|

市場調查報告書

商品編碼

1644640

亞太倉庫自動化-市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia Pacific Warehouse Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

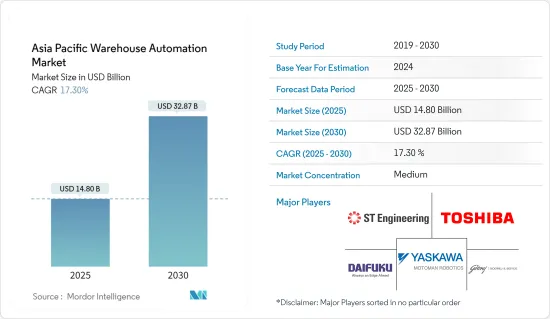

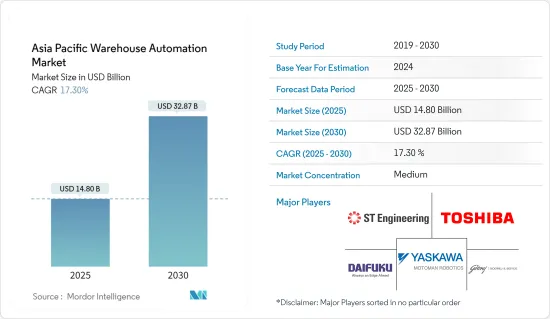

亞太地區倉庫自動化市場規模預計在 2025 年為 148 億美元,預計到 2030 年將達到 328.7 億美元,預測期內(2025-2030 年)的複合年成長率為 17.3%。

新冠疫情對中國、日本和印度等主要經濟體造成了嚴重破壞,預計將影響未來幾年的市場成長。在亞太地區,大量投資正在影響電子商務產業滾筒輸送機的興起以及越來越多的網路消費者的需求。

此外,隨著對該行業的大量投資,製造業預計將佔據相當大的市場佔有率,並成為該國的主要貢獻者之一。在短時間內交付各種產品的需求日益成長,這就要求有高效率的庫存管理和逆向物流系統。

關鍵亮點

- 亞太地區倉庫自動化市場的成長情況在印度、中國、澳洲、韓國、日本和亞洲其他地區均有考察。中國作為世界領先經濟體之一,正在持續開發和部署倉庫機器人。預計中國將佔據主要市場佔有率。由於自動化程度高、知名供應商的存在以及倉庫機器人的廣泛使用,中國對倉庫機器人的需求很高。

- 製造業、零售業和快速消費品產業的崛起繼續推動亞太地區對工業自動化解決方案的需求。穿梭搜尋系統、自動化倉庫和移動機器人平台的數量大幅增加。隨著倉儲和工業的組織參與,全部區域的工業和貨運路線正在興起。

- 此外,根據 Zebra Technologies 進行的 2022 年倉庫願景調查,該研究對澳洲、中國、印度、日本和新加坡的 1,500 多名倉庫決策者和同事進行了調查。根據調查,包括亞太地區在內的全球27%的倉庫業者已經採用了自主移動機器人(AMR)。預計未來五年,亞太地區將上升至 92%,國際上這一數字將上升至 90%。

- 雖然大多數倉庫將採用 AMR 進行 P2G 揀選、物料轉移和其他自動化庫存移動,但更多的倉庫也將投資軟體來實現分析和決策的自動化。在亞太地區,95%的決策者打算投資此類軟體,以提高勞動效率和效力,同時降低人事費用,略高於全球平均(94%)。

- 此外,在新冠疫情爆發後,該地區的公司正紛紛在全部區域採用倉庫自動化。總部位於上海的移動工業機器人公司表示,其自主機器人可以在倉庫和工廠內移動托盤和大件貨物,在各行各業都很受歡迎。空中巴士、Flex、霍尼韋爾和 DHL 是需求成長的主要貢獻者。

亞太倉庫自動化市場趨勢

自動導引運輸車(AGV) 預計將大幅成長

- 移動機器人的主要應用是作為倉庫和儲存設施中的移動自動導引運輸車(AGV) 在亞太地區運輸貨物。這些機器人按照預先設定的路線,每週 7 天、每天 24 小時移動物品進行運輸或存放。 AGV 對於降低物流成本和簡化供應鏈至關重要。

- 除補貨和揀貨外,AGV還用於入境和出站處理。例如,AGV 用於將庫存從接收地點運送到儲存地點或從長期儲存地點運送到揀選地點以補充庫存。將庫存從長期倉庫轉移到揀選地點可確保揀選人員有足夠的庫存,從而實現更有效率的揀貨流程。

- 亞太地區倉儲業正在不斷發展,不斷提高自動化程度和最佳化手動任務,以降低成本並提高利潤。倉庫工人應該將他們的人類智慧應用於更高附加價值的活動中,而機器人則提高效率並減少浪費以實現順暢的流程。

- 例如,2020 年 9 月,GreyOrange 宣布了一項技術專利,該技術對於幫助公司實現高產量比率的履約並透過多層次營運能力最大限度地提高設施空間利用率至關重要。專利包括「先填先得」技術、零售就緒履行技術和多層機器人移動技術。

- 機器人技術對於多個最終用戶的盈利來說已經變得至關重要。 AMR 之所以處於領先地位,是因為它們對於快速、安全、無誤交付、加快上市速度、降低成本和端到端可追溯性至關重要。自主移動機器人 (AMR) 與自主地面車輛 (AGV) 的差異在於自主程度。

- DHL 於 2021 年 10 月在新加坡開設了亞太研發中心,作為新展覽的展示平台,展示尖端、自動化和完全整合的電子商務系統。 Geek+ 宣布與 DHL 合作,在其亞太研發中心展示該公司的一些最偉大的發明。 Geek+ 和 DHL 展示了倉庫機器人自動化的未來。

印度可望見證亞太倉庫自動化市場的強勁成長

- 印度的倉儲產業正在經歷重大變革時期,以跟上不斷發展的製造業和龐大的物流業的步伐。預計倉儲業將從商品及服務稅的實施和房地產投資中受益匪淺。預計商品及服務稅將確保印度首次出現擁有中央倉儲園區的廣大綜合區域,而非目前分散的獨立設施。

- 此外,隨著印度電子商務的普及,倉儲業業務呈指數級成長。這種快速擴張帶來了許多新的障礙。運輸延誤、經驗豐富的勞動力短缺以及其他因素促使相關人員不再局限於傳統策略,而是轉向機器人自動化系統。

- 例如,電子商務巨頭亞馬遜計劃在印度投資 50 億美元,專注於建造該國的自動化倉庫。我們開設了多家新倉庫以滿足不同客戶的需求。亞馬遜是首批在倉庫中嘗試部署機器人的印度公司之一。

- 此外,印度的倉儲格局正在發生變化,自動化程度更高,手動任務更最佳化,以降低成本並提高利潤。倉庫工人應該將他們的人類智慧用於更高附加價值的活動,而機器人則進行效率映射和減少浪費以實現順暢的流程。機器人技術對於提高多個最終用戶的盈利至關重要。

- 印度以倉庫自動化聞名的公司 Atmos Systems 於 2021 年 12 月宣布推出 Atmos A42N,這是一款自主箱體處理機器人 (ACR) 系統,可大幅提高倉庫出入庫效率。該系統具有許多易於使用的功能,並允許倉庫位置具有更大的靈活性。

亞太地區倉庫自動化產業概況

亞太地區倉庫自動化市場競爭適中且細分化,許多全球和地區參與企業佔據了相當大的市場佔有率。為了保持市場佔有率,公司可能會不斷創新並形成策略聯盟。 ST Engineering、東芝全球、安川電機株式會社(Yaskawa Motoman)、大福、Grey Orange、Godrej Consoveyo Logistics Automation Ltd.(GCLA)等引領倉庫自動化市場。 (GCLA)是該市場的重要參與企業。

- 2022 年 5 月-物流自動化公司 SYNUS Tech 和首個面向現代商業的 3D 機器人供應鏈系統供應商 Attabotics 今天建立了獨家合作關係,為韓國市場提供綜合物流系統倉庫解決方案。在 Attabotics 等合作夥伴的幫助下,SYNUS Tech 在韓國率先開發智慧工業解決方案並將 AI 融入倉庫。

- 2022 年 2 月—印度 Addverb Technologies 將以 1.32 億美元收購其倉庫機器人系列,並將其推向北美市場。 Addverb 憑藉自動化機器人、物料輸送技術、系統整合服務和軟體解決方案,協助倉庫和工業業務提高效能和精度。

- 2020年8月-村田機械同意與Alpen合作打造日本首個3D機器人倉庫系統「Alphabot」。 Alphabot 將安裝在 Alpen 集團主要物流中心之一的 Alpen Komaki物流中心,以提高儲存能力並減少約 60% 的挑選、分類和包裝程序。該系統於2021年7月開始實施。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 倉庫投資場景

- 宏觀經濟因素對倉庫自動化市場的影響

- COVID-19 市場影響

第5章 市場動態

- 市場促進因素

- 電子商務行業的快速成長和客戶期望

- 對更好的庫存管理和控制的需求日益增加

- 市場問題

- 高資本投入

- 廉價勞動力和惡劣的工作條件

第6章 市場細分

- 成分

- 硬體

- 移動機器人(AGV、AMR)

- 自動儲存和搜尋系統 (AS/RS)

- 自動輸送機及分類系統

- 卸垛/碼垛系統

- 自動識別和資料收集(AIDC)

- 拾料機器人

- 軟體(倉庫管理系統 (WMS)、倉庫執行系統 (WES))

- 服務(附加價值服務、維護等)

- 硬體

- 最終用戶

- 食品和飲料(包括製造設施和配送中心)

- 郵政和小包裹

- 食物

- 通用產品

- 服飾

- 製造業(耐久財和非耐久財)

- 其他

- 國家

- 中國

- 印度

- 日本

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- ST Engineering

- ABB Limited

- Toshiba Global

- Yaskawa Electric Corporation(Yaskawa Motoman)

- Daifuku Co., Ltd.

- Grey Orange

- Godrej Consoveyo Logistics Automation Ltd.(GCLA)

- Bastian Solution Private Limited

- Murata Manufacturing Co., Ltd.

- Geek+Inc.

第8章投資分析

第9章 未來市場展望

The Asia Pacific Warehouse Automation Market size is estimated at USD 14.80 billion in 2025, and is expected to reach USD 32.87 billion by 2030, at a CAGR of 17.3% during the forecast period (2025-2030).

The COVID-19 pandemic, which wreaked havoc on major economies such as China, Japan, and India, is predicted to impact future market growth. Significant investments are influencing the rise of roller conveyors in the Asia-Pacific in the e-commerce industry and demand from ever-increasing internet-enabled consumers.

Furthermore, with large investments in the industry, the manufacturing sector is predicted to account for a significant market share and become one of the country's major contributors. The requirement to deliver varied products in short durations has grown, necessitating efficient inventory management and reverse logistics systems.

Key Highlights

- The expansion of the Asia-Pacific warehouse automation market is examined by looking at India, China, Australia, South Korea, Japan, and the rest of Asia. China, one of the world's major economies, is continually creating and deploying warehouse robots. China is expected to have a significant share in the market. As a result of the high automation rates, the presence of prominent vendors, and the widespread availability of warehouse robots, China's demand for warehouse robotics is significant.

- Due to the rise of the manufacturing, retail, and FMCG industries, there is an ever-increasing demand for industrial automation solutions across the APAC region. Shuttle retrieval systems, as well as automated storage and mobile robot platforms, are seeing a significant increase. Industrial and freight routes are sprouting up throughout the region, increasing the number of organized participants in the storage and industrial parks.

- Moreover, According to a 2022 study on warehouse vision conducted by Zebra Technologies, For the survey, more than 1,500 warehouse decision-makers and colleagues were polled from Australia, China, India, Japan, and Singapore. According to the survey, 27% of warehouse operators worldwide, including those in APAC, have already employed autonomous mobile robots (AMR). This ratio is expected to climb to 92% in APAC and 90% internationally in the next five years.

- While most warehouses will employ AMRs for P2G picking, material movements, and other automated inventory moves, more will invest in software that automates analytics and decision-making. In APAC, 95% of decision-makers expressed willingness to invest in such software to improve worker effectiveness and efficiency while lowering labor costs, slightly exceeding the global average (94%).

- Additionally, companies in the region are hurrying to adopt warehouse automation across the region in the wake of the COVID-19 outbreak. According to Mobile Industrial Robots in Shanghai, China, the company's autonomous robots that can transport pallets and large loads around warehouses and factories have seen growing demand across a wide range of industries. Airbus, Flex, Honeywell, and DHL are the major firms responsible for the rising demand.

APAC Warehouse Automation Market Trends

Automated Guided Vehicles (AGVs) is Expected to Have a Significant Growth

- The major application of mobile robots is in mobile automated guided vehicles (AGVs) that transfer items across APAC in warehouses and storage facilities. These robots follow pre-programmed paths, transporting things for transportation and storage 24 hours a day, seven days a week. AGVs are vital for lowering logistical costs and streamlining the supply chain.

- In addition to replenishing and picking, AGVs are used in inbound and outbound handling. AGVs, for instance, are used to move inventory from receipt to storage or from long-term storage to forward-picking locations to restock stock. Moving inventory from long-term storage to forward-picking locations guarantees enough inventory is available to selectors, resulting in a more effective order-picking process.

- The APAC warehouse landscape is evolving, with more automation and manual labor optimization used to cut costs and boost profits. Workers in a warehouse should spend their human intelligence on more value-adding activities while the robots step in and take care of efficiency mapping and waste reduction to produce a smooth flow.

- For instance, GreyOrange announced patents in September 2020 for technology critical for businesses to achieve high-yield omnichannel fulfillment and maximize facility space utilization through multilayer operation capabilities. First-to-Fill Technology, Retail-Ready Fulfilment, and Multilevel Robot Mobility are all covered by the patents.

- Robotics has become crucial to the profitability of several end users. The AMRs are leading the way since they are critical for quick, secure, and error-free delivery, a quick time to market, lower costs, and end-to-end trackability. The degree of autonomy distinguishes autonomous mobile robots (AMRs) from autonomous ground vehicles (AGVs).

- DHL established the Asia Pacific Innovation Center in Singapore in October 2021 as a showcase for new displays showcasing a cutting-edge, automated, and fully integrated e-commerce system. Geek+ announced a relationship with DHL to exhibit some of the company's greatest inventions at the Asia Pacific Innovation Center. Geek+ and DHL will demonstrate the future of warehouse robot automation.

India is Expected To Witness High Growth In The Asia-Pacific Warehouse Automation Market

- The warehousing industry in India is undergoing a considerable transformation to keep pace with the country's growing manufacturing sector and massive logistics industry. The warehouse industry is expected to benefit significantly from adopting the goods and services tax and real estate investments. Instead of the current scattered and standalone facilities, GST would ensure that India sees a vast, consolidated area with central warehousing parks for the first time.

- Furthermore, India's adoption of e-commerce has resulted in a tremendous increase in business for the warehousing industry. This rapid expansion has brought with it a slew of new obstacles. Transportation delays, a shortage of experienced labor, and other factors prompted stakeholders to look beyond traditional tactics in favor of robotics-enabled automation systems.

- For instance, e-commerce giant Amazon, which plans to invest USD 5.0 billion in India, is focusing on automated warehouses around the country. It opened several new warehouses to serve a variety of customers. Amazon was one of the first few Indian corporations to experiment with and implement robotics in its warehouses.

- Also, India's warehouse landscape is evolving, with more automation and manual labor optimization used to save costs and boost profits. Workers in a warehouse should spend their human intelligence on more value-adding activities while the robots step in and take care of efficiency mapping and waste reduction to produce a smooth flow. Robotics has become crucial to multiple end users' profitability.

- Atmos Systems, India, a prominent name in warehouse automation, announced the Atmos A42N, an autonomous case handling robotic (ACR) system that can greatly improve a warehouse's inbound and outgoing efficiency in December 2021. The system is packed with user-friendly features, allowing greater warehouse location flexibility.

APAC Warehouse Automation Industry Overview

The APAC warehouse automation market is moderately competitive and fragmented, with many global and regional players holding significant market shares. To maintain their market share, corporations will continue to innovate and form strategic collaborations. ST Engineering, Toshiba Global, Yaskawa Electric Corporation (Yaskawa Motoman), Daifuku Co., Ltd., Grey Orange, Godrej Consoveyo Logistics Automation Ltd. (GCLA), and others are some of the prominent players in this market.

- May 2022 - SYNUS Tech, a logistics automation firm, and Attabotics, the first 3D robotics supply chain system for modern commerce, established an exclusive cooperation today to provide integrated logistics system warehousing solutions to the South Korean markets. SYNUS Tech is developing smart industrial solutions and integrating AI into warehouses for the first time in Korea, thanks to partners like Attabotics.

- February 2022 - Addverb Technologies, India is pushing its warehouse robotics product suite to the North American market after acquiring USD 132.0 million. With its fleet of automated robots, material handling technology, system integration services, and software solutions, Addverb will help improve the performance and precision of warehouse and industrial operations.

- August 2020 - Murata Machinery has agreed to build Japan's first 3D robot warehousing system, "ALPHABOT," in collaboration with Alpen Co. Ltd. ALPHABOT will be installed at the Alpen Komaki Distribution Center, one of Alpen Group's key distribution centers, to increase storage capacity and cut picking, sorting, and packaging procedures by about 60%. The system was started in July 2021.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study assumptions and market definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness -Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Warehouse Investment Scenario

- 4.6 Impact of Macro-economic Factors on the Warehouse Automation Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Exponential Growth of the E-commerce Industry and Customer Expectation

- 5.1.2 Increasing Need for Better Inventory Management and Control

- 5.2 Market Challenges

- 5.2.1 High Capital Investments

- 5.2.2 Availability of Cheap Labor and Harsh Operating Conditions

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Hardware

- 6.1.1.1 Mobile Robots (AGV, AMR)

- 6.1.1.2 Automated Storage and Retrieval Systems (AS/RS)

- 6.1.1.3 Automated Conveyor & Sorting Systems

- 6.1.1.4 De-palletizing/Palletizing Systems

- 6.1.1.5 Automatic Identification and Data Collection (AIDC)

- 6.1.1.6 Piece Picking Robots

- 6.1.2 Software (Warehouse Management Systems(WMS), Warehouse Execution Systems (WES))

- 6.1.3 Services (Value Added Services, Maintenance, etc.)

- 6.1.1 Hardware

- 6.2 End-User

- 6.2.1 Food and Beverage (Including Manufacturing Facilities and Distribution Centers)

- 6.2.2 Post and Parcel

- 6.2.3 Groceries

- 6.2.4 General Merchandise

- 6.2.5 Apparel

- 6.2.6 Manufacturing (Durable and Non-Durable)

- 6.2.7 Other End-user Industries

- 6.3 Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 Rest Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ST Engineering

- 7.1.2 ABB Limited

- 7.1.3 Toshiba Global

- 7.1.4 Yaskawa Electric Corporation (Yaskawa Motoman)

- 7.1.5 Daifuku Co., Ltd.

- 7.1.6 Grey Orange

- 7.1.7 Godrej Consoveyo Logistics Automation Ltd. (GCLA)

- 7.1.8 Bastian Solution Private Limited

- 7.1.9 Murata Manufacturing Co., Ltd.

- 7.1.10 Geek+ Inc.