|

市場調查報告書

商品編碼

1643031

店內分析 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)In-store Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

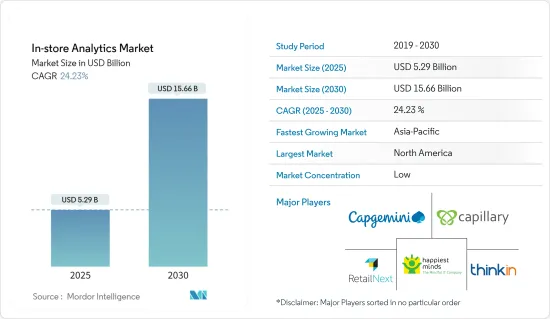

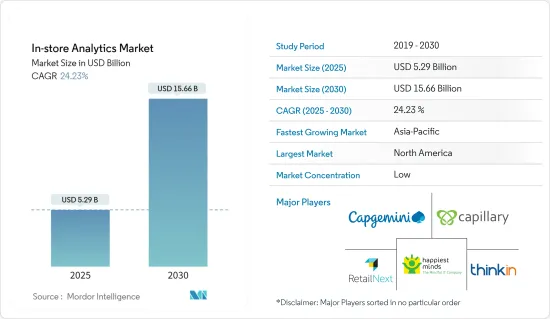

店內分析市場規模預計在 2025 年為 52.9 億美元,預計到 2030 年將達到 156.6 億美元,預測期內(2025-2030 年)的複合年成長率為 24.23%。

電子商務參與企業日益激烈的競爭以及改善購物和客戶服務的需求,大大促進了全球店內分析市場的成長。

關鍵亮點

- 店內分析是指分析顧客行為並從中得出結論。此分析重點在於顧客造訪商店時觀察到的一系列消費行為。它被店主廣泛使用它來促進銷售並提高客戶滿意度。

- 零售品牌正專注於整合雲端運算。雲端運算提供靈活、強大的雲端基礎的彙報解決方案,為您提供整體情況,幫助您在提高銷售額的同時做出更快、更明智的決策。雲端運算日益增強的優勢是推動店內分析市場發展的強勁趨勢。據NewGenApps稱,充分利用雲端運算潛力進行巨量資料分析的零售商可以將其營業利潤率提高約60%。全通路零售商還可以監控店內顧客的行為,並及時向顧客提供優惠,以確保他們在零售商的承受範圍內購買商品。

- 商店環境中的顧客體驗是吸引回頭客和忠誠顧客的主要品牌差異化因素之一。它還包括從商店的外觀到員工如何對待顧客的一切。更好的客戶服務、更令人滿意的購物體驗以及增加銷售的幾種廉價方法的需求可能會推動對店內分析的需求。

- 然而,對更多人力資源技能的需求對市場成長提出了挑戰。市場面臨一些問題,這些問題源於需要更多熟練的人力,他們需要更有效地從零售資料中獲得必要和關鍵的見解。

- 此外,COVID-19 疫情正在推動分析服務供應商的業務成長。在這次疫情期間,實體業務陷入停頓,雲端運算對於業務連續性的重要性不言而喻。積極抵制數位化的零售組織可能會面臨疫情的嚴酷現實,而雲端供應商則處於有利地位。 Instore Analytics 也將平台列入供應鏈分銷鏈,這是疫情期間市場需求的關鍵。隨著新市場參與企業進入市場並擴展到新的地域,預計未來幾年這一趨勢將繼續成長。

店內分析市場趨勢

客戶管理領域市場成長顯著

- 根據美國人口普查局的數據,今年第三季全球零售額為 7,7457.4 億美元,高於去年同期的 6,5948.1 億美元。雖然銷售額正在成長,但人口結構快速變化和經濟復甦不確定等其他因素往往給零售商帶來挑戰。此外,零售商試圖了解哪些產品、服務和優惠對顧客更具吸引力,這大大提高了店內分析平台的重要性,並進一步增加了零售商對消費者參與度分析的需求。

- 最近,雲端客服中心供應商 Five9, Inc. 宣布了新的功能,幫助企業透過語音和數位管道提供更具凝聚力和吸引力的客戶體驗。不一致和支離破碎的客戶體驗可能會導致不良行為,甚至更糟的是,客戶流失。 Five9 透過提供靈活、實用的工具來部署和管理 AI 系統,並持續整合即時客戶分析,幫助公司克服這些挑戰。

- 基於人工智慧的視訊分析還可以提高效率並為企業提供與安全無關的見解。在零售市場,監視攝影機加上分析技術可以幫助店主發現偷竊者並提醒保全人員即時介入。店內分析還可以測量熱點、人流、停留時間和商品擺放位置。

- 此外,了解商店最繁忙的時間可以幫助您更好地調整人員配備水平與客戶需求,降低成本,提高轉換率並改善客戶在商店的體驗。此類用於客戶分析和管理的店內分析的多種應用預計將進一步推動全球店內分析市場的成長。

北美佔據主要市場佔有率

- 該地區擁有最多的技術創新者和零售商,由於擴大採用店內分析來改善顧客購物體驗,預計將佔據主要的市場佔有率。雲端運算和人工智慧等技術的快速應用正在滿足該地區店內分析的需求。零售業務的擴張也有望推動店內分析解決方案的採用。

- 與店內分析相關的軟體頻繁更新的需求以及對新興技術的資料安全和隱私擔憂可能繼續成為該地區店內分析成長抑制因素。然而,由於基於人工智慧的店內分析的採用率不斷提高,加上北美地區需要提供更好的購物體驗,店內分析市場可能會經歷市場成長。

- 此外,COVID-19 對美國零售業的影響導致零售商以前所未有的速度產生大量非結構化資料,這使得識別和利用新的有利可圖的機會變得困難。然而,後疫情時代的世界可能會受到多種因素的影響,這些因素將對零售商的運作方式產生重大影響。

- 透過分析多個資料集,店內分析可以提供可行的見解,並幫助零售商確定正確的策略來恢復損失的銷售額,並透過滿足客戶的動態需求來增加市場佔有率。預計此類店內分析應用將有助於北美市場對店內分析的需求。

店內分析行業概覽

店內分析市場細分化,有多個參與企業,他們不斷推出新平台進行創新,加劇了市場競爭。主要參與企業包括 Capgemini SE 和 RetailNext, Inc.近期市場趨勢如下:

- 2022 年 12 月,VSBLTY Group Technologies Corp 與 Al Jabr Group 旗下的商業平台投資控股 (BPIH) 簽署協議,獲得數位戶外解決方案、商店即媒介 (SaaM) 計劃以及零售店、石油和天然氣行業和智慧城市的安全解決方案,涵蓋五個中東國家。

- 2022年11月,總部位於馬尼拉的食品飲料和零售管理系統供應商Mosaic Solutions與菲律賓SM Supermalls合作,在全國82家商場部署先進的軟體,為改善資料主導的決策和業務效率提供先進的見解。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 增加雲端優勢

- 需要更好的客戶服務和改善購物體驗

- 客戶管理預計將經歷顯著的市場成長

- 市場限制

- 人力資源技能短缺

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場區隔

- 按組件

- 軟體

- 按服務

- 按部署

- 雲

- 本地

- 按組織規模

- 大型企業

- 中小型企業

- 按應用

- 客戶管理

- 風險與合規管理

- 店鋪營運管理

- 產品管理

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Capgemini SE

- RetailNext, Inc.

- Happiest Minds Technologies

- Capillary Technologies

- Thinkinside SRL

- Trax Image Recognition

- Cloud4Wi, Inc.

- Amoobi Inc.

- Hoxton Analytics Limited

- Motionloft Inc.

- SAP SE

第7章投資分析

第8章 市場機會與未來趨勢

The In-store Analytics Market size is estimated at USD 5.29 billion in 2025, and is expected to reach USD 15.66 billion by 2030, at a CAGR of 24.23% during the forecast period (2025-2030).

Increased Competition From E-commerce Players coupled with the need for enhanced shopping and customer services has been significant contributors to the growth of the In-store Analytics Market globally.

Key Highlights

- In-store analytics refers to analyzing customer behavior and drawing conclusions from it. This analysis focuses on the number of consumer behaviors observed when a customer visits a store. Store owners widely use it to boost their sales and improve customer satisfaction.

- Retail brands are focused on integrating cloud computing, a highly flexible and robust cloud-based reporting solution that provides a complete view of the business and empowers it to make informed decisions faster with increasing sales. The increasing advantage of the cloud further holds a strong trend in driving the in-store analytics market. According to NewGenApps, retailers leveraging the full potential of cloud computing for big data analytics can optimize their operating margins by approximately 60%. Also, the omnichannel retailer can monitor in-store customer behavior and drive timely offers to customers, thereby keeping the purchase within the fold of the retailer.

- Customer experience in in-store environments is one of the great brand differentiators which generates repeat buyers and loyal customers. It also includes everything from how the store looks and how employees engage with customers. The need for better customer service, enhanced shopping experience, and several techniques to increase sales without spending money could drive the demand for the in-store analytics market.

- However, the need for more personnel skills challenges the market's growth. The market faces a few issues owing to the need for more skilled personnel, which need to be more efficient to derive the required and vital insights from the retail data.

- Further, due to the COVID-19 pandemic, the business growth for analytics service providers is penetrating. As businesses for brick and mortar are shuttered during this pandemic, it is clear how important the cloud is for the continuity of operations. Any retail organization that actively resisted digitalization may face the harsh reality of the pandemic, which puts cloud providers in a strong position. In-store analytics also provides a platform for the supply chain distribution chain, which holds the demand for the market during the pandemic. This trend would continue to grow over the next few years due to entrant of new market players and expansion into new regions.

Instore Analytics Market Trends

Customer Management Segment to Witness Significant Market Growth

- According to the US Census Bureau, global retail sales were USD 7745.74 billion till Q3 in the current year, which increased compared to USD 6594.81 billion in the previous year. With growing sales, other factors, such as rapidly changing demographics and uncertain economic recovery, often present retailers with challenges. Moreover, retailers try to understand which products, services, and offers are more attractive to customers, which significantly caters to the importance of the in-store analytics platform and further needs the demand for consumer engagement analytics for the retailers.

- Recently, Five9, Inc., a cloud contact center provider, unveiled new features that support companies in providing more cohesive and engaging customer experiences across voice and digital channels. The inconsistent and fragmented customer experience can lead to annoyance and, even worse, attrition. By providing flexible and practical tools for installing and managing AI systems and continuing to integrate real-time customer analytics, Five9 is assisting enterprises in overcoming these difficulties.

- AI-based video analytics also create efficiencies and offer non-security-related insights for businesses. In the retail market, store owners using surveillance cameras with analytics can spot shoplifters and alert security personnel to intervene in real-time. The in-store analytics can also measure hotspots, visitor flow, dwell time, and product display activity.

- Further, knowing the busiest store periods would help ensure staffing levels appropriately meet customer demand, keep costs down, drive conversion rates, and improve the store's customer journey. Such multiple applications of In-store analytics for customer analytics and management are expected to further fuel the market growth of the in-store analytics market globally.

North America Accounts for Significant Market Share

- With the highest number of technology innovators and retail corporations, this region is expected to witness a significant market share with the increasing adoption of in-store analytics to enhance customers' buying experiences. Rapid embracement of technology such as cloud, AI, and others is complementing the requirement for in-store analytics in the region. Retail business enlargement is also expected to boost the implementation of in-store analytics solutions.

- The need for frequent software updates associated with in-store analytics and data security and privacy concerns over new advanced technologies would likely remain potent growth retardants for in-store analytics in the region. However, the in-store analytics market is likely to experience market growth due to the increasing adoption of AI-based in-store analytics coupled with the need for providing an improved shopping experience in the North American region.

- Further, due to COVID-19's impact on the US Retail Industry, retail companies generate a considerable base of unstructured data at an unprecedented rate, which makes it challenging to identify and capitalize on new lucrative opportunities. However, the post-pandemic world would be shaped by several factors contributing significantly to how retailers function.

- The in-store analytics would offer actionable insights by analyzing multiple data sets to help the retailers identify the right strategies for recovering lost sales and boosting market share by addressing the dynamic needs of its customers. Such applications of in-store analytics are expected to contribute to the demand for In-store Analytics in the market in North America.

Instore Analytics Industry Overview

The in-store analytics market is fragmented due to several players who keep innovating new platforms, penetrating the market rivalry. Key players are Capgemini SE, RetailNext, Inc., etc. Recent developments in the market are -

- In December 2022, VSBLTY Groupe Technologies Corp signed an agreement with Business Platform Investment Holdings (BPIH), a division of Al Jabr Group, to have access to digital out-of-home solutions, the Store as a Medium (SaaM) program, as well as security solutions for Retail outlets, the oil and gas industry, and smart cities in five Middle Eastern nations.

- In November 2022, Mosaic Solutions, a Manila-based F&B and retail management system provider, partnered with Philippines SM Supermalls to deploy advanced software for 82 malls nationwide and provide advanced insights to improve data-driven decision-making and operational efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing advantage of the Cloud

- 4.2.2 Need for Better Customer Service and Enhanced Shopping Experience

- 4.2.3 Customer Management Segment to Witness Significant Market Growth

- 4.3 Market Restraints

- 4.3.1 Lack of Personnel Skills

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 Cloud

- 5.2.2 On-Premises

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small & Medium Enterprises

- 5.4 By Application

- 5.4.1 Customer Management

- 5.4.2 Risk and Compliance Management

- 5.4.3 Store Operations Management

- 5.4.4 Merchandise Management

- 5.4.5 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Capgemini SE

- 6.1.2 RetailNext, Inc.

- 6.1.3 Happiest Minds Technologies

- 6.1.4 Capillary Technologies

- 6.1.5 Thinkinside SRL

- 6.1.6 Trax Image Recognition

- 6.1.7 Cloud4Wi, Inc.

- 6.1.8 Amoobi Inc.

- 6.1.9 Hoxton Analytics Limited

- 6.1.10 Motionloft Inc.

- 6.1.11 SAP SE