|

市場調查報告書

商品編碼

1644638

歐洲倉庫自動化 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Warehouse Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

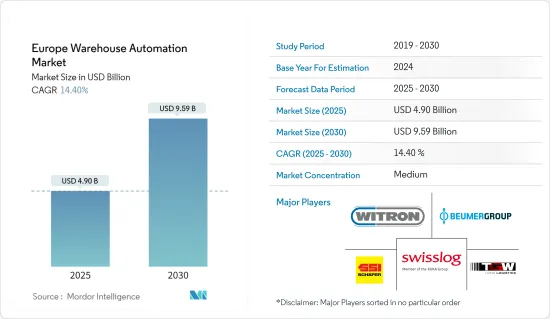

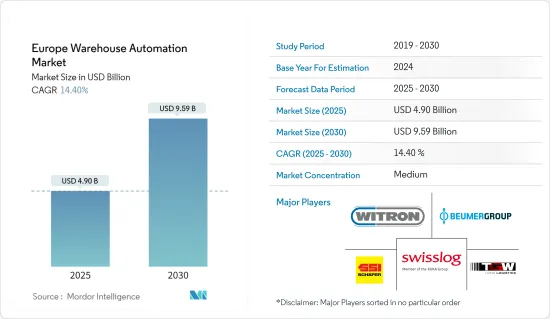

預計 2025 年歐洲倉庫自動化市場規模為 49 億美元,到 2030 年將達到 95.9 億美元,預測期內(2025-2030 年)的複合年成長率為 14.4%。

此外,儘管迄今為止倉庫機器人的部署速度非常快,但 COVID-19 可能會顯著加快其部署速度。 COVID-19 疫情的爆發促使倉庫所有者希望加快自動化和機器人部署的時間表。成功採用自動化的公司也展示瞭如何透過限制工人互動來創造更安全的職場,同時提高生產力以滿足日益成長的電子商務需求。近年來電子商務的興起已導致數千家實體店關閉。

關鍵亮點

- 在歐洲,自疫情爆發以來,倉庫自動化成長有所回升。這是由於兩個相互關聯的趨勢造成的:電子商務似乎不可阻擋的崛起以及持續的人事費用。歐洲倉庫機器人市場受到倉庫數量的增加、倉庫自動化支出的增加、人事費用的上升以及可擴展技術解決方案的可用性的推動。

- 從需求量以及OEM和系統整合商數量來看,德國是倉庫自動化領域中領先的國家之一。許多OEM都位於歐洲,包括德國、義大利、法國、荷蘭和西班牙。中歐和東歐是歐洲發展最快的地區之一,波蘭和捷克共和國已成為具有良好經濟潛力的物流中心。然而,包括俄羅斯-烏克蘭衝突在內的當前地緣政治局勢已使擴張和投資計畫被擱置。

- 物聯網正在推動庫存和倉庫自動化的發展。物聯網正在幫助將倉庫轉變為互聯的協作系統。 2021 年以後,更低的成本和更完善的物聯網感測器預計將推動物聯網在倉庫中的應用。例如,2020 年 5 月,德國物流公司 DHL 宣布已與美國科技公司思科合作,在歐洲三個大型倉庫業務中部署物聯網。

- 然而,自動化倉庫管理對於降低整體業務費用和消除產品交付故障非常有益。儘管具有這些優勢,但據著名的 3PL 營運商和倉庫自動化技術的主要終端用戶 DHL 稱,80% 的倉庫仍然在沒有自動化輔助的情況下手動操作。此外,基於輸送機、分類機和拾放式倉庫佔所有倉庫的 15%。相比之下,只有 5% 的倉庫實現了自動化。

歐洲倉庫自動化市場趨勢

自主移動機器人 (AMR) 在歐洲越來越受歡迎

- 歐洲倉庫自動化領域的兩大發展包括使用能夠在滿載貨架間導航的自主機器人以及升級堆高機以實現繁忙時段的自動化。輸送機、手動堆高機、手推車、牽引裝置等可用於轉移和接管傳統上由移動機器人處理的任務。其他應用包括包裝、運輸和分類。

- 自主移動機器人 (AMR) 正在取代歐洲各地物流應用中的自動導引車 (AGV)。與 AGV 不同,AMR 擁有更先進的車載電腦,可連接到慣性測量單元 (IMU)、雷射掃描測距儀、2D 和 3D 彩色攝影機以及馬達控制器。 AMR 也為庫存管理開闢了新的可能性。當與帶有 RFID 標籤的產品和設備結合時,這些設備可以在倉庫中按照設定的時間表自主執行庫存清掃。

- 例如,總部位於英國的 Iconsys 透過推出 Iconsys 自主移動機器人 (iAM-R) 擴展到自主移動解決方案領域。這是為了向公司的客戶提供自主機器人解決方案。

- 2022 年 5 月,IFOY 提名者、履約倉庫自主移動機器人 (AMR) 領域的領導者 Locus Robotics 宣布擴大其倉庫 AMR 產品線。這些新外形與 Locus Origin 機器人一起,形成了全面的 AMR 系列,可滿足當今履約和配送設施中的所有產品移動需求,從電子商務、箱體揀選和托盤揀選到需要更大、更重有效載荷的場景。

- 2022 年 6 月在斯圖加特舉辦的 LogiMAT 展會上,生產和倉庫物流用高科技自動導引運輸車(AGV) 的領先製造商和整合商 ek robotics 宣布與全球領先的靈活智慧自主移動機器人 (AMR) 公司 OTTO Motors 建立全球技術合作夥伴關係。兩家公司提供的AGV硬體與AMR軟體的組合將使全球製造業和倉儲業客戶受益。

汽車產業自動儲存和搜尋系統 (AS/RS) 的採用率很高

- 許多著名汽車品牌都在歐洲設有基地,包括賓士、沃爾沃、阿斯頓馬丁、賓利、保時捷、蘭博基尼和法拉利。德國、法國和英國的許多汽車生產廠都嚴重依賴 AS/RS 系統來保持競爭力。總部位於英國的 Exmac Automation 為阿斯頓馬丁、賓利、捷豹和 IBC 汽車提供儲存解決方案。

- 例如,英國領先的 AS/RS 解決方案供應商 Industore 提供適用於各種規模的倉庫和儲存設施的各種產品。另一家主要企業ExMac Automation 為全國各行業提供自動化儲存和搜尋起重機系統 - 從大容量小型負載起重機和貨架到高架倉庫起重機。

- 歐盟委員會支持全球技術協調,並提供研發資金,以幫助汽車產業保持競爭力和技術領先地位。此外,根據歐洲汽車製造商協會(ACEA)的調查,歐盟每1000人擁有持有569輛。盧森堡是歐盟中汽車密度最高的國家(每千人擁有 694 輛汽車),拉脫維亞最低。根據OICA預測,2020年歐洲乘用車總銷量將達1,416萬輛。

- 英國汽車供應鏈是需求主導的(包括車輛客製化程度的提升),迫使OEM供應商選擇更靈活的倉庫自動化。汽車製造過程中 AS/RS 系統和自動化的日益普及、數位化和人工智慧的出現是推動荷蘭汽車產業數位化需求的一些關鍵因素。

- 此外,德國是世界上最大的自動化物料輸送系統使用者之一。根據國際機器人聯合會(IFR)的數據,德國是繼韓國和日本之後機器人密度最高的國家,每10,000名工人擁有294台機器人。這些因素可能會推動整個歐洲對倉庫自動化的需求。

歐洲倉庫自動化產業概況

根據競爭格局,歐洲倉庫自動化市場呈現分散狀態。 Dematic Group、Swisslog Holding AG、Swisslog Holding AG (KUKA AG) WITRON、Logistik+Informatik GmbH SSI Schaefer AG BEUMER Group GmbH &Co.KG、TGW Logistics Group GmbH 和 Jungheinrich AG 是該地區的一些重要競爭對手。

這些佔據了很大市場佔有率的主要競爭對手正專注於在新的國家擴大消費群。此外,倉庫自動化領域的市場參與企業正在採用產品發布、收購和合作等關鍵策略。以下是一些最新趨勢。

- 2022 年 2 月-DHL 供應鏈在德國布倫瑞克的全通路競標網站 1-2-3.tv 部署了首個配備機器人揀選功能的全自動汽車商店物流系統。 AutoStore 系統由物流技術公司 Element Logic 建立,使用機器人揀選和軟體解決方案來加快每個訂單的履行速度,提高業務效率並最大限度地提高地點的儲存容量。

- 2021 年 11 月 - Honeywell Intelligrated 倉庫自動化宣布計畫建立一個新的先進研發 (R&D) 測試中心,以滿足對更快、更準確的供應鏈技術日益成長的需求。該中心將使霍尼韋爾的硬體和軟體工程師能夠創建、製作原型並測試供物流公司使用的新型倉庫自動化系統。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 倉庫投資場景

- 宏觀經濟因素對倉庫自動化市場的影響

- COVID-19 市場影響

第5章 市場動態

- 市場促進因素

- 電子商務行業的快速成長和客戶期望

- 製造複雜性和技術可用性不斷提高

- 工業 4.0 投資推動自動化和物料輸送需求

- 市場問題

- 高資本投入

- 嚴格的監管要求

第6章 市場細分

- 成分

- 硬體

- 移動機器人(AGV、AMR)

- 自動儲存和搜尋系統 (AS/RS)

- 自動輸送機及分類系統

- 卸垛/碼垛系統

- 自動識別和資料收集(AIDC)

- 拾料機器人

- 軟體(倉庫管理系統 (WMS)、倉庫執行系統 (WES))

- 服務(附加價值服務、維護等)

- 硬體

- 最終用戶

- 食品和飲料(包括製造設施和配送中心)

- 郵政和小包裹

- 食物

- 通用產品

- 服飾

- 製造業(耐久財和非耐久財)

- 其他

- 國家

- 英國

- 德國

- 法國

- 歐洲其他地區

第7章 競爭格局

- 公司簡介

- Swisslog Holding AG(KUKA AG)

- WITRON Logistik+Informatik GmbH

- SSI Schaefer AG

- BEUMER Group GmbH & Co. KG

- TGW Logistics Group GmbH

- Kion Group AG(Dematic Group)

- Knapp AG

- Jungheinrich AG

- Vanderlande Industries BV

- Mecalux SA

第8章投資分析

第9章 未來市場展望

The Europe Warehouse Automation Market size is estimated at USD 4.90 billion in 2025, and is expected to reach USD 9.59 billion by 2030, at a CAGR of 14.4% during the forecast period (2025-2030).

Furthermore, whereas warehouse robots have had enormous deployments, COVID-19 is likely to significantly increase deployment speed. The COVID-19 outbreak has prompted warehouse owners to explore expediting their automation and robotics implementation timelines. Those who have successfully adopted automation have also demonstrated the establishment of safer workplaces by limiting worker interactions while raising productivity to meet rising e-commerce needs. Thousands of brick-and-mortar stores have closed their doors due to the recent increase in e-commerce.

Key Highlights

- In Europe, the warehouse automation growth increased post-pandemic. This results from two interconnected trends: a seemingly unstoppable rise in e-commerce and a persistent labor shortage resulting in rising labor prices. The market for warehouse robots in Europe has been driven by the growing number of warehouses and increased expenditures on warehouse automation, rising labor costs, and the availability of scalable technical solutions.

- Regarding demand and the presence of OEMs and System Integrators, Germany is one of the leading countries in warehouse automation. OEMs are well-represented in Europe, with strongholds in Germany, Italy, France, the Netherlands, and Spain. Central and Eastern Europe is a rapidly growing region within Europe, with Poland and the Czech Republic emerging as logistical hubs with promising economic potential. However, expansion and investment plans have been put on hold due to the present geopolitical circumstances, including the Russia-Ukraine conflict.

- The Internet of Things is driving inventory and warehouse automation developments. It's contributing to the transformation of the warehouse into a connected and coordinated system. In 2021 and beyond, lower costs and enhanced IoT sensors are expected to boost the use of IoT in warehouses. For Instance, In May 2020, DHL, a German logistics company, said that it had partnered with Cisco, a US technology company, to introduce IoT to three large warehouse operations across Europe.

- However, warehousing automation is extremely beneficial when it comes to lowering overall business expenditures and eliminating product delivery faults. Despite the benefits, 80 percent of warehouses are "still manually operated with no supporting automation," according to DHL, a notable 3PL business and a major end-user of warehouse automation technologies. Furthermore, conveyor-based, sorter-based, and pick-and-place warehouses account for 15% of all warehouses. In comparison, only 5% of today's warehouses are automated.

Europe Warehouse Automation Market Trends

Autonomous Mobile Robots (AMRs) are Gaining Popularity Throughout Europe

- Two European warehouse automation developments include using autonomous robots capable of transferring filled shelves and updating forklifts to help automation during busy periods. To transfer and take over activities traditionally handled by mobile robots, conveyors, manual forklifts, carts, and towing devices can all be used. Other applications include packing, transportation, and sorting.

- Autonomous mobile robots (AMRs) in logistical applications across Europe are displacing automatic guided vehicles (AGVs). AMRs, unlike AGVs, have more advanced onboard computers linked to inertial measuring units (IMU), laser scanning range finders, 2D and 3D color cameras, and motor controllers. AMR also opens up new possibilities for inventory management. These devices may now execute inventory sweeps autonomously at warehouse-determined schedules when paired with RFID-tagged products and equipment.

- For instance, the United Kingdom-based Iconsys expanded into autonomous mobile solutions with the launch of its iAM-R (Iconsys Autonomous Mobile Robot). It is designed to provide autonomous robotic solutions to the company's customers.

- In May 2022, Locus Robotics, a 2022 IFOY nominee and leader in autonomous mobile robots (AMRs) for fulfillment warehouses, announced the expansion of its warehouse AMR line. These new form factors join the Locus Origin robot to form a comprehensive family of AMRs that handle the full range of product movement needs in today's fulfillment and distribution facilities, from e-commerce, case-picking, and pallet-picking to scenarios needing larger, heavier payloads.

- In June 2022, At LogiMAT in Stuttgart, ek robotics, the leading manufacturer and integrator of high-tech automated guided vehicles (AGVs) for production and warehouse logistics, announced a global technology partnership with OTTO Motors, the world's leading developer of flexible and intelligent autonomous mobile robots (AMR). Customers in the manufacturing and warehousing industries worldwide will benefit from the combination of AGV hardware and AMR software offered by the two firms.

High Adoption of Automated Storage and Retrieval Systems (AS/RS) in Automotive Sector

- Many well-known vehicle brands are based in Europe, including Mercedes-Benz, Volvo, Aston Martin, Bentley, Porsche, Lamborghini, Ferrari, and others. Numerous vehicle production facilities in Germany, France, and the United Kingdom rely heavily on AS/RS systems to stay competitive. Exmac Automation, situated in the United Kingdom, provides storage solutions for Aston Martin, Bentley, Jaguar, and IBC vehicles.

- For instance, Industore, a major AS/RS solution provider in the UK, has a wide range of products utilized in warehouses and small and large storage units. ExMac Automation, another key player in AS/RS, provides automated storage and retrieval crane systems (ranging from high-capacity mini-load cranes and racking to high-bay warehouse cranes) to various industries across the country.

- The European Commission supports worldwide technical harmonization and offers to fund R&D to help the automotive industry maintain its competitiveness and technological leadership. Furthermore, according to ACEA research, 569 automobiles per 1,000 people in the European Union. Luxembourg has the highest car density in the EU (694 cars per 1,000 people), while Latvia has the lowest. According to the OICA, total European passenger car sales reached 14.16 million in 2020.

- The demand-driven nature of the UK automotive supply chain (including increasing levels of customization within a car) is compelling OEM suppliers to choose warehouse automation with greater flexibility. The increasing adoption of AS/RS systems and automation in the automotive manufacturing process and the advent of digitization and AI are some of the primary factors driving the demand for digitalization in the automotive sector of the Netherlands.

- Moreover, Germany is one of the world's largest users of automated material handling systems. According to the International Federation of Robotics (IFR), Germany has the highest robot density (294 units per 10,000 workers), behind South Korea and Japan. These factors will increase the demand for warehouse automation throughout Europe.

Europe Warehouse Automation Industry Overview

The European warehouse automation market is fragmented by its competitive landscape. Dematic Group, Swisslog Holding AG, and Swisslog Holding AG (KUKA AG) WITRON, Logistik + Informatik GmbH SSI Schaefer AG BEUMER Group GmbH & Co. KG TGW Logistics Group GmbH, and Jungheinrich AG are some of the regional significant competitors in this sector.

These major competitors, which hold a considerable share of the market, are concentrating on growing their consumer base in new countries. Furthermore, market participants in the warehouse automation sector use major strategies, including product launches, acquisitions, and collaborations. The following are some of the most recent developments:

- February 2022 -DHL Supply Chain has deployed the first fully automated auto store logistics system with robot picking for the omnichannel auction site 1-2-3.tv in Braunschweig, Germany. The Autostore system was created by Element Logic, a logistics technology company, and it uses robot picking and a software solution to increase the processing speed of each order, improve operational efficiency, and maximize the location's storage capacity.

- November 2021 - Honeywell Intelligrated warehouse automation announced plans to create a new advanced research and development (R&D) testing center to fulfill the growing demand for technologies that enable speedier, more accurate supply chains. Honeywell hardware and software engineers will be able to create, prototype, and test novel warehouse automation systems utilized by logistics companies at the site.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study assumptions and market definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness -Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Warehouse Investment Scenario

- 4.6 Impact of Macro-economic Factors on the Warehouse Automation Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Exponential Growth of the E-commerce Industry and Customer Expectation

- 5.1.2 Increasing Manufacturing Complexity and Technology Availability

- 5.1.3 Industry 4.0 Investments Driving The Demand For Automation & Material Handling

- 5.2 Market Challenges

- 5.2.1 High Capital Investment

- 5.2.2 Stringent Regulatory Requirements

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Hardware

- 6.1.1.1 Mobile Robots (AGV, AMR)

- 6.1.1.2 Automated Storage and Retrieval Systems (AS/RS)

- 6.1.1.3 Automated Conveyor & Sorting Systems

- 6.1.1.4 De-palletizing/Palletizing Systems

- 6.1.1.5 Automatic Identification and Data Collection (AIDC)

- 6.1.1.6 Piece Picking Robots

- 6.1.2 Software (Warehouse Management Systems(WMS), Warehouse Execution Systems (WES))

- 6.1.3 Services (Value Added Services, Maintenance, etc.)

- 6.1.1 Hardware

- 6.2 End-User

- 6.2.1 Food and Beverage (Including Manufacturing Facilities and Distribution Centers)

- 6.2.2 Post and Parcel

- 6.2.3 Groceries

- 6.2.4 General Merchandise

- 6.2.5 Apparel

- 6.2.6 Manufacturing (Durable and Non-Durable)

- 6.2.7 Other End-user Industries

- 6.3 Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Swisslog Holding AG (KUKA AG)

- 7.1.2 WITRON Logistik + Informatik GmbH

- 7.1.3 SSI Schaefer AG

- 7.1.4 BEUMER Group GmbH & Co. KG

- 7.1.5 TGW Logistics Group GmbH

- 7.1.6 Kion Group AG (Dematic Group)

- 7.1.7 Knapp AG

- 7.1.8 Jungheinrich AG

- 7.1.9 Vanderlande Industries BV

- 7.1.10 Mecalux SA