|

市場調查報告書

商品編碼

1830047

全球電子式駐煞車系統(EPB) 系統市場(按類型、車輛等級、零件、車輛類型、電動車類型、銷售管道和地區分類)- 預測至 2032 年Electronic Parking Brake System Market by Type (Cable Pull, Electric-hydraulic Caliper, Brake-by-Wire System), Vehicle Class (A&B, C&D, E&F), Component (ECU, Actuator), Vehicle Type (PC, CV), EV Type, Sales Channel, and Region - Global Forecast to 2032 |

||||||

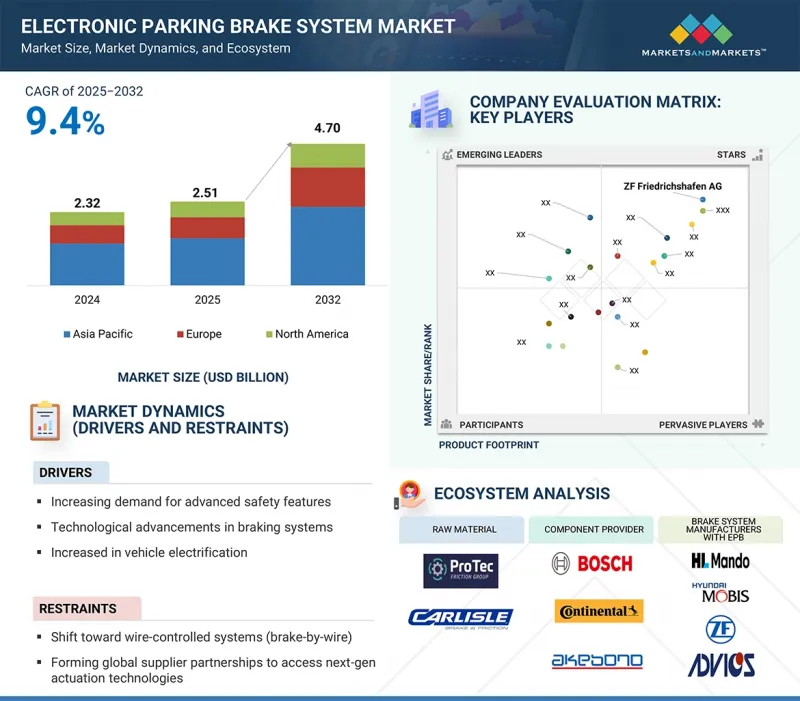

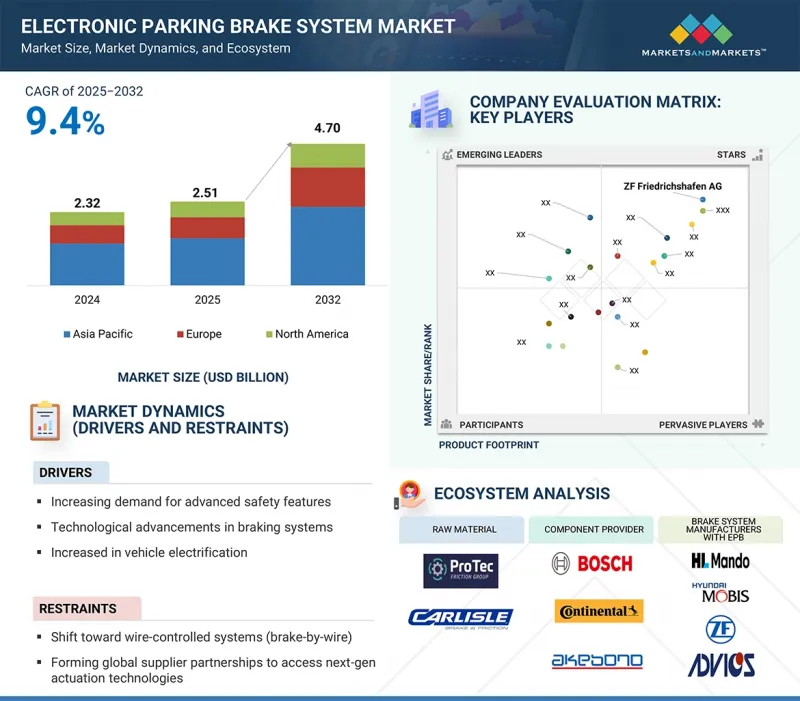

預計 2025 年全球電子式駐煞車系統(EPB) 系統市場規模為 25.1 億美元,到 2032 年將達到 47 億美元,2025 年至 2032 年的複合年成長率為 9.4%。

自動停車輔助、自動緊急煞車、上坡起步輔助等 ADAS 功能的日益普及正在推動 EPB 市場的發展,因為將電子式駐煞車系統(EPB) 整合到這些系統中可以實現無縫電子控制、增強安全自動化並支援向更高車輛自主性的轉變。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2032 |

| 基準年 | 2024 |

| 預測期 | 2025-2032 |

| 單元 | 100萬美元,1000個單位 |

| 部分 | 車輛類型、車輛等級、EPB類型、零件、EV類型、銷售管道、地區 |

| 目標區域 | 亞太地區、歐洲、北美 |

線傳煞車技術正逐漸被廣泛採用,因為它能夠實現精確的電子控制、降低機械複雜性並增強自動保持和緊急煞車等安全功能。

此外,輕量化卡鉗設計、智慧診斷和無線 (OTA) 軟體更新等技術創新提高了可靠性並減少了維護,使 EPB 成為 OEM 的首選。隨著對自動化程度更高的中檔和豪華車的需求不斷成長,以及監管機構對提高安全性和能源效率的推動,先進的 EPB 技術必將繼續擴大其市場佔有率。

“預計入門級汽車市場在預測期內將以較高的複合年成長率成長。”

在入門級細分市場,OEM 致力於在緊湊型轎車中提供先進的安全性和舒適性功能,同時又不顯著增加成本,這推動了 EPB 的普及。現代(i20)、起亞(Sonet)、大眾(Polo)、比亞迪(Dolphin)、寶馬(1 系列)和福特(Focus)等製造商已在部分車型中引入了 EPB,吸引了那些即使在經濟型車輛中也期待新技術的年輕都市區消費者。雷諾-日產的 CMF-A 和現代-起亞的 K2 平台實現了平台標準化,允許 EPB 模組在多個緊湊型車型之間共用,從而降低了系統成本。此外,歐洲和亞洲日益嚴格的安全法規迫使 OEM 將 EPB 整合到緊湊型掀背車和入門級轎車中,以滿足上坡起步輔助和 ESP 整合的要求。這些法規的推動、消費者對便利性的需求以及 OEM 平台共用策略的結合,正在加速 EPB 在入門級車輛中的普及。

“預測期內,線傳煞車系統將以較高的複合年成長率成長。”

汽車產業對汽車產量、輕量化以及與ADAS(高級駕駛輔助系統)整合的需求推動了線傳煞車(BBW)電子式駐煞車系統(EPB) 的普及。 BBW EPB 消除了機械連桿,實現了更快、更精準的煞車控制,並與自動駕駛和再生煞車系統順暢整合。越來越多的主機廠在豪華車和電動車中採用 BBW,以最佳化內部空間、減少零件磨損,並增強自動停車和上坡起步輔助等安全功能。例如,耐世特汽車系統於 2025 年 4 月發布了其先進的線傳煞車制動 (BBW) 解決方案“機電煞車”,可提升安全性、舒適性和易維護性,並支援軟體定義底盤整合。耐世特將利用其技術組件建構模組化、高精度煞車系統,並策略性地拓展「線控運動」底盤控制領域。 2025年3月,採埃孚(ZF Friedrichshafen)和布雷博(Brembo)宣布計畫推出線傳煞車系統,以電子元件取代傳統的液壓煞車。這些系統有望提高安全性、縮短反應時間並減少維護,預計此類發展將在預測期內推動市場發展。

本報告分析了全球電子式駐煞車系統(EPB) 系統市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 電子式駐煞車系統(EPB)系統市場充滿機遇

- 電子式駐煞車系統(EPB)系統市場(依車輛類型)

- 電子式駐煞車系統(EPB)系統市場(依車輛類型)

- 電子式駐煞車系統(EPB)系統市場類型

- 電子式駐煞車系統(EPB)系統市場(按組件)

- 電子式駐煞車系統(EPB)系統市場(以電動車類型)

- 電子式駐煞車系統(EPB)系統市場(依銷售管道)

- 電子式駐煞車系統(EPB)系統市場(按地區)

第5章 市場概況

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 市場動態的影響

- 影響客戶業務的趨勢和中斷

- 定價分析

- 按類型分類的平均銷售價格趨勢

- 各地區平均銷售價格趨勢

- 平均售價趨勢:印度,依類型

- 生態系分析

- 供應鏈分析

- 技術藍圖

- 監管格局

- 車輛安全標準

- 監管機構、政府機構和其他組織

- 有關電子式駐煞車系統(EPB)系統的規定

- 強制性電子煞車系統

- 車輛煞車安全標準

- 煞車系統調節器

- 大型會議及活動

- 案例研究分析

- 投資金籌措場景

- 專利分析

- 貿易分析

- 進口場景(870,830)

- 出口情境(870,830)

- 人工智慧/生成式人工智慧的影響

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 供應商分析

- 材料清單

- 電子式駐煞車系統(EPB)系統在全球的採用

- 全球採用線傳煞車和其他電子式駐煞車系統(EPB) 系統

- 電子式駐煞車系統(EPB)系統技術成熟度考量

- 技術成熟度

- 子技術成熟度

- 主要主機工廠的技術成熟度

- 全球電子式駐煞車系統(EPB)系統需求熱點

- 主要汽車製造商對線傳煞車制動系統的考慮

- 考慮線傳煞車技術應用的短期至中期障礙

- 線傳煞車技術應用的短期至中期障礙及策略因應措施

- 印度實施線傳煞車制動系統的短期與中期障礙

- 印度OEM廠商技術整合能力一覽

- 印度汽車製造商的採用時間表和投資訊號洞察

- 主要相關利益者和採購標準

第6章電子式駐煞車系統(EPB)系統市場(按類型)

- 介紹

- 拉線

- 電液卡鉗

- 線傳煞車

- 主要發現

第7章電子式駐煞車系統(EPB)系統市場(依車輛類型)

- 介紹

- 搭乘用車

- 商用車

- 主要發現

第 8 章電子式駐煞車系統(EPB) 系統市場(依車輛類別)

- 介紹

- 入門級

- 中間的

- 奢華

- 主要發現

第9章電子式駐煞車系統(EPB)系統市場(以電動車類型)

- 介紹

- 電動車

- PHEV

- 主要發現

第 10 章。電子式駐煞車系統(EPB) 系統市場(按組件)

- 介紹

- ECU

- 致動器

- 轉變

- 其他組件

- 主要發現

第 11 章電子式駐煞車系統(EPB) 系統市場(依銷售管道)

- 介紹

- OEM

- 售後市場

- 主要發現

第12章電子式駐煞車系統(EPB)系統市場(按地區)

- 介紹

- 亞太地區

- 宏觀經濟展望

- 中國

- 印度

- 日本

- 韓國

- 歐洲

- 宏觀經濟展望

- 法國

- 德國

- 西班牙

- 英國

- 俄羅斯

- 北美洲

- 宏觀經濟展望

- 美國

- 加拿大

第13章競爭格局

- 介紹

- 主要參與企業的策略/優勢(2021-2025)

- 市佔率分析(2024年)

- 世界

- 中國

- 印度

- 收益分析(2020-2024)

- 公司估值及財務指標

- 品牌/產品比較

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第14章:公司簡介

- 主要企業

- ZF FRIEDRICHSHAFEN AG

- CONTINENTAL AG

- ASTEMO, LTD.

- BREMBO NV

- ADVICS CO., LTD.

- HYUNDAI MOBIS

- HL MANDO CORP.

- WANXIANG QIANCHAO CO., LTD.

- BRAKES INDIA

- ANAND GROUP

- AKEBONO BRAKE INDUSTRY CO., LTD.

- DURA|SHILOH

- BEIJING YINGCHUANGHUIZHI AUTOMOTIVE TECHNOLOGY CO., LTD.

- BETHEL AUTOMOTIVE SAFETY SYSTEMS CO., LTD.

- 其他公司

- ZHEJIANG ASIA PACIFIC MECHANICAL & ELECTRICAL CO., LTD.

- KUSTER HOLDING GMBH

- ROBERT BOSCH GMBH

- VALEO

- INFAC CORPORATION

- HUGO BENZING GMBH & CO. KG

- KEYANG ELECTRIC CO., LTD.

第 15 章:MARKETSANDMARKETS 的建議

- 亞太地區是電子式駐煞車系統(EPB) 系統的利潤豐厚市場

- 預計中檔汽車在預測期內將變得更加受歡迎

- 煞車系統的技術進步

- 結論

第16章 附錄

The electronic parking brake (EPB) system market is estimated to be USD 2.51 billion in 2025 and is projected to reach USD 4.70 billion by 2032 at a CAGR of 9.4% from 2025 to 2032. The growing adoption of ADAS features such as automated parking assist, autonomous emergency braking, and hill-start assist is driving the EPB market, as the integration of electronic parking brakes with these systems enables seamless electronic control, enhances safety automation, and supports the shift toward higher vehicle autonomy.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Segments | Vehicle Type, Vehicle Class, EPB Type, Component, EV Type, Sales Channel, and Region |

| Regions covered | Asia Pacific, Europe, and North America |

The adoption of brake-by-wire technology is accelerating as it enables precise electronic control, reduces mechanical complexity, and enhances safety features such as automatic hold and emergency braking.

Additionally, innovations such as lightweight caliper designs, smart diagnostics, and over-the-air software updates are enhancing reliability and reducing maintenance, making EPBs a preferred choice for OEMs. The increasing demand for mid-sized and premium vehicles with higher levels of automation, coupled with regulatory pushes for improved safety and energy efficiency, ensures that advanced EPB technologies continue to expand their market footprint.

"The Entry-level vehicle segment is projected to grow at a higher CAGR during the forecast period."

The entry-level (A&B) segment is projected to grow at a higher CAGR during the forecast period. In the entry-level segment, the adoption of EPB is being driven by OEMs' efforts to offer advanced safety and comfort features to compact cars without significantly raising costs. Manufacturers like Hyundai with the i20, Kia with the Sonet, Volkswagen with the Polo, BYD with the Dolphin, BMW with the 1 Series, Ford with the Focus, and EV models such as the Hyundai Kona Electric and Volkswagen ID.3 have begun introducing EPB in select trims to appeal to young urban buyers who expect modern technology even in affordable cars. The move toward platform standardization, as seen in Renault-Nissan's CMF-A and Hyundai-Kia's K2 platforms, allows EPB modules to be shared across multiple compact models, reducing system cost. In addition, stricter safety regulations in Europe and Asia are compelling OEMs to include EPB in small hatchbacks and entry sedans to comply with requirements for hill-start assist and integration with electronic stability programs. This combination of regulatory push, consumer demand for convenience, and OEM platform-sharing strategies is accelerating EPB penetration in the entry-level class.

"Brake-by-Wire system will grow at a higher CAGR during the forecast period."

The adoption of brake-by-wire (BBW) electronic parking brakes is driven by the automotive sector's push for vehicle production, weight reduction, and integration with advanced driver-assistance systems (ADAS). BBW EPBs eliminate mechanical linkages, enabling faster, more precise braking control and smoother integration with autonomous driving and regenerative braking systems. OEMs are increasingly deploying BBW in premium and electric vehicles to optimize cabin space, reduce component wear, and enhance safety features such as automatic hold and hill-start assist. For instance, in April 2025, Nexteer Automotive launches its Electro-Mechanical Brake system, an advanced Brake-by-Wire (BBW) solution that enhances safety, comfort, serviceability, and supports software-defined chassis integration. The company leveraged its technology building blocks to create a modular, high-precision braking system and strategically expand into "Motion-by-Wire" chassis control. In March 2025, ZF Friedrichshafen and Brembo planned to introduce a brake-by-wire system, replacing traditional hydraulic brakes with electronic components. These systems promise improved safety, faster response times, and reduced maintenance. Such developments are projected to drive the market during the forecast period.

"India is projected to grow at a high CAGR in the Asia Pacific electronic parking brake system market."

India is projected to grow at a high CAGR in the Asia Pacific EPB market as domestic OEMs accelerate the integration of electronic parking brakes into mid-size SUVs and EVs to meet evolving safety norms. The government's Bharat NCAP crash safety framework and increasing alignment with global safety standards are compelling automakers like Tata Motors, Mahindra & Mahindra, and Hyundai India to adopt advanced braking technologies beyond conventional systems. Additionally, companies in the region are pursuing strategic development, such as in June 2024, ADVICS signed a joint venture agreement with Brakes India Pvt. Ltd., to produce and localize advanced braking products in India, with production slated for around 2027. Also, in July 2025, ZF Group started the production of its EPB in India, marking the first time this technology is being produced locally for a passenger vehicle. The EPB will be supplied to a passenger car OEM for its newly launched electric vehicle. Further, with the rising demand for connected and feature-rich vehicles among India's expanding middle-class buyers, EPBs are increasingly being offered as standard in premium trims of models like Tata Harrier, Mahindra XUV700, and Hyundai Creta, further strengthening India's position as the fastest-growing market in the region.

Breakup of Primaries:

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs- 41%, Tier I- 35%, and Tier II - 24%

- By Designation: CXOs - 60%, Managers - 10%, and Executives- 30%

- By Region: Asia Pacific-41%, Europe-34%, North America-25%

The electronic parking brake system market is dominated by major players, including ZF Friedrichshafen AG (Germany), Continental AG (Germany), Astemo, Ltd. (Japan), Brembo N.V. (Italy), and ADVICS Co., Ltd. (Japan).

The study includes an in-depth competitive analysis of these key players in the electronic parking brake system market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

This research report categorizes the electronic parking brake system market by type (cable pull, electric-hydraulic caliper, brake-by-wire system), vehicle class (entry, mid, premium), components (ECUs, actuators, switches, others), vehicle type (passenger cars and commercial vehicles), EV Type (BEV, PHEV), sales channel (OEM, Aftermarket), and region (Asia Pacific, Europe, and North America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the market. This report covers a detailed analysis of OEMs' strategies toward the adoption of the EPB by key OEMs, strategic insights on the technology maturity of the EPB, and strategic insights on short-to-mid-term barriers to brake-by-wire adoption. Analysis of the key industry players has been done to provide insights into their business overview, solutions & services, key strategies, contracts, partnerships, agreements, new product & service launches, mergers & acquisitions, and recent developments associated with the electronic parking brake system market. Competitive analysis of upcoming startups in the electronic parking brake system market ecosystem has been covered in this report.

Reasons to Buy this Report

The report will help the market leaders/new entrants in this market with information on the OEMs' strategies toward adoption of the EPB, strategic insights on the technology maturity of the EPB, and supplier analysis. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Increasing demand for advanced safety features, technological advancements in braking systems, increased in vehicle electrification, strict government regulations towards braking system, growing mid- and high-end vehicle sales), restraints (dependence on vehicle electronic architecture, limited aftermarket potential), opportunities (shift toward wire-controlled systems [brake-by-wire], Forming global supplier partnerships to access next-gen actuation technologies, establishing or expanding R&D centers for cost-effective innovation, joint ventures with EV startups and mobility OEMS), and challenges (integration challenges in existing platforms, Limited penetration in low-cost vehicles, lack of localized manufacturing ecosystem) influencing the growth of the electronic parking brake market

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the electronic parking brake market

- Market Development: Comprehensive information about lucrative markets (the report analyses the electronic parking brake system market across varied regions)

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the electronic parking brake market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, ZF Friedrichshafen AG (Germany), Continental AG (Germany), Astemo, Ltd. (Japan), Brembo N.V. (Italy), and ADVICS Co., Ltd. (Japan), among others, in the electronic parking brake market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews: demand and supply sides

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Primary interview participants

- 2.1.2.4 Objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRONIC PARKING BRAKE SYSTEM MARKET

- 4.2 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE TYPE

- 4.3 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS

- 4.4 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY TYPE

- 4.5 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COMPONENT

- 4.6 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY EV TYPE

- 4.7 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY SALES CHANNEL

- 4.8 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in demand for advanced safety and convenience features

- 5.2.1.2 Technological advancements in braking systems

- 5.2.1.3 Rise of vehicle electrification

- 5.2.1.4 Stringent government regulations for braking systems

- 5.2.1.5 Increase in mid- and high-end vehicle sales

- 5.2.2 RESTRAINTS

- 5.2.2.1 Reliance on vehicle electronic architecture

- 5.2.2.2 Limited aftermarket potential

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Shift toward wire-controlled systems

- 5.2.3.2 Rise in global supplier partnerships to access next-generation actuation technologies

- 5.2.3.3 Establishment of R&D centers for cost-effective innovation

- 5.2.3.4 Joint ventures with EV start-ups and mobility OEMS

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration challenges in existing platforms

- 5.2.4.2 Limited penetration in low-cost vehicles

- 5.2.4.3 Lack of localized manufacturing ecosystem

- 5.2.5 IMPACT OF MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY TYPE

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.4.3 AVERAGE SELLING PRICE TREND IN INDIA, BY TYPE

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TECHNOLOGY ROADMAP

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 VEHICLE SAFETY STANDARDS

- 5.8.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.3 REGULATIONS FOR ELECTRONIC PARKING BRAKE SYSTEMS

- 5.8.4 ELECTRONIC BRAKE SYSTEM MANDATES

- 5.8.5 VEHICLE BRAKE SAFETY STANDARDS

- 5.8.6 REGULATORY AUTHORITIES FOR BRAKE SYSTEMS

- 5.9 KEY CONFERENCES AND EVENTS

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ADOPTION OF SIEMENS SIMCENTER AMESIM SOFTWARE TO DESIGN ACTUATORS

- 5.10.2 REDUCTION OF WEAR ON SWITCHES WITH RHEOLUBE 362HB

- 5.10.3 DEVELOPMENT OF END-TO-END ASIL-D COMPLIANT ELECTRONIC PARKING BRAKE SYSTEM

- 5.11 INVESTMENT AND FUNDING SCENARIO

- 5.12 PATENT ANALYSIS

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (870830)

- 5.13.2 EXPORT SCENARIO (870830)

- 5.14 IMPACT OF AI/GEN AI

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 KEY TECHNOLOGIES

- 5.15.1.1 Electronic parking brake system with lightweight drum

- 5.15.1.2 Front electric park brake

- 5.15.1.3 Software-defined functionality and remote update

- 5.15.2 COMPLEMENTARY TECHNOLOGIES

- 5.15.2.1 Electronic stability control

- 5.15.2.2 Electric actuator/caliper motor technology

- 5.15.3 ADJACENT TECHNOLOGIES

- 5.15.3.1 Copper-free XTRA brake pad

- 5.15.3.2 Anti-lock braking system

- 5.15.1 KEY TECHNOLOGIES

- 5.16 SUPPLIER ANALYSIS

- 5.17 BILL OF MATERIALS

- 5.18 GLOBAL ADOPTION OF ELECTRONIC PARKING BRAKE SYSTEMS

- 5.19 GLOBAL PENETRATION OF BRAKE-BY-WIRE AND OTHER ELECTRONIC PARKING BRAKE SYSTEMS

- 5.20 INSIGHTS ON TECHNOLOGY MATURITY OF ELECTRONIC PARKING BRAKE SYSTEMS

- 5.20.1 TECHNOLOGY MATURITY

- 5.20.2 SUB-TECHNOLOGY MATURITY

- 5.20.3 TECHNOLOGY MATURITY BY KEY OEMS

- 5.21 GLOBAL ELECTRONIC PARKING BRAKE SYSTEM DEMAND HOTSPOTS

- 5.22 INSIGHTS ON BRAKE-BY-WIRE ADOPTION BY KEY OEMS

- 5.23 INSIGHTS ON SHORT-TO-MID-TERM BARRIERS TO BRAKE-BY-WIRE ADOPTION

- 5.23.1 SHORT-TO-MID-TERM BARRIERS TO BRAKE-BY-WIRE ADOPTION AND STRATEGIC RESPONSES

- 5.23.2 SHORT-TO-MID TERM BARRIERS TO BRAKE-BY-WIRE ADOPTION IN INDIA

- 5.24 INSIGHTS ON TECHNICAL INTEGRATION CAPABILITY OF INDIAN OEMS

- 5.25 INSIGHTS ON ADOPTION TIMELINES AND INVESTMENT SIGNALS BY INDIAN OEMS

- 5.26 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.26.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.26.2 BUYING CRITERIA

6 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 CABLE PULL

- 6.2.1 PREFERENCE FOR ADVANCED SAFETY AND CONVENIENCE FEATURES TO DRIVE MARKET

- 6.3 ELECTRIC-HYDRAULIC CALIPER

- 6.3.1 TECHNICAL REQUIREMENTS AND OEM DEMANDS TO DRIVE MARKET

- 6.4 BRAKE-BY-WIRE

- 6.4.1 PUSH FOR VEHICLE ELECTRIFICATION TO DRIVE MARKET

- 6.5 PRIMARY INSIGHTS

7 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE TYPE

- 7.1 INTRODUCTION

- 7.2 PASSENGER CAR

- 7.2.1 SHIFT IN SUPPLIER CHOICES AND SPECIFICATIONS TO DRIVE MARKET

- 7.3 COMMERCIAL VEHICLE

- 7.3.1 HIGHER LOAD CAPACITY REQUIREMENTS IN ICE TRUCKS TO DRIVE MARKET

- 7.4 PRIMARY INSIGHTS

8 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS

- 8.1 INTRODUCTION

- 8.2 ENTRY LEVEL

- 8.2.1 REGULATORY PUSH AND CONSUMER DEMAND FOR CONVENIENCE TO DRIVE MARKET

- 8.3 MID-SIZED

- 8.3.1 STANDARDIZATION OF EPB IN HIGH-VOLUME SEDANS AND SUVS TO DRIVE MARKET

- 8.4 PREMIUM

- 8.4.1 ELECTRIFICATION OF LUXURY VEHICLES TO DRIVE MARKET

- 8.5 PRIMARY INSIGHTS

9 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY EV TYPE

- 9.1 INTRODUCTION

- 9.2 BEV

- 9.2.1 SUPPLIERS' TAILORING EPB MODULES FOR BATTERY PACKAGING TO DRIVE MARKET

- 9.3 PHEV

- 9.3.1 OEMS' FOCUS ON ENHANCING SAFETY AND WEIGHT OPTIMIZATION TO DRIVE MARKET

- 9.4 PRIMARY INSIGHTS

10 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COMPONENT

- 10.1 INTRODUCTION

- 10.2 ELECTRONIC CONTROL UNIT

- 10.2.1 TREND OF ELECTRIFIED VEHICLES TO DRIVE MARKET

- 10.3 ACTUATOR

- 10.3.1 VEHICLES' TRANSITION TOWARD ADVANCED BRAKE-BY-WIRE ARCHITECTURES TO DRIVE MARKET

- 10.4 SWITCH

- 10.4.1 REPLACEMENT OF MECHANICAL LEVERS WITH ELECTRONIC ALTERNATIVES TO DRIVE MARKET

- 10.5 OTHER COMPONENTS

- 10.6 PRIMARY INSIGHTS

11 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY SALES CHANNEL

- 11.1 INTRODUCTION

- 11.2 OEM

- 11.2.1 SURGE IN COLLABORATION WITH TIER-1 SUPPLIERS TO DRIVE MARKET

- 11.3 AFTERMARKET

- 11.3.1 NEED FOR REPLACEMENT PARTS DUE TO AGING OF VEHICLES TO DRIVE MARKET

- 11.4 PRIMARY INSIGHTS

12 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 MACROECONOMIC OUTLOOK

- 12.2.2 CHINA

- 12.2.2.1 Strategic supplier partnerships and model-specific adoption to drive market

- 12.2.3 INDIA

- 12.2.3.1 Focus of OEMs on vehicle safety and convenience to drive market

- 12.2.4 JAPAN

- 12.2.4.1 Compliance with stringent safety regulations to drive market

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Collaborations between OEMs and local suppliers to drive market

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK

- 12.3.2 FRANCE

- 12.3.2.1 Regulatory push for vehicle safety and accident prevention to drive market

- 12.3.3 GERMANY

- 12.3.3.1 OEM adoption in mainstream ICE models and supplier-driven innovation to drive market

- 12.3.4 SPAIN

- 12.3.4.1 Rapid integration of advanced safety and convenience features in mid-sized and compact vehicles to drive market

- 12.3.5 UK

- 12.3.5.1 Increased adoption of mid- to large-sized passenger cars with advanced safety features to drive market

- 12.3.6 RUSSIA

- 12.3.6.1 Trend of advanced braking technologies to drive market

- 12.4 NORTH AMERICA

- 12.4.1 MACROECONOMIC OUTLOOK

- 12.4.2 US

- 12.4.2.1 Tightening federal safety and efficiency regulations to drive market

- 12.4.3 CANADA

- 12.4.3.1 Emphasis on reducing mechanical complexity and maintenance costs to drive market

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.3.1 GLOBAL

- 13.3.2 CHINA

- 13.3.3 INDIA

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Type footprint

- 13.7.5.4 Vehicle type footprint

- 13.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING

- 13.8.5.1 List of start-ups/SMEs

- 13.8.5.2 Competitive benchmarking of start-ups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 ZF FRIEDRICHSHAFEN AG

- 14.1.1.1 Business overview

- 14.1.1.2 Supplier analysis

- 14.1.1.3 Products offered

- 14.1.1.4 Recent developments

- 14.1.1.4.1 Product launches

- 14.1.1.4.2 Other developments

- 14.1.1.5 MnM view

- 14.1.1.5.1 Key strengths

- 14.1.1.5.2 Strategic choices

- 14.1.1.5.3 Weaknesses and competitive threats

- 14.1.2 CONTINENTAL AG

- 14.1.2.1 Business overview

- 14.1.2.2 Supplier analysis

- 14.1.2.3 Products offered

- 14.1.2.4 Recent developments

- 14.1.2.4.1 Deals

- 14.1.2.4.2 Expansions

- 14.1.2.5 MnM view

- 14.1.2.5.1 Key strengths

- 14.1.2.5.2 Strategic choices

- 14.1.2.5.3 Weaknesses and competitive threats

- 14.1.3 ASTEMO, LTD.

- 14.1.3.1 Business overview

- 14.1.3.2 Supplier analysis

- 14.1.3.3 Products offered

- 14.1.3.4 Recent developments

- 14.1.3.4.1 Product launches

- 14.1.3.5 MnM view

- 14.1.3.5.1 Key strengths

- 14.1.3.5.2 Strategic choices

- 14.1.3.5.3 Weaknesses and competitive threats

- 14.1.4 BREMBO N.V.

- 14.1.4.1 Business overview

- 14.1.4.2 Supplier analysis

- 14.1.4.3 Products offered

- 14.1.4.4 Recent developments

- 14.1.4.4.1 Deals

- 14.1.4.4.2 Other developments

- 14.1.4.5 MnM view

- 14.1.4.5.1 Key strengths

- 14.1.4.5.2 Strategic choices

- 14.1.4.5.3 Weaknesses and competitive threats

- 14.1.5 ADVICS CO., LTD.

- 14.1.5.1 Business overview

- 14.1.5.2 Supplier analysis

- 14.1.5.3 Products offered

- 14.1.5.4 Recent developments

- 14.1.5.4.1 Product launches

- 14.1.5.4.2 Deals

- 14.1.5.5 MnM view

- 14.1.5.5.1 Key strengths

- 14.1.5.5.2 Strategic choices

- 14.1.5.5.3 Weaknesses and competitive threats

- 14.1.6 HYUNDAI MOBIS

- 14.1.6.1 Business overview

- 14.1.6.2 Supplier analysis

- 14.1.6.3 Products offered

- 14.1.6.4 Recent developments

- 14.1.6.4.1 Expansions

- 14.1.7 HL MANDO CORP.

- 14.1.7.1 Business overview

- 14.1.7.2 Supplier analysis

- 14.1.7.3 Products offered

- 14.1.7.4 Recent developments

- 14.1.7.4.1 Deals

- 14.1.7.4.2 Other developments

- 14.1.8 WANXIANG QIANCHAO CO., LTD.

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.9 BRAKES INDIA

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Other developments

- 14.1.10 ANAND GROUP

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.11 AKEBONO BRAKE INDUSTRY CO., LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Other developments

- 14.1.12 DURA | SHILOH

- 14.1.12.1 Business overview

- 14.1.12.2 Supplier analysis

- 14.1.12.3 Products offered

- 14.1.12.4 Recent developments

- 14.1.12.4.1 Deals

- 14.1.13 BEIJING YINGCHUANGHUIZHI AUTOMOTIVE TECHNOLOGY CO., LTD.

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.14 BETHEL AUTOMOTIVE SAFETY SYSTEMS CO., LTD.

- 14.1.14.1 Business overview

- 14.1.14.2 Supplier analysis

- 14.1.14.3 Products offered

- 14.1.14.4 Recent developments

- 14.1.14.4.1 Product launches

- 14.1.1 ZF FRIEDRICHSHAFEN AG

- 14.2 OTHER PLAYERS

- 14.2.1 ZHEJIANG ASIA PACIFIC MECHANICAL & ELECTRICAL CO., LTD.

- 14.2.2 KUSTER HOLDING GMBH

- 14.2.3 ROBERT BOSCH GMBH

- 14.2.4 VALEO

- 14.2.5 INFAC CORPORATION

- 14.2.6 HUGO BENZING GMBH & CO. KG

- 14.2.7 KEYANG ELECTRIC CO., LTD.

15 RECOMMENDATIONS BY MARKETSANDMARKETS

- 15.1 ASIA PACIFIC TO BE LUCRATIVE MARKET FOR ELECTRONIC PARKING BRAKE SYSTEMS

- 15.2 MID-SIZED VEHICLES TO BE PREVALENT DURING FORECAST PERIOD

- 15.3 TECHNOLOGICAL ADVANCEMENTS IN BRAKING SYSTEMS

- 15.4 CONCLUSION

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.4.1 COMPANY PROFILE

- 16.4.1.1 Profiling of up to five additional market players

- 16.4.2 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, AT COUNTRY LEVEL

- 16.4.3 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COMPONENT, AT COUNTRY LEVEL

- 16.4.4 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY EV TYPE, AT COUNTRY LEVEL

- 16.4.1 COMPANY PROFILE

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS

List of Tables

- TABLE 1 MARKET DEFINITION, BY TYPE

- TABLE 2 MARKET DEFINITION, BY PROPULSION

- TABLE 3 MARKET DEFINITION, BY COMPONENT

- TABLE 4 MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 5 MARKET DEFINITION, BY VEHICLE CLASS

- TABLE 6 USD EXCHANGE RATES, 2021-2025

- TABLE 7 VEHICLES EQUIPPED WITH ELECTRONIC PARKING BRAKE SYSTEMS

- TABLE 8 BRAKING SYSTEM TECHNOLOGY ROADMAP

- TABLE 9 ZERO-EMISSION LIGHT-DUTY VEHICLE POLICIES AND INCENTIVES IN SELECT COUNTRIES

- TABLE 10 SALES OF VEHICLES EQUIPPED WITH ELECTRONIC PARKING BRAKE SYSTEMS, 2023-2024

- TABLE 11 ELECTRIC VS. CONVENTIONAL PARKING BRAKE AND ITS IMPACT ON MARKET GROWTH

- TABLE 12 R&D CENTERS BY KEY PLAYERS

- TABLE 13 KEY OEM STRATEGIC DEVELOPMENTS

- TABLE 14 LOW-COST VEHICLE MODELS WITH TRADITIONAL PARKING BRAKES

- TABLE 15 ELECTRONIC PARKING BRAKE SYSTEM LOCALIZATION IN INDIA

- TABLE 16 AVERAGE SELLING PRICE TREND, BY TYPE, 2022-2024 (USD)

- TABLE 17 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- TABLE 18 AVERAGE SELLING PRICE TREND IN INDIA, BY TYPE, 2022-2024 (USD)

- TABLE 19 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 20 VEHICLE SAFETY STANDARDS, BY COUNTRY/REGION

- TABLE 21 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 REGULATIONS FOR ELECTRONIC PARKING BRAKE SYSTEMS, BY COUNTRY/REGION

- TABLE 25 ELECTRONIC BRAKE SYSTEM MANDATES, BY COUNTRY/REGION

- TABLE 26 NORTH AMERICA: VEHICLE BRAKE SAFETY STANDARDS

- TABLE 27 EUROPE: VEHICLE BRAKE SAFETY STANDARDS

- TABLE 28 REGULATORY AUTHORITIES FOR BRAKE SYSTEMS, BY REGION

- TABLE 29 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 30 LIST OF FUNDING

- TABLE 31 PATENT ANALYSIS

- TABLE 32 IMPORT DATA FOR HS CODE 870830-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 33 EXPORT DATA FOR HS CODE 870830-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 34 SUPPLIER ANALYSIS FOR ELECTRONIC PARKING BRAKE SYSTEMS, 2023-2025

- TABLE 35 SUPPLIER ANALYSIS FOR BRAKE CALIPERS WITH ELECTRONIC PARKING BRAKE SYSTEMS, 2023-2025

- TABLE 36 TECHNOLOGY MATURITY BY KEY OEMS

- TABLE 37 BRAKE-BY-WIRE ADOPTION BY KEY OEMS

- TABLE 38 SHORT-TO-MID-TERM BARRIERS TO BRAKE-BY-WIRE ADOPTION AND STRATEGIC RESPONSES

- TABLE 39 SHORT-TO-MID TERM BARRIERS TO BRAKE-BY-WIRE ADOPTION IN INDIA

- TABLE 40 TECHNICAL INTEGRATION CAPABILITY OF INDIAN OEMS

- TABLE 41 ADOPTION TIMELINES BY INDIAN OEMS

- TABLE 42 INVESTMENTS BY INDIAN OEMS

- TABLE 43 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE

- TABLE 44 KEY BUYING CRITERIA, BY VEHICLE TYPE

- TABLE 45 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 46 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 47 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 48 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 49 CABLE PULL: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 50 CABLE PULL: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 51 CABLE PULL: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 CABLE PULL: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 53 ELECTRIC-HYDRAULIC CALIPER: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 54 ELECTRIC-HYDRAULIC CALIPER: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 55 ELECTRIC-HYDRAULIC CALIPER: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 ELECTRIC-HYDRAULIC CALIPER: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 57 BRAKE-BY-WIRE: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 58 BRAKE-BY-WIRE: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 59 BRAKE-BY-WIRE: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 BRAKE-BY-WIRE: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 61 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 62 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 63 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 64 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 65 PASSENGER CAR MODELS EQUIPPED WITH ELECTRONIC PARKING BRAKE SYSTEMS

- TABLE 66 COMMERCIAL VEHICLE MODELS EQUIPPED WITH ELECTRONIC PARKING BRAKE SYSTEMS

- TABLE 67 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 68 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 69 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (USD MILLION)

- TABLE 70 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (USD MILLION)

- TABLE 71 ENTRY LEVEL: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 72 ENTRY LEVEL: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 73 ENTRY LEVEL: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 ENTRY LEVEL: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 75 MID-SIZED: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 76 MID-SIZED: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 77 MID-SIZED: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 MID-SIZED: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 79 PREMIUM: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 80 PREMIUM: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 81 PREMIUM: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 PREMIUM: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 83 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY EV TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 84 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY EV TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 85 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY EV TYPE, 2021-2024 (USD MILLION)

- TABLE 86 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY EV TYPE, 2025-2032 (USD MILLION)

- TABLE 87 BEV: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 88 BEV: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 89 BEV: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 BEV: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 91 PHEV: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 92 PHEV: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 93 PHEV: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 PHEV: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 95 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COMPONENT, 2021-2024 (THOUSAND UNITS)

- TABLE 96 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COMPONENT, 2025-2032 (THOUSAND UNITS)

- TABLE 97 ELECTRONIC CONTROL UNIT: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 98 ELECTRONIC CONTROL UNIT: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 99 ACTUATOR: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 100 ACTUATOR: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 101 SWITCH: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 102 SWITCH: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 103 OTHER COMPONENTS: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 104 OTHER COMPONENTS: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 105 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY SALES CHANNEL, 2021-2024 (THOUSAND UNITS)

- TABLE 106 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY SALES CHANNEL, 2025-2032 (THOUSAND UNITS)

- TABLE 107 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 108 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 109 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 112 ASIA PACIFIC: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 113 ASIA PACIFIC: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 115 CHINA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 116 CHINA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 117 CHINA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (USD MILLION)

- TABLE 118 CHINA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (USD MILLION)

- TABLE 119 INDIA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 120 INDIA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 121 INDIA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (USD MILLION)

- TABLE 122 INDIA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (USD MILLION)

- TABLE 123 JAPAN: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 124 JAPAN: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 125 JAPAN: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (USD MILLION)

- TABLE 126 JAPAN: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (USD MILLION)

- TABLE 127 SOUTH KOREA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 128 SOUTH KOREA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 129 SOUTH KOREA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (USD MILLION)

- TABLE 130 SOUTH KOREA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (USD MILLION)

- TABLE 131 EUROPE: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 132 EUROPE: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 133 EUROPE: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 EUROPE: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 135 FRANCE: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 136 FRANCE: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 137 FRANCE: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (USD MILLION)

- TABLE 138 FRANCE: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (USD MILLION)

- TABLE 139 GERMANY: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 140 GERMANY: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 141 GERMANY: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (USD MILLION)

- TABLE 142 GERMANY: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (USD MILLION)

- TABLE 143 SPAIN: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 144 SPAIN: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 145 SPAIN: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (USD MILLION)

- TABLE 146 SPAIN: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (USD MILLION)

- TABLE 147 UK: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 148 UK: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 149 UK: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (USD MILLION)

- TABLE 150 UK: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (USD MILLION)

- TABLE 151 RUSSIA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 152 RUSSIA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 153 RUSSIA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (USD MILLION)

- TABLE 154 RUSSIA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (USD MILLION)

- TABLE 155 NORTH AMERICA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 156 NORTH AMERICA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 157 NORTH AMERICA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 158 NORTH AMERICA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 159 US: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 160 US: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 161 US: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (USD MILLION)

- TABLE 162 US: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (USD MILLION)

- TABLE 163 CANADA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 164 CANADA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 165 CANADA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2021-2024 (USD MILLION)

- TABLE 166 CANADA: ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025-2032 (USD MILLION)

- TABLE 167 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 168 GLOBAL: MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- TABLE 169 CHINA: MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- TABLE 170 INDIA: MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- TABLE 171 REGION FOOTPRINT

- TABLE 172 TYPE FOOTPRINT

- TABLE 173 VEHICLE TYPE FOOTPRINT

- TABLE 174 LIST OF START-UPS/SMES

- TABLE 175 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 176 ELECTRONIC PARKING BRAKE SYSTEM MARKET: PRODUCT LAUNCHES, 2021-2025

- TABLE 177 ELECTRONIC PARKING BRAKE SYSTEM MARKET: DEALS, 2021-2025

- TABLE 178 ELECTRONIC PARKING BRAKE SYSTEM MARKET: EXPANSIONS, 2021-2025

- TABLE 179 ELECTRONIC PARKING BRAKE SYSTEM MARKET: OTHER DEVELOPMENTS, 2021-2025

- TABLE 180 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW

- TABLE 181 ZF FRIEDRICHSHAFEN AG: SUPPLIER ANALYSIS

- TABLE 182 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

- TABLE 183 ZF FRIEDRICHSHAFEN AG: PRODUCT LAUNCHES

- TABLE 184 ZF FRIEDRICHSHAFEN AG: OTHER DEVELOPMENTS

- TABLE 185 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 186 CONTINENTAL AG: SUPPLIER ANALYSIS

- TABLE 187 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 188 CONTINENTAL AG: DEALS

- TABLE 189 CONTINENTAL AG: EXPANSIONS

- TABLE 190 ASTEMO, LTD.: COMPANY OVERVIEW

- TABLE 191 ASTEMO, LTD.: SUPPLIER ANALYSIS

- TABLE 192 ASTEMO, LTD.: PRODUCTS OFFERED

- TABLE 193 ASTEMO, LTD.: PRODUCT LAUNCHES

- TABLE 194 BREMBO N.V.: COMPANY OVERVIEW

- TABLE 195 BREMBO N.V.: SUPPLIER ANALYSIS

- TABLE 196 BREMBO N.V.: PRODUCTS OFFERED

- TABLE 197 BREMBO N.V.: DEALS

- TABLE 198 BREMBO N.V.: OTHER DEVELOPMENTS

- TABLE 199 ADVICS CO., LTD.: COMPANY OVERVIEW

- TABLE 200 ADVICS CO., LTD.: SUPPLIER ANALYSIS

- TABLE 201 ADVICS CO., LTD.: PRODUCTS OFFERED

- TABLE 202 ADVICS CO., LTD.: PRODUCT LAUNCHES

- TABLE 203 ADVICS CO., LTD.: DEALS

- TABLE 204 HYUNDAI MOBIS: COMPANY OVERVIEW

- TABLE 205 HYUNDAI MOBIS: SUPPLIER ANALYSIS

- TABLE 206 HYUNDAI MOBIS: PRODUCTS OFFERED

- TABLE 207 HYUNDAI MOBIS: EXPANSIONS

- TABLE 208 HL MANDO CORP.: COMPANY OVERVIEW

- TABLE 209 HL MANDO CORP.: SUPPLIER ANALYSIS

- TABLE 210 HL MANDO CORP.: PRODUCTS OFFERED

- TABLE 211 HL MANDO CORP.: DEALS

- TABLE 212 HL MANDO CORP.: OTHER DEVELOPMENTS

- TABLE 213 WANXIANG QIANCHAO CO., LTD.: COMPANY OVERVIEW

- TABLE 214 WANXIANG QIANCHAO CO., LTD.: PRODUCTS OFFERED

- TABLE 215 BRAKES INDIA: COMPANY OVERVIEW

- TABLE 216 BRAKES INDIA: PRODUCTS OFFERED

- TABLE 217 BRAKES INDIA: OTHER DEVELOPMENTS

- TABLE 218 ANAND GROUP: COMPANY OVERVIEW

- TABLE 219 ANAND GROUP: PRODUCTS OFFERED

- TABLE 220 AKEBONO BRAKE INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 221 AKEBONO BRAKE INDUSTRY CO., LTD.: PRODUCTS OFFERED

- TABLE 222 AKEBONO BRAKE INDUSTRY CO., LTD.: OTHER DEVELOPMENTS

- TABLE 223 DURA | SHILOH: COMPANY OVERVIEW

- TABLE 224 DURA | SHILOH: SUPPLIER ANALYSIS

- TABLE 225 DURA | SHILOH: PRODUCTS OFFERED

- TABLE 226 DURA | SHILOH: DEALS

- TABLE 227 BEIJING YINGCHUANGHUIZHI AUTOMOTIVE TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 228 BEIJING YINGCHUANGHUIZHI AUTOMOTIVE TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 229 BETHEL AUTOMOTIVE SAFETY SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 230 BETHEL AUTOMOTIVE SAFETY SYSTEMS CO., LTD.: SUPPLIER ANALYSIS

- TABLE 231 BETHEL AUTOMOTIVE SAFETY SYSTEMS CO., LTD.: PRODUCTS OFFERED

- TABLE 232 BETHEL AUTOMOTIVE SAFETY SYSTEMS CO., LTD.: PRODUCT LAUNCHES

- TABLE 233 ZHEJIANG ASIA PACIFIC MECHANICAL & ELECTRICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 234 KUSTER HOLDING GMBH: COMPANY OVERVIEW

- TABLE 235 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 236 VALEO: COMPANY OVERVIEW

- TABLE 237 INFAC CORPORATION: COMPANY OVERVIEW

- TABLE 238 HUGO BENZING GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 239 KEYANG ELECTRIC CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ELECTRONIC PARKING BRAKE SYSTEM MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS

- FIGURE 9 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

- FIGURE 10 ELECTRONIC PARKING BRAKE SYSTEM MARKET OVERVIEW

- FIGURE 11 ASIA PACIFIC TO BE LEADING REGIONAL MARKET DURING FORECAST PERIOD

- FIGURE 12 MID-SIZED SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 13 BRAKE-BY-WIRE SEGMENT TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 RISING ADOPTION IN ENTRY-LEVEL AND MID-SIZED VEHICLES TO DRIVE MARKET

- FIGURE 15 PASSENGER CAR SEGMENT TO BE LARGER THAN COMMERCIAL VEHICLE SEGMENT DURING FORECAST PERIOD

- FIGURE 16 MID-SIZED TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 17 ELECTRIC-HYDRAULIC CALIPER TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 18 ELECTRONIC CONTROL UNIT TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 19 BEV TO HOLD HIGHER SHARE THAN PHEV DURING FORECAST PERIOD

- FIGURE 20 AFTERMARKET TO RECORD FASTER GROWTH THAN OEM DURING FORECAST PERIOD

- FIGURE 21 EUROPE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 ELECTRONIC PARKING BRAKE SYSTEM MARKET DYNAMICS

- FIGURE 23 GLOBAL ELECTRIFICATION TARGETS, 2025-2050

- FIGURE 24 EV SALES, BY COUNTRY, 2021-2024

- FIGURE 25 FUNCTIONAL ARCHITECTURE OF INTEGRATED ELECTRONIC PARKING BRAKE SYSTEMS

- FIGURE 26 STRUCTURE OF BRAKE-BY-WIRE SYSTEMS

- FIGURE 27 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 AVERAGE SELLING PRICE TREND, BY TYPE, 2022-2024 (USD)

- FIGURE 29 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- FIGURE 30 AVERAGE SELLING PRICE TREND IN INDIA, BY TYPE, 2022-2024 (USD)

- FIGURE 31 ECOSYSTEM MAP

- FIGURE 32 ECOSYSTEM ANALYSIS

- FIGURE 33 SUPPLY CHAIN ANALYSIS

- FIGURE 34 TECHNOLOGY ROADMAP OF ELECTRONIC PARKING BRAKE SYSTEMS

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO, 2022-2025

- FIGURE 36 PATENT ANALYSIS

- FIGURE 37 IMPORT DATA FOR HS CODE 870830-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 38 EXPORT DATA FOR HS CODE 870830-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 39 BILL OF MATERIALS FOR AUTOMOTIVE BRAKE SYSTEMS WITH ELECTRONIC PARKING BRAKE SYSTEMS

- FIGURE 40 GLOBAL ADOPTION OF ELECTRONIC PARKING BRAKE SYSTEMS, 2024-2032

- FIGURE 41 GLOBAL PENETRATION OF BRAKE-BY-WIRE AND OTHER ELECTRONIC PARKING BRAKE SYSTEMS, 2024-2032

- FIGURE 42 SUB-TECHNOLOGY MATURITY

- FIGURE 43 TECHNOLOGY MATURITY, BY OEM

- FIGURE 44 GLOBAL ELECTRONIC PARKING BRAKE SYSTEM DEMAND HOTSPOTS

- FIGURE 45 TECHNICAL INTEGRATION CAPABILITY OF INDIAN OEMS

- FIGURE 46 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE

- FIGURE 47 KEY BUYING CRITERIA, BY VEHICLE TYPE

- FIGURE 48 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 49 CABLE PULL SNAPSHOT

- FIGURE 50 ELECTRIC-HYDRAULIC CALIPER SNAPSHOT

- FIGURE 51 BRAKE-BY-WIRE SNAPSHOT

- FIGURE 52 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 53 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY VEHICLE CLASS, 2025 VS. 2032 (USD MILLION)

- FIGURE 54 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY EV TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 55 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY COMPONENT, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 56 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY SALES CHANNEL, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 57 ELECTRONIC PARKING BRAKE SYSTEM MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 58 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 59 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 60 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 61 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 62 ASIA PACIFIC: ELECTRONIC PARKING BRAKE SYSTEM MARKET SNAPSHOT

- FIGURE 63 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 64 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 65 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 66 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 67 EUROPE: ELECTRONIC PARKING BRAKE SYSTEM MARKET SNAPSHOT

- FIGURE 68 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 69 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 70 NORTH AMERICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 71 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 72 NORTH AMERICA: ELECTRONIC PARKING BRAKE SYSTEM MARKET SNAPSHOT

- FIGURE 73 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 74 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 75 COMPANY VALUATION (USD BILLION)

- FIGURE 76 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 77 BRAND/PRODUCT COMPARISON

- FIGURE 78 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 79 COMPANY FOOTPRINT

- FIGURE 80 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 81 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

- FIGURE 82 ZF FRIEDRICHSHAFEN AG: PRODUCT SNAPSHOT

- FIGURE 83 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 84 CONTINENTAL AG: GLOBAL PRESENCE

- FIGURE 85 CONTINENTAL AG: PRODUCT SNAPSHOT

- FIGURE 86 ASTEMO, LTD.: COMPANY SNAPSHOT

- FIGURE 87 ASTEMO, LTD.: PRODUCT SNAPSHOT

- FIGURE 88 BREMBO N.V.: COMPANY SNAPSHOT

- FIGURE 89 BREMBO N.V.: PRODUCT SNAPSHOT

- FIGURE 90 ADVICS CO., LTD.: PRODUCT SNAPSHOT

- FIGURE 91 HYUNDAI MOBIS: COMPANY SNAPSHOT

- FIGURE 92 HYUNDAI MOBIS: PRODUCT SNAPSHOT

- FIGURE 93 HL MANDO CORP.: COMPANY SNAPSHOT

- FIGURE 94 HL MANDO CORP.: PRODUCT SNAPSHOT

- FIGURE 95 WANXIANG QIANCHAO CO., LTD.: COMPANY SNAPSHOT

- FIGURE 96 WANXIANG QIANCHAO CO., LTD.: PRODUCT SNAPSHOT

- FIGURE 97 BRAKES INDIA: COMPANY SNAPSHOT

- FIGURE 98 BRAKES INDIA: PRODUCT SNAPSHOT

- FIGURE 99 ANAND GROUP: PRODUCT SNAPSHOT

- FIGURE 100 AKEBONO BRAKE INDUSTRY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 101 AKEBONO BRAKE INDUSTRY CO., LTD.: NET SALES BY CUSTOMER

- FIGURE 102 AKEBONO BRAKE INDUSTRY CO., LTD.: PRODUCT SNAPSHOT

- FIGURE 103 BETHEL AUTOMOTIVE SAFETY SYSTEMS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 104 BETHEL AUTOMOTIVE SAFETY SYSTEMS CO., LTD.: PRODUCT SNAPSHOT