|

市場調查報告書

商品編碼

1693683

東南亞倉庫自動化:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Southeast Asia Warehouse Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

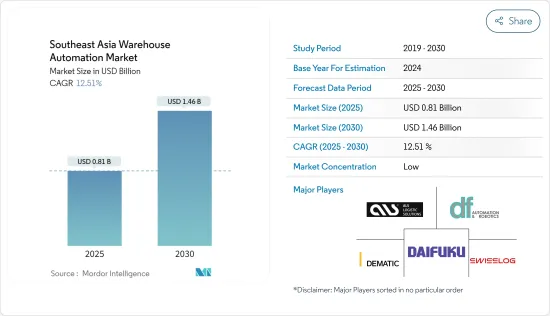

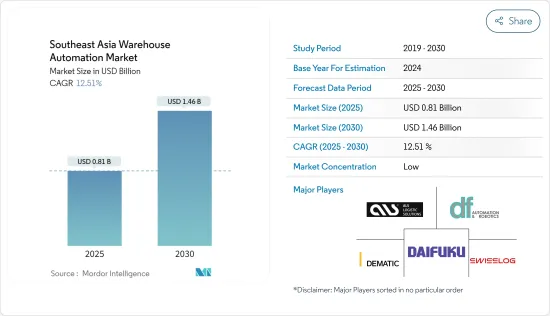

東南亞倉庫自動化市場規模預計在2025年為8.1億美元,預計到2030年將達到14.6億美元,預測期內(2025-2030年)的複合年成長率為12.51%。

在預測期內,東南亞市場將受到生產複雜性增加、技術進步和電子商務產業快速崛起的推動。此外,一些擁有強大技術力和資金支持的新興企業的出現也有助於所調查市場的成長。

主要亮點

- 隨著自動化投資在所有工業市場變得越來越普遍,倉庫業者擴大採用自動化技術來提高業務效率、生產力並最大限度地縮短處理時間。由於存在各種機會和價值創造機會,預計未來幾年受調查的市場將穩定成長。

- 電子商務的興起將進一步推動該行業的發展。倉庫自動化正日益成為尋求競爭優勢的公司的王牌,尤其是在競爭激烈的電子雜貨市場。根據國際貿易管理局(ITA)預測,到2026年,新加坡電子商務市場規模將達100億美元。

- 此外,根據國際機器人聯合會的數據,泰國在工業、倉儲,特別是醫療保健領域對自動導引車的使用預計將持續成長,年成長率預計為 60%,到 2022 年將達到 70 多萬輛。在預測期內,預計所研究市場的成長將受到各行業對機器人技術的日益廣泛使用的推動。

- 然而,經驗豐富的工人短缺、高投資成本以及與倉庫機器人相關的技術問題等障礙預計將在預測期內抑制東南亞倉庫自動化市場的發展。

- 新冠疫情加速了向電子商務的轉變,並導致了消費者行為的改變。多樣化的支付方式也促進了網上購物。疫情過後,一些最重要的新興發展包括微型倉配中心、電子雜貨店的擴張、黑暗商店和自動冷藏倉庫。預計這些產業的企業增加投資將推動疫情後的市場擴張。例如,Tee Yih Jia Food Manufacturing Pte Ltd 和 SSI Schafer 宣布將於 2022 年 2 月開設新加坡最大的自動化貨架高架倉庫,該倉庫位於 Tee Yih Jia 位於聖諾哥的價值 4.5 億美元的最先進的生產工廠。

東南亞倉庫自動化市場趨勢

零售(包括電子商務)產業將主導市場

- 零售業的倉庫自動化是一種旨在簡化物流業務、提高客戶滿意度和增加收益的服務。零售企業以超級市場、百貨公司、服飾、百貨、電器產品產品、食品和飲料等形式向最終用戶提供產品和服務。此外,該研究還涵蓋電子商務。零售倉庫通常會處理托盤或箱子上的大量 SKU。每個步驟都需要最佳化,以避免錯誤並確保您的客戶收到他們的貨物。

- 零售商將繼續使用倉庫自動化來跟上電子商務的成長軌跡以及消費者對服務和個人化的需求。為了增加價值並滿足高品牌標準,領先的零售商正在採用自動化來加快其供應鏈的最後一英里。我們不僅管理許多 SKU,而且每天還要準備和運送大量訂單到各個地點。考慮到這些限制,自動化是提高產量同時確保揀貨的準確性和速度的最佳方法。

- 根據新加坡商業時報報道,大多數公司打算不同程度地利用對新技術的投資。 76% 的商店打算透過在商店中實施識別系統為顧客提供個人化的購物體驗。除了高度自動化的業務外,還有望採用用於倉庫管理的感測器和攝影機。

- 食品和飲料倉庫需要更多的庫存和容量來滿足 COVID-19 帶來的需求變化。為了在有限的空間中妥善管理大量 SKU,食品和飲料倉庫必須具備必要的物流能力。設施必須滿足對自有品牌、已烹調商品和電子雜貨的激增需求,並提供各種出站訂單類型。

預計印尼將佔據較大的市場佔有率

- 印尼2025年的物流願景是“本地整合,全球連結”,與該國物流體係向物流4.0轉型一致。目標是實現全國物流系統的互聯互通和全面整合。第二,疫情對國際貿易供需格局產生重大負面影響。 「智慧物流4.0」的誕生,是為了實現科技型物流的現代化。因此,供應商、物流服務和最終消費者之間的貿易流程得到了顯著改善。

- 此外,智慧倉庫有助於減少人為錯誤,這些錯誤會給承包商帶來高昂的成本,並大幅增加營運費用。儘管疫情肆虐,BGR 物流仍為該國的經濟復甦做出了貢獻。 BGR 物流開發了包括智慧倉庫在內的多項創新,以發展印尼的物流業。

- 此外,預計2023年印尼電子商務市場的用戶數量將會增加,這將推動倉庫自動化的需求。值得注意的是,過去幾年該市場的用戶數量一直在穩步成長。隨著越來越多的消費者將購買習慣轉向線上平台,對數位商務的需求正在成長。一個值得注意的市場趨勢是行動商務的使用日益成長,因為消費者擴大使用智慧型手機和平板電腦購物。

- 此外,印尼是世界上電子商務普及率最高的國家之一。預計2021年印尼電商市場規模將成長至430億美元,成為全球第九大電商市場。印尼蓬勃發展的電子商務市場線上銷售額成長了23%,新增用戶約6,300萬。該國90%的16歲至64歲網路用戶會進行網路購物。精通科技的消費者願意為便利性支付更多費用,他們的消費行為正在發生變化,這推動著印尼電子商務市場的發展。由於年輕的人口結構、不斷成長的網際網路普及率、電子錢包的蓬勃發展以及面向數位經濟的政策,印尼的電子商務市場前景光明。

東南亞倉儲自動化產業概況

東南亞倉庫自動化市場分散,有眾多區域和全球參與者,包括 ALS Logistic Solutions、Dematic、DF Automation & Robotics Sdn。 Bhd.、Daifuku 和 Swisslog Holding AG。這些公司不斷進行產品推出、聯盟、夥伴關係和合併等策略發展,以獲得市場佔有率並擴大其影響力。

2023 年 3 月,Swisslog 的 CarryPick 移動機器人物品到人類儲存和搜尋系統發布。新的 CarryPick 移動機器人平台現在速度更快了。移動機器人還配備了創新的升降轉盤,使其能夠旋轉貨架並在旋轉時保持貨架靜止,從而實現更快、更靈活的物到人存儲和揀選流程。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章市場動態

- 市場促進因素

- 電子商務快速成長

- 各行各業擴大採用自動化

- 市場限制

- 初始設備成本高

第6章市場區隔

- 依產品類型

- 輸送機/分類系統

- 自動儲存和搜尋系統(AS/RS)

- 移動機器人

- 倉庫管理系統(WMS)

- 自動識別和資料擷取(AIDC)

- 按最終用戶產業

- 零售(含電子商務)

- 物流與運輸

- 車

- 製造業

- 醫療保健和製藥

- 其他最終用戶產業

- 按國家

- 馬來西亞

- 泰國

- 新加坡

- 印尼

- 越南

- 菲律賓

第7章競爭格局

- 公司簡介

- ALS Logistic Solutions

- Dematic Corp.(kion Group Ag)

- DF Automation & Robotics Sdn. Bhd.

- Daifuku Co., Ltd.

- Swisslog Holding Ag(kuka Ag)

- Gen Surv Robotics

- Omron Corporation

- PingSpace Sdn Bhd

- Sun & Siasun Robot Co., Ltd

- System Logistics Asia Co. Ltd(krones Group)

第8章:未來市場展望

The Southeast Asia Warehouse Automation Market size is estimated at USD 0.81 billion in 2025, and is expected to reach USD 1.46 billion by 2030, at a CAGR of 12.51% during the forecast period (2025-2030).

Over the projected period, the market in Southeast Asia will be driven by rising production complexity, technological advancement, and the rapid rise of the e-commerce industry. Furthermore, the emergence of several startup firms with strong technological capabilities and financial backups supports the studied market's growth.

Key Highlights

- As investments in automation are prevalent across all industrial markets, warehouse operators are increasingly adopting automation technologies to boost operational efficiency and productivity and minimize handling time. With a range of investment and value-creation opportunities, the studied market is expected to witness steady growth in the next few years.

- The increased volume of e-commerce will drive the industry ahead. Warehouse automation is increasingly establishing the trump card for companies pursuing a competitive edge, especially in the competitive e-grocery market, as traders struggle to keep up with the expanding number of transactions and related last-mile shipping needs. According to the International Trade Administration (ITA), the e-commerce market in Singapore is expected to reach USD 10 billion by 2026.

- Furthermore, Thailand's usage of autonomous guide vehicles in industries and warehouses, especially healthcare, is expected to increase by 60% per annum to over 700,000 units by 2022, according to the International Federation of Robotics, and is expected to increase in the coming years. During the forecast period, the growth of the studied market should be helped by the fact that robotic technology is being used more and more in different industries.

- However, obstacles such as a shortage of experienced workers, high investment, and technical problems associated with warehouse robotics are expected to restrain the Southeast Asia warehouse automation market over the forecast period.

- The COVID-19 outbreak hastened the shift to e-commerce, resulting in a shift in customer behavior. A variety of payment options has also contributed to the online purchase. Following the pandemic, the most significant and rising developments have included micro-fulfillment centers, e-grocery expansion, dark stores, and automated cold storage. Increasing investments by players in these sectors are expected to propel market expansion in the post-covid period. Tee Yih Jia Food Manufacturing Pte Ltd and SSI Schafer, for example, announced in February 2022 the opening of Singapore's largest automation rack-clad high bay warehouse, storing capacity at Tee Yih Jia's newest USD 450 million production plant in Senoko.

Southeast Asia Warehouse Automation Market Trends

Retail (Incl. e-commerce) Sector to Dominate the Market

- Retail warehouse automation is a service that retailers may employ to streamline logistical operations, enhance customer satisfaction, and boost revenues. Retail enterprises provide products and services to end users, including supermarkets, departmental stores, clothing, general merchandise, appliances, and food and beverages. Additionally, the segment in the study also considers e-commerce. The warehouses of retail businesses often handle a huge volume of SKUs, which can be kept on pallets or in boxes. All procedures must be optimized to avoid mistakes and ensure the product is available to clients.

- Retailers will continue using warehouse automation to keep up with an ever-increasing e-commerce trajectory and consumer service and personalization demands. To add value and meet high brand standards, top retailers are implementing automation to speed up the last mile of their supply chain. In addition to managing many SKUs, they prepare and ship a tremendous volume of orders daily to a wide range of locations. Given these limitations, automation is a great way to increase production while ensuring accuracy and speed in order picking.

- According to The Business Times in Singapore, most businesses intend to utilize their investments in new technology on various levels. 76% intend to provide clients with individualized shopping experiences by installing identifying systems in the establishments. In addition to the substantial automation of operations, sensors and cameras for warehouse management are also anticipated.

- Food and beverage warehouses required more stock and throughput to keep up with the shift in demand brought on by COVID-19. In order to correctly manage many SKUs in a constrained amount of space, food and beverage warehouses must have the necessary logistical capabilities. Facilities must adjust and offer a range of outbound order types due to a surge in demand for own-brand labels, prepared goods, and e-grocery.

Indonesia is Expected to Hold a Significant Market Share

- The logistics vision for Indonesia for 2025 is "locally integrated, globally connected," consistent with transforming the national logistics system into Logistics 4.0. The goal is to connect and fully integrate the domestic distribution system across the entire nation. Second, the pandemic has had a significant negative impact on supply and demand patterns for international trade. "Smart Logistics 4.0" was created to modernize technology-based logistics. As a result, trade processes between vendors, logistics services, and final consumers are greatly improved.

- Additionally, smart warehouses assist in lowering human errors that can be costly for building contractors and significantly raise operating expenses. Despite the pandemic, BGR Logistics contributed to the nation's economic recovery. BGR Logistics has developed several innovations, including smart warehouses, to advance Indonesia's logistics sector.

- Furthermore, as the number of users in Indonesia's e-commerce market is expected to grow in 2023, e-commerce is expected to increase the demand for warehouse automation. Notably, the market's user base has steadily increased over the past few years. The demand for digital commerce is rising as more consumers switch their purchasing habits to online platforms. With more consumers using their smartphones and tablets to make purchases, one of the market's prominent trends is the expanding use of mobile commerce.

- Moreover, Indonesia has one of the highest e-commerce adoption rates globally. Indonesia's e-commerce market value increased to USD 43 billion in 2021, making it the ninth largest in the world. Online sales in Indonesia's thriving e-commerce market grew by 23%, and there were about 63 million additional users. 90% of the country's internet users between 16 and 64 have purchased online. A change in consumer behavior among tech-savvy consumers willing to pay more for convenience is propelling the e-commerce market in Indonesia. Indonesia's e-commerce market has a bright future thanks to its youthful population, rising internet penetration, e-wallet boom, and policies geared toward the digital economy.

Southeast Asia Warehouse Automation Industry Overview

The Southeast Asia warehouse automation market is fragmented, with the presence of numerous regional and global players such as ALS Logistic Solutions, Dematic, DF Automation & Robotics Sdn. Bhd., Daifuku Co., Ltd., and Swisslog Holding AG, among others. These players continuously engage in strategic developments such as product launches, collaborations, partnerships, and mergers to gain market share and expand their business footprint.

In March 2023, Swisslog's CarryPick mobile robotic goods-to-person storage and retrieval system was released. The new, updated CarryPick mobile robotic platform offers a much faster working speed. The mobile robots also employ a revolutionary lifting turntable that allows them to turn a rack or hold the rack stationary as it turns, enabling quicker and more adaptable storage and selection processes for goods-to-person solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Exponential Growth of E-commerce

- 5.1.2 Growing Adoption of Automation Across Various Industries

- 5.2 Market Restraints

- 5.2.1 High Initial Equipment Cost

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Conveyor/Sortation Systems

- 6.1.2 Automated Storage & Retrieval System (AS/RS)

- 6.1.3 Mobile Robots

- 6.1.4 Warehouse Management Systems (WMS)

- 6.1.5 Automatic Identification and Data Capture (AIDC)

- 6.2 By End-user Industry

- 6.2.1 Retail (including e-commerce)

- 6.2.2 Logistics and Transportation

- 6.2.3 Automotive

- 6.2.4 Manufacturing

- 6.2.5 Healthcare and Pharmaceutical

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 Malaysia

- 6.3.2 Thailand

- 6.3.3 Singapore

- 6.3.4 Indonesia

- 6.3.5 Vietnam

- 6.3.6 Philippines

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ALS Logistic Solutions

- 7.1.2 Dematic Corp. (kion Group Ag)

- 7.1.3 DF Automation & Robotics Sdn. Bhd.

- 7.1.4 Daifuku Co., Ltd.

- 7.1.5 Swisslog Holding Ag (kuka Ag)

- 7.1.6 Gen Surv Robotics

- 7.1.7 Omron Corporation

- 7.1.8 PingSpace Sdn Bhd

- 7.1.9 Sun & Siasun Robot Co., Ltd

- 7.1.10 System Logistics Asia Co. Ltd (krones Group)