|

市場調查報告書

商品編碼

1685811

再生包裝解決方案:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Recycled Materials Packaging Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

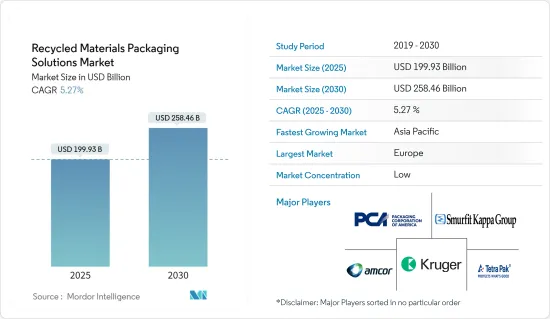

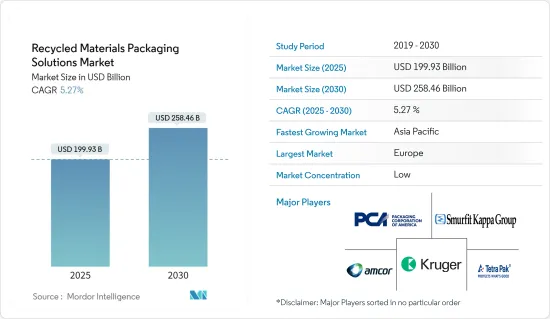

再生材料包裝解決方案市場規模預計在 2025 年為 1,999.3 億美元,預計到 2030 年將達到 2,584.6 億美元,預測期內(2025-2030 年)的複合年成長率為 5.27%。

就產量而言,預計將從 2025 年的 2.6076 億噸成長到 2030 年的 3.3106 億噸,預測期內(2025-2030 年)的複合年成長率為 4.89%。

主要亮點

- 再生材料包裝解決方案是從製造過程中回收的材料中再加工出來的材料,並包含在最終產品或零件中。再生材料是已經完成其原定用途並用於包裝的材料。

- 回收材料受到推廣,因為它們可以最佳化製造流程,同時顯著減少組織的廢棄物足跡。與再生產品一樣,再生材料可以提高公司的永續性,並且由於流程效率的提高還可以帶來更高的成本效益。

- 此外,技術進步正在推動創新可回收包裝解決方案的發展。製造商正致力於開發不僅環保而且還能為包裝產品提供必要保護和功能的包裝材料。因此,再生包裝市場正在引入新材料、新設計和新製造程序,以滿足不同行業的需求。

- 生物分解性塑膠包裝解決方案因其對環境的影響較小、對可回收性和永續性的日益關注以及政府對高效包裝管理的興趣日益濃厚,在包裝行業中正日益興起。

- 生物基材料在其生命週期內就溫室氣體預算和其他環境影響而言具有多種潛在優勢。生物分解性材料的使用有助於永續性,並有望顯著減少與石油基聚合物處置相關的生態影響。然而,預計這將抑制該市場的成長。

- 廢棄物處理是地方政府和市政當局的主要成本負擔。促進回收可以減少送往廢棄物垃圾掩埋場的垃圾量並降低廢棄物管理成本。這些節省下來的成本可以轉移到教育、醫療保健和基礎建設等其他重要領域。

再生材料包裝解決方案的市場趨勢

最大的最終用戶產業是食品業

- 由於消費者對環境問題的認知不斷提高以及各個行業提倡永續實踐,食品業的再生包裝市場正在成長。回收包裝有幾個好處,包括減少廢棄物、節省資源和減少生產過程中的碳排放。

- 然而,循環經濟的概念開始在食品業紮根,即資源被重新利用和回收,而不是在一次使用後就被丟棄。回收包裝可以實現更循環的資源管理和減少廢棄物的方法。

- 烘焙點心零售額的增加可以推動對環保包裝解決方案的需求,從而促進再生材料包裝市場的擴張。隨著消費者意識和監管壓力的不斷成長,公司可能會優先考慮永續包裝選擇,從而進一步推動再生材料包裝市場的成長。

- 據加拿大農業和食品部稱,烘焙點心的零售額預計將從 2022 年的約 67.7 億美元成長到 2026 年的 77.8 億美元,這表明食品市場正在不斷擴大。

- 隨著烘焙點心零售額的增加,對包裝材料的需求也可能增加。隨著消費者環保意識的增強,他們越來越偏好使用永續包裝,包括再生材料。

歐洲佔主要市場佔有率

- 歐洲採用再生包裝材料正在重塑整個包裝產業價值鏈,從採購和製造到分銷和消費者互動。這項變革將推動材料採購、生產流程和供應鏈物流的創新,同時影響消費行為和法律規範,最終促進包裝產業更永續和循環的經濟。

- 目前,製藥公司優先考慮環保解決方案,以減少碳排放並滿足監管標準。

- 向再生包裝的轉變反映了行業更廣泛的環保趨勢,提高了品牌聲譽和消費者信任,同時也推動了製藥業的循環經濟模式。

- 雅詩蘭黛、Aveda 和 Origins 等全球美容公司正在製定永續性策略,以減少對塑膠包裝的依賴。雅詩蘭黛的目標是到 2025 年將其包裝中的消費後回收 (PCR) 內容量提高 50%。 5 這些公司正在採取的策略包括低影響採購包裝材料、尋求更多可回收的初級包裝以及盡可能消除包裝組件。

再生包裝解決方案產業概覽

再生材料包裝解決方案市場主要企業:Amcor Group GmbH、Kruger Inc.、Smurfit Kappa Group、Packaging Corporation of America、Tetra Laval International SA 等。這些公司不斷創新並建立策略合作夥伴關係以維持其市場佔有率。

2024年2月,安姆科與吉百利達成協議,採購約1000噸消費後再生塑膠,用於其旗艦產品吉百利巧克力的包裝,從而加速吉百利減少所需原生塑膠量的努力。

2023 年 11 月,英國紙板和包裝製造商 DS Smith 開始向飛利浦在荷蘭生產的家電品牌 Versuni 供應再生材料和可回收包裝。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- 地緣政治因素如何影響市場

第5章市場動態

- 市場促進因素

- 嚴格的政府法規推動產品回收需求

- 市場挑戰

- 生物分解性塑膠的發展與進步

第6章市場區隔

- 依材料類型

- 塑膠

- 紙

- 玻璃

- 金屬

- 按最終用戶產業

- 食物

- 飲料

- 家庭和個人護理

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Amcor Group GmbH

- Kruger Inc.

- Smurfit Kappa Group

- Packaging Corporation of America

- Tetra Laval International SA

- International Paper Company

- Mondi Group

- DS Smith PLC

- WestRock Company

- Sealed Air Corp.

第8章投資分析

第9章:未來市場展望

The Recycled Materials Packaging Solutions Market size is estimated at USD 199.93 billion in 2025, and is expected to reach USD 258.46 billion by 2030, at a CAGR of 5.27% during the forecast period (2025-2030). In terms of production volume, the market is expected to grow from 260.76 million tons in 2025 to 331.06 million tons by 2030, at a CAGR of 4.89% during the forecast period (2025-2030).

Key Highlights

- Recycled material packaging solutions are the materials that have been reprocessed from a recovered material using a manufacturing process and then included in a final product or component. Recycled material is any material that has already served the use that it was initially intended for and is being used for packaging.

- Recycled content is promoted as it significantly reduces organizational waste footprints while optimizing the manufacturing process. As with recycled products, recycled content will improve a company's sustainability, and due to the efficiency of the process, it is also associated with increased cost benefits.

- Additionally, technological advancements are leading to the development of innovative recyclable packaging solutions. Manufacturers are concentrating on creating packaging materials that are not only environmentally friendly but also offer the required protection and functionality for the products being packaged. As a result, the recycled packaging market is witnessing the introduction of new materials, designs, and manufacturing processes that cater to diverse industry needs.

- Biodegradable plastic packaging solutions are witnessing a rise in the packaging industry owing to their low environmental impact, growing focus on recyclability and sustainability, and governments' focus on efficient packaging management.

- Bio-based materials have several potential advantages for greenhouse gas balances and other environmental impacts over life cycles. It is anticipated that using biodegradable materials will contribute to sustainability and a high reduction in the ecological effects related to the disposal of oil-based polymers. However, it is expected to restrain the growth of the market studied.

- Waste management is a major cost burden for municipalities and governments. Promoting recycling decreases the volume of waste sent to landfills, reducing waste management costs. These cost savings can be diverted to other critical areas, such as education, healthcare, and infrastructure development.

Recycled Materials Packaging Solutions Market Trends

Food Industry to be the Largest End-user Industry

- The market for recycled packaging in the food industry has grown due to increasing consumer awareness of environmental issues and the push for sustainable practices across various sectors. Recycled packaging offers several benefits, including reducing waste, conserving resources, and lowering carbon emissions associated with production.

- However, the concept of a circular economy, where resources are reused and recycled rather than discarded after a single use, is gaining traction in the food industry. Recycled packaging enables a more circular approach to resource management and waste reduction.

- The growth in retail sales of baked goods can contribute to expanding the recycled material packaging market by driving demand for environmentally friendly packaging solutions. As consumer awareness and regulatory pressures continue to increase, businesses are likely to prioritize sustainable packaging options, further increasing the growth of the recycled material packaging market.

- According to Agriculture and Agri-Food Canada, the projected growth in retail sales of baked goods, from approximately USD 6.77 billion in 2022 to a forecasted USD 7.78 billion by 2026, indicates an expanding market for food products.

- With a rise in retail sales of baked goods, there will likely be an increased demand for packaging materials. As consumers become more environmentally conscious, there is a growing preference for sustainable packaging options, including recycled materials.

Europe to Hold the Major Market Share

- The adoption of recycled packaging materials in Europe is reshaping the entire value chain of the packaging industry, from procurement and manufacturing to distribution and consumer engagement. The shift drives innovation in material sourcing, production processes, and supply chain logistics while influencing consumer behavior and regulatory frameworks, ultimately fostering a more sustainable and circular economy within the packaging sector.

- Introducing recycled glass packaging in Europe's pharmaceutical market is revolutionizing sustainability efforts, as pharmaceutical companies prioritize environmentally friendly solutions to reduce their carbon footprint and meet regulatory standards.

- The shift toward recycled material packaging reflects a broader industry trend toward eco-conscious practices, enhancing brand reputation and consumer trust while promoting a circular economy model within the pharmaceutical sector.

- Global cosmetic companies like Estee Lauder, Aveda, and Origins have developed sustainability strategies to reduce dependence on plastic packaging materials. Estee Lauder is working toward increasing the amount of post-consumer recycled (PCR) material in its packaging by up to 50% by 2025.5. Some strategies these companies employ include low-impact sourcing for packaging materials, pursuing more recycled primary packaging, and eliminating packaging components wherever possible.

Recycled Materials Packaging Solutions Industry Overview

The recycled materials packaging solutions market is fragmented with major players such as Amcor Group GmbH, Kruger Inc., Smurfit Kappa Group, Packaging Corporation of America, Tetra Laval International SA, etc. The corporations continue to innovate and form strategic partnerships to maintain their market share.

In February 2024, Amcor agreed with Cadbury to procure approximately 1,000 tonnes of post-consumer recycled plastic to be used in the packaging of Cadbury's core range of Cadbury chocolates, helping to accelerate Cadbury's efforts to reduce their virgin plastic requirements.

In November 2023, Paperboard and packaging manufacturer DS Smith, based in the United Kingdom, started providing recycled content and recyclable packaging to Philips Home Appliance brands manufactured in the Netherlands by Versuni.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Geo-political Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Government Regulations Driving the Demand for Recycling of Products

- 5.2 Market Challenges

- 5.2.1 Growth and Advancement in Biodegradable Plastics

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Paper

- 6.1.3 Glass

- 6.1.4 Metal

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Home and Personal Care

- 6.2.4 Healthcare

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Kruger Inc.

- 7.1.3 Smurfit Kappa Group

- 7.1.4 Packaging Corporation of America

- 7.1.5 Tetra Laval International SA

- 7.1.6 International Paper Company

- 7.1.7 Mondi Group

- 7.1.8 DS Smith PLC

- 7.1.9 WestRock Company

- 7.1.10 Sealed Air Corp.