|

市場調查報告書

商品編碼

1637759

進階通訊服務:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Rich Communication Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

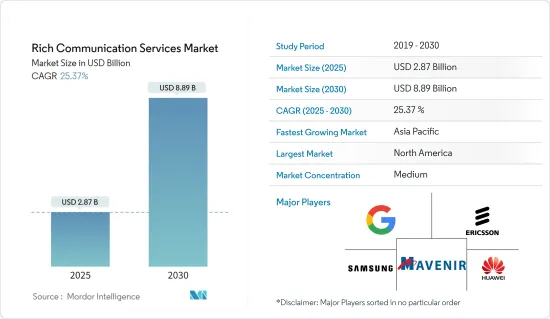

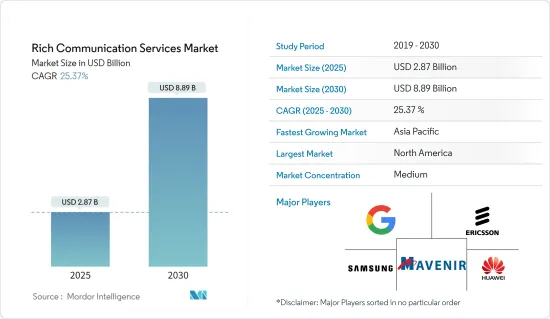

進階通訊服務市場規模預計在 2025 年為 28.7 億美元,預計到 2030 年將達到 88.9 億美元,預測期內(2025-2030 年)的複合年成長率為 25.37%。

主要亮點

- 進階通訊服務是一組通訊協定和高級通訊標準,用於增強安裝在行動電話上的訊息應用程式的效能並提供進階通訊服務。

- 隨著全球行動電話數量的增加,未來幾年對優質通訊服務的需求預計將會成長。隨著智慧型手機的普及,簡訊通訊的需求日益增加。高階溝通服務提供增強使用者溝通體驗的功能,例如已讀回執和群組聊天。隨著配備此類先進功能的智慧型手機的興起,RCS通訊服務的採用預計將蓬勃發展。

- SMS 和 MMS 預計將被 RCS 完全取代,包括具有群組聊天、媒體共用、視訊通話、位置共用等高級功能的訊息。因此,預計未來幾年行動電話用戶的增加將對市場成長產生重大影響。

- 預計通訊服務市場的強勁成長將源自於行動電話用戶的不斷成長。行動電話服務用戶是指訂閱使用蜂窩技術並為用戶提供交換公共電話網路 (PSTN) 接入的公共行動電話服務的用戶。其中包括預付和後付費用戶,以及類比和數位行動電話技術。

- 然而,端到端加密存在局限性, Over-The-Top平台的競爭日益激烈,以及由於進階通訊服務端對端加密而產生的互通性和隱私問題。

進階通訊服務(RCS) 市場趨勢

VO-LTE 技術推動的行動服務發展與普及

- 由於可以同時撥打電話和瀏覽網頁以及發送帶有圖像的訊息等優點,對進階通訊服務的需求正在成長,並且 LTE-VO 的普及也在不斷推進。

- 智慧型手機和行動服務正在對每個職場產生深遠的影響。物聯網(IoT)和人工智慧(AI)等最尖端科技的發展正在為此做出貢獻。我們把隨時隨地使用通訊設備稱為行動服務。由於行動裝置和雲端服務的普及,行動服務擴大被企業採用。

- 行動解決方案提供最佳化的網路、更輕鬆的業務資訊存取和更好的客戶體驗,以提高生產力。進階通訊服務滿足了組織對行動性和通訊多樣性日益成長的需求。

- 行動服務中的進階通訊服務通訊具有諸多優勢,例如透過自帶裝置 (BYOD) 計畫攜帶自帶裝置時進行檔案共用。因此,VOLTE 和行動服務日益成長的需求推動了在安全的企業環境中使用軟體定義網路技術。

北美佔有最大市場佔有率

- 該地區 5G 網路普及率較高,且人工智慧和其他智慧連網設備的使用日益廣泛。此外,對下一代通訊服務的需求激增、將客戶服務趨勢從對話互動中轉移的聊天機器人以及進階通訊服務正在推動行動網路營運商 (MNO) 接受為本地通訊管道開發的最新進展。技術進步配置服務的機會。

- 預計該地區高階通訊服務市場的成長將受到越來越多的公司(例如 Subway IP LLC 和 Express)採用 RCS 平台進行廣告宣傳的推動。與簡訊宣傳活動相比,這些企業透過使用進階通訊服務A2P 來提高客戶參與。

- 北美是世界上簡訊應用和智慧型手機普及率最高的地區之一。根據CTIA的報告,2019年,99.7%的美國人口居住在4G LTE覆蓋的地區。此外,據愛立信稱,到2025年,行動用戶數量預計將達到3.2億。

- 此外,預計到 2025 年,北美 74% 的行動用戶將由 5G 組成。 2019年,全部區域的LTE安裝率為91%。鑑於這一普及率,該地區對各種智慧型手機通訊應用程式的需求可能會很大。

- 這一成長是由於該地區行動銀行服務的接受度不斷提高。進階通訊服務平台旨在為銀行提供行動付款、新開戶、信用卡和簽帳金融卡申請、分店和 ATM搜尋以及客戶支援等功能。

進階通訊服務(RCS) 產業概覽

市場競爭格局依然溫和,各公司正積極探索進階通訊服務領域所提供的眾多機會。該公司正在與科技公司和網路營運商建立策略夥伴關係,以利用先進的技術力並推動創新。

2023 年 2 月,沃達豐宣布了雄心勃勃的計劃,將與Google的合作擴展到歐洲市場,涵蓋行動通訊服務、Pixel 設備和沃達豐的電視平台。此次加強的夥伴關係將使沃達豐客戶能夠透過利用 Google Jibe Cloud 享受更豐富的通訊體驗,並將加強沃達豐對進階通訊服務(RCS) 的實施。

2022 年 10 月,Sinch AB(發布)宣布將把 KakaoTalk 頻道整合到其對話 API 中。這項新增功能大大擴展了企業與全球消費者進行全通路對話的可用溝通管道範圍。擴充的管道包括 SMS、RCS、WhatsApp、Viber、Business、Facebook Messenger 以及現在的 KakaoTalk。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 市場覆蓋

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 產業相關人員分析

- COVID-19 對 RCS 市場的影響評估

第5章 市場動態

- 市場促進因素

- 投資廣告和行銷

- Android 手機支援 RCS通訊的最新進展及其快速普及

- 與服務提供者直接合作

- 持續監管 OTT通訊創造新機遇

- 採用 VO-LTE 技術的行動服務不斷發展和普及,將推動成長

- 市場限制

- 缺乏端對端加密引發互通性和隱私問題

第 6 章 RCS通訊- 時間軸與實施

- RCS 的演變

- 目前使用案例和實施研究

- 巴克萊銀行和 HDFC 銀行專注於轉向 RCS 以提高客戶參與

- Virgin Trains 和 JR 為旅遊業客戶支援引入 RCS

- 谷歌在歐洲主要國家推出 RCS,繞過當地營運商支持

- 主要應用

7. RCS引入對原生簡訊的影響分析

- 2016 年至 2021 年 A2P SMS 與 OTT通訊細分

- A2P 在總數位廣告收入中所佔的佔有率

- P2P 格局的預測變化

第 8 章市場細分

- 按最終用戶

- BFSI

- 媒體與娛樂

- 旅遊與飯店

- 零售

- 衛生保健

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 拉丁美洲

- 中東和非洲

第9章 競爭格局

- 公司簡介

- Telefonaktiebolaget LM Ericsson

- Google LLC

- Huawei Technologies Co Ltd

- Mavenir Systems

- Samsung Electronics Co Ltd

- ZTE Corporation

- Global Message Services

- Sinch AB

- Juphoon System Software Co Ltd

- Summit Tech

- AT&T Inc

- T-Mobile USA Inc

- Verizon Wireless

- SK Telecom Co Ltd

- Telstra Corporation Limited

- Vodafone Group PLC

第 10 章 主要 MNO 的 RCS藍圖

第11章 市場展望

The Rich Communication Services Market size is estimated at USD 2.87 billion in 2025, and is expected to reach USD 8.89 billion by 2030, at a CAGR of 25.37% during the forecast period (2025-2030).

Key Highlights

- Rich communication services is a set of protocols and advanced messaging standards to enhance the performance of message applications that are installed in mobile phones, which provide rich communication services.

- The demand for premium communication services is expected to grow in the coming years as the number of mobile phones increases worldwide. Demand for SMS communication is increasing due to the rising use of smartphones. High communications services offer features to enhance the user's experience of communicating, such as read receipt and group chat. The adoption of RCS messaging services is expected to be strengthened by the increasing number of smartphones with such advanced features.

- SMS and MMS are supposed to be completely replaced by RCS. Messages with advanced features such as group chat, media sharing, video call, or location sharing. Therefore, a significant influence on market growth in the coming years is expected to be the increased uptake of mobile phone subscribers.

- The strong growth in the telecommunications services market is likely to be driven by increased subscribers, who are increasingly adopting cell phones. A mobile service subscriber is an agreement for a public mobile phone service using cellular technologies to provide users with access to the switched Public Telephone Network PSTN. Both prepaid and postpaid subscribers are covered by this provision, as well as Analog and Digital mobile technologies.

- However, limited end-to-end encryption and increasing competition by over-the-top platforms, along with Interoperability and Privacy concerns due to lack of end-to-end encryption, hinder the rich communication services market growth.

Rich Communication Services (RCS) Market Trends

Increasing Development and Adoption of Mobility Service Along with (VO-LTE) Technology to Witness the Growth

- The growing demand for rich communication services due to its benefits, such as the simultaneous use of calls and web surfing while sending messages with images, is a result of an increasing uptake of voice over long-term evolution (LTEVO).

- Smartphones and mobility services are having a profound effect in every workplace. The development of cutting-edge technologies such as the Internet of Things (IoT) and artificial intelligence (AI) has contributed to this. The use of communication devices at any location and time shall be referred to as mobility services. Mobility services are becoming more and more widely adopted by enterprises, thanks to their widespread use of mobility devices and cloud services.

- Mobility solutions offer an optimized network, easy access to business information, and better customer experiences in order to improve productivity. Rich communication services meet the growing need for mobility and diversity of communication in organizations.

- The benefits of rich communication service messaging in mobility services, e.g., file sharing when you bring your own device through the bring-your-own-device (BYOD) program, are many. Consequently, the use of software-defined networking technologies in secured enterprise environments is driven by a growing demand for VOLTE along with mobility services.

North America to Hold the Largest Market Share

- In this region, owing to the high network penetration of 5G and the growing use of artificial intelligence & other smart connected devices. Moreover, the surge in need for next-generation messaging service, chatbots shifting the inclination of customer service from conversational interactions, and rich communication service provide opportunities for mobile network operators (MNOs) to set up service on the latest technical advances being developed for the native messaging channel.

- The growth of the market for high communication services in this region is expected to be driven by an increase in the number of businesses adopting RCS platforms, like Subway IP LLC and Express, which are running their advertising campaigns. These companies have seen an increase in their customer engagement through the use of rich communication services, A2P, as opposed to SMS campaigns.

- North American region to one of the highest penetration of SMS applications and smartphones and users in the world. CTIA reported that 99.7% of the American population lived in areas with fourth-generation LTE coverage in 2019; also, the number of mobile subscriptions was estimated to reach 320 million by 2025, according to Ericsson.

- Furthermore, in 2025, 74% of North America's mobile subscriptions are projected to be made up of 5G. In 2019, there were 91% LTE installations across the region. In view of this adoption rate, a considerable demand for various smartphone communication applications will be generated in the region.

- This growth is a result of the increasing acceptance of mobile banking services within the region. Rich communication service platforms are designed to provide banks with functionalities such as mobile payments, opening new accounts, applying for credit or debit cards, searching branches and ATMs, and customer support.

Rich Communication Services (RCS) Industry Overview

The competitive landscape within the market remains moderate, with companies actively exploring the numerous opportunities presented by the rich communication services sector. Organizations are forging strategic partnerships with technology firms and network operators to harness advanced technological capabilities and foster innovation.

In February 2023, Vodafone unveiled its ambitious plans to extend its collaboration with Google across the European market, encompassing mobile messaging services, Pixel devices, and Vodafone's TV platform. This enhanced partnership will enable Vodafone customers to relish enriched messaging experiences through the utilization of Google Jibe Cloud, which will empower Vodafone's implementation of Rich Communications Services (RCS).

In October 2022, Sinch AB (publ) announced the integration of the KakaoTalk channel into its Conversation API. This addition significantly broadens the array of communication channels available for enterprises seeking to engage in omnichannel conversations with their global consumer base. The extended channels now encompass SMS, RCS, WhatsApp, Viber, Business, Facebook Messenger, and the latest inclusion, KakaoTalk.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the market

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 Assessment of the Impact of COVID-19 on the RCS Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Investments in the field of advertising and marketing

- 5.1.2 Recent developments associated with Android phones enabling RCS messaging to rapidly drive adoption

- 5.1.3 Direct Association of the Service Providers

- 5.1.4 Ongoing efforts to regulate OTT messaging to also open up new opportunities

- 5.1.5 Increasing Development and Adoption of Mobility Service Along with (VO-LTE) Technology to Witness the Growth

- 5.2 Market Restraints

- 5.2.1 Interoperability and Privacy concerns due to lack of end-to-end encryption

6 RCS MESSAGING - TIMELINE and IMPLEMENTATION

- 6.1 Evolution of RCS

- 6.2 Current use-cases and implementation studies

- 6.2.1 Barclays & HDFC Banks focus on switching to RCS to drive customer engagement

- 6.2.2 Virgin Trains and Japan Railway company launch RCS to provide customer support in the travel industry

- 6.2.3 Google bypasses local operator support to launch RCS in major European countries

- 6.3 Major Applications

7 ANALYSIS ON THE IMPACT OF RCS ADOPTION ON NATIVE SMS

- 7.1 Breakdown of A2P SMS and OTT Messaging for 2016-2021

- 7.2 Share of A2P of the overall Digital Advertising revenue

- 7.3 Anticipated changes in the P2P landscape

8 MARKET SEGMENTATION

- 8.1 End-User

- 8.1.1 BFSI

- 8.1.2 Media and Entertainment

- 8.1.3 Travel and Hospitality

- 8.1.4 Retail

- 8.1.5 Healthcare

- 8.1.6 Other End-User verticals

- 8.2 Geography

- 8.2.1 North America

- 8.2.2 Europe

- 8.2.3 Asia

- 8.2.4 Latin America

- 8.2.5 Middle East and Africa

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Telefonaktiebolaget LM Ericsson

- 9.1.2 Google LLC

- 9.1.3 Huawei Technologies Co Ltd

- 9.1.4 Mavenir Systems

- 9.1.5 Samsung Electronics Co Ltd

- 9.1.6 ZTE Corporation

- 9.1.7 Global Message Services

- 9.1.8 Sinch AB

- 9.1.9 Juphoon System Software Co Ltd

- 9.1.10 Summit Tech

- 9.1.11 AT&T Inc

- 9.1.12 T-Mobile USA Inc

- 9.1.13 Verizon Wireless

- 9.1.14 SK Telecom Co Ltd

- 9.1.15 Telstra Corporation Limited

- 9.1.16 Vodafone Group PLC