|

市場調查報告書

商品編碼

1408750

有機基板包裝材料:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Organic Substrate Packaging Material - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

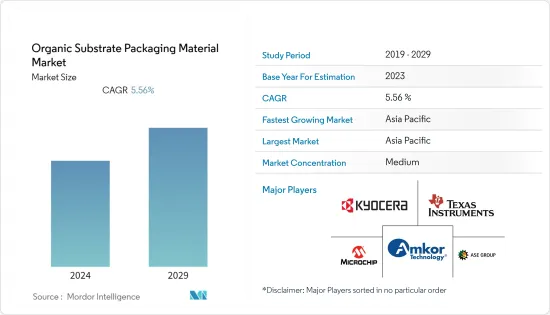

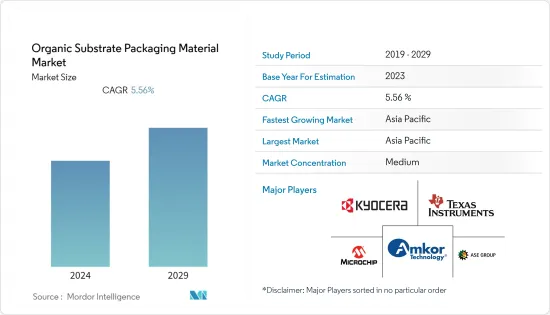

目前有機基板封裝市場規模為138.7億美元。

預計未來五年將達到 181.8 億美元,預測期內複合年成長率為 5.56%。

主要亮點

- 在預測期內,對 ADAS(高級駕駛輔助系統)的需求不斷成長將推動有機基板封裝材料的需求。根據英特爾預測,2030年國際汽車銷售量預計將達到約1.014億輛,而自動駕駛汽車預計到2030年將佔車輛登記量的約12%。

- 使用有機基板使印刷基板製造商能夠採用增材篩選製程而不是邊緣去除蝕刻方法,最終結果是幾乎完全有機的 PCB 設計。

- 科技網際網路 (IoT) 技術應用於多種產業。由於其快速成長,印刷基板(PCB) 製造商正在引入各種變革和創新來滿足客戶需求。從智慧型手機和健身追蹤器到創新的工廠設備,行動裝置的空間管理至關重要。隨著企業尋求建立數位足跡以及人們依靠物聯網來支援他們的日常生活功能,這種需求預計會在接受調查的市場中成長。

- 2022年6月,代表歐洲整個電子製造和設計供應鏈的組織SEMI Europe呼籲儘早通過《歐洲晶片法》,並敦促歐盟委員會、成員國和議會參與該法案的辯論。叫出來。該法律旨在增強歐洲在半導體技術和應用方面的競爭力和彈性,同時支持該地區向數位和綠色經濟轉型。

- 此外,汽車電子產品需要能夠承受高溫的有效封裝解決方案。如此惡劣的條件需要基於對所用有機基板材料的熱機械行為的詳細了解的新方法。此外,由於現代車輛更加依賴電子元件,將基板PCB 涵蓋某些新應用中變得越來越普遍。它們用於汽車行業的各種應用,包括電源管理、駕駛員輔助系統、照明控制、車內娛樂系統和其他電子控制。據 OICA 稱,2022 年全球汽車產量將達到約 8,500 萬輛。這個數字比與前一年同期比較增加了約6%。

- 此外,電動車和混合動力汽車在沿岸地區普及,特別是在以色列、阿曼、沙烏地阿拉伯、約旦和阿拉伯聯合大公國。例如,透過杜拜計程車管理局的2021-2023年戰略計劃,杜拜道路和運輸管理局(RTA)宣布簽署採購2,219輛新車的契約,以補充杜拜計程車管理局的車隊。此次採購包括1,775輛混合動力汽車,使車輛總數達到4,105輛。電動車的擴張可能會進一步刺激所研究市場的需求。

- 各國政府正在進行大量投資以支持先進技術的普及,從而增加了對有機基板封裝的半導體封裝的需求。根據 WSTS 數據,2022 年 10 月美洲半導體銷售額為 122.9 億美元,高於上月的 120.3 億美元。

- 此外,市場參與者正在開拓新產品來滿足廣泛的客戶需求。例如,2022 年 6 月,PCB Technologies 宣布推出 iNPACK,這是一家先進的系統級封裝(SiP) 解決方案異質整合提供者。 iNPACK 專注於提高訊號完整性並減少不必要的電感效應的高階技術。 iNPACK應用於許多要求最嚴苛的產業,包括航太、國防、醫療、消費性電子、汽車、能源、通訊、SiP、半導體封裝、有機基板(25微米線、25微米間距)、3D、2.5D、提供2D包裝解決方案。

- 此外,俄羅斯和烏克蘭之間持續的衝突預計將對電子產業產生重大影響。這場衝突已經加劇了已經影響該行業的半導體供應鏈問題和晶片短缺問題。這種干擾可能會表現為鎳、鈀、銅、鈦、鋁和鐵礦石等關鍵原料的價格波動,從而導致材料短缺。這可能會擾亂所研究市場的製造業。

有機基板封裝材料市場趨勢

消費性電子產品佔據主要市場佔有率

- 有機構裝基板(例如家用電子電器中的小型薄型封裝)近年來大幅成長,因為它們能夠提高設備性能和功能,同時減少尺寸和重量。此外,由於系統處理的資料量增加,5G 網路將需要智慧型手機更大的電池容量。正因為如此,其他部分也需要更加緻密並壓縮尺寸。基板PCB 是高密度印刷電路基板(PCB),需要高達 30X30 的微跡間距。

- 此外,隨著向 5G 的轉變,智慧型手機目標商標產品製造商 (OEM) 正在增加這種有機基板技術的採用,這是市場成長的關鍵驅動力。愛立信預計,截至2022年,全球5G活躍用戶數將達到10.5億,幾乎是前一年的兩倍。預計未來幾年將快速成長,到 2028 年訂閱數量預計將達到近 50 億。 5G 合約數量的大幅增加可能會推動研究市場的需求。

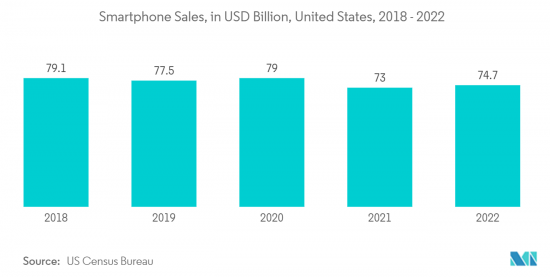

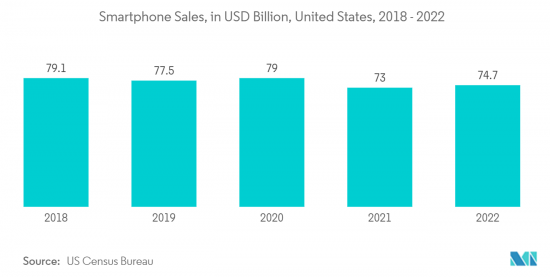

- 根據美國人口普查局數據,2022年1月美國行動電話銷量成長17億美元,達到747億美元銷售額。此外,根據 5G Americas 的數據,截至 2023 年,全球第五代 (5G) 用戶數價值達 19 億。預計到 2024 年,這一數字將增至 28 億,到 2027 年將增至 59 億。

- 此外,研究部門正大力投資有機基板包裝材料市場。智慧型手機的成長、穿戴式裝置和智慧型裝置的普及不斷提高,以及消費者物聯網 (IoT) 裝置在智慧家庭等應用中的普及不斷提高,是影響該細分市場成長的一些因素。愛立信預計,2022年全球智慧型手機行動網路用戶數量預計將達到約66億,2028年將超過78億人。

- 例如,華為計劃於2023年3月推出一款電池大幅升級的折疊式智慧型手機。據傳該設備將進行電池升級並命名為「Mate X3」。此外,華為還計劃採用高矽負極材料來增強智慧型手機的電池容量,預計電池容量將達到5060mAh。

- 2022年6月,英特爾公司與倫敦大學學院(UCL)聯合發布了一款新型非接觸式電腦,可以透過手、頭、臉和全身的手勢進行操作和控制。電子市場不斷要求更高的功耗、更快的速度、更多的引腳數、更小的佔地面積和更薄的設計。半導體的小型化和整合化正在創造更輕、更小、更攜帶的消費性電子產品,例如智慧型手機、平板電腦和新興的物聯網 (IoT) 設備。

- 消費性電子產業正在不斷成長,考慮到該產業最近的重大發展,預計未來幾年將大幅擴張。消費性電子產品的成熟可能會進一步推動研究市場的需求。

亞太地區預計將佔據主要市場佔有率

- 推動亞太地區研究市場成長的關鍵因素包括智慧型手機普及的提高、網路用戶數量的增加以及能夠吸引新客戶並擴大其在新興市場的影響力的新功能和技術的推出。此外,該地區在全球印刷基板市場的主導地位也促進了有機基板印刷電路板的成長。

- 全球主要構裝基板製造商集中在台灣、韓國、日本。正處於有機封裝基板發展「新興期」的日本,在積體電路(IC)封裝基板的開發和應用方面處於世界領先地位。

- 亞太地區汽車需求的不斷成長促使各國政府制定主動和被動車輛安全措施,推動該地區汽車印刷基板(PCB)市場的成長。各國政府正在向消費者提供補貼,以鼓勵該地區購買電動車。例如,日本政府的目標是到2050年在該國停止使用內燃機汽車,並已開始提供臨時補貼以幫助實現這一目標。該國已開始向電動車購買者提供臨時補貼。

- 根據印度品牌股權基金會(IBEF)介紹,印度幾年前啟動了FAME-II計劃,預算為13億美元,目標是生產100萬輛E- 二輪車和50萬輛E-3輪車。汽車、55,000 輛電動小客車和 7,000 輛電動巴士。正如 2022-23 年聯邦預算中所宣布的,政府已將該計劃延長至 2024 年。

- 此外,由於國內晶片需求的增加,預計中國將取代美國成為全球領先的半導體產業強國。根據半導體產業協會(SIA)預測,到2030年,半導體市場規模將加倍,達到1兆美元以上,其中中國貢獻了60%以上的成長。預計這種快速成長將增加對有機基板半導體的需求。

- 市場參與者正在推出新工廠,以滿足對 PCB 不斷成長的需求。例如,2022年1月,韓國印刷基板和半導體構裝基板製造商Simtek在馬來西亞檳城峇都加灣工業的第一座大型PCB工廠即將完工。該工廠是該公司在東南亞韓國、日本和中國現有PCB工廠網路的一部分。該工廠將專門生產 DRAM/NAND 記憶體晶片的第一批構裝基板以及記憶體模組/SSD 的 HDI PCB。

- 此外,2023 年 2 月,LG Innotek 宣布推出 XR 裝置必不可少的 2 金屬薄膜晶片 (COF)。在LG Innotek的元宇宙專區,這款產品引起了參觀者的興趣。 COF是連接軟性印刷電路基板和顯示器的半導體構裝基板。它有助於縮小智慧型手機、筆記型電腦、電視和顯示器等設備的模組外形尺寸和顯示邊框。在極薄的薄膜上形成微電路需要先進的技術。又稱替代FPCB的超薄軟性PCB。 2 金屬 COF 在技術上優於標準單面 COF。雙金屬COF的最大優點是透過在兩側形成電路來實現超整合,而不是傳統COF僅在一側形成電路。

有機基板包裝材料產業概況

有機基板封裝材料市場競爭激烈,Amkor Technology Inc、Competitive Technology、Kyocera 等大公司佔據了很大的市場佔有率,同時積極擴大全球基本客群。這些公司正在採取策略合作措施來提高市場佔有率和盈利。然而,技術進步和產品創新也使中小企業能夠贏得獨特的合約並拓展新市場。

2023年6月,美國晶片製造商美光科技計劃在古吉拉突邦開設半導體組裝和測試工廠,並計劃最快於2024年開始生產。這項發展將極大推動印度晶片製造的野心。該工廠的主要業務是晶片封裝,將晶圓轉換成球柵陣列積體電路封裝、記憶體模組和固態驅動器。

2022年1月,韓國PCB和半導體構裝基板製造商Simtek宣布,其位於馬來西亞檳城佔地18英畝的第一座大型PCB製造工廠即將即將完工。該工廠補充了 Simtech 在東南亞(特別是韓國、日本和中國)現有的 PCB 業務。該工廠專門生產動態隨機存取記憶體 (DRAM)/NAND 記憶體晶片的構裝基板,以及記憶體模組和固態硬碟 (SSD) 裝置的高密度互連 (HDI) PCB。這就是我的意思。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 宏觀經濟走勢對市場的影響

第5章市場動態

- 市場促進因素

- 自動駕駛汽車的普及

- 行動裝置的使用增加

- 市場挑戰

- 與 PCB 等基板相關的設定成本增加

第6章市場區隔

- 依技術

- 小薄型封裝

- 引腳柵格陣列 (PGA) 封裝

- 扁平無鉛封裝

- 四方扁平封裝 (QFP)

- 雙列直插式封裝 (DIP)

- 其他技術

- 按申請

- 家用電子電器

- 車

- 製造業

- 工業的

- 衛生保健

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Amkor Technology Inc

- Kyocera Corporation

- Microchip Technology Inc.

- Texas Instruments Incorporated

- ASE Kaohsiung

- Simmtech Co., Ltd

- Shinko Electric Industries Co. Ltd

- LG Innotek Co.Ltd

- At&s

- Daeduck Electronics Co.,Ltd

第8章投資分析

第9章市場的未來

The organic substrate packaging material market is valued at USD 13.87 billion in the current year. It is expected to register a CAGR of 5.56% during the forecast period to become USD 18.18 billion by the next five years.

Key Highlights

- The increasing demand for advanced driver assistance systems (ADAS) would drive the demand for organic substrate packaging material in the forecasted period. According to Intel, international car sales are predicted to reach around 101.4 million units in 2030, and autonomous motorcars are expected to account for about 12% of car registrations by 2030.

- An organic substrate allows the printed circuit board manufacturer to employ an additive screen process instead of an edge-removal, etched method, and the end result is a PCB design that is nearly entirely organic.

- The Internet of Technology (IoT) technologies are being used across various industries. Because of their rapid growth, printed circuit board (PCB) manufacturers have introduced various changes and innovations to meet their clients' demands. From smartphones and fitness trackers to innovative factory equipment, managing space on mobile devices is highly important. With businesses trying to establish their digital footprint and people relying on IoT to drive their routine life functions, this demand is expected to grow in the studied market.

- In June 2022, SEMI Europe, the organization representing the entire European electronics manufacturing and design supply chain, immediately called for the quick passage of the European Chips Act and invited the European Commission, Member States, and Parliament to participate in discussions about the proposed legislation. The Act intends to support the region's transition to a digital and green economy while enhancing Europe's competitiveness and resilience in semiconductor technologies and applications.

- Moreover, electronics for automotive applications require effective packaging solutions that can withstand high temperatures. For these extreme conditions, a new attempt is necessary based on detailed knowledge about the thermo-mechanical behavior of the utilized organic substrate materials. In addition, with the increasing reliance on electronic components in modern automobiles, incorporating substrate PCBs into specific novel applications is becoming more common. They are used for various applications in the automotive industry, including power management, driver assistance systems, lighting control, in-car entertainment systems, and other electronic controls. According to OICA, in 2022, around 85 million automobiles will be produced worldwide. This figure represents an increase of about 6% over the previous year.

- Further, electric and hybrid modes of transport are gaining traction in the Gulf region, especially in Israel, Oman, Saudi Arabia, Jordan, and the United Arab Emirates. For example, through the Dubai Taxi Corporation's Strategic Plan 2021-2023, the Roads and Transport Authority (RTA) of Dubai has declared the signing of a contract to procure 2,219 new vehicles to supplement the fleet of the Dubai Taxi Corporation. The latest batch includes 1,775 hybrid vehicles, bringing the fleet's total number to 4,105. Such expansion in electric vehicles may further drive the studied market demand.

- Various government has significantly invested in boosting the penetration of advanced technologies, bolstering the demand for organic substrate packaging semiconductor packaging. According to WSTS, in October 2022, semiconductor sales in the Americas amounted to USD 12.29 billion, an increase from the USD 12.03 billion recorded for the previous month.

- Furthermore, the players in the market are developing new products to cater to customers' wide range of needs. For instance, in June 2022, PCB Technologies introduced iNPACK, an advanced heterogeneous integration provider of system-in-package (SiP) solutions. iNPACK focuses on high-end technology that improves signal integrity and reduces unwanted inductance effects. This is accomplished through powerful components that increase functionality and utilize embedded coins for heat dissipation. iNPACK provides SiP, semiconductor packaging, organic substrates (25-micron lines and 25-micron spacing), and 3D, 2.5D, and 2D packaging solutions to many of the most demanding industries, including aerospace, defense, medical, consumer electronics, automotive, energy and communications.

- Moreover, the ongoing conflict between Russia and Ukraine is expected to impact the electronics industry significantly. The conflict has already exacerbated the semiconductor supply chain issues and the chip shortage that have affected the industry for some time. The disruption may come in the form of volatile pricing for critical raw materials such as nickel, palladium, copper, titanium, aluminum, and iron ore, resulting in material shortages. This would obstruct manufacturing in the studied market.

Organic Substrate Packaging Material Market Trends

Consumer Electronics holds Significant Share in the Market

- Organic packaging substrates such as small, thin outline packages in consumer electronics have grown significantly in recent years due to their ability to improve devices' performance and functionality while reducing their size and weight. Additionally, with a 5G network, the amount of data processed by the system is propitiating, resulting in a need for more battery space in a smartphone. This leads to a need for other components to be of compressed size with higher density. Substrate PCBs are high-density printed circuit boards (PCBs) that require a maximum of 30X30 µmtrace spacing.

- Further, Smartphone original equipment manufacturers (OEMs) increasingly use this organic substrate technology with a shift toward 5G, which is the primary driver for the market's growth. According to Ericsson, as of 2022, there were a reported 1.05 billion active 5G subscriptions worldwide, almost twice as many as the previous year. Rapid growth is expected over the coming years, with subscriptions forecasted to reach nearly 5 billion by 2028. Such a massive rise in the 5g subscriptions would propel the demand for the studied market.

- According to the US Census Bureau, in January 2022, a USD 1.7 billion increase in the sales value of mobile phones sold in the United States, for a count of USD 74.7 billion in sales. In addition, as per 5G Americas, as of 2023, there are an evaluated 1.9 billion fifth-generation (5G) subscriptions worldwide. This figure is forecast to increase to 2.8 billion by 2024 and 5.9 billion by 2027.

- Moreover, the studied segment significantly invests in the organic substrate packaging material market. Growth of the smartphone, rising wearable and smart device adoption, and increasing consumer Internet of Things (IoT) device penetration in applications like smart homes are a few of the influential factors influencing the segment's growth. According to Ericsson, smartphone mobile network subscriptions worldwide reached nearly 6.6 billion in 2022 and are predicted to exceed 7.8 billion by 2028.

- For instance, in March 2023, Huawei plans to launch its foldable smartphone with a significant battery upgrade in the coming years. The device will feature an upgrade to its battery, and it is rumored to be named the Mate X3. Further, Huawei will use the high-silicon anode material to enhance the smartphone's battery capacity, which is expected to be 5060mAh.

- Intel Corporation and the University College London (UCL) collaborated in June 2022 to introduce a new touchless computer that can be operated and controlled by gesturing the hands, head, face, and entire body. Higher power dissipation, faster speeds, higher pin counts, smaller footprints, and lower profiles are all constant demands in the electronics market. Semiconductor miniaturization and integration have resulted in lighter, smaller, and more portable appliances such as smartphones, tablets, and emerging Internet of Things (IoT) devices.

- The consumer electronics industry is constantly growing and is projected to expand significantly in the coming years, considering the recent critical developments in the industry. Such maturation in consumer electronics may further propel the demand in the studied market.

Asia Pacific is Expected to Hold the Significant Market Share

- The primary factors bolstering the growth of the studied market in the Asia-Pacific region contain the increasing adoption of smartphones, the rising number of Internet users, and the introduction of new features and technologies that can attract new customers and expand footprints in emerging markets. Additionally, the region's dominance in the global printed circuit board market contributes to the growth of the organic substrate PCBs.

- The major global packaging substrate manufacturers are concentrated in Taiwan, South Korea, and Japan. In the "emergent stage" of the development of organic packaging substrates, Japan is at the forefront of developing and applying integrated circuit (IC) packaging substrates worldwide.

- The rising demand for automobiles in Asia-Pacific prompted regional governments to legislate a few active and passive vehicle safety measures, boosting the region's automotive printed circuit boards (PCBs) market growth. Governments are providing subsidies to customers to encourage the purchase of electric vehicles in the area. For instance, Japan's government has set a goal of stopping the use of internal combustion engine automobiles in the country by 2050, and to help achieve this goal. The country has started granting one-time subsidies to buyers of electric cars.

- According to the India Brand Equity Foundation (IBEF), the FAME-II scheme was launched in India a few years ago with a budget outlay of USD 1.3 billion to support 1 million e-two-wheelers, 0.5 million e-three-wheelers, 55,000 e-passenger vehicles, and 7,000 e-buses. The government extended the scheme until 2024, as announced in the Union Budget 2022-23.

- In addition, it is anticipated that China will surpass the United States as the world's significant semiconductor industry powerhouse due to its growing domestic chip demand. According to the Semiconductor Industry Association (SIA), the semiconductor market will double in size to reach more than USD 1 trillion by 2030, with China accounting for more than 60% of that growth. Such exponential growth is anticipated to increase demand for organic substrate semiconductors.

- The players in the market are commissioning new factories to cater to the rising demand of the PCB. For instance, in January 2022, Simmtech, a South Korean maker of Printed Circuit Boards and packaging substrates for semiconductors, has almost finished constructing its first large-scale PCB factory in Batu Kawan Industrial Park, Penang, Malaysia. This factory is part of its existing network of PCB factories in South Korea, Japan, and China, located in Southeast Asia. It will specialize in producing the first packaging substrates for DRAM/ NAND memory chips and HDI PCBs for memory modules/ SSDs.

- Further, in February 2023, LG Innotek introduced a 2-metal chip on film (COF), an essential product for XR devices. At LG Innotek's metaverse zone, the product piqued visitors' interest. A semiconductor package substrate, COF, connects flexible PCBs and displays. It helps reduce the form factor of modules and reduces the display bezels on devices like smartphones, notebook computers, televisions, and monitors. It requires advanced technology because it produces microcircuits on a very thin film. It is also known as the FPCB, or ultra-thin flexible PCB, which takes the place of the FPCB. 2-Metal COF is technically superior to standard one-side COF. The most significant advantage of a 2-metal COF is that it is super integrated by forming circuits on both sides, in contrast to a conventional COF, which only implements circuits on one side.

Organic Substrate Packaging Material Industry Overview

The organic substrate packaging material market is highly competitive and is dominated by major players, including Amkor Technology Inc, Compass Technology Co. Ltd., Kyocera Corporation, among others, who hold a significant market share while actively expanding their customer base globally. These companies employ strategic collaborative initiatives to enhance their market share and profitability. Nevertheless, due to technological advancements and product innovations, smaller and mid-sized companies are making inroads into new markets by securing unique contracts.

In June 2023, US chipmaker Micron Technology is set to launch its semiconductor assembly and test facility in Gujarat, with plans to commence production as early as 2024. This development will significantly bolster India's chip-making aspirations. The primary focus of the plant will be packaging chips, where it will convert wafers into ball grid array integrated circuit packages, memory modules, and solid-state drives.

In January 2022, Simmtech, a South Korean manufacturer of PCBs and semiconductor packaging substrates, announced the near completion of its first large-scale PCB manufacturing facility located on an 18-acre site in Penang, Malaysia. This facility complements Simmtech's existing PCB operations in Southeast Asia, particularly in South Korea, Japan, and China. It specializes in producing packaging substrates for dynamic random-access memory (DRAM) / NAND memory chips, as well as high-density interconnect (HDI) PCBs for memory modules and solid-state drive (SSD) devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Self-Driving Vehicles

- 5.1.2 Increasing Use of Portable Devices

- 5.2 Market Challenges

- 5.2.1 Higher Setup Cost Associated with Substrate like PCBs

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Small Thin Outline Packages

- 6.1.2 Pin Grid Array (PGA) Packages

- 6.1.3 Flat no-leads Packages

- 6.1.4 Quad Flat Package (QFP)

- 6.1.5 Dual inline Package (DIP)

- 6.1.6 Other Technologies

- 6.2 By Application

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 Manufacturing

- 6.2.4 Industrial

- 6.2.5 Healthcare

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amkor Technology Inc

- 7.1.2 Kyocera Corporation

- 7.1.3 Microchip Technology Inc.

- 7.1.4 Texas Instruments Incorporated

- 7.1.5 ASE Kaohsiung

- 7.1.6 Simmtech Co., Ltd

- 7.1.7 Shinko Electric Industries Co. Ltd

- 7.1.8 LG Innotek Co.Ltd

- 7.1.9 At&s

- 7.1.10 Daeduck Electronics Co.,Ltd