|

市場調查報告書

商品編碼

1440246

數位農業:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Digital Agriculture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

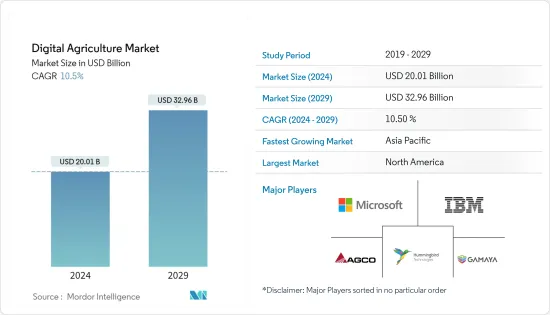

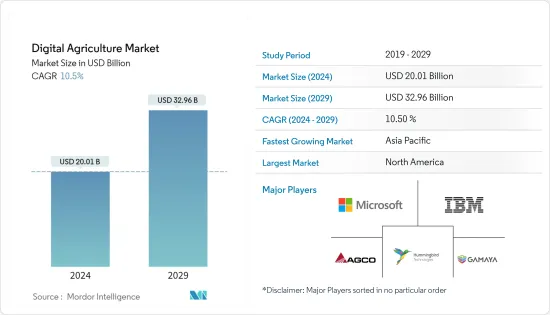

數位農業市場規模預計到2024年為200.1億美元,預計到2029年將達到329.6億美元,在預測期內(2024-2029年)複合年成長率為10.5%。

人們越來越認知到數位農業在最佳化農業生產方面的好處,正在推動農業市場的繁榮。隨著人口成長對糧食的需求增加,數位農業工具的引入是不可避免的。

對糧食安全和營養的日益關注預計將為該行業的蓬勃發展提供一些機會。 預計美國將進行大量投資,以促進未來的糧食生態系統。 隨著消費者對“從農場到餐桌的新鮮度”的洞察不斷發展,預計美國將有更多機會在零售店提供新鮮採摘的蔬菜。 例如,2021年6月,美國國家科學基金會的網路物理系統計劃和美國農業部的國家糧食和農業研究所 (NIFA) 向由愛荷華州立大學和伊利諾伊大學厄巴納分校的工程師領導的研究人員提供了700萬美元的贈款。 - 加強農場管理運營,包括單個作物層面的感測、建模和決策。

英國政府已在其產業戰略中引入人工智慧(AI),以提高作物生產力。該國承諾2027年將研發支出增加到GDP的2.4%。此外,劍橋還宣布了一個耗資 5 億歐元的新計劃,旨在加強英國作為不斷發展的農業技術產業創新者的地位。該開發案將容納多達 4,000 名員工,並將農業和科技公司聚集在一起,在世界農業創新和生產力中心發揮領導作用。

各國關於精密農業的策略政策決策預計將鼓勵農民採用相關技術。農場諮詢服務彌合了科學與實踐之間的差距。這些服務幫助農民採用市場最新趨勢的新技術和創新技術。它們可以更好地利用可用資源,具有成本效益,並有助於應對課題。

技術進步和創新是推動數位農業市場的關鍵因素之一,幫助農民有效利用資源,最大限度地提高產量並最大限度地減少損失。因此,有限的自然資源稀缺性以及滿足不斷成長的人口需求的不斷成長的需求預計將在預測期內推動全球數位農業市場。

數位農業市場趨勢

提高生產力和改善作物健康的壓力越來越大

農民始終面臨著用更少的化學物質生產更多食物和飼料的壓力。同時,必須減少能源和勞動力的使用,同時改善環境土地和水資源管理。隨著人口的快速成長,養活不斷成長的人口變得非常困難,提高農業生產力的壓力很大。使用軟體和物聯網 (IoT) 工具(例如精密農業)可以滿足所有這些要求。

根據糧農組織的資料,水稻、小麥、大麥、玉米和其他穀物等主要穀物的產量大幅下降,從2019年的41,079汞/公頃降至2020年小麥的40,708汞/公頃。大麥和其他粗糧也觀察到類似的下降趨勢。精密農業幫助農民了解他們需要種植什麼種子、需要施用多少肥料、收穫作物的最佳時間以及預期產量。

歐洲和北美的技術引進提高了作物生產力。例如,2022年6月,法國Idele(Institut d'Elevage)開發了一個名為CAP'2ER的資料庫線上應用程式,該資料庫以30組活動資料進入該計劃,以確定生態學指標。該應用程式包括農場的年度燃料消費量總量、動物生產力(繁殖力、生長情況、銷售年齡)、購買的飼料、肥料數量和管理、樹木、灌木、灌木、樹籬、草屑、磚石等資訊。石牆、水體。

巴西精密農業研究網路(Embrapa)由巴西農業研究公司創立,針對大豆、玉米、小麥、稻米、棉花、牧草、尤加利、松樹等作物開發了多種工具。巴西精密農業的應用提高了作物產量並保護了環境。例如,2022 年 6 月,聖卡洛斯酒莊 Terras Altas(裡貝朗普雷圖,SP)與聖保羅州立大學合作開展了一項研究,透過採用雙重修剪系統的精密農業生產優質葡萄酒。和其他管理實務。

因此,使用MapShots、AgDNA和AgroSense等精密農業軟體將有助於提高作物生產力,從而改善土壤健康並推動世界其他地區對數位農業的需求。

亞太地區是成長最快的市場

近年來,中國農業部門在採用智慧農業實踐方面經歷了一場突破性的革命。儘管物聯網 (IoT)行動電話設備、基於齒輪感測器的灌溉和施肥設備以及閥門位置感測器等基於感測器的技術的出現對該行業來說相對較新,但該國正在經歷對感測器的新需求。發現,這主要是由於機械化率的提高和農民採用的智慧農業實踐。

中國對農業科技進步的貢獻率,標誌著中國農業現代化的振興策略。 2020年,中國中央政府推出了「數位鄉村」試點計劃,以促進資訊科技的應用,刺激國內消費,帶動行動網際網路主導的經濟繁榮。

同樣,印度農業對數位化的需求不斷成長是眾所周知的,並且正在努力實現現有價值鏈的數位化。 2021 年 9 月,聯邦農業和農民福利部長與 CISCO、Ninjacart、Jio Platforms Limited、ITC Limited 和 NCDEX e-Markets Limited 簽署了五份合作備忘錄 (MoU),並啟動了 2021-2025 年數字農業任務。 。 (NeML),透過先導計畫促進數位農業。 2021-2025年數位農業任務旨在支援和加速基於人工智慧、區塊鏈、遙感探測、GIS技術以及無人機和機器人使用等新技術的計劃。

2020 年 2 月,Reliance Group of Companies推出了Jio Agri (JioKrishi) 平台,旨在數位化農業生態系統,並為整個價值鏈上的農民賦能。該平台的核心功能使用獨立的應用程式資料來提供諮詢服務。高級功能使用各種來源的資料並將資料輸入人工智慧 (AI)/機器學習 (ML) 演算法,以提供準確、個人化的建議。該計劃的先導計畫將在賈爾納和納西克(馬哈拉斯特拉邦)進行。因此,技術主導農業機械的可用性不斷增加,以及政府對設立技術公司的資助不斷增加,正在推動亞太地區數位農業市場的發展。

數位農業產業概況

數位農業市場高度分散,各種小公司與巨頭爭奪市場佔有率。市場上產生收益的主要企業包括 AGCO Corporation、HummingBird Technologies、IBM Corporation、Gamaya SA、Bayer Cropscience AG、Microsoft Corporation 和 Trimble Inc.。

隨著領導企業採取併購、擴張、合作和產品發佈等各種策略來擴大業務和進行投資,預計未來市場將變得更加整合。兩家公司都可能推出新的產品線,並與其他公司合作,以實現數位農業業務的多元化。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 新進入者的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 作物監測

- 科技

- 引導系統

- 遙感探測

- 可變利率技術

- 解決方案

- 硬體

- 軟體

- 服務

- 其他解決方案

- 目的

- 現場測繪

- 土壤監測

- 作物調查

- 產量監控

- 浮動利率的應用

- 其他用途

- 科技

- 人工智慧

- 目的

- 天氣追蹤

- 精密農業

- 無人機分析

- 配置

- 雲

- 本地

- 混合

- 目的

- 精密農業

- 目的

- 作物管理

- 財務管理

- 農場庫存管理

- 人力資源管理

- 氣象追蹤與預報

- 其他用途

- 類型

- 本地/基於網路

- 雲端基礎

- 目的

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 澳洲

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 其他非洲

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 市場佔有率分析

- Company Profile

- Gamaya SA

- Easytosee Agtech

- AGCO Corporation

- Small Robot Company

- Microsoft Corporation

- IBM Corporation

- Hummingbird Technologies Limited

- Deere &Company

- AgEagle Aerial Systems Inc.

- Bayer CropScience AG

- Case IH Agriculture(CNH Industrial America LLC.)

- DTN(CLEAR AG SOLUTIONS)

- Conservis Corporation

- Raven Industries

- Topcon Positioning Systems

- Trimble Inc.

第7章市場機會與未來趨勢

The Digital Agriculture Market size is estimated at USD 20.01 billion in 2024, and is expected to reach USD 32.96 billion by 2029, growing at a CAGR of 10.5% during the forecast period (2024-2029).

The increasing awareness about the benefits of digital agriculture in optimizing agricultural production has resulted in a great boom in the agriculture market. With the growing food demand, owing to the increasing population, the adoption of digital agriculture tools is inevitable.

Growing concerns regarding food security and nutrition are anticipated to provide several opportunities for the industry to prosper. The United States is expected to invest a significant share in facilitating the ecosystem for future foods. As more consumer insights are developed in terms of 'fresh-from-farm-to-table,' the availability of freshly harvested vegetables across retail outlets is expected to increase in the United States. For instance, in June 2021, the National Science Foundation's Cyber-Physical Systems program and the USDA's National Institute of Food and Agriculture (NIFA) provided USD 7 million in grants to researchers led by engineers from the Iowa State University and the University of Illinois Urbana-Champaign on operations of farm managing, like sensing, modeling, and decision-making at the level of individual crops.

The United Kingdom government, in its industrial strategy, has put artificial intelligence (AI) aimed at escalating crop productivity. The country has committed to boosting R&D spending to 2.4% of the GDP by 2027. Furthermore, a new EUR 500 million project has been announced in Cambridge, which seeks to cement Britain's position as an innovator in the growing agri-tech industry. The development will accommodate up to 4,000 employees and will bring together agricultural and tech companies to spearhead a center of global agricultural innovation and productivity.

Strategic policymaking for precision farming by the countries is expected to encourage farmers to adopt the related technologies. Farm advisory services are bridging the gap between science and practice. These services help farmers in adopting new innovative technologies, which is the latest trend in the market. They are more efficient in utilizing the available resources, are cost-effective, and can help face challenges.

Technological advancements and innovations are among the major factors driving the digital agriculture market, helping farmers maximize their yield and minimize losses with efficient use of resources. Hence, the increased need to meet the demand of the growing population, along with the limited scarcity of natural resources, is anticipated to drive the market for digital farming globally during the forecast period.

Digital Agriculture Market Trends

Increasing Pressure for Higher Productivity and Improved Crop Health

There is constant pressure on the farmers to produce more food and animal feed with lesser amounts of chemicals. At the same time, it is essential to use less energy and labor while improving the management of environmental land and water. With the population growing rapidly, it is becoming very difficult to feed the increasing population, thereby creating high pressure to increase agricultural productivity. The use of software such as precision farming, along with the Internet of Things (IoT) tools, is a solution to all these requirements.

According to the FAO data, the yield for major cereal crops like rice, wheat, barley, corn, and other grains reduced considerably from 41,079 hg/ha in 2019 to 40,708 hg/ha in 2020 for wheat; a similar reduced trend for barley and other coarse grains was observed. Precision farming helps farmers know the seeds that have to be planted, the number of fertilizers that need to be applied, the best time to harvest the crops, and the expected output.

The adoption of technology in Europe and North America has increased crop productivity. For instance, in June 2022, Idele (Institut d'Elevage), France, developed a data-based online application called CAP'2ER, with thirty sets of activity data entered into the program to determine agro-ecological indicators. This application analyzes five sets of databases, such as livestock, manure management, fields, feed, and energy consumption, by analyzing total annual fuel consumption, animal productivity (fertility, growth, and marketing age), feed purchased, manure quantities and management, number of trees and thickets, shrubs, hedges, grass strips, stone piles and stone walls, and water bodies on the farm.

The Brazilian Precision Agriculture Research Network (Embrapa), established by Brazil Agricultural Research Corporation, has generated various tools for soybean, maize, wheat, rice, cotton, pasture, eucalyptus, pines, and other crops. The use of precision agriculture in Brazil has led to improvements in crop yields as well as environmental protection. For instance, in June 2022, a study was conducted by Embrapa instrumentation, Sao Carlos, in the winery Terras Altas (Ribeirao Preto, SP), in partnership with the Sao Paulo State University, to produce distinguished wines by precision farming by double pruning systems and other management practices.

Thus, the use of precision farming software, such as MapShots, AgDNA, AgroSense, and others, will help increase crop productivity, thereby improving soil health and driving the demand for digital agriculture in other regions of the world.

Asia-Pacific is the Fastest-growing Market

The Chinese agricultural sector has undergone a groundbreaking revolution with respect to the adoption of smart farming practices in recent years. Although the advent of sensor-based technologies, such as Internet of Things (IoT) cellular devices, gear tooth sensor-based irrigation and fertilization equipment, and valve position sensors, among others, is relatively new in the domain, the country has been witnessing a new-found demand for sensors, primarily due to the increased rate of mechanization and smart agricultural practices adopted by the farmers.

China's contribution rate to its agricultural science and technology progress indicates the country's revitalization strategy in terms of agricultural modernization. In 2020, the Chinese central government launched a pilot project named ''digital village', promoting the use of information technology to stimulate domestic consumption, leading to a boom in the mobile internet-driven economy.

Similarly, the rising demand for digitization in Indian agriculture is well acknowledged, with efforts being made toward digitizing the prevailing value chain. In September 2021, the Union Minister of Agriculture & Farmers Welfare launched the initiation of the Digital Agriculture Mission 2021-2025 while signing five memoranda of understanding (MoUs) with CISCO, Ninjacart, Jio Platforms Limited, ITC Limited, and NCDEX e-Markets Limited (NeML), to forward digital agriculture through pilot projects. The Digital Agriculture Mission 2021-2025 aims to support and accelerate projects based on new technologies, like AI, blockchain, remote sensing, and GIS technology and the use of drones and robots.

In February 2020, the Jio Agri (JioKrishi) platform was launched by Reliance Group of Company to digitize the agricultural ecosystem along the entire value chain to empower farmers. The core function of the platform uses stand-alone application data to provide advisory services. The advanced functions use data from various sources, feed the data into artificial intelligence (AI)/machine learning (ML) algorithms, and provide accurate, personalized advice. The pilot project for this initiative will take place at Jalna and Nashik (Maharashtra). Thus, the rise in technology-driven agricultural equipment availability and an increase in government funding for the establishment of tech firms are driving the digital agriculture market in the Asia-Pacific region.

Digital Agriculture Industry Overview

The digital agriculture market is highly fragmented, with various small players competing against giant firms to occupy market share. Some of the major revenue-generating companies in the market include AGCO Corporation, HummingBird Technologies, IBM Corporation, Gamaya SA, Bayer Cropscience AG, Microsoft Corporation, and Trimble Inc.

The market is expected to be more consolidated in the future, with the major players expanding and investing in their businesses by adopting various strategies, such as mergers and acquisitions, expansions, partnerships, and product launches. The companies are likely to introduce new product lines and partner with other firms to diversify their digital agriculture businesses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of Substitute Products

- 4.4.4 Threat of New Entrants

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Crop Monitoring

- 5.1.1 Technology

- 5.1.1.1 Guidance System

- 5.1.1.2 Remote Sensing

- 5.1.1.3 Variable Rate Technology

- 5.1.2 Solution

- 5.1.2.1 Hardware

- 5.1.2.2 Software

- 5.1.2.3 Services

- 5.1.2.4 Other Solutions

- 5.1.3 Application

- 5.1.3.1 Field Mapping

- 5.1.3.2 Soil Monitoring

- 5.1.3.3 Crop Scouting

- 5.1.3.4 Yield Monitoring

- 5.1.3.5 Variable Rate Application

- 5.1.3.6 Other Applications

- 5.1.1 Technology

- 5.2 Artificial Intelligence

- 5.2.1 Application

- 5.2.1.1 Weather Tracking

- 5.2.1.2 Precision Farming

- 5.2.1.3 Drone Analytics

- 5.2.2 Deployment

- 5.2.2.1 Cloud

- 5.2.2.2 On-premise

- 5.2.2.3 Hybrid

- 5.2.1 Application

- 5.3 Precision Farming

- 5.3.1 Application

- 5.3.1.1 Crop Management

- 5.3.1.2 Financial Management

- 5.3.1.3 Farm Inventory Management

- 5.3.1.4 Personnel Management

- 5.3.1.5 Weather Tracking and Forecasting

- 5.3.1.6 Other Applications

- 5.3.2 Type

- 5.3.2.1 Local/Web-based

- 5.3.2.2 Cloud-based

- 5.3.1 Application

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 Australia

- 5.4.3.3 China

- 5.4.3.4 Japan

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profile

- 6.3.1 Gamaya SA

- 6.3.2 Easytosee Agtech

- 6.3.3 AGCO Corporation

- 6.3.4 Small Robot Company

- 6.3.5 Microsoft Corporation

- 6.3.6 IBM Corporation

- 6.3.7 Hummingbird Technologies Limited

- 6.3.8 Deere & Company

- 6.3.9 AgEagle Aerial Systems Inc.

- 6.3.10 Bayer CropScience AG

- 6.3.11 Case IH Agriculture (CNH Industrial America LLC.)

- 6.3.12 DTN (CLEAR AG SOLUTIONS)

- 6.3.13 Conservis Corporation

- 6.3.14 Raven Industries

- 6.3.15 Topcon Positioning Systems

- 6.3.16 Trimble Inc.