|

市場調查報告書

商品編碼

1804839

全球壓力感測器市場(按檢測方法、類型和壓力範圍)- 預測至2030年Pressure Sensor Market by Sensing Method, Type, Range PSI - Global Forecast to 2030 |

||||||

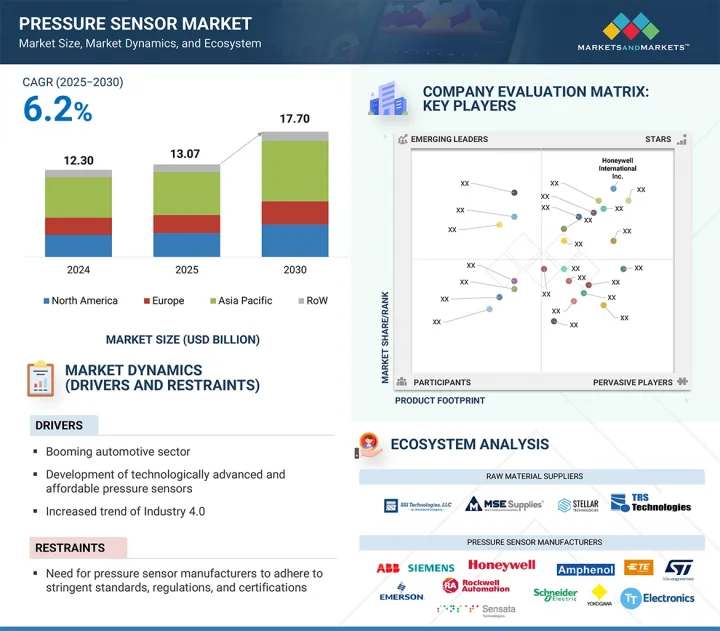

全球壓力感測器市場預計將從 2025 年的 130.7 億美元成長到 2030 年的 177 億美元,2025 年至 2030 年的複合年成長率為 6.2%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 10億美元 |

| 部分 | 連接性、檢測方法、檢測類型、壓力範圍、最終用途、區域 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

各行各業擴大採用預測性維護策略,特別是透過整合工業IoT技術,這為壓力感測器市場創造了巨大的成長機會。預測性維護依賴於即時狀態監測,而壓力感測器對於追蹤機器和系統內的壓力波動以及在潛在異常導致代價高昂的故障之前檢測出它們至關重要。製造業、石油和天然氣、公共產業和運輸業等行業擴大採用預測性維護,以最大限度地減少計劃外停機時間、延長設備使用壽命並降低營運成本。嵌入在支援物聯網的網路中的壓力感測器提供連續的資料流,可透過進階分析平台進行分析,以準確預測設備健康狀況和維護需求。這使公司能夠從被動維護計劃轉變為主動維護計劃,從而提高生產力和資產可靠性。

此外,雲端基礎的分析平台和安全資料通訊通訊協定的興起簡化了預測性維護程序的部署,同時確保了資料完整性。隨著企業持續優先考慮效率、成本控制和業務彈性,用於預測性維護應用的智慧感測器(壓力感測器)的需求預計將激增。這一趨勢將刺激感測器製造商的技術創新,開發高精度、耐用且支援物聯網的解決方案,從而進一步推動壓力感測器市場的發展。

“預計2025年至2030年間,壓阻感測方法部分將在壓力感測器市場中實現顯著的複合年成長率。”

壓阻檢測方法領域預計將在 2025 年至 2030 年期間在壓力感測器市場中實現顯著的複合年成長率,這得益於其在準確性、穩定性和成本效益方面的公認優勢。壓阻壓力感測器透過檢測因機械應變引起的半導體材料電阻變化來運作,從而產生高靈敏度和線性的輸出訊號。它們與 MEMS 製造技術的兼容性實現了小型化,使其成為整合到醫療、汽車和消費性電子領域使用的小型攜帶式設備中的理想選擇。在汽車工業中,壓阻感知器因其在各種環境條件下的耐用性和高精度而廣泛應用於歧管絕對壓力 (MAP)、燃油和輪胎壓力監測系統 (TPMS)。在醫療設備中,尤其是導管和輸液幫浦等侵入式應用中,壓阻感測器因其體積小、精度高而受到青睞。此外,矽基感測器技術的進步和製造技術的改進正在降低生產成本,同時提高感測器性能。隨著各行各業尋求更可靠、更節能、更貼合應用的感測解決方案,壓阻式壓力感測器因其廣泛的應用場景而日益普及。這些因素共同促成了預測期內壓阻式感測方法細分市場的高成長潛力。

“絕對壓力感測器領域很可能在 2025 年至 2030 年期間佔據壓力感測器市場的很大佔有率。”

絕對壓力感測器領域預計將在2025年至2030年期間保持強勁的市場地位,因為它廣泛效用需要精確測量真空壓力的應用整體。這些感測器在即使是輕微的壓力變化也會影響性能的環境中至關重要,例如航太、氣象學、工業真空系統和汽車引擎診斷。在汽車領域,絕對壓力感知器是歧管絕對壓力 (MAP) 感知器的關鍵組件,用於計算引擎負載,這對於最佳化燃油噴射和排放氣體控制至關重要。此外,這些感測器也用於汽車和航空連網型設備中的溫度調節器和氣壓監測。它們在高振動和極端溫度環境下的可靠性使其特別適用於航太和重工業應用。此外,對無人機、氣象監測設備和可攜式電子設備等智慧連網設備的需求不斷成長,進一步推動了對緊湊、堅固且精確的絕對壓力感測器的需求。絕對壓力感測器可以提供不受大氣壓力變化影響的穩定測量值,也非常適合監測密封系統。這些特性,加上 MEMS 技術和小型化的進步,使得絕對壓力感測器成為市場永續的重要貢獻者。

本報告分析了全球壓力感測器市場,並提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 壓力感測器市場為企業帶來誘人機會

- 北美壓力感測器市場按最終用途和國家分類

- 壓力感測器市場(按最終用途)

- 各國壓力感測器市場

第5章市場概述

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 供應鏈分析

- 生態系分析

- 投資金籌措場景

- 影響客戶業務的趨勢/中斷

- 定價分析

- 主要企業絕對壓力感知器價格分佈(2024年)

- 壓力感測器各應用平均售價趨勢(2021-2024)

- 各地區壓力感測器平均售價趨勢(2021-2024)

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 波特五力分析

- 主要相關利益者和採購標準

- 案例研究分析

- ALTHEN SENSORS & CONTROLS 利用微型壓力感測器增強荷蘭 DELFT HYPERLOOP計劃

- 薩裡感測器有限公司部署霍尼韋爾壓力感測器,以提高無人機和航太測試的準確性

- 主要農業機械製造商採用 WIKA 液位感測器進行機器控制

- 壓力感測器監控使 EMPTEEZY 能夠維持緊急水箱淋浴設備中的恆定水流

- 醫療設備公司採用壓力感測器監測嚴重疾病患者的血壓

- 貿易分析

- 進口情形(HS 編碼 902620)

- 出口情形(HS 編碼 902620)

- 關稅和監管格局

- 海關分析

- 監管機構、政府機構和其他組織

- 標準/法規

- 專利分析

- 大型會議和活動(2025-2026年)

- 人工智慧/產生人工智慧對壓力感測器市場的影響

- 2025年美國關稅對壓力感測器市場的影響

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對國家的影響

- 對最終用途的影響

第6章 各種介質的壓力感測器

- 介紹

- 氣壓感知器

- 氣壓感知器

- 氣壓感知器

- 水壓感測器

- 液體壓力感測器

- 空氣和液壓感知器

- 腐蝕性液體和氣體壓力感測器

第7章 壓力感測器相關技術

- 介紹

- 微加工技術

- MEMS

- CMOS

- AI感測器技術

- 機器學習(ML)

- 自然語言處理(NLP)

- 情境感知計算

- 電腦視覺

第8章壓力感測器市場:連通性的性別

- 介紹

- 有線

- 無線的

9. 壓力感測器市場(按檢測方法)

- 介紹

- 壓電電阻

- 電容

- 共振固體

- 電磁

- 光學

- 其他檢測方法

第 10 章 壓力感測器市場(按感測器類型)

- 介紹

- 絕對壓力感測器

- 表壓感測器

- 差壓感知器

- 密封壓力感測器

- 真空壓力感知器

第11章 壓力感測器市場(按壓力範圍)

- 介紹

- 小於100 PSI

- 101~1,000PSI

- 超過 1,000 PSI

第12章 壓力感測器市場(依最終用途)

- 介紹

- 車

- 醫療保健

- 製造業

- 公共產業

- 航空

- 石油和天然氣

- 海上

- 消費性設備

- 其他用途

第13章 壓力感測器市場(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 其他地區

- 其他地區的宏觀經濟展望

- 中東

- 非洲

- 南美洲

第14章競爭格局

- 概述

- 主要策略/優勢(2021-2025)

- 市場佔有率分析(2024年)

- 收益分析(2020-2024)

- 公司估值及財務指標

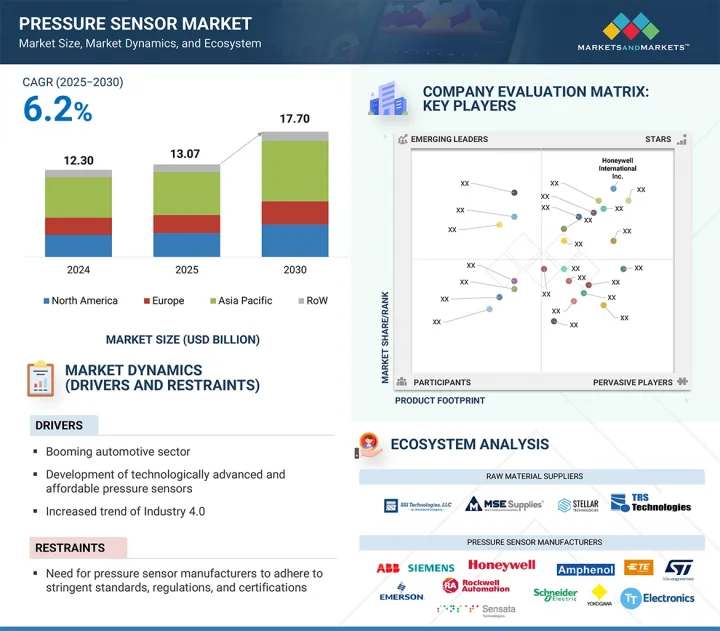

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第15章:公司簡介

- 主要企業

- HONEYWELL INTERNATIONAL INC.

- TE CONNECTIVITY

- SENSATA TECHNOLOGIES, INC.

- EMERSON ELECTRIC CO.

- AMPHENOL CORPORATION

- ABB

- TT ELECTRONICS

- ROCKWELL AUTOMATION

- SCHNEIDER ELECTRIC

- SIEMENS

- STMICROELECTRONICS

- INFINEON TECHNOLOGIES AG

- NXP SEMICONDUCTORS

- YOKOGAWA ELECTRIC CORPORATION

- ENDRESS+HAUSER GROUP SERVICES AG

- 其他公司

- BOSCH SENSORTEC GMBH

- IFM ELECTRONIC GMBH

- JUMO GMBH & CO. KG

- KITA SENSOR TECH. CO., LTD.

- NIDEC CORPORATION

- PHOENIX SENSORS

- MICRO SENSOR CO., LTD

- BD|SENSORS GMBH

- KISTLER GROUP

- OMEGA ENGINEERING INC.

第16章 附錄

The pressure sensor market is projected to grow from USD 13.07 billion in 2025 to USD 17.70 billion by 2030, at a CAGR of 6.2% between 2025 and 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By connectivity, sensing method, sensing type, pressure range, end use, and region |

| Regions covered | North America, Europe, APAC, RoW |

The rising adoption of predictive maintenance strategies across industries creates significant growth opportunities for the pressure sensor market, particularly through the integration of Industrial Internet of Things (IoT) technologies. Predictive maintenance depends on real-time condition monitoring, where pressure sensors are critical in tracking pressure fluctuations within machinery and systems to detect potential anomalies before they lead to costly failures. Industries such as manufacturing, oil & gas, utilities, and transportation increasingly implement predictive maintenance to minimize unplanned downtime, extend equipment lifespan, and reduce operational costs. Pressure sensors embedded in IoT-enabled networks provide continuous data streams that, when analyzed through advanced analytics platforms, allow accurate forecasting of equipment health and maintenance needs. This enables companies to shift from reactive to proactive maintenance planning, improving productivity and asset reliability.

Moreover, the rise in cloud-based analytics platforms and secure data communication protocols simplifies the deployment of predictive maintenance programs while ensuring data integrity. As organizations continue to prioritize efficiency, cost control, and operational resilience, the demand for smart sensors-pressure sensors-tailored to predictive maintenance applications is expected to surge. This trend drives innovation among sensor manufacturers to develop high-precision, durable, and IoT-compatible solutions, further propelling the pressure sensor market.

"Piezoresistive sensing method segment is expected to record a significant CAGR in the pressure sensor market from 2025 to 2030."

The piezoresistive sensing method segment is projected to register a significant CAGR in the pressure sensor market from 2025 to 2030 due to its proven advantages in accuracy, stability, and cost-effectiveness. Piezoresistive pressure sensors operate by detecting resistance changes in semiconductor materials under mechanical strain, which allows them to deliver highly sensitive and linear output signals. Their compatibility with MEMS fabrication techniques has enabled miniaturization, making them ideal for integration into compact, portable devices used in medical, automotive, and consumer electronics sectors. In the automotive industry, piezoresistive sensors are widely used in manifold absolute pressure (MAP), fuel, and tire pressure monitoring systems (TPMS) due to their durability and precision under varying environmental conditions. In medical devices, especially in invasive applications such as catheters and infusion pumps, piezoresistive sensors are favored for their small size and high accuracy. Furthermore, advancements in silicon-based sensor technology and improvements in fabrication techniques are reducing production costs while increasing sensor performance. As industries demand more reliable, energy-efficient, and application-specific sensing solutions, piezoresistive pressure sensors are gaining traction due to their adaptability across use cases. These factors collectively contribute to the high growth potential of the piezoresistive sensing method segment during the forecast period.

"Absolute pressure sensor segment is likely to contribute a major share of the pressure sensor market from 2025 to 2030."

The absolute pressure sensor segment is expected to maintain a strong market position from 2025 to 2030, driven by its broad utility across applications that require precise measurement of pressure relative to a vacuum. These sensors are indispensable in environments where even small pressure changes can impact performance, such as aerospace, meteorology, industrial vacuum systems, and automotive engine diagnostics. In the automotive sector, absolute pressure sensors are key components in manifold absolute pressure (MAP) sensors used to calculate engine load, which is critical for optimizing fuel injection and emissions control. Additionally, these sensors are used in climate control and barometric pressure monitoring in automotive and aviation systems. Their reliability in high-vibration and extreme temperature environments makes them particularly suitable for aerospace and heavy industrial applications. Furthermore, the rise in demand for smart and connected devices, including drones, weather monitoring equipment, and portable electronics, further fuels the need for compact, robust, and accurate absolute pressure sensors. Their ability to offer consistent readings unaffected by atmospheric pressure changes also makes them a preferred choice for sealed system monitoring. These characteristics, combined with advances in MEMS technology and miniaturization, ensure a sustained and significant contribution of the absolute pressure sensor segment to the market.

"North America accounted for the largest share of the pressure sensor market in 2024."

North America held the largest share in the pressure sensor market in 2024, primarily due to its advanced industrial infrastructure, strong automotive and aerospace sectors, and the rapid adoption of smart technologies across key verticals. The US, in particular, is a global hub for innovation in sensor technology, with leading companies, such as Honeywell, Emerson Electric, and Amphenol, headquartered in the region. These firms continue to invest heavily in R&D to develop high-performance, application-specific pressure sensors. The early embrace of Industrial IoT (IIoT) and predictive maintenance strategies across manufacturing plants has significantly increased the deployment of pressure sensors for real-time equipment monitoring and operational optimization. Furthermore, the stringent regulatory frameworks, especially regarding vehicle safety and emissions standards, have driven the integration of pressure sensors into engine control units, exhaust systems, and tire pressure monitoring systems (TPMS). In the medical domain, the strong healthcare infrastructure and the growing demand for advanced diagnostic and monitoring equipment have also contributed to increased sensor adoption. Additionally, the push toward renewable energy and smart grid systems creates new applications for pressure sensors in the utility and energy sectors. These diverse and mature end-user markets reinforce North America's leading market share in 2024.

- By Company Type: Tier 1 - 26%, Tier 2 - 32%, and Tier 3 - 42%

- By Designation: C-level Executives - 40%, Managers - 30%, and Others - 30%

- By Region: North America - 34%, Europe - 25%, Asia Pacific- 30%, and RoW - 11%

Prominent players profiled in this report include Honeywell International Inc. (US), ABB (Switzerland), Emerson Electric Co. (US), Amphenol Corporation (US), and TE Connectivity (Switzerland).

Report Coverage

The report defines, describes, and forecasts the pressure sensor market based on connectivity (wired sensors, wireless sensors), sensing method (piezoresistive, capacitive, resonant solid-state, electromagnetic, optical, other sensing methods), sensor type (absolute, gauge, differential, sealed, vacuum), pressure range (up to 100 psi, 101-1,000 psi, above 1,000 psi), end use (automotive, medical, manufacturing, utilities, aviation, oil & gas, marine, consumer devices, other end use) and region (North America, Europe, Asia Pacific, RoW). It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth. It also analyzes competitive developments such as acquisitions, product launches, expansions, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue for the overall pressure sensor market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following points:

- Analysis of key drivers (Booming automotive sector, Development of technologically advanced and affordable pressure sensors, Increased trend of Industry 4.0, Rising demand for pressure sensors in medical device industry), restraints (Need for pressure sensor manufacturers to adhere to stringent standards, regulations, and certifications), opportunities (Rising demand for advanced pressure sensors in consumer electronics industry, Adoption of pressure sensors in IoT-enabled predictive maintenance programs, Rapid advancements in AI and ML technologies), and challenges (Shrinking profit margins of manufacturers with declining prices, increasing competition, and commoditization of technology) of the pressure sensor market

- Product development /Innovation: Detailed insights into upcoming technologies, research & development activities, and new product launches in the pressure sensor market

- Market Development: Comprehensive information about lucrative markets; the report analyses the pressure sensor market across various regions

- Market Diversification: Exhaustive information about new products launched, untapped geographies, recent developments, and investments in the pressure sensor market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and offering of leading players, including Honeywell International Inc. (US), ABB (Switzerland), Emerson Electric Co. (US), Amphenol Corporation (US), TE Connectivity (Switzerland), Sensata Technologies, Inc. (US), TT Electronics (UK), Rockwell Automation (US), Schneider Electric (France), Siemens (Germany), STMicroelectronics (Switzerland), Infineon Technologies AG (Germany), and NXP Semiconductors (Netherlands) in the pressure sensor market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRESSURE SENSOR MARKET

- 4.2 PRESSURE SENSOR MARKET IN NORTH AMERICA, BY END USE AND COUNTRY

- 4.3 PRESSURE SENSOR MARKET, BY END USE

- 4.4 PRESSURE SENSOR MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Booming automotive sector

- 5.2.1.2 Rising adoption of microelectromechanical systems and miniaturization trends

- 5.2.1.3 Shift toward smart manufacturing due to Industry 4.0 evolution

- 5.2.1.4 Mounting demand for telemedicine, home healthcare, and wearable medical devices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Need to adhere to stringent standards, regulations, and certifications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Strong focus on enhancing functionality and user experience of consumer electronics

- 5.2.3.2 Rising implementation of IoT-enabled predictive maintenance programs

- 5.2.3.3 Rapid advances in AI and ML technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Shrinking profit margins with declining prices and increasing competition

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 PRICING ANALYSIS

- 5.7.1 PRICING RANGE OF ABSOLUTE PRESSURE SENSORS PROVIDED BY KEY PLAYERS, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND OF PRESSURE SENSORS, BY END USE, 2021-2024

- 5.7.3 AVERAGE SELLING PRICE TREND OF PRESSURE SENSORS, BY REGION, 2021-2024

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Microelectromechanical systems (MEMS)

- 5.8.1.2 Piezoresistive sensors

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Wireless communication protocols

- 5.8.2.2 Advanced material innovations

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Internet of Things (IoT)

- 5.8.3.2 Sensor fusion

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF NEW ENTRANTS

- 5.9.5 THREAT OF SUBSTITUTES

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 ALTHEN SENSORS & CONTROLS ENHANCES DUTCH DELFT HYPERLOOP PROJECT WITH MINIATURE PRESSURE SENSORS

- 5.11.2 SURREY SENSORS LTD DEPLOYS HONEYWELL'S PRESSURE SENSORS TO ELEVATE PRECISION IN UAV AND AEROSPACE TESTING

- 5.11.3 MAJOR AGRICULTURAL MACHINERY COMPANY STARTS USING WIKA'S LEVEL SENSORS FOR MACHINE CONTROL

- 5.11.4 PRESSURE TRANSDUCER MONITORING ENABLES EMPTEEZY TO ENSURE CONSISTENT WATER FLOW IN EMERGENCY TANK SHOWERS

- 5.11.5 MEDICAL DEVICE COMPANY ADOPTS PRESSURE SENSOR FOR CRITICAL CARE BLOOD PRESSURE MONITORING

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 902620)

- 5.12.2 EXPORT SCENARIO (HS CODE 902620)

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 STANDARDS/REGULATIONS

- 5.14 PATENT ANALYSIS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 IMPACT OF AI/GEN AI ON PRESSURE SENSOR MARKET

- 5.16.1 TOP AI/GEN AI USE CASES

- 5.16.1.1 Smart tire pressure monitoring systems (TPMS)

- 5.16.1.2 Respiratory monitoring in medical devices

- 5.16.1.3 Leak detection in water and gas pipelines

- 5.16.1.4 Aerospace cabin pressure and structural integrity monitoring

- 5.16.1.5 Smart fluid management in robotics and Industry 4.0

- 5.16.1 TOP AI/GEN AI USE CASES

- 5.17 IMPACT OF 2025 US TARIFF ON PRESSURE SENSOR MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END USES

6 PRESSURE SENSORS FOR DIFFERENT MEDIA TYPES

- 6.1 INTRODUCTION

- 6.2 AIR PRESSURE SENSORS

- 6.3 BAROMETRIC (ATMOSPHERIC) PRESSURE SENSORS

- 6.4 GAS PRESSURE SENSORS

- 6.5 WATER PRESSURE SENSORS

- 6.6 LIQUID PRESSURE SENSORS

- 6.7 PNEUMATIC & HYDRAULIC PRESSURE SENSORS

- 6.8 CORROSIVE LIQUID & GAS PRESSURE SENSORS

7 TECHNOLOGIES RELATED TO PRESSURE SENSORS

- 7.1 INTRODUCTION

- 7.2 MICROFABRICATION TECHNOLOGIES

- 7.2.1 MICROELECTROMECHANICAL SYSTEMS (MEMS)

- 7.2.2 COMPLEMENTARY METAL-OXIDE-SEMICONDUCTORS (CMOS)

- 7.3 AI SENSOR TECHNOLOGIES

- 7.3.1 MACHINE LEARNING (ML)

- 7.3.2 NATURAL LANGUAGE PROCESSING (NLP)

- 7.3.3 CONTEXT-AWARE COMPUTING

- 7.3.4 COMPUTER VISION

8 PRESSURE SENSOR MARKET, BY CONNECTIVITY

- 8.1 INTRODUCTION

- 8.2 WIRED

- 8.2.1 HIGH RELIABILITY AND ROBUSTNESS IN INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 8.3 WIRELESS

- 8.3.1 EASE OF DEPLOYMENT IN HARD-TO-REACH OR DYNAMIC ENVIRONMENTS TO BOOST DEMAND

9 PRESSURE SENSOR MARKET, BY SENSING METHOD

- 9.1 INTRODUCTION

- 9.2 PIEZORESISTIVE

- 9.2.1 HIGH RELIABILITY AND ACCURACY TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.3 CAPACITIVE

- 9.3.1 RISING USE IN ENERGY-EFFICIENT AND SMART DEVICES TO FUEL SEGMENTAL GROWTH

- 9.4 RESONANT SOLID-STATE

- 9.4.1 INCREASING DEMAND IN OIL & GAS INDUSTRY FOR PRECISE PRESSURE MEASUREMENTS TO AUGMENT SEGMENTAL GROWTH

- 9.5 ELECTROMAGNETIC

- 9.5.1 HIGH SUITABILITY IN EXTREME CONDITIONS ACROSS MULTIPLE INDUSTRIES TO EXPEDITE SEGMENTAL GROWTH

- 9.6 OPTICAL

- 9.6.1 INCREASING DEPLOYMENT IN MEDICAL APPLICATIONS TO ACCELERATE SEGMENTAL GROWTH

- 9.7 OTHER SENSING METHODS

10 PRESSURE SENSOR MARKET, BY SENSOR TYPE

- 10.1 INTRODUCTION

- 10.2 ABSOLUTE PRESSURE SENSORS

- 10.2.1 INCREASING NEED TO ACHIEVE PRECISE PRESSURE MEASUREMENTS RELATIVE TO PERFECT VACUUM TO FOSTER SEGMENTAL GROWTH

- 10.3 GAUGE PRESSURE SENSORS

- 10.3.1 GROWING USE IN INDUSTRIAL AUTOMATION AND PROCESS MONITORING APPLICATIONS TO DRIVE MARKET

- 10.4 DIFFERENTIAL PRESSURE SENSORS

- 10.4.1 INCREASING FOCUS OF INDUSTRY PLAYERS ON ENHANCING ENERGY EFFICIENCY AND ACHIEVING SUSTAINABILITY TO BOOST DEMAND

- 10.5 SEALED PRESSURE SENSORS

- 10.5.1 RISING ADOPTION IN EXTREME CONDITIONS TO AUGMENT SEGMENTAL GROWTH

- 10.6 VACUUM PRESSURE SENSORS

- 10.6.1 GROWING NEED FOR HIGH ACCURACY AND STABILITY VACUUM IN CHEMICAL PROCESSING TO FUEL SEGMENTAL GROWTH

11 PRESSURE SENSOR MARKET, BY PRESSURE RANGE

- 11.1 INTRODUCTION

- 11.2 UP TO 100 PSI

- 11.2.1 RISING INTEGRATION INTO PORTABLE AND WEARABLE DEVICES TO ACCELERATE SEGMENTAL GROWTH

- 11.3 101-1,000 PSI

- 11.3.1 INCREASING NEED FOR PRECISE PRESSURE CONTROL IN INDUSTRIAL PROCESSES TO BOOST SEGMENTAL GROWTH

- 11.4 ABOVE 1,000 PSI

- 11.4.1 GROWING DEMAND IN OIL & GAS AND MANUFACTURING SECTORS TO FOSTER SEGMENTAL GROWTH

12 PRESSURE SENSOR MARKET, BY END USE

- 12.1 INTRODUCTION

- 12.2 AUTOMOTIVE

- 12.2.1 INCREASING VEHICLE SALES DUE TO GOVERNMENT TAX BREAKS TO AUGMENT SEGMENTAL GROWTH

- 12.3 MEDICAL

- 12.3.1 RAPID INNOVATION IN MEDTECH ECOSYSTEM TO BOLSTER SEGMENTAL GROWTH

- 12.4 MANUFACTURING

- 12.4.1 GROWING ADOPTION OF AUTOMATION TECHNOLOGIES AND ROBOTICS TO FUEL SEGMENTAL GROWTH

- 12.5 UTILITIES

- 12.5.1 RAPID EXPANSION OF SMART GRID INFRASTRUCTURE TO CONTRIBUTE TO SEGMENTAL GROWTH

- 12.6 AVIATION

- 12.6.1 RISING FOCUS ON ENHANCING AIRCRAFT EFFICIENCY, SAFETY, AND PASSENGER COMFORT TO FUEL SEGMENTAL GROWTH

- 12.7 OIL & GAS

- 12.7.1 HIGH SAFETY REQUIREMENTS DUE TO EXPOSURE TO DYNAMIC ENVIRONMENT TO DRIVE DEMAND

- 12.8 MARINE

- 12.8.1 INCREASING NEED TO MONITOR WATER DEPTH AND OTHER CRUCIAL PARAMETERS TO BOOST SEGMENTAL GROWTH

- 12.9 CONSUMER DEVICES

- 12.9.1 RISING INSTALLATION OF PORTABLE DEVICES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 12.10 OTHER END USES

13 PRESSURE SENSOR MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Rising development of microelectronics and printed sensor technology advancements to boost market growth

- 13.2.3 CANADA

- 13.2.3.1 Thriving automotive industry to contribute to market growth

- 13.2.4 MEXICO

- 13.2.4.1 Increasing production of vehicles, oil, and gas to foster market growth

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 GERMANY

- 13.3.2.1 Increasing new vehicle registration and robust manufacturing base to drive market

- 13.3.3 UK

- 13.3.3.1 High investments in electric vehicles to support decarbonization goals to fuel market growth

- 13.3.4 FRANCE

- 13.3.4.1 Mounting production of commercial vehicles to contribute to market growth

- 13.3.5 ITALY

- 13.3.5.1 Thriving automotive and healthcare sectors to drive market

- 13.3.6 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Rapid industrialization and infrastructure development to boost market growth

- 13.4.3 JAPAN

- 13.4.3.1 Expanding process industries to contribute to market growth

- 13.4.4 INDIA

- 13.4.4.1 Mounting demand for consumer goods to augment market growth

- 13.4.5 SOUTH KOREA

- 13.4.5.1 Booming consumer electronics industry to bolster market growth

- 13.4.6 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 13.5.2 MIDDLE EAST

- 13.5.2.1 Bahrain

- 13.5.2.1.1 Industrial automation and infrastructure modernization to accelerate market growth

- 13.5.2.2 Kuwait

- 13.5.2.2.1 Strong commitment to diversifying economy and expanding renewable energy infrastructure to drive market

- 13.5.2.3 Oman

- 13.5.2.3.1 Rising emphasis on energy efficiency, industrial safety, and water resource management to fuel market growth

- 13.5.2.4 Qatar

- 13.5.2.4.1 Burgeoning demand for high-performance sensors for monitoring and control systems to boost market growth

- 13.5.2.5 Saudi Arabia

- 13.5.2.5.1 Robust industrial base and large-scale smart infrastructure projects to contribute to market growth

- 13.5.2.6 UAE

- 13.5.2.6.1 Increasing investment in smart cities to accelerate market growth

- 13.5.2.7 Rest of Middle East

- 13.5.2.1 Bahrain

- 13.5.3 AFRICA

- 13.5.3.1 Rising need to monitor and control critical processes to drive market

- 13.5.4 SOUTH AMERICA

- 13.5.4.1 Substantial growth in automobile production to bolster market growth

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY STRENGTHS/RIGHT TO WIN, 2021-2025

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2020-2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Company footprint

- 14.6.5.2 Region footprint

- 14.6.5.3 Connectivity footprint

- 14.6.5.4 Sensing method footprint

- 14.6.5.5 Sensor type footprint

- 14.6.5.6 Pressure range footprint

- 14.6.5.7 End use footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.7.5.1 Detailed list of key startups/SMEs

- 14.7.5.2 Competitive benchmarking of key startups/SMEs

- 14.8 COMPETITIVE SCENARIO

- 14.8.1 PRODUCT LAUNCHES

- 14.8.2 DEALS

- 14.8.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 HONEYWELL INTERNATIONAL INC.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 TE CONNECTIVITY

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 SENSATA TECHNOLOGIES, INC.

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Expansions

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 EMERSON ELECTRIC CO.

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 AMPHENOL CORPORATION

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.3.2 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths/Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses/Competitive threats

- 15.1.6 ABB

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches

- 15.1.6.3.2 Deals

- 15.1.6.3.3 Expansions

- 15.1.7 TT ELECTRONICS

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Expansions

- 15.1.8 ROCKWELL AUTOMATION

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.9 SCHNEIDER ELECTRIC

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.10 SIEMENS

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.11 STMICROELECTRONICS

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Product launches

- 15.1.12 INFINEON TECHNOLOGIES AG

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Product launches

- 15.1.12.3.2 Deals

- 15.1.12.3.3 Expansions

- 15.1.13 NXP SEMICONDUCTORS

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Deals

- 15.1.14 YOKOGAWA ELECTRIC CORPORATION

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.15 ENDRESS+HAUSER GROUP SERVICES AG

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Expansions

- 15.1.1 HONEYWELL INTERNATIONAL INC.

- 15.2 OTHER PLAYERS

- 15.2.1 BOSCH SENSORTEC GMBH

- 15.2.2 IFM ELECTRONIC GMBH

- 15.2.3 JUMO GMBH & CO. KG

- 15.2.4 KITA SENSOR TECH. CO., LTD.

- 15.2.5 NIDEC CORPORATION

- 15.2.6 PHOENIX SENSORS

- 15.2.7 MICRO SENSOR CO., LTD

- 15.2.8 BD|SENSORS GMBH

- 15.2.9 KISTLER GROUP

- 15.2.10 OMEGA ENGINEERING INC.

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS

List of Tables

- TABLE 1 PRESSURE SENSOR MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 PRESSURE SENSOR MARKET: SUMMARY OF CHANGES

- TABLE 3 MAJOR SECONDARY SOURCES

- TABLE 4 PRESSURE SENSOR MARKET: RISK ANALYSIS

- TABLE 5 ROLES OF COMPANIES IN PRESSURE SENSOR ECOSYSTEM

- TABLE 6 PRICING RANGE OF ABSOLUTE PRESSURE SENSORS PROVIDED BY KEY PLAYERS, 2024 (USD/UNIT)

- TABLE 7 AVERAGE SELLING PRICE TREND OF PRESSURE SENSORS, BY END USE, 2021-2024 (USD/UNIT)

- TABLE 8 AVERAGE SELLING PRICE TREND OF PRESSURE SENSORS, BY REGION, 2021-2024 (USD/UNIT)

- TABLE 9 IMPACT OF PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS TOP THREE END USES (%)

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE END USES

- TABLE 12 IMPORT DATA FOR HS CODE 902620-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 EXPORT DATA FOR HS CODE 902620-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 MFN TARIFF FOR HS CODE 902620-COMPLIANT PRODUCTS EXPORTED BY US, 2024

- TABLE 15 MFN TARIFF FOR HS CODE 902620-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2024

- TABLE 16 MFN TARIFF FOR HS CODE 902620-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2024

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 STANDARDS/REGULATIONS

- TABLE 22 LIST OF KEY PATENTS, 2025

- TABLE 23 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKETS DUE TO TARIFF

- TABLE 26 PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 27 PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 28 PRESSURE SENSOR MARKET, BY SENSING METHOD, 2021-2024 (USD MILLION)

- TABLE 29 PRESSURE SENSOR MARKET, BY SENSING METHOD, 2025-2030 (USD MILLION)

- TABLE 30 PIEZORESISTIVE: PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 31 PIEZORESISTIVE: PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 32 CAPACITIVE: PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 33 CAPACITIVE: PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 34 RESONANT SOLID-STATE: PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 35 RESONANT SOLID-STATE: PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 36 ELECTROMAGNETIC: PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 37 ELECTROMAGNETIC: PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 38 OPTICAL: PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 39 OPTICAL: PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 40 OTHER SENSING METHODS: PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 41 OTHER SENSING METHODS: PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 42 PRESSURE SENSOR MARKET, BY SENSOR TYPE, 2021-2024 (USD MILLION )

- TABLE 43 PRESSURE SENSOR MARKET, BY SENSOR TYPE, 2025-2030 (USD MILLION )

- TABLE 44 PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2021-2024 (USD MILLION )

- TABLE 45 PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2025-2030 (USD MILLION )

- TABLE 46 UP TO 100 PSI: PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 47 UP TO 100 PSI: PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 48 101-1,000 PSI: PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 49 101-1,000 PSI: PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 50 ABOVE 1,000 PSI: PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 51 ABOVE 1,000 PSI: PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 52 PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 53 PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (USD MILLION )

- TABLE 54 PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (MILLION UNITS)

- TABLE 55 PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (MILLION UNITS)

- TABLE 56 USE CASES OF PRESSURE SENSORS IN AUTOMOTIVE INDUSTRY

- TABLE 57 AUTOMOTIVE: PRESSURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 AUTOMOTIVE: PRESSURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 AUTOMOTIVE: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2021-2024 (USD MILLION)

- TABLE 60 AUTOMOTIVE: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2025-2030 (USD MILLION)

- TABLE 61 AUTOMOTIVE: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2021-2024 (USD MILLION)

- TABLE 62 AUTOMOTIVE: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2025-2030 (USD MILLION)

- TABLE 63 USE CASES OF PRESSURE SENSORS IN MEDICAL INDUSTRY

- TABLE 64 MEDICAL: PRESSURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 MEDICAL: PRESSURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 MEDICAL: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2021-2024 (USD MILLION)

- TABLE 67 MEDICAL: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2025-2030 (USD MILLION)

- TABLE 68 MEDICAL: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2021-2024 (USD MILLION)

- TABLE 69 MEDICAL: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2025-2030 (USD MILLION)

- TABLE 70 USE CASES OF PRESSURE SENSORS IN MANUFACTURING SECTOR

- TABLE 71 MANUFACTURING: PRESSURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 MANUFACTURING: PRESSURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 MANUFACTURING: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2021-2024 (USD MILLION)

- TABLE 74 MANUFACTURING: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2025-2030 (USD MILLION)

- TABLE 75 MANUFACTURING: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2021-2024 (USD MILLION)

- TABLE 76 MANUFACTURING: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2025-2030 (USD MILLION)

- TABLE 77 USE CASES OF PRESSURE SENSORS IN UTILITIES INDUSTRY

- TABLE 78 UTILITIES: PRESSURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 UTILITIES: PRESSURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 UTILITIES: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2021-2024 (USD MILLION)

- TABLE 81 UTILITIES: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2025-2030 (USD MILLION)

- TABLE 82 UTILITIES: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2021-2024 (USD MILLION)

- TABLE 83 UTILITIES: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2025-2030 (USD MILLION)

- TABLE 84 USE CASES OF PRESSURE SENSORS IN AVIATION INDUSTRY

- TABLE 85 AVIATION: PRESSURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 AVIATION: PRESSURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 AVIATION: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2021-2024 (USD MILLION)

- TABLE 88 AVIATION: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2025-2030 (USD MILLION)

- TABLE 89 AVIATION: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2021-2024 (USD MILLION)

- TABLE 90 AVIATION: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2025-2030 (USD MILLION)

- TABLE 91 USE CASES OF PRESSURE SENSORS IN OIL & GAS INDUSTRY

- TABLE 92 OIL & GAS: PRESSURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 93 OIL & GAS: PRESSURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 OIL & GAS: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2021-2024 (USD MILLION)

- TABLE 95 OIL & GAS: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2025-2030 (USD MILLION)

- TABLE 96 OIL & GAS: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2021-2024 (USD MILLION)

- TABLE 97 OIL & GAS: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2025-2030 (USD MILLION)

- TABLE 98 USE CASES OF PRESSURE SENSORS IN MARINE INDUSTRY

- TABLE 99 MARINE: PRESSURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 MARINE: PRESSURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 MARINE: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2021-2024 (USD MILLION)

- TABLE 102 MARINE: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2025-2030 (USD MILLION)

- TABLE 103 MARINE: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2021-2024 (USD MILLION)

- TABLE 104 MARINE: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2025-2030 (USD MILLION)

- TABLE 105 USE CASES OF PRESSURE SENSORS IN CONSUMER DEVICES INDUSTRY

- TABLE 106 CONSUMER DEVICES: PRESSURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 CONSUMER DEVICES: PRESSURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 CONSUMER DEVICES: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2021-2024 (USD MILLION)

- TABLE 109 CONSUMER DEVICES: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2025-2030 (USD MILLION)

- TABLE 110 CONSUMER DEVICES: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2021-2024 (USD MILLION)

- TABLE 111 CONSUMER DEVICES: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2025-2030 (USD MILLION)

- TABLE 112 OTHER END USES: PRESSURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 OTHER END USES: PRESSURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 OTHER END USES: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2021-2024 (USD MILLION)

- TABLE 115 OTHER END USES: PRESSURE SENSOR MARKET, BY SENSING METHOD, 2025-2030 (USD MILLION)

- TABLE 116 OTHER END USES: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2021-2024 (USD MILLION)

- TABLE 117 OTHER END USES: PRESSURE SENSOR MARKET, BY PRESSURE RANGE, 2025-2030 (USD MILLION)

- TABLE 118 PRESSURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 PRESSURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 PRESSURE SENSOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 121 PRESSURE SENSOR MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 122 NORTH AMERICA: PRESSURE SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 123 NORTH AMERICA: PRESSURE SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 126 US: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 127 US: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 128 CANADA: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 129 CANADA: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 130 MEXICO: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 131 MEXICO: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: PRESSURE SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 EUROPE: PRESSURE SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 135 EUROPE: PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 136 GERMANY: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 137 GERMANY: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 138 UK: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 139 UK: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 140 FRANCE: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 141 FRANCE: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 142 ITALY: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 143 ITALY: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 144 REST OF EUROPE: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 145 REST OF EUROPE: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: PRESSURE SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 147 ASIA PACIFIC: PRESSURE SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 149 ASIA PACIFIC: PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 150 CHINA: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 151 CHINA: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 152 JAPAN: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 153 JAPAN: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 154 INDIA: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 155 INDIA: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 156 SOUTH KOREA: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 157 SOUTH KOREA: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 160 ROW: PRESSURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 161 ROW: PRESSURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 162 ROW: PRESSURE SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 163 ROW: PRESSURE SENSOR MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST: PRESSURE SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 165 MIDDLE EAST: PRESSURE SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 167 MIDDLE EAST: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 168 AFRICA: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 169 AFRICA: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 170 SOUTH AMERICA: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 171 SOUTH AMERICA: PRESSURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 172 PRESSURE SENSOR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-AUGUST 2025

- TABLE 173 PRESSURE SENSOR MARKET: DEGREE OF COMPETITION, 2024

- TABLE 174 PRESSURE SENSOR MARKET: REGION FOOTPRINT

- TABLE 175 PRESSURE SENSOR MARKET: CONNECTIVITY FOOTPRINT

- TABLE 176 PRESSURE SENSOR MARKET: SENSING METHOD FOOTPRINT

- TABLE 177 PRESSURE SENSOR MARKET: SENSOR TYPE FOOTPRINT

- TABLE 178 PRESSURE SENSOR MARKET: PRESSURE RANGE FOOTPRINT

- TABLE 179 PRESSURE SENSOR MARKET: END USE FOOTPRINT

- TABLE 180 PRESSURE SENSOR MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 181 PRESSURE SENSOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 182 PRESSURE SENSOR MARKET: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 183 PRESSURE SENSOR MARKET: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 184 PRESSURE SENSOR MARKET: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 185 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 186 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 188 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 189 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 190 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 TE CONNECTIVITY: PRODUCT LAUNCHES

- TABLE 192 TE CONNECTIVITY: DEALS

- TABLE 193 SENSATA TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 194 SENSATA TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 SENSATA TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 196 SENSATA TECHNOLOGIES, INC.: EXPANSIONS

- TABLE 197 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 198 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 EMERSON ELECTRIC CO.: DEALS

- TABLE 200 AMPHENOL CORPORATION: COMPANY OVERVIEW

- TABLE 201 AMPHENOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 AMPHENOL CORPORATION: PRODUCT LAUNCHES

- TABLE 203 AMPHENOL CORPORATION: DEALS

- TABLE 204 ABB: COMPANY OVERVIEW

- TABLE 205 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 ABB: PRODUCT LAUNCHES

- TABLE 207 ABB: DEALS

- TABLE 208 ABB: EXPANSIONS

- TABLE 209 TT ELECTRONICS: COMPANY OVERVIEW

- TABLE 210 TT ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 TT ELECTRONICS: EXPANSIONS

- TABLE 212 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 213 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 215 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 SIEMENS: COMPANY OVERVIEW

- TABLE 217 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 219 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 221 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 222 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 224 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 225 INFINEON TECHNOLOGIES AG: EXPANSIONS

- TABLE 226 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 227 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 NXP SEMICONDUCTORS: DEALS

- TABLE 229 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 230 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 231 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY OVERVIEW

- TABLE 232 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 233 ENDRESS+HAUSER GROUP SERVICES AG: EXPANSIONS

List of Figures

- FIGURE 1 PRESSURE SENSOR MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DURATION CONSIDERED

- FIGURE 3 PRESSURE SENSOR MARKET: RESEARCH DESIGN

- FIGURE 4 PRESSURE SENSOR MARKET: RESEARCH APPROACH

- FIGURE 5 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 DATA CAPTURED FROM PRIMARY SOURCES

- FIGURE 8 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 9 PRESSURE SENSOR MARKET: RESEARCH FLOW

- FIGURE 10 PRESSURE SENSOR MARKET: BOTTOM-UP APPROACH

- FIGURE 11 PRESSURE SENSOR MARKET: TOP-DOWN APPROACH

- FIGURE 12 PRESSURE SENSOR MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 13 PRESSURE SENSOR MARKET: DATA TRIANGULATION

- FIGURE 14 PRESSURE SENSOR MARKET: RESEARCH ASSUMPTIONS

- FIGURE 15 PRESSURE SENSOR MARKET: RESEARCH LIMITATIONS

- FIGURE 16 PIEZORESISTIVE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 17 WIRED SEGMENT TO HOLD LARGER MARKET SHARE IN 2025

- FIGURE 18 AUTOMOTIVE SEGMENT TO DOMINATE PRESSURE SENSOR MARKET FROM 2025 TO 2030

- FIGURE 19 ASIA PACIFIC HELD LARGEST SHARE OF PRESSURE SENSOR MARKET IN 2024

- FIGURE 20 INCREASING DEMAND FOR ELECTRIC VEHICLES AND SMART CITY INITIATIVES TO DRIVE PRESSURE SENSOR MARKET

- FIGURE 21 AUTOMOTIVE SEGMENT AND US CAPTURED LARGEST SHARES OF NORTH AMERICAN PRESSURE SENSOR MARKET IN 2024

- FIGURE 22 AUTOMOTIVE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 23 INDIA TO RECORD HIGHEST CAGR IN PRESSURE SENSOR MARKET DURING FORECAST PERIOD

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 IMPACT ANALYSIS: DRIVERS

- FIGURE 26 GLOBAL VEHICLE SALES, 2020-2024

- FIGURE 27 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 28 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 29 IMPACT ANALYSIS: CHALLENGES

- FIGURE 30 SUPPLY CHAIN ANALYSIS

- FIGURE 31 PRESSURE SENSOR ECOSYSTEM

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 33 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 34 AVERAGE SELLING PRICE TREND OF PRESSURE SENSORS, BY END USE, 2021-2024

- FIGURE 35 AVERAGE SELLING PRICE TREND OF PRESSURE SENSORS, BY REGION, 2021-2024

- FIGURE 36 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES

- FIGURE 38 KEY BUYING CRITERIA FOR TOP THREE END USES

- FIGURE 39 IMPORT DATA FOR HS CODE 902620-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 40 EXPORT DATA FOR HS CODE 902620-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 41 PATENTS APPLIED AND GRANTED, 2016-2025

- FIGURE 42 IMPACT OF AI/GEN AI ON PRESSURE SENSOR MARKET

- FIGURE 43 PRESSURE SENSORS FOR DIFFERENT MEDIA TYPES

- FIGURE 44 WIRED SEGMENT TO DOMINATE PRESSURE SENSOR MARKET BETWEEN 2025 AND 2030

- FIGURE 45 PIEZORESISTIVE SEGMENT TO LEAD PRESSURE SENSOR MARKET DURING FORECAST PERIOD

- FIGURE 46 ABSOLUTE PRESSURE SENSORS SEGMENT TO CAPTURE LARGEST SHARE OF PRESSURE SENSOR MARKET IN 2030

- FIGURE 47 UP TO 100 PSI SEGMENT TO DOMINATE PRESSURE SENSOR MARKET DURING FORECAST PERIOD

- FIGURE 48 AUTOMOTIVE SEGMENT TO DOMINATE PRESSURE SENSOR MARKET DURING FORECAST PERIOD

- FIGURE 49 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN PRESSURE SENSOR MARKET FROM 2025 TO 2030

- FIGURE 50 NORTH AMERICA: PRESSURE SENSOR MARKET SNAPSHOT

- FIGURE 51 EUROPE: PRESSURE SENSOR MARKET SNAPSHOT

- FIGURE 52 ASIA PACIFIC: PRESSURE SENSOR MARKET SNAPSHOT

- FIGURE 53 ROW: PRESSURE SENSOR MARKET SNAPSHOT

- FIGURE 54 MARKET SHARE ANALYSIS OF COMPANIES OFFERING PRESSURE SENSORS, 2024

- FIGURE 55 PRESSURE SENSOR MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 56 COMPANY VALUATION

- FIGURE 57 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 58 PRESSURE SENSOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 59 PRESSURE SENSOR MARKET: COMPANY FOOTPRINT

- FIGURE 60 PRESSURE SENSOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 61 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 62 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 63 SENSATA TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 64 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 65 AMPHENOL CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 ABB: COMPANY SNAPSHOT

- FIGURE 67 TT ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 68 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 69 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 70 SIEMENS: COMPANY SNAPSHOT

- FIGURE 71 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 72 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 73 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 74 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 75 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY SNAPSHOT