|

市場調查報告書

商品編碼

1641865

入門 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Primer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

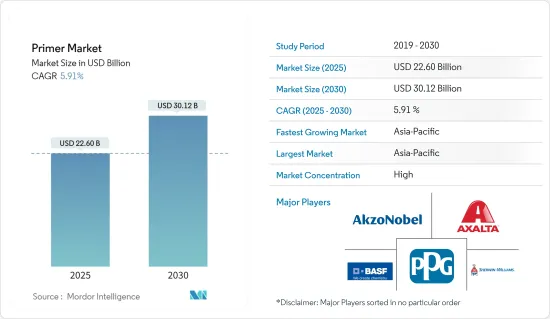

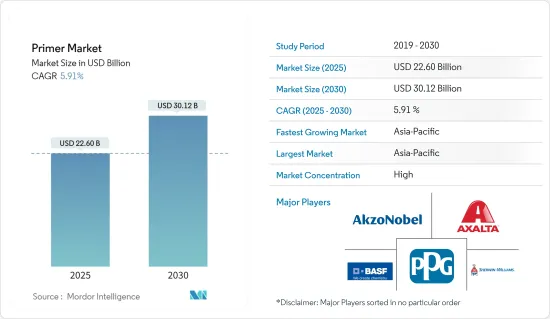

預計 2025 年底漆市場規模為 226 億美元,到 2030 年將達到 301.2 億美元,預測期內(2025-2030 年)的複合年成長率為 5.91%。

COVID-19 疫情對市場產生了負面影響,因為建築和汽車製造活動已暫時停止,以遏制新的 COVID-19 病例的傳播,從而減少了這些終端用戶行業的底漆消耗。不過,這種情況在2021年開始有所改善。預計這將在預測期內增加對產品的需求。

關鍵亮點

- 短期內,亞太地區建設活動的增加和汽車產業的不斷發展預計將推動市場成長。

- 另一方面,有關底漆使用的規定可能會阻礙市場成長。

- 生物性底漆使用方面的技術創新有望成為市場成長的機會。

- 亞太地區是全球最大的市場,其中印度、中國和其他國家的需求和消費量最高,預計將主導全球市場。

底漆市場趨勢

建築和施工領域佔據市場主導地位

- 底漆廣泛用於建築和施工領域。它可用作牆壁和其他基材上塗漆前的底漆。

- 底漆是一種有色塗料,在塗Undercoats底漆或面漆之前塗在新表面或舊表面上。建築業的成長在增加油漆和被覆劑的需求方面發揮著重要作用。隨著建設活動數量的增加,對油漆和被覆劑的需求也隨之增加,最終促進底漆市場的發展。

- 過去幾年,由於人口成長、新城市開發、都市區移民增加以及成熟城市老化基礎設施更新等因素,建築和建築業一直保持成長勢頭。美元。

- 美國佔據北美建築業的很大佔有率。美國、加拿大和墨西哥也對建築業投資做出了重大貢獻。

- 根據美國人口普查局的數據,2023年美國年度建築價值為19,787億美元,較2022年增加約7.03。

- 亞太地區的建築業是世界上最大的。由於人口成長、中產階級的壯大和都市化,中國正經歷健康的成長率。

- 受中國和印度住宅建築市場擴張的推動,預計亞太地區將出現最高成長。預計到2030年,這些國家將佔全球中階的43.3%以上。

- 因此,預計上述因素將在未來幾年對市場產生重大影響。

亞太地區佔市場主導地位

- 預計亞太地區將在預測期內經歷最大的成長。這是由於該地區建築業和汽車生產的不斷發展。

- 亞太地區擁有許多新興經濟體,如印度、中國、印尼和越南。這使得它成為投資者感興趣的市場。

- 到2030年,全球建築市場規模預計將達到8兆美元。預計印度、中國和美國等國家將推動大部分成長。

- 中國正經歷建築熱潮。中國擁有全球最大的建築市場,佔全球建築投資總額的20%。到2030年,預計光是中國就在建築領域投資約13兆美元。

- 根據中國國家統計局預測,2023年中國建築業總產值將成長1.99%,達到人民幣712847.2億元(108,678億美元)。

- 此外,印度的住宅產業正在成長,政府的支持和舉措進一步刺激了需求。在 2022-2023 年預算中,住房與城市發展部(MoHUA) 已撥款約 98.5 億美元用於住宅建設和籌集資金以完成停滯的計劃。

- 除了建築業之外,汽車業也是該地區的主要產業,對底漆的需求很大。

- 亞太地區是全球最有價值汽車製造商的所在地。中國、印度、日本和韓國等國家正致力於加強製造地和發展高效的供應鏈以提高盈利。

- 根據中國工業協會(CAAM)統計,中國是全球最重要的汽車生產基地,預計2023年汽車總產量將達到3,016萬輛,較去年的2,702萬輛成長11.6%。根據國際貿易管理局(ITA)預測,2025年國內汽車產量將達3,500萬輛。

- 此外,印度的汽車工業是世界第五大汽車工業,預計2030年將成為世界第三大汽車工業。根據國際汽車結構組織(OICA)的數據,到 2023 年,印度的汽車產量預計將成長約 7%,達到 585 萬輛。

- 預計上述因素將在未來幾年對市場產生重大影響。

底漆產業概覽

底漆市場本質上呈現整合狀態。主要企業(不分先後順序)包括 AkzoNobel NV、宣威公司、Axalta Coating Systems LLC、PPG Industries Inc. 和BASF SE。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 亞太地區建設活動不斷增加

- 不斷發展的汽車產業

- 其他促進因素

- 限制因素

- 有關底漆使用的嚴格環境法規

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 按組件

- 樹脂

- 丙烯酸纖維

- 環氧樹脂

- 聚醋酸乙烯酯

- 醇酸

- 其他樹脂(馬來酸、聚酯、聚醯胺等)

- 按添加劑

- 分散劑

- 除生物劑

- 表面改質劑

- 其他添加物(防銹劑、鹽害抑制劑、乳化劑、穩定劑等)

- 其他成分(溶劑、顏料等)

- 樹脂

- 按最終用戶產業

- 車

- 建築和施工

- 家具

- 工業的

- 包裝

- 其他終端用戶產業(金屬加工、塑膠、橡膠)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AkzoNobel NV

- Asian Paints

- Axalta Coating Systems LLC

- BASF SE

- Berger Paints India Limited

- Hempel A/S

- Jotun

- Kansai Paint Co. Ltd

- Masco Corporation

- NIPSEA Group

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- Tikkurila

第7章 市場機會與未來趨勢

- 生物性底漆的創新

- 其他機會

The Primer Market size is estimated at USD 22.60 billion in 2025, and is expected to reach USD 30.12 billion by 2030, at a CAGR of 5.91% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market as construction and automotive manufacturing activities were temporarily halted to reduce the spread of new COVID-19 cases, thereby decreasing the consumption of primer in these end-user industries. However, the condition started recovering in 2021. This is expected to increase the demand for the product during the forecast period.

Key Highlights

- Over the short term, the growth of the market is likely driven by increasing construction activities in Asia-Pacific and the growing automotive industry.

- On the flip side, regulations regarding the use of primers are likely to hinder market growth.

- Innovations in the use of bio-based primers are expected to act as opportunities for market growth.

- Asia-Pacific is the largest market in the world and is expected to dominate the global market, with the highest demand and consumption from India, China, and other countries.

Primer Market Trends

Building and Construction Segment to Dominate the Market

- Primer is extensively used in the building and construction sectors. It is used as a preparatory coat on walls and other substrates before applying the paint.

- Primers are pigmented coatings that are applied to new or old surfaces prior to the application of undercoats or topcoats. The growing construction industry plays a keen role in the increasing demand for paints and coatings. The greater the increase in the number of construction activities, the greater the demand for paints and coatings, which will eventually boost the market for primers.

- The building and construction industry has been growing for the past few years, owing to factors such as increasing population, development of new cities, growing migration in urban areas, renewal of old infrastructure in established cities, and others, and it is expected to reach a revenue of USD 4.4 trillion by 2030.

- The United States includes a significant share of the construction industry in North America. The United States, Canada, and Mexico also contribute significantly to the construction sector investments.

- According to the US Census Bureau, the annual value for construction in the United States accounted for USD 1,978.7 billion in 2023, which was an increase of about 7.03 compared to 2022.

- The construction sector in Asia-Pacific is the largest in the world. It is growing at a healthy rate, owing to the rising population, increase in middle-class income, and urbanization.

- The highest growth for housing is expected to be registered in Asia-Pacific, owing to the expanding housing construction markets in China and India. These countries are expected to represent over 43.3% of the global middle class by 2030.

- Therefore, the factors mentioned above are expected to have a significant impact on the market in the coming years.

Asia-Pacific to Dominate the Market

- During the forecast period, Asia-Pacific is expected to witness the maximum growth. This is because the construction industry and automotive production in the region are growing.

- Asia-Pacific has a lot of countries with emerging economies, like India, China, Indonesia, and Vietnam. This has made it a market that investors are interested in.

- By 2030, the global construction market is expected to be worth USD 8 trillion. Countries like India, China, and the United States are expected to drive most of this growth.

- China is amid a construction boom. The country has the world's largest building market, accounting for 20% of all construction investment globally. The country alone is expected to spend nearly USD 13 trillion on buildings by 2030.

- According to the National Bureau of Statistics of China, the gross output value of the construction industry in China in 2023 increased by 1.99%, accounting for CNY 71,284.72 billion (USD 10,086.78 billion).

- In addition, the residential sector in India is growing, and government support and initiatives are further boosting demand. In the budget of 2022-2023, the Ministry of Housing and Urban Development (MoHUA) allocated about USD 9.85 billion to construct houses and create funds to complete the halted projects.

- Along with the construction industry, the automotive industry is another major industry in the region contributing to significant demand for primers.

- Asia-Pacific is home to some of the world's most valuable vehicle manufacturers. Countries like China, India, Japan, and South Korea have been working hard to strengthen their manufacturing bases and develop efficient supply chains for greater profitability.

- According to the China Association of Automobile Manufacturers (CAAM), China has the most significant automotive production base in the world, with a total vehicle production of 30.16 million units in 2023, registering an increase of 11.6% compared to 27.02 million units produced last year. As per the International Trade Administration (ITA), domestic automotive production is expected to reach 35 million units by 2025.

- Further, the Indian automotive industry is the fifth largest in the world and is projected to become the third largest by 2030. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), Indian automotive production in 2023 increased by about 7% and was valued at 5.85 million units.

- The above factors are likely to have a significant effect on the market in the coming years.

Primer Industry Overview

The primer market is consolidated in nature. The major players (not in any particular order) include AkzoNobel NV, The Sherwin-Williams Company, Axalta Coating Systems LLC, PPG Industries Inc., and BASF SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Construction Activities in the Asia-Pacific Region

- 4.1.2 Growing Automotive Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding the Use of Primers

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Ingredient

- 5.1.1 Resin

- 5.1.1.1 Acrylic

- 5.1.1.2 Epoxy

- 5.1.1.3 Poly Vinyl Acetate

- 5.1.1.4 Alkyd

- 5.1.1.5 Other Resins (Maleic, Polyester, Polyamide, etc.)

- 5.1.2 By Additives

- 5.1.2.1 Dispersant

- 5.1.2.2 Biocides

- 5.1.2.3 Surface Modifier

- 5.1.2.4 Other Additives (Rust Inhibitors, Salt Inhibitors, Emulsifiers, Stabilizers, etc)

- 5.1.3 Other Ingredients (Solvent, Pigments, etc.)

- 5.1.1 Resin

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.2 Building and Construction

- 5.2.3 Furniture

- 5.2.4 Industrial

- 5.2.5 Packaging

- 5.2.6 Other End-user Industries (Metalworking, Plastic, and Rubber)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AkzoNobel NV

- 6.4.2 Asian Paints

- 6.4.3 Axalta Coating Systems LLC

- 6.4.4 BASF SE

- 6.4.5 Berger Paints India Limited

- 6.4.6 Hempel A/S

- 6.4.7 Jotun

- 6.4.8 Kansai Paint Co. Ltd

- 6.4.9 Masco Corporation

- 6.4.10 NIPSEA Group

- 6.4.11 PPG Industries Inc.

- 6.4.12 RPM International Inc.

- 6.4.13 The Sherwin-Williams Company

- 6.4.14 Tikkurila

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation of Bio-based Primers

- 7.2 Other Opportunities