|

市場調查報告書

商品編碼

1685895

安全儀器系統-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Safety Instrumented System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

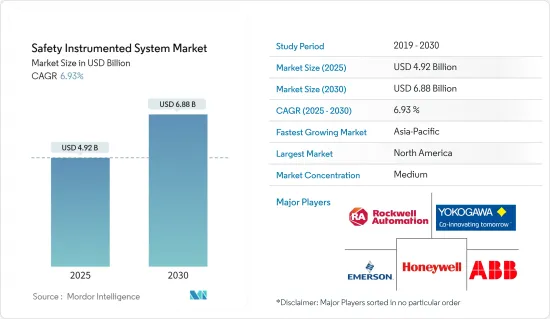

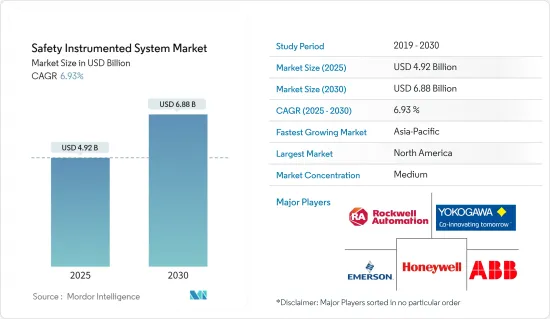

安全儀器系統市場規模預計在 2025 年為 49.2 億美元,預計到 2030 年將達到 68.8 億美元,預測期內(2025-2030 年)的複合年成長率為 6.93%。

安全法規和標準的激增,加上個人和組織層面對工業安全管理和能力需求的認知不斷提高,導致製造設備迅速採用安全開關來預防事故。

主要亮點

- 2023 年 8 月,印度中央邦一家食品廠的五名工人因吸入儲槽中疑似有毒氣體而死亡。事故原因是工廠疏忽了安全措施。印度古吉拉突邦一家化工廠的 18 名工人因吸入儲罐洩漏的有毒氣體而入院治療。這種令人擔憂的發展凸顯了該國各個終端用戶產業採用可靠壓力保護系統的必要性。

- 化學和石化、發電、製藥、食品和飲料、石油和天然氣以及其他最終用戶的工業流程受到各個管理機構的嚴格監管,以防止突然發生故障和災難。法規環境正在收緊,以鼓勵部署 SIS 作為預防措施。安全法規和標準的廣泛採用以及個人和組織層面對工業安全管理和能力需求的認知不斷提高,導致製造設備迅速採用安全開關來防止任何事故的發生。

- 石油和天然氣行業採用 SIS 是由旨在限制災難性洩漏和避免環境污染的嚴格法律和立法推動的。

- 例如,美國《石油污染法》以及《石油洩漏預防和準備條例》旨在防止此類事件發生。一些合規計劃,例如行政命令 13892 第 7 節設想的現場民事檢查程序規則,將確保進行合理的行政檢查,以檢查設施是否遵守環境法。各行業法規環境的不斷加強促進了市場的成長。

- 自以色列-哈馬斯危機爆發以來,油價已上漲約6%,預計將繼續上漲。世界各地的經濟學家正在製定策略來應對持續戰爭帶來的通膨影響。分析師正密切關注中東危機的發展軌跡,並將其與該地區過去的衝突進行比較,以評估其潛在的經濟影響。

- 世界銀行表示,以色列和巴勒斯坦武裝分子之間的衝突升級可能導致數十年來首次發生重大能源衝擊。這一發展發生在俄羅斯與烏克蘭最近爆發戰爭以及中東持續危機之後,引發了人們對 20 世紀 70 年代石油價格危機重演的擔憂。因此,預計此次危機將對安全儀器系統 (SIS) 產業產生重大影響,因為石油和天然氣產業是 SIS 的最大終端用戶。

- 戰爭也可能導致食品和能源價格上漲,加劇經濟影響並對全球大宗商品市場造成雙重衝擊。因此,石油和天然氣價格上漲可能會產生連鎖反應,增加航運和化肥產業的成本。這可能會導致農產品價格上漲,進一步影響安全儀器系統(SIS)的發展。

安全儀器系統市場趨勢

化工和石化行業預計將佔據主要市場佔有率

- 安全儀器系統包含感測器、邏輯控制器和最終控制元件,以便在指定條件被違反時確保製程的安全。安全儀器系統相對於傳統系統的優勢日益增強,刺激了市場需求。化學和石化行業被認為是一個不斷發展的行業,存在著老化的安全問題以及擴大和升級基礎設施的必要性。

- 例如,根據 Brand Finance 的數據,到 2023 年,全球工產業品牌價值將達到約 620 億美元。這意味著自 2015 年以來,全球工業品牌價值增加了 360 多億美元。傳統的安全系統透過電氣控制系統部署,並且是硬接線的,這為影響人員、財產和環境的事故敞開了大門。

- 預計這將推動石化行業對安全儀表系統的需求,該系統具有多種優勢,例如延長現場壽命、減少計劃外停機時間、降低年度維護成本、消除意外儀器成本以及符合現行法規和標準。因此,安全儀器系統相對於傳統安全系統日益增強的優勢有望推動該產業的發展。

- 化學工業的環境十分危險,氣體、油和灰塵會在機械內部和周圍形成爆炸性環境。此外,與監管、地緣政治風險、自然資源使用的法律限制、股東積極性和公眾監督力度加強有關的行業問題也帶來了進一步的挑戰。因此,火災和氣體監測與偵測、SCADA 以及 HIPPS 的安裝等安全設備至關重要。

- 此外,許多公司還提供商務用控制器,以處理石化工廠複雜的設備維護。例如,智慧安全公司 HIMA 提供執行經典緊急關閉業務和處理複雜設備功能的控制器。 SafeEthernet通訊協定可確保控制器之間的安全通訊達到安全完整性等級 3 (SIL 3)。此外,安全停車期間的快速反應時間和安全關鍵生產過程中的高操作安全性(SIL 3)有助於提高乙炔廠的運轉率和生產力。

亞太地區預計將實現高成長

- 在許多工業製程和自動化系統中,安全儀器系統在提供一層保護功能方面發揮著至關重要的作用。 「安全系統工程」一詞是指在工廠的整個生命週期內識別危險、指定安全要求以及維護和操作系統的規範而系統的方法。石化和能源產業的崛起對於安全儀器系統產業的發展至關重要。

- 此外,隨著製程工業逐漸採用更高的安全標準,可能需要能夠管理蒸氣渦輪、壓縮機、變速驅動器等變化的控制系統,以在滿足敏捷需求的同時保持盈利。

- 隨著工業國家工業成長放緩,對閥門和致動器的需求也放緩。政府對新興產業的支持力道不斷加大,政治條件將有利於產業擴張。因此,外國公司正在尋求投資該行業。此外,該地區還在努力並計劃建立水和污水處理廠。

- 例如,柬埔寨政府與日本國際協力機構已同意在當哥地區興建污水處理廠。這個耗資 2500 萬美元的計劃旨在改善該地區的排水基礎設施,使廢水直接流入工廠而不是河流。預計此類計劃將推動亞太地區安全儀器系統市場的發展。

- 食品和飲料行業有道德和法律責任保護其員工。重型機械、危險化學物質和光滑的表面是人們最關心的問題,而吸入灰塵、聽力損失和重複性勞損則是較為輕微的威脅。全球最大的飲料公司可口可樂注意到東南亞對無糖和低糖飲料的需求激增。自從新冠疫情爆發以來,這一點變得更加明顯。

- 由於工業活動的快速成長、成本壓力和生產率的上升以及中國和印度等新興經濟體的政府政策的優惠,亞太地區預計將呈現最快的成長率。製造商正在透過開發針對特定應用的新產品來滿足基於應用的不斷變化的需求。

- 此外,安全儀器系統的激增正在創造更複雜的系統。此外,石油和天然氣、化學和電力行業對這些系統的使用正在增加,因為它們有助於監控使用時間、鍋爐管理的各個方面、煙囪溫度、鍋爐和燃料效率——所有這些都是該行業中重要的因素。

- 此外,中國共產黨在2020年全國人民代表大會上宣布,將投資約1.4兆美元用於數位基礎設施公共支出計劃,並加倍推進「中國舉措2025」和「中國標準2035」計劃。中國的新基礎設施計畫為全球企業提供了令人興奮的機會。因此,預計新能源汽車、石油天然氣、5G設備、物流、能源電力等各領域對SIS設備的採用將會增加,進而推動該地區的市場成長。

安全儀器系統產業概況

安全儀器系統市場較為固體,主要由西門子股份公司、ABB 有限公司和Schneider Electric股份有限公司等幾家主要公司組成。這些佔據了絕對市場佔有率的大公司正致力於擴大海外基本客群。這些公司正在利用策略合作措施來增加市場佔有率和盈利。預計市場競爭、技術的快速進步以及消費者偏好的頻繁變化將在預測期內威脅市場成長。

- Honeywell10 月霍尼韋爾推出了一款鋰離子 (Li-ion) 電池安全感測器,旨在在識別電動車 (EV) 中潛在的電池火災方面發揮重要作用。為了補充這一點,Honeywell提供了一系列個人防護設備(PPE) 和氣體檢測解決方案,以提高電動車工廠工人的安全性。將Honeywell電池安全感測器整合到電動車和Scooter電池組中,可提前檢測到熱失控風險,及時向乘客發出警告,並協助製造商滿足全球電池防火安全標準。

- 2023 年 8 月,橫河電機宣布計劃發布其協作資訊伺服器(CI 伺服器)的升級版本,這是其 OpreX 控制和安全系統套件的關鍵組件。此次升級增強了警報管理,改善了維護資訊的訪問,並擴大了對全球通訊標準的支援。該解決方案旨在匯總來自不同工廠設備和系統的大量資料,並促進整個企業生產活動的合理管理。這創造了一個能夠進行遠端監控、從任何位置控制操作和快速決策的環境。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀趨勢如何影響市場

第5章市場動態

- 市場促進因素

- 產業法規環境日益完善

- 強大的SIS服務生態系統

- 市場限制

- 操作複雜,維護成本高

第6章市場區隔

- 按應用

- 緊急關閉系統(ESD)

- 火災和氣體監控系統(F&GC)

- 高完整性壓力保護系統 (HIPPS)

- 燃燒器管理系統(BMS)

- 渦輪機械控制

- 其他用途

- 按最終用戶

- 化工和石化

- 發電

- 製藥

- 食品和飲料

- 石油和天然氣

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東

- 非洲

第7章競爭格局

- 公司簡介

- Rockwell Automation Inc.

- Emerson Electric Company

- Honeywell International Inc.

- Yokogawa Electric Corporation

- ABB Ltd

- Schneider Electric SE

- Siemens AG

- HIMA Paul Hildebrandt GmbH

- SIS-TECH Solutions LP

- Schlumberger Limited

第8章投資分析

第9章:市場的未來

The Safety Instrumented System Market size is estimated at USD 4.92 billion in 2025, and is expected to reach USD 6.88 billion by 2030, at a CAGR of 6.93% during the forecast period (2025-2030).

The widespread adoption of safety regulations and standards, coupled with increased awareness about the need for industrial safety management and competency at individual and organizational levels, has led to the rapid adoption of safety switches in manufacturing units to prevent accidents.

Key Highlights

- In August 2023, five laborers died after inhaling a suspected poisonous gas that emanated from a tank at a food product factory in Madhya Pradesh. It was due to a lack of negligence in taking safety measures at the factory. Also, 18 workers were hospitalized after inhaling a toxic gas that leaked from a tank in a chemical factory in Gujarat, India. Such an alarming situation has emphasized the need for various end-user industries in the country to adopt high-integrity pressure protection systems.

- The industrial processes across chemicals and petrochemicals, power generation, pharmaceuticals, food and beverage, oil and gas, and other end users are closely regulated by various governing bodies to prevent sudden breakdowns and mishaps. The regulatory environment has tightened to encourage the deployment of SIS as a precautionary measure. The widespread adoption of safety regulations and standards, coupled with increased awareness about the need for industrial safety management and competency at both individual and organizational levels, has led to the rapid adoption of safety switches in manufacturing units to prevent any accidents.

- The deployment of the SIS in the oil and gas industry is driven by the strict laws and acts that are formulated to restrict catastrophic spillage and avoid environmental pollution.

- For instance, the US Oil Pollution Act, alongside Oil Spills Prevention and Preparedness Regulations, is placed to prevent such accidents. Several compliance programs, such as the On-Site Civil Inspection Procedures Rule, as contemplated by section 7 of EO 13892, ensure that reasonable administrative inspections check whether the facilities comply with environmental laws. The growing regulatory environment in various industries contributes to market growth.

- Since the onset of the Israeli-Hamas crisis, oil prices have surged by approximately 6%, with expectations of further increases. Global economists are formulating strategies to address the inflationary impact resulting from the ongoing war, which has already left a lasting mark on the global economy, causing continuous disruptions. Analysts are closely scrutinizing the trajectory of the Middle East crisis, drawing comparisons with past conflicts in the region to assess potential economic repercussions.

- According to the World Bank, an escalation in the conflict between Israel and the Palestinian militant group could trigger a significant energy shock, marking the first such occurrence in decades. These consequences stem from the aftermath of Russia's recent war with Ukraine and the persisting Middle East crisis, raising concerns of a recurrence of the oil price crisis seen in the 1970s. Consequently, the crisis is anticipated to significantly impact the Safety Instrumented Systems (SIS) sector, given that the oil and gas industry ranks among the largest end-users of SIS.

- The war is also poised to lead to higher food and energy prices, potentially intensifying economic consequences and causing a dual shock in global commodity markets. The resulting surge in oil and gas prices would have a cascading effect, elevating costs in the shipping and fertilizer sectors. This, in turn, could translate into increased prices for agricultural commodities, further influencing the growth of Safety Instrumented Systems (SIS).

Safety Instrumented System Market Trends

Chemical and Petrochemical Industry is Expected to Hold a Major Market Share

- A safety instrumented system encompasses sensors, logic solvers, and final control elements to keep the process safe when predetermined conditions are violated. The growing benefits of safety instrumented systems over traditional ones fuel the market demand. The chemicals and petrochemicals industries are identified as continuously developing industries where the need to expand and upgrade aging safety problems and infrastructures is essential.

- For instance, according to Brand Finance, in 2023, the world's chemical industry had a brand value of nearly USD 62 billion. This represents an increase of over USD 36 billion in 2015 when comparing the global chemical industry's brand value. Traditional safety systems are deployed through an electrical control system and are hardwired, leading to potential accidents affecting people, assets, and the environment.

- This is expected to increase the demand for safety-instrumented systems in petrochemical industries that deliver several advantages, such as prolonged field life, reduction in unplanned downtime, reduction in annual maintenance cost, elimination of unexpected repair expenses, and adherence to current codes and standards. Thus, the increasing advantages of safety instrumented systems over traditional safety systems are expected to drive industry growth.

- Chemical industries have hazardous environments due to gas, oil, or dust, creating an explosive atmosphere in and around the machines. Moreover, the industry issues related to regulation, geopolitical risk, legal limits on using natural resources, shareholder activism, and increasing public scrutiny have created additional challenges. Thus, safety equipment such as fire and gas monitoring and detection, SCADA, and HIPPS installation is paramount.

- Further, many companies offer controllers for emergency and safety shutdown duties and handle complex equipment maintenance in the petrochemical plant. For instance, HIMA, an intelligent safety company, offers controllers that perform classic emergency shutdown duties and handle complex equipment functions. The SafeEthernet protocol ensures safe cross-communication between controllers at safety integrity level 3 (SIL 3). It also offers fast response times in a safety shutdown, and the high operational safety (SIL 3) within safety-critical production processes contributes to the acetylene plant's high availability and productivity.

Asia-Pacific is Expected to Witness High Growth Rate

- In many industrial processes and automation systems, safety instrumented systems play an important role in delivering protective layer functions. The term "safety system engineering" refers to a disciplined and methodical approach to hazard identification, safety requirement specifications, and system maintenance and operation throughout the life of a plant. The rise of the petrochemical and energy sectors is critical to the growth of the safety instrumented system industry.

- Furthermore, as the process sector advances toward embracing greater safety standards, control systems that can manage changes, such as steam turbines, compressors, and variable speed drives, may become necessary to maintain profitability while meeting agile needs.

- Because of stagnating industrial growth in industrialized countries, demand for valves and actuators has slowed. The government's increasing support for new industries, as well as political conditions, make the country conducive to industrial expansion. As a result, foreign corporations are looking to invest in this industry. In addition, there are ongoing and planned initiatives for establishing water and wastewater treatment plants in the region.

- For example, the Cambodian government and the Japanese International Cooperation Agency struck an agreement to construct a wastewater treatment plant in the Dangkor area. With a USD 25 million investment, the project aims to improve the drainage infrastructure in the district so that wastewater can flow directly to the plant rather than into the river. Such projects are expected to fuel the safety instrumentation systems market in Asia-Pacific.

- The food and beverage sector has a moral and legal responsibility to protect its employees. Heavy machinery, hazardous chemicals, and slick surfaces are among the immediate concerns, while dust inhalation, hearing loss, and repetitive strain injuries are among the more gradual threats. Coca-Cola, the world's largest beverage company, has noticed a surge in demand for sugar-free and low-sugar beverages in Southeast Asia. After the COVID-19 pandemic, this became more prominent.

- Due to rapidly increasing industrial activities, rising cost pressures and production rates, and favorable government policies in developing countries like China and India, Asia-Pacific is predicted to witness the fastest growth rate. Manufacturers have responded by developing new goods for specific uses in response to changing demands based on usage.

- Furthermore, an increase in the number of safety instrumented systems has resulted in the creation of more complex systems. Furthermore, the use of these systems has increased in the oil and gas, chemicals, and power industries because they help monitor usage hours, different aspects of boiler management, stack temperature, boiler, and fuel efficiency, all of which are important in this business.

- Moreover, at the 2020 National People's Congress, the CCP announced that in addition to doubling down on its Made in China 2025 and China Standards 2035 initiatives, it might spend approximately USD 1.4 trillion on a digital infrastructure public spending program. China's New Infrastructure initiative presents exciting opportunities for global companies. Owing to the same, the number of SIS equipment adopters in different sectors, such as new energy vehicles, oil and gas, 5G equipment, logistics, and energy and power, is expected to grow, boosting the growth of the market in the region.

Safety Instrumented System Industry Overview

The safety instrumented systems market is semi-consolidated with several significant players like Siemens AG, ABB Ltd, and Schneider Electric SE. With a prominent share in the market, these major players are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. Competition, rapid technological advancements, and frequent changes in consumer preferences are expected to threaten the market's growth during the forecast period.

- October 2023: Honeywell launched lithium-ion (Li-ion) battery safety sensors designed to play a pivotal role in identifying potential battery fires in electric vehicles (EVs). Complementing this, Honeywell offers a range of personal protective equipment (PPE) and gas detection solutions to enhance worker safety in EV plants. The integration of Honeywell battery safety sensors into EV and scooter battery packs enables the early detection of thermal runaway risks, providing timely warnings to passengers and assisting manufacturers in meeting global battery fire safety standards.

- August 2023: Yokogawa Electric Corporation unveiled plans to launch an upgraded version of the Collaborative Information Server (CI Server), a key component within the OpreX Control and Safety System suite. This upgrade boasts enhanced alarm management, improved accessibility to maintenance information, and extended support for global communication standards. The solution aims to aggregate substantial data from diverse plant equipment and systems, facilitating the streamlined management of production activities throughout the enterprise. It establishes an environment conducive to remote monitoring, control operations from any location, and prompt decision-making.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.1.1 Threat of New Entrants

- 4.1.2 Bargaining Power of Buyers

- 4.1.3 Bargaining Power of Suppliers

- 4.1.4 Threat of Substitute Products

- 4.1.5 Intensity of Competitive Rivalry

- 4.2 Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Regulatory Environment in the Industry

- 5.1.2 Presence of Robust SIS Service Ecosystem

- 5.2 Market Restraints

- 5.2.1 Operational Complexity Coupled with High Maintenance Costs

6 Market SEGMENTATION

- 6.1 By Application

- 6.1.1 Emergency Shutdown Systems (ESD)

- 6.1.2 Fire and Gas Monitoring and Control (F&GC)

- 6.1.3 High Integrity Pressure Protection Systems (HIPPS)

- 6.1.4 Burner Management Systems (BMS)

- 6.1.5 Turbo Machinery Control

- 6.1.6 Other Applications

- 6.2 By End User

- 6.2.1 Chemicals and Petrochemicals

- 6.2.2 Power Generation

- 6.2.3 Pharmaceutical

- 6.2.4 Food and Beverage

- 6.2.5 Oil and Gas

- 6.2.6 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East

- 6.3.7 Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 Emerson Electric Company

- 7.1.3 Honeywell International Inc.

- 7.1.4 Yokogawa Electric Corporation

- 7.1.5 ABB Ltd

- 7.1.6 Schneider Electric SE

- 7.1.7 Siemens AG

- 7.1.8 HIMA Paul Hildebrandt GmbH

- 7.1.9 SIS-TECH Solutions LP

- 7.1.10 Schlumberger Limited