|

市場調查報告書

商品編碼

1626302

歐洲安全儀器系統:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Europe Safety Instrumented Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

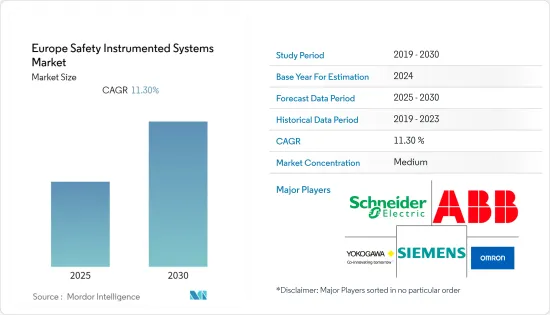

歐洲安全儀器系統 (SIS) 市場預計在預測期內複合年成長率為 11.3%

主要亮點

- 德國是歐盟最重要的製造地。根據世界銀行官方資料和貿易經濟預測,德國GDP佔全球經濟的3.33%,遵循自由市場原則,但有相當程度的政府監管和廣泛的社會福利計畫。

- 世界經濟論壇表示,德國在規劃和營運安全方面是世界上最好的國家之一。多項政府法規和政策要求多個最終用戶行業在發布成品之前採取重要的預防措施。根據汽車和建築行業的現有政策和框架,安全儀器系統的範圍正在日益擴大。

- 2020年4月,海王星能源公司宣佈在德國西北部發現了兩項重要的碳氫化合物。據該公司稱,天然氣加工廠將於2020年上半年建成,預計年終開始生產。此類案例可能會推動對保護植物的 SIS 設備的需求。

- 對安全至關重要的起重設備的檢查和維護對於陸地和海上安全高效的操作至關重要。 2020年4月,Sparrows Group獲得英國認證服務機構(UKAS)認證。 UKAS是英國唯一由英國政府指定的國家認可機構。 UKAS 根據國際商定的標準對提供認證、測試、檢驗和校準服務的組織進行評估。

- COVID-19的全球爆發極大地影響了汽車行業等各個行業的成長,因為它涉及大量機械和勞動力。例如,歐洲汽車需求因對經濟狀況和經濟前景敏感而大幅下降。根據歐洲汽車工業協會統計,2020年歐盟汽車銷量與前一年同期比較下降25%。這限制了所研究市場的成長。

歐洲安全儀器系統市場趨勢

緊急關閉系統預計將佔據主要市場佔有率

- 緊急關閉系統 (ESD) 是一種自動保護系統,可在潛在危險情況時啟動和關閉工廠或製程站。 ESD 是安全儀器系統 (SIS) 的一部分,主要用於保護植物和人員的安全目的。這些系統旨在透過防止火災、爆炸以及碳氫化合物和其他有害氣體的洩漏,最大限度地減少設備損壞、受傷和工人死亡等緊急情況的影響。

- 在核能、石油和天然氣、化學工業等高風險產業以及其他具有爆炸風險的環境中,當製程超出控制裕度時,專業且可靠的緊急關閉(ESD)系統將發揮重要作用。為了確保可靠性,緊急關閉系統通常擁有自己的邏輯控制器,並且能夠比常規 PLC 系統更快地對故障做出反應,這在緊急情況下至關重要。

- 隨著製造和工業應用的複雜性不斷增加,全球範圍內的災難性事故不斷增加。除此之外,鼓勵採用先進技術以確保工人安全的政府法規正在支持 ESD 等安全系統的發展。

- 緊急關閉系統利用安裝在功能關鍵位置的多個感測器和開關來持續監控工業系統中製程的運作。這些系統通常安裝在燃氣渦輪機和蒸氣渦輪中,例如發電廠、油田、石油和天然氣加工廠以及鍋爐。為了滿足對安全系統不斷成長的需求,市場上大多數供應商不僅提供 ESD 系統作為 SIS 的一部分,而且還提供獨立的系統。

- 例如,系統800xA是ABB的主控制系統,800xA High Integrity構成安全儀器系統(SIS)的一部分。 ESD 安全系統可與系統 800xA 基本製程控制系統 (BPCS) 完全整合,為 BPCS 和 SIS 提供通用的操作、工程和資訊環境。

化學和石化領域預計將推動市場成長

- 安全儀器系統由感測器、邏輯控制器和最終控制元件組成,其唯一目的是在違反指定條件時使製程進入安全狀態。與傳統安全系統相比,安全儀器系統的優勢越來越大,正在推動市場需求。化學和石化行業是一個不斷發展的行業,存在老化的安全問題以及基礎設施擴建和升級的必要性。傳統的安全系統是透過電氣控制系統進行部署和硬連線的,這可能會導致影響人員、財產和環境的潛在事故。

- 因此,安全儀器系統具有多種優勢,包括延長現場壽命、減少計劃外停機時間、降低年度維護成本、消除計劃外維修成本以及遵守現行法規和標準的需求將迅速增加。安全儀器系統相對於傳統安全系統不斷增加的優勢正在推動產業成長。

- 為了最大限度地減少各種風險,安裝製程控制系統以維持工廠安全運行,並由強大的警報檢測和報告系統支持,並由合格且經過培訓的負責人進行操作。無論風險類型如何,安全儀器系統、警報和操作員介入都能為您的流程提供第一層保護。

- 在製程設計過程中,請注意指定具有適當尺寸、結構材料和適當配件的管線、設備和閥門。基本的安全儀器系統安裝有適當的儀器、控制設備和監控邏輯,使工廠能夠在最安全的壓力、溫度和流量範圍內運作。設定警報是為了讓操作員能夠對異常情況做出反應,並在風險演變成事故之前採取糾正措施。

- 為了減少上述風險,OSHA(職業安全與健康管理局)、化工行業的幾家公司、ISA 和其他專家小組已開始將風險識別為不孤立的加工線或儲罐風險。定義為與整個處理功能相關的風險。 ISA 84 和 IEC 61508 標準是基於功能安全的概念而製定的。這些美國ISA 和歐洲 IEC 標準隨後統一為單一標準 ISA-84/IEC-61511。 2021年3月,BASF德國路德維希港工廠安裝新生產裝置,年產乙炔9萬噸。BASF選擇了德國布留爾 HIMA 的安全技術,包括硬體、軟體和工程,以保護和保障這項複雜計劃的安全關鍵生產過程。

歐洲安全儀器系統產業概述

歐洲安全儀器系統市場與西門子股份公司、ABB 有限公司和Schneider Electric公司等幾家主要參與者的競爭中等。從市場佔有率來看,目前該市場由幾家大型企業主導。憑藉主導市場佔有率,這些領先公司正專注於擴大海外基本客群。這些公司利用策略合作計劃來增加市場佔有率和盈利。在預測期內,競爭、快速的技術進步和消費者偏好的頻繁變化預計將威脅每家公司的市場成長。

- 2021 年 1 月 - ABB Ltd. 推出適用於提昇機的 ABBbility Safety Plus,這是首款經過全面 SIL 3 認證、具有最高安全等級的礦井起吊裝置解決方案。包括 Safety Plus 煞車系統 (SPBS),其中包括 Safety Plus起吊裝置監視器 (SPHM)、Safety Plus起吊裝置保護器 (SPHP) 和安全煞車液壓 (SBH)。依照國際「機械安全」標準IEC62061設計。

- 2020 年 11 月 - 西門子交通和德國鐵路公司將開發氫動力燃料電池列車和加油站,以取代德國區域鐵路網路上的柴油引擎,並於 2024 年開始試運行。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 業界安全標準

- 汽車製造業增加

- 抑制因素

- 缺乏意識且標準複雜

- 回覆率低

- 營運成本高

第6章 市場細分

- 按成分

- 感應器

- 轉變

- 可程式裝置

- 致動器和閥門

- 按用途

- 緊急關閉系統(ESD)

- 火災與氣體監測與控制 (F&GC)

- 高可靠性壓力保護系統(HIPPS)

- 燃燒器管理系統 (BMS)

- 渦輪機械控制

- 按最終用戶

- 化工/石化

- 發電

- 製藥

- 飲食

- 石油和天然氣

- 按國家/地區

- 英國

- 德國

- 法國

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- Siemens AG

- ABB Ltd

- Emerson Process Management

- General Electric Company

- HIMA Paul Hildebrandt GmbH

- Honeywell International, Inc.

- Schneider Electric SE

- Yokogawa Electric Corporation

- OMRON Corporation

- Johnson Controls, Inc

- Tyco International Plc

第8章投資分析

第9章 未來展望

The Europe Safety Instrumented Systems Market is expected to register a CAGR of 11.3% during the forecast period.

Key Highlights

- Germany is the most significant manufacturing hub in the European Union. According to official data from the World Bank and projections from Trading Economics, Germany's GDP value represents 3.33% of the world economy, following free-market principles, with a considerable degree of government regulation and wide-ranging social welfare programs.

- According to WEF, Germany is one of the world's best locations in planning and operational security. Multiple government regulations and policies require significant precautionary measures to be taken before the release of finished products in multiple end-user industries. In accordance with the existing policies and framework present in the automotive and construction sectors, the scope for safety instrumented systems is increasing day by day.

- In April 2020, Neptune Energy announced two important hydrocarbon discoveries had been made in Northwestern Germany. According to the company, a processing plant for natural gas was being constructed during H1 2020, with production expected to start toward the end of the year. Such instances are likely to boost the demand for SIS equipment, as they are to safeguard the plants.

- Inspection and maintenance of safety-critical lifting equipment are essential for safe and efficient onshore and offshore operations. In April 2020, Sparrows Group achieved the United Kingdom Accreditation Service (UKAS) accreditation. The UKAS is the sole national accreditation body of the United Kingdom appointed by the UK government. It assesses organizations that provide certification, testing, inspection, and calibration services against internationally agreed standards.

- The global outbreak of COVID-19 has significantly impacted the growth of various industries like the automotive sector, owing to a large number of machinery and workforce involved. For instance, the European region's demand for cars declined significantly as it is susceptible to economic conditions and economic prospects. According to the European Automobile Manufacturers' Association, car sales in the European Union fell by 25% in 2020 compared to the previous year. This restrains the growth of the studied market.

Europe Safety Instrumented Systems Market Trends

The Emergency Shutdown Systems are Expected to Hold a Major Market Share

- Emergency Shutdown System (ESD) is an automatic protection system that activates to shut down the plant or process stations if it enters a potentially dangerous state. ESD is part of the Safety Instrumented System (SIS) which is primarily used for safety purposes to protect either plants or people. These systems are designed to minimize the consequences of emergency situations, such as damage to equipment, injury, or loss of lives of the workers, by protecting against things like fire outbreaks, explosions, and leaks of hydrocarbons and other hazardous gases.

- For high-risk industries like Nuclear Power, Oil, and Gas, Chemical Industries, or other Environments with explosion risk, specialized, highly reliable Emergency Shutdown (ESD) System play a crucial role in cases the process goes beyond the control margins. To ensure reliability, the Emergency Shutdown systems usually have their own logic controller so that they can react to failures much faster than a normal PLC system which can be crucial in emergency cases.

- Owing to increasingly complex manufacturing and industrial applications, there has been a rise in the number of global catastrophic accidents. This, along with the supporting government regulations which promote the adoption of advanced technologies to ensure workers' safety, is supporting the growth of safety systems such as ESD.

- Emergency shutdown systems make use of several sensors and switches installed at functionally important locations to continuously monitor the working of the processes of an industrial system. These systems can usually be found on gas and steam turbines in power plants, oilfields, oil and gas processing plants, and boilers. To fulfill the growing demand for safety systems majority of vendors operating in the market are offering ESD systems in the standalone format as well as a part of SIS.

- For instance, System 800xA is ABB's main control system offering in which 800xA High Integrity constitutes the Safety Instrumented Systems (SIS) portion. The ESD safety system can be fully integrated with the System 800xA Basic Process Control System (BPCS), thereby providing a common operational, engineering, and information environment for BPCS and SIS.

Chemicals and Petrochemicals Segment is Expected to Drive the Market Growth

- A Safety Instrumented System is encompassed of sensors, logic solvers, and final control elements for the single purpose of taking the process to a safe state when predetermined conditions are violated. The growing benefits of safety instrumented systems over traditional safety systems are fueling the market demand. The chemicals & petrochemicals industries are identified as continuously developing industries, wherein the need for expansion and upgrading of aging safety problems and infrastructures is essential. Traditional safety systems are deployed through an electrical control system and are hardwired, which could perhaps lead to potential accidents affecting people, assets, and the environment.

- This will surge the demand for safety instrumented systems which deliver several advantages such as prolonged field life, reduction in unplanned downtime, reduction in annual maintenance cost, and elimination of unexpected repair expenses, and adhering to current codes and standards. Thus, the increasing advantages of safety instrumented systems over traditional safety systems will drive industry growth.

- In order to minimize various risks, process control systems are mounted to maintain a safe operation of the plant, supported by a robust alarm detection and reporting system, and operated by qualified, trained personnel. Regardless of the types of risks, the safety instrumentation systems, alarms, and operator intervention, provide the first layers of protection for the process.

- In the process design, care is taken to specify lines, equipment, and valves with the appropriate sizes, materials of construction, and appropriate accessories. The basic safety instrumentation system is installed with suitable instruments, controls, and monitoring logic to enable the plant to be operated within the safest ranges for pressure, temperature, and flow rate. Alarms are configured to allow the operators to respond to abnormal conditions and take corrective actions before a risk becomes an accident.

- In order to mitigate risks like the ones above, OSHA, The Occupational Safety and Health Administration, and several companies in the chemical industry, along with ISA and other professional groups, embraced the idea of defining risks, not as isolated processing line or tank risks, but as risks associated with processing functions as a whole. Standards ISA 84 and IEC 61508 were developed around the concept of functional safety. Later, these standards, ISA in the US and IEC in Europe, were harmonized in a single standard, ISA-84/IEC-61511. In March 2021, BASF's Ludwigshafen, Germany, site have introduced a new production facility with the capacity to produce 90,000 mt/y of acetylene. BASF has opted for safety technology from HIMA, Bruhl, Germany, which consists of hardware, software, and engineering to protect and secure safety-critical production processes in the complex project.

Europe Safety Instrumented Systems Industry Overview

The Europe Safety Instrumented Systems Market is moderately competitive with several major players like Siemens AG, ABB Ltd., Schneider Electric SE, etc. In terms of market share, few significant players currently dominate the market. With a prominent share in the market, these major players are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. The competition, rapid technological advancements, and frequent changes in consumer preferences are expected to threaten the market's growth of the companies during the forecast period.

- January 2021 - ABB Ltd. Launched ABB Ability Safety Plus for hoists, the first fully SIL 3 certified mine hoist solutions with the highest level of safety. It includes include Safety Plus Hoist Monitor (SPHM), Safety Plus Hoist Protector (SPHP), and Safety Plus Brake System (SPBS), including Safety Brake Hydraulics (SBH). It has been designed in accordance with the international 'safety of machinery' standard IEC62061.

- November 2020 - Siemens Mobility and Deutsche Bahn started developing hydrogen-powered fuel cell trains and a filling station which will be trialed in 2024 with a view to replacing diesel engines on German local rail networks.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Industry Safety Standards

- 5.1.2 Rise in Automotive Manufacturing

- 5.2 Restraints

- 5.2.1 Lack of Awareness and Complexity of Standards

- 5.2.2 Low Response Rate

- 5.2.3 High Operational Costs

6 MARKET SEGMENTATION

- 6.1 By Components

- 6.1.1 Sensors

- 6.1.2 Switches

- 6.1.3 Programable Devices

- 6.1.4 Actuators and Valves

- 6.2 By Application

- 6.2.1 Emergency Shutdown Systems (ESD)

- 6.2.2 Fire and Gas Monitoring and Control (F&GC)

- 6.2.3 High Integrity Pressure Protection Systems (HIPPS)

- 6.2.4 Burner Management Systems (BMS)

- 6.2.5 Turbo Machinery Control

- 6.3 By End-User

- 6.3.1 Chemicals and Petrochemicals

- 6.3.2 Power Generation

- 6.3.3 Pharmaceutical

- 6.3.4 Food and Beverage

- 6.3.5 Oil and Gas

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

- 6.4.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 ABB Ltd

- 7.1.3 Emerson Process Management

- 7.1.4 General Electric Company

- 7.1.5 HIMA Paul Hildebrandt GmbH

- 7.1.6 Honeywell International, Inc.

- 7.1.7 Schneider Electric SE

- 7.1.8 Yokogawa Electric Corporation

- 7.1.9 OMRON Corporation

- 7.1.10 Johnson Controls, Inc

- 7.1.11 Tyco International Plc