|

市場調查報告書

商品編碼

1440135

CPaaS(通訊平台即服務):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Communication Platform-as-a-Service (CPaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

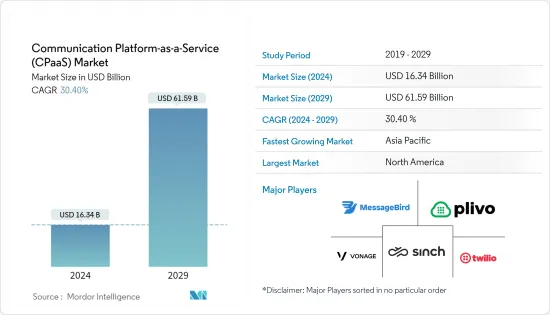

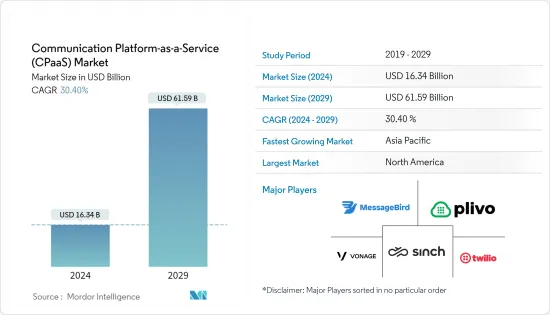

2024 年通信平臺即服務 (CPaaS) 市場規模估計為 163.4 億美元,預計到 2029 年將達到 615.9 億美元,在預測期間(2024-2029 年)以 30.40% 的複合年增長率增長。

人們對易於維護的網路系統的需求日益成長,這些系統能夠在醫療保健、零售和製造等眾多最終用戶行業之間實現高效通訊。此外,通常以 IT 預算最少的醫療保健提供者擴大了對經濟高效的雲端基礎的解決方案的採用。如今,醫療保健客服中心已經建立了 PBX(專用交換機)系統,並藉助基於訂閱的聯合通訊服務成功處理來自不同站點的多個消費者請求。

主要亮點

- 由於 BYOD 趨勢和其他行動解決方案的快速普及,CPaaS 解決方案的採用預計將進一步加速。在這個為世界各地不同公司的員工提供彈性和網路存取的新時代,自帶設備 (BYOD) 已發展成為提高辦公室效率的關鍵趨勢。據思科稱,採用 BYOD 策略的公司平均每名員工每年節省 350 美元。此外,反應性措施和計畫可以將每位員工每年節省的費用增加至 1,300 美元。對於中小型企業 (SMB) 來說,這些成本節省會迅速增加,幫助他們更好地保護收益,同時提高員工的工作效率。

- 利用CPaaS不斷成長的需求,市場供應商也正在推出與市場相關的新解決方案和服務。例如,Syniverse於2022年2月推出了雲端原生超大規模數位參與平台,以增強企業的客戶體驗並加速數位轉型。此外,教育指導和金融投資公司Regum也提高了反應速度。透過實施 Avaya 的 IX雲端基礎的整合通訊和協作解決方案來增強客戶服務。該平台幫助企業在分店之間建立即時、無縫的通訊,無論分店位置如何,為世界各地的消費者提供服務,無需額外費用。

- 公司目前正在進行策略併購,以獲得在目標市場的競爭優勢。 Value First 是印度 CPaaS 供應商之一,於 2021 年 3 月被 Twilio 收購。此次收購將整合CPaaS平台和雲端通訊。 Twilio 的決定符合該國在通訊、對話式人工智慧和行銷技術方面的快速發展。

- 此外,2022 年 2 月,API/通訊平台即服務 (CPaaS) 產業的雲端通訊軟體供應商 Kaleyra Inc. 被國際領先的技術和服務供應商博世集團選為值得信賴的供應商。博世行動解決方案將加強其在印度的雲端通訊。

- 為因應新冠肺炎 (COVID-19)感染疾病,福布斯全球 2000 大企業被迫加速數位轉型。例如,Syniverse 於 2022 年 3 月推出了 Kore,透過為福布斯全球 2000 強公司提供對話式人工智慧 (AI) 和專家服務來支援其通訊平台即服務 (CPaaS) 策略。與人工智慧的合作。 Syniverse 透過由 Syniverse 和 Kore.ai 組成的專業服務團隊向企業提供端到端功能,例如網路機器人設計和建置、全通路選擇、宣傳活動管理和訊息傳遞以及分析,從而增強了其 CPaaS 產品組合。市場準備好捕獲雲端基礎的軟體,包括基本的通訊即服務解決方案,促使疫情後的整體收益成長。

CPaaS市場趨勢

零售和電子商務行業推動市場成長

- 零售業正在經歷重大變化,這主要是由於消費者購買偏好的快速變化,從傳統的單點互動轉向透過網路和社群媒體的全通路互動。不斷成長的消費者需求正在所有管道中建立更好的購物和服務體驗。因此,它主要透過先進的通訊解決方案來解決,這些解決方案可以自動化客戶服務和零售業務流程。

- 根據埃森哲的研究,超過 73% 的客戶表示,他們期望客戶服務比現在更簡單、更快、更方便。此外,許多重要零售商都將全通路視為獲得競爭優勢的絕佳機會。隨著大多數大公司跨多種管道(線上和行動)營運,客戶服務已成為選擇供應商或商店而不是另一家時最重要的標準。

- CPaaS 是雲端基礎的框架,可讓企業同步即時視訊、音訊和文字通訊。面向開發人員的 API 使零售商能夠將這些重要功能整合到他們的社交管道、行動應用程式和網站中。此外,Voxvalley Technologies Pvt Ltd 等主要市場參與者也提供 Vox CPaaS。 Vox CPaaS 讓個人可以透過對話式商務、交付追蹤、交付警報、廢棄購物車簡訊提醒和促銷訊息來填補空白,從而增強客戶服務。所有這些都可以在行動或網路應用程式中輕鬆完成,讓您的客戶可以輕鬆溝通。

- 此外,一些知名組織已經在利用 CPaaS 透過新的通訊功能來增強其客戶旅程。 Booking.com 是全球最大的旅遊電子商務公司之一,它使用 CPaaS 將語音通訊整合到其行動應用程式預訂和顧客關懷流程中。 Booking.com 在 70 個國家設有 198 個辦事處。

- 此外,一些零售商正在將 CPaaS 與 CRM(客戶關係管理)介面整合,以改善整個客戶參與流程。這有助於解讀消費者的問題並將他們引導到正確的區域進行澄清。此外,多家公司已經採用CPaaS視訊解決方案來提供高清品質的視訊和無縫連接,主要是透過視訊通話向客戶展示產品功能。另外,由於多數消費者都選擇網路購物,為了留住更多消費者,Croma(Infinity Retail Limited)等公司在疫情期間在班加羅爾設立了線上展示店,開設了第一家試點店。

北美地區佔比最大

- 由於最近移動性的增加以及智慧型行動裝置普及的顯著提高,預計北美將主導 CPaaS 市場。此外,隨著對方便用戶使用且具有成本效益的基於瀏覽器的通訊解決方案的需求不斷成長,知名市場參與者正計劃在該地區推出整合且統一的CPaaS解決方案,這將有助於市場加速擴張。

- 此外,該地區的 CPaaS 市場預計將受益於通訊業物聯網的持續部署。美國通訊供應商正在利用基於物聯網的技術來加快流程並提高效率。 2020 年,美國每月產生 5,155 萬Exabyte的網路流量。根據 Telecom Advisory Services 的預測,到 2023 年,這一數字預計將增加至每月 9,864 萬Exabyte。

- 此外,5G部署的高投資率使美國成為5G市場的最大投資者和創新者之一。中國的通訊業正在推動全球 5G 技術消費的很大一部分。美國在投資、部署和應用方面也主導大部分地區5G市場。此外,為了在美國發展5G網路基礎設施,Verizon、AT&T和T-Mobile等通訊營運商已與三星、愛立信、諾基亞、華為和中興通訊等網路設備製造商簽署了數十億美元的協議。總結。

- 2021年11月,愛立信宣布以62億美元收購Vonage,專注於打造開放創新的全球網路和通訊平台。此次收購將使愛立信更能實現其在全球擴大無線企業客戶群的既定目標。 UCaaS 和 CCaaS 皆由 Vonage Communications 平台提供。

- 此外,該領域合作水準的提高有望加速市場擴張。 例如,2022 年 3 月,美國知名的電信運營商和數位運營商通信解決方案供應商 iBASIS 與 Mavenir 合作,宣佈推出其 CPaaS(通信平臺即服務)產品。 一家可在任何雲上運行的網路軟體供應商,正在通過改變通信的雲原生軟體塑造網路的未來。 這種獨特的 CPaaS 方法能夠透過應用程式程式設計介面將下一代功能順利整合到當前的工藝和軟體應用程式中。

CPaaS產業概述

CPaaS(通訊平台即服務)市場競爭非常激烈,因為市場上有大大小小的供應商,他們不僅在國內市場營運,而且在國際市場營運。市場似乎呈現零碎化,主要供應商採取併購和產品創新等關鍵策略來擴大整體產品能力並保持競爭力。

- 2022 年 2 月,為歐洲和南非的企業和聚合商提供雲端通訊服務的 MR Messaging FZC 簽訂了最終協議,該協議將被 Route Mobile 的完全子公司Routesms Solutions FZE 收購。此次收購擴大了 Root Mobile 在全球 CPaaS 的影響力,並符合該公司的全球擴張策略。

- 2022 年 1 月,全球領先的客戶經驗編配雲端服務供應商Genesys 和全球領先的企業雲端通訊公司 Bandwidth Inc. 公佈了未來企業客服中心的重大進展。 Bandwidth 現在整合到 Genesys Cloud CX 平台中,擴展了 DuetSM 解決方案的範圍,使公司能夠將複雜的語音通訊與通訊系統分開,並將其引入客服中心領域。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業生態系統分析

- 純CPaaS

- 企業級CPaaS

- 通訊業者主導的CPaaS

- 基於服務供應商的CPaaS(支援合作夥伴)

- 混合CPaaS 產品

- 評估 COVID-19 對市場的影響

- 定價策略和經營模式分析

- UCaaS 等鄰近市場與傳統部署的比較分析

第5章市場動態

- 市場促進因素

- 公司正在擺脫相鄰的傳統模式

- 全通路行銷需求不斷成長

- 市場課題

- 個人資料法規擴展到醫療保健等最終用戶領域

- 市場機會(技術創新,例如基於情勢的交易、輕量級部署,以進一步加速採用)

第6章 CPaaS產業主要趨勢

- 無伺服器部署

- 機器學習和人工智慧的到來

- 透過機器人進行全通路溝通

- 安全和隱私範式

第7章市場區隔

- 最終用戶產業

- 資訊科技和電信

- BFSI

- 零售與電子商務

- 衛生保健

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第8章 競爭形勢

- 公司簡介

- Twilio Inc.

- Vonage Holdings Corp

- MessageBird BV

- Plivo Inc.

- Snich AB

- Voximplant(Zingaya Inc.)

- 8x8 Inc.

- Voxvalley Technologies

- Bandwidth Inc.(Bandwidth.com)

- IntelePeer Cloud Communications

- Wazo Communication Inc.

- Avaya Inc.

- AT&T Inc.

- Mitel Networks Corporation

- Telestax

- Voxbone SA

- Iotum Inc.

- M800 Limited

- Infobip Ltd

- EnableX.io(VCLOUDX PTE. LTD)

第9章投資分析

第10章市場的未來

The Communication Platform-as-a-Service Market size is estimated at USD 16.34 billion in 2024, and is expected to reach USD 61.59 billion by 2029, growing at a CAGR of 30.40% during the forecast period (2024-2029).

There is a rising need for easily maintained network systems allowing efficient communications across numerous end-user industries, including healthcare, retail, and manufacturing. In addition, healthcare providers, frequently characterized as having minimal IT budgets, expanded their adoption of cost-effective cloud-based solutions. Nowadays, healthcare contact centers set up their PBX (Private Branch Exchange) systems and handle several consumer requests from different sites without any problems due to the subscription-based United Communication Services.

Key Highlights

- The adoption of CPaaS solutions is anticipated to be further accelerated by the fast-growing uptake of the BYOD trend and other mobility solutions. In this new era of flexibility and network accessibility for employees globally for various firms, Bring Your Own Device (BYOD) developed as a significant trend, increasing office productivity. As per Cisco, businesses with a BYOD strategy save, on average, USD 350 annually per employee. Additionally, reactive initiatives and programs can increase these savings to USD 1,300 per employee year. These cost savings for Small to Medium Sized Businesses (SMBs) can mount up quickly and help SMBs better safeguard their bottom line while increasing staff productivity.

- Leveraging the rising need for CPaaS, market vendors are also launching new solutions and services related to the market. For instance, Syniverse introduced a cloud-native, hyperscale digital engagement platform to enhance the enterprises' customer experiences and boost their digital transformations in February 2022. Additionally, Regum, a company engaged in educational instruction and financial investing, increased the responsiveness and speed of its customer service by implementing Avaya's IX cloud-based unified communications and collaboration solution. The platform assisted the business in establishing immediate and seamless communication among its branches, regardless of branch location, and it offers service to consumers worldwide at no extra cost.

- Businesses are now engaging in strategic mergers and acquisitions to obtain a competitive edge in the target market. One of the CPaaS providers in India, Value First, was acquired by Twilio in March 2021. The acquisition unites the CPaaS platform and cloud communication. The decision by Twilio is consistent with the country's rapid advancements in messaging, conversational AI, and mar-tech.

- In addition, in February 2022, Kaleyra Inc., a cloud communications software provider in the API/Communications Platform as a Service (CPaaS) industry, was chosen by Bosch Group, a major international provider of technology and services, as their trusted vendor to power the Bosch Mobility Solutions cloud communications in India.

- Companies in the Forbes Global 2000 have been compelled to quicken their digital transitions in response to the COVID-19 pandemic. For instance, Syniverse announced in March 2022 that it had entered a global partnership with Kore.ai to support its Communications Platform-as-a-Service (CPaaS) strategy by offering conversational artificial intelligence (AI) and expert services to Forbes Global 2000 firms. Syniverse increases its CPaaS portfolio and provides end-to-end capabilities to businesses through a professional services team staffed by Syniverse and Kore.ai, including internet bot design and build, omnichannel selection, campaign management and message delivery, and analytics. The increased market readiness to acquire cloud-based software, including foundational communication platform-as-a-service solutions, resulted in increased overall revenue growth post-pandemic.

CPaaS Market Trends

Retail and E-commerce Industry to Drive the Market Growth

- The retail business has witnessed a significant transformation mainly due to the fast-changing consumer purchasing preferences, moving from the previous single point of interaction to omnichannel interactions via the web or social media. A better shopping and service experience has been well established across all channels due to the rising consumer demand. Hence, it is being catered to by advanced communication solutions that primarily automate customer service and retail business processes.

- More than 73% of customers stated that they had expected customer service to be quite simpler, quicker, and more convenient than it is now, as per a survey by Accenture. Also, a wide range of crucial retail businesses sees omnichannel as a golden chance to acquire a competitive edge. Customer service has emerged as the most vital criterion in choosing one supplier or store over another since most large enterprises now operate across several channels (online and mobile).

- CPaaS is a cloud-based framework that lets businesses synchronize real-time video, audio, and text communication. By utilizing developer-friendly APIs, retailers can integrate these vital features into their social channels, mobile apps, and websites. Further, key market players, like Voxvalley Technologies Pvt Ltd, offer Vox CPaaS, where an individual can augment customer service by filling the gap with conversational commerce, delivery tracking, shipping alerts, abandoned cart SMS reminders, and promotional messages. All of this can be easily achieved within the mobile or web application, and hence the customers can enjoy the ease of communication.

- Additionally, several well-known organizations are already utilizing CPaaS to enhance their client journey with new communication capabilities. One of the biggest travel e-commerce companies in the world, Booking.com, uses CPaaS to assist in integrating voice communication into its mobile apps' booking and customer care processes. Booking.com has 198 offices across 70 different countries.

- Additionally, several retailers are integrating CPaaS with their CRM (Customer Relationship Management) interfaces, improving the overall customer engagement process. It helps in decoding consumer questions and directing them to the appropriate areas for clarification. Additionally, Several businesses employ CPaaS video solutions to provide high HD quality video and seamless connectivity primarily for demonstrating product features and functionality to clients through video calling. Also, to retain more consumers, as most of them chose to shop online, companies like Croma (Infiniti Retail Limited) opened their first pilot store for an online demonstration in Bangalore during the pandemic.

North America Accounts for the Largest Share

- North America is expected to dominate the CPaaS market due to the recent increase in mobility and the massive growth in the penetration of smart mobile devices. Moreover, with the rising demand for user-friendly and cost-effective browser-based communication solutions, prominent market players are planning to launch integrated and unified CPaaS solutions in the region, which is expected to augment the market's expansion.

- Additionally, the region's CPaaS market is anticipated to benefit from the growing deployment of IoT in the telecom industry. American telecom providers are utilizing the ability of IoT-based technologies to expedite processes and boost effectiveness. The United States produced 51.55 million exabytes of internet traffic per month in 2020. It is projected that this number will rise to 98.64 million exabytes per month in 2023, according to projections from Telecom Advisory Services.

- Additionally, due to a high investment rate for 5G deployment, the United States is one of the top investors and innovators in the 5G market. The telecom industry in the nation drives a significant portion of the world's 5G technology consumption. The US also controls most of the regional 5G market in terms of investment, adoption, and applications. Moreover, to develop their 5G network infrastructure in the United States, telecom providers, including Verizon, AT&T, and T-Mobile, have signed billion-dollar contracts with network equipment manufacturers like Samsung, Ericsson, Nokia, Huawei, and ZTE.

- In November 2021, to concentrate on creating a global network and communication platform for open innovation, Ericsson announced the acquisition of Vonage for USD 6.2 billion. With the acquisition, Ericsson can better fulfill its stated goal of growing its wireless enterprise clientele globally. Unified Communications as a Service (UCaaS) and Contact Center as a Service (CCaaS) are both offered by the Vonage Communications Platform.

- Additionally, the increasing level of collaboration in the area is expected to accelerate market expansion. In March 2022, for instance, iBASIS, a well-known US-based provider of communications solutions for operators and digital players, declared the launch of its Carrier Communications Platform-as-a-Service (CPaaS) offering in collaboration with Mavenir, the Network Software Provider shaping the future of networks with cloud-native software that operates on any cloud and transforms the communication. This unique CPaaS approach allows the frictionless integration of next-generation capabilities into the current processes and software applications through application programming interfaces.

CPaaS Industry Overview

The Communications Platform-as-a-Service (CPaaS) Market is extremely competitive, mainly due to the existence of various small and large vendors in the market conducting business in domestic as well as international markets. The market appears to be fragmented, with key vendors adopting major strategies like mergers, and acquisitions, product innovation to widen their overall product functionality and stay competitive.

- In February 2022, A provider of cloud communications services to businesses and aggregators in Europe and South Africa, M. R. Messaging FZC, has signed definitive agreements to be acquired by Route Mobile's wholly owned subsidiary, Routesms Solutions FZE. The acquisition expands Route Mobile's global presence in CPaaS and is consistent with its global expansion strategy.

- In January 2022, With Genesys, a worldwide cloud service provider in customer experience orchestration, Bandwidth Inc., a major global corporate cloud communications company, disclosed a significant advancement in the future of the enterprise contact center. With its inclusion in the Genesys Cloud CX platform, Bandwidth is expanding its range of DuetSM solutions, which enable businesses to decouple complicated telephony from their communications systems, into the contact center sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.2.1 Pure-play CPaaS

- 4.2.2 Enterprise-grade CPaaS

- 4.2.3 Telco-driven CPaaS

- 4.2.4 Service Provider-based CPaaS (enablement partners)

- 4.2.5 Hybrid CPaaS Offerings

- 4.3 Assessment of COVID-19 Impact on the Market

- 4.4 Pricing strategies and Business Model Analysis

- 4.5 Comparative Analysis of Adjacent Markets, such as UCaaS and Traditional Deployments

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Shift of Companies from Adjacent and Traditional Models

- 5.1.2 Growing Demand for Omnichannel Marketing

- 5.2 Market Challenges

- 5.2.1 Growing Personal Data Regulations across End-user Verticals, such as Healthcare

- 5.3 Market Opportunities (Technological Innovations, such as Context-based Transactions, Lightweight Deployments to further Drive Adoption)

6 KEY TRENDS IN CPAAS INDUSTRY

- 6.1 Serverless Deployments

- 6.2 Advent of Machine Learning and Artificial Intelligence

- 6.3 Omnichannel Communication Through Bots

- 6.4 Security and Privacy Paradigm

7 MARKET SEGMENTATION

- 7.1 End-User Vertical

- 7.1.1 IT and Telecom

- 7.1.2 BFSI

- 7.1.3 Retail and E-commerce

- 7.1.4 Healthcare

- 7.1.5 Other End-User Verticals

- 7.2 Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia Pacific

- 7.2.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Twilio Inc.

- 8.1.2 Vonage Holdings Corp

- 8.1.3 MessageBird B.V.

- 8.1.4 Plivo Inc.

- 8.1.5 Snich AB

- 8.1.6 Voximplant (Zingaya Inc.)

- 8.1.7 8x8 Inc.

- 8.1.8 Voxvalley Technologies

- 8.1.9 Bandwidth Inc. (Bandwidth.com)

- 8.1.10 IntelePeer Cloud Communications

- 8.1.11 Wazo Communication Inc.

- 8.1.12 Avaya Inc.

- 8.1.13 AT&T Inc.

- 8.1.14 Mitel Networks Corporation

- 8.1.15 Telestax

- 8.1.16 Voxbone SA

- 8.1.17 Iotum Inc.

- 8.1.18 M800 Limited

- 8.1.19 Infobip Ltd

- 8.1.20 EnableX.io (VCLOUDX PTE. LTD)