|

市場調查報告書

商品編碼

1636221

法國電動車用鋰離子電池市場佔有率分析、產業趨勢、成長預測(2025-2030)France Lithium-ion Battery For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

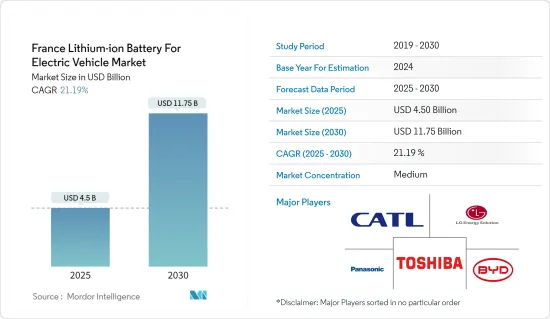

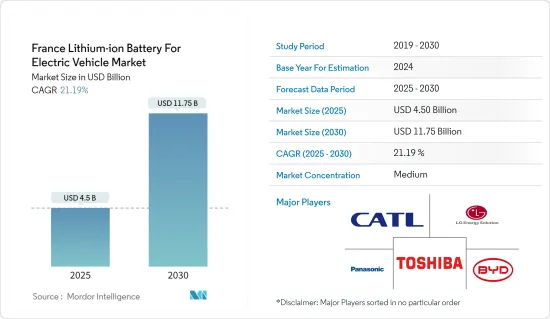

法國電動車鋰離子電池市場規模預計到2025年為45億美元,預計2030年將達到117.5億美元,預測期內(2025-2030年)複合年成長率為21.19%。

主要亮點

- 從中期來看,電動車的普及、鋰離子電池價格的下降以及法國各地政府對電動車的支持措施和舉措預計將在預測期內推動電動車鋰離子電池的需求。

- 另一方面,蘊藏量的短缺和新興的替代電池技術可能會顯著抑制電動車鋰離子電池市場的成長。

- 電動車採用固體鋰離子電池預計將為法國電動車鋰離子電池市場創造巨大機會。

法國電動車鋰離子電池市場趨勢

鋰離子電池價格下跌帶動市場

- 鋰離子電池價格的下降是法國電動車(EV)鋰離子電池市場成長的主要動力。隨著全球鋰離子電池產量的增加,製造商受惠於規模經濟,進而降低生產成本。節省的成本將惠及消費者和企業,使電動車變得更實惠。

- 鋰離子電池的價格通常高於其他電池。然而,市場上的主要企業正在投資研發活動,以獲得規模經濟並提高性能,加劇競爭,進而降低鋰離子電池的價格。

- 由於電動車(EV)和電池能源儲存系統(BESS)的平均電池組價格上漲,電池價格將在 2023 年降至 139 美元/kWh,降幅超過 13%。隨著技術創新和製造水準的提高,電池組價格預計將進一步下降,2025年達到113美元/度,2030年達到80美元/度。

- 此外,由於技術進步、生產規模擴大和供應鏈效率提高,鋰離子電池價格一直在穩步下降。這一趨勢正在對全球能源市場產生重大影響,使電動車 (EV) 和可再生能源儲存系統變得更便宜、更容易獲得。近年來,該市場的主要企業取得了重大技術進步。

- 2024 年 7 月,Stellantis 和 CEA 宣布了一項為期五年的新合作,以內部設計下一代電池,包括用於電動車的鋰離子電池。該聯合研究計畫旨在開發先進技術電池,以具有競爭力的成本提高性能、延長使用壽命和降低碳排放。這些進步預計將在未來幾年推動對先進鋰離子電池的需求,導致法國各地電池價格大幅下降。

- 此外,鋰離子電池價格下降、需求增加以及法國各地新鋰離子生產工廠的建立是相互關聯的現象,正在推動能源和汽車產業的重要轉變。近年來,法國各地對增加鋰離子電池產量的投資大幅增加。

- 例如,2024年2月,該國從公共和私人資金中獲得總計100億歐元(108.4億美元),用於在不久的將來在全國範圍內開設四家電動汽車電池(包括鋰離子電池)的超級工廠宣布他們將投資。此類投資和獎勵可能會在未來幾年加速全國範圍內的電池生產,從而推動未來對鋰離子電池的需求。

- 因此,這些進步和舉措預計將進一步降低鋰離子電池的價格,使其比其他電池類型更具成本競爭力,從而在法國各地的眾多應用中得到更多採用。

純電動車 (BEV) 領域將在預測期內顯著成長

- 近年來,純電動車 (BEV) 領域經歷了顯著成長,這一趨勢與電動車 (EV) 中鋰離子電池的進步和日益普及密切相關。

- 法國電動車(EV)的引進量正在迅速增加,這推動了電動車充電器市場的擴張。該國是世界領先的電動車生產國之一。該國正在經歷向清潔能源和電動車的轉變,這是企業現在更加關注的重要領域。

- 過去幾年,該國電動車銷量急劇成長。例如,根據國際能源總署(IEA)的數據,2023年法國電動車銷量為47萬輛,較2022年成長38.2%。電動車銷量預計在未來幾年將大幅成長,從而推動法國各地對純電動車的需求。

- 該國已採取多項措施來推廣電動車(EV)並支持向低碳交通產業轉型。這些措施旨在降低消費者的總擁有成本,並鼓勵從內燃機汽車轉向純電動車。

- 例如,2024年5月,政府與主要汽車製造商達成協議,透過簽署新的中期計畫協議,將電動車銷量從2022年的20萬輛增加到2027年的80萬輛。政府也累計15 億歐元(16 億美元),透過各種計畫支持電動車的生產和購買。這些舉措和目標預計將在未來幾年加速全國純電動車的生產和需求。

- 另一個主要因素是人們擴大轉向電動車。主要企業已啟動眾多計劃和投資,以在未來幾年增加純電動車的產量。

- 例如,2024年6月,中國電動車巨頭比亞迪宣布將在法國開設電動車生產工廠。該設施預計將於年終投入運作。預計這些類型的計劃將在預測期內提高該國的純電動車產量。

- 因此,預計此類舉措和計劃將在預測期內推動純電動車銷售並增加法國各地對鋰離子電池的需求。

法國電動車鋰離子電池產業概況

法國電動車鋰離子電池市場已被削減一半。主要參與企業(排名不分先後)包括 LG Energy Solution Ltd、東芝公司、松下控股公司、比亞迪有限公司、寧德時代新能源科技有限公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車 (EV) 的擴張

- 鋰離子電池價格下降

- 政府支持措施和舉措

- 抑制因素

- 原料蘊藏量不足

- 新的替代電池技術

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 車型

- 客車

- 商用車

- 其他(摩托車、Scooter等)

- 推進類型

- 純電動車(BEV)

- 插電式混合動力汽車(PHEV)

- 混合動力電動車(HEV)

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略及SWOT分析

- 公司簡介

- LG Energy Solution Ltd

- BYD Company Limited

- Toshiba Corporation

- Panasonic Holdings Corporation

- Contemporary Amperex Technology Co. Limited

- Automotive Cells Company

- Automotive Energy Supply Corporation(AESC)

- Verkor

- Saft Groupe SA

- EnerSys

- 其他知名公司名單(公司名稱、總部地點、相關產品及服務、聯絡等)

- 市場排名/佔有率分析

第7章 市場機會及未來趨勢

- 電動車採用固體鋰離子電池

簡介目錄

Product Code: 50003484

The France Lithium-ion Battery For Electric Vehicle Market size is estimated at USD 4.50 billion in 2025, and is expected to reach USD 11.75 billion by 2030, at a CAGR of 21.19% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increasing adoption of electric vehicles, declining lithium-ion battery prices, and supportive government policies and initiatives for electric vehicles across France are expected to drive the demand for lithium-ion batteries for electric vehicles during the forecast period.

- On the other hand, the lack of raw material reserves and emerging alternative battery technologies can significantly restrain the growth of the lithium-ion battery for electric vehicles market.

- Nevertheless, the adoption of solid-state lithium-ion batteries for electric vehicles is anticipated to create vast opportunities for the French lithium-ion battery in electric vehicles market.

France Lithium-ion Battery for Electric Vehicle Market Trends

Declining Lithium-ion Battery Prices Driving the Market

- The declining prices of lithium-ion batteries are significantly driving the growth of the lithium-ion battery market for electric vehicles (EVs) in France. As the production of lithium-ion batteries increases globally, manufacturers benefit from economies of scale, leading to lower production costs. This cost reduction is passed down to consumers and businesses, making EVs more affordable.

- The price of lithium-ion batteries is usually higher than that of other batteries. However, major players across the market have been investing to gain economies of scale and in R&D activities to enhance their performance, increasing the competition and, in turn, reducing lithium-ion battery prices.

- Owing to the increasing average battery pack prices of electric vehicles (EV) and battery energy storage systems (BESS), battery prices declined in 2023 to 139 USD/kWh, a decrease of over 13%. The trajectory of technological innovation and manufacturing enhancements is anticipated to decrease the battery pack prices further, with prices projected to reach USD 113/kWh in 2025 and USD 80/kWh in 2030.

- Furthermore, the price of lithium-ion batteries has been steadily decreasing due to technological advancements, increased production scale, and improved supply chain efficiencies. This trend is significantly impacting the global energy market, making electric vehicles (EVs) and renewable energy storage systems more affordable and accessible. Leading companies in the market have made significant technological advances in the past few years.

- In July 2024, Stellantis and CEA announced a new five-year collaboration to design next-generation battery cells, including lithium-ion batteries for electric vehicles, in-house. The joint research program aims to develop advanced technology cells with enhanced performance, longer lifespan, and lower carbon footprint at competitive costs. Such advancements are expected to boost the demand for advanced lithium-ion batteries in the coming years and positively reduce the battery price across France.

- Moreover, the decreasing price of lithium-ion batteries, rising demand, and the establishment of new lithium-ion production plants across France are interlinked phenomena driving significant shifts in the energy and automotive industries. Investments in enhancing lithium-ion battery production have increased exponentially across the country in recent years.

- For instance, in February 2024, the country announced a total investment of EUR 10 billion (USD 10.84 billion) from public and private funds to open four gigafactories of electric vehicle batteries, including lithium-ion batteries, around the national territory in the near future. Such investments and incentives are likely to accelerate battery production across the country over the coming years and boost the demand for lithium-ion batteries in the future.

- Hence, such advancements and initiatives are expected to reduce lithium-ion battery prices further, making them much more cost-competitive than other battery types and resulting in their increasing adoption for numerous applications across France.

Battery Electric Vehicle (BEV) Segment to Witness Significant Growth Over the Forecast Period

- The battery electric vehicle (BEV) segment has experienced significant growth in recent years, a trend closely tied to the advancements and increased adoption of lithium-ion batteries in electric vehicles (EVs).

- France is experiencing a significant surge in the adoption of electric vehicles (EVs), which is driving the expansion of the EV charging equipment market. The country is the leading EV producer worldwide. The country is shifting toward clean energy and transitioning to electric vehicles, which is an essential segment on which companies are currently focusing more.

- EV sales have been rising exponentially in the country over the last few years. For instance, according to the International Energy Agency (IEA), in 2023, the number of electric vehicles sold in France was 0.47 million, up by 38.2% from 2022. The number of electric vehicle sales is expected to increase significantly in the coming years, raising the demand for BEVs across France.

- The country has implemented several policies to promote electric vehicles (EVs) and support the transition to a low-carbon transportation industry. These policies aim to reduce consumers' overall cost of ownership and encourage the switch from internal combustion engine vehicles to BEVs.

- For instance, in May 2024, the government signed an agreement with leading car manufacturers to agree to an interim goal of 800,000 electric vehicle sales by 2027 under a new medium-term planning agreement with the government, up from 200,000 in 2022. The government also earmarked EUR 1.5 billion (USD 1.6 billion) to support the production and purchase of electric vehicles through various programs. Such initiatives and targets are likely to accelerate the production and demand for BEVs across the country in the coming years.

- Furthermore, the rising shift toward electric vehicles is a significant factor. Leading companies across the country have launched numerous projects and investments to raise the production of battery electric vehicles over the coming years.

- For instance, in June 2024, BYD, a Chinese electric vehicle giant, announced it would open an EV production factory in France. The facility is expected to be operational by the end of the next year. Such types of projects are expected to boost BEV production across the country during the forecast period.

- Hence, such initiatives and plans are likely to enhance BEV sales across the country and hike the demand for lithium-ion batteries during the forecast period.

France Lithium-ion Battery for Electric Vehicle Industry Overview

The French lithium-ion battery for electric vehicles market is semi-fragmented. Some of the key players (not in any particular order) are LG Energy Solution Ltd, Toshiba Corporation, Panasonic Holdings Corporation, BYD Company Limited, and Contemporary Amperex Technology Co. Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles (EV)

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.1.3 Supportive Government Policies and Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.2.2 Emerging Alternative Battery Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.1.3 Other Vehicles (Bikes, Scooters, etc.)

- 5.2 Propulsion Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.3 Hybrid Electric Vehicles (HEV)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 LG Energy Solution Ltd

- 6.3.2 BYD Company Limited

- 6.3.3 Toshiba Corporation

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Contemporary Amperex Technology Co. Limited

- 6.3.6 Automotive Cells Company

- 6.3.7 Automotive Energy Supply Corporation (AESC)

- 6.3.8 Verkor

- 6.3.9 Saft Groupe SA

- 6.3.10 EnerSys

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Solid-state Lithium-ion Batteries for Electric Vehicles

02-2729-4219

+886-2-2729-4219