|

市場調查報告書

商品編碼

1797407

氫氣檢測市場(按感測器技術、實施類型、檢測範圍、製程階段、應用和地區分類)- 2030 年預測Hydrogen Detection Market by Electrochemical, Metal Oxide Semiconductor (MOS), Catalytic, Thermal Conductivity, Micro-Electromechanical Systems (MEMS), Detection Range (0-1000 ppm, 0-5000 ppm, 0-20,000 ppm, >0-20,000 ppm) - Global Forecast to 2030 |

||||||

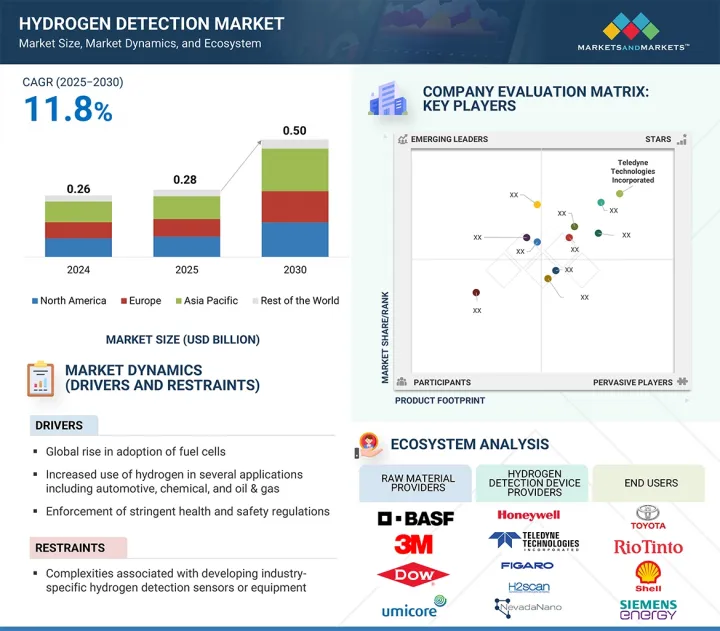

全球氫氣檢測市場預計將從 2025 年的 2.8 億美元成長到 2030 年的 5 億美元,預測期內的複合年成長率為 11.8%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(十億美元) |

| 按細分市場 | 按感測器技術、安裝類型、檢測範圍、製程階段、應用和區域 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

由於燃料電池的廣泛應用、氫氣在各種工業應用中的使用日益增加以及全球範圍內嚴格的健康和安全法規的實施,氫氣檢測市場正在經歷顯著成長。這些因素促使各行各業投資先進的氫氣檢測系統,以確保職場安全、防止洩漏並保持合規性。然而,由於開發行業專用的氫氣檢測感測器的複雜性,市場也面臨挑戰。根據汽車、能源和化學等各個行業的獨特需求客製化解決方案會增加開發時間、成本和技術門檻,這可能會在一定程度上阻礙整體市場的擴張。

預計在預測期內,0-1000 ppm 檢測範圍段將成為氫氣檢測市場中成長速度第二快的領域。此範圍對於需要早期洩漏檢測以確保運行安全和合規的應用至關重要。低濃度氫氣監測在密閉且敏感的環境中尤其重要,例如電池能源儲存系統(BESS)、實驗室、半導體工廠和燃料電池電動車 (FCEV) 服務區。在這些環境中,即使是少量的氫氣洩漏,如果未被發現,也可能導致危險情況,因此該範圍的感測器對於預防性保養和風險降低至關重要。

隨著氫氣在封閉的工業和商業環境中的日益普及,全球安全法規對氫氣的合規性提出了更高的要求,這些法規要求氫氣必須及早檢測,以避免達到爆炸性濃度。這推動了對0-1000 ppm範圍內高靈敏度和高可靠性感測器的需求。 Nissha FIS和Drager等領先公司提供專為此目的而設計的電化學、熱導和金屬氧化物感測器。這些解決方案廣泛應用於固定安裝和可攜式檢測器,進一步鞏固了該產品系列在各種氫氣使用案例中的市場地位。

預計在整個預測期內,石油和天然氣產業將主導氫氣檢測市場。氫氣通常在石油煉製和石化過程(例如加氫裂解和脫硫)中作為副產品生成、使用和生產。在這些操作中,氫氣高度易燃並迅速擴散到空氣中,如果未被發現,可能會導致災難性的後果。因此,氫氣檢測系統對於煉油廠安全通訊協定和風險緩解策略至關重要。此外,美國職業安全與健康管理局 (OSHA) 等法律規範機構規定的嚴格合規要求以及對 ATEX 和 IECEx 等國際安全標準的遵守要求,要求營運商部署可靠的即時氣體監測設備。氫氣檢測在管道、倉儲設施、海上平台和氫能發電機組中的整合正在擴大,尤其是在大型石油公司增加對藍氫和碳捕獲技術的投資的情況下。此外,傳統產油區老化的基礎設施正在推動對洩漏偵測系統維修的需求。隨著全球脫碳運動重塑能源格局,石油和天然氣產業在傳統氫能製程和清潔氫能舉措中的戰略作用將繼續支持其在氫能檢測市場的主導地位。

在清潔能源轉型的堅定承諾、嚴格的環境法規和政府支持措施的推動下,歐洲預計將在預測期內成為氫氣檢測領域中成長第二快的區域市場。德國、法國、英國和荷蘭等已開發國家正在透過國家戰略和資助氫能基礎設施建設推動氫氣的普及。例如,歐洲各國政府正在支持加氫站和生產基地的部署,對可靠的氫氣洩漏檢測系統產生了巨大的需求。此外,該地區成熟的汽車、能源和化學工業正在整合氫氣解決方案以實現脫碳目標,這進一步增加了對準確且高效的氫氣檢測技術的需求。當地公司也積極投資先進的感測器技術,增強該地區滿足日益成長的安全和營運需求的能力。歐洲的協作政策框架和在工業創新方面的領導地位使其成為全球氫氣檢測市場的有力競爭者。

本報告研究了全球氫氣檢測市場,按感測器技術、實施類型、檢測範圍、製程階段、應用和區域趨勢對其進行細分,並介紹了參與市場的公司。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章市場概述

- 介紹

- 市場動態

- 價值鏈分析

- 生態系分析

- 影響客戶業務的趨勢和中斷

- 技術分析

- 定價分析

- 波特五力分析

- 主要相關人員和採購標準

- 案例研究分析

- 貿易分析

- 專利分析

- 監管狀況

- 2025-2026年主要會議和活動

- 人工智慧/生成式人工智慧對氫氣檢測市場的影響

- 2025年美國關稅對氫感測市場的影響—概述

第6章:各種技術對氫氣檢測市場的影響

- 介紹

- 氫的分類

- 氫氣檢測市場的新趨勢

- 先進感測材料

- 量子感測器

- 物聯網(IoT)和人工智慧(AI)

- 無線連接,實現遠端監控

- 感測器小型化

第7章 氫氣檢測的主要應用

- 介紹

- 氫氣檢測的主要應用

- 安全和過程控制

- 氫氣洩漏檢測

- 過程監控和危害緩解

- 整合警報和停機系統

- 排放和合規性監測

8. 氫氣檢測市場(按感測器技術)

- 介紹

- 電化學

- MOS

- 催化劑

- 熱導率

- MEMS

9. 氫氣檢測市場(依實施型)

- 介紹

- 固定型

- 活字印刷

第10章 氫氣檢測市場(依檢測範圍)

- 介紹

- 0~1,000 PPM

- 0~5,000 PPM

- 0~20,000 PPM

- 0~20,000 PPM

第 11 章。氫氣檢測市場(依製程階段)

- 介紹

- 產生

- 保持

- 送貨

- 使用

第12章 氫氣檢測市場(依應用)

- 介紹

- 石油和天然氣

- 汽車和運輸

- 化學品

- 金屬和採礦

- 能源與電力

- 其他

第13章 氫氣檢測市場(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲宏觀經濟展望

- 英國

- 德國

- 法國

- 其他

- 亞太地區

- 亞太宏觀經濟展望

- 日本

- 中國

- 印度

- 其他

- 其他地區

- 南美洲

- 中東和非洲

第14章競爭格局

- 概述

- 主要參與企業的策略/優勢,2020-2025

- 2024年市場佔有率分析

- 2020-2024年收益分析

- 估值和財務指標

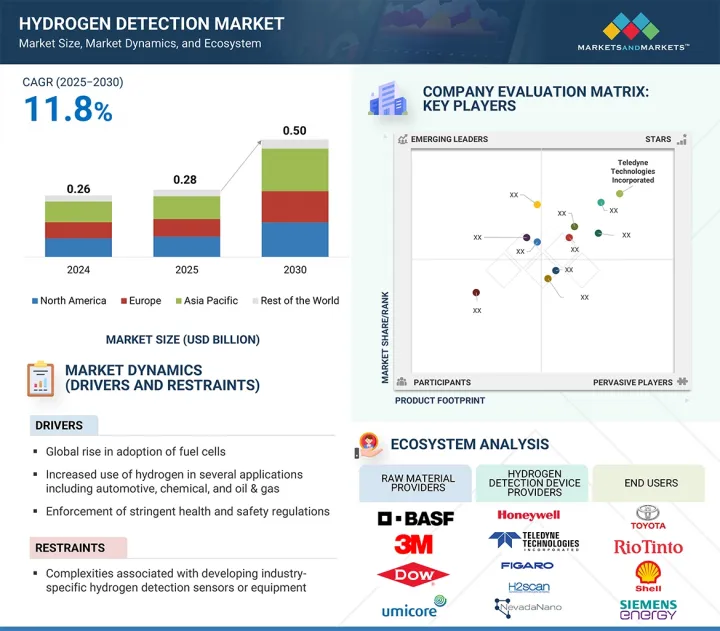

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 品牌/產品比較

- 競爭場景

第15章:公司簡介

- 主要參與企業

- TELEDYNE TECHNOLOGIES INCORPORATED

- HONEYWELL INTERNATIONAL INC.

- FIGARO ENGINEERING INC.

- H2SCAN

- NISSHA FIS, INC.

- HYDROGEN SENSE TECHNOLOGY CO., LTD.

- NEVADANANO

- DRAGERWERK AG & CO. KGAA

- MSA SAFETY INCORPORATED

- SGX SENSORTEC

- 其他公司

- AEROQUAL

- ALPHASENSE

- NEOXID GROUP

- BOSCH SENSORTEC GMBH

- MEMBRAPOR

- EAGLE EYE POWER SOLUTIONS LLC

- ELTRA GMBH

- EVIKON MCI OU

- INTERNATIONAL GAS DETECTORS

- MAKEL ENGINEERING INC.

- MPOWER ELECTRONICS INC.

- PROSENSE GAS AND FLAME DETECTORS

- SENKO INTERNATIONAL INC.

- RC SYSTEMS

- WINSEN

第16章 附錄

The global hydrogen detection market is estimated to be valued at USD 0.50 billion by 2030, up from USD 0.28 billion in 2025, at a CAGR of 11.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Sensor Technology, Implementation Type, Detection Range, Process Stage, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The hydrogen detection market is experiencing significant growth driven by the widespread adoption of fuel cells, the increasing use of hydrogen across various industrial applications, and the enforcement of stringent health and safety regulations worldwide. These factors encourage industries to invest in advanced hydrogen detection systems to ensure workplace safety, prevent leaks, and maintain regulatory compliance. However, the market faces challenges due to the complexities involved in developing industry-specific hydrogen detection sensors. Tailoring solutions to meet the unique requirements of different sectors, such as automotive, energy, or chemicals, can increase development time, costs, and technical hurdles, slightly restraining overall market expansion.

"By detection range, 0-1000 ppm is expected to register the second-fastest growth during the forecast period."

The 0-1000 ppm detection range segment is expected to witness the second-fastest growth in the hydrogen detection market during the forecast period. This range is essential for applications that require early leak detection to ensure operational safety and regulatory compliance. Low-level hydrogen monitoring is particularly important in confined and sensitive environments such as battery energy storage systems (BESS), laboratories, semiconductor fabs, and fuel cell electric vehicle (FCEV) service areas. In such setups, even minor hydrogen leaks can lead to hazardous conditions if undetected, making sensors within this range crucial for preventive maintenance and risk mitigation.

The increasing deployment of hydrogen in enclosed industrial and commercial environments has prompted stricter adherence to global safety regulations, which require early-stage detection to avoid explosive concentrations. This has driven demand for sensors with high sensitivity and reliability in the 0-1000 ppm range. Leading players such as Nissha FIS and Drager offer electrochemical, thermal conductivity, and metal oxide-based sensors designed for this purpose. These solutions are being widely adopted across fixed installations and portable detectors, further strengthening the market position of this range across diverse hydrogen use cases.

By application, the oil & gas segment is projected to account for the largest market share during the forecast period."

The oil & gas industry is expected to dominate the hydrogen detection market's application segment throughout the forecast period. Hydrogen is commonly generated, used, or produced as a byproduct in several oil refining and petrochemical processes, such as hydrocracking and desulfurization. In such operations, undetected hydrogen leaks can lead to catastrophic incidents due to its high flammability and rapid dispersion in air. As a result, hydrogen detection systems are integral to refinery safety protocols and risk mitigation strategies. Additionally, regulatory oversight from bodies such as OSHA and adherence to international safety standards like ATEX and IECEx enforce strict compliance requirements, prompting operators to deploy highly reliable, real-time gas monitoring equipment. The integration of hydrogen detection in pipelines, storage facilities, offshore platforms, and hydrogen-based power generation units is expanding, especially as oil majors increase investment in blue hydrogen and carbon capture technologies. Moreover, aging infrastructure in traditional oil-producing regions is driving the need for retrofitted leak detection systems. As the global push toward decarbonization reshapes the energy landscape, the oil & gas industry's strategic role in both conventional hydrogen processes and clean hydrogen initiatives will continue to support its leading position in the hydrogen detection market.

By region, Europe is expected to register the second-fastest growth during the forecast period.

Europe is projected to emerge as the second-fastest-growing regional market for hydrogen detection during the forecast period, driven by the region's strong commitment to clean energy transition, stringent environmental regulations, and supportive government initiatives. Countries such as Germany, France, the UK, and the Netherlands are advancing hydrogen adoption through national strategies and funding for hydrogen infrastructure development. For example, European governments are supporting the rollout of hydrogen refueling stations and production hubs, creating significant demand for reliable hydrogen leak detection systems. Additionally, the region's well-established automotive, energy, and chemical industries are integrating hydrogen solutions to achieve decarbonization goals, further contributing to the need for accurate and efficient hydrogen detection technologies. Local companies are also actively investing in advanced sensor technologies, enhancing the region's capability to meet rising safety and operational requirements. Europe's coordinated policy frameworks and its leadership in industrial innovation position it as a strong contender in the global hydrogen detection market.

The break-up of the profile of primary participants in the hydrogen detection market-

- By Company Type: Tier 1 - 40%, Tier 2 - 25%, Tier 3 - 35%

- By Designation Type: C Level - 25%, Director Level - 40%, Others - 35%

- By Region Type: Asia Pacific - 40%, Europe - 25%, North America- 30%, Rest of the World - 5%

Note: Other designations include sales, marketing, and product managers.

The three tiers of the companies are based on their total revenues as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million.

The major players in the hydrogen detection market with a significant global presence include Teledyne Technologies Incorporated (US), Honeywell International (US), H2San (US), Figaro Engineering (Japan), Nissha FIS (Japan), and others.

Study Coverage

The report segments the hydrogen detection market and forecasts its size by sensor technology, implementation type, detection range, process stage, application, and region. It also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall hydrogen detection market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (high adoption of fuel cells globally, increased use of hydrogen in several applications, enforcement of stringent health and safety regulations worldwide), restraints (complexities involved in developing industry-specific hydrogen detection sensors or equipment), opportunities (shifting focus of OEMs to low-carbon energy systems, rising deployment of IoT-enabled gas detection systems), and challenges (production and revenue losses due to unwanted downtime of detection equipment, technical issues associated with integration of sensing elements)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the hydrogen detection market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the hydrogen detection market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the hydrogen detection market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including Teledyne Technologies Incorporated (US), Honeywell International (US), H2San (US), Figaro Engineering (Japan), and Nissha FIS (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HYDROGEN DETECTION MARKET

- 4.2 HYDROGEN DETECTION MARKET, BY SENSOR TECHNOLOGY

- 4.3 HYDROGEN DETECTION MARKET, BY DETECTION RANGE AND PROCESS STAGE

- 4.4 HYDROGEN DETECTION MARKET, BY APPLICATION

- 4.5 HYDROGEN DETECTION MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High adoption of fuel cells globally

- 5.2.1.2 Increased use of hydrogen across industries

- 5.2.1.3 Enforcement of stringent health and safety regulations worldwide

- 5.2.1.4 Substantial investment in expanding hydrogen ecosystem

- 5.2.2 RESTRAINTS

- 5.2.2.1 Prolonged development timelines and technical/regulatory barriers

- 5.2.2.2 High cost of advanced hydrogen detection technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for portable and wearable hydrogen detectors in field operations

- 5.2.3.2 Advent of miniaturized, low-power sensors to detect hydrogen leaks in EVs and drones

- 5.2.3.3 Emergence of AI-powered predictive maintenance platforms for gas detection systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardized performance metrics and globally harmonized calibration protocols

- 5.2.4.2 Cybersecurity issues associated with IoT-integrated hydrogen detection networks

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Electrochemical sensing

- 5.6.1.2 Optical sensing

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Energy harvesting

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Gas chromatography

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 PRICING OF HYDROGEN DETECTION EQUIPMENT OFFERED BY KEY PLAYERS, BY TECHNOLOGY, 2024

- 5.7.2 PRICING TREND OF HYDROGEN DETECTION EQUIPMENT, BY TECHNOLOGY, 2021-2024

- 5.7.3 AVERAGE SELLING PRICE TREND OF HYDROGEN DETECTION EQUIPMENT, BY REGION, 2021-2024

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 HEMPFLAX ACHIEVES ISCC PLUS CERTIFICATION WITH DEKRA TO STRENGTHEN SUSTAINABILITY LEADERSHIP

- 5.10.2 SANDERSON DESIGN GROUP AND PLANET MARK COLLABORATE ON NET-ZERO ROADMAP FOR SUSTAINABLE OPERATIONS

- 5.10.3 SGS SA AND JAMES HARDIE COLLABORATE ON LCA FOR SUSTAINABLE GYPSUM FIBER BOARDS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 9027)

- 5.11.2 EXPORT SCENARIO (HS CODE 9027)

- 5.12 PATENT ANALYSIS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 SAFETY STANDARDS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 IMPACT OF AI/GEN AI ON HYDROGEN DETECTION MARKET

- 5.16 IMPACT OF 2025 US TARIFF ON HYDROGEN DETECTION MARKET - OVERVIEW

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 KEY IMPACTS ON COUNTRIES/REGIONS

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON APPLICATIONS

6 IMPACT OF DIFFERENT TECHNOLOGIES ON HYDROGEN DETECTION MARKET

- 6.1 INTRODUCTION

- 6.2 CLASSIFICATION OF HYDROGEN

- 6.3 EMERGING TRENDS IN HYDROGEN DETECTION MARKET

- 6.3.1 ADVANCED SENSING MATERIALS

- 6.3.2 QUANTUM SENSORS

- 6.3.3 INTERNET OF THINGS (IOT) AND ARTIFICIAL INTELLIGENCE (AI)

- 6.3.4 WIRELESS CONNECTIVITY FOR REMOTE MONITORING

- 6.3.5 MINIATURIZATION OF SENSORS

7 KEY APPLICATION AREAS OF HYDROGEN DETECTION

- 7.1 INTRODUCTION

- 7.2 KEY APPLICATION AREAS OF HYDROGEN DETECTION

- 7.2.1 SAFETY AND PROCESS CONTROL

- 7.2.2 HYDROGEN LEAK DETECTION

- 7.2.3 PROCESS MONITORING AND HAZARD MITIGATION

- 7.2.4 ALARM AND SHUTDOWN SYSTEM INTEGRATION

- 7.2.5 EMISSION AND COMPLIANCE MONITORING

8 HYDROGEN DETECTION MARKET, BY SENSOR TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 ELECTROCHEMICAL

- 8.2.1 EXCELLENCE IN DETECTING TOXIC AND COMBUSTIBLE GASES IN INDUSTRIAL AND SAFETY-CRITICAL SETTINGS TO SPUR DEMAND

- 8.3 MOS

- 8.3.1 ABILITY TO DETECT HYDROGEN IN PPB CONCENTRATIONS TO FOSTER SEGMENTAL GROWTH

- 8.4 CATALYTIC

- 8.4.1 SUITABILITY FOR HIGH-TEMPERATURE-RANGE OPERATIONS TO PROPEL SEGMENTAL GROWTH

- 8.5 THERMAL CONDUCTIVITY

- 8.5.1 PROFICIENCY IN DETECTING HYDROGEN LEAKAGE IN PIPELINES AND INDUSTRIAL PROCESSES TO SPIKE DEMAND

- 8.6 MEMS

- 8.6.1 DURABILITY AND RESISTANCE TO ENVIRONMENTAL INTERFERENCE TO STIMULATE DEMAND

9 HYDROGEN DETECTION MARKET, BY IMPLEMENTATION TYPE

- 9.1 INTRODUCTION

- 9.2 FIXED

- 9.2.1 ELEVATING USE IN HIGH-RISK INDUSTRIAL PROCESSES TO ENSURE OPERATIONAL SAFETY AND ACCELERATE SEGMENTAL GROWTH

- 9.3 PORTABLE 94 9.3.1 EXCELLENCE IN INSPECTING CONFINED OR HARD-TO-REACH AREAS TO SPIKE DEMAND

10 HYDROGEN DETECTION MARKET, BY DETECTION RANGE

- 10.1 INTRODUCTION

- 10.2 0-1,000 PPM

- 10.2.1 OIL & GAS REFINERIES, FUEL CELL PRODUCTION, AND STORAGE FACILITIES TO CONTRIBUTE TO SUBSTANTIAL DEMAND

- 10.3 0-5,000 PPM

- 10.3.1 APPLICATIONS REQUIRING MODERATE CONCENTRATION OF HYDROGEN GAS TO SUPPORT SEGMENTAL GROWTH

- 10.4 0-20,000 PPM

- 10.4.1 SURGING DEMAND FROM COGENERATION SYSTEMS, TURBINES, AND GAS-FIRED POWER PLANTS TO FUEL SEGMENTAL GROWTH

- 10.5 >0-20,000 PPM

- 10.5.1 RISING USE IN ELECTROLYSIS PLANTS, HYDROGEN GENERATION STATIONS, AND HYDROGEN STORAGE FACILITIES TO DRIVE MARKET

11 HYDROGEN DETECTION MARKET, BY PROCESS STAGE

- 11.1 INTRODUCTION

- 11.2 GENERATION

- 11.2.1 USE OF CLEAN ENERGY SOURCES IN HYDROGEN PRODUCTION TO ACCELERATE DEPLOYMENT

- 11.3 STORAGE

- 11.3.1 EMPHASIS ON SETTING SAFE HYDROGEN STORAGE INFRASTRUCTURE TO BOOST DEMAND

- 11.4 TRANSPORTATION

- 11.4.1 EXPANSION OF HYDROGEN SUPPLY CHAINS TO CREATE GROWTH OPPORTUNITIES

- 11.5 USAGE

- 11.5.1 IMPLEMENTATION OF DECARBONIZATION AND GREEN HYDROGEN INITIATIVES TO DRIVE MARKET

12 HYDROGEN DETECTION MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 OIL & GAS

- 12.2.1 STRINGENT SULFUR-CONTENT REGULATIONS TO BOOST DEMAND

- 12.3 AUTOMOTIVE & TRANSPORTATION

- 12.3.1 RISING USE OF FUEL CELL ELECTRIC VEHICLES TO DRIVE MARKET

- 12.4 CHEMICAL

- 12.4.1 NECESSITY TO SYNTHESIZE AMMONIA IN CHEMICAL PROCESSING PLANTS TO PROPEL MARKET

- 12.5 METAL & MINING

- 12.5.1 RISING FOCUS ON OPERATIONAL SAFETY BY PREVENTING EXPLOSIVE ATMOSPHERE TO SPIKE DEMAND

- 12.6 ENERGY & POWER

- 12.6.1 EVOLVING SAFETY REGULATIONS AND TRANSITION TO CLEAN ENERGY TO FOSTER MARKET GROWTH

- 12.7 OTHER APPLICATIONS

13 HYDROGEN DETECTION MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Accelerated rollout of fuel cell electric vehicles to drive market

- 13.2.3 CANADA

- 13.2.3.1 Government focus on developing sustainable hydrogen economy to support market growth

- 13.2.4 MEXICO

- 13.2.4.1 Structural energy reforms and substantial demand from oil and chemicals industries to boost market

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 UK

- 13.3.2.1 Hydrogen transport and storage reforms to elevate demand

- 13.3.3 GERMANY

- 13.3.3.1 Flagship initiatives aimed at scaling hydrogen economy to augment market growth

- 13.3.4 FRANCE

- 13.3.4.1 Surging demand for FCVs to create opportunities for market players

- 13.3.5 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 JAPAN

- 13.4.2.1 Launch of hydrogen-based power generation projects to escalate demand

- 13.4.3 CHINA

- 13.4.3.1 Growing hydrogen deployment in transportation and industrial sectors to drive market

- 13.4.4 INDIA

- 13.4.4.1 Energy transition plans and initiatives to develop hydrogen infrastructure to augment market growth

- 13.4.5 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 SOUTH AMERICA

- 13.5.1.1 Rising use of biofuels in transportation sector to elevate demand

- 13.5.2 MIDDLE EAST & AFRICA

- 13.5.2.1 Abundance of oil and energy resources to contribute to market growth

- 13.5.1 SOUTH AMERICA

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2020-2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Company footprint

- 14.6.5.2 Region footprint

- 14.6.5.3 Detection range footprint

- 14.6.5.4 Sensor technology footprint

- 14.6.5.5 Implementation type footprint

- 14.6.5.6 Application footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.7.5.1 Detailed list of startups/SMEs

- 14.7.5.2 Competitive benchmarking of key startups/SMEs

- 14.8 BRAND/PRODUCT COMPARISON

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 TELEDYNE TECHNOLOGIES INCORPORATED

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Other developments

- 15.1.1.4 MNM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 HONEYWELL INTERNATIONAL INC.

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.4 MNM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 FIGARO ENGINEERING INC.

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Deals

- 15.1.3.4 MNM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 H2SCAN

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.4 MNM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 NISSHA FIS, INC.

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 MNM view

- 15.1.5.3.1 Key strengths/Right to win

- 15.1.5.3.2 Strategic choices

- 15.1.5.3.3 Weaknesses/Competitive threats

- 15.1.6 HYDROGEN SENSE TECHNOLOGY CO., LTD.

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.7 NEVADANANO

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.7.3.2 Deals

- 15.1.7.3.3 Expansions

- 15.1.7.3.4 Other developments

- 15.1.8 DRAGERWERK AG & CO. KGAA

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.9 MSA SAFETY INCORPORATED

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.10 SGX SENSORTEC

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.1 TELEDYNE TECHNOLOGIES INCORPORATED

- 15.2 OTHER PLAYERS

- 15.2.1 AEROQUAL

- 15.2.2 ALPHASENSE

- 15.2.3 NEOXID GROUP

- 15.2.4 BOSCH SENSORTEC GMBH

- 15.2.5 MEMBRAPOR

- 15.2.6 EAGLE EYE POWER SOLUTIONS LLC

- 15.2.7 ELTRA GMBH

- 15.2.8 EVIKON MCI OU

- 15.2.9 INTERNATIONAL GAS DETECTORS

- 15.2.10 MAKEL ENGINEERING INC.

- 15.2.11 MPOWER ELECTRONICS INC.

- 15.2.12 PROSENSE GAS AND FLAME DETECTORS

- 15.2.13 SENKO INTERNATIONAL INC.

- 15.2.14 R.C. SYSTEMS

- 15.2.15 WINSEN

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 2 ROLE OF COMPANIES IN HYDROGEN DETECTION ECOSYSTEM

- TABLE 3 PRICING RANGE OF HYDROGEN DETECTION EQUIPMENT OFFERED BY KEY PLAYERS, BY TECHNOLOGY, 2024 (USD)

- TABLE 4 PRICING TREND OF HYDROGEN DETECTION EQUIPMENT BASED ON ADVANCED TECHNOLOGIES, 2021-2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF HYDROGEN DETECTION EQUIPMENT, BY REGION, 2021-2024 (USD)

- TABLE 6 HYDROGEN DETECTION MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 9 IMPORT DATA FOR HS CODE 9027-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 9027-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 LIST OF MAJOR PATENTS, 2021-2024

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 HYDROGEN DETECTION MARKET: SAFETY STANDARDS

- TABLE 17 HYDROGEN DETECTION MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 19 HYDROGEN DETECTION MARKET, BY SENSOR TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 20 HYDROGEN DETECTION MARKET, BY SENSOR TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 21 ELECTROCHEMICAL: HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 22 ELECTROCHEMICAL: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 23 MOS: HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 24 MOS: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 25 CATALYTIC: HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 26 CATALYTIC: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 27 THERMAL CONDUCTIVITY: HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 28 THERMAL CONDUCTIVITY: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 29 MEMS: HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 30 MEMS: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 31 HYDROGEN DETECTION MARKET, BY IMPLEMENTATION TYPE, 2021-2024 (USD MILLION)

- TABLE 32 HYDROGEN DETECTION MARKET, BY IMPLEMENTATION TYPE, 2025-2030 (USD MILLION)

- TABLE 33 FIXED: HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 34 FIXED: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 35 PORTABLE: HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 36 PORTABLE: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 37 HYDROGEN DETECTION MARKET, BY DETECTION RANGE, 2021-2024 (USD MILLION)

- TABLE 38 HYDROGEN DETECTION MARKET, BY DETECTION RANGE, 2025-2030 (USD MILLION)

- TABLE 39 0-1,000 PPM: HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 40 0-1,000 PPM: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 41 0-5,000 PPM: HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 42 0-5,000 PPM: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 43 0-20,000 PPM: HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 44 0-20,000 PPM: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 45 >0-20,000 PPM: HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 46 >0-20,000 PPM: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 47 HYDROGEN DETECTION MARKET, BY PROCESS STAGE, 2021-2024 (USD MILLION)

- TABLE 48 HYDROGEN DETECTION MARKET, BY PROCESS STAGE, 2025-2030 (USD MILLION)

- TABLE 49 HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 50 HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 51 OIL & GAS: HYDROGEN DETECTION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 52 OIL & GAS: HYDROGEN DETECTION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 53 OIL & GAS: HYDROGEN DETECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 OIL & GAS: HYDROGEN DETECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 OIL & GAS: HYDROGEN DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 OIL & GAS: HYDROGEN DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 OIL & GAS: HYDROGEN DETECTION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 OIL & GAS: HYDROGEN DETECTION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 OIL & GAS: HYDROGEN DETECTION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 OIL & GAS: HYDROGEN DETECTION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 OIL & GAS: HYDROGEN DETECTION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 OIL & GAS: HYDROGEN DETECTION MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 AUTOMOTIVE & TRANSPORTATION: HYDROGEN DETECTION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 64 AUTOMOTIVE & TRANSPORTATION: HYDROGEN DETECTION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 65 AUTOMOTIVE & TRANSPORTATION: HYDROGEN DETECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 AUTOMOTIVE & TRANSPORTATION: HYDROGEN DETECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 AUTOMATION & TRANSPORTATION: HYDROGEN DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 68 AUTOMATION & TRANSPORTATION: HYDROGEN DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 AUTOMATION & TRANSPORTATION: HYDROGEN DETECTION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 AUTOMATION & TRANSPORTATION: HYDROGEN DETECTION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 AUTOMATION & TRANSPORTATION: HYDROGEN DETECTION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 AUTOMATION & TRANSPORTATION: HYDROGEN DETECTION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 AUTOMATION & TRANSPORTATION: HYDROGEN DETECTION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 AUTOMATION & TRANSPORTATION: HYDROGEN DETECTION MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 CHEMICAL: HYDROGEN DETECTION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 76 CHEMICAL: HYDROGEN DETECTION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 77 CHEMICAL: HYDROGEN DETECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 CHEMICAL: HYDROGEN DETECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 CHEMICAL: HYDROGEN DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 CHEMICAL: HYDROGEN DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 CHEMICAL: HYDROGEN DETECTION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 CHEMICAL: HYDROGEN DETECTION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 CHEMICAL: HYDROGEN DETECTION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 84 CHEMICAL: HYDROGEN DETECTION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 CHEMICAL: HYDROGEN DETECTION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 CHEMICAL: HYDROGEN DETECTION MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 METAL & MINING: HYDROGEN DETECTION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 88 METAL & MINING: HYDROGEN DETECTION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 89 METAL & MINING: HYDROGEN DETECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 METAL & MINING: HYDROGEN DETECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 METAL & MINING: HYDROGEN DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 METAL & MINING: HYDROGEN DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 METAL & MINING: HYDROGEN DETECTION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 METAL & MINING: HYDROGEN DETECTION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 METAL & MINING: HYDROGEN DETECTION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 METAL & MINING: HYDROGEN DETECTION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 METAL & MINING: HYDROGEN DETECTION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 METAL & MINING: HYDROGEN DETECTION MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 ENERGY & POWER: HYDROGEN DETECTION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 100 ENERGY & POWER: HYDROGEN DETECTION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 101 ENERGY & POWER: HYDROGEN DETECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 ENERGY & POWER: HYDROGEN DETECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 ENERGY & POWER: HYDROGEN DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 ENERGY & POWER: HYDROGEN DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 ENERGY & POWER: HYDROGEN DETECTION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 ENERGY & POWER: HYDROGEN DETECTION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 ENERGY & POWER: HYDROGEN DETECTION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 108 ENERGY & POWER: HYDROGEN DETECTION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 109 ENERGY & POWER: HYDROGEN DETECTION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 ENERGY & POWER: HYDROGEN DETECTION MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 OTHER APPLICATIONS: HYDROGEN DETECTION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 112 OTHER APPLICATIONS: HYDROGEN DETECTION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 113 OTHER APPLICATIONS: HYDROGEN DETECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 OTHER APPLICATIONS: HYDROGEN DETECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 OTHER APPLICATIONS: HYDROGEN DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 OTHER APPLICATIONS: HYDROGEN DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 OTHER APPLICATIONS: HYDROGEN DETECTION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 OTHER APPLICATIONS: HYDROGEN DETECTION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 OTHER APPLICATIONS: HYDROGEN DETECTION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 120 OTHER APPLICATIONS: HYDROGEN DETECTION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 OTHER APPLICATIONS: HYDROGEN DETECTION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 122 OTHER APPLICATIONS: HYDROGEN DETECTION MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 123 HYDROGEN DETECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 124 HYDROGEN DETECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: HYDROGEN DETECTION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 126 NORTH AMERICA: HYDROGEN DETECTION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: HYDROGEN DETECTION MARKET, BY APPLICATION 2021-2024 (USD MILLION)

- TABLE 128 NORTH AMERICA: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: HYDROGEN DETECTION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 130 EUROPE: HYDROGEN DETECTION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 131 EUROPE: HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 132 EUROPE: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: HYDROGEN DETECTION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: HYDROGEN DETECTION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 ROW: HYDROGEN DETECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 138 ROW: HYDROGEN DETECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 139 ROW: HYDROGEN DETECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 140 ROW: HYDROGEN DETECTION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 HYDROGEN DETECTION MARKET: KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- TABLE 142 HYDROGEN DETECTION MARKET: MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2024

- TABLE 143 HYDROGEN DETECTION MARKET: REGION FOOTPRINT

- TABLE 144 HYDROGEN DETECTION MARKET: DETECTION RANGE FOOTPRINT

- TABLE 145 HYDROGEN DETECTION MARKET: SENSOR TECHNOLOGY FOOTPRINT

- TABLE 146 HYDROGEN DETECTION MARKET: IMPLEMENTATION TYPE FOOTPRINT

- TABLE 147 HYDROGEN DETECTION MARKET: APPLICATION FOOTPRINT

- TABLE 148 HYDROGEN DETECTION MARKET: KEY STARTUPS/SMES

- TABLE 149 HYDROGEN DETECTION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 150 HYDROGEN DETECTION MARKET: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 151 HYDROGEN DETECTION MARKET: DEALS, JANUARY 2020-JULY 2025

- TABLE 152 HYDROGEN DETECTION MARKET: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 153 HYDROGEN DETECTION MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JULY 2025

- TABLE 154 TELEDYNE TECHNOLOGIES INCORPORATED: BUSINESS OVERVIEW

- TABLE 155 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS OFFERED

- TABLE 156 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES

- TABLE 157 TELEDYNE TECHNOLOGIES INCORPORATED: OTHER DEVELOPMENTS

- TABLE 158 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- TABLE 159 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 160 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 161 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 162 FIGARO ENGINEERING INC.: BUSINESS OVERVIEW

- TABLE 163 FIGARO ENGINEERING INC.: PRODUCTS OFFERED

- TABLE 164 FIGARO ENGINEERING INC.: PRODUCT LAUNCHES

- TABLE 165 FIGARO ENGINEERING INC.: DEALS

- TABLE 166 H2SCAN: BUSINESS OVERVIEW

- TABLE 167 H2SCAN: PRODUCTS OFFERED

- TABLE 168 H2SCAN: PRODUCT LAUNCHES

- TABLE 169 NISSHA FIS, INC.: BUSINESS OVERVIEW

- TABLE 170 NISSHA FIS, INC.: PRODUCTS OFFERED

- TABLE 171 HYDROGEN SENSE TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- TABLE 172 HYDROGEN SENSE TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 173 NEVADANANO: BUSINESS OVERVIEW

- TABLE 174 NEVADANANO: PRODUCTS OFFERED

- TABLE 175 NEVADANANO: PRODUCT LAUNCHES

- TABLE 176 NEVADANANO: DEALS

- TABLE 177 NEVADANANO: EXPANSIONS

- TABLE 178 NEVADANANO: OTHER DEVELOPMENTS

- TABLE 179 DRAGERWERK AG & CO. KGAA: BUSINESS OVERVIEW

- TABLE 180 DRAGERWERK AG & CO. KGAA: PRODUCTS OFFERED

- TABLE 181 MSA SAFETY INCORPORATED: BUSINESS OVERVIEW

- TABLE 182 MSA SAFETY INCORPORATED: PRODUCTS OFFERED

- TABLE 183 SGX SENSORTECH: BUSINESS OVERVIEW

- TABLE 184 SGX SENSORTEC: PRODUCTS OFFERED

- TABLE 185 AEROQUAL: COMPANY OVERVIEW

- TABLE 186 ALPHASENSE: COMPANY OVERVIEW

- TABLE 187 NEOXID GROUP: COMPANY OVERVIEW

- TABLE 188 BOSCH SENSORTEC GMBH: COMPANY OVERVIEW

- TABLE 189 MEMBRAPOR: COMPANY OVERVIEW

- TABLE 190 EAGLE EYE POWER SOLUTIONS LLC: COMPANY OVERVIEW

- TABLE 191 ELTRA GMBH: COMPANY OVERVIEW

- TABLE 192 EVIKON MCI OU: COMPANY OVERVIEW

- TABLE 193 INTERNATIONAL GAS DETECTORS: COMPANY OVERVIEW

- TABLE 194 MAKEL ENGINEERING INC.: COMPANY OVERVIEW

- TABLE 195 MPOWER ELECTRONICS INC.: COMPANY OVERVIEW

- TABLE 196 PROSENSE GAS AND FLAME DETECTORS: COMPANY OVERVIEW

- TABLE 197 SENKO INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 198 R.C. SYSTEMS: COMPANY OVERVIEW

- TABLE 199 WINSEN: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HYDROGEN DETECTION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HYDROGEN DETECTION MARKET: RESEARCH DESIGN

- FIGURE 3 HYDROGEN DETECTION MARKET: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED FROM SALES OF HYDROGEN DETECTION EQUIPMENT

- FIGURE 5 HYDROGEN DETECTION MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 HYDROGEN DETECTION MARKET SIZE, IN TERMS OF VALUE, 2021-2030

- FIGURE 8 ELECTROCHEMICAL SEGMENT TO DOMINATE HYDROGEN DETECTION MARKET, BY SENSOR TECHNOLOGY, IN 2025

- FIGURE 9 FIXED SEGMENT TO ACCOUNT FOR PROMINENT SHARE OF HYDROGEN DETECTION MARKET, BY IMPLEMENTATION TYPE, IN 2025

- FIGURE 10 OIL & GAS SEGMENT TO HOLD LARGEST MARKET SHARE, BY APPLICATION, IN 2025

- FIGURE 11 GENERATION SEGMENT TO CAPTURE LARGEST MARKET SHARE, BY PROCESS STAGE, IN 2025

- FIGURE 12 ASIA PACIFIC COMMANDED HYDROGEN DETECTION MARKET IN 2024

- FIGURE 13 GROWING DEMAND FOR HYDROGEN-POWERED FUEL CELL VEHICLES TO DRIVE MARKET

- FIGURE 14 ELECTROCHEMICAL SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 0-5,000 PPM AND GENERATION SEGMENTS ACCOUNTED FOR LARGER SHARE OF HYDROGEN DETECTION MARKET IN 2024

- FIGURE 16 AUTOMOTIVE & TRANSPORTATION SEGMENT TO REGISTER HIGHEST CAGR IN HYDROGEN DETECTION MARKET DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC TO BE FASTEST-GROWING HYDROGEN DETECTION MARKET DURING FORECAST PERIOD

- FIGURE 18 HYDROGEN DETECTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 HYDROGEN DETECTION MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 20 HYDROGEN DETECTION MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 21 HYDROGEN DETECTION MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 22 HYDROGEN DETECTION MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 23 HYDROGEN DETECTION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 HYDROGEN DETECTION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 TRENDS AND DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 26 AVERAGE SELLING PRICE OF HYDROGEN DETECTION EQUIPMENT PROVIDED BY KEY PLAYERS, BY TECHNOLOGY, 2024

- FIGURE 27 AVERAGE SELLING PRICE TREND OF HYDROGEN DETECTION EQUIPMENT, BY REGION, 2021-2024

- FIGURE 28 HYDROGEN DETECTION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 WEIGHTED IMPACT ASSESSMENT OF EACH FORCE ON MARKET

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 32 IMPORT SCENARIO FOR HS CODE 9027-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 33 EXPORT SCENARIO FOR HS CODE 9027-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 34 PATENTS ANALYSIS

- FIGURE 35 IMPACT OF AI/GEN AI ON HYDROGEN DETECTION MARKET

- FIGURE 36 HYDROGEN DETECTION MARKET, BY SENSOR TECHNOLOGY

- FIGURE 37 ELECTROCHEMICAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 38 HYDROGEN DETECTION MARKET, BY IMPLEMENTATION TYPE

- FIGURE 39 FIXED SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 40 HYDROGEN DETECTION MARKET, BY DETECTION RANGE

- FIGURE 41 0-5,000 PPM SEGMENT TO HOLD LARGEST SHARE OF HYDROGEN DETECTION MARKET IN 2025

- FIGURE 42 HYDROGEN DETECTION MARKET, BY PROCESS STAGE

- FIGURE 43 GENERATION SEGMENT TO CAPTURE LARGEST SHARE OF HYDROGEN DETECTION MARKET IN 2025

- FIGURE 44 HYDROGEN DETECTION MARKET, BY APPLICATION

- FIGURE 45 OIL & GAS SEGMENT TO HOLD LARGEST SHARE OF HYDROGEN DETECTION MARKET IN 2025

- FIGURE 46 HYDROGEN DETECTION MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 47 NORTH AMERICA: HYDROGEN DETECTION MARKET SNAPSHOT

- FIGURE 48 EUROPE: HYDROGEN DETECTION MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: HYDROGEN DETECTION MARKET SNAPSHOT

- FIGURE 50 HYDROGEN DETECTION MARKET SHARE ANALYSIS, 2024

- FIGURE 51 REVENUE ANALYSIS OF KEY PLAYERS IN HYDROGEN DETECTION MARKET, 2020-2024

- FIGURE 52 COMPANY VALUATION

- FIGURE 53 FINANCIAL METRICS

- FIGURE 54 HYDROGEN DETECTION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 55 HYDROGEN DETECTION MARKET: COMPANY FOOTPRINT

- FIGURE 56 HYDROGEN DETECTION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 57 HYDROGEN DETECTION MARKET: BRAND/SERVICE COMPARISON

- FIGURE 58 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 59 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 60 DRAGERWERK AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 61 MSA SAFETY INCORPORATED: COMPANY SNAPSHOT