|

市場調查報告書

商品編碼

1693657

公車:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Bus - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

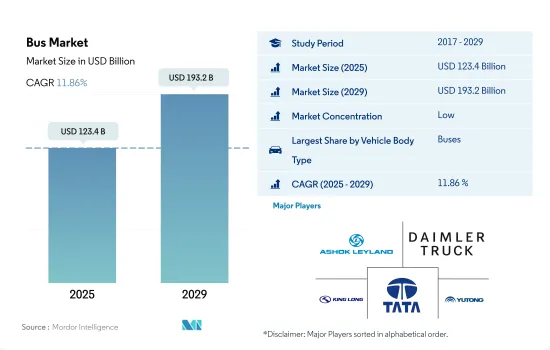

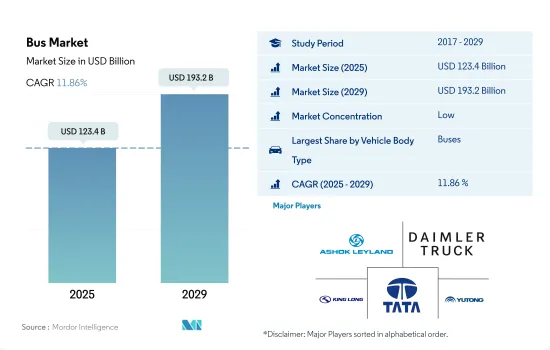

預計 2025 年公車市場規模為 1,234 億美元,到 2029 年將達到 1,932 億美元,預測期內(2025-2029 年)的複合年成長率為 11.86%。

由於燃料和維護成本的降低,電動公車的總擁有成本比柴油公車低得多。

- 燃料是任何車輛營運成本的主要部分。使用電動公車進行公共運輸可以降低燃料成本、其他前期成本和總擁有成本。到2030年,電動公車的價格預計將降至柴油公車的水平。與柴油公車相比,電動公車可減少81-83%的維護和營運成本。

- 一輛電動公車的價格為 75 萬美元,而一輛普通柴油公車的價格為 50 萬美元。雖然前期成本較高,但電動公車是一種經濟有效的替代方案。由於維護和燃料成本較低,電動公車的營運成本也較低,而且由於電價相對於石化燃料價格相對穩定,因此成本可預測性更高,從而在其整個使用壽命期間節省大量成本。隨著有利立法的實施,電動公車將變得更具經濟可行性。電動公車製造商聲稱,節省 400 萬美元的燃料費用和節省約 12.5 萬美元的維護費用足以彌補電動公車較高的初始成本。

- 雖然全球電動公車生態系統的各個組成部分正在按照既定的政府法規實施,但必須優先解決在規劃、問責和營運方面安裝和管理電動公車充電站的直接挑戰,以促進電動公車生態系統的全球發展。

全球客車市場趨勢

全球需求成長和政府支持將推動電動車市場成長

- 電動車(EV)已成為汽車產業的重要組成部分,因為它具有提高能源效率、減少溫室氣體和污染排放的潛力。這種快速成長背後的主要因素是日益成長的環境問題和政府的支持。其中,電動車全球銷售呈現強勁成長勢頭,2022年較2021年成長10.82%。據預測,2025年底,電動乘用車年銷量將超過500萬輛,約佔汽車總銷量的15%。

- 領先的製造商和組織(例如倫敦警察廳和消防隊)正在積極推行電動車策略。例如,該公司設定了在 2025 年實現零排放汽車、在 2030 年實現 40% 貨車電氣化、到 2040 年實現全電動化的目標。預計全球也將出現類似的趨勢,2024 年至 2030 年間電動車的需求和銷售量將急劇成長。

- 在電池技術和汽車電氣化進步的推動下,亞太地區和歐洲有望主導電動車生產。 2020年5月,起亞汽車歐洲公司宣布“S計劃”,宣布轉向電動化策略。這項決定是在起亞電動車在歐洲創下銷售紀錄之際做出的。起亞雄心勃勃地計劃在 2025 年之前在全球推出 11 款電動車,涵蓋轎車、SUV 和 MPV 等各個領域。該公司的目標是到 2026 年實現全球電動車年銷量達到 50 萬輛。

客車業概況

客車市場分散,前五大企業市佔率為12.60%。市場的主要企業是:阿蕭克利蘭有限公司、戴姆勒卡車控股股份公司、金龍聯合汽車工業、塔塔汽車有限公司和鄭州宇通客車(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 人均GDP

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 消費者汽車購買支出(cvp)

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 通貨膨脹率

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 汽車貸款利率

- 共乘

- 共乘

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 新款 Xev 車型發布

- 燃油價格

- OEM生產統計

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 推進類型

- 混合動力汽車和電動車

- 按燃料類別

- BEV

- FCEV

- HEV

- PHEV

- ICE

- 按燃料類別

- 混合動力汽車和電動車

- 按地區

- 非洲

- 亞太地區

- 印度

- 日本

- 歐洲

- 捷克共和國

- 中東

- 北美洲

- 加拿大

- 墨西哥

- 美國

- 南美洲

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Anhui Ankai Automobile Co. Ltd.

- Ashok Leyland Limited

- Byd Auto Industry Company Limited

- Daimler Truck Holding AG

- King Long United Automotive Industry Co. Ltd.

- NFI Group Inc.

- Proterra INC.

- Tata Motors Limited

- Volvo Group

- Zhengzhou Yutong Bus Co. Ltd.

- Zhongtong Bus Holding Co. Ltd.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 93050

The Bus Market size is estimated at 123.4 billion USD in 2025, and is expected to reach 193.2 billion USD by 2029, growing at a CAGR of 11.86% during the forecast period (2025-2029).

Electric buses offer significantly lower total cost of ownership compared to diesel buses through reduced fuel and maintenance costs

- Fuel constitutes a major part of the operating cost of any vehicle. Using an electric bus for public transport reduces fuel costs, along with other upfront costs and the total cost of ownership. By 2030, the prices for electric buses are expected to decrease to the price level of diesel fuel buses. Electric buses help reduce 81-83% of the maintenance and operating costs compared to a diesel-engine bus.

- An electric bus costs USD 750,000 compared to USD 500,000 for a typical diesel transit vehicle. Despite their higher initial costs, electric buses are a cost-effective alternative. They offer lower operating costs due to lower maintenance and fuel expenditures, as well as greater cost predictability due to the relative stability of electricity prices compared to fossil fuel prices, resulting in significant savings over the course of their lifetime. With favorable legislation, electric buses are more financially feasible. Manufacturers of electric buses assert that these vehicles more than make up for their higher initial cost, with fuel savings of USD 4,00,000 and maintenance savings of about USD 1,25,000.

- Although the components of the global e-bus ecosystem are being implemented in accordance with established government regulations, the immediate challenge of setting up and managing e-bus charging stations in terms of planning, the scope of responsibilities, and operation must be addressed on a high-priority basis to expedite the development of the e-bus ecosystem across the world.

Global Bus Market Trends

The rising global demand and government support propel electric vehicle market growth

- Electric vehicles (EVs) have become indispensable in the automotive industry, driven by their potential to enhance energy efficiency and reduce greenhouse gas and pollution emissions. This surge is primarily attributed to growing environmental concerns and supportive government initiatives. Notably, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021. Projections indicate that annual sales of electric passenger cars will surpass 5 million by the end of 2025, accounting for approximately 15% of total vehicle sales.

- Leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, have been actively pursuing their electric mobility strategies. For instance, they have set a target of a zero-emission fleet by 2025, with a goal of electrifying 40% of their vans by 2030 and achieving full electrification by 2040. Similar trends are expected globally, with the period from 2024 to 2030 witnessing a surge in demand and sales of electric vehicles.

- Asia-Pacific and Europe are poised to dominate electric vehicle production, driven by their advancements in battery technology and vehicle electrification. In May 2020, Kia Motors Europe unveiled its "Plan S," signaling a strategic shift toward electrification. This decision came on the heels of record-breaking sales of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning various segments like passenger vehicles, SUVs, and MPVs. The company aims to achieve annual global EV sales of 500,000 by 2026.

Bus Industry Overview

The Bus Market is fragmented, with the top five companies occupying 12.60%. The major players in this market are Ashok Leyland Limited, Daimler Truck Holding AG, King Long United Automotive Industry Co. Ltd., Tata Motors Limited and Zhengzhou Yutong Bus Co. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.1.1 Africa

- 4.1.2 Asia-Pacific

- 4.1.3 Europe

- 4.1.4 Middle East

- 4.1.5 North America

- 4.1.6 South America

- 4.2 GDP Per Capita

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.3.1 Africa

- 4.3.2 Asia-Pacific

- 4.3.3 Europe

- 4.3.4 Middle East

- 4.3.5 North America

- 4.3.6 South America

- 4.4 Inflation

- 4.4.1 Africa

- 4.4.2 Asia-Pacific

- 4.4.3 Europe

- 4.4.4 Middle East

- 4.4.5 North America

- 4.4.6 South America

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Shared Rides

- 4.8 Impact Of Electrification

- 4.9 EV Charging Station

- 4.10 Battery Pack Price

- 4.10.1 Africa

- 4.10.2 Asia-Pacific

- 4.10.3 Europe

- 4.10.4 Middle East

- 4.10.5 North America

- 4.10.6 South America

- 4.11 New Xev Models Announced

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Hybrid and Electric Vehicles

- 5.1.1.1 By Fuel Category

- 5.1.1.1.1 BEV

- 5.1.1.1.2 FCEV

- 5.1.1.1.3 HEV

- 5.1.1.1.4 PHEV

- 5.1.2 ICE

- 5.1.2.1 By Fuel Category

- 5.1.1 Hybrid and Electric Vehicles

- 5.2 Region

- 5.2.1 Africa

- 5.2.2 Asia-Pacific

- 5.2.2.1 India

- 5.2.2.2 Japan

- 5.2.3 Europe

- 5.2.3.1 Czech Republic

- 5.2.4 Middle East

- 5.2.5 North America

- 5.2.5.1 Canada

- 5.2.5.2 Mexico

- 5.2.5.3 US

- 5.2.6 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Anhui Ankai Automobile Co. Ltd.

- 6.4.2 Ashok Leyland Limited

- 6.4.3 Byd Auto Industry Company Limited

- 6.4.4 Daimler Truck Holding AG

- 6.4.5 King Long United Automotive Industry Co. Ltd.

- 6.4.6 NFI Group Inc.

- 6.4.7 Proterra INC.

- 6.4.8 Tata Motors Limited

- 6.4.9 Volvo Group

- 6.4.10 Zhengzhou Yutong Bus Co. Ltd.

- 6.4.11 Zhongtong Bus Holding Co. Ltd.

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219