|

市場調查報告書

商品編碼

1438297

自行車:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Bicycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

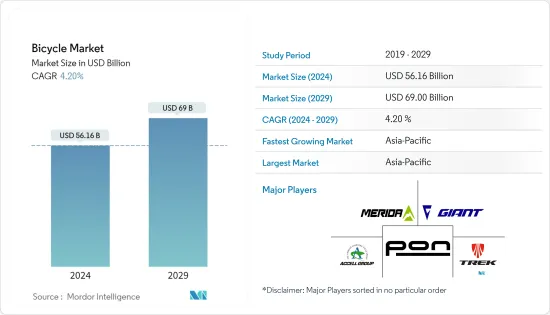

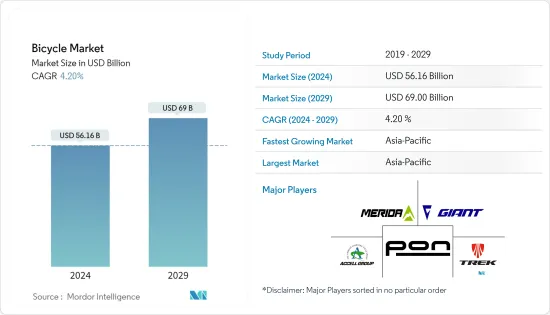

自行車市場規模預計到 2024 年為 561.6 億美元,預計到 2029 年將達到 690 億美元,在預測期內(2024-2029 年)年複合成長率為 4.20%。

主要亮點

- 隨著消費者健康意識的增強,自行車越來越被認為是可靠、健康的出行選擇。例如,2021 年 9 月,荷蘭電動自行車品牌 VanMoof 從創投家那裡獲得了超過 1.28 億美元的資金,因為電池驅動自行車(電動自行車)的銷量從2020 年到2021 年增加了兩倍。我已經採購了它。

- 此外,近年來舉辦的自行車賽事數量有所增加,推動了市場成長。有利的政府和雇主措施預計將在預測期內推動所研究的市場。此外,歐洲、亞太地區和非洲(特別是南非)的各種統籌組織也推廣公路賽車、巡迴賽、休閒自行車、場地賽車、越野賽車和山地自行車賽事。

- 除此之外,電動自行車在中國、日本等國家也引起了廣泛關注。在這些國家採用和運作電動自行車的重要原因包括健康益處、避免交通堵塞、環境效益以及對電動自行車作為運動器材的需求不斷成長。人均收入水準的提高和道路基礎設施的改善也是影響亞太地區騎普及的重要因素。

- 此外,憑藉持續的技術進步,Accell Group 和 Giant Manufacturing Co. 等領先製造商透過設計和開發可以與騎士智慧型手機整合的自行車來改進整體用戶介面,以提供有關速度和電池的即時資訊。關於加強它。情況。因此,預計上述因素將在預測期內推動市場成長。

自行車市場趨勢

自行車賽事增多

- 擴大使用自行車進行健行和休閒活動,以及自行車賽事的數量不斷增加,預計將增加對普通自行車和運動自行車的需求。名人代言影響力的增強和媒體對此類活動的報告的增加預計將增加自行車的銷量。

- 例如,根據德國Allgemeiner Deutsche Farad Club(ADFC)的一項調查顯示,2022年約有96%的受訪者使用自己的自行車。此外,歐洲國家的各種統籌機構,例如愛爾蘭自行車協會,也促進公路賽車、旅遊和休閒自行車、場地賽車和越野賽車活動。

- 據愛爾蘭體育理事會稱,愛爾蘭體育局對愛爾蘭自行車運動的投資將從2021年的518,400美元增加到2022年的1,000美元,鼓勵消費者參與愛爾蘭的一系列自行車活動。該活動的最終目標是提高人們對自行車運動的認知並提高自行車運動在城市的普及。此類宣傳宣傳活動也促進了所研究市場的成長。此外,自行車錦標賽等國際體育賽事也有望鼓勵人們參與自行車運動並推動市場成長。

亞太地區佔主要市場佔有率

- 亞太地區是自行車市場最大且成長最快的地區。中國、日本、澳洲、印度、韓國是該地區的主要國家。 2022 年,印度每週至少騎一次自行車的經常騎自行車者的比例最高。緊隨其後的是中國和荷蘭,這兩個國家大約有三分之二的人口每週騎自行車。此外,這些國家開始舉辦一些自行車錦標賽,這可能會增加運動自行車的普及和需求。

- 例如,自1963年以來,亞洲自行車錦標賽是由參賽國國家治理機構選出的專門針對亞洲自行車運動員的一年一度的洲際自行車公路賽和自行車場地錦標賽。

- 女性參與體育運動的增加和政府措施等因素可能會增加該地區對自行車的需求。此外,由於需求不斷成長,自行車公司正在推出創新的自行車和配件,預計這將在預測期內導致市場顯著成長。

自行車產業概況

自行車市場競爭非常激烈,有許多全球和區域參與者。該市場的主要企業包括 Giant Manufacturing、Accell Group、Trek Bicycle Corporation、Merida Industry 和 Pon Holdings BV。這些主要企業正在著手製造創新自行車,與其他公司結盟、併購,並制定線上和線下行銷策略,以擴大其在全球市場的影響力。

兩家公司也都在利用線上銷售管道的成長。此外,該公司還透過推出專門針對女性騎士和兒童的自行車來實現產品組合多元化,變得更加以消費者為中心。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 類型

- 公路自行車

- 混合自行車

- 全地形自行車

- 電動自行車

- 其他類型

- 分銷管道

- 線下零售店

- 網路零售店

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 英國

- 德國

- 西班牙

- 法國

- 義大利

- 俄羅斯

- 荷蘭

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 主要企業採取的策略

- 市場佔有率分析

- 公司簡介

- Accell Group NV

- Trek Bicycle Corporation

- Pon Holdings BV

- Giant Manufacturing Co. Ltd

- Bulls Bikes

- Pedego Inc.

- Benno Bikes LLC

- Hero Cycles Limited

- Ribble Cycles

- Riese Und Muller Gmbh

第7章市場機會與未來趨勢

The Bicycle Market size is estimated at USD 56.16 billion in 2024, and is expected to reach USD 69 billion by 2029, growing at a CAGR of 4.20% during the forecast period (2024-2029).

Key Highlights

- With the growing health consciousness among consumers, bicycles are seen as an increasingly dependable and healthy mobility option. For instance, in September 2021, the Dutch e-bike brand VanMoof raised over USD 128 million from venture capitalists as sales of battery-powered bikes (e-bikes) tripled during 2020-2021.

- Furthermore, the number of cycling events increased in recent years, propelling the market growth. Over the forecast period, favorable government and employer initiatives are expected to drive the market studied. In addition, various governing bodies in Europe, Asia-Pacific, and Africa, particularly South Africa, promote road racing, touring, leisure cycling, track racing, off-road racing, and mountain biking events.

- Besides this, e-bikes are gaining immense traction in countries like China and Japan. Some significant reasons considered for adopting and driving e-bikes in these countries are their health benefits, the avoidance of traffic congestion, the environmental benefits, and the increased demand for e-bikes as sports equipment. Rising per capita income levels and improving road infrastructure are other significant factors influencing the adoption of bicycles in the Asia Pacific region.

- Furthermore, with consistent technological advancements, key manufacturers, such as Accell Group and Giant Manufacturing Co., focus on enhancing the overall user interface by designing and developing bicycles that can integrate with the rider's smartphone and provide real-time information on the speed and battery status. Therefore, the abovementioned factors are expected to propel market growth over the forecast period.

Bicycle Market Trends

Increasing Number of Cycling Events

- The increasing application of bicycles in trekking and recreational activities, coupled with a rising number of cycling events, is expected to boost demand for both general and sports bicycles. The growing influence of celebrity endorsements and increased media coverage of such events are expected to boost the sales of bikes.

- For instance, according to a survey conducted by Allgemeiner Deutscher Fahrrad-Club (ADFC) in Germany, in 2022, around 96% of respondents used their own bikes. Furthermore, various governing bodies in European countries, such as Cycling Ireland, promote road racing, touring and leisure cycling, track racing, and off-road racing events.

- According to the Irish Sports Council, Sport Ireland's investments in Cycling Ireland increased from USD 518.40 thousand in 2021 to thousand in 2022, encouraging consumers to participate in various cycling activities in Ireland. The event's ultimate goal was to raise cycling awareness and increase cycling adoption in the city. Such awareness campaigns also boost the growth of the market studied. Moreover, international sports events, such as cycling championships, also encourage the involvement of people in cycling, which is expected to drive market growth.

Asia-Pacific Holds Significant Market Share

- Asia-Pacific is the largest and fastest-growing region in the bicycle market. China, Japan, Australia, India, and South Korea are some of the leading countries in the region. In 2022, India had the largest share of regular cyclists, who used their bikes at least once weekly. It was closely followed by China and the Netherlands, where around two-thirds of the population are weekly bicycle riders. Moreover, these countries have started hosting numerous cycling tournaments, which may increase the popularity and demand for sports bicycles.

- For instance, the Asian Cycling Championship has been an annual continental championship for road bicycle racing and track cycling since 1963, exclusively for Asian cyclists selected by the national governing bodies of the participating countries.

- Factors such as the rise in women's sports participation rates and government initiatives will likely boost the demand for bicycles in the region. Moreover, due to increased demand, bicycle companies are launching innovative bicycles and accessories, which is expected to lead to significant market growth during the forecast period.

Bicycle Industry Overview

The bicycle market is highly competitive, with many global and regional players. Major players in the market include Giant Manufacturing Co. Ltd, Accell Group, Trek Bicycle Corporation, Merida Industry Co. Ltd, and Pon Holdings BV. These key players are venturing into the manufacturing of innovative bicycles, embarking on partnerships with other players, mergers and acquisitions, and shaping up their online and offline marketing strategies to expand their presence in the global market.

The companies are also leveraging the growth of online distribution channels. Moreover, companies are diversifying their portfolios by launching bicycles explicitly targeted toward women riders and kids, thus making them more consumer-centric.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Road Bicycle

- 5.1.2 Hybrid Bicycle

- 5.1.3 All Terrain Bicycle

- 5.1.4 E-bicycle

- 5.1.5 Other Types

- 5.2 Distribution Channel

- 5.2.1 Offline Retail Stores

- 5.2.2 Online Retail Stores

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Netherlands

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Accell Group NV

- 6.3.2 Trek Bicycle Corporation

- 6.3.3 Pon Holdings BV

- 6.3.4 Giant Manufacturing Co. Ltd

- 6.3.5 Bulls Bikes

- 6.3.6 Pedego Inc.

- 6.3.7 Benno Bikes LLC

- 6.3.8 Hero Cycles Limited

- 6.3.9 Ribble Cycles

- 6.3.10 Riese Und Muller Gmbh