|

市場調查報告書

商品編碼

1640612

生物基琥珀酸 -市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Bio-Based Succinic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

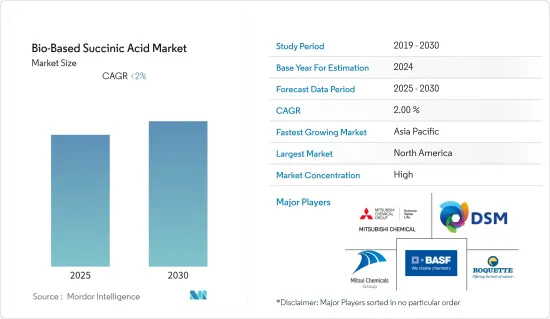

預測期內,生物基琥珀酸市場預計複合年成長率低於 2%

關鍵亮點

- 2020 年,新冠疫情對市場產生了負面影響。不過,預計 2022 年市場將達到疫情前的水平,並持續穩定成長。

- 由於石化燃料價格的不確定性、碳足跡的增加以及綠色化學品的日益普及,預計生物基琥珀酸的需求將激增。另一方面,生物基琥珀酸價格昂貴,且需要冗長的提取過程,限制了其市場拓展。

- 此外,由生物琥珀酸製成的永續染料有望在未來提供市場機會。預計預測期內亞太地區對生物基琥珀酸的需求將很高。

生物基琥珀酸市場趨勢

工業領域佔市場主導地位

- 生物基琥珀酸被廣泛用作工業應用的中間體,用於製造塑膠、聚氨酯、溶劑、塗料、潤滑劑等。由生物基琥珀酸製成的塑化劑用於地板材料和通用應用,以提供耐熱性、食品包裝等。此外,這種環保的琥珀酸也廣泛用於樹脂、被覆劑、油墨的生產,並具有多種工業應用。

- 生物基琥珀酸廣泛用於各種工業應用中,用於製造黏合劑、溶劑、密封劑、樹脂、被覆劑和聚合物等產品。這些產品廣泛應用於建築領域。

- 因此,建築業的擴張預計將增加對生物基琥珀酸的需求。例如,根據美國人口普查局的數據,2021年美國新建設的年金額達到16264億美元,而2020年為14996億美元。

- 為了生產黏合劑,食品飲料、消費品和其他產業依靠有吸引力的包裝材料來不斷創新新產品、提高產量並減少碳排放。例如,印度的包裝產業是最大的終端用戶產業,佔黏合劑總用戶的67%左右。

- 工業領域擴大使用生物基琥珀酸來生產各種產品,預計將在未來幾年推動市場成長。

亞太地區成長速度最快

- 過去幾年來,亞太地區一直是最大的聚醯胺市場。亞太地區各國的製藥、個人護理、油漆和塗料等新興產業正在推動所研究市場的發展。由於都市化進程加快,各行業對生物基琥珀酸的需求日益增加。

- 利用生物基琥珀酸可以生產黏合劑、溶劑、密封劑、樹脂、被覆劑和聚合物等產品。印度21會計年度生產了約1,210萬噸聚合物。印度多元化的化學工業生產約80,000種產品,推動了對生物基琥珀酸的不斷成長的需求。

- 琥珀酸的主要工業產品是1,4-丁二醇(BDO)。 BDO及其生物基琥珀酸衍生物是工業上應用最廣泛的產品。用作工程塑膠、聚氨酯體係等的中間體。此外,在預測期內,BDO、聚丁烯-琥珀酸 (PBS)、塑化劑(如聚丙烯)和聚酯多元醇等新興應用預計將增加生物基琥珀酸的消耗量。

- 在印度,信實工業的聚丙烯產能將在2022年達到316.5萬噸。這佔印度聚烯生產能力的一半以上,支持了該地區市場的成長。

- 因此,由於上述原因,預計亞太地區在預測期內將實現高速成長。

生物基琥珀酸產業概況

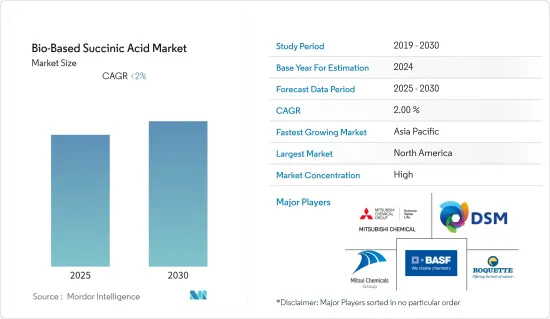

生物基琥珀酸市場本質上正在整合。市場的主要企業包括BASF公司、羅蓋特公司、帝斯曼公司、三井化學公司和三菱化學公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 擴大綠色化學品的使用

- 其他促進因素

- 限制因素

- 生物基琥珀酸成本上漲

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 應用

- 工業的

- 藥品

- 個人護理

- 油漆和塗料

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- DSM

- Mitsui Chemicals, Inc.

- Mitsubishi Chemical Corporation

- Roquette Freres

- Technip Energies NV

- Corbion

第7章 市場機會與未來趨勢

- 由生物基琥珀酸製成的永續染料

簡介目錄

Product Code: 55696

The Bio-Based Succinic Acid Market is expected to register a CAGR of less than 2% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The price uncertainty of fossil fuels, the increase in carbon footprints, and the increasing adoption of green chemicals are expected to surge the demand for bio-based succinic acid. On the other hand, the market's expansion is constrained by the higher cost of bio-based succinic acid and the prolonged extraction procedures.

- Further, sustainable dyes made from bio-succinic acid are anticipated to present a market opportunity in the future. The Asia-Pacific region is expected to witness high demand for bio-based succinic acid during the forecast period.

Bio-Based Succinic Acid Market Trends

Industrial Segment Dominated the Market

- Bio-based succinic acid is used as an intermediate in a wide range of industrial applications to make plastics, polyurethanes, solvents, coating, lubricants, and a variety of other things. The plasticizers made from bio-based succinic acid are used in flooring and general-purpose usage to provide heat resistance, food packaging, etc. Moreover, this eco-friendly succinic acid is also widely used in making resins, coatings, and ink for several industrial purposes.

- Bio-based succinic acid is widely used in various industrial applications to make products such as adhesives, solvents, sealants, resins, coatings, and polymers. Such products are widely used in the construction sector.

- Thus, the expanding construction industry is expected to surge the demand for bio-based succinic acid. For example, According to the US Census Bureau, the annual value for new construction put in place in the United States accounted for USD 1,626.4 billion in 2021, compared to USD 1,499.6 billion in 2020.

- Industries such as food and beverage, consumer goods, etc., continuously innovate new products, increase production, and resort to attractive packaging materials to reduce carbon footprints, thus surging the demand for bio-based succinic acid to produce adhesives. For example, the packaging sector in India is the highest end-user sector, holding about 67% of total adhesive users.

- The increased use of bio-based succinic acid in the industrial sector for the production of various products is expected to boost market growth in the coming years.

Asia-Pacific to Witness fastest Growth Rate

- Asia-Pacific accounted for the largest polyamide market in the past few years. The growing pharmaceutical, personal care, paints and coatings, etc. industries in various countries in the Asia-Pacific region are driving the market studied. Due to rising urbanization, the demand for bio-based succinic acid has increased across various industries.

- Products such as adhesives, solvents, sealants, resins, coatings, and polymers, are produced using bio-based succinic acid. Around 12.1 million metric tons of polymers were manufactured in India during the fiscal year 2021. India's highly varied chemical industry produces almost 80,000 items, augmenting the rise in demand for bio-based succinic acid.

- The key industrial product of succinic acid is 1,4-butanediol (BDO). BDO and its bio-based succinic acid derivatives are the industries' most used products. It is used as an intermediate in engineering plastics, polyurethane systems, etc. Additionally, emerging applications such as BDO, poly (butylene-co-succinate) (PBS), plasticizers (such as polypropylene), and polyester polyols are expected to increase the consumption of bio-based succinic acid during the forecast period.

- In India, Reliance Industries' production capacity for polypropylene reached 3,165 kilotons in 2022. This accounted for more than half of India's polyolefin production capacity, supporting the market growth in the region.

- Hence, due to the above-mentioned reasons, Asia-Pacific is anticipated to witness high growth during the forecast period.

Bio-Based Succinic Acid Industry Overview

The bio-based succinic acid market is consolidated in nature. Some of the major players in the market include BASF SE, Roquette Freres, DSM, Mitsui Chemicals, Inc., and Mitsubishi Chemical Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Adoption of Green Chemicals

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Higher Cost of Bio-based Succinic Acid

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Industrial

- 5.1.2 Pharmaceutical

- 5.1.3 Personal Care

- 5.1.4 Paints and Coatings

- 5.1.5 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 DSM

- 6.4.3 Mitsui Chemicals, Inc.

- 6.4.4 Mitsubishi Chemical Corporation

- 6.4.5 Roquette Freres

- 6.4.6 Technip Energies N.V.

- 6.4.7 Corbion

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Sustainable Dyes Made from Bio-based Succinic Acid

02-2729-4219

+886-2-2729-4219