|

市場調查報告書

商品編碼

1833619

氫氣管道市場機會、成長動力、產業趨勢分析及2025-2035年預測Hydrogen Pipeline Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2035 |

||||||

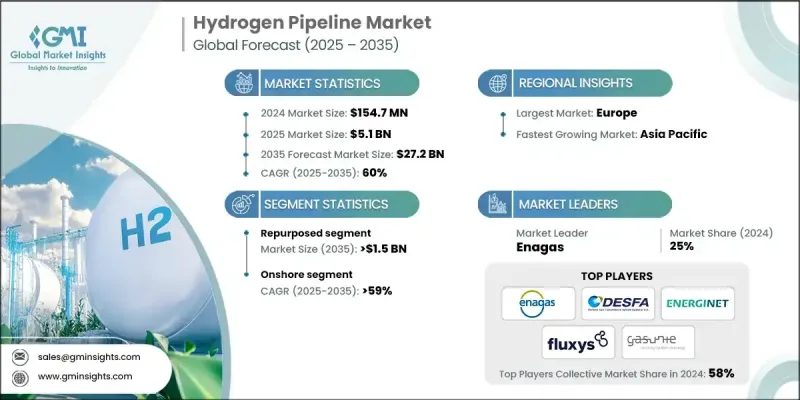

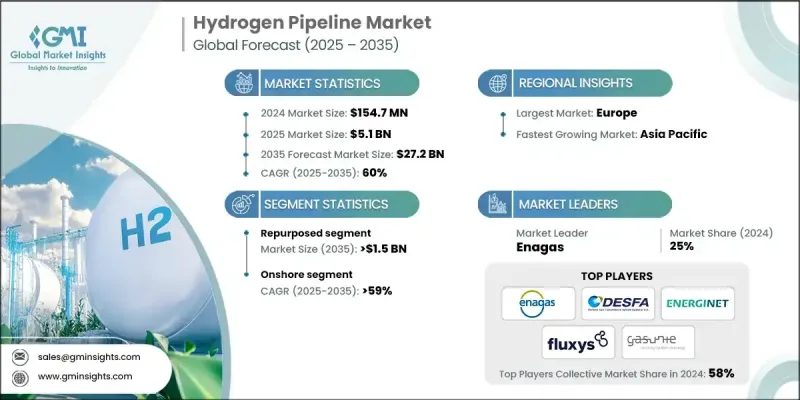

2024 年全球氫氣管道市場規模估計為 1.547 億美元,預計將從 2025 年的 51 億美元成長到 2035 年的 272 億美元,複合年成長率為 60%。

世界各國政府和各行各業都致力於實現淨零排放目標,大力投資清潔氫能,將其作為重要的脫碳工具,尤其是在鋼鐵、化學和重型運輸等難以減排的行業。這刺激了對包括管道在內的可靠氫能運輸基礎設施的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2035 |

| 起始值 | 1.547億美元 |

| 預測值 | 272億美元 |

| 複合年成長率 | 60% |

再利用領域需求不斷成長

由於營運商尋求經濟高效的解決方案來加速基礎設施部署,氫能改造領域在2024年將佔據顯著佔有率。企業不再從零開始建造新管線,而是將現有的天然氣管道改造成氫氣輸送管道,這種方法可以降低資本支出並縮短開發週期。這種方法在擁有大量傳統天然氣管網的地區尤其具有吸引力,因為它在現有的化石能源系統和未來的綠色能源分配之間架起了一座實用的橋樑。

陸上需求不斷成長

2024年,陸上管道業務創造了可觀的收入,這得益於其物流優勢、更低的安裝成本以及與海上基礎設施相比更容易獲得法規核准。陸上管道對於連接電解廠等生產基地與工業用戶、加氫站和出口終端至關重要。這一領域對於在工業園區之間建立區域氫能樞紐和走廊尤其重要。

歐洲將崛起為利潤豐厚的地區

2024年,歐洲氫氣管道市場佔據了相當大的佔有率,這得益於雄心勃勃的氣候目標、協調一致的基礎設施規劃以及歐盟氫能戰略強力的監管支持。德國、荷蘭和西班牙等主要國家正大力投資建立跨國管線網路,以連結跨境生產和消費中心。此外,跨產業合作、政府資助以及「歐洲氫能骨幹網路」等計劃下的天然氣管道改造也推動了這一成長。

氫氣管道市場的主要參與者包括 Denys、Terega、ENERGINET、Siemens Energy、GRTgaz、REN、Fluxys、Bonatti、Tekfen、The ROSEN Group、Spiecapag、Corinth Pipeworks、TENARIS、DESFA、SROnam、ONTRAS Gasport、EnAZAZs、SYS膜、EnAZs、Gasunie、EU

為了鞏固其在不斷發展的氫氣管道市場中的地位,各公司正在尋求技術創新、戰略合作夥伴關係和監管協調相結合的方案。許多公司正在投資先進的管道材料和監控系統,以應對氫氣的安全挑戰並滿足未來標準。與再生能源開發商和工業氫氣用戶的合作正在實現垂直整合的價值鍊和保障需求。此外,各公司正積極與政策制定者合作,以建立監管框架,確保專案核准和融資資格更加順暢。地理多元化,尤其是在歐洲和亞洲,是另一項關鍵策略,使公司能夠進入高成長市場並平衡跨地區的專案風險。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成本結構分析

- 潛在的管道項目

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率(按地區分類)

- 北美洲

- 歐洲

- 亞太地區

- 戰略儀表板

- 策略舉措

- 公司標竿分析

- 創新與技術格局

第5章:市場規模及預測:依類型,2021 - 2035

- 主要趨勢

- 陸上

- 海上

第6章:市場規模及預測:依分類,2021 - 2035

- 主要趨勢

- 新的

- 重新利用

第7章:市場規模及預測:按地區,2021 - 2035

- 主要趨勢

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第8章:公司簡介

- Bonatti

- Corinth Pipeworks

- DESFA

- Denys

- Enagas SA

- Energinet

- EUROPIPE

- Fluxys

- Gasunie

- GAZ-SYSTEM

- GRTgaz

- ONTRAS Gastransport GmbH

- REN

- Siemens Energy

- Spiecapag

- Snam

- Tekfen

- Tenaris

- Terega

- The ROSEN Group

The global hydrogen pipeline market was estimated at USD 154.7 million in 2024 and is expected to grow from USD 5.1 billion in 2025 to USD 27.2 billion by 2035, at a CAGR of 60%.

Governments and industries worldwide are committing to net-zero emissions targets, driving massive investments in clean hydrogen as a key decarbonization tool-especially for hard-to-abate sectors like steel, chemicals, and heavy transport. This fuels demand for reliable hydrogen transport infrastructure, including pipelines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2035 |

| Start Value | $154.7 Million |

| Forecast Value | $27.2 Billion |

| CAGR | 60% |

Rising Demand for the Repurposed Sector

The repurposed segment held a significant share in 2024, as operators look for cost-effective solutions to accelerate infrastructure deployment. Instead of building new lines from scratch, companies are converting existing natural gas pipelines to carry hydrogen an approach that reduces capital expenditure and shortens development timelines. This method is particularly appealing in regions with extensive legacy gas networks, offering a practical bridge between current fossil-based systems and future green energy distribution.

Increasing Demand for Onshore

The onshore segment generated significant revenues in 2024, owing to its logistical advantages, lower installation costs, and easier regulatory approvals compared to offshore infrastructure. Onshore pipelines are essential for connecting production sites, such as electrolysis plants, with industrial users, hydrogen refueling stations, and export terminals. This segment is especially critical for enabling regional hydrogen hubs and corridors across industrial zones.

Europe to Emerge as a Lucrative Region

Europe hydrogen pipeline market held a sizeable share in 2024, fueled by ambitious climate goals, coordinated infrastructure plans, and strong regulatory support through the EU Hydrogen Strategy. Major countries like Germany, the Netherlands, and Spain are investing heavily in transnational pipeline networks to connect production and consumption hubs across borders. The growth is also benefiting from cross-industry collaborations, government funding, and repurposing gas networks under initiatives like the European Hydrogen Backbone.

Major players in the hydrogen pipeline market are Denys, Terega, ENERGINET, Siemens Energy, GRTgaz, REN, Fluxys, Bonatti, Tekfen, The ROSEN Group, Spiecapag, Corinth Pipeworks, TENARIS, DESFA, Snam, ONTRAS Gastransport, Enagas, Gasunie, EUROPIPE, and GAZ-SYSTEM.

To strengthen their position in the evolving hydrogen pipeline market, companies are pursuing a combination of technological innovation, strategic partnerships, and regulatory alignment. Many are investing in advanced pipeline materials and monitoring systems to address hydrogen's safety challenges and meet future standards. Collaborations with renewable energy developers and industrial hydrogen users are enabling vertically integrated value chains and guaranteed demand. In addition, firms are actively engaging with policymakers to shape regulatory frameworks, ensuring smoother project approvals and eligibility for funding. Geographic diversification, particularly in Europe and Asia, is another key strategy, allowing companies to tap into high-growth markets and balance project risk across regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2035

- 2.2 Business trends

- 2.3 Type trends

- 2.4 Classification trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Cost structure analysis

- 3.5 Potential Pipeline Projects

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2035 (USD Million, Km)

- 5.1 Key trends

- 5.2 Onshore

- 5.3 Offshore

Chapter 6 Market Size and Forecast, By Classification, 2021 - 2035 (USD Million, Km)

- 6.1 Key trends

- 6.2 New

- 6.3 Repurposed

Chapter 7 Market Size and Forecast, By Region, 2021 - 2035 (USD Million, Km)

- 7.1 Key trends

- 7.2 North America

- 7.3 Europe

- 7.4 Asia Pacific

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 Bonatti

- 8.2 Corinth Pipeworks

- 8.3 DESFA

- 8.4 Denys

- 8.5 Enagas S.A.

- 8.6 Energinet

- 8.7 EUROPIPE

- 8.8 Fluxys

- 8.9 Gasunie

- 8.10 GAZ-SYSTEM

- 8.11 GRTgaz

- 8.12 ONTRAS Gastransport GmbH

- 8.13 REN

- 8.14 Siemens Energy

- 8.15 Spiecapag

- 8.16 Snam

- 8.17 Tekfen

- 8.18 Tenaris

- 8.19 Terega

- 8.20 The ROSEN Group