|

市場調查報告書

商品編碼

1430026

電動汽車電池:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

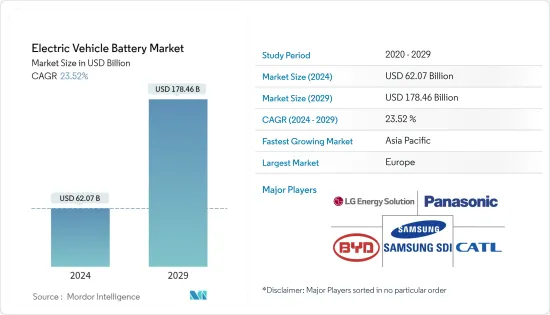

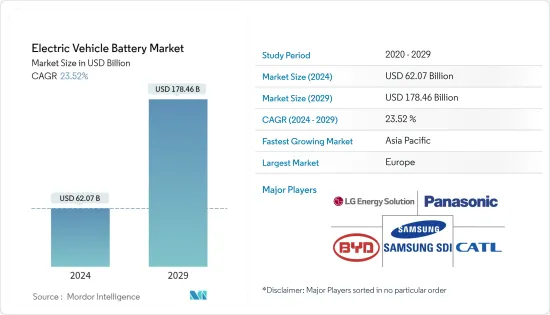

電動車電池市場規模預計到2024年為620.7億美元,預計到2029年將達到1784.6億美元,在預測期內(2024-2029年)複合年成長率為23.52%。

主要亮點

- 中期來看,鋰離子電池價格下降、電動車需求成長以及政府促銷的支持政策等因素預計將成為預測期內電動車電池市場最重要的促進因素之一預計會有一個。

- 另一方面,重要原料的供需有缺口。這對預測期內的電動車電池市場構成威脅。

- 然而,政府對公共充電基礎設施部署的支持政策和投資,加上電動車效率的提高,預計將在不久的將來為市場成長創造重大機會。

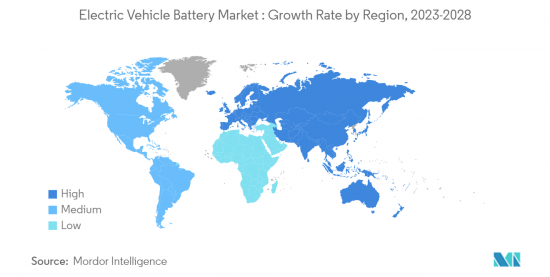

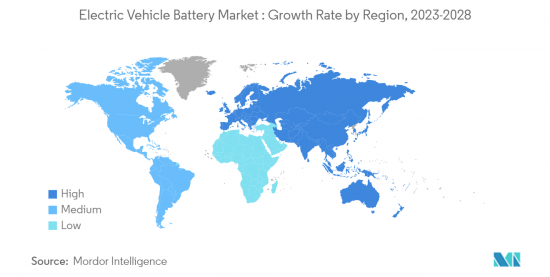

- 由於中國、印度和日本等國家的需求不斷成長,預計亞太地區電動車電池市場將顯著成長。

電動車電池市場趨勢

鋰離子電池佔市場主導地位

- 鋰離子電池是一種安裝在電動車中的二次電池,具有比鎳鎘二次電池或鉛酸二次電池更高的能量密度。鋰離子電池的這些特性使得製造商能夠縮小電池組的整體尺寸以節省空間。鋰離子電池是最輕的金屬之一。鋰離子電池不含鋰金屬,但含有離子。

- 鋰離子電池越來越受歡迎,主要是因為與其他類型的電池相比,其具有良好的容量重量比。推動鋰離子電池普及的其他因素包括改進的性能(更長的使用壽命、更少的維護)、更長的保存期限、環保和更快的充電。鋰離子電池的價格通常高於其他電池,但由於競爭對手研發活動的活性化,鋰離子電池的價格開始下降。

- 鋰離子電池傳統上主要用於行動電話和電腦等家用電子電器,但電動車越來越受歡迎,因為它不排放任何二氧化碳或氮氧化物等溫室氣體,對環境影響較小。因此,重新設計它們以用於為混合動力汽車和全電動汽車 (EV) 提供動力的趨勢日益明顯。

- 蜂巢能源科技將在德國薩爾路易斯興建歐洲首家鋰離子電池工廠,計畫於年終投產。

- 2022年5月,Stellantis NV和三星SDI宣布將在美國印第安納州科科莫建造電動車鋰離子電池製造工廠。該工廠計劃於2025年運作,初始產能為23GWh,目標是在未來幾年擴大至33GWh。該合資企業計劃在該製造工廠投資超過25億美元。

- 鋰離子電池比其他電池技術更安全,所有電池製造商都制定了安全措施和標準,以在電池故障時保護消費者。

- 預計私人和商用車應用電動車將出現令人興奮的新市場,這將推動全球對鋰離子電池的需求。此外,與其他電池(即閥控鉛酸電池)相比,鋰離子電池具有多種優勢,使其適合在資料中心使用。

- 此外,由於電動車佔小客車總數和銷售車輛數量的比例增加,歐洲和北美對鋰離子電池的需求正在增加。此外,歐盟2019年推出的「綠色交易」可能會增加電動車的佔有率,從而進一步提振預測期內對鋰離子電池的需求。 《綠色交易新政》的目標是到2030年將碳排放減少50%以上,到2050年達到碳中和。

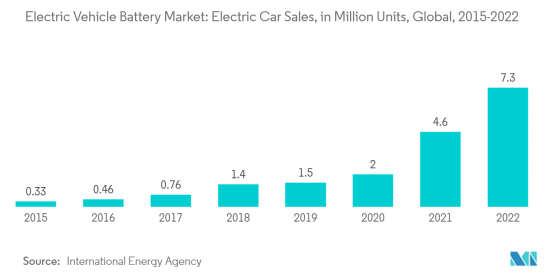

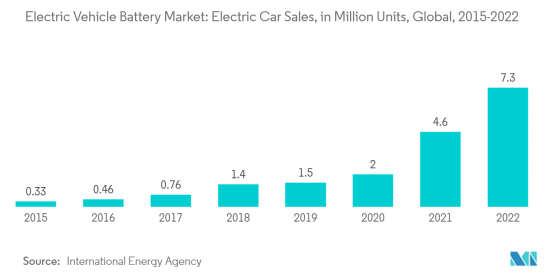

- 全球電動車銷量大幅成長。 2022 年全球銷售量達 730 萬台,高於 2021 年的 460 萬台。電動車銷量的增加將導致鋰離子電池的需求增加。

- 因此,鑑於以上幾點,預計鋰離子電池將在預測期內佔據市場主導地位。

亞太地區預計將出現顯著成長

- 預計亞太地區將主導全球市場。隨著中國、日本和印度等國家越來越多部署電動車,以及都市化和購電平上漲導致汽車需求增加,預計該地區的鋰離子電池使用量將大幅成長。

- 商業和工業(C&I)行業正在吸引更多計劃開發商的關注,主要是由於中國和印度的強勁成長,以及能源效率標準、高峰電價上漲和技術進步等有利政策的推動。該地區對鋰離子能源儲存系統的需求。

- 中國是最大的電動車市場之一,該國增加電動車的採用符合清潔能源政策。此外,中國政府也提供財政和非財政獎勵來鼓勵電動車的採用。

- 在印度,鋰離子電池主要用於電動車。印度是亞太地區鋰離子電池的主要進口國,2022年4月至11月期間進口約5.486億個鋰離子電池,2021年至2022年期間進口約600萬個鋰離子電池(當量)至18.3 億美元)。

- 印度政府的目標是到 2030 年將 100% 的兩輪車和三輪車轉化為電動車,並將 30% 的汽車銷量轉化為電動交通。目前,印度依賴其他國家採購電動車電池,導致電動車價格飆升。如果電動車在印度汽車產業普及,預計鋰離子電池的國內生產將得到促進並在經濟上變得可行。

- 綜上所述,預計亞太地區電動汽車電池市場在預測期內將顯著成長。

電動汽車電池產業概況

電動車電池市場適度分散。市場主要企業(排名不分先後)包括松下公司、LG Energy Solution Ltd、當代新能源科技、三星SDI、比亞迪等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028年之前的市場規模與需求預測(單位:美元)

- 政府法規政策

- 最新趨勢和發展

- 投資機會

- 市場動態

- 促進因素

- 鋰離子電池價格下降

- 政府扶持政策促銷

- 抑制因素

- 主要原料供需缺口

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 電池類型

- 鉛酸蓄電池

- 鋰離子電池

- 其他電池類型

- 車輛類型

- 純電動車(BEV)

- 插電式混合動力汽車(PHEV)

- 混合動力電動車(HEV)

- 按地區分類的市場分析(到 2028 年的市場規模和需求預測(僅按地區))

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 市場佔有率分析

- 公司簡介

- Panasonic Corporation

- LG Energy Solution Ltd

- Contemporary Amperex Technology Co. Ltd

- Samsung SDI Co. Ltd

- BYD Co. Ltd

- Narada Power Source Co. Ltd

- East Penn Manufacturing Company

- GS Yuasa Corporation

- Clarios

- Hitachi Ltd

第7章 市場機會及未來趨勢

- 隨著電動車變得更加高效,公共充電基礎設施投資增加

簡介目錄

Product Code: 54316

The Electric Vehicle Battery Market size is estimated at USD 62.07 billion in 2024, and is expected to reach USD 178.46 billion by 2029, growing at a CAGR of 23.52% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as declining lithium-ion battery prices, growing demand for electric vehicles and supportive government policies to promote electric vehicle sales, are expected to be one of the most significant drivers for the electric vehicle battery market during the forecast period.

- On the other hand, demand-supply gap of the vital raw materials. This poses a threat to the electric vehicle battery market during the forecast period.

- Nevertheless, supportive government policies and investment for the deployment of the public charging infrastructure clubbed with the increasing efficiency of the electric vehicle are expected to create a significant opportunity for the market's growth in the near future.

- Asia-Pacific is expected to witness a significant growth in the electric vehicle battery market, owing to the increasing demand from countries such as China, India, Japan, and other countries.

EV Battery Market Trends

Lithium-ion Battery to Dominate the Market

- A lithium-ion battery is a type of rechargeable battery installed in electric vehicles and has a higher energy density when compared to nickel-cadmium and lead-acid rechargeable batteries. These features of the lithium-ion batteries will enable the manufacturers to save space by reducing the overall battery pack size. It is one of the lightest metals. Although lithium-ion batteries do not contain any lithium metal, they contain ions.

- Lithium-ion battery is gaining more popularity compared to other battery types, majorly due to its favorable capacity-to-weight ratio. Other factors that contribute towards boosting its adoption include better performance (long life and low maintenance), better shelf life, Environment friendly and fast charging. The price of lithium-ion batteries is usually higher than other batteries but it has started declining due to increase in R&D activities by other competitors.

- Lithium-ion batteries have traditionally been used mainly in consumer electronic devices, such as mobile phones and PCs, but are increasingly being redesigned for use as the power source of choice in hybrid and the complete electric vehicle (EV) range, owing to factors, such as low environmental impact, as EV does not emit any CO2, nitrogen oxides, or any other greenhouse gases.

- SVOLT energy Technology plans to build the first European lithium-ion cell factory in Saarlouis, Germany, with production scheduled to begin by the end of 2023.

- In May 2022, Stellantis N.V. and Samsung SDI announced the construction of an electric-vehicle lithium-ion battery manufacturing facility in Kokomo, Indiana, United States. It is anticipated that the plant will be operational in 2025, with an initial capacity of 23 GWh, with an aim to increase to 33 GWh in the next few years. The joint venture company is going to invest over USD 2.5 billion in the manufacturing plant.

- Lithium-ion batteries are more than safer than other battery technologies, and all the battery manufacturers ensure safety measures and standards to protect consumers in case of a battery failure.

- The emergence of new and exciting markets via electric vehicles for both personal and commercial vehicle applications is projected to drive the demand for lithium-ion batteries across the globe. Furthermore, lithium-ion batteries have several merits over other batteries (i.e., valve-regulated lead-acid), which make it preferable to be used in data centers.

- Further, the share of EVs in total passenger cars has been increasing and owing to the increased sales, the demand for lithium-ion batteries in Europe and North America has been increasing. Moreover, with the 'Green Deal policy' launched in 2019 by the European Union, the share of EVs is likely to increase, further driving the demand for lithium-ion batteries during the forecast timeframe. 'Green Deal Policy' aims to reduce the carbon emission by more than 50% by 2030 to achieve carbon neutrality target by 2050.

- The sales of electric vehicles is increasing significantly across the world. The global sales reached 7.3 million units in 2022 increased from 4.6 million in 2021. The rising sales of electric vehicles leads to rise in the demand for lithium-ion batteries.

- Hence, owing to the above points, the lithium-ion batteries are expected to dominate the market during the forecast period.

Asia-Pacific Expected to Witness Significant Growth

- The Asia-Pacific region is expected to dominate the global market. With the increasing deployment of electric vehicles in countries such as China, Japan, and India, and the high demand for vehicles with urbanization and increasing power purchase parity, the usage of lithium-ion batteries is expected to witness significant growth in the region.

- Favorable policies, such as the energy efficiency standards and increasing peak demand charges and technological advances, have led to the commercial and industrial (C&I) sector receiving more attention from project developers, primarily driven by strong growth in China and India, which, in turn, is expected to drive the demand for lithium-ion-based energy storage systems in the region.

- China is one of the largest markets for electric vehicles, and the increasing adoption of electric vehicles in the country has been in line with the clean energy policy. Moreover, the Government of China has been providing both financial and non-financial incentives to promote the adoption of electric vehicles.

- In India, lithium-ion batteries are mainly used in electric vehicles. India is a major importer of lithium-ion batteries in the Asia-Pacific region and during April-November 2022, the country had imported approximately 548.6 million units of lithium-ion batteries and the country imported around 616.8 million units of lithium-ion batteries during 2021-2022 worth USD 1.83 billion.

- The government of India is targeting the conversion of two and three-wheelers into 100% electric ones and the total automotive sales to 30% into e-mobility by 2030. Currently, India is dependent on other countries for sourcing EV batteries, which has resulted in the hiked price of EVs. The penetration of EVs in the Indian automotive sector is expected to bolster indigenous manufacturing of Li-ion batteries to make them economically viable.

- Hence, owing to the above points, Asia-Pacific is expected to witness a significant growth in EV battery market during the forecast period.

EV Battery Industry Overview

The electric vehicle battery market is moderately fragmented. Some of the major companies in the market (in no particular order) include Panasonic Corporation, LG Energy Solution Ltd, Contemporary Amperex Technology Co. Ltd, Samsung SDI Co. Ltd, and BYD Co. Ltd., amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, until 2028

- 4.3 Government Policies and Regulations

- 4.4 Recent Trends and Developments

- 4.5 Investment Opportunities

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Declining Lithium-ion Battery Prices

- 4.6.1.2 Supportive Government Policies to Promote Electric Vehicle Sales

- 4.6.2 Restraints

- 4.6.2.1 Demand-Supply Gap of the Vital Raw Materials

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead-acid Battery

- 5.1.2 Lithium-ion Battery

- 5.1.3 Other Battery Types

- 5.2 Vehicle Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.3 Hybrid Electric Vehicle (HEV)

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Panasonic Corporation

- 6.4.2 LG Energy Solution Ltd

- 6.4.3 Contemporary Amperex Technology Co. Ltd

- 6.4.4 Samsung SDI Co. Ltd

- 6.4.5 BYD Co. Ltd

- 6.4.6 Narada Power Source Co. Ltd

- 6.4.7 East Penn Manufacturing Company

- 6.4.8 GS Yuasa Corporation

- 6.4.9 Clarios

- 6.4.10 Hitachi Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Investment for the Deployment of the Public Charging Infrastructure Clubbed with the Increasing Efficiency of the Electric Vehicle

02-2729-4219

+886-2-2729-4219