|

市場調查報告書

商品編碼

1429218

電動汽車電池系統:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Battery Systems For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

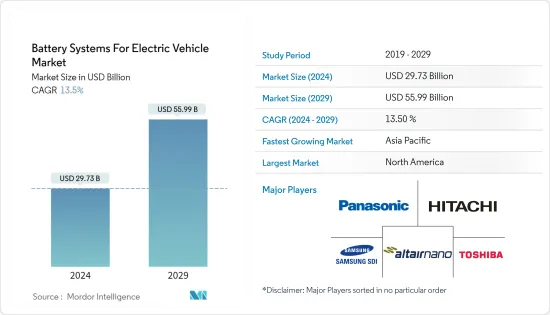

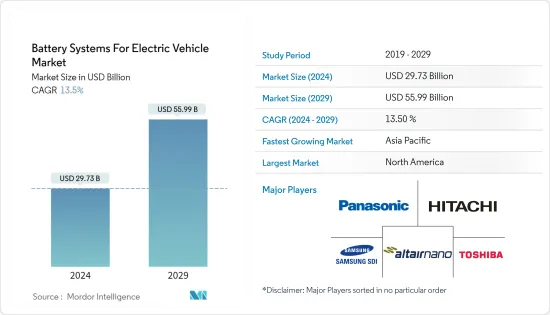

電動車電池系統市場規模預計2024年為297.3億美元,預計2029年將達到559.9億美元,在預測期內(2024-2029年)複合年成長率為13.5%成長。

主要亮點

- COVID-19大流行為電動車電池系統市場帶來了前所未有的挑戰。封鎖措施和旅行限制擾亂了全球供應鏈,導致電池生產延誤和短缺。製造設施和原料供應鏈受到影響,影響了電動車的可用性和價格。經濟不確定性、消費者支出減少和旅行限制導致電動車銷量大幅下降。這種下滑直接影響了電池系統市場。

- 由於多種因素的影響,後疫情時期的電動車電池系統市場已經復甦並恢復了成長軌跡。世界各國政府繼續優先考慮脫碳和永續交通。經濟獎勵策略和支持政策可能會實施以增加電動車的普及,這將推動對電池系統的需求。

- 隨著全球經濟復甦和監管放鬆,電動車的需求預計將復甦。消費者對永續性和環境意識的興趣日益濃厚可能會促進電池系統市場的成長。持續的研發工作預計將帶來電池技術的進步,包括更高的能量密度、更快的充電能力和更長的續航里程。這些進步提高了電動車的性能和吸引力,並推動了對電池系統的需求。

- 電池式電動車由汽車電池中儲存的電力提供動力來源。電動車使用的汽車電池分為三種類型之一:鎳氫電池、鉛酸電池和鋰離子電池。純電動車中安裝的二次電池組中儲存的化學能驅動電動馬達和馬達控制器。

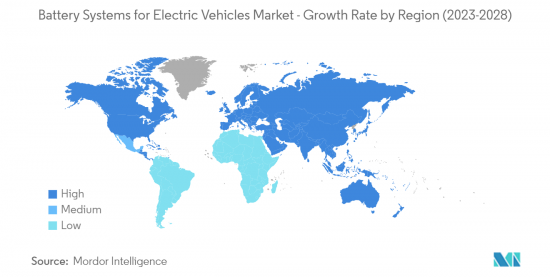

- 中國、美國、日本等已開發國家的主要政府正在投資電動車,這將為電動車電池系統市場提供巨大的成長機會。在預測期內,亞太地區和北美可能會主導市場。

電動車電池系統市場趨勢

高成本和有限的續航里程阻礙了市場成長

- 有幾個因素正在推動全球電池式電動車市場的發展,例如政府補貼和獎勵。許多國家的政府以經濟獎勵的形式向純電動車的購買者提供福利。這些獎勵的金額通常取決於電池的大小。

- 例如,愛爾蘭永續能源管理局(SEAI)向純電動車購買者提供高達5,400美元的補貼,並免徵車輛登記稅。儘管電動車市場的電池不斷成長,但它受到一些嚴峻挑戰的限制。

- 電動汽車電池的續航里程和性能是市場的主要限制因素。電池通常被認為功率較弱且續航里程有限(一次充電 60-100 英里),因此僅適合短途旅行。由於電動車電池的續航里程有限,消費者擔心在到達目的地之前就會耗盡電量或電力。

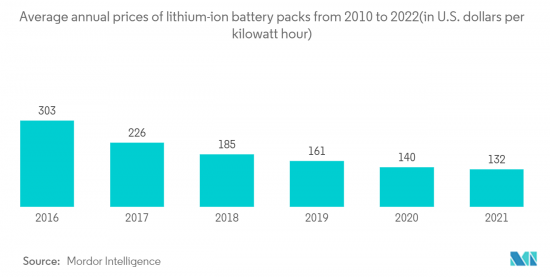

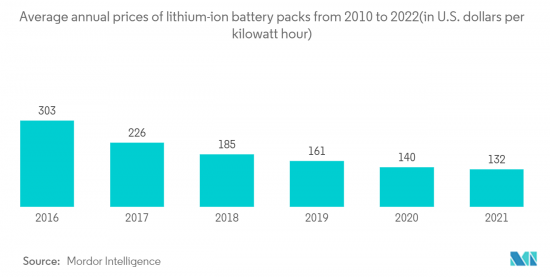

- 充電時間長也是市場面臨的一大挑戰。增壓站的不可用也增加了與電動車電池使用相關的擔憂。電動車中安裝的電池的高成本也威脅著電池市場的成長,特別是整體電池式電動車的成長。例如,鋰離子電池每可用千瓦時的成本在 500 美元至 650 美元之間,使其在車輛成本中佔據很大一部分。

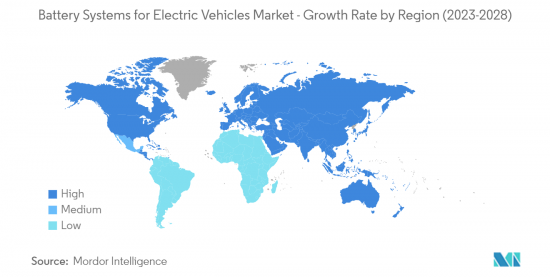

亞太市場加速成長

亞太地區電動車電池系統市場正在快速成長。該地區在這一領域不斷成長的影響力背後有幾個因素。中國、日本和韓國等國的電動車銷量大幅成長。這些國家正在透過支持性政策、補貼和基礎設施發展積極推動電動車的採用。亞太地區對電動車的需求不斷成長,推動了對先進電池系統的需求。

- 例如,2023年5月,中國汽車製造商江淮汽車集團與高科技公司海鈉電池合作開發了一款配備鈉離子電池的電動車。

此外,亞太地區已成為電動車及其零件的主要製造地。該地區擁有強大的供應鏈和熟練的勞動力,使其成為電池系統製造商有吸引力的目的地。本地生產可降低生產成本並實現高效分銷。亞太地區擁有多家創新電池技術公司和研究機構。這些公司致力於開發具有更高能量密度、更高安全性和更快充電能力的先進電池系統。對研發的重視促進了創新,使該地區處於電池系統進步的前沿。

此外,亞太地區各國政府正在認知到電動車和電池系統在實現永續交通目標方面的潛力。這些政府提供財政獎勵、補貼和津貼,鼓勵國內電池製造和研究。這些努力正在加速該地區電池系統市場的成長。亞太地區正在投資充電基礎設施,以適應道路上不斷成長的電動車數量。各國政府正在與私人公司合作安裝充電站並部署智慧電網解決方案,以解決續航里程問題並改善整體電動車體驗。這些基礎設施的發展進一步推動了對電池系統的需求。

考慮到這些因素,與其他地區相比,亞太地區電動車電池系統市場的成長速度預計將更快。這為電池製造商、供應商和相關人員提供了利用快速成長的電動車市場的巨大機會。

電動汽車電池系統產業概況

主要供應商包括三星SDI、東芝公司、比亞迪、松下公司等。電動車電池製造商目前正在投資研發,以改善電池化學成分,以增加放電時間。

與傳統鉛酸或閥控式鉛酸 (VRLA) 電池相比,鋰離子電池的技術進步使其相對輕巧且持久耐用。由於電池式電動車車正在成為內燃機火車頭最可行的替代品,同時也是排放問題的解決方案,預計在預測期內,此類車輛的需求將大幅增加,這為電動電池製造商提供了巨大的機會。

例如,瑞士新興企業Morand 宣布了一項突破性電池技術,可將電動車的充電時間大幅縮短至約 72 秒。該公司的創新電動車電池採用混合系統,巧妙地將傳統電池技術和超級電容器技術(稱為電子技術)結合在一起。這種開創性的方法使電動車能夠在短短 72 秒內實現令人難以置信的 80% 充電,並在短短 2.5 分鐘內充滿 100%。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 世界各國政府正在實施嚴格的法規並提供獎勵以促進電動車的普及。

- 其他

- 市場限制因素

- 初始成本高

- 其他

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 種類

- 鋰離子電池

- 鎳氫電池

- 鉛酸蓄電池

- 超級電容器

- 其他

- 車輛類型

- 小客車

- 商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- A123 Systems LLC

- Altairnano

- Boston-Power, Inc.

- Hitachi, Ltd.

- Johnson Controls International PLC

- LG Chem

- NEC Corporation

- Panasonic Corporation

- Toshiba Corporation

- Samsung SDI Co Ltd

第7章 市場機會及未來趨勢

- 對遠距電動車的需求不斷成長

- 關注永續性和環境影響

- 電動車充電基礎設施的成長

The Battery Systems For Electric Vehicle Market size is estimated at USD 29.73 billion in 2024, and is expected to reach USD 55.99 billion by 2029, growing at a CAGR of 13.5% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic brought unprecedented challenges to the battery systems for the electric vehicles market. Lockdown measures and travel restrictions disrupted global supply chains, leading to delays and shortages in battery production. Manufacturing facilities and raw material supply chains were affected, impacting the availability and affordability of electric vehicles. Economic uncertainty, reduced consumer spending, and mobility restrictions resulted in a significant decline in electric vehicle sales. This decline directly impacted the battery systems market.

- The battery systems for electric vehicles market recovered and resumed its growth trajectory post-COVID due to several factors. Governments worldwide continue to prioritize decarbonization and sustainable transportation. Stimulus packages and supportive policies are likely to be implemented to boost the adoption of electric vehicles, which will drive the demand for battery systems.

- As the global economy recovers and restrictions ease, the demand for electric vehicles is expected to rebound. Consumers' increased focus on sustainability and environmental consciousness will contribute to the growth of the battery systems market. Continued research and development efforts will lead to advancements in battery technologies, including higher energy densities, faster charging capabilities, and longer ranges. These advancements will enhance the performance and attractiveness of electric vehicles, driving the demand for battery systems.

- Battery electric vehicles are powered by the electricity stored in the onboard battery. The onboard battery used in electric vehicles can be classified under one of the following three types: nickel metal hydride, lead-acid, and lithium-ion. The chemical energy stored in rechargeable battery packs installed in battery electric vehicles propels the electric motors and motor controllers.

- Major governments across developed countries, including China, the United States, and Japan, are investing in electric mobility, which is likely to provide significant growth opportunities for the battery system for electric vehicle market. Asia-Pacific and North America are likely to dominate the market during the forecast period.

Battery Systems for Electric Vehicles Market Trends

High Cost of Battery and Limited Driving Range Hindering the Market Growth

- Several factors, such as government subsidies and incentives, drive the global battery electric vehicles market. Governments in many countries have extended benefits in the form of financial incentives to the buyers of battery electric vehicles. The amount of these incentives usually depends on the size of the battery.

- For instance, the Sustainable Energy Authority of Ireland (SEAI) provides buyers of battery electric vehicles with grants of up to USD 5,400 and exempts them from vehicle registration tax. Despite the growth of the battery in the electric vehicles market, it is also curtailed by some serious challenges.

- The range and performance of the battery in electric vehicles are significant restraints for the market. The batteries are typically less powerful and have a limited range (60-100 miles per charge), and are considered suitable only for short-distance travel. The limited travel range of batteries of electric vehicles raises concerns among consumers that their vehicles may run out of charge/power before reaching their destination.

- Longer charging duration is another major challenge for the market. The lack of availability of supercharging stations adds to the woes associated with the use of batteries in an electric vehicle. The high cost of the battery in the electric vehicle also poses a threat to the growth of the battery market in particular and battery electric vehicles in general. For instance, the price per usable kilowatt-hour of a lithium-ion battery ranges from USD 500 to USD 650, and thus, makes up a large proportion of the vehicle's cost.

Asia-Pacific Market Growing at a Faster Pace

The Asia-Pacific region is indeed experiencing rapid growth in the battery systems for electric vehicles market. Several factors contribute to the region's increasing prominence in this sector. Countries like China, Japan, and South Korea have witnessed a substantial increase in electric vehicle sales. These nations are actively promoting the adoption of electric vehicles through supportive policies, subsidies, and infrastructure development. The rising demand for electric vehicles in the Asia-Pacific region drives the need for advanced battery systems.

- For instance, In May 2023, Chinese automaker JAC Group and tech company HiNa Battery teamed up to create an electric car powered by a sodium-ion battery.

Additionally, Asia-Pacific has emerged as a major manufacturing hub for electric vehicles and their components. The region boasts a robust supply chain and a skilled workforce, making it an attractive destination for battery system manufacturers. This localized manufacturing reduces production costs and allows for efficient distribution. The Asia-Pacific region is home to several innovative battery technology companies and research institutes. These entities are dedicated to developing advanced battery systems with higher energy density, improved safety, and faster charging capabilities. The emphasis on research and development fosters innovation and positions the region at the forefront of battery system advancements.

Moreover, governments in the Asia-Pacific region have recognized the potential of electric vehicles and battery systems in achieving sustainable transportation goals. They provide financial incentives, subsidies, and grants to promote domestic battery manufacturing and research. These initiatives accelerate the growth of the battery systems market in the region. The Asia-Pacific region is investing in the development of charging infrastructure to support the growing number of electric vehicles on the roads. Governments, in collaboration with private players, are establishing charging stations and implementing smart grid solutions to address range anxiety and enhance the overall EV experience. This infrastructure development further propels the demand for battery systems.

Considering these factors, the Asia-Pacific region is expected to witness a faster pace of growth in the battery systems for electric vehicles market compared to other regions. It offers significant opportunities for battery manufacturers, suppliers, and related stakeholders to capitalize on the burgeoning electric vehicle market.

Battery Systems for Electric Vehicles Industry Overview

The key vendors include Samsung SDI Co Ltd, Toshiba Corporation, BYD, and Panasonic Corporation, as they will be responsible for providing the automobile makers with the battery kit shortly. Currently, the battery manufacturers of electric vehicles are investing in R&D to improve the chemistry of the batteries to give a longer discharge time.

Technological advances in Li-ion batteries have made them comparatively lightweight with a long lifespan compared to conventional lead-acid and valve-regulated lead-acid battery (VRLA) batteries. With battery electric vehicles becoming the most viable alternative to ICE-powered automobiles and a solution to the problem of emissions, the demand for this type of vehicle is expected to increase considerably during the forecasted period, which calls for an excellent opportunity for electric battery manufacturers.

For instance, Swiss start-up Morand has introduced a groundbreaking battery technology that significantly reduces the charging time of electric vehicles to approximately 72 seconds. Their innovative EV battery utilizes a hybrid system, cleverly combining conventional battery technology with ultracapacitor technology, aptly named eTechnology. This pioneering approach allows electric vehicles to achieve an impressive 80% charge in a mere 72 seconds and complete a full 100% charge in just 2.5 minutes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Governments worldwide are implementing strict regulations and providing incentives to promote the adoption of electric vehicles

- 4.1.2 Others

- 4.2 Market Restraints

- 4.2.1 High Initial Costs

- 4.2.2 Others

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Nickel-Metal Hydride Batteries

- 5.1.3 Lead-Acid Batteries

- 5.1.4 Ultra capacitors

- 5.1.5 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 A123 Systems LLC

- 6.2.2 Altairnano

- 6.2.3 Boston-Power, Inc.

- 6.2.4 Hitachi, Ltd.

- 6.2.5 Johnson Controls International PLC

- 6.2.6 LG Chem

- 6.2.7 NEC Corporation

- 6.2.8 Panasonic Corporation

- 6.2.9 Toshiba Corporation

- 6.2.10 Samsung SDI Co Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Long-Range Evs

- 7.2 Focus on Sustainability and Environmental Impact

- 7.3 Growing Infrastructure for EV Charging