|

市場調查報告書

商品編碼

1816008

全球教育科技和智慧教室市場(按解決方案、最終用戶和部署類型)預測至 2030 年Edtech and Smart Classrooms Market by Solution (Projection & Display Systems, Adaptive & Personalized Learning, Augmented Reality (AR), Virtual Reality (VR) & Simulations), End User, and Deployment Type - Global Forecast to 2030 |

||||||

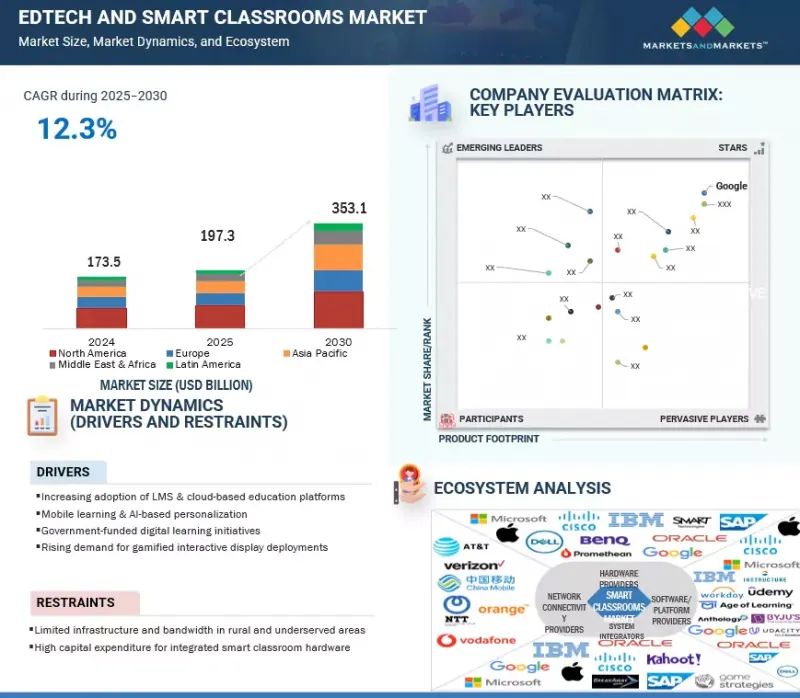

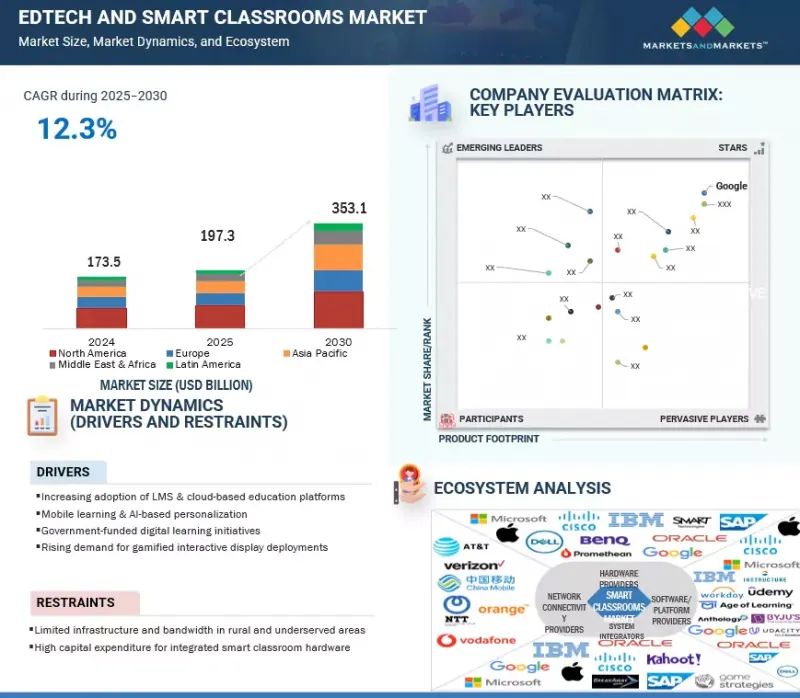

預計 2025 年全球教育科技和智慧教室市場價值將達到 1,973 億美元,到 2030 年將達到 3,531 億美元,複合年成長率為 12.3%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2020-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 百萬美元/十億美元 |

| 部分 | 解決方案、最終用戶、部署類型和區域 |

| 目標區域 | 北美、歐洲、亞太地區、中東和非洲、拉丁美洲 |

世界各國政府在加速教育科技和智慧教室的普及方面發揮關鍵作用。公共部門的投資、政策框架以及對數位教育基礎設施的資金支持正在推動這一市場的發展。例如,印度總理的「eVidya」計劃旨在為所有學生提供多種模式的線上教育途徑,而歐盟的「數位教育行動計畫(2021-2027)」則致力於打造高效的數位生態系統。同樣,美國也在大力投資支持STEM教育和農村學校寬頻接入的計畫。

世界各國政府正透過補貼平板電腦、電子白板和Wi-Fi等硬體,使科技驅動的學習更具包容性。這些措施也鼓勵在課堂上使用人工智慧、擴增實境/虛擬實境和雲端平台等新技術。除了學校之外,政府還資助職業培訓和技能提升項目,以確保更廣泛的學習者群體。這些舉措不僅彌合了數位鴻溝,也為教育科技公司提供了長期成長機會。

“在預測期內,AR、VR 和模擬領域將成長最快。”

AR、VR 和模擬工具正在透過提供沉浸式、體驗式學習環境來改變課堂。這些解決方案利用頭戴式耳機、行動應用程式和 3D 模擬來創建虛擬實驗室、歷史重現和基於技能的互動式培訓模組。 AR 應用程式可以將數位內容疊加在教科書上,VR 則允許醫學生在虛擬手術室中進行手術練習。 ClassVR、zSpace 和 Meta 等供應商正在透過更經濟實惠的硬體和雲端基礎的模擬庫推動 AR/VR 的普及。由於對個人化、體驗式學習的需求不斷成長,尤其是在 STEM 教育和職業培訓領域,預計這一領域將以最高的複合年成長率成長。向基於能力的學習和遊戲化的轉變進一步加速了應用。此外,政府和機構將身臨其境型技術融入課堂的舉措正在推動 AR/VR 的快速發展,使其成為教育科技和智慧教室生態系統中關鍵的下一代解決方案。

“預計在預測期內,K-12 領域將佔據最大的市場規模。”

K-12 細分市場指的是中小學教育中科技的應用,其中智慧工具的整合提升了教育品質和學生參與。為了滿足科技型學習者的需求,這類學校正迅速採用數位內容傳送平台、遊戲化學習工具和課堂協作解決方案。該細分市場的一大趨勢是整合由智慧白板、平板電腦和人工智慧自我調整系統支援的互動式學習環境,從而實現個人化教育,以滿足個人學習進度。 Google(旗下有 Google Classroom)和 SMART Technologies 等供應商已深度融入 K-12 生態系統,提供價格合理且可擴展的工具。該地區各國政府,例如印度的「數位印度」計劃和美國的「教育費率」計劃,正在透過資助學校的數位基礎設施來進一步加速科技的應用。在家長對創新教育日益成長的需求的推動下,K-12 仍然是教育科技解決方案的最大消費領域,推動著全球市場的穩定成長。

本報告對全球教育科技和智慧教室市場進行了分析,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 教育科技與智慧教室市場為企業帶來誘人機會

- 教育科技與智慧教室市場(按部署方式)

- 教育科技與智慧教室市場(按解決方案)

- 教育科技和智慧教室市場(按最終用戶分類)

- 北美教育科技和智慧教室市場(按最終用戶和地區分類)

第5章市場概況及產業趨勢

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 案例研究分析

- 生態系分析

- 供應鏈分析

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 波特五力分析

- 定價分析

- 平均銷售價格:按主要企業和地區

- 教育科技與智慧教室解決方案參考價格分析

- 專利分析

- 貿易分析

- 導入場景

- 出口場景

- 監管格局

- 監管機構、政府機構和其他組織

- 主要法規

- 法規:按地區

- 影響客戶業務的趨勢和中斷

- 主要相關利益者和採購標準

- 大型會議和活動(2025-2026)

- 生成式人工智慧對教育科技與智慧教室市場的影響

- 教育科技和智慧教室市場中的生成式人工智慧用例

- 案例研究

- 供應商舉措

- 經營模式

- 投資狀況及資金籌措情景

- 2025年美國關稅的影響

- 介紹

- 主要關稅稅率

- 對國家的影響

- 對終端產業的影響

第6章:教育科技與智慧教室市場(按解決方案)

- 介紹

- 學習內容與課程管理

- 課堂互動與協作工具

- 投影和顯示系統

- 學生監控與出席管理

- 評估和評分工具

- 學生資訊系統(SIS)和學校ERP

- 自適應和個人化學習

- AR、VR 和模擬

- 特殊教育和無障礙工具

- 其他解決方案

第7章:教育科技與智慧教室市場(按最終用戶分類)

- 介紹

- K-12

- 高等教育

- 職業訓練中心

第 8 章:教育科技與智慧教室市場(按部署類型)

- 介紹

- 本地部署

- 雲

第9章:教育科技與智慧教室市場(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲宏觀經濟展望

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 韓國

- 其他亞太地區

- 中東和非洲

- 中東和非洲的宏觀經濟展望

- 阿拉伯聯合大公國

- 沙烏地阿拉伯王國

- 南非

- 其他中東和非洲地區

- 拉丁美洲

- 拉丁美洲宏觀經濟展望

- 巴西

- 墨西哥

- 其他拉丁美洲

第10章 競爭格局

- 介紹

- 主要參與企業的策略/優勢(2022-2025)

- 收益分析(2020-2024)

- 市佔率分析(2024年)

- 品牌/產品比較

- 公司估值及財務指標

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第11章:公司簡介

- 介紹

- 主要企業

- MICROSOFT

- PEARSON

- ANTHOLOGY

- INSTRUCTURE

- CISCO

- IBM

- MCGRAW HILL

- ORACLE

- POWERSCHOOL

- 其他公司

- 2U INC

- ELLUCIAN

- TURNITIN

- KAHOOT!

- SMART TECHNOLOGIES

- IXL LEARNING

- D2L

- WORKDAY

- PROMETHEAN

- DISCOVERY EDUCATION

- BYJU'S

- YUANFUDAO

- VIPKID

- 17ZUOYE

- SEESAW

- UDACITY

- AGE OF LEARNING

- NEARPOD

第 12 章:相鄰/相關市場

- 介紹

- 學習管理系統市場

- 市場定義

- 市場概況

- 學習管理系統市場(按產品提供)

- 按交付方式分類的學習管理系統市場

- 按組織規模分類的學習管理系統市場

- 學習管理系統市場(按部署類型)

- 學習管理系統市場(按應用領域)

- 按使用者類型分類的學習管理系統市場

- 學習管理系統市場(按地區)

- 智慧學習市場

- 市場定義

- 市場概況

- 智慧學習市場(依產品分類)

- 智慧學習市場(按硬體)

- 智慧學習市場(按解決方案)

- 智慧學習市場:按服務

- 智慧學習市場:按學習類型

- 智慧學習市場(按最終用戶分類)

- 智慧學習市場(按地區)

第13章 附錄

The edtech and smart classrooms market is estimated at USD 197.3 billion in 2025 and is expected to reach USD 353.1 billion by 2030 at a CAGR of 12.3%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By Solution, End User, Deployment Type, and Region |

| Regions covered | North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

Governments worldwide are playing a crucial role in accelerating the adoption of edtech and smart classrooms. Public sector investment in digital education infrastructure, policy frameworks, and funding support has given momentum to this market. For instance, India's PM eVidya initiative aims to provide multi-mode access to online education for all students, while the European Union's Digital Education Action Plan (2021-2027) focuses on fostering high-performing digital ecosystems. Similarly, the US invests heavily in programs supporting STEM education and broadband access to rural schools.

Governments are making technology-enabled learning more inclusive by subsidizing hardware such as tablets, digital boards, and Wi-Fi access. These initiatives also promote the use of emerging technologies like AI, AR/VR, and cloud platforms in classrooms. Beyond schools, vocational training and upskilling programs are also supported by government funding, ensuring a broader learner base. Such initiatives not only bridge the digital divide but also ensure long-term growth opportunities for edtech players.

"Augmented Reality (AR), Virtual Reality (VR) & Simulations segment will witness the fastest growth during the forecast period."

AR, VR, and simulation tools are transforming classrooms by providing immersive, experiential learning environments. These solutions use headsets, mobile apps, and 3D simulations to create virtual laboratories, historical recreations, and interactive skill-based training modules. AR apps can overlay digital content on textbooks, while VR enables medical students to practice surgeries in virtual operating rooms. Vendors such as ClassVR, zSpace, and Meta are pushing AR/VR adoption through more affordable hardware and cloud-based simulation libraries. This segment is poised for the highest CAGR due to rising demand for personalized and experiential learning, especially in STEM education and vocational training. The shift toward competency-based learning and gamification is further accelerating adoption. Additionally, government and institutional initiatives to integrate immersive technologies in classrooms are driving rapid expansion, making AR/VR a critical next-wave solution in the edtech and smart classrooms ecosystem.

"The K-12 segment is expected to have the largest market size during the forecast period."

The K-12 segment refers to technology adoption across primary and secondary education, where smart tools are integrated to improve teaching quality and student engagement. Schools in this category are rapidly embracing digital content delivery platforms, gamified learning tools, and classroom collaboration solutions to cater to tech-savvy learners. A strong trend in this segment is the integration of interactive learning environments, supported by smart boards, tablets, and AI-powered adaptive systems that personalize education to individual learning paces. Vendors like Google (with Google Classroom) and SMART Technologies are deeply embedded in K-12 ecosystems, providing affordable and scalable tools. Governments across regions, such as India's Digital India initiative and the US E-rate program, are further accelerating adoption by funding digital infrastructure in schools. With increasing parental demand for innovative education, K-12 remains the largest consumer of edtech solutions, driving consistent growth in the global market.

"Asia Pacific is expected to record the highest growth rate during the forecast period."

The edtech and smart classrooms market in Asia Pacific continues to emerge as a global hub for edtech adoption, supported by government initiatives such as India's National Education Policy (NEP) 2020 and China's emphasis on "smart education" infrastructure. Countries like South Korea and Singapore are leading with investments in AI-driven learning platforms and adaptive assessment tools, making classrooms more personalized and data-driven. Partnerships between edtech startups and telecom operators are accelerating digital access, ensuring rural and remote learners are included in the digital transformation wave. The region also witnesses active participation from players like Byju's, Yuanfudao, and ClassIn, who are expanding content libraries and offering hybrid classroom solutions to cater to a diverse student base.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 48%, Tier 2 - 37%, and Tier 3 - 15%

- By Designation: C-level - 35%, D-level - 40%, and Others - 25%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 30%, Middle East & Africa - 5%, and Latin America - 5%

The major players in the edtech and smart classrooms market include Pearson (UK), Cisco (US), Anthology (US), IBM (US), McGraw Hill Education (US), Google (US), Microsoft (US), Oracle (US), PowerSchool (US), Instructure (US), 2U (US), Ellucian (US), Turnitin (US), Kahoot (Norway), Smart Technologies (Canada), IXL Learning (US), D2L (Canada), Workday (US), Discovery Education (US), Promethean (US), Byju's (India), Yuanfudao (China), VipKid (US), 17Zuoye (China), Seesaw (US), Nearpod (US), Age of Learning (US), and Brightbytes (US). These players have adopted various growth strategies, such as partnerships, agreements, collaborations, product launches, enhancements, and acquisitions, to expand their edtech and smart classrooms market footprint.

Research Coverage

- The market study covers the edtech and smart classrooms market size and growth potential across different segments, including solutions, end user, deployment type, and region. The solutions studied under the edtech and smart classrooms market include learning content & curriculum management, classroom interaction & collaboration tools, projection & display systems, student monitoring & attendance management, assessment & grading tools, student information systems (SIS) & school ERP, adaptive & personalized learning, augmented reality (AR), virtual reality (VR) & simulations, special education & accessibility tools, and other solutions. The end user segment includes K-12, higher education, and vocational training centers. The deployment type segment includes on-premises and cloud, where cloud is further segmented into private, public, and hybrid. The regional analysis of the edtech and smart classrooms market covers North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Key Benefits of Buying the Report

This report will help market leaders and new entrants with information on the closest approximations of the global edtech and smart classrooms market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape, gain insights, and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides the following insights.

1. Analysis of key drivers (increasing adoption of LMS & cloud-based education platforms, mobile learning & AI-based personalization, government-funded digital learning initiatives, and rising demand for gamified interactive display deployments), restraints (limited infrastructure and bandwidth in rural and underserved areas, and high capital expenditure for integrated smart classroom hardware), opportunities (demand for interoperable, analytics-enabled platforms, rising preference for hybrid learning models, and rising demand for AR/VR-enabled immersive learning solutions), and challenges (integration with legacy systems and cross-platform compatibility, and cybersecurity risks and regulatory compliance) influencing the growth of the edtech and smart classrooms market

2. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the edtech and smart classrooms market

3. Market Development: The report provides comprehensive information about lucrative markets, analyzing the edtech and smart classrooms market across various regions

4. Market Diversification: Comprehensive information about new products and services, untapped geographies, recent developments, and investments in the edtech and smart classrooms market

5. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Pearson (UK), Cisco (US), Anthology (US), IBM (US), McGraw Hill Education (US), Google (US), Microsoft (US), Oracle (US), PowerSchool (US), Instructure (US), 2U (US), Ellucian (US), Turnitin (US), Kahoot (Norway), Smart Technologies (Canada), IXL Learning (US), D2L (Canada), Workday (US), Discovery Education (US), Promethean (US), Byju's (India), Yuanfudao (China), VipKid (US), 17Zuoye (China), Seesaw (US), Nearpod (US), Age of Learning (US), and Brightbytes (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 MARKET FORECAST

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS OF STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EDTECH & SMART CLASSROOMS MARKET

- 4.2 EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT MODE

- 4.3 EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION

- 4.4 EDTECH & SMART CLASSROOMS MARKET, BY END USER

- 4.5 NORTH AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY END USER AND REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in adoption of LMS and cloud-based education platforms

- 5.2.1.2 Mobile learning and AI-based personalization

- 5.2.1.3 Government-funded digital learning initiatives

- 5.2.1.4 Rise in demand for gamified interactive display deployments

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited infrastructure and bandwidth in rural and underserved areas

- 5.2.2.2 High capital expenditure for integrated smart classroom hardware

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Demand for interoperable, analytics-enabled platforms

- 5.2.3.2 Rise in preference for hybrid learning models

- 5.2.3.3 Rise in demand for AR/VR-enabled immersive learning solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration with legacy systems and cross-platform compatibility

- 5.2.4.2 Cybersecurity risks and regulatory compliance

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 GENERATION: YOU EMPLOYED, INC. EMPLOYED SCALES GLOBAL WORKFORCE TRAINING WITH INSTRUCTURE'S CANVAS LMS

- 5.3.2 FORT BEND ISD FUTURE-PROOFED CLASSROOMS WITH SMART TECHNOLOGIES' OPS MODULES

- 5.3.3 CHONG GENE HANG COLLEGE PARTNERS WITH LENOVO FOR AI-DRIVEN EDUCATION

- 5.3.4 AGORA CYBER CHARTER SCHOOL ENHANCED VIRTUAL SCIENCE INSTRUCTION WITH DISCOVERY EDUCATION'S MYSTERY SCIENCE

- 5.3.5 SAANICH SCHOOL DISTRICT STREAMLINES STUDENT PROGRESS REPORTING WITH D2L

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Learning management systems (LMS)

- 5.6.1.2 Interactive flat panel displays (IFPDs)

- 5.6.1.3 Virtual classroom platforms

- 5.6.1.4 Digital content creation tools

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 AI-powered assessment tools

- 5.6.2.2 Classroom management software

- 5.6.2.3 Video-based learning platforms

- 5.6.2.4 Adaptive learning engines

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Augmented reality (AR) for experiential learning

- 5.6.3.2 Blockchain for academic credentialing

- 5.6.3.3 Learning record stores (LRS)

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY REGION

- 5.8.2 INDICATIVE PRICING ANALYSIS FOR EDTECH & SMART CLASSROOM SOLUTIONS

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- 5.10.2 EXPORT SCENARIO

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 KEY REGULATIONS

- 5.11.2.1 North America

- 5.11.2.1.1 US

- 5.11.2.1.2 Canada

- 5.11.2.2 Europe

- 5.11.2.3 Asia Pacific

- 5.11.2.3.1 South Korea

- 5.11.2.3.2 China

- 5.11.2.4 Rest of the World

- 5.11.2.4.1 UAE

- 5.11.2.4.2 South Africa

- 5.11.2.4.3 Brazil

- 5.11.2.5 General Data Protection Regulation

- 5.11.2.6 SEC Rule 17a-4

- 5.11.2.7 ISO/IEC 27001

- 5.11.2.8 University Grants Commission Regulations, 2018

- 5.11.2.9 Higher Education Opportunity Act - 2008

- 5.11.2.10 Distance Learning and Innovation Regulation

- 5.11.2.1 North America

- 5.11.3 REGULATIONS, BY REGION

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 IMPACT OF GENERATIVE AI ON EDTECH & SMART CLASSROOM MARKET

- 5.15.1 USE CASES OF GENERATIVE AI IN EDTECH & SMART CLASSROOMS MARKET

- 5.15.2 CASE STUDIES

- 5.15.2.1 iSchoolConnect and Google Cloud transform AI-driven admissions in higher education

- 5.15.2.2 Saxion University leverages D2L and LearnWise AI to streamline LMS transition and student support

- 5.15.3 VENDOR INITIATIVE

- 5.15.3.1 D2L

- 5.16 BUSINESS MODELS

- 5.17 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 IMPACT ON COUNTRY/REGION

- 5.18.3.1 North America

- 5.18.3.2 Europe

- 5.18.3.3 Asia Pacific

- 5.18.4 IMPACT ON END-USE INDUSTRIES

- 5.18.4.1 Manufacturing & industrial (Industrial IoT)

- 5.18.4.2 Telecommunications & 5G networks

- 5.18.4.3 Healthcare & life sciences

- 5.18.4.4 Retail

- 5.18.4.5 Transportation & automotive

- 5.18.4.6 Energy & utilities

- 5.18.4.7 Government & defense

6 EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION

- 6.1 INTRODUCTION

- 6.1.1 SOLUTION: MARKET DRIVERS

- 6.2 LEARNING CONTENT & CURRICULUM MANAGEMENT

- 6.2.1 ACCELERATING PERSONALIZED LEARNING THROUGH AI-ENABLED CONTENT PLATFORMS

- 6.3 CLASSROOM INTERACTION & COLLABORATION TOOLS

- 6.3.1 ENHANCING STUDENT ENGAGEMENT VIA INTERACTIVE AND INCLUSIVE COLLABORATION TOOLS

- 6.4 PROJECTION & DISPLAY SYSTEMS

- 6.4.1 TRANSFORMING LESSON DELIVERY WITH IMMERSIVE AND INTERACTIVE VISUALIZATION TECHNOLOGIES

- 6.5 STUDENT MONITORING & ATTENDANCE MANAGEMENT

- 6.5.1 AUTOMATING ATTENDANCE AND ENGAGEMENT TRACKING TO IMPROVE CLASSROOM ACCOUNTABILITY

- 6.6 ASSESSMENT & GRADING TOOLS

- 6.6.1 ENABLING ADAPTIVE EVALUATION AND REAL-TIME FEEDBACK THROUGH AI-DRIVEN ASSESSMENT PLATFORMS

- 6.7 STUDENT INFORMATION SYSTEMS (SIS) & SCHOOL ERP

- 6.7.1 STREAMLINING ACADEMIC AND ADMINISTRATIVE OPERATIONS VIA INTEGRATED DIGITAL SYSTEMS

- 6.8 ADAPTIVE & PERSONALIZED LEARNING

- 6.8.1 DELIVERING TAILORED LEARNING EXPERIENCES WITH AI-POWERED ADAPTIVE PLATFORMS

- 6.9 AUGMENTED REALITY (AR), VIRTUAL REALITY (VR), AND SIMULATIONS

- 6.9.1 FACILITATING EXPERIENTIAL LEARNING THROUGH IMMERSIVE AR/VR TECHNOLOGIES

- 6.10 SPECIAL EDUCATION & ACCESSIBILITY TOOLS

- 6.10.1 PROMOTING INCLUSIVE LEARNING THROUGH AI-ENHANCED ACCESSIBILITY SOLUTIONS

- 6.11 OTHER SOLUTIONS

7 EDTECH & SMART CLASSROOMS MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.1.1 END USER: MARKET DRIVERS

- 7.2 K-12

- 7.2.1 ENGAGING YOUNG LEARNERS THROUGH INTERACTIVE MEDIA, GAMIFICATION, AND SMART CLASSROOM INFRASTRUCTURE

- 7.3 HIGHER EDUCATION

- 7.3.1 ENHANCING LEARNING AND RESEARCH WITH CLOUD-BASED TOOLS, LECTURE CAPTURE, AND IMMERSIVE TECHNOLOGIES

- 7.4 VOCATIONAL TRAINING CENTERS

- 7.4.1 ENABLING HANDS-ON SKILL DEVELOPMENT VIA AR/VR AND SPECIALIZED TECHNICAL TRAINING SOLUTIONS

8 EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE

- 8.1 INTRODUCTION

- 8.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

- 8.2 ON-PREMISES

- 8.2.1 ENSURING DATA SECURITY AND SYSTEM CONTROL THROUGH LOCAL HOSTING AND CUSTOM INTEGRATION

- 8.3 CLOUD

- 8.3.1 SCALING ACCESS AND FLEXIBILITY WITH CLOUD-BASED EDTECH PLATFORMS FOR REMOTE AND HYBRID LEARNING

- 8.3.2 PRIVATE

- 8.3.3 PUBLIC

- 8.3.4 HYBRID

9 EDTECH & SMART CLASSROOMS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.3 CANADA

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.3 GERMANY

- 9.3.4 FRANCE

- 9.3.5 ITALY

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.3 INDIA

- 9.4.4 JAPAN

- 9.4.5 AUSTRALIA & NEW ZEALAND

- 9.4.6 SOUTH KOREA

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 UNITED ARAB EMIRATES

- 9.5.3 KINGDOM OF SAUDI ARABIA

- 9.5.4 SOUTH AFRICA

- 9.5.5 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.3 MEXICO

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6.1 COMPANY VALUATION

- 10.6.2 FINANCIAL METRICS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Regional footprint

- 10.7.5.3 Deployment type footprint

- 10.7.5.4 End user footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS

- 11.2.1 MICROSOFT

- 11.2.1.1 Business overview

- 11.2.1.2 Products/Solutions/Services offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Product launches

- 11.2.1.3.2 Deals

- 11.2.1.4 MnM view

- 11.2.1.4.1 Key strengths/right to win

- 11.2.1.4.2 Strategic choices

- 11.2.1.4.3 Weaknesses and competitive threats

- 11.2.2 GOOGLE

- 11.2.2.1 Business overview

- 11.2.2.2 Products/Solutions/Services offered

- 11.2.2.3 Recent developments

- 11.2.2.3.1 Product launches

- 11.2.2.3.2 Deals

- 11.2.2.4 MnM view

- 11.2.2.4.1 Key strengths/right to win

- 11.2.2.4.2 Strategic choices

- 11.2.2.4.3 Weaknesses and competitive threats

- 11.2.3 PEARSON

- 11.2.3.1 Business overview

- 11.2.3.2 Products/Solutions/Services offered

- 11.2.3.3 Recent developments

- 11.2.3.3.1 Product launches

- 11.2.3.3.2 Deals

- 11.2.3.4 MnM view

- 11.2.3.4.1 Key strengths/right to win

- 11.2.3.4.2 Strategic choices

- 11.2.3.4.3 Weaknesses and competitive threats

- 11.2.4 ANTHOLOGY

- 11.2.4.1 Business overview

- 11.2.4.2 Products/Solutions/Services offered

- 11.2.4.3 Recent Developments

- 11.2.4.3.1 Product launches

- 11.2.4.3.2 Deals

- 11.2.4.4 MnM view

- 11.2.4.4.1 Key strengths/right to win

- 11.2.4.4.2 Strategic choices

- 11.2.4.4.3 Weaknesses and competitive threats

- 11.2.5 INSTRUCTURE

- 11.2.5.1 Business overview

- 11.2.5.2 Products/Solutions/Services offered

- 11.2.5.3 Recent developments

- 11.2.5.3.1 Product launches

- 11.2.5.3.2 Deals

- 11.2.5.4 MnM view

- 11.2.5.4.1 Key strengths/right to win

- 11.2.5.4.2 Strategic choices

- 11.2.5.4.3 Weaknesses and competitive threats

- 11.2.6 CISCO

- 11.2.6.1 Business overview

- 11.2.6.2 Products/Solutions/Services offered

- 11.2.6.3 Recent Developments

- 11.2.6.3.1 Deals

- 11.2.7 IBM

- 11.2.7.1 Business overview

- 11.2.7.2 Products/Solutions/Services offered

- 11.2.7.3 Recent developments

- 11.2.7.3.1 Product launches

- 11.2.7.3.2 Deals

- 11.2.8 MCGRAW HILL

- 11.2.8.1 Business overview

- 11.2.8.2 Products/Solutions/Services offered

- 11.2.8.3 Recent developments

- 11.2.8.3.1 Deals

- 11.2.9 ORACLE

- 11.2.9.1 Business overview

- 11.2.9.2 Products/Solutions/Services offered

- 11.2.9.3 Recent developments

- 11.2.9.3.1 Product launches

- 11.2.10 POWERSCHOOL

- 11.2.10.1 Business overview

- 11.2.10.2 Products/Solutions/Services offered

- 11.2.10.3 Recent developments

- 11.2.10.3.1 Product launches

- 11.2.10.3.2 Deals

- 11.2.1 MICROSOFT

- 11.3 OTHER PLAYERS

- 11.3.1 2U INC

- 11.3.2 ELLUCIAN

- 11.3.3 TURNITIN

- 11.3.4 KAHOOT!

- 11.3.5 SMART TECHNOLOGIES

- 11.3.6 IXL LEARNING

- 11.3.7 D2L

- 11.3.8 WORKDAY

- 11.3.9 PROMETHEAN

- 11.3.10 DISCOVERY EDUCATION

- 11.3.11 BYJU'S

- 11.3.12 YUANFUDAO

- 11.3.13 VIPKID

- 11.3.14 17ZUOYE

- 11.3.15 SEESAW

- 11.3.16 UDACITY

- 11.3.17 AGE OF LEARNING

- 11.3.18 NEARPOD

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LEARNING MANAGEMENT SYSTEM MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING

- 12.2.4 LEARNING MANAGEMENT SYSTEM MARKET, BY DELIVERY MODE

- 12.2.5 LEARNING MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE

- 12.2.6 LEARNING MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE

- 12.2.7 LEARNING MANAGEMENT SYSTEM MARKET, BY APPLICATION AREA

- 12.2.8 LEARNING MANAGEMENT SYSTEM MARKET, BY USER TYPE

- 12.2.9 LEARNING MANAGEMENT SYSTEM MARKET, BY REGION

- 12.3 SMART LEARNING MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 SMART LEARNING MARKET, BY OFFERING

- 12.3.4 SMART LEARNING MARKET, BY HARDWARE

- 12.3.5 SMART LEARNING MARKET, BY SOLUTION

- 12.3.6 SMART LEARNING MARKET, BY SERVICE

- 12.3.7 SMART LEARNING MARKET, BY LEARNING TYPE

- 12.3.8 SMART LEARNING MARKET, BY END USER

- 12.3.9 SMART LEARNING MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2022-2024

- TABLE 2 LIST OF KEY PRIMARY INTERVIEW PARTICIPANTS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 RESEARCH ASSUMPTIONS

- TABLE 5 EDTECH & SMART CLASSROOM MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 6 IMPACT OF PORTER'S FIVE FORCES ON EDTECH & SMART CLASSROOMS MARKET

- TABLE 7 AVERAGE SELLING PRICE OF KEY PLAYERS, BY REGION, 2025 (USD)

- TABLE 8 INDICATIVE PRICING ANALYSIS FOR EDTECH & SMART CLASSROOM SOLUTIONS, BY KEY PLAYERS

- TABLE 9 PATENTS GRANTED TO VENDORS IN EDTECH & SMART CLASSROOMS MARKET

- TABLE 10 IMPORT DATA FOR HS CODE 8528, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 8528, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: LIST OF REGULATIONS

- TABLE 18 EUROPE: LIST OF REGULATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATIONS

- TABLE 20 MIDDLE EAST & AFRICA: LIST OF REGULATIONS

- TABLE 21 LATIN AMERICA: LIST OF REGULATIONS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- TABLE 23 KEY BUYING CRITERIA FOR END USER

- TABLE 24 EDTECH & SMART CLASSROOM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 25 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 26 EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 27 EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 28 LEARNING CONTENT & CURRICULUM MANAGEMENT SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 LEARNING CONTENT & CURRICULUM MANAGEMENT SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 CLASSROOM INTERACTION & COLLABORATION TOOLS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 CLASSROOM INTERACTION & COLLABORATION TOOLS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 PROJECTION & DISPLAY SYSTEMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 PROJECTION & DISPLAY SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 STUDENT MONITORING & ATTENDANCE MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 STUDENT MONITORING & ATTENDANCE MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 ASSESSMENT & GRADING TOOLS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 ASSESSMENT & GRADING TOOLS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 STUDENT INFORMATION SYSTEMS (SIS) & SCHOOL ERP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 STUDENT INFORMATION SYSTEMS (SIS) & SCHOOL ERP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 ADAPTIVE & PERSONALIZED LEARNING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 ADAPTIVE & PERSONALIZED LEARNING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 AUGMENTED REALITY (AR), VIRTUAL REALITY (VR), AND SIMULATIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 AUGMENTED REALITY (AR), VIRTUAL REALITY (VR), AND SIMULATIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 SPECIAL EDUCATION & ACCESSIBILITY TOOLS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 SPECIAL EDUCATION & ACCESSIBILITY TOOLS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 OTHER EDTECH & SMART CLASSROOM SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 OTHER EDTECH & SMART CLASSROOM SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 49 EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 50 EDTECH & SMART CLASSROOMS MARKET FOR K-12, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 EDTECH & SMART CLASSROOMS MARKET FOR K-12, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 EDTECH & SMART CLASSROOMS MARKET FOR HIGHER EDUCATION, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 EDTECH & SMART CLASSROOMS MARKET FOR HIGHER EDUCATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 EDTECH & SMART CLASSROOMS MARKET FOR VOCATIONAL TRAINING CENTERS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 EDTECH & SMART CLASSROOMS MARKET FOR VOCATIONAL TRAINING CENTERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 57 EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 58 ON-PREMISE EDTECH & SMART CLASSROOMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 ON-PREMISE EDTECH & SMART CLASSROOMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 CLOUD-BASED EDTECH & SMART CLASSROOMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 CLOUD-BASED EDTECH & SMART CLASSROOMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 CLOUD-BASED EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 63 CLOUD-BASED EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 64 PRIVATE CLOUD-BASED EDTECH & SMART CLASSROOMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 PRIVATE CLOUD-BASED EDTECH & SMART CLASSROOMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 PUBLIC CLOUD-BASED EDTECH & SMART CLASSROOMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 PUBLIC CLOUD-BASED EDTECH & SMART CLASSROOMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 HYBRID CLOUD-BASED EDTECH & SMART CLASSROOMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 HYBRID CLOUD-BASED EDTECH & SMART CLASSROOMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 EDTECH & SMART CLASSROOMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 EDTECH & SMART CLASSROOMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 75 NORTH AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 77 NORTH AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 82 US: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 83 US: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 84 US: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 85 US: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 86 US: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 87 US: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 88 US: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 89 US: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 90 CANADA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 91 CANADA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 92 CANADA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 93 CANADA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 94 CANADA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 95 CANADA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 96 CANADA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 97 CANADA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 98 EUROPE: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 99 EUROPE: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 100 EUROPE: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 101 EUROPE: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 102 EUROPE: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 103 EUROPE: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 104 EUROPE: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 105 EUROPE: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 106 EUROPE: EDTECH & SMART CLASSROOMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 107 EUROPE: EDTECH & SMART CLASSROOMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 108 UK: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 109 UK: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 110 UK: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 111 UK: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 112 UK: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 113 UK: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 114 UK: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 115 UK: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 116 GERMANY: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 117 GERMANY: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 118 GERMANY: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 119 GERMANY: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 120 GERMANY: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 121 GERMANY: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 122 GERMANY: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 123 GERMANY: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 124 FRANCE: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 125 FRANCE: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 126 FRANCE: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 127 FRANCE: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 128 FRANCE: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 129 FRANCE: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 130 FRANCE: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 131 FRANCE: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 132 ITALY: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 133 ITALY: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 134 ITALY: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 135 ITALY: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 136 ITALY: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 137 ITALY: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 138 ITALY: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 139 ITALY: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 143 ASIA PACIFIC: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 145 ASIA PACIFIC: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 147 ASIA PACIFIC: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: EDTECH & SMART CLASSROOMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 149 ASIA PACIFIC: EDTECH & SMART CLASSROOMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 CHINA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 151 CHINA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 152 CHINA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 153 CHINA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 154 CHINA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 155 CHINA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 156 CHINA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 157 CHINA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 158 INDIA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 159 INDIA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 160 INDIA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 161 INDIA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 162 INDIA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 163 INDIA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 164 INDIA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 165 INDIA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 166 JAPAN: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 167 JAPAN: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 168 JAPAN: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 169 JAPAN: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 170 JAPAN: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 171 JAPAN: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 172 JAPAN: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 173 JAPAN: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 174 AUSTRALIA & NEW ZEALAND: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 175 AUSTRALIA & NEW ZEALAND: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 176 AUSTRALIA & NEW ZEALAND: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 177 AUSTRALIA & NEW ZEALAND: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 178 AUSTRALIA & NEW ZEALAND: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 179 AUSTRALIA & NEW ZEALAND: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 180 AUSTRALIA & NEW ZEALAND: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 181 AUSTRALIA & NEW ZEALAND: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 182 SOUTH KOREA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 183 SOUTH KOREA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 184 SOUTH KOREA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 185 SOUTH KOREA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 186 SOUTH KOREA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 187 SOUTH KOREA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 188 SOUTH KOREA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 189 SOUTH KOREA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 200 UNITED ARAB EMIRATES: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 201 UNITED ARAB EMIRATES: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 202 UNITED ARAB EMIRATES: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 203 UNITED ARAB EMIRATES: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 204 UNITED ARAB EMIRATES: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 205 UNITED ARAB EMIRATES: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 206 UNITED ARAB EMIRATES: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 207 UNITED ARAB EMIRATES: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 208 KINGDOM OF SAUDI ARABIA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 209 KINGDOM OF SAUDI ARABIA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 210 KINGDOM OF SAUDI ARABIA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 211 KINGDOM OF SAUDI ARABIA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 212 KINGDOM OF SAUDI ARABIA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 213 KINGDOM OF SAUDI ARABIA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 214 KINGDOM OF SAUDI ARABIA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 215 KINGDOM OF SAUDI ARABIA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 216 SOUTH AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 217 SOUTH AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 218 SOUTH AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 219 SOUTH AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 220 SOUTH AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 221 SOUTH AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 222 SOUTH AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 223 SOUTH AFRICA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 224 LATIN AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 225 LATIN AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 226 LATIN AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 227 LATIN AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 228 LATIN AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 229 LATIN AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 230 LATIN AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 231 LATIN AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 232 LATIN AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 233 LATIN AMERICA: EDTECH & SMART CLASSROOMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 234 BRAZIL: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 235 BRAZIL: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 236 BRAZIL: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 237 BRAZIL: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 238 BRAZIL: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 239 BRAZIL: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 240 BRAZIL: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 241 BRAZIL: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 242 MEXICO: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 243 MEXICO: EDTECH & SMART CLASSROOMS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 244 MEXICO: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 245 MEXICO: EDTECH & SMART CLASSROOMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 246 MEXICO: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 247 MEXICO: EDTECH & SMART CLASSROOMS MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 248 MEXICO: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 249 MEXICO: EDTECH & SMART CLASSROOMS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 250 OVERVIEW OF STRATEGIES ADOPTED BY KEY EDTECH & SMART CLASSROOM MARKET PLAYERS, 2022-2025

- TABLE 251 EDTECH & SMART CLASSROOMS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 252 EDTECH & SMART CLASSROOMS MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 253 EDTECH & SMART CLASSROOMS MARKET: DEPLOYMENT TYPE FOOTPRINT, 2024

- TABLE 254 EDTECH & SMART CLASSROOMS MARKET: END USER FOOTPRINT, 2024

- TABLE 255 EDTECH & SMART CLASSROOMS MARKET: LIST OF KEY STARTUPS/SMES, 2024

- TABLE 256 EDTECH & SMART CLASSROOMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2O24

- TABLE 257 EDTECH & SMART CLASSROOMS MARKET: PRODUCT LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 258 EDTECH & SMART CLASSROOMS MARKET: DEALS, JANUARY 2022-JULY 2025

- TABLE 259 MICROSOFT: BUSINESS OVERVIEW

- TABLE 260 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 MICROSOFT: PRODUCT LAUNCHES

- TABLE 262 MICROSOFT: DEALS

- TABLE 263 GOOGLE: BUSINESS OVERVIEW

- TABLE 264 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 GOOGLE: PRODUCT LAUNCHES

- TABLE 266 GOOGLE: DEALS

- TABLE 267 PEARSON: BUSINESS OVERVIEW

- TABLE 268 PEARSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 PEARSON: PRODUCT LAUNCHES

- TABLE 270 PEARSON: DEALS

- TABLE 271 ANTHOLOGY: BUSINESS OVERVIEW

- TABLE 272 ANTHOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 ANTHOLOGY: PRODUCT LAUNCHES

- TABLE 274 ANTHOLOGY: DEALS

- TABLE 275 INSTRUCTURE: BUSINESS OVERVIEW

- TABLE 276 INSTRUCTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 INSTRUCTURE: PRODUCT LAUNCHES

- TABLE 278 INSTRUCTURE: DEALS

- TABLE 279 CISCO: BUSINESS OVERVIEW

- TABLE 280 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 CISCO: DEALS

- TABLE 282 IBM: BUSINESS OVERVIEW

- TABLE 283 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 IBM: PRODUCT LAUNCHES

- TABLE 285 IBM: DEALS

- TABLE 286 MCGRAW HILL: BUSINESS OVERVIEW

- TABLE 287 MCGRAW HILL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 MCGRAW HILL: DEALS

- TABLE 289 ORACLE: BUSINESS OVERVIEW

- TABLE 290 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 ORACLE: PRODUCT LAUNCHES

- TABLE 292 POWERSCHOOL: BUSINESS OVERVIEW

- TABLE 293 POWERSCHOOL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 POWERSCHOOL: PRODUCT LAUNCHES

- TABLE 295 POWERSCHOOL: DEALS

- TABLE 296 LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 297 LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 298 LEARNING MANAGEMENT SYSTEM MARKET, BY DELIVERY MODE, 2018-2022 (USD MILLION)

- TABLE 299 LEARNING MANAGEMENT SYSTEM MARKET, BY DELIVERY MODE, 2023-2028 (USD MILLION)

- TABLE 300 LEARNING MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 301 LEARNING MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 302 LEARNING MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 303 LEARNING MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 304 LEARNING MANAGEMENT SYSTEM MARKET, BY APPLICATION AREA, 2018-2022 (USD MILLION)

- TABLE 305 LEARNING MANAGEMENT SYSTEM MARKET, BY APPLICATION AREA, 2023-2028 (USD MILLION)

- TABLE 306 LEARNING MANAGEMENT SYSTEM MARKET, BY USER TYPE, 2018-2022 (USD MILLION)

- TABLE 307 LEARNING MANAGEMENT SYSTEM MARKET, BY USER TYPE, 2023-2028 (USD MILLION)

- TABLE 308 LEARNING MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 309 LEARNING MANAGEMENT SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 310 SMART LEARNING MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 311 SMART LEARNING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 312 SMART LEARNING MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 313 SMART LEARNING MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 314 SMART LEARNING MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 315 SMART LEARNING MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 316 SMART LEARNING MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 317 SMART LEARNING MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 318 SMART LEARNING MARKET, BY LEARNING TYPE, 2018-2023 (USD MILLION)

- TABLE 319 SMART LEARNING MARKET, BY LEARNING TYPE, 2024-2029 (USD MILLION)

- TABLE 320 SMART LEARNING MARKET, BY END USER, 2018-2023 (USD MILLION)

- TABLE 321 SMART LEARNING MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 322 SMART LEARNING MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 323 SMART LEARNING MARKET, BY REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 EDTECH & SMART CLASSROOMS MARKET SEGMENTATION

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 EDTECH & SMART CLASSROOMS MARKET: RESEARCH DESIGN

- FIGURE 4 SECONDARY SOURCES

- FIGURE 5 SECONDARY SOURCES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 7 EDTECH & SMART CLASSROOMS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 8 APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN EDTECH & SMART CLASSROOMS MARKET

- FIGURE 9 APPROACH 2 (DEMAND SIDE): EDTECH & SMART CLASSROOMS MARKET

- FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 11 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- FIGURE 12 DATA TRIANGULATION

- FIGURE 13 EDTECH & SMART CLASSROOMS MARKET, 2023-2030 (USD MILLION)

- FIGURE 14 EDTECH & SMART CLASSROOMS MARKET: REGIONAL AND COUNTRY-WISE SHARES, 2025

- FIGURE 15 INCREASING ADOPTION OF CLOUD-BASED PLATFORMS, AR/VR, AND AI-ENABLED TOOLS TO DRIVE THE MARKET

- FIGURE 16 CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 17 PROJECTION & DISPLAY SYSTEMS TO BE LARGEST SOLUTIONS MARKET IN 2025

- FIGURE 18 K-12 SEGMENT TO LEAD GLOBAL MARKET AMONG END USERS IN 2025

- FIGURE 19 K-12 SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN NORTH AMERICA IN 2025

- FIGURE 20 EDTECH & SMART CLASSROOM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 EDTECH & SMART CLASSROOM MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 EDTECH & SMART CLASSROOM MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 EDTECH & SMART CLASSROOMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 AVERAGE SELLING PRICE ACROSS KEY PLAYERS, BY REGION, 2025 (USD)

- FIGURE 25 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2015-2025

- FIGURE 26 IMPORT DATA FOR HS CODE 8528, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 27 EXPORT DATA FOR HS CODE 8528, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 28 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN EDTECH & SMART CLASSROOM MARKET

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- FIGURE 30 KEY BUYING CRITERIA FOR END USER

- FIGURE 31 MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING EDTECH & SMART CLASSROOM ACROSS KEY USE CASES

- FIGURE 32 EDTECH & SMART CLASSROOM MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO, 2025 (USD MILLION)

- FIGURE 33 PROJECTION & DISPLAY SYSTEMS SEGMENT TO HAVE LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 34 VOCATIONAL TRAINING CENTERS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 CLOUD DEPLOYMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 36 HYBRID SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS IN EDTECH & SMART CLASSROOMS MARKET, 2023-2024 (USD MILLION)

- FIGURE 40 SHARES OF LEADING COMPANIES IN EDTECH & SMART CLASSROOMS MARKET, 2024

- FIGURE 41 EDTECH & SMART CLASSROOMS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 42 COMPANY VALUATION OF KEY VENDORS, 2025 (USD BILLION)

- FIGURE 43 FINANCIAL METRICS OF KEY VENDORS, 2025

- FIGURE 44 EDTECH & SMART CLASSROOMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 EDTECH & SMART CLASSROOMS MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 46 EDTECH & SMART CLASSROOMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 48 GOOGLE: COMPANY SNAPSHOT

- FIGURE 49 PEARSON: COMPANY SNAPSHOT

- FIGURE 50 CISCO: COMPANY SNAPSHOT

- FIGURE 51 IBM: COMPANY SNAPSHOT

- FIGURE 52 ORACLE: COMPANY SNAPSHOT