|

市場調查報告書

商品編碼

1636174

電動汽車用鋰離子電池:市場佔有率分析、產業趨勢、成長預測(2025-2030)Lithium-ion Battery For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

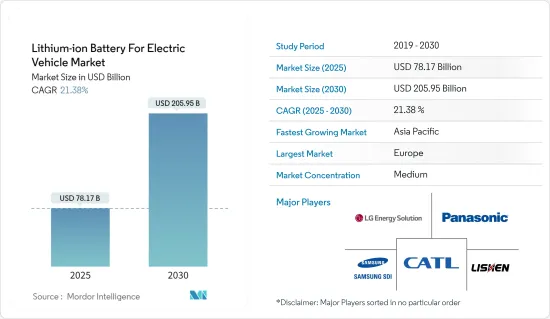

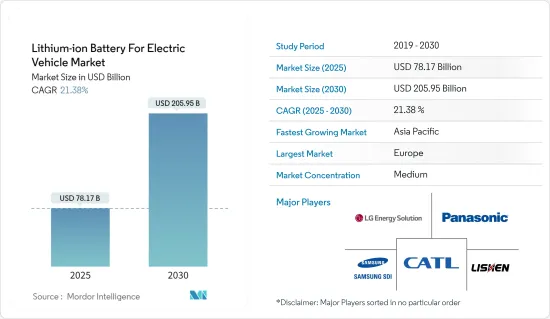

預計2025年電動車鋰離子電池市場規模為781.7億美元,預計2030年將達2,059.5億美元,預測期內(2025-2030年)複合年成長率為21.38%。

從中期來看,鋰離子電池價格的下降、電動車的普及以及政府的支持措施和舉措預計將在預測期內推動電動車市場對鋰離子電池的需求。

同時,替代電池技術的興起和原料供需失配預計將阻礙預測期內的市場成長。電動車採用固體鋰離子電池預計將為電動車市場的鋰離子電池創造巨大的機會。由於亞太地區電動車的普及率不斷提高,預計亞太地區將成為電動車市場鋰離子電池的主導地區。

電動車鋰離子電池市場趨勢

純電動車 (BEV) 領域出現顯著成長

- 純電動車(BEV)通常也被稱為帶有馬達的電動車。純電動車是全電動汽車,這意味著它們沒有內燃機 (ICE)、燃料箱或排氣管,而是依靠電力來推進。車輛的能量來自電池組並透過電網充電。純電動車是零排放車,這意味著它們不會像傳統汽油動力汽車那樣帶來有害廢氣排放或空氣污染的風險。

- 隨著電動車,特別是純電動車 (BEV) 的發展和普及,全球汽車產業正在經歷轉型。隨著技術的進步、政府的支持以及人們對環境問題認知的提高,純電動車已成為應對氣候變遷挑戰和減少對石化燃料依賴的有前景的解決方案。

- 近年來,純電動車的採用在全球範圍內顯著成長。電池技術的進步正在帶來更長的行駛里程和充電基礎設施的普及,有助於克服最初的進入障礙。特斯拉、比亞迪、塔塔、雪佛蘭、日產和福特等汽車製造商對於純電動車的採用至關重要,它們提供價格實惠的車款來吸引廣大消費者。

- 根據國際能源總署(IEA)預測,2023年全球純電動車(BEV)銷量約950萬輛,比2022年的約730萬輛成長30%以上。同樣,2023年全球純電動汽車總保有量達到約2,800萬輛。隨著純電動車銷量的不斷增加,對鋰離子電池等電動車電池的需求變得越來越重要。

- 各國正實施各種措施和獎勵,以加速純電動車的普及。在美國,聯邦稅額扣抵抵免、州回扣和補貼使更多人負擔得起並使用電動車。一些州制定了雄心勃勃的目標,以逐步淘汰內燃機汽車(ICE)並推廣電動車的使用。因此,純電動車的採用正在增加,預計將在預測期內增加對鋰離子電池的需求。

- 未來幾年,多個政府計劃加速電動車的採用。 2024年5月,法國政府設定了國內汽車製造商未來10年生產200萬輛電動或混合動力汽車的目標。根據財政部的簡報,根據與政府達成的新中期規劃協議,該行業將同意到 2027 年銷售 80 萬輛電動車的臨時目標,高於 2022 年的 20 萬輛。該汽車製造商的目標是將電動車銷量從 2022 年的 16,500 輛增加到同期的每年 10 萬輛。預計這些將為電動車二次電池(例如鋰離子電池)帶來巨大需求,以支持該地區道路上越來越多的電池驅動電動車。

- 幾家中國汽車製造商正在尋求在世界各地建立和擴大電動車製造和組裝工廠,以擴大銷售。例如,中國出口量最大的汽車製造商奇瑞汽車於2024年4月宣布,將與西班牙EV Motors成立合資企業,並在加泰隆尼亞開設其在歐洲的第一個生產基地。生產計劃於 2024 年下半年開始,初級合作夥伴奇瑞將在該工廠生產 Omoda 車輛。汽車製造商正在考慮到 2030 年在英國建立汽車工廠。

- 2024年3月,印度政府核准了一項價值5億美元的新電動車(EV)計劃,提供各種獎勵以吸引全球電動車公司的投資,並將印度定位為尖端電動車製造商的主要基地。其他目標包括為印度消費者提供先進的電動車車型、擴大印度製造生態系統、降低生產成本以及培育具有競爭力的國內汽車製造業等。這種情況預計將對純電動車製造業產生正面影響,進而推動電動車應用對鋰離子電池的需求。

- 由於上述因素,預計純電動車領域將在預測期內主導電動車(EV)鋰離子電池市場。

亞太地區預計將主導市場

- 亞太地區擁有全球最大、成長最快的經濟體,預計將主導全球電動車 (EV) 鋰離子電池市場。隨著電動車在中國、印度和日本等國家的快速普及,鋰離子電池已成為重要的電池化學材料。

- 根據國際能源總署(IEA)的公告,2023年中國電動車(包括純電動車和插電式混合動力車)持有將約為2,180萬輛。同樣,同年印度和日本的電動車庫存量分別約為 15 萬輛和 54 萬輛。 2023年中國電動車電池需求量約為每年417GWh,約佔2023年全球需求的54%,較2022年大幅成長32%以上。這凸顯了中國在電動車電池領域的主導地位的重要性。

- 亞太地區也正在成為電動車和電池系統的製造地,預計鋰離子電池等二次電池將取得重大發展。中國、韓國和日本的主要汽車製造商預計將加快該地區的鋰離子電池生產能力。

- 國際能源總署(IEA)表示,在中國的帶動下,亞太地區的鋰離子電池製造能力預計在未來幾年將大幅成長。該機構預計,中國鋰離子電池製造能力將從2022年的約1.20太瓦時增加到2030年的4.65太瓦時。

- 該地區的鋰離子電池開發正在取得進展。 2024年6月,印度電池製造商Amara Raja Energy and Mobility與中國國軒高科子公司Gotion-InoBat-Batteries (GIB)簽署授權合約,在印度生產鋰離子電池。吉布磷酸鋰鐵

- 根據授權合約,這家印度公司將獲得電池技術智慧財產權、建立超級工廠設施的支持,以及融入國軒的全球供應鏈網路。 Gothion的最大股東是德國汽車製造商大眾汽車,專門生產新能源汽車用鋰離子二次電池。印度汽車製造商主要從中國和韓國進口電動車電池,國內電池供應商近年來也投資發展國內鋰離子電池產能。

- 亞太地區也是一些全球最大的鋰離子電池關鍵原料(例如鋰、鈷和石墨)生產商和供應商的所在地。豐富的原料供應,加上該地區強大的製造能力,為鋰離子電池市場的成長創造了有利的環境。

- 例如,印尼持有約全球22%的鎳蘊藏量。同樣,西澳大利亞地區的鋰蘊藏量佔全球的24%,使亞太地區成為鋰離子電池開發和製造的理想地區。

- 因此,鑑於上述幾點,預計亞太地區將成為預測期內電動車市場鋰離子電池的主導地區。

電動汽車鋰離子電池產業概況

電動車鋰離子電池市場正在變得半固體。該市場的主要企業包括松下公司、三星SDI、寧德時代新能源科技有限公司(CATL)、LG能源解決方案有限公司、天津力神電池股份有限公司等。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 鋰離子電池價格下降

- 電動車的擴張

- 政府支持措施和舉措

- 抑制因素

- 替代電池技術的興起

- 原料供需不匹配

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 車型

- 客車

- 商用車

- 其他(摩托車、Scooter等)

- 推進類型

- 純電動車(BEV)

- 插電式混合動力汽車(PHEV)

- 混合動力電動車(HEV)

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐的

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 馬來西亞

- 印尼

- 越南

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 奈及利亞

- 卡達

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略及SWOT分析

- 公司簡介

- Panasonic Corporation

- Samsung SDI Co. Ltd

- Contemporary Amperex Technology Co. Ltd(CATL)

- Tianjin Lishen Battery Joint-Stock Co. Ltd

- LG Energy Solution Ltd

- Trontek Electronics Pvt. Ltd

- Greenfuel Energy Solutions Pvt. Ltd

- Tesla Inc.

- 其他知名公司名單(公司名稱、總部地點、相關產品及服務、聯絡資訊等)

- 市場排名分析

第7章 市場機會及未來趨勢

- 電動車採用固體鋰離子電池

The Lithium-ion Battery For Electric Vehicle Market size is estimated at USD 78.17 billion in 2025, and is expected to reach USD 205.95 billion by 2030, at a CAGR of 21.38% during the forecast period (2025-2030).

Over the medium term, declining lithium-ion battery prices, increasing adoption of electric vehicles, and supportive government policies and initiatives are expected to drive the demand for lithium-ion batteries in the electric vehicle market during the forecast period.

On the other hand, the emerging alternative battery technologies and the demand-supply mismatch of raw materials are expected to hinder the market's growth during the forecast period. The adoption of solid-state lithium-ion batteries for electric vehicles is anticipated to create vast opportunities for lithium-ion batteries in the electric vehicle market. Due to the increasing adoption of electric vehicles in the region, Asia-Pacific is expected to be a dominant region for lithium-ion batteries in the electric vehicle market.

Lithium-ion Battery For Electric Vehicle Market Trends

Battery Electric Vehicle (BEV) Segment to Witness Significant Growth

- Battery electric vehicles (BEVs) are also commonly known as electric vehicles with an electric motor. BEVs are fully electric vehicles that typically do not include an internal combustion engine (ICE), fuel tank, or exhaust pipe and rely on electricity for propulsion. The vehicle's energy comes from the battery pack, which is recharged from the grid. BEVs are zero-emission vehicles, as they do not generate harmful tailpipe emissions or air pollution hazards caused by traditional gasoline-powered vehicles.

- The global automotive industry has been transforming, with electric vehicles, particularly battery electric vehicles (BEVs), gaining momentum and popularity. With the growing technological advancements, government support, and increasing environmental concerns, BEVs emerged as a promising solution to address the challenges of climate change and reduce reliance on fossil fuels.

- In recent years, the adoption of battery-electric vehicles has grown significantly worldwide. Improving battery technology has led to extended driving ranges and a surge in charging infrastructure, helping overcome the initial entry barriers. Automakers such as Tesla, BYD, Tata, Chevrolet, Nissan, and Ford are vital in popularizing BEVs, offering affordable models that appeal to a broader range of consumers.

- As per the International Energy Agency (IEA), the global battery electric vehicle (BEV) cars sales were around 9.5 million units (BEV cars) in 2023, an increase of over 30% from around 7.3 million units in 2022. Similarly, the total BEV car stocks worldwide reached around 28 million units in 2023. As the sales of BEVs continue to rise, the demand for EV batteries, such as lithium-ion batteries, has become increasingly vital.

- Countries have been implementing various initiatives and incentives to accelerate the adoption of BEVs. In the United States, federal tax credits, state rebates, and subsidies helped make EVs affordable and accessible to a broader audience. Several states have set ambitious targets to phase out internal combustion engine (ICE) vehicles and promote the use of electric cars. Therefore, the growing adoption of BEVs is anticipated to boost the demand for lithium-ion batteries over the forecast period.

- Several governments plan to boost the adoption of EVs in the coming years. In May 2024, the French government set a goal for the nation's carmakers to produce two million electric or hybrid vehicles by the end of the decade. Under a new medium-term planning agreement with the government, the industry is set to agree to an interim goal of 800,000 electric vehicle sales by 2027, up from 200,000 in 2022, according to a finance ministry briefing. Carmakers aim to increase sales of electric light utility vehicles to 100,000 annually over the same period, from only 16,500 in 2022. All these are expected to create a vast demand for rechargeable EV batteries, such as lithium-ion batteries, to support the growing battery electric vehicles on the roads in the region.

- Several Chinese carmakers have been looking to set up and expand EV manufacturing and assembly plants globally to ramp up sales. For example, Chery Auto, China's largest automaker by export volume, announced on April 2024 that it signed a joint venture with Spain's EV Motors to open its first European manufacturing site in Catalonia. The production is set to start later in 2024, with junior partner Chery producing its Omoda vehicles at the plant. Carmakers are considering building car factories in Britain by 2030.

- In March 2024, the Indian government approved a new USD 500-million-worth Electric Vehicle (EV) Policy, offering a range of incentives to draw investments from global EV companies and positioning India as a prime manufacturing hub for state-of-the-art EVs. Other objectives include providing Indian consumers access to cutting-edge EV models, expanding the Make in India ecosystem, lowering production costs, and fostering a competitive domestic auto manufacturing industry. Such a scenario is expected to impact the BEV manufacturing industry positively, which, in turn, boosts the demand for lithium-ion batteries for EV applications.

- Due to the abovementioned factors, the BEV segment is expected to dominate the lithium-ion battery for electric vehicle (EV) market over the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the global lithium-ion battery for electric vehicle (EV) market, as the region is home to some of the world's largest and fastest-growing economies. Countries such as China, India, and Japan are experiencing a surge in the adoption of electric vehicles, where lithium-ion batteries are crucial battery chemistries.

- As per the International Energy Agency (IEA), the total EV car stocks, including (both BEV and PHEV) in China was around 21.8 million units in 2023. Similarly, India and Japan had approximately 0.15 million and 0.54 million units of EV car stocks in the same year, respectively. In 2023, China had an EV battery demand of about 417 GWh per year, or about 54% of the world demand in 2023, recording over 32% surge from 2022. This highlights the importance of the country's dominance in EV batteries.

- Asia-Pacific is also emerging as a manufacturing hub for electric vehicles and battery systems, which is expected to witness significant developments in rechargeable batteries such as lithium-ion batteries. Major automotive manufacturers in China, South Korea, and Japan are expected to accelerate the region's lithium-ion battery manufacturing capacity.

- As per the International Energy Agency (IEA), the lithium-ion battery manufacturing capacity in Asia-Pacific is expected to grow significantly in the coming years, with China leading the way. The agency estimated that the Chinese lithium-ion battery manufacturing capacity will rise to 4.65 TWh in 2030 from around 1.20 TWh in 2022.

- The region has been seeing developments in the lithium-ion batteries. In June 2024, Indian battery maker Amara Raja Energy and Mobility signed a licensing agreement with Gotion-InoBat-Batteries (GIB), a unit of China-based Gotion High Tech Co, to produce lithium-ion batteries in India. GIB EnergyX Slovakia, a joint venture between Gotion and Slovakia-based InoBat, will license Gotion's lithium iron phosphate technology for lithium-ion cells to a unit of Amara Raja.

- Under the licensing agreement, the Indian company will gain access to cell technology IP, support for establishing Gigafactory facilities, and integration into Gotion's global supply chain network. Gotion, whose largest shareholder is the German automaker Volkswagen, specializes in lithium-ion rechargeable batteries for new-energy vehicles. Indian automakers mainly import EV batteries from China and South Korea, and domestic battery suppliers have invested in developing lithium-ion battery production capabilities within the country in recent years.

- Asia-Pacific is also home to some of the world's largest producers and suppliers of critical raw materials used in lithium-ion batteries, such as lithium, cobalt, and graphite. This abundant availability of raw materials, coupled with the region's strong manufacturing capabilities, has created a favorable environment for the growth of the lithium-ion battery market.

- For instance, Indonesia holds approximately 22% of the global nickel reserves. Similarly, the Western Australia region has 24% of the global lithium reserves, which makes Asia-Pacific ideal for lithium-ion battery development and manufacturing.

- Therefore, as per the abovementioned points, Asia-Pacific is expected to be the dominant region for lithium-ion batteries in the electric vehicle market during the forecast period.

Lithium-ion Battery For Electric Vehicle Industry Overview

The lithium-ion battery for the electric vehicle market is semi-consolidated. Some key players in the market include Panasonic Corporation, Samsung SDI Co. Ltd, Contemporary Amperex Technology Co. Ltd (CATL), LG Energy Solution Ltd, and Tianjin Lishen Battery Joint-Stock Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Lithium-ion Battery Prices

- 4.5.1.2 Increasing Adoption of Electric Vehicles

- 4.5.1.3 Supportive Government Policies and Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Emerging Alternative Battery Technologies

- 4.5.2.2 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.1.3 Other Vehicles (Bikes, Scooters, etc.)

- 5.2 Propulsion Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.3 Hybrid Electric Vehicles (HEV)

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Nordic

- 5.3.2.7 Russia

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Thailand

- 5.3.3.6 Malaysia

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 South Africa

- 5.3.4.4 Egypt

- 5.3.4.5 Nigeria

- 5.3.4.6 Qatar

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Chile

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Samsung SDI Co. Ltd

- 6.3.3 Contemporary Amperex Technology Co. Ltd (CATL)

- 6.3.4 Tianjin Lishen Battery Joint-Stock Co. Ltd

- 6.3.5 LG Energy Solution Ltd

- 6.3.6 Trontek Electronics Pvt. Ltd

- 6.3.7 Greenfuel Energy Solutions Pvt. Ltd

- 6.3.8 Tesla Inc.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Solid-state Lithium-Ion Batteries for Electric Vehicles