|

市場調查報告書

商品編碼

1693681

設施管理軟體-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Facility Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

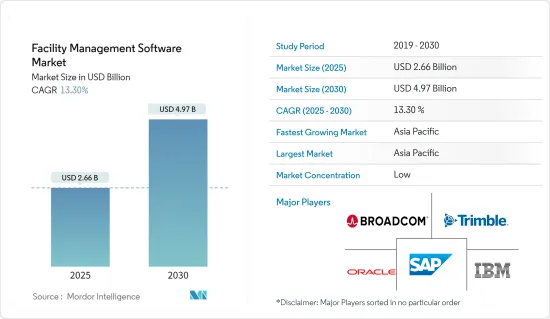

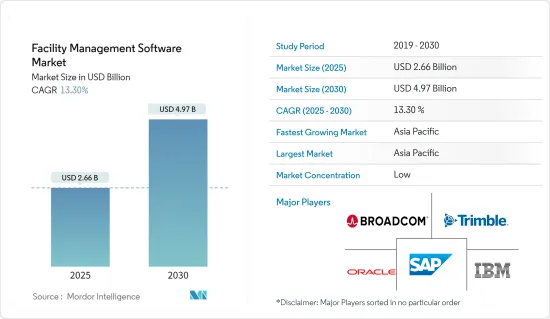

設施管理軟體市場規模預計在 2025 年為 26.6 億美元,預計到 2030 年將達到 49.7 億美元,在市場估計和預測期(2025-2030 年)內複合年成長率為 13.3%。

設施管理由幾個影響組織生產力和效率的部分組成。新的管理系統標準與行業最佳實踐保持一致,將成為在全球範圍內制定和推廣有效的策略、戰術性和營運 FM 原則的基準。

關鍵亮點

- 電腦輔助設施管理 (CAFM) 軟體可讓設施經理組織、實施和追蹤所有維護業務,包括糾正和規劃預防性維護、空間和移動管理、資產管理、營運設施服務、房間預訂和其他客戶服務。 CAFM 佔據了設施管理軟體市場的很大一部分。

- 由於大型企業定期採用 CAFM 服務和軟體來管理其資產、空間、建築物和財產,預計預測期內對 CAFM 的需求將會成長。基礎建設,包括鐵路、港口和機場建設,是多國政府的優先事項。這導致對 CAFM 軟體的需求增加。這是因為政府與服務供應商的合作更加緊密,以保持基礎設施清潔並促進綠化。

- 基礎建設,包括鐵路、港口和機場建設,是世界各國政府的優先事項。這導致對 CAFM 軟體的需求增加。因為政府正在與幫助保持基礎設施清潔和綠色的服務供應商更緊密地合作。如今,雲端運算技術為最終用戶提供了更多選擇,將軟體和服務的可配置性與運算移動性結合在一起。

- 由於公司內的每個人都可以使用應用程式和服務,這使得公司之間的資料共用更加成功。市場參與企業定期投資開發根據業務需求量身訂做的 CAFM 解決方案。因此,軟體公司正在大力投資研發,以透過先進技術擴大其提供的服務範圍。

- 缺乏與現有工作流程的適當整合可能會導致效率低下、資料孤島和使用者採用阻力,從而阻礙設施管理軟體市場的發展。如果軟體無法無縫融入您現有的流程,它可能會擾亂業務並降低整體生產力。對於那些優先考慮相容性和易於部署的潛在買家來說,整合挑戰也可能是一種阻礙。

- 在經濟擴張期間,對商業產品和服務的需求更大。隨著活動的增加,企業經常投資設施管理軟體等技術來提高生產力和業務效率。目標是簡化業務、降低開支並使您的公司長期成功。

設施管理軟體市場趨勢

商業領域將強勁成長

- 商業房地產包括企業或營業單位建造或占用的辦公大樓,例如製造業辦公室、IT、通訊和其他服務供應商。由於全球商業建築的不斷增加,設施管理的重要性日益增加,推動了 FM 軟體市場的成長。

- 商業區需要物業會計、租賃、合約管理、採購管理等服務,有效的設施管理軟體是必要的。因此,商業類別在市場上正見證著指數級的成長機會,並且預計這一趨勢將在整個預測期內持續下去。

- 從類型來看,CAFM(電腦輔助設施管理)預計將顯著成長。電腦輔助設施管理 (CAFM) 軟體使設施管理人員能夠規劃、執行和監控預防性維護、空間管理、資產管理、營運設施服務和其他客戶服務。對空間規劃和管理、租賃和物業管理、資本計劃管理、資產管理、能源性能分析、維護管理、實體建築管理和空間預訂的需求不斷成長,可能會增加商業領域對 CAFM 軟體的採用。

- 2024 年 3 月,關鍵基礎設施服務服務供應商與物業營運軟體公司 Facilio 合作,部署該公司雲端基礎的Connected CaFM 解決方案,以最佳化和簡化資料中心業務。 Facilio 的 Connected CaFM 解決方案提高了效率、回應能力和整體效能,提供了可擴展的架構以滿足 CFS 日益成長的需求。該公司的人工智慧主導平台使商業終端用戶能夠集中匯總數據、最佳化效能並管理其投資組合。

- 中東和非洲正在見證 FM 軟體的廣泛採用。沙烏地阿拉伯的 CIT 集團和杜拜的優質設施管理 (QFM) 等綜合 FM服務供應商已採用 Connected CaFM 作為其 FM 平台,以集中管理業務內部和外包業務,提供完整的可視性、控制力和增值。

- 全球IT和電訊產業的興起正在推動商業物業管理軟體的擴張。例如,通訊業者正專注於部署5G,為該地區的設施管理產業創造了巨大的機會。此外,愛立信預計,到2029年,5G將覆蓋全球85%的人口。例如,加強夥伴關係和協作將實現建築物檢查以及通風、空調、電氣、暖氣和衛生系統、儀器和控制技術的維護和維修。這將使市場參與企業能夠在市場上建立強大的影響力並擴大基本客群。

亞太地區預計將經歷強勁成長

- 亞太地區的設施管理軟體市場可能會受到多種趨勢的推動。例如,物聯網 (IoT) 是指使用網際網路連接到 FM 團隊的實體設備和感測器。這些會產生性能數據,提醒設施管理人員潛在問題。 FM 軟體可讓您從任何地方監控和控制您的流程。物聯網可以為您的營運提供即時洞察。

- 物聯網將與 FM 軟體(例如電腦化維護管理系統 (CMMS))相結合,以識別問題(例如,辦公室溫度不適合)、建立和調度工作訂單並追蹤其執行情況——所有這些都無需人工干預。

- 智慧城市和智慧建築在市場上的出現刺激了對設施管理軟體的整體需求,這促使該地區的市場參與企業推出新產品和服務。

- 例如,在印度擁有大量業務的全球物聯網推動者公司 Telit Cinterion 也提供物聯網模組、邊緣到雲端服務、物聯網內建軟體和設施管理軟體分析。此外,該公司的服務還包括能源使用管理和衛生管理等功能,這些功能以前在傳統的建築管理中都是手動完成的。智慧設施解決方案透過將感測器輸入和機器學習與連接性和分析相結合來自動化這些流程。透過基於物聯網的設施管理,可以提前安排和協調這些功能以實現最高效率。

- 建設活動的增加和住宅的擴張可能會促進印度設施管理軟體市場的成長。

設施管理軟體產業概況

設施管理軟體市場分散,包括擁有數十年行業經驗的國內和國際參與企業。場地供應商利用他們的專業知識,採取了強力的競爭策略。設施軟體公司正在將技術融入其服務中,以增強其服務組合。主要參與企業包括 IBM Corporation、Broadcom、Oracle Corporation、SAP SE 和 Trimble Inc.。

- 2024 年 3 月,關鍵基礎設施服務服務供應商與物業營運軟體公司 Facilio 合作,部署該公司雲端基礎的Connected CaFM 解決方案,以最佳化和簡化資料中心營運。 Facilio 的 Connected CaFM 解決方案提高了效率、回應能力和整體效能,提供了可擴展的架構以滿足 CFS 日益成長的需求。該公司的人工智慧主導平台使商業終端用戶能夠集中匯總數據、最佳化效能並管理其投資組合。

- 2023年11月,德勤宣布將與IBM合作,協助客戶加速其排放策略,並將永續性計畫融入其組織的核心營運。它還可以幫助監控資產監控、管理、預測性維護和可靠性規劃的績效目標和脫碳計劃,並與 IBM 永續性軟體解決方案套件 IBM Maximo Application Suite 中的其他產品整合。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- CAFM解決方案需求旺盛

- 人工智慧和物聯網在設施管理軟體中的應用日益廣泛

- 市場限制

- 缺乏與工作流程的適當整合

第6章市場區隔

- 按類型

- 電腦輔助設施管理(CAFM)

- 整合工作場所管理系統 (IWMS)

- 電腦化維護管理系統(CMMS)

- 按最終用戶

- 商業設施

- 設施

- 公共基礎設施

- 工業的

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- IBM Corporation

- Broadcom

- Oracle Corporation

- SAP SE

- Trimble Inc.

- Upkeep Maintenance Management

- Accruent LLC(Fortive Corporation)

- Planon Software Services Private Limited

- FTMaintenance(FasTrak SoftWorks Inc.)

- Eptura

第8章投資分析

第9章 市場機會與未來趨勢

The Facility Management Software Market size is estimated at USD 2.66 billion in 2025, and is expected to reach USD 4.97 billion by 2030, at a CAGR of 13.3% during the forecast period (2025-2030).

Facility management consists of multiple factors that influence the productivity and efficiency of organizations. The new management system standard, conforming with the best industry practices, constitutes a benchmark for developing and driving effective strategic, tactical, and operational FM principles globally.

Key Highlights

- Facility managers can use computer-aided facility management (CAFM) software to organize, carry out, and keep track of all maintenance tasks, such as reactive and planned preventative maintenance, space and move management, asset management, operational facility services, room reservations, and other client services. CAFM holds a significant portion of the facility management software market.

- The demand for CAFM is expected to grow during the forecast period as large enterprises regularly implement CAFM services and software to manage assets, spaces, buildings, and properties. Infrastructure development, including building railways, ports, and airports, is a priority for governments in several nations. With this, the need for CAFM software has grown because the government works more closely with service providers that help keep infrastructure clean and green.

- Infrastructure development, including building railways, ports, and airports, is a priority for governments in several different nations. With this, the need for CAFM software has grown because the government works more closely with service providers that help keep infrastructure clean and green. At present, end users are getting various options due to cloud computing technology, which combines software and service configurability and computing mobility.

- Due to this, sharing data between businesses is now more successful because it ensures that everyone in the company can use applications and services. The key players in the market regularly invest in developing customized CAFM solutions according to business demand. As a result, software companies are investing heavily in research and development to broaden their offerings through advanced technology.

- The lack of proper integration with existing workflows can hinder the facility management software market by causing inefficiencies, data silos, and resistance to adoption among users. When software does not seamlessly fit into existing processes, it can disrupt operations and decrease overall productivity. Integration challenges may also deter potential buyers who prioritize compatibility and ease of implementation.

- There is a greater need for business goods and services during economic expansion. Due to this increase in activity, businesses frequently invest in technology like facility management software that can increase productivity and operational efficiency. The goal is to streamline operations, cut expenses, and put the company in a position for long-term success.

Facility Management Software Market Trends

Commercial Sector to Witness Significant Growth

- The commercial entities include office buildings constructed or occupied by businesses or enterprises, such as manufacturers' offices, IT and telecommunication, and other service providers. Owing to the increasing establishment of commercial buildings across the globe, facility management has gained significant importance, driving the growth of the FM software market.

- Commercial spaces require property accounting, renting, contract management, procurement management, and other services, so effective facility management software becomes necessary. Therefore, the commercial category is witnessing exponential growth opportunities in the market, and the trend is likely to continue throughout the forecast period.

- By type, Computer-Aided Facility Management (CAFM) is anticipated to grow significantly. Computer-Aided Facility Management (CAFM) software enables facility managers to plan, execute, and monitor preventative maintenance, space management, asset management, operational facility services, and other customer services. Growing demands for space planning and management, leasing and real estate management, capital project management, asset management, energy performance analysis, maintenance management, physical building administration, and space reservations will likely increase the adoption of CAFM software in the commercial segment.

- In March 2024, MDS Critical Facilities Services, a service provider for critical infrastructure, partnered with property operations software firm Facilio to implement their cloud-based Connected CaFM solution to optimize and streamline its data center operations. Facilio's Connected CaFM solution enhances efficiency, responsiveness, and overall performance, offering a scalable architecture that aligns with CFS's growing needs. The company's AI-driven platform allows commercial sector end users to aggregate data, optimize performance, and control portfolio operations from a single place.

- The Middle East and African region is witnessing a significant adoption of FM software. Integrated FM service providers such as CIT Group in Saudi Arabia, Quality Facility Management (QFM) in Dubai, and others have adopted Connected CaFM as their FM platform for centralized management of in-house and contracted operations, providing complete visibility, control, and increased value.

- The rise in the global IT and telecom industry will enable commercial facility management software expansion. For instance, the telecom players focus on 5G deployments, creating significant opportunities for the region's facilities management sector. Moreover, according to Ericsson, the global 5G population is expected to be 85% by 2029. For example, increased partnerships and collaborations enable building inspection, maintenance, and repair of ventilation, air conditioning, electrical, heating, sanitary systems, instrumentation, and control technology. This will allow the market players to establish a strong position in the market and expand the customer base.

Asia-Pacific Expected to Register Significant Growth

- Numerous trends may propel the facility management software market in Asia-Pacific. For example, the Internet of Things (IoT) refers to physical equipment and sensors that use the Internet to connect with FM teams. They produce performance data that alerts facility managers to potential problems. FM software can monitor and control the processes from any location. It uses IoT to deliver real-time insights into its operations.

- IoT paired with FM software, such as a computerized maintenance management system (CMMS), identifies problems (e.g., uncomfortable office temperatures), inevitably prepares and dispenses work orders without human intervention, and tracks their execution.

- The advent of smart cities and smart buildings in the developing countries in the region is fueling the overall demand for facility management software, which has encouraged the market players in the region to launch new products and services.

- For instance, Telit Cinterion, a global IoT enabler company with critical operations in India, also provides IoT modules, edge-to-cloud services, IoT embedded software, and analytics for facility management software applications. Moreover, the company's services deliver functions like energy usage management and sanitation, which are manual operations in traditional building management. Smart facility solutions automate these processes by combining sensor input and machine learning with connectivity and analytics. With IoT-based facilities management, these functions can be prescheduled and adjusted for maximum efficiency.

- The increase in construction activities and the expansion of residential buildings would contribute to the growth of the Indian facility management software market.

Facility Management Software Industry Overview

The facility management software market is fragmented, with local and international players having decades of industry experience. The facility vendors are incorporating a powerful competitive strategy by leveraging their expertise. Facility software companies are incorporating technologies into their services, strengthening their service portfolio. The major players are IBM Corporation, Broadcom, Oracle Corporation, SAP SE, and Trimble Inc.

- In March 2024, MDS Critical Facilities Services, a service provider for critical infrastructure, partnered with property operations software firm Facilio to implement their cloud-based Connected CaFM solution to optimize and streamline its data center operations. Facilio's Connected CaFM solution enhances efficiency, responsiveness, and overall performance, offering a scalable architecture that aligns with CFS's growing needs. The company's AI-driven platform allows commercial sector end users to aggregate data, optimize performance, and control portfolio operations from a single place.

- In November 2023, Deloitte announced that the company collaborated with IBM to help clients accelerate emissions reduction strategies and make sustainability programs an embedded part of their organization's core business. It will also help monitor performance targets and decarbonization programs, which are integrated with other products from IBM's suite of Sustainability Software solutions, IBM Maximo Application Suite, for asset monitoring, management, predictive maintenance, and reliability planning.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Demand for CAFM Solutions

- 5.1.2 Rising Use of AI and IoT in Facility Management Software

- 5.2 Market Restraints

- 5.2.1 Lack of Proper Integration with the Workflow

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Computer Aided Facility Management (CAFM)

- 6.1.2 Integrated Workplace Management Systems (IWMS)

- 6.1.3 Computerized Maintenance Management Systems (CMMS)

- 6.2 By End User

- 6.2.1 Commercial

- 6.2.2 Institutional

- 6.2.3 Public Infrastructure

- 6.2.4 Industrial

- 6.2.5 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Broadcom

- 7.1.3 Oracle Corporation

- 7.1.4 SAP SE

- 7.1.5 Trimble Inc.

- 7.1.6 Upkeep Maintenance Management

- 7.1.7 Accruent LLC (Fortive Corporation)

- 7.1.8 Planon Software Services Private Limited

- 7.1.9 FTMaintenance (FasTrak SoftWorks Inc.)

- 7.1.10 Eptura