|

市場調查報告書

商品編碼

1640633

拉丁美洲安全儀器系統市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)LA Safety Instrumented Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

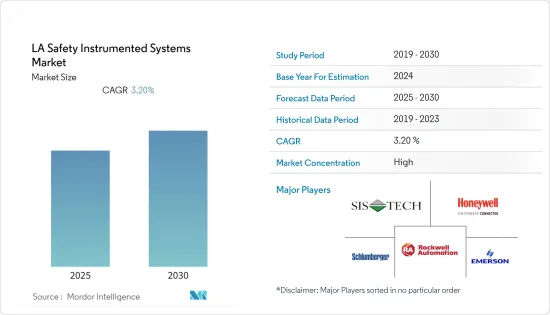

預測期內拉丁美洲安全儀器系統市場預計複合年成長率為 3.2%

關鍵亮點

- 經濟成長、人口增加和外商投資是市場擴大的跡象。安全儀器系統不再只是政府監管的需要。如今,安全儀器系統幾乎已成為所有發展中和新興產業的必備條件。

- 工業過程中存在許多危險,特別是在化學和天然氣領域。這些安全儀器系統用於確保員工、設備和環境的安全。安全儀器系統保護危險區域內的所有工業製程。

- 巴西和墨西哥由於汽車行業的成長已成為該地區的兩個重要國家。預計明年兩國的汽車產業都將成長。

- 隨著行業參與企業制定擴張計劃,墨西哥的汽車製造業正在呈現顯著成長。根據墨西哥國家汽車工業統計局統計,墨西哥輕型汽車產量已超過250萬輛。

- COVID-19 疫情導致各行各業的商品和服務產量急劇下降,因為政府為遏制病毒傳播而製定的多項限制措施使大多數公司不得不完全停止或限制生產。因此,疫情對安全儀器系統(SIS)的發展產生了重大影響。

拉丁美洲安全儀器系統市場趨勢

化工和石化行業預計將佔據主要市場佔有率

- 安全儀器系統由感測器、邏輯控制器和最終控制元件組成,用於在指定條件被違反時保證製程的安全。

- 安全儀器系統相對於傳統系統的優勢日益增強,推動了市場需求。化學和石化行業被視為一項持續發展的行業,其中老化的安全問題以及擴大和升級基礎設施的需求至關重要。傳統的安全系統是透過電氣控制系統部署的,而且是硬接線的,這很容易引發影響人員、財產和環境的事故。

- 這一趨勢可能會推動石化產業對安全儀器系統的需求激增。安全儀器系統具有多種優勢,包括延長現場使用壽命、減少非計劃停機時間、降低年度維護成本、消除意外維修成本以及符合現行法規和標準。因此,安全儀器系統相對於傳統安全系統日益成長的優勢可能會推動該產業的發展。

- 化學工業的環境十分危險,因為氣體、油和灰塵會在機械內部和周圍形成爆炸性環境。與監管、地緣政治風險、自然資源使用的法律限制、股東積極性和日益嚴格的社會審查相關的行業問題帶來了進一步的挑戰。因此,火災和氣體監測和偵測、SCADA 以及 HIPPS 的安裝等安全設備至關重要。

- 根據墨西哥國家化學工業協會統計,2021年墨西哥化學工業產值達194億美元,與前一年同期比較成長約15.7%。預計化學品需求的增加將對該地區的安全儀器系統市場產生正面影響。

預計其他國家將佔據較大市場佔有率

- 阿根廷是主要原油生產國和消費國之一。由於瓦卡穆埃爾塔頁岩和內烏肯盆地緻密氣產量增加,該國的天然氣產量正在增加。

- 該國能源部估計,到 2023 年,瓦卡穆埃爾塔的石油產量可能會從 2019 年的 50 萬桶/日翻倍增至 100 萬桶/日。隨著產量的增加,阿根廷已恢復透過管道向智利和巴西等鄰國出口天然氣,進一步刺激了對 SIS 設備的需求。

- 根據世界銀行的數據,2021年工業產值約佔阿根廷GDP的23.6%。同年,21.41%的阿根廷就業者在工業部門工作。據設備製造商協會稱,未來幾年阿根廷的工業價值預計將會增加。

- 儘管受到疫情和全球半導體短缺的影響,大眾汽車仍有望在拉丁美洲首次累計。大眾汽車計劃在未來五年內投資18億美元,以更好地在這個重要產業中競爭並確保其長期盈利。

- 除了進一步的本地汽車計劃外,拉丁美洲的數位化和脫碳努力也可能得到加強,其中包括建立生質燃料研究設施作為市場橋接技術,以幫助大眾汽車推進其全球電氣化努力。透過這些舉措,儘管疫情導致供應鏈中斷,但該地區預計未來幾年仍將實現成長。

- 根據阿根廷DNRNPACP的數據,2021年阿根廷約有1,700萬輛汽車合法上市流通,比上年成長約2%。

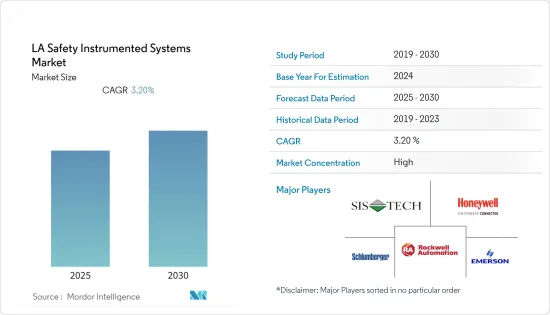

拉丁美洲安全儀器系統產業概況

拉丁美洲安全儀器系統市場集中在羅克韋爾自動化公司、霍尼韋爾國際公司和艾默生電氣公司等主要企業。從市場佔有率來看,目前市場主要被少數幾家大公司佔據。這些擁有較大市場佔有率的大公司正致力於擴大其國際基本客群。這些公司正在利用策略合作措施來增加市場佔有率和盈利。預計競爭、快速的技術進步以及消費者偏好的頻繁變化將在預測期內威脅到公司的成長。

- 2022 年12 月- PE Energy Group 正在與奈及利亞合作制定能源轉型計劃,到2035 年消除常規天然氣燃燒,並努力提高奈及利亞在石油和天然氣價值鏈中的本地參與度。了首個高誠信專案壓力保護系統 (HIPPS) 重新認證設施。

- 2022 年 11 月-印度理工學院古瓦哈提分校與印度石油公司簽署合作備忘錄。該實驗室將為該公司位於阿薩姆邦的杜里亞詹工廠設計和開發帶有引燃燃燒器火焰偵測功能的原型遠端點火系統。該技術為替代老舊石油生產設施上的手動點火系統提供了更安全的選擇。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 工業影響評估

第5章 市場動態

- 市場促進因素

- 產業法規環境日益加強

- 強大的SIS服務生態系統

- 市場限制

- 操作複雜,維護成本高

第6章 市場細分

- 應用

- 緊急停機系統 (ESD)

- 火災和氣體監控系統 (F&GC)

- 高完整性壓力保護系統 (HIPPS)

- 燃燒器管理系統 (BMS)

- 渦輪機械控制

- 其他

- 最終用戶

- 化工和石化

- 發電

- 藥品

- 飲食

- 石油和天然氣(上游、下游和中游佔比)

- 其他

- 國家

- 巴西

- 墨西哥

- 其他國家

第7章 競爭格局

- 公司簡介

- Rockwell Automation Inc.

- Emerson Electric Company

- Honeywell International Inc.

- SIS-TECH Solutions LP

- Schlumberger Limited

- Yokogawa Electric Corporation

- ABB Ltd

第8章投資分析

第9章:市場的未來

The LA Safety Instrumented Systems Market is expected to register a CAGR of 3.2% during the forecast period.

Key Highlights

- The expanding economy, population numbers, and foreign investments are signs of market expansion. Imports of products and services have been steadily increasing, indicating a stronger consumption rate in the Latin American region. Safety-instrumented systems are becoming more than just a government regulatory need. They are now a requirement in practically all developing and rising industries.

- Many dangers are present in industrial processes, particularly in the chemicals and gas sectors. These safety-instrumented systems are used to safeguard the safety of employees, equipment, and the environment. A safety-instrumented system protects all industrial processes in hazardous zones.

- Brazil and Mexico emerged as two significant nations in the region due to the growing automobile sector. The industry is expected to grow in both countries next year.

- Mexico's automotive manufacturing sector is witnessing significant growth due to the players in the industry rolling out expansion plans. As per INEGI, the production of light vehicles in Mexico exceeded 2.5 million units.

- The COVID-19 pandemic significantly impacted the growth of various industries as most companies had to put a complete stop or limit their production owing to several restrictions set by the government to curb the spread of the virus. As a result, the pandemic notably impacted the growth of safety instrumented systems (SIS).

Latin America Safety Instrumented Systems Market Trends

Chemical and Petrochemical Industry is expected to Hold a Major Market Share

- A safety instrumented system comprises sensors, logic solvers, and final control elements for keeping the process safe when predetermined conditions are violated.

- The growing benefits of safety instrumented systems over traditional systems fuel market demand. The chemicals and petrochemicals industries are identified as continuously developing initiatives wherein the need to expand and upgrade aging safety problems and infrastructures is essential. Traditional safety systems are deployed through an electrical control system and are hardwired, leading to potential accidents affecting people, assets, and the environment.

- This trend may surge the demand for safety instrumented systems in petrochemical industries that deliver several advantages, such as prolonged field life, reduction in unplanned downtime, reduction in annual maintenance cost, elimination of unexpected repair expenses, and adherence to current codes and standards. Thus, the increasing advantages of safety instrumented systems over traditional safety systems may drive industry growth.

- Chemical industries have hazardous environments due to gas, oil, or dust, creating an explosive atmosphere in and around the machines. The industry issues related to regulation, geopolitical risk, legal limits on using natural resources, shareholder activism, and increasing public scrutiny create additional challenges. Thus, safety equipment such as fire and gas monitoring and detection, SCADA, and HIPPS installation is of utmost importance.

- As per Asociacion Nacional de la Industria Quimica (Mexico), the chemical industry's production in Mexico amounted to USD 19.4 billion in 2021, an increase of approximately 15.7% compared to the previous year. Such an increase in chemical demand is estimated to impact the region's safety instrumented systems market positively.

Other Countries Expected to Hold Significant Market Shares

- Argentina has been one of crude oil's significant producers and consumers. The country has been witnessing increased natural gas production due to the increasing production from the Neuquen Basin's Vaca Muerta shale and tight gas play.

- The country's energy department estimated that Vaca Muerta might double the country's oil production to 1 million b/d by 2023 from 500,000 b/d in 2019. As production has grown, Argentina has resumed exporting natural gas by pipeline to neighboring countries, like Chile, Brazil, etc., further boosting the demand for SIS equipment.

- According to World Bank, in 2021, the share of industrial production in Argentina's GDP was approximately 23.6%. In the same year, 21.41% of the employees in Argentina were active in the industrial sector. According to the Association of Equipment Manufacturers, the industry's value in Argentina is expected to increase in the following years.

- Volkswagen intends to report a positive result in Latin America for the first time, despite the pandemic and the global semiconductor scarcity. Volkswagen plans to spend USD 1.8 billion over the next five years to improve its competitive position in this vital industry and ensure long-term profitability.

- In addition to further local vehicle projects, Latin America's digitization and decarbonization efforts may be bolstered, which include a biofuels research facility as a market-bridging technology to support Volkswagen's global electrification push. Despite the supply chain disruption due to the pandemic, the region is anticipated to witness growth in the coming years due to such initiatives.

- As per the DNRNPACP (Argentina), nearly 17 million automobiles were duly authorized to circulate in Argentina in 2021, around 2% more than the last year.

Latin America Safety Instrumented Systems Industry Overview

The Latin American safety instrumented systems market is concentrated with several major players like Rockwell Automation Inc., Honeywell International Inc., Emerson Electric Company, etc. In terms of market share, few significant players currently dominate the market. With a prominent share in the market, these major players are focusing on expanding their customer base internationally. These companies leverage strategic collaborative initiatives to increase their market share and profitability. The competition, rapid technological advancements, and frequent changes in consumer preferences are expected to threaten the companies' growth during the forecast period.

- December 2022 - PE Energy Group inaugurated its first High Integrity Pressure Protection System (HIPPS)recertification facility in line with Nigeria's energy transition plan to attain zero routine gas flaring by 2035 and the nation's increasing efforts to improve local participation in the oil and gas value chain.

- November 2022 - The Indian Institute of Technology Guwahati signed an MoU with Oil India. The institute will design and develop a prototype for Remote Ignition with Pilot Burner Flame Detection System for the company's Duliajan plant in Assam. The technology will provide a safer option by replacing manual fire ignition systems at old oil production installations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Regulatory Environment in the Industry

- 5.1.2 Presence of Robust SIS Service Ecosystem

- 5.2 Market Restraints

- 5.2.1 Operational Complexity and High Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 Application

- 6.1.1 Emergency Shutdown Systems (ESD)

- 6.1.2 Fire and Gas Monitoring and Control (F&GC)

- 6.1.3 High Integrity Pressure Protection Systems (HIPPS)

- 6.1.4 Burner Management Systems (BMS)

- 6.1.5 Turbo Machinery Control

- 6.1.6 Other Applications

- 6.2 End User

- 6.2.1 Chemicals and Petrochemicals

- 6.2.2 Power Generation

- 6.2.3 Pharmaceutical

- 6.2.4 Food and Beverage

- 6.2.5 Oil and Gas (with a Percentage Breakdown by Upstream, Downstream, and Midstream)

- 6.2.6 Other End Users

- 6.3 Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 Emerson Electric Company

- 7.1.3 Honeywell International Inc.

- 7.1.4 SIS-TECH Solutions LP

- 7.1.5 Schlumberger Limited

- 7.1.6 Yokogawa Electric Corporation

- 7.1.7 ABB Ltd