|

市場調查報告書

商品編碼

1404469

汽車駕駛座電子設備:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Automotive Cockpit Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

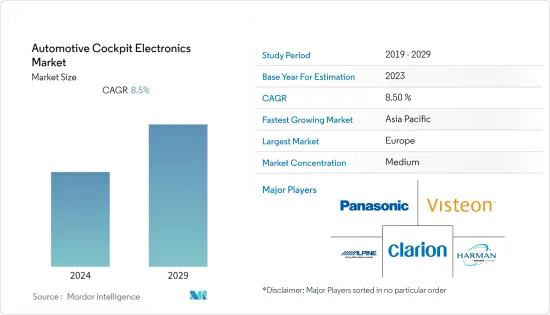

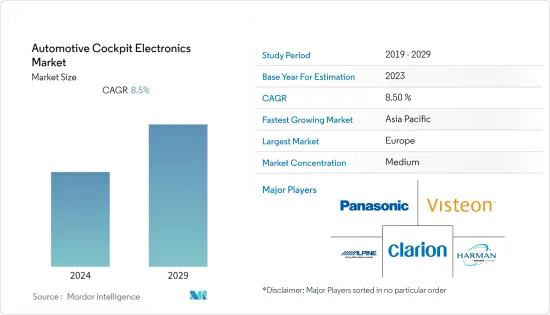

目前汽車駕駛座電子市場規模為403.6億美元。

預計未來五年將成長至 656.8 億美元,預測期內複合年成長率超過 8.5%。

隨著乘客舒適度和安全意識的增強,以及政府法規強制要求安全功能的推動,整合 ADAS 功能的車輛產量不斷增加,預計將推動市場需求。此外,自動駕駛和自動駕駛車輛的接受度不斷提高也有助於加強市場成長。

為了提高安全性和舒適性而對數位化和連接性的需求不斷成長,正在推動汽車駕駛座電子市場的發展。除了消費者需求外,各國政府和安全機構實施的嚴格監管規範也進一步推動了汽車駕駛座電子市場的成長。

到2022年,北美將成為汽車駕駛座電子產品的最大市場,其次是亞太地區和西歐。不過,亞洲地區預計將成為汽車駕駛座電子系統製造和使用的主要市場,而印度的汽車零件製造地正在逐步向全國擴張。

感測器和現代車輛控制設備在小客車中的廣泛使用增加了對駕駛員可存取的車輛控制功能的需求。

汽車駕駛座電子市場趨勢

客戶對嵌入系統導航系統的偏好日益成長

近年來,客戶對汽車儀表板導航系統的偏好顯著增加。推動這一趨勢的因素有很多,包括技術進步、支援 GPS 的智慧型手機的普及以及對無縫、便捷駕駛體驗的渴望。客戶更喜歡購買該系列的頂級型號來體驗所有功能。

嵌入系統導航系統的主要優點之一是,與使用智慧型手機應用程式或紙質地圖相比,它們提供更可靠、更準確的導航。嵌入系統的導航系統可讓駕駛輕鬆取得路線導航、即時交通資訊、附近景點的資訊等。駕駛者可以更快、更有效率地到達目的地,降低迷路或塞車的風險。

嵌入系統系統不僅提供更好的導航功能,而且還提供更整合和直覺的使用者體驗。大多數現代系統都配備易於使用的高解析度觸控屏,可提供各種非導航功能,包括娛樂、氣候控制和車輛診斷。這使得駕駛員可以更輕鬆地專注於道路,並減少駕駛時擺弄其他設備或應用程式的需要。例如

- 2023 年 2 月,MapmyIndia 宣布推出一系列新的汽車Mappls 小工具,包括先進的車輛 GPS 追蹤器、行車記錄器和儀表板導航系統。

推動儀表板導航系統日益普及的另一個因素是語音命令、預測路線以及與智慧家庭設備整合等高級功能的可用性不斷增加。例如,某些系統可以根據駕駛者的位置和駕駛習慣自動調整家中的溫度和照明。另一方面,一些系統使用機器學習演算法根據即時交通資料提案最有效的路線。

總體而言,客戶對儀表板內導航系統的偏好日益成長,反映出對更先進、整合和便利的車輛技術不斷成長的需求。隨著這些系統不斷發展並變得更加複雜,我們預計它們將成為未來幾年駕駛體驗中更不可或缺的一部分。

北美在駕駛座電子市場佔據主要佔有率

近年來,駕駛座電子市場經歷了顯著成長,北美已成為該市場的領先地區之一。該市場的成長歸因於多種因素,包括對先進安全功能的需求不斷成長以及聯網汽車的成長趨勢。

北美是一些世界上最大的汽車製造商的所在地,包括通用汽車、福特和特斯拉。這些公司正在大力投資開發 ADAS(高級駕駛輔助系統)和資訊娛樂系統等新技術,這些技術正在推動駕駛座電子市場的成長。例如,2022會計年度,美國汽車業銷售了約286萬輛汽車。同年,美國汽車和輕型卡車總銷量約1,375萬輛。

除了汽車產業外,北美航太業也為駕駛座電子市場的成長做出了貢獻。該地區是波音和空中巴士等主要航太公司的所在地,這些公司為民航機和軍用飛機開發先進的航空電子系統。這些系統包括先進的飛行顯示器、導航系統、通訊系統等,對於確保航空旅行的安全和效率至關重要。

對連網型汽車的需求不斷成長也是北美駕駛座電子市場的主要驅動力。消費者對汽車配備車載 Wi-Fi、智慧型手機整合和語音控制等功能的要求越來越高。這些功能需要複雜的駕駛座電子系統,這在新車中變得越來越常見。

此外,電動車和混合動力汽車的採用也促進了北美駕駛座電子市場的成長。這些車輛需要將先進的電池管理系統整合到車輛的駕駛座電子系統中。

此外,美國政府也對新車上安裝的許多 ADAS 系統進行監管,包括主動式車距維持定速系統、後交叉路徑偵測和前行人保護。美國公路安全保險協會(IIHS)也宣布,所有新小客車都將配備自動緊急煞車(AEB)。

汽車駕駛座電子產業概況

汽車駕駛座電子市場由偉世通公司、阿爾派電子公司、松下公司、大陸集團、哈曼國際工業公司、德爾福汽車公司 (Aptiv PLC)、歌樂和 Luxoft Holding Inc. 等多家參與企業主導。這些公司正在透過創新的新產品來擴展業務,這使他們比競爭更具優勢。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 對聯網汽車的需求增加

- 人機介面 (HMI) 技術的進步

- 市場抑制因素

- 快速的技術進步

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模(單位:美元))

- 產品

- 抬頭顯示器

- 資訊顯示

- 資訊娛樂和導航

- 儀錶群

- 遠端資訊處理

- 其他產品

- 汽車模型

- 小客車

- 商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東/非洲

- 北美洲

第6章競爭形勢

- 供應商市場佔有率

- 公司簡介

- Visteon Corporation

- Panasonic Corporation

- Harman International Industries Inc.

- Clarion Co. Ltd

- Alpine Electronics Inc.

- Continental AG

- Magneti Marelli SPA

- Yazaki Corporation

- Denso Corporation

- Garmin Ltd

- Nippon-Seiki Co. Ltd

- Tomtom International BV

第7章 市場機會及未來趨勢

- 人工智慧 (AI) 整合

- 越來越關注使用者體驗和人機介面 (HMI)

The automotive cockpit electronics market is valued at USD 40.36 billion in the current year. It is expected to grow to USD 65.68 billion within the next five years by registering a CAGR of over 8.5% during the forecast period.

Growing production of vehicles with integrated ADAS features in the wake of rising awareness toward the comfort and safety of passengers and government regulations mandating safety features are expected to drive demand in the market. Moreover, the rising acceptance of self-driving or automated vehicles further contributes to the enhanced growth of the market.

The rising demand for digitization and connectivity to enhance safety and comfort features is driving the market for cockpit electronics in vehicles. In addition to consumer demand, the stringent regulatory norms posed by various governments and safety organizations are further boosting the growth of the automotive cockpit electronics market.

North America was the largest market for automotive cockpit electronics until 2022, followed by Asia-Pacific and Western Europe. However, the Asian region is estimated to become the key market for the manufacturing and usage of automotive cockpit electronics systems, with India gradually expanding its automotive parts and components-manufacturing hubs across the country.

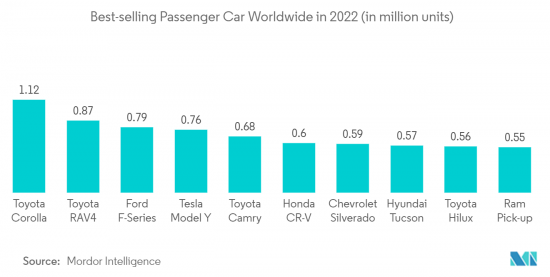

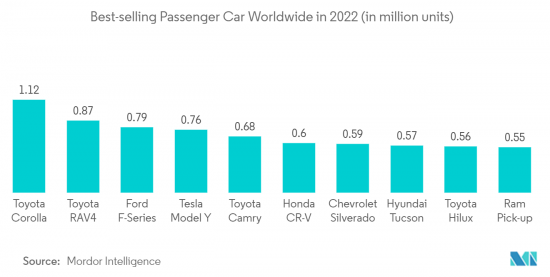

The increasing demand for automotive control functions, which are accessible by the driver, is growing in automobiles due to the wide-ranging use of sensors and modern automotive control amenities in passenger cars.

Automotive Cockpit Electronics Market Trends

Increasing Customer Preference for In-Dash Navigation System

Over the past few years, there is a significant increase in customer preference for in-dash navigation systems in their vehicles. Several factors, including advances in technology, the growing popularity of GPS-enabled smartphones, and the desire for a seamless and convenient driving experience, are driving this trend. Customers prefer to buy top-end models in the series of cars to experience all the features.

One of the primary benefits of in-dash navigation systems is that they offer a more reliable and accurate way to navigate than using a smartphone app or paper maps. With an in-dash navigation system, drivers can easily access turn-by-turn directions, real-time traffic updates, and information on nearby points of interest. It helps drivers reach their destination more quickly and efficiently and reduces the risk of getting lost or stuck in traffic.

In addition to providing better navigation capabilities, in-dash systems also offer a more integrated and intuitive user experience. Most modern systems feature large, high-resolution touchscreens that are easy to use and provide access to a range of features beyond navigation, such as entertainment, climate control, and vehicle diagnostics. It makes it easier for drivers to stay focused on the road and reduces the need to fumble with separate devices or apps while driving. For instance,

- In February 2023, MapmyIndia launched its new line of Mappls Gadgets for cars, including advanced Vehicle GPS trackers, Dash Cameras, and In-Dash navigation systems.

Another factor driving the growing popularity of in-dash navigation systems is the increasing availability of advanced features such as voice commands, predictive routing, and integration with smart home devices. For example, some systems can automatically adjust the temperature and lighting in a driver's home based on their location and driving habits. In contrast, others can use machine learning algorithms to suggest the most efficient route based on real-time traffic data.

Overall, the increasing customer preference for in-dash navigation systems reflects a growing demand for more advanced, integrated, and convenient automotive technologies. As these systems continue to evolve and become more sophisticated, we can expect to see them become an even more essential part of the driving experience in the years ahead.

North America Holds a Significant Share in the Cockpit Electronics Market

The cockpit electronics market experienced significant growth in recent years, and North America emerged as one of the leading regions for this market. The growth of this market can be attributed to several factors, including the increasing demand for advanced safety features and the rising trend of connected cars.

North America is home to some of the largest automotive manufacturers in the world, including General Motors, Ford, and Tesla. These companies are investing heavily in the development of new technologies, including advanced driver assistance systems (ADAS) and infotainment systems, which are driving the growth of the cockpit electronics market. For instance, IN FY 2022, The United States auto industry sold nearly 2.86 million cars in 2022. That year, total car and light truck sales were approximately 13.75 million in the United States.

In addition to the automotive industry, the aerospace sector in North America is also contributing to the growth of the cockpit electronics market. The region is home to some of the largest aerospace companies, such as Boeing and Airbus, which are developing advanced avionics systems for commercial and military aircraft. These systems include advanced flight displays, navigation systems, and communication systems, which are essential for ensuring the safety and efficiency of air travel.

The increasing demand for connected cars is also a key driver of the cockpit electronics market in North America. Consumers are increasingly seeking vehicles that are equipped with features such as in-car Wi-Fi, smartphone integration, and voice-activated controls. These features require advanced cockpit electronics systems, which are becoming increasingly common in new vehicles.

Furthermore, the adoption of electric and hybrid vehicles is also contributing to the growth of the cockpit electronics market in North America. These vehicles require sophisticated battery management systems, which are integrated into the cockpit electronics systems of the vehicle.

In addition, the government of the United States regulates many ADAS systems in new vehicles, such as adaptive cruise control, rear cross-path detection, and front pedestrian detection. The Insurance Institute for Highway Safety (IIHS) also announced that all new passenger vehicles would include automatic emergency braking (AEB).

Automotive Cockpit Electronics Industry Overview

The automotive cockpit electronics market is dominated by several players, such as Visteon Corporation, Alpine Electronics Inc., Panasonic Corporation, Continental AG, Harman International Industries Inc., Delphi Automotive (Aptiv PLC), Clarion Co. Ltd, and Luxoft Holding Inc. These companies are expanding their business by new innovative products so that they can hold an edge over their competitors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Connected Cars

- 4.1.2 Advancements in Human-Machine Interface (HMI) Technologies

- 4.2 Market Restraints

- 4.2.1 Rapid Technological Advancements

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value in USD)

- 5.1 Product

- 5.1.1 Head-up Display

- 5.1.2 Information Display

- 5.1.3 Infotainment and Navigation

- 5.1.4 Instrument Cluster

- 5.1.5 Telematics

- 5.1.6 Other Products

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share**

- 6.2 Company Profiles*

- 6.2.1 Visteon Corporation

- 6.2.2 Panasonic Corporation

- 6.2.3 Harman International Industries Inc.

- 6.2.4 Clarion Co. Ltd

- 6.2.5 Alpine Electronics Inc.

- 6.2.6 Continental AG

- 6.2.7 Magneti Marelli SPA

- 6.2.8 Yazaki Corporation

- 6.2.9 Denso Corporation

- 6.2.10 Garmin Ltd

- 6.2.11 Nippon-Seiki Co. Ltd

- 6.2.12 Tomtom International BV

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of Artificial Intelligence (AI)

- 7.2 Increasing Focus on User Experience and Human-Machine Interface (HMI)