|

市場調查報告書

商品編碼

1876440

全球電動車半導體市場按技術、動力系統、組件、應用和地區分類-預測至2032年EV Semiconductors Market by Technology, Propulsion, Application, Component, and Region - Global Forecast to 2032 |

||||||

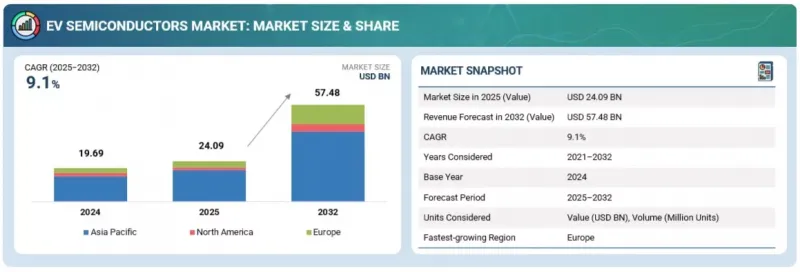

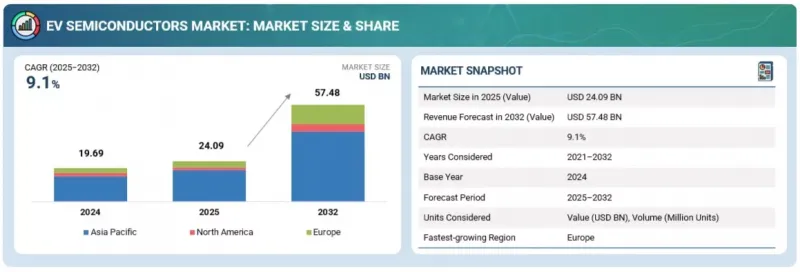

預計電動車半導體市場將從 2025 年的 240.9 億美元成長到 2032 年的 574.8 億美元,複合年成長率為 9.1%。

推動市場成長的因素包括乘用車半導體含量的增加以及向純電動平台的轉型。電動車需要更多的感測器和運算能力來實現安全和自動化功能,因此,與內燃機汽車相比,高級駕駛輔助系統 (ADAS) 對高性能微控制器、雷達和視覺晶片的普及率要求更高。電池電子元件也日益複雜,因為快速充電、延長電池壽命和精確的電池監控都需要高精度類比前端、功率元件和功能安全處理器。

| 調查範圍 | |

|---|---|

| 調查期 | 2021-2032 |

| 基準年 | 2024 |

| 預測期 | 2025-2032 |

| 目標單元 | 數量(百萬)和金額(百萬美元) |

| 部分 | 按技術、推進方式、部件、應用和區域分類 |

| 目標區域 | 亞太地區、歐洲、北美 |

包括碳化矽 (SiC) 和氮化鎵 (GaN) 在內的寬能能隙技術、混合型 SiC-GaN 逆變器以及先進封裝技術,能夠提高效率、降低發熱量,並實現緊湊型高功率設計。美國CHIPS 法案和歐盟 CHIPS 法案等政府主導,正推動德克薩斯(TI)、英飛凌 (Infineon) 和意法半導體 (STMicroelectronics) 等公司在本地擴大晶圓廠規模。軟體定義汽車平臺不斷提升對記憶體和處理能力的需求,而與原始設備製造商 (OEM) 供應商的更緊密合作,則加速了創新進程。高階純電動車 (BEV) 中採用的 800V 架構,推動了先進功率半導體在快速充電和延長續航里程方面的應用。 Audi A6 和賓士 C-Class 等車型採用的 48V 系統,在無需全面採用高壓電動車設計的情況下,滿足了對高效能功率元件的需求,從而支援高負載電力需求。

電池管理系統 (BMS) 應用預計將在電動車半導體市場實現顯著成長。現代 BMS 硬體必須在大容量電池組中提供精確的測量、快速的數據處理和高效的熱控制。要實現電池電壓、溫度、荷電狀態和健康狀態的精確測量,需要先進的微控制器、電源管理 IC、感測器和通訊模組。

2025年4月,義法半導體(STMicroelectronics)發布了其「Stellar with xMemory」微控制器,該微控制器支援軟體驅動的電池控制和靈活的電池均衡架構。同樣,2025年3月,瑞薩電子(Renesas)發布了其「RBMS F」平台,該平台將電量計IC、微控制器和模擬前端(AFE)整合到單一設計中。這透過更快的故障檢測提高了安全性,並最佳化了充放電過程。此外,2025年6月,恩智浦半導體(NXP Semiconductors)完成了對TTTech Auto的收購,增強了其在高能量電池系統即時功能安全計算方面的能力。封裝技術的改進和向更高能量密度電池的轉變也推動了BMS模組內部SiC和GaN基組件的應用,這些組件可以減少發熱量並提高效率。這些進步使得BMS成為北美和中國電動車生產中心半導體需求的最強驅動力之一。

功率整合電路和模組,包括 MOSFET、IGBT 以及 SiC 和 GaN 等寬能能隙裝置,是逆變器、車載充電器和 DC-DC 轉換器的關鍵組件,直接影響車輛的效率、續航里程和散熱性能。保時捷 Taycan 和福特 Mustang Mach-E 均採用基於 SiC 的逆變器,以提高能源效率並實現快速充電。為了體現業界對下一代功率元件規模化的關注,英飛凌和羅姆於 2025 年 3 月簽署的關於 SiC 功率封裝的合作備忘錄 (MOU) 凸顯了業界在下一代功率元件規模化方面所做的努力。同樣,意法半導體於 2025 年 9 月對面板級封裝的投資也將進一步提高汽車功率半導體的效率和可靠性。

高性能純電動車 (BEV) 加速採用 800V 平台,以及全球電動車產量的擴張,正在推動對高效能功率元件的需求。對混合 SiC-GaN 解決方案和先進溫度控管封裝的投資,正幫助原始設備製造商 (OEM) 實現高功率密度、更低的損耗和更佳的系統整體可靠性,使功率半導體領域成為電動車半導體市場的關鍵驅動力。

受乘用車電氣化程度不斷提高以及強大的區域汽車製造業基礎的推動,歐洲電動車半導體市場預計將迎來顯著成長。大眾、寶馬和Stellantis等主要汽車製造商正在擴大其純電動車產品線,並投資於軟體定義汽車平臺,從而增加了對高性能微控制器、電力電子裝置和雷達/ADAS晶片的需求。同時,中國主要汽車製造商也在歐洲建立製造地。例如,比亞迪於2025年3月宣布計劃在匈牙利新建一座工廠,以服務歐洲市場。歐盟晶片法案是推動這一成長的關鍵因素,該法案旨在透過超過465億美元的公共和私人投資,到2030年將歐洲在全球半導體市場的佔有率加倍,達到20%,從而增強汽車晶片等關鍵零件的自給自足能力和供應鏈韌性。

該地區的主要投資包括英飛凌在德累斯頓投資49億美元的擴建項目、意法半導體在卡塔尼亞投資55億美元的碳化矽晶圓廠計劃,以及意法半導體和格羅方德在法國格勒諾布爾附近投資82億美元的FD-SOI晶圓廠合資項目。包括英飛凌科技和意法半導體在內的歐洲供應商正在擴大碳化矽和氮化鎵的生產,以滿足對高效能逆變器和車載充電器的需求。加之政府對電氣化的支持、電動車強制令以及對節能型汽車電子產品的獎勵,這些舉措使歐洲成為電動車半導體市場的關鍵成長區域。

本報告分析了全球電動汽車半導體市場,提供了按技術、推進方式、組件、應用和地區分類的趨勢資訊,以及參與該市場的公司的概況。

目錄

第1章 引言

第2章執行摘要

第3章重要考察

第4章 市場概覽

- 介紹

- 市場動態

- 未滿足的需求和差距

- 相互關聯的市場與跨產業機遇

- 一級/二級/三級公司的策略性舉措

第5章 產業趨勢

- 總體經濟指標

- 生態系分析

- 供應鏈分析

- 定價分析

- 影響客戶業務的趨勢/干擾因素

- 投資和資金籌措方案

- 按用例資金籌措

- 大型會議和活動

- 貿易分析

- 案例研究分析

- 2025年美國關稅

第6章:技術進步、人工智慧的影響、專利、創新與未來應用

- 主要技術

- 互補技術

- 鄰近技術

- 技術藍圖

- 專利分析

- 未來應用

- 人工智慧/生成式人工智慧的影響

- 成功案例和實際應用

- 區域半導體熱點地區及本地化趨勢

- SiC與GaN晶圓集中度的供應鏈風險

- 政策影響半導體採購

- 下一代半導體成本趨勢

- 半導體在電動車零件中的佔有率

- 採購模式:多供應商模式與專屬式模式

- 未來電動車車型發布計畫和半導體需求

第7章永續性和監管環境

- 地方法規和合規性

- 對永續性的承諾

- 永續性影響和監管政策舉措

- 認證、標籤和環境標準

第8章:顧客狀況與購買行為

- 決策流程

- 買方相關人員和採購評估標準

- 招募障礙和內部挑戰

- 來自各個終端使用者產業的未滿足需求

- 市場盈利

第9章:電動車半導體市場(依技術分類)

- 介紹

- 矽基半導體

- 寬能能隙半導體

- 關鍵見解

第10章:電動車半導體市場(依動力系統分類)

- 介紹

- 電動車

- PHEV

- 關鍵見解

第11章:電動車半導體市場(按組件分類)

- 介紹

- 電源積體電路和模組

- 微控制器和處理器

- 離散的

- 通訊和介面積體電路

- 感測器積體電路

- 閘極驅動器積體電路

- 記憶體和儲存積體電路

- 其他

- 關鍵見解

第12章 電動車半導體市場(依應用領域分類)

- 介紹

- BMS

- 動力傳動系統系統

- ADAS

- 車身和底盤

- 資訊娛樂和互聯

- 關鍵見解

第13章:電動車半導體市場(按地區分類)

- 介紹

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 歐洲

- 德國

- 法國

- 義大利

- 西班牙

- 英國

- 北美洲

- 美國

- 加拿大

- 墨西哥

第14章 競爭格局

- 介紹

- 主要參與企業的策略/優勢,2022-2025年

- 2024年市佔率分析

- 2020-2024年收入分析

- 估值和財務指標

- 品牌/產品對比

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:新興企業/中小企業,2024 年

- 競爭場景

第15章:公司簡介

- 主要參與企業

- INFINEON TECHNOLOGIES AG

- STMICROELECTRONICS

- NXP SEMICONDUCTORS

- TEXAS INSTRUMENTS INCORPORATED

- RENESAS ELECTRONICS CORPORATION

- QUALCOMM TECHNOLOGIES, INC.

- NVIDIA CORPORATION

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- ANALOG DEVICES, INC.

- ROBERT BOSCH GMBH

- MICRON TECHNOLOGY, INC.

- MICROCHIP TECHNOLOGY INC.

- 其他公司

- TOSHIBA CORPORATION

- POLAR SEMICONDUCTOR, LLC

- ROHM CO., LTD.

- MARVELL

- BROADCOM

- MITSUBISHI ELECTRIC CORPORATION

- STARPOWER SEMICONDUCTOR LTD.

- SEMIKRON DANFOSS

- CAMBRIDGE GAN DEVICES

- HUAWEI TECHNOLOGIES CO., LTD.

- BOS SEMICONDUCTORS

- ENSILICA

- INDIE

第16章調查方法

第17章附錄

The EV semiconductors market is projected to reach USD 57.48 billion in 2032, growing from USD 24.09 billion in 2025, at a CAGR of 9.1%. The market's growth is driven by increasing semiconductor content per passenger car and the shift to fully electric platforms. EVs use more sensors and computing for safety and automation features, so ADAS requires high-performance MCUs, radar, and vision chips at higher penetration than ICE vehicles. Battery electronics are becoming more advanced because fast charging, longer cycle life, and precise cell monitoring need high-accuracy analog front ends, power devices, and functional safety processors.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (Million Units) and Value (USD Million) |

| Segments | Technology, Propulsion, Application, Component Type |

| Regions covered | Asia Pacific, Europe, and North America |

Wide-bandgap technologies, including SiC and GaN, hybrid SiC GaN inverters, and advanced packaging, improve efficiency, lower heat, and enable compact high-power designs. Government initiatives, such as the US CHIPS Act and the EU Chips Act, drive local fab expansion by Texas Instruments, Infineon, and STMicroelectronics. Software-defined vehicle platforms increase the demand for memory and processing, and tighter OEM supplier collaboration accelerates innovation. 800V architectures in premium BEVs are pushing the adoption of advanced power semiconductors for faster charging and a longer range. 48V systems in models like Audi A6 and Mercedes-Benz C Class sustain demand for efficient power devices to support high electrical load without moving to full high voltage EV designs.

"Battery management system applications are expected to witness notable demand in the EV semiconductors market during the forecast period."

Battery management system applications are set to witness substantial growth in the EV semiconductors market. Modern BMS hardware must deliver precise measurement, fast data processing, and efficient thermal control inside large battery packs. Advanced microcontrollers, power management ICs, sensors, and communication modules are required to achieve cell voltage, temperature, charge state, and health accuracy.

In April 2025, STMicroelectronics announced its Stellar with xMemory MCUs that support software-driven battery control and flexible cell balancing architectures. Similarly, in March 2025, Renesas launched the RBMS F platform, which combines fuel gauge ICs, microcontrollers, and analog front ends in one design that improves safety through faster fault detection and optimizes charging and discharging. Likewise, in June 2025, NXP Semiconductors completed its acquisition of TTTech Auto to enhance real-time functional safety computing for high-energy battery systems. Packaging improvements and shifting toward high-power-density batteries also increase the use of SiC and GaN-based components inside BMS modules because they reduce heat and improve efficiency. These developments make BMS one of North America and China's strongest semiconductor demand drivers across EV production hubs.

"By component type, the power ICs & modules segment is projected to register strong growth in the EV semiconductors market during the forecast period."

Power ICs & modules, including MOSFETs, IGBTs, and wide-bandgap devices such as SiC and GaN, are critical for inverters, onboard chargers, and DC-DC converters and directly impact vehicle efficiency, range, and thermal performance. Porsche Taycan and Ford Mustang Mach-E employ SiC-based inverters to enhance energy efficiency and enable faster charging. Reflecting the industry's focus on scaling these next-generation power devices, Infineon and ROHM's March 2025 memorandum of understanding to collaborate on SiC power packages highlights industry efforts to scale next-generation power devices. Similarly, STMicroelectronics' investment in September 2025 in panel-level packaging further improves the efficiency and reliability of power semiconductors for automotive applications.

The accelerated adoption of 800V platforms in high-performance BEVs and ongoing global EV production are increasing the demand for high-efficiency power devices. Investments in hybrid SiC-GaN solutions and advanced thermal management packaging are helping OEMs achieve high power density, low losses, and improved overall system reliability, positioning the power semiconductor segment as a significant growth driver in the EV semiconductors market.

"Europe is projected to witness significant growth in the EV semiconductors market during the forecast period."

Europe is projected to experience significant growth in the EV semiconductors market, driven by the increasing passenger car electrification and strong regional automotive manufacturing. Leading OEMs such as Volkswagen, BMW, and Stellantis are expanding BEV lineups and investing in software-defined vehicle platforms, increasing demand for high-performance MCUs, power electronics, and radar/ADAS chips. At the same time, key Chinese OEMs are establishing European manufacturing presence. For instance, in March 2025, BYD announced plans for a new plant in Hungary to serve the European market. The EU Chips Act is a primary catalyst, aiming to double Europe's global semiconductor market share to 20% by 2030 through over USD 46.5 billion in public and private investment, fostering self-sufficiency and supply chain resilience for critical components like automotive chips.

Key investments in the region include Infineon's investment of USD 4.9 billion for expansion in Dresden, STMicroelectronics' SiC fab project worth USD 5.5 billion in Catania, and joint ventures (USD 8.2 billion FD-SOI fab by ST and GlobalFoundries near Grenoble, France). European suppliers, including Infineon Technologies AG and STMicroelectronics, are scaling SiC and GaN production to meet demand for high-efficiency inverters and onboard chargers. Combined with government support for electrification, EV mandates, and incentives for energy-efficient vehicle electronics, these developments position Europe as a key growth region for the EV semiconductors market.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Tier I - 41%, Tier II - 36%, and Tier III - 23%

- By Designation: Directors - 32%, Managers - 47%, and Others - 21%

- By Region: Asia Pacific - 27%, North America - 42%, and Europe - 31%

The EV semiconductors market is dominated by major players, including Infineon Technologies AG (Germany), STMicroelectronics (Switzerland), NXP Semiconductors (Netherlands), Texas Instruments Incorporated (US), Renesas Electronics Corporation (Japan), and more. These companies are expanding their portfolios to strengthen their market position.

Research Coverage:

The report covers the EV semiconductors market in terms of Technology (Silicon-based Semiconductor, Wide-Bandgap Semiconductor), Propulsion [Battery Electric Vehicle (BEV) and Plug-In Hybrid Electric Vehicle (PHEV)], Application (Battery Management System, Powertrain System, ADAS, Body & Chassis, and Infotainment & Connectivity), Component Type (Power ICs & Modules, Microcontrollers & Processors, Discretes, Communication & Interface ICs, Sensor ICs, Gate Driver ICs, Memory & Storage ICs, Other Semiconductors), and Region. It covers the competitive landscape and company profiles of significant players in the EV semiconductors market. The study includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the EV semiconductors market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report will also help stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report will also help stakeholders understand the EV semiconductors market's current and future pricing trends.

- The report will also help market leaders/new entrants with information on various market trends based on technology, propulsion, application, component type, and Region.

The report provides insight into the following pointers:

- Analysis of key drivers (Rising EV adoption, high semiconductor content per EV, technological advancements in chip design and integration), restraints (Long qualification cycles and strict automotive reliability standards; high cost of advanced materials; and geopolitical, trade, and export control risks; fragmented standards and interoperability challenges), opportunities (Growth in wide-bandgap materials, expansion in emerging markets, tier-1 and OEM partnerships/co-development), and challenges (Intense competition and margin pressure; cybersecurity, safety, and liability concerns).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the EV semiconductors market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the EV semiconductors market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players like Infineon Technologies AG (Germany), STMicroelectronics (Switzerland), NXP Semiconductors (Netherlands), Texas Instruments Incorporated (US), and Renesas Electronics Corporation (Japan), among others, in the EV semiconductors market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EV SEMICONDUCTORS MARKET

- 3.2 EV SEMICONDUCTORS MARKET, BY TECHNOLOGY

- 3.3 EV SEMICONDUCTORS MARKET, BY PROPULSION

- 3.4 EV SEMICONDUCTORS MARKET, BY APPLICATION

- 3.5 EV SEMICONDUCTORS MARKET, BY COMPONENT

- 3.6 EV SEMICONDUCTORS MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Increased semiconductor content in EVs

- 4.2.1.2 Innovations in chip design and integration

- 4.2.1.3 Heightened EV adoption

- 4.2.1.4 Rapid evolution of EV architectures

- 4.2.2 RESTRAINTS

- 4.2.2.1 Long qualification cycles and strict automotive reliability standards

- 4.2.2.2 High cost of advanced materials

- 4.2.2.3 Fragmented standards and limited interoperability

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Extensive use of wide-bandgap materials

- 4.2.3.2 Expansion into emerging markets

- 4.2.3.3 Collaborations between Tier 1s and OEMs

- 4.2.3.4 Emerging applications of EV semiconductors

- 4.2.4 CHALLENGES

- 4.2.4.1 Stiff competition and margin pressure

- 4.2.4.2 Cybersecurity, safety, and liability concerns

- 4.2.4.3 Geopolitical, trade, and export control risks

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 POWER ELECTRONICS FOR 800V SYSTEMS

- 4.3.2 EV ARCHITECTURE AND COMPUTING

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 MACROECONOMIC INDICATORS

- 5.1.1 INTRODUCTION

- 5.1.2 GDP TRENDS AND FORECAST

- 5.1.3 TRENDS IN GLOBAL EV INDUSTRY

- 5.1.4 TRENDS IN GLOBAL AUTOMOTIVE AND TRANSPORTATION INDUSTRY

- 5.2 ECOSYSTEM ANALYSIS

- 5.2.1 RAW MATERIAL SUPPLIERS

- 5.2.2 CHIP DESIGN COMPANIES

- 5.2.3 FOUNDRIES

- 5.2.4 OSAT PROVIDERS

- 5.2.5 COMPONENT MANUFACTURERS

- 5.2.6 TIER-1 SUPPLIERS

- 5.2.7 OEMS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF EV SEMICONDUCTORS OFFERED BY KEY PLAYERS

- 5.4.2 AVERAGE SELLING PRICE TREND, BY TECHNOLOGY

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 FUNDING, BY USE CASE

- 5.8 KEY CONFERENCES AND EVENTS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8541)

- 5.9.2 EXPORT SCENARIO (HS CODE 8541)

- 5.9.3 TRADE RESTRICTIONS

- 5.9.4 US-CHINA EXPORT BANS

- 5.9.5 EU SUBSIDY RACE

- 5.9.6 IMPACT OF LOCALIZATION POLICIES ON SOURCING

- 5.9.7 CXO PRIORITIES

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ELECTROTHERMAL SIMULATION FOR AEC COMPLIANCE IN AUTOMOTIVE SMART FET DRIVERS

- 5.10.2 SMART DATA CONTROL ROOM INTEGRATION FOR SEMICONDUCTOR MANUFACTURING OPTIMIZATION

- 5.10.3 LEGACY SEMICONDUCTOR FAB MODERNIZATION THROUGH ADVANCED AUTOMATION PLATFORM

- 5.10.4 RAPID EV MOTOR CONTROL UNIT DEVELOPMENT THROUGH SEMICONDUCTOR SENSOR INTEGRATION

- 5.10.5 POWER ELECTRONICS AND COMPOUND SEMICONDUCTORS ACCELERATE EV INNOVATION

- 5.10.6 BYD ADVANCES EV SEMICONDUCTOR INNOVATION WITH 1500V SIC CHIPS FOR 1000V SUPER E-PLATFORM

- 5.10.7 WIDE-BANDGAP SEMICONDUCTORS ENABLING 800V POWERTRAIN

- 5.11 2025 US TARIFF

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.5 IMPACT ON AUTOMOTIVE INDUSTRY

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 SIC MOSFETS AND JFETS

- 6.1.2 800V TRACTION INVERTERS

- 6.1.3 GAN HEMTS

- 6.1.4 COMPACT ONBOARD CHARGERS AND DC-DC CONVERTERS

- 6.1.5 HYBRID SIC-GAN MODULES

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ADVANCED PACKAGING AND INTEGRATION

- 6.2.2 NEXT-GENERATION SENSOR SEMICONDUCTORS

- 6.2.3 POWER AND CONTROL ICS

- 6.2.4 HIGH-VOLTAGE INTERCONNECTS

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 AI AND EDGE PROCESSING CHIPS

- 6.3.2 V2X AND CONNECTIVITY SEMICONDUCTORS

- 6.4 TECHNOLOGY ROADMAP

- 6.5 PATENT ANALYSIS

- 6.6 FUTURE APPLICATIONS

- 6.7 IMPACT OF AI/GEN AI

- 6.7.1 TOP USE CASES AND MARKET POTENTIAL

- 6.7.2 BEST PRACTICES

- 6.7.3 CASE STUDIES

- 6.7.4 ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.7.5 CLIENTS' READINESS TO ADOPT AI/GEN AI

- 6.8 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.8.1 INFINEON TECHNOLOGIES AG: AI-ENHANCED POWER MODULE OPTIMIZATION

- 6.8.2 TEXAS INSTRUMENTS INCORPORATED: PREDICTIVE SEMICONDUCTOR MANUFACTURING

- 6.8.3 STMICROELECTRONICS: AI-ASSISTED DESIGN AND VERIFICATION

- 6.8.4 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY: AI-DRIVEN YIELD AND SUPPLY CHAIN RESILIENCE

- 6.9 REGIONAL SEMICONDUCTOR HOTSPOTS AND LOCALIZATION DYNAMICS

- 6.10 SUPPLY CHAIN RISKS IN SIC AND GAN WAFER CONCENTRATION

- 6.11 POLICY DRIVES SHAPING SEMICONDUCTOR SOURCING

- 6.12 COST TRAJECTORIES FOR NEXT-GENERATION SEMICONDUCTORS

- 6.13 SEMICONDUCTOR SHARE OF EV BILL OF MATERIALS

- 6.14 SOURCING MODELS: MULTI-SUPPLIER VS. CAPTIVE DESIGN

- 6.15 FUTURE EV MODEL LAUNCH PIPELINE AND SEMICONDUCTOR DEMAND

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

9 EV SEMICONDUCTORS MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 SILICON-BASED SEMICONDUCTOR

- 9.2.1 STRONG ECOSYSTEM FOR MCUS, SENSORS, AND POWER ICS TO DRIVE MARKET

- 9.3 WIDE-BANDGAP SEMICONDUCTOR

- 9.3.1 SOFTWARE-BASED ARCHITECTURE, ADAS ADVANCEMENTS, AND SHIFT TO 800V EV ARCHITECTURE TO DRIVE MARKET

- 9.4 PRIMARY INSIGHTS

10 EV SEMICONDUCTORS MARKET, BY PROPULSION

- 10.1 INTRODUCTION

- 10.2 BEV

- 10.2.1 ADOPTION OF SIC/GAN POWER DEVICES FOR TRACTION INVERTERS TO DRIVE MARKET

- 10.3 PHEV

- 10.3.1 DEMAND FOR DUAL-MODE BMS ICS AND POWER MODULES FOR MULTI-VOLTAGE SYSTEMS TO DRIVE MARKET

- 10.4 PRIMARY INSIGHTS

11 EV SEMICONDUCTORS MARKET, BY COMPONENT

- 11.1 INTRODUCTION

- 11.2 POWER IC & MODULE

- 11.2.1 TRANSITION TO HIGH-VOLTAG EV ARCHITECTURE AND WBG MATERIALS TO DRIVE MARKET

- 11.3 MICROCONTROLLER & PROCESSOR

- 11.3.1 GROWTH OF ZONAL/DOMAIN CONTROLLERS AND REAL-TIME SENSOR FUSION FOR ADAS TO DRIVE MARKET

- 11.4 DISCRETE

- 11.4.1 INCREASE IN 48V SUBSYSTEMS FOR BODY AND COMFORT ELECTRONICS TO DRIVE MARKET

- 11.5 COMMUNICATION & INTERFACE IC

- 11.5.1 DEPLOYMENT OF MULTI-PROTOCOL 10 GBPS ETHERNET & V2X AND TELEMATICS GATEWAYS TO DRIVE MARKET

- 11.6 SENSOR IC

- 11.6.1 RAPID SENSOR PROLIFERATION FOR LIDAR, IMAGING RADAR, AND BMS TO DRIVE MARKET

- 11.7 GATE DRIVER IC

- 11.7.1 PRECISION CONTROL OF HIGH-SPEED SIC/GAN MOSFETS TO DRIVE MARKET

- 11.8 MEMORY & STORAGE IC

- 11.8.1 HIGH-BANDWIDTH DRAM FOR INFOTAINMENT AND RESILIENT NAND STORAGE FOR OTA/DIAGNOSTICS TO DRIVE MARKET

- 11.9 OTHER SEMICONDUCTORS

- 11.10 PRIMARY INSIGHTS

12 EV SEMICONDUCTORS MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 BMS

- 12.2.1 FOCUS ON CELL-LEVEL MONITORING AND COMPLEX THERMAL MANAGEMENT TO DRIVE MARKET

- 12.3 POWERTRAIN SYSTEM

- 12.3.1 SIC MOSFET TRANSITION AND INTEGRATED GATE DRIVERS TO DRIVE MARKET

- 12.4 ADAS

- 12.4.1 HIGHER LEVEL OF AUTONOMY AND HIGH-SPEED IN-VEHICLE NETWORKS TO DRIVE MARKET

- 12.5 BODY & CHASSIS

- 12.5.1 ELECTRIFICATION OF MECHANICAL SYSTEMS AND SHIFT TO ZONAL CONTROLLERS TO DRIVE MARKET

- 12.6 INFOTAINMENT & CONNECTIVITY

- 12.6.1 INNOVATION IN SDV ARCHITECTURE, OTA UPDATES, AND HIGH-SPEED CONNECTIVITY MODULES TO DRIVE MARKET

- 12.7 PRIMARY INSIGHTS

13 EV SEMICONDUCTORS MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 CHINA

- 13.2.1.1 Local semiconductor production scale and localization efforts for SiC/GaN semiconductors to drive market

- 13.2.2 INDIA

- 13.2.2.1 Government incentives for local manufacturing and substantial investments by OEMs to drive market

- 13.2.3 JAPAN

- 13.2.3.1 Power semiconductor leadership and high ADAS integration to drive market

- 13.2.4 SOUTH KOREA

- 13.2.4.1 Strong local EV battery supply chains and high export focus to drive market

- 13.2.1 CHINA

- 13.3 EUROPE

- 13.3.1 GERMANY

- 13.3.1.1 Premium EV platforms with high semiconductor content to drive market

- 13.3.2 FRANCE

- 13.3.2.1 Growing ADAS integration in passenger EVs to drive market

- 13.3.3 ITALY

- 13.3.3.1 SiC FAB scale-ups and robust supplier ecosystem to drive market

- 13.3.4 SPAIN

- 13.3.4.1 EU funding alignment and strong local manufacturing hub to drive market

- 13.3.5 UK

- 13.3.5.1 Increased SiC production and government-supported industrialization and development centers to drive market

- 13.3.1 GERMANY

- 13.4 NORTH AMERICA

- 13.4.1 US

- 13.4.1.1 Rigorous onshoring policies and supporting government funding to drive market

- 13.4.2 CANADA

- 13.4.2.1 Strong automotive semiconductor R&D and growing IC design hubs to drive market

- 13.4.3 MEXICO

- 13.4.3.1 Export-focused assembly hubs and integration into North American supply chains to drive market

- 13.4.1 US

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2020-2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Technology footprint

- 14.7.5.4 Application footprint

- 14.7.5.5 Propulsion footprint

- 14.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING

- 14.8.5.1 List of start-ups/SMEs

- 14.8.5.2 Competitive benchmarking of start-ups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 INFINEON TECHNOLOGIES AG

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches/developments

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Expansions

- 15.1.1.3.4 Other developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 STMICROELECTRONICS

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches/developments

- 15.1.2.3.2 Deals

- 15.1.2.3.3 Expansions

- 15.1.2.3.4 Other developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 NXP SEMICONDUCTORS

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches/developments

- 15.1.3.3.2 Deals

- 15.1.3.3.3 Expansions

- 15.1.3.3.4 Other developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 TEXAS INSTRUMENTS INCORPORATED

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches/developments

- 15.1.4.3.2 Deals

- 15.1.4.3.3 Expansions

- 15.1.4.3.4 Other developments

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 RENESAS ELECTRONICS CORPORATION

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches/developments

- 15.1.5.3.2 Deals

- 15.1.5.3.3 Expansions

- 15.1.5.3.4 Other developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 QUALCOMM TECHNOLOGIES, INC.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches/developments

- 15.1.6.3.2 Expansions

- 15.1.7 NVIDIA CORPORATION

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches/developments

- 15.1.7.3.2 Deals

- 15.1.8 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches/developments

- 15.1.8.3.2 Deals

- 15.1.8.3.3 Expansions

- 15.1.9 ANALOG DEVICES, INC.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.9.3.2 Expansions

- 15.1.10 ROBERT BOSCH GMBH

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product launches/developments

- 15.1.10.3.2 Deals

- 15.1.10.3.3 Expansions

- 15.1.11 MICRON TECHNOLOGY, INC.

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Expansions

- 15.1.11.3.2 Other developments

- 15.1.12 MICROCHIP TECHNOLOGY INC.

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Product launches/developments

- 15.1.12.3.2 Deals

- 15.1.12.3.3 Expansions

- 15.1.1 INFINEON TECHNOLOGIES AG

- 15.2 OTHER PLAYERS

- 15.2.1 TOSHIBA CORPORATION

- 15.2.2 POLAR SEMICONDUCTOR, LLC

- 15.2.3 ROHM CO., LTD.

- 15.2.4 MARVELL

- 15.2.5 BROADCOM

- 15.2.6 MITSUBISHI ELECTRIC CORPORATION

- 15.2.7 STARPOWER SEMICONDUCTOR LTD.

- 15.2.8 SEMIKRON DANFOSS

- 15.2.9 CAMBRIDGE GAN DEVICES

- 15.2.10 HUAWEI TECHNOLOGIES CO., LTD.

- 15.2.11 BOS SEMICONDUCTORS

- 15.2.12 ENSILICA

- 15.2.13 INDIE

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 Secondary sources

- 16.1.1.2 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 Primary interviews: demand and supply sides

- 16.1.2.2 Breakdown of primary interviews

- 16.1.2.3 Primary participants

- 16.1.1 SECONDARY DATA

- 16.2 MARKET SIZE ESTIMATION

- 16.2.1 BOTTOM-UP APPROACH

- 16.2.2 TOP-DOWN APPROACH

- 16.3 DATA TRIANGULATION

- 16.4 FACTOR ANALYSIS

- 16.5 RESEARCH ASSUMPTIONS

- 16.6 RESEARCH LIMITATIONS

- 16.7 RISK ASSESSMENT

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.4.1 EV SEMICONDUCTORS MARKET FOR HYBRID ELECTRIC VEHICLES AT REGIONAL LEVEL (FOR COUNTRIES COVERED IN REPORT)

- 17.4.2 EV SEMICONDUCTORS MARKET, BY TECHNOLOGY, FOR ADDITIONAL COUNTRIES (FOR COUNTRIES NOT COVERED IN REPORT)

- 17.4.3 COMPANY INFORMATION (PROFILING OF UP TO FIVE ADDITIONAL MARKET PLAYERS)

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS

List of Tables

- TABLE 1 MARKET DEFINITION, BY TECHNOLOGY

- TABLE 2 MARKET DEFINITION, BY PROPULSION

- TABLE 3 MARKET DEFINITION, BY APPLICATION

- TABLE 4 MARKET DEFINITION, BY COMPONENT

- TABLE 5 CURRENCY EXCHANGE RATES, 2019-2024

- TABLE 6 AUTOMOTIVE SEMICONDUCTOR QUALIFICATION STANDARDS

- TABLE 7 SI VS. SIC VS. GAN

- TABLE 8 COMPARISON BETWEEN WIDE-BANDGAP MATERIALS

- TABLE 9 GROWTH IN EV ADOPTION IN SPECIFIC MARKETS

- TABLE 10 COLLABORATIONS BETWEEN TIER 1S AND OEMS

- TABLE 11 STRATEGIC OPPORTUNITIES IN NEXT-GEN EV SILICON

- TABLE 12 VEHICULAR CYBERATTACKS

- TABLE 13 TRADE RESTRICTIONS AND TARIFF IMPACT ON AUTOMOTIVE SEMICONDUCTORS IN US

- TABLE 14 IMPACT OF MARKET DYNAMICS

- TABLE 15 UNMET TECHNOLOGY NEEDS AND WHITE SPACES IN 800V POWER ELECTRONICS

- TABLE 16 EMERGING SEMICONDUCTOR OPPORTUNITIES IN ZONAL AND SDV ARCHITECTURES

- TABLE 17 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS IN EV SEMICONDUCTORS MARKET

- TABLE 18 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021-2030

- TABLE 19 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 20 AVERAGE SELLING PRICE OF EV SEMICONDUCTORS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 21 AVERAGE SELLING PRICE TREND, BY TECHNOLOGY, 2022-2024 (USD)

- TABLE 22 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- TABLE 23 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 24 IMPORT DATA FOR HS CODE 8541-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 25 EXPORT DATA FOR HS CODE 8541-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 26 TRADE RESTRICTIONS AND EFFECT ON EV SEMICONDUCTOR SUPPLY

- TABLE 27 US-CHINA EXPORT BANS TIMELINE AND EFFECT ON AUTOMOTIVE SEMICONDUCTORS

- TABLE 28 EU SUBSIDIES AND EFFECT ON AUTOMOTIVE SEMICONDUCTORS

- TABLE 29 LOCALIZATION EFFECT BY SEMICONDUCTOR CATEGORY ON OEM SOURCING

- TABLE 30 TARIFF SNAPSHOT FOR SEMICONDUCTOR-RELATED GOODS

- TABLE 31 IMPACT OF TARIFFS ON EV COMPONENT COSTS

- TABLE 32 REGIONAL EXPOSURE PROFILE

- TABLE 33 INDUSTRY-LEVEL EXPOSURE AND MITIGATION ACTIONS

- TABLE 34 CURRENT STATUS AND SHORT/MID/LONG-TERM PROSPECTS OF SILICON-BASED AND WIDE-BANDGAP SEMICONDUCTORS

- TABLE 35 PATENTS ANALYSIS

- TABLE 36 FUTURE APPLICATIONS OF EV SEMICONDUCTORS

- TABLE 37 TOP USE CASES AND MARKET POTENTIAL

- TABLE 38 COMPANIES IMPLEMENTING AI/GEN AI

- TABLE 39 CASE STUDIES OF AI/GEN AI IMPLEMENTATION IN EV SEMICONDUCTORS MARKET

- TABLE 40 ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 41 REGIONAL SEMICONDUCTOR HOTSPOTS AND LOCALIZATION DYNAMICS

- TABLE 42 SUPPLY CHAIN RISKS IN SIC AND GAN WAFER CONCENTRATION

- TABLE 43 POLICY DRIVES IN MAJOR ECONOMIES AFFECTING SEMICONDUCTORS MARKET

- TABLE 44 SEMICONDUCTOR SHARE OF EV BILL OF MATERIALS

- TABLE 45 ANALYSIS OF OEM SEMICONDUCTOR SOURCING MODELS

- TABLE 46 COMPARATIVE ANALYSIS OF SEMICONDUCTOR STRATEGIES, BY OEM

- TABLE 47 EV LAUNCH PIPELINE AND SEMICONDUCTOR DEMAND

- TABLE 48 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 49 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 50 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 51 GLOBAL INDUSTRY STANDARDS

- TABLE 52 POLICY INITIATIVES AFFECTING SUSTAINABILITY IN EV SEMICONDUCTORS MARKET

- TABLE 53 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

- TABLE 54 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TECHNOLOGY (%)

- TABLE 55 KEY BUYING CRITERIA, BY TECHNOLOGY

- TABLE 56 AUTOMOTIVE SEMICONDUCTOR PROFITABILITY, BY COMPONENT

- TABLE 57 TECHNOLOGY COMPARISON IN EV SEMICONDUCTORS

- TABLE 58 EV SEMICONDUCTORS MARKET, BY TECHNOLOGY, 2021-2024 (USD BILLION)

- TABLE 59 EV SEMICONDUCTORS MARKET, BY TECHNOLOGY, 2025-2032 (USD BILLION)

- TABLE 60 SILICON-BASED SEMICONDUCTOR OFFERINGS BY KEY PROVIDERS

- TABLE 61 SILICON-BASED EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 62 SILICON-BASED EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 63 WIDE-BANDGAP SEMICONDUCTOR OFFERINGS BY KEY PROVIDERS

- TABLE 64 WIDE-BANDGAP EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 65 WIDE-BANDGAP EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 66 EV SEMICONDUCTORS MARKET, BY PROPULSION, 2021-2024 (USD BILLION)

- TABLE 67 EV SEMICONDUCTORS MARKET, BY PROPULSION, 2025-2032 (USD BILLION)

- TABLE 68 SEMICONDUCTOR LAUNCHES/AGREEMENTS FOR BEVS, 2024-2025

- TABLE 69 BEV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 70 BEV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 71 SEMICONDUCTOR LAUNCHES/AGREEMENTS FOR PHEVS, 2024-2025

- TABLE 72 PHEV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 73 PHEV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 74 EV SEMICONDUCTORS MARKET, BY COMPONENT, 2021-2024 (USD BILLION)

- TABLE 75 EV SEMICONDUCTORS MARKET, BY COMPONENT, 2025-2032 (USD BILLION)

- TABLE 76 POWER IC & MODULE: EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 77 POWER IC & MODULE: EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 78 MICROCONTROLLER & PROCESSOR: EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 79 MICROCONTROLLER & PROCESSOR: EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 80 DISCRETE: EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 81 DISCRETE: EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 82 COMMUNICATION & INTERFACE IC: EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 83 COMMUNICATION & INTERFACE IC: EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 84 SENSOR IC: EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 85 SENSOR IC: EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 86 GATE DRIVER IC: EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 87 GATE DRIVER IC: EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 88 MEMORY & STORAGE IC: EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 89 MEMORY & STORAGE IC: EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 90 OTHER SEMICONDUCTORS: EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 91 OTHER SEMICONDUCTORS: EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 92 EV SEMICONDUCTORS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 93 EV SEMICONDUCTORS MARKET, BY APPLICATION, 2025-2032 (USD BILLION)

- TABLE 94 BMS: EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 95 BMS: EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 96 POWERTRAIN SYSTEM: EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 97 POWERTRAIN SYSTEM: EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 98 ADAS: EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 99 ADAS: EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 100 BODY & CHASSIS: EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 101 BODY & CHASSIS: EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 102 INFOTAINMENT & CONNECTIVITY: EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 103 INFOTAINMENT & CONNECTIVITY: EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 104 EV SEMICONDUCTORS MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 105 EV SEMICONDUCTORS MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 106 ASIA PACIFIC: EV SEMICONDUCTORS MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 107 ASIA PACIFIC: EV SEMICONDUCTORS MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- TABLE 108 CHINA: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 109 CHINA: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2025-2032 (USD BILLION)

- TABLE 110 INDIA: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 111 INDIA: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2025-2032 (USD BILLION)

- TABLE 112 JAPAN: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 113 JAPAN: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2025-2032 (USD BILLION)

- TABLE 114 SOUTH KOREA: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 115 SOUTH KOREA: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2025-2032 (USD BILLION)

- TABLE 116 EUROPE: EV SEMICONDUCTORS MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 117 EUROPE: EV SEMICONDUCTORS MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- TABLE 118 GERMANY: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 119 GERMANY: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2025-2032 (USD BILLION)

- TABLE 120 FRANCE: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 121 FRANCE: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2025-2032 (USD BILLION)

- TABLE 122 ITALY: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 123 ITALY: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2025-2032 (USD BILLION)

- TABLE 124 SPAIN: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 125 SPAIN: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2025-2032 (USD BILLION)

- TABLE 126 UK: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 127 UK: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2025-2032 (USD BILLION)

- TABLE 128 NORTH AMERICA: EV SEMICONDUCTORS MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 129 NORTH AMERICA: EV SEMICONDUCTORS MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- TABLE 130 US: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 131 US: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2025-2032 (USD BILLION)

- TABLE 132 CANADA: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 133 CANADA: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2025-2032 (USD BILLION)

- TABLE 134 MEXICO: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 135 MEXICO: EV SEMICONDUCTORS MARKET, BY APPLICATION, 2025-2032 (USD BILLION)

- TABLE 136 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- TABLE 137 EV SEMICONDUCTORS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 138 REGION FOOTPRINT

- TABLE 139 TECHNOLOGY FOOTPRINT

- TABLE 140 APPLICATION FOOTPRINT

- TABLE 141 PROPULSION FOOTPRINT

- TABLE 142 LIST OF START-UPS/SMES

- TABLE 143 COMPETITIVE BENCHMARKING OF START-UPS/SMES (1/2)

- TABLE 144 COMPETITIVE BENCHMARKING OF START-UPS/SMES (2/2)

- TABLE 145 EV SEMICONDUCTORS MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2022-2025

- TABLE 146 EV SEMICONDUCTORS MARKET: DEALS, 2022-2025

- TABLE 147 EV SEMICONDUCTORS MARKET: EXPANSIONS, 2022-2025

- TABLE 148 EV SEMICONDUCTORS MARKET: OTHER DEVELOPMENTS, 2022-2025

- TABLE 149 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 150 INFINEON TECHNOLOGIES AG: SEMICONDUCTOR SUPPLY DEALS, BY OEM

- TABLE 151 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS OFFERED

- TABLE 152 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 153 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 154 INFINEON TECHNOLOGIES AG: EXPANSIONS

- TABLE 155 INFINEON TECHNOLOGIES AG: OTHER DEVELOPMENTS

- TABLE 156 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 157 STMICROELECTRONICS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 158 STMICROELECTRONICS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 159 STMICROELECTRONICS: DEALS

- TABLE 160 STMICROELECTRONICS: EXPANSIONS

- TABLE 161 STMICROELECTRONICS: OTHER DEVELOPMENTS

- TABLE 162 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 163 NXP SEMICONDUCTORS: SEMICONDUCTOR SUPPLY DEALS, BY OEM

- TABLE 164 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 165 NXP SEMICONDUCTORS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 166 NXP SEMICONDUCTORS: DEALS

- TABLE 167 NXP SEMICONDUCTORS: EXPANSIONS

- TABLE 168 NXP SEMICONDUCTORS: OTHER DEVELOPMENTS

- TABLE 169 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 170 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS OFFERED

- TABLE 171 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 172 TEXAS INSTRUMENTS INCORPORATED: DEALS

- TABLE 173 TEXAS INSTRUMENTS INCORPORATED: EXPANSIONS

- TABLE 174 TEXAS INSTRUMENTS INCORPORATED: OTHER DEVELOPMENTS

- TABLE 175 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 176 RENESAS ELECTRONICS CORPORATION: SEMICONDUCTOR SUPPLY DEALS, BY OEM

- TABLE 177 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 178 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 179 RENESAS ELECTRONICS CORPORATION: DEALS

- TABLE 180 RENESAS ELECTRONICS CORPORATION: EXPANSIONS

- TABLE 181 RENESAS ELECTRONICS CORPORATION: OTHER DEVELOPMENTS

- TABLE 182 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 183 QUALCOMM TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 184 QUALCOMM TECHNOLOGIES, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 185 QUALCOMM TECHNOLOGIES, INC.: EXPANSIONS

- TABLE 186 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 187 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 188 NVIDIA CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 189 NVIDIA CORPORATION: DEALS

- TABLE 190 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY OVERVIEW

- TABLE 191 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 192 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 193 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: DEALS

- TABLE 194 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: EXPANSIONS

- TABLE 195 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 196 ANALOG DEVICES, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 197 ANALOG DEVICES, INC.: DEALS

- TABLE 198 ANALOG DEVICES, INC.: EXPANSIONS

- TABLE 199 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 200 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS OFFERED

- TABLE 201 ROBERT BOSCH GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 202 ROBERT BOSCH GMBH: DEALS

- TABLE 203 ROBERT BOSCH GMBH: EXPANSIONS

- TABLE 204 MICRON TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 205 MICRON TECHNOLOGY, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 206 MICRON TECHNOLOGY, INC.: EXPANSIONS

- TABLE 207 MICRON TECHNOLOGY, INC.: OTHER DEVELOPMENTS

- TABLE 208 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 209 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 210 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 211 MICROCHIP TECHNOLOGY INC.: DEALS

- TABLE 212 MICROCHIP TECHNOLOGY INC.: EXPANSIONS

- TABLE 213 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 214 POLAR SEMICONDUCTOR, LLC: COMPANY OVERVIEW

- TABLE 215 ROHM CO., LTD.: COMPANY OVERVIEW

- TABLE 216 MARVELL: COMPANY OVERVIEW

- TABLE 217 BROADCOM: COMPANY OVERVIEW

- TABLE 218 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 219 STARPOWER SEMICONDUCTOR LTD.: COMPANY OVERVIEW

- TABLE 220 SEMIKRON DANFOSS: COMPANY OVERVIEW

- TABLE 221 CAMBRIDGE GAN DEVICES: COMPANY OVERVIEW

- TABLE 222 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 223 BOS SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 224 ENSILICA: COMPANY OVERVIEW

- TABLE 225 INDIE: COMPANY OVERVIEW

List of Figures

- FIGURE 1 EV SEMICONDUCTORS MARKET SEGMENTATION

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 STRATEGIES ADOPTED BY KEY PLAYERS IN EV SEMICONDUCTORS MARKET

- FIGURE 4 DISRUPTIVE TRENDS IMPACTING EV SEMICONDUCTORS MARKET

- FIGURE 5 POWER IC AND MODULE TO BE LARGEST COMPONENT IN 2025

- FIGURE 6 EUROPE TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 7 800V ARCHITECTURE SHIFT AND HIGH-PERFORMANCE MCUS FOR ADAS AND INFOTAINMENT TO DRIVE MARKET

- FIGURE 8 WIDE-BANDGAP SEMICONDUCTOR TO RECORD HIGHER CAGR THAN SILICON-BASED SEMICONDUCTOR DURING FORECAST PERIOD

- FIGURE 9 BEV TO HOLD HIGHER SHARE THAN PHEV DURING FORECAST PERIOD

- FIGURE 10 POWERTRAIN SYSTEM TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 11 POWER IC & MODULE TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO BE LARGEST MARKET FOR EV SEMICONDUCTORS IN 2025

- FIGURE 13 EV SEMICONDUCTORS MARKET DYNAMICS

- FIGURE 14 SEMICONDUCTORS FITTED IN PASSENGER CARS

- FIGURE 15 MONOLITHIC VS. CHIPLET APPROACH

- FIGURE 16 EV SALES IN SELECT MARKETS, 2019-2024

- FIGURE 17 CYBERATTACK TARGET AREAS IN VEHICLES

- FIGURE 18 ECOSYSTEM ANALYSIS

- FIGURE 19 SUPPLY CHAIN ANALYSIS

- FIGURE 20 AVERAGE SELLING PRICE TREND, BY TECHNOLOGY, 2022-2024 (USD)

- FIGURE 21 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 INVESTMENT AND FUNDING SCENARIO, 2023-2025 (USD BILLION)

- FIGURE 24 IMPORT DATA FOR HS CODE 8541-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- FIGURE 25 EXPORT DATA FOR HS CODE 8541-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- FIGURE 26 BLOCK DIAGRAM OF 800V SIC-BASED TRACTION INVERTER ARCHITECTURE

- FIGURE 27 STRUCTURAL DIAGRAM OF GAN HEMT

- FIGURE 28 ADVANCED SEMICONDUCTOR PACKAGING TECHNOLOGIES

- FIGURE 29 TRANSITION FROM SILICON TO WIDE-BANDGAP SEMICONDUCTORS

- FIGURE 30 PATENT ANALYSIS

- FIGURE 31 AI/GEN AI USE CASES IN SEMICONDUCTOR DESIGN AND VERIFICATION

- FIGURE 32 SEMICONDUCTOR BOM: ICE VS. BEV, 2024-2030

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TECHNOLOGY

- FIGURE 34 KEY BUYING CRITERIA, BY TECHNOLOGY

- FIGURE 35 EV SEMICONDUCTORS MARKET, BY TECHNOLOGY, 2025 VS. 2032 (USD BILLION)

- FIGURE 36 EV SEMICONDUCTORS MARKET, BY PROPULSION, 2025 VS. 2032 (USD BILLION)

- FIGURE 37 EV SEMICONDUCTORS MARKET, BY COMPONENT, 2025 VS. 2032 (USD BILLION)

- FIGURE 38 ELECTRIC MOTOR CONTROL BLOCK DIAGRAM

- FIGURE 39 MCUS FOR EV CONTROL PLATFORMS

- FIGURE 40 AUTOMOTIVE-GRADE PHASE CHANGE MEMORY CELL STRUCTURE

- FIGURE 41 EV SEMICONDUCTOR COST PER VEHICLE (%)

- FIGURE 42 EV SEMICONDUCTORS MARKET, BY APPLICATION, 2025 VS. 2032 (USD BILLION)

- FIGURE 43 BMS SEMICONDUCTOR ARCHITECTURE

- FIGURE 44 DOMAIN AND ZONAL CONTROL SEMICONDUCTORS

- FIGURE 45 CONNECTED VEHICLE FEATURE SEMICONDUCTORS

- FIGURE 46 EV SEMICONDUCTORS MARKET, BY REGION, 2025 VS. 2032 (USD BILLION)

- FIGURE 47 ASIA PACIFIC: EV SEMICONDUCTORS MARKET SNAPSHOT

- FIGURE 48 EUROPE: EV SEMICONDUCTORS MARKET SNAPSHOT

- FIGURE 49 UK: ELECTRIC VEHICLE ROADMAP

- FIGURE 50 NORTH AMERICA: EV SEMICONDUCTORS MARKET SNAPSHOT

- FIGURE 51 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 52 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 53 COMPANY VALUATION (USD BILLION)

- FIGURE 54 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 55 BRAND/PRODUCT COMPARISON

- FIGURE 56 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 57 COMPANY FOOTPRINT

- FIGURE 58 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 59 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 60 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 61 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 62 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 63 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 65 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY SNAPSHOT

- FIGURE 67 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 68 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 69 MICRON TECHNOLOGY, INC.: COMPANY SNAPSHOT

- FIGURE 70 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 71 RESEARCH DESIGN

- FIGURE 72 RESEARCH DESIGN MODEL

- FIGURE 73 KEY INDUSTRY INSIGHTS

- FIGURE 74 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 75 BOTTOM-UP APPROACH

- FIGURE 76 TOP-DOWN APPROACH

- FIGURE 77 DATA TRIANGULATION

- FIGURE 78 GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS