|

市場調查報告書

商品編碼

1549951

零售和消費品領域的網路分析 -市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Web Analytics In Retail And CPG - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

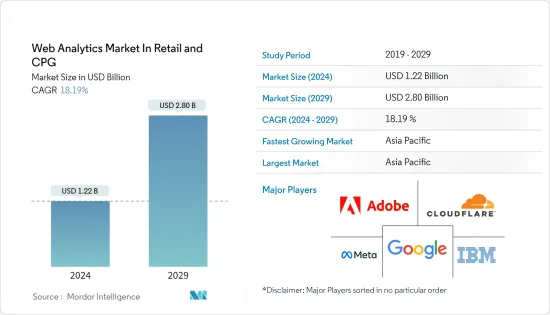

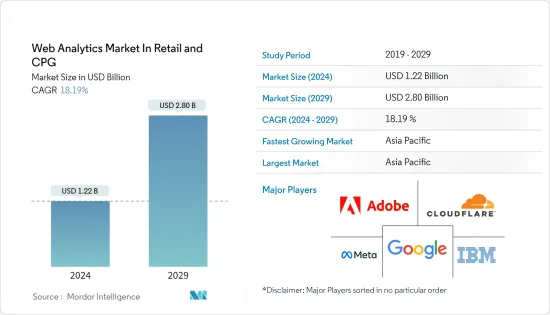

零售和消費品領域的網路分析市場預計將從 2024 年的 12.2 億美元成長到 2029 年的 28 億美元,預測期內(2024-2029 年)複合年成長率為 18.19%。

主要亮點

- 零售和消費品領域的網路分析對於企業來說極為重要。我們幫助您增強線上形象、提高客戶參與、最佳化您的行銷策略並增加銷售額。隨著數位轉型的進展,這些領域的網路分析變得越來越重要,在現代零售和消費品策略中發揮著至關重要的作用。

- 透過先進的資料分析諮詢,零售和 CGP 公司可以提高行銷投資報酬率。這些服務提供的對消費者行為和購買趨勢的即時洞察非常寶貴。透過分析社交媒體和品牌網站等平台的指標,公司可以確定其當前策略的有效性。

- 隨著越來越多的企業轉向線上,透過網路分析來了解和最佳化其數位化存在的需求也在成長。根據 Wunderman Thompson Commerce 的數據,eBay、阿里巴巴和京東等線上市場佔全球網路購物訂單的三分之一以上。 2023 年,15% 的數位購物者在電子雜貨店和超級市場進行購物,其中品牌網站以 14% 的比例排名第三,緊隨其後的是零售商網站 (13%)。

- 此外,公司越來越依賴資料洞察來指南其策略和業務。網路購物的成長推動了對電子商務分析的需求,以了解客戶行為並提高轉換率。根據 NEPA 的數據,截至 2023 年初,大約 43% 的美國消費者表示,他們更喜歡網上購物而不是實體店購物,這使得美國成為最喜歡網路購物的國家。

- 人工智慧和機器學習等分析技術的不斷進步正在增強網路分析工具的功能。中國國務院最近詳細制定了到 2030 年成為人工智慧強國的戰略,打造 1500 億美元的國家人工智慧產業。此類政府措施可能會進一步促進所研究市場的成長。

- 網路分析整合了來自不同來源的資料,例如搜尋引擎最佳化、社群媒體、電子郵件行銷和付費廣告。這種整體方法使零售和消費品公司能夠了解不同的行銷管道如何相互作用,使他們能夠微調其數位策略。根據 We Are Social 的報告,印度有 4.62 億活躍社群媒體用戶。尤其是 WhatsApp 和 Instagram 處於領先地位,到 2023 年第三季滲透率分別超過 83% 和 80%。

- 嚴格的政府和資料隱私法規可能會帶來挑戰,並為零售和消費品網路分析市場提出合規要求。這些法規旨在保護使用者隱私並確保負責任地處理個人資料,但它們也可能限制並影響網路分析業務的某些方面。

- 通膨上升可能會對零售和消費品 (CPG) 網路分析市場的成長產生重大影響。當通貨膨脹影響消費者的購買力時,他們的購物習慣可能會改變。消費者可能會對價格敏感並轉向折扣店和替代產品。網路分析可協助企業即時追蹤和回應這些變化,提供對新興趨勢的洞察並允許快速調整行銷策略。

網路分析市場趨勢

搜尋引擎最佳化和排名領域是市場成長的主要驅動力

- SEO 和排名方面的持續努力極大地推動了零售和消費品 (CPG) 行業對網路分析的需求。企業投資 SEO 是為了提高搜尋引擎排名並增加網站的自然流量。網路分析工具對於衡量此類 SEO 工作的有效性至關重要。透過分析頁面瀏覽量、跳出率和轉換率等資料,企業可以評估其 SEO 策略的有效性並做出必要的調整。

- 此外,SEO排名的提高將導致網站流量的增加。網路分析提供了有關這些訪客如何與您的網站互動、他們造訪哪些頁面、他們停留的時間以及他們離開的位置的詳細資訊。了解這種行為可以讓零售商和消費品公司改善網站內容、佈局和使用者體驗,以滿足消費者需求並提高參與度。

- 2024 年 1 月,Ahrefs 發布了 Rank Tracker Overview 2.0 和 Site Explorer 的新功能。透過此增強功能,用戶將能夠精確找到 Ahrefs 認為好的連結。此濾波器基於預先定義的參數組,例如 DR 大於 30 且流量大於 500 的引用域。

- 網路分析可以透過分析搜尋引擎排名、關鍵字策略和流量模式來深入了解競爭對手的 SEO 表現。零售和消費品公司可以利用這些資訊將其績效與競爭對手進行比較,並發現改進的機會。隨著越來越多的零售企業轉向線上,對搜尋搜尋引擎結果可見性的競爭日益激烈。因此,對先進的 SEO 工具來提高競爭力的需求不斷成長。

- 電子商務的持續成長需要可靠的搜尋引擎最佳化策略來吸引和留住客戶。有效的搜尋引擎最佳化可以顯著提高零售商的線上形象並推動銷售。根據AMI報告稱,2023年,亞洲將主導全球電子商務,交易額將超過1.8兆美元。

亞太地區佔主要市場佔有率

- 亞太地區許多國家正在快速數位化。企業擴大採用線上平台,並且需要網路分析來了解和增強他們的線上形象。亞太地區電商市場蓬勃發展,中國、印度、東南亞等國家呈現強勁成長。零售商和消費品公司正在利用網路分析來最佳化其電子商務策略、改善用戶體驗並增加銷售額。

- 據 EBANX 稱,到 2023 年,印度的數位購物者數量將超過 3.45 億。據預測,到2027年,這一數字將迅速上升至4億多人。此外,2023年7月,拼多多旗下超低價電商平台Temu開始向日本銷售,首次進軍區域市場。此外,中國折扣電子商務平台拼多多的姊妹網站向國際客戶運送各種產品,從電子產品、服飾到家居用品,主要從中國商家採購,價格都非常有競爭力。該地區電子商務行業的擴張可能會進一步推動所研究市場的成長。

- 此外,該市場見證了主要企業的合併、收購和投資,作為其策略的一部分,以改善其業務並增加其影響力,以接觸客戶並滿足各種應用的要求。例如,2024 年 4 月,數位解決方案、技術諮詢和 IT 服務的多產業供應商 Cognizant 宣布與 Shopify 和 Google 建立合作夥伴關係,幫助品牌和零售商為其網路商店提供支援。此次合作將把 Shopify 的線上銷售平台與 Google Cloud 的系統整合,並利用 Cognizant 零售技術專家的專業知識。

- 機器學習 (ML)、人工智慧和巨量資料分析等先進技術正在引入。這些技術增強了網路分析能力,並提供對消費行為和市場趨勢的更深入的洞察。此外,亞太地區各國政府正在推動數位經濟措施。支持數位基礎設施和創新的政策正在鼓勵公司投資網路分析。

- 2023 年 8 月,電子與資訊科技部 (MeitY) 宣布啟動「數位印度」計劃。該計劃旨在推動印度邁向數位賦能社會和知識密集型經濟。我們的主要目標是彌合數位鴻溝,專注於確保數位存取、包容性和賦權。

- 此外,社群媒體在亞太地區具有很大的影響力。網路分析工具可衡量社群媒體宣傳活動的影響力、追蹤影響者的表現並了解社群媒體主導的流量和轉換。根據 GSMA 的數據,截至 2024 年 1 月,中國公民在網路上擁有強大的影響力,擁有約 10.6 億社群媒體使用者帳號。印度和印尼在社群媒體上排名第二和第三,分別擁有 4.62 億和 1.39 億社群媒體用戶帳號。

網路分析產業概述

零售和 CPG 網路分析市場由 Google LLC、IBM Corporation、Meta 和 Cloudflare 等重要參與者細分。公司不斷投資於策略聯盟和產品開拓,以獲得市場佔有率。近期市場趨勢如下:

- 2024 年 3 月 - Google 宣布過渡到新的 Google Analytics 4。此更新版本著重於保護消費者隱私,並引入了從網站和應用程式安全收集資料的增強功能。負責人可以期待更強大的平台來確保永續的資料收集和彙報。

- 2024 年 2 月 - Wipro Limited 宣布推出Wipro 企業人工智慧 (AI) 就緒平台。 Wipro 企業 AI-Ready 平台利用 IBM Watson AI 和資料平台,其中包含 watsonx.ai、watsonx Data 和 watsonx Governance 以及 AI 助理。這種整合使客戶能夠快速採用人工智慧。該服務透過一組工具和廣泛的語言模型為業務提供支持,以確保簡化的流程和強力的管治。此外,它還為未來以 WatsonX Data 和 AI 為中心的產業分析解決方案奠定了基礎。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 網路購物需求不斷成長趨勢

- 更多採用分析工具來了解客戶偏好

- 更多地使用以客戶為中心的方法和建議引擎

- 市場限制因素

- 資料隱私和安全

- 實施所需時間

- 案例研究分析

- 生態系分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 主要宏觀經濟趨勢對市場的影響

第5章市場區隔

- 透過提供

- 解決方案

- 服務

- 按組織規模

- 小型企業

- 主要企業

- 按用途

- 搜尋引擎最佳化和排名

- 網路行銷和行銷自動化

- 客戶分析和回饋

- 應用效能管理

- 社群媒體管理

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- Google LLC

- IBM Corporation

- Meta

- Cloudflare

- Adobe

- Microsoft

- Splunk

- SAS

- Teradata Corporation

- Salesforce

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 50002600

The Web Analytics Market In Retail And CPG Industry is expected to grow from USD 1.22 billion in 2024 to USD 2.80 billion by 2029, at a CAGR of 18.19% during the forecast period (2024-2029).

Key Highlights

- Web analytics in the retail and CPG sectors is crucial for businesses. It assists in strengthening their online presence, refining customer engagement, optimizing marketing strategies, and boosting sales. With the ongoing digital transformation, the significance of web analytics in these sectors is set to grow, cementing its role as a crucial of modern retail and CPG strategies.

- Through advanced data analytics consulting, retail and CGP companies can boost their marketing RoI. Real-time insights into consumer behavior and purchasing trends, obtained through these services, are invaluable. By analyzing metrics from platforms like social media and brand websites, businesses can determine the efficacy of their current strategies.

- As businesses increasingly move online, the need for web analytics to understand and optimize digital presence grows. According to Wunderman Thompson Commerce, online marketplaces such as eBay, Alibaba, or JD.com accounted for over one-third of global online shopping orders. In a 2023 survey, 15% of digital shoppers purchased from e-grocers and supermarkets, while branded websites secured the third spot at 14%, closely followed by retailer websites at 13%.

- Furthermore, companies are increasingly relying on data insights to guide their strategies and operations. The rise of online shopping boosts the demand for e-commerce analytics to understand customer behavior and improve conversion rates. According to NEPA, as of early 2023, around 43% of consumers in the United States said they would prefer to shop mostly online rather than in-store, making it the country with the highest online shopping preference.

- Continuous advancements in analytics technologies, such as AI and machine learning, enhance the capabilities of web analytics tools. The State Council of China recently detailed its strategy to become the leading AI superpower by 2030 by building a USD 150 billion national AI industry. Such governmnet initiatives may further propel the studied market growth.

- Web analytics consolidate data from diverse sources like SEO, social media, email marketing, and paid advertising. This comprehensive approach aids retail and CPG firms in grasping how various marketing channels interact, enabling them to fine-tune their digital strategies. We Are Social reports that India boasted a staggering 462 million active social media users. Notably, WhatsApp and Instagram led the charge, with penetration rates exceeding 83% and 80%, respectively, by Q3 2023.

- Rigid government and data privacy regulations can pose challenges and create compliance requirements for the web analytics market in retail and CPG. These regulations aim to protect user privacy and ensure responsible handling of personal data, but they can also impose limitations and impact certain aspects of web analytics practices.

- Increasing inflation can significantly impact the growth of the web analytics market in retail and consumer packaged goods (CPG). As inflation affects consumer purchasing power, shopping habits may change. Consumers might become more price-sensitive, shifting towards discount retailers or alternative products. Web analytics can help companies track and respond to these changes in real time, offering insights into emerging trends and allowing for quick adjustments in marketing strategies.

Web Analytics Market Trends

Search Engine Optimization and Ranking Sector Significantly Driving the Market Growth

- The increase in SEO and ranking efforts significantly propels the demand for web analytics in the retail and consumer packaged goods (CPG) sectors. Companies invest in SEO to improve search engine rankings and increase organic website traffic. Web analytics tools are crucial for measuring the effectiveness of these SEO efforts. Companies can assess how well their SEO strategies are working and make necessary adjustments by analyzing data such as page views, bounce rates, and conversion rates.

- In addition, higher SEO rankings lead to increased website traffic. Web analytics provide detailed insights into how these visitors interact with the site, which pages they visit, how long they stay, and where they drop off. Understanding this behavior helps retail and CPG companies refine their website content, layout, and user experience to meet consumer needs better and increase engagement.

- In January 2024, Ahrefs announced Rank Tracker's Overview 2.0 and a new feature in Site Explorer, allowing users to filter by "best links." This enhancement empowers users to pinpoint what Ahrefs deems "good" links. The filter is based on a predefined group of parameters, which contains referring domains with a DR of at least 30, traffic of 500 or more, and so on.

- Web analytics can provide insights into competitors' SEO performance by analyzing search engine rankings, keyword strategies, and traffic patterns. Retail and CPG companies can use this information to benchmark their performance against competitors and recognize opportunities for improvement. As more retailers move online, the competition for visibility in search engine results intensifies. This drives demand for sophisticated SEO tools to gain a competitive edge.

- The continuous growth of e-commerce necessitates robust SEO strategies to attract and retain customers. Effective SEO can significantly enhance a retailer's online presence and drive sales. In 2023, as AMI reported, Asia dominated the global e-commerce landscape, surpassing a staggering USD 1.8 trillion in transaction volume.

Asia Pacific to Witness Significant Market Share

- Many countries in the APAC region are experiencing fast-paced digitalization. Businesses are increasingly adopting online platforms, necessitating web analytics to understand and enhance their online presence. The e-commerce market in APAC is booming, with countries like China, India, and Southeast Asia showing significant growth. Retailers and CPG companies leverage web analytics to optimize their e-commerce strategies, improve user experience, and drive sales.

- According to EBANX, in 2023, India boasted a digital buyer base exceeding 345 million. Projections indicate that this figure will surge, surpassing 400 million by 2027. Additionally, in July 2023, Ultra-low-cost e-commerce platform Temu, owned by PDD Holdings, started selling to Japan, marking its first foray into the regional market. Additionally, the sister site of the Chinese discount e-commerce platform Pinduoduo ships a significant range of products, from electronics and clothing to home goods primarily sourced from Chinese merchants to international customers, all at highly competitive prices. Such expansion in the e-commerce sector in the region may further propel the studied market growth.

- Moreover, the market studied is witnessing key players' mergers, acquisitions, and investments as part of its strategy to improve business and their presence to reach customers and meet their requirements for various applications. For instance, in April 2024, Cognizant, a company that offers digital solutions, technology consulting, and IT services to multiple industries, announced a partnership with Shopify and Google to assist brands and retailers in enhancing their online stores. This collaboration integrates Shopify's online selling platform with Google Cloud's system, utilizing the expertise of Cognizant's retail technology specialists.

- There is a growing adoption of advanced technologies such as machine learning (ML), AI, and big data analytics. These technologies enhance web analytics capabilities, providing deeper insights into consumer behavior and market trends. Also, various governments in the APAC region are promoting digital economy initiatives. Policies supporting digital infrastructure and innovation encourage businesses to invest in web analytics.

- In August 2023, the Ministry of Electronics and Information Technology (MeitY) announced the launch of the 'Digital India' initiative. The program aims to propel India towards a digitally empowered society and a knowledge-based economy. It focuses on ensuring digital access, inclusion, and empowerment, with a critical goal of bridging the digital divide.

- Furthermore, social media's influence in the APAC region is substantial. Web analytics tools measure the impact of social media campaigns, track influencer performance, and understand social media-driven traffic and conversions. According to GSMA, Chinese citizens displayed a solid online presence, having approximately 1.06 billion social media user accounts as of January 2024. India and Indonesia, the second and third-ranking countries for social media, had 462 and 139 million social media user accounts, respectively.

Web Analytics Industry Overview

Web Analytics Market in Retail and CPG is fragmented with significant companies like Google LLC, IBM Corporation, Meta, Cloudflare, and many more. The companies continuously invest in strategic collaborations and product developments to gain market share. Some of the recent developments in the market are:

- March 2024 - Google has announced its shift to the new Google Analytics 4. This updated version emphasizes safeguarding consumer privacy and introduces enhanced features for secure data collection from websites and applications. Marketers can now look forward to a more robust platform that ensures sustainable data collection and reporting.

- February 2024 - Wipro Limited announced the launch of the Wipro Enterprise Artificial Intelligence (AI)-Ready Platform, a unique service that allows clients to create enterprise-level, fully integrated, and customized AI environments. The Wipro Enterprise AI-Ready Platform harnesses the IBM Watson AI and data platform, incorporating watsonx.ai, watsonx Data, and watsonx Governance, along with AI assistants. This integration enables clients to embrace AI swiftly. The service boosts operations with a suite of tools and large language models and ensures streamlined processes and robust governance. Moreover, it sets the stage for future industry analytics solutions anchored on watsonx Data and AI.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Online Shopping Trends

- 4.2.2 Rising Adoption of Analytics Tools to Understand Customer Preferences

- 4.2.3 Increasing Customer Centric Approach and Use of Recommendation Engines

- 4.3 Market Restraints

- 4.3.1 Data Privacy and Security

- 4.3.2 Time Consumption in Implementation

- 4.4 Case Study Analysis

- 4.5 Ecosystem Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Key Macroeconomic Trends on the Market

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solution

- 5.1.2 Services

- 5.2 By Organization Size

- 5.2.1 SMEs

- 5.2.2 Large Enterprises

- 5.3 By Application

- 5.3.1 Search Engine Optimization and Ranking

- 5.3.2 Online Marketing & Marketing Automation

- 5.3.3 Customer Profiling and Feedback

- 5.3.4 Application Performance Management

- 5.3.5 Social Media Management

- 5.3.6 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Google LLC

- 6.1.2 IBM Corporation

- 6.1.3 Meta

- 6.1.4 Cloudflare

- 6.1.5 Adobe

- 6.1.6 Microsoft

- 6.1.7 Splunk

- 6.1.8 SAS

- 6.1.9 Teradata Corporation

- 6.1.10 Salesforce

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219