type (New Installation, and Retrofit Installation), Application (Commercial Offices, Retail Stores, and More), End User (Indoor, Outdoor, and More), and Country (United Kingdom, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Signify N.V.

- Zumtobel Group AG

- Osram Licht AG (ams-Osram)

- Schreder SA

- Fagerhult Group

- Acuity Brands Lighting Inc.

- Havells Sylvania Europe Ltd.

- Legrand S.A.

- Eaton Corporation plc (Cooper Lighting)

- TRILUX GmbH and Co. KG

- Thorn Lighting Ltd.

- FW Thorpe Plc

- LEDVANCE GmbH

- Helvar Oy Ab

- iGuzzini illuminazione S.p.A.

- Glamox AS

- Cree Lighting Europe S.p.A.

- ITECH LED Lighting

- Hella GmbH and Co. KGaA

- Nichia Europe GmbH

- Samsung Electronics Europe (LED business)

- LG Innotek Europe GmbH

- Valmont Industries (EU lighting poles)

- Opple Lighting Europe B.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent EU energy-efficiency regulations

- 4.2.2 Rapid phase-out of halogen and fluorescent lamps

- 4.2.3 Corporate net-zero commitments driving retrofits

- 4.2.4 Falling LED cost per lumen

- 4.2.5 On-site renewable + DC micro-grids adoption

- 4.2.6 Smart-city tenders bundling IoT sensors

- 4.3 Market Restraints

- 4.3.1 Price-sensitive retrofit payback period in SMEs

- 4.3.2 Supply-chain volatilities for rare-earth phosphors

- 4.3.3 Complexity of EU eco-design / WEEE compliance

- 4.3.4 Lack of skilled installers for connected lighting systems

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Lamps

- 5.1.2 Luminaires / Fixtures

- 5.2 By Distribution Channel

- 5.2.1 Direct Sales

- 5.2.2 Wholesale / Retail

- 5.2.3 E-commerce

- 5.3 By Installation Type

- 5.3.1 New Installation

- 5.3.2 Retrofit Installation

- 5.4 By Application

- 5.4.1 Commercial Offices

- 5.4.2 Retail Stores

- 5.4.3 Hospitality

- 5.4.4 Industrial

- 5.4.5 Highway and Roadway

- 5.4.6 Architectural

- 5.4.7 Public Places

- 5.4.8 Hospitals

- 5.4.9 Horticulture Gardens

- 5.4.10 Residential

- 5.4.11 Automotive

- 5.4.12 Others (Chemicals, Oil and Gas, Agriculture)

- 5.5 By End User

- 5.5.1 Indoor

- 5.5.2 Outdoor

- 5.5.3 Automotive

- 5.6 By Country

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Netherlands

- 5.6.7 Sweden

- 5.6.8 Poland

- 5.6.9 Russia

- 5.6.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Signify N.V.

- 6.4.2 Zumtobel Group AG

- 6.4.3 Osram Licht AG (ams-Osram)

- 6.4.4 Schreder SA

- 6.4.5 Fagerhult Group

- 6.4.6 Acuity Brands Lighting Inc.

- 6.4.7 Havells Sylvania Europe Ltd.

- 6.4.8 Legrand S.A.

- 6.4.9 Eaton Corporation plc (Cooper Lighting)

- 6.4.10 TRILUX GmbH and Co. KG

- 6.4.11 Thorn Lighting Ltd.

- 6.4.12 FW Thorpe Plc

- 6.4.13 LEDVANCE GmbH

- 6.4.14 Helvar Oy Ab

- 6.4.15 iGuzzini illuminazione S.p.A.

- 6.4.16 Glamox AS

- 6.4.17 Cree Lighting Europe S.p.A.

- 6.4.18 ITECH LED Lighting

- 6.4.19 Hella GmbH and Co. KGaA

- 6.4.20 Nichia Europe GmbH

- 6.4.21 Samsung Electronics Europe (LED business)

- 6.4.22 LG Innotek Europe GmbH

- 6.4.23 Valmont Industries (EU lighting poles)

- 6.4.24 Opple Lighting Europe B.V.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment