|

市場調查報告書

商品編碼

1783242

電動施工機械市場(按類型、電池容量、電池化學性質、功率輸出、推進力、應用和地區分類)- 預測至 2032 年Electric Construction Equipment Market by Type (Excavator, Loader, Grader, Dump Truck, LHD, Self-propelled Sprayer, Tractor), Propulsion (Electric, Hybrid, Hydrogen), Battery Capacity & Chemistry, Power Output, and Region - Global Forecast to 2032 |

||||||

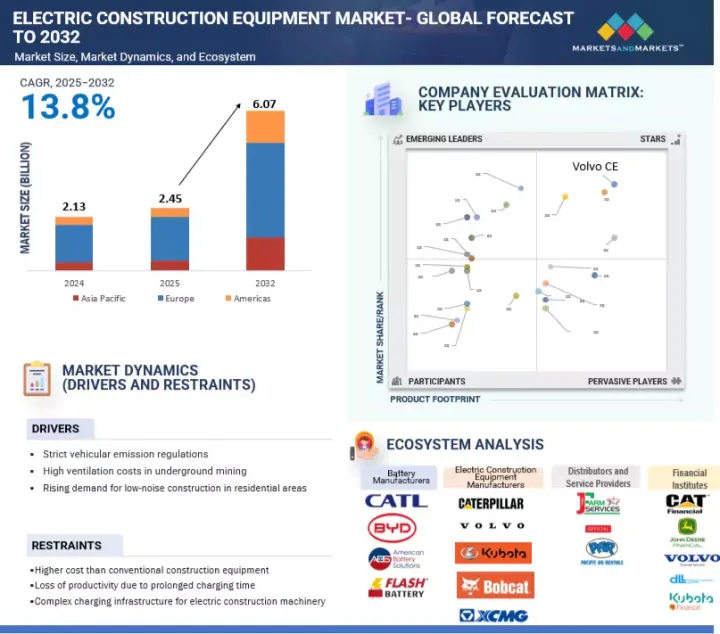

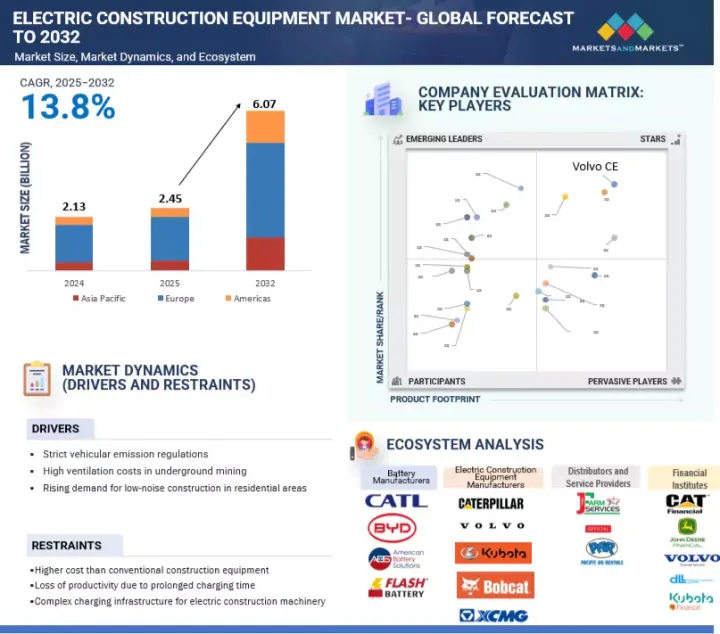

電動施工機械市場預計將從 2025 年的 24.5 億美元成長到 2032 年的 60.7 億美元,複合年成長率為 13.8%。

人們對都市區空氣品質的擔憂以及新的降噪規定推動了建築和採礦業電氣化的趨勢。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2032 |

| 基準年 | 2024 |

| 預測期 | 2025-2032 |

| 目標單位 | 數量(單位)及金額(千美元/百萬美元) |

| 部分 | 按類型、電池容量、電池化學性質、功率輸出、推進力、應用和地區 |

| 目標區域 | 亞太地區、美洲、歐洲 |

近年來,由於各國基礎設施需求不斷成長,尤其是中東和歐洲持續的衝突,主要市場參與企業發現了推廣電動挖土機及相關產品的新機會。此外,城市排放法規迫使原始設備製造商開發先進的電池電動車型,而混合動力解決方案和自動駕駛技術在需要高能量密度和長行駛週期的應用中越來越受歡迎。

電子機械在城市環境和無石化燃料施工區表現出色,具有零排放、降低噪音水平和提高運作效率等優勢。此外,它們能夠與數位監控系統和智慧數據分析整合,進一步提升了其吸引力。由此帶來的向純電動、混合動力甚至氫燃料電池動力傳動系統的轉變,正在對包括建築、採礦和農業在內的各種非公路用車 (OHV) 行業產生重大影響。

歐洲對電池容量超過 100 kWh 的電動曳引機的需求正在蓬勃發展,其中大容量電池組的成長最為強勁。這種快速成長是由對更長的駕駛自主性、更高的扭矩輸出以及在具有挑戰性的農業環境中為先進農具提供動力的能力的需求所驅動。例如,2024 年推出的 Fendt e100 Vario 配備 100 kWh 電池,為農民提供更長的田間作業時間和強大的性能,對於大型農場和專業化作業尤其有價值。包括 AGCO 和 Deere & Company 在內的主要企業正在主導開發和商業化容量為 100 kWh 或更高的電動曳引機,用於高階應用,並配備先進的電池管理系統。這一趨勢得到了歐盟和各國嚴格的法規的大力支持,例如通用農業政策 (CAP),該政策將從 2025 年 3 月起為採用電動農業機械提供高達 45,000 美元的補貼。

此外,《歐洲綠色新政》對永續農業方法的更廣泛推動也推動了這一趨勢。由於政府的支持性政策、具有前瞻性思維的農民的強勁需求以及主要製造商對推動創新和永續性的承諾,歐洲在大容量電動曳引機市場中處於領先地位。然而,儘管擁有這些優勢,但廣泛採用仍面臨重大挑戰。這些挑戰包括高昂的初始成本、漫長的充電時間、農村地區有限的充電基礎設施以及對持續重負載下電池劣化的擔憂。

與混合動力和燃料電池替代品相比,電池電動行業由於操作簡單、維護要求低、排放立即減少排放氣體,在電動施工機械市場佔有率。這使其成為製造商和最終用戶的首選。在美洲,向電氣化的轉變受到嚴格的環境法規、政府激勵措施以及凱斯建築 12EV 輪式裝載機和 580EV後鏟挖土機、沃爾沃 CE 電動裝載機和山貓電動緊湊型履帶式裝載機等新車型的推出的推動。這些發展反映了市場向永續機械的重大轉變。在雄心勃勃的脫碳目標、強力的法規結構以及對低噪音、零排放設備的高需求的推動下,歐洲在市場佔有率方面處於領先地位。

同時,亞太地區正經歷快速成長,這得益於快速的都市化、基礎建設以及中國、印度和日本等國政府的政策。這些政策要求控制污染並支持電動設備的本地生產。這些地區的政府正透過財政獎勵、稅收減免和直接補貼等方式積極推廣用於建築和採礦應用的純電動車 (BEV)。這些措施使電子機械更具經濟吸引力,並有助於抵消高昂的前期成本。Caterpillar、沃爾沃建築設備、小松、日立、JCB 和山貓等該市場的主要企業正在擴大產品系列,以滿足對電動施工機械日益成長的需求,並推出新型電動挖土機、裝載機和卡車。

在環境法規、政府激勵措施和永續建築實踐需求不斷成長的共同作用下,美洲的電動施工機械趨勢正在迅速擴大。在美國,電動施工機械市場正在擴大,其中挖土機在銷售方面處於領先地位,到 2025 年將佔據約 60% 的市場佔有率。這種成長是由挖掘機的多功能性、高現場運轉率以及適用於必須最大限度地減少噪音和排放氣體的都市區和室內環境所驅動的。促成這一趨勢的一個關鍵因素是 Li-NMC(鋰鎳錳鈷)電池的廣泛採用,到 2025 年這種電池將佔據 45% 以上的市場佔有率。這些電池具有卓越的能量密度、更長的循環壽命和更快的充電能力,使其成為運作和性能至關重要的嚴苛建築和採礦環境的理想選擇。

美洲地區的主要企業包括山貓、Caterpillar、沃爾沃建築設備、小松、約翰迪爾和凱斯建築設備。近年來,這些公司推出了新的電動車型,並擴展了其電氣化策略。近期的監管變化,例如加州更嚴格的排放氣體標準以及主要城市新的噪音法規,正在加速向電氣化的轉變。例如,洛杉磯和紐約市大力推行零排放建築工地,以及聯邦和州政府購買綠色設備的獎勵措施,也鼓勵製造商投資電動技術。

此外,各省和市政當局通常會實施進一步的規定,例如限制學校、醫院和法院等敏感地點附近的噪音水平。安大略省多倫多市限制晚上 7 點至早上 7 點之間的施工噪音,紐約市則要求在這些時段以外的施工必須獲得特殊許可。為了支持電氣化進程,各政府和機構提供稅額扣抵和購買低噪音電氣設備的補貼等獎勵。然而,這些政策因省份和地區而異,有些政策提供的支持度較大。

本報告研究了全球電動施工機械市場,並提供了按類型、電池容量、電池化學性質、功率輸出、推進力、應用和地區分類的趨勢資訊,以及參與市場的公司概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章市場概述

- 介紹

- 市場動態

- 貿易分析

- 影響客戶業務的趨勢和中斷

- 專利分析

- 供應鏈分析

- 生態系分析

- 定價分析

- 技術分析

- 監管狀況

- 2025-2026年主要會議和活動

- 案例研究分析

- 主要相關人員和採購標準

- 電動施工機械的總擁有成本

- 電動曳引機的總擁有成本

- 裝載機總擁有成本

- 電池技術的未來發展

- OEM分析

第6章 電動施工機械市場(依類型)

- 介紹

- 電動挖土機

- 電動裝載機

- 電動平土機機

- 電動推土機

- 純電動自動卸貨卡車/寬體貨車

- 電動裝卸自卸裝載機

- 關鍵見解

第7章 電動施工機械市場(以電池容量)

- 介紹

- 少於50KWH

- 50~200KWH

- 200~500KWH

- 超過500度

- OEM級設備的電池容量

- 關鍵見解

8. 電動施工機械市場(以電池化學分類)

- 介紹

- 磷酸鋰鐵

- 鋰鎳錳鈷氧化物

- 其他

- 成本分析

- 電池化學的進展

- 關鍵見解

第9章 電動施工機械市場(依產量)

- 介紹

- 低於50 HP

- 50~150HP

- 150~300HP

- 超過300馬力

- 關鍵見解

第10章 電動施工機械市場(依推進力)

- 介紹

- 電池電動

- 油電混合車

- 氫

- 關鍵見解

第 11 章 電動施工機械市場(依應用)

- 介紹

- 建造

- 礦業

- 園藝

- 農業

- 關鍵見解

第12章 電動農業設備市場(按類型)

- 介紹

- 營運數據

- 電動割草機

- 電動自走式噴霧器

- 電動曳引機

- 關鍵見解

第13章 電動曳引機市場(以電池容量)

- 介紹

- 少於50KWH

- 50~100KWH

- 超過100KWH

- 電動曳引機型號及電池容量

- 關鍵見解

第 14 章電動曳引機市場(按電池化學分類)

- 介紹

- 磷酸鋰鐵

- 鋰鎳錳鈷氧化物

- 其他

- 關鍵見解

第 15 章電動曳引機市場(按推進力)

- 介紹

- 電池電動

- 油電混合車

- 氫

- 關鍵見解

第16章 電動施工機械市場(按地區)

- 介紹

- 亞太地區

- 宏觀經濟展望

- 中國

- 印度

- 日本

- 韓國

- 其他

- 歐洲

- 宏觀經濟展望

- 德國

- 英國

- 法國

- 西班牙

- 俄羅斯

- 義大利

- 其他

- 美洲

- 宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 巴西

- 阿根廷

- 關鍵見解

第17章競爭格局

- 概述

- 主要參與企業的策略/優勢,2021-2025

- 2020-2024年收益分析

- 2024年市場佔有率分析

- 企業評估

- 財務指標

- 品牌/產品比較

- 公司估值矩陣:電動施工機械製造商,2024 年

- 公司估值矩陣:2025 年電動挖土機製造商

- 競爭場景

第18章:公司簡介

- 主要參與企業

- HITACHI CONSTRUCTION MACHINERY CO., LTD.

- CATERPILLAR INC.

- KOMATSU LTD.

- VOLVO CONSTRUCTION EQUIPMENT

- SANY HEAVY INDUSTRIES CO., LTD.

- JCB

- DEERE & COMPANY

- SANDVIK AB

- EPIROC AB

- LIEBHERR

- BOBCAT COMPANY

- 其他公司

- SOLETRAC INC.

- FENDT

- HUSQVARNA AB

- XUZHOU CONSTRUCTION MACHINERY GROUP CO., LTD.

- KUBOTA CORPORATION

- KOBELCO CONSTRUCTION MACHINERY EUROPE BV

- BHARAT EARTH MOVERS LIMITED

- CNH INDUSTRIAL NV

- WACKER NEUSON SE

- TAKEUCHI GLOBAL

- HD HYUNDAI HEAVY INDUSTRIES CO., LTD.

- LUIGONG MACHINERY CO., LTD.

第19章市場建議

第20章 附錄

The electric construction equipment market is projected to reach USD 6.07 billion by 2032, from USD 2.45 billion in 2025, with a CAGR of 13.8%. The electrification trend in the construction and mining industries is driven by concerns over urban air quality and new noise reduction mandates.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (Unit) and Value (USD Thousand/Million) |

| Segments | Type, Battery Capacity, Battery Chemistry, Power Output, Application, and Region |

| Regions covered | Asia Pacific, Americas, and Europe |

Recently, key players in the market have new opportunities to promote their electric excavators and related products due to increased infrastructure demand in various countries, particularly as a result of the ongoing conflicts in the Middle East and Europe. Additionally, city-level emissions regulations are compelling OEMs to develop advanced battery-electric models, while hybrid solutions and autonomous technologies are gaining popularity for applications that require high energy density or extended operating cycles.

Electric machinery performs exceptionally well in urban environments and fossil-free construction zones, offering benefits such as zero emissions, reduced noise levels, and improved operational efficiency. Furthermore, their capability to integrate with digital monitoring systems and smart data analytics enhances their attractiveness. As a result, there is a noticeable shift toward battery-electric, hybrid, and even hydrogen fuel cell powertrains, which significantly impact various off-highway vehicle (OHV) sectors, including construction, mining, and agriculture.

Tractors with >100 kWh battery capacity exhibit the fastest growth in Europe.

Electric tractors with battery capacities exceeding 100 kWh are experiencing rapidly increasing demand in Europe, which is seeing the strongest growth for large-capacity battery packs. This surge is driven by the need for longer operational autonomy, higher torque output, and the ability to power advanced implements in demanding agricultural environments. For instance, the Fendt e100 Vario, launched in 2024, features a 100-kWh battery that provides farmers with extended field hours and robust performance, making it especially valuable for large-scale farms and specialized operations. Major European manufacturers, including AGCO Corporation and Deere & Company, are leading the charge by developing and commercializing electric tractors equipped with advanced battery management systems and capacities that meet or exceed 100 kWh for high-end applications. This trend is strongly supported by stringent EU and national regulations, such as the Common Agricultural Policy (CAP), which offers grants of up to USD 45,000 for adopting electric farm equipment starting in March 2025.

Additionally, the broader push toward sustainable farming practices under Europe's Green Deal bolsters this movement. Europe is at the forefront of the market for large-capacity electric tractors due to supportive government policies, strong demand from progressive farmers, and a commitment from major manufacturers to innovate and promote sustainability. However, despite these advantages, significant challenges remain for widespread adoption. These include high upfront costs, longer charging times, limited charging infrastructure in rural areas, and concerns about battery degradation under continuous high-load use.

The battery electric segment secures the leading market position.

The battery electric segment holds the largest market share in electric construction equipment due to its operational simplicity, lower maintenance requirements, and immediate emissions reduction when compared to hybrid or fuel cell alternatives. This makes it the preferred choice for both manufacturers and end users. In the Americas, the shift toward electrification is driven by strict environmental regulations, government incentives, and the introduction of new models such as Case Construction's 12EV wheel loader and 580EV backhoe, Volvo CE's electric loader, and Bobcat's electric compact track loader. These developments reflect a significant market shift toward sustainable machinery. Europe leads in market share, fueled by ambitious decarbonization targets, strong regulatory frameworks, and a high demand for low-noise, zero-emission equipment.

Meanwhile, the Asia Pacific region is experiencing the fastest growth, driven by rapid urbanization, infrastructure development, and government policies in countries like China, India, and Japan. These policies mandate pollution control and support the local manufacturing of electric equipment. Governing bodies across these regions actively promote battery electric vehicles (BEVs) for construction and mining through financial incentives, tax breaks, and direct subsidies. These measures make electric machinery more economically attractive and help offset higher upfront costs. Key players in the market, including Caterpillar, Volvo Construction Equipment, Komatsu, Hitachi, JCB, and Bobcat, have launched new electric excavators, loaders, and trucks, expanding their product portfolios to meet the rising demand for electric construction equipment.

The Americas is the second fastest-growing market for electric construction equipment.

The trend of electric construction equipment in the Americas is rapidly growing, driven by a mix of environmental regulations, government incentives, and increasing demand for sustainable building practices. In the United States, the electric construction equipment market is expanding, with excavators leading sales and accounting for around 60% of the market share by 2025. This growth is attributed to excavators' versatility, high utilization rates on job sites, and their suitability for urban and indoor environments where minimizing noise and emissions is essential. A significant factor contributing to this trend is the prevalence of Li-NMC (Lithium Nickel Manganese Cobalt) batteries, which will make up more than 45% of the market share in 2025. These batteries offer superior energy density, longer cycle life, and faster charging capabilities, making them ideal for demanding construction and mining environments where uptime and performance are critical.

Key players in the Americas include Bobcat, Caterpillar, Volvo Construction Equipment, Komatsu, John Deere, and CASE Construction Equipment. These companies have introduced new electric models and expanded their electrification strategies in recent years. Recent regulatory changes, such as stricter emissions standards in California and new noise level ordinances in major cities, have accelerated the shift toward electrification. For example, the push for zero-emission construction sites in Los Angeles and New York City, along with federal and state incentives for purchasing green equipment, has encouraged manufacturers to invest in electric technology.

Additionally, states and municipalities often implement further ordinances, such as restrictions on noise levels near sensitive areas like schools, hospitals, and courts. In Toronto, Ontario, construction noise is restricted from 7 PM to 7 AM, while in New York City, after-hours construction requires special authorization. To support the move toward electrification, governments and agencies offer incentives such as tax credits or grants for purchasing quieter electric equipment. However, these policies vary by state and locality, with some regions providing more robust support than others.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

- By Company Type: Electric Construction Equipment OEM - 100%

- By Designation: C Level - 30%, Directors- 20%, and Others - 50%

- By Region: Asia Pacific - 50%, Americas - 30%, and Europe -20%

The key players in the electric construction equipment market are Hitachi Construction Machinery (Japan), Caterpillar Inc. (US), Komatsu Ltd. (Japan), Volvo Construction Equipment (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), and JCB (UK). Major companies' key strategies to maintain their position in the global electric construction equipment market are strong global networking, mergers and acquisitions, partnerships, and technological advancement.

Research Coverage

The study segments and forecasts the size of the electric construction equipment market based on type (electric excavators, electric motor graders, electric dozers, electric loaders, electric dump trucks, and electric load-haul-dump loaders), battery capacity (<50 kWh, 50-200 kWh, 200-500 kWh, and >500 kWh), battery chemistry (lithium iron phosphate, lithium nickel manganese cobalt oxide, and others), power output (<50 hp, 50-150 hp, 150-300 hp, and >300 hp), application (construction, mining, agriculture, and gardening), propulsion (battery electric, hybrid electric, and hydrogen), electric agriculture equipment market by type (electric lawnmowers, electric self-propelled sprayers, and electric tractors), electric tractor market by propulsion (battery electric, hybrid electric, and hydrogen), electric tractor market by battery capacity (<50 KWh, 50-100 KWh, and >100 KWh), electric tractor market by battery chemistry (lithium iron phosphate, lithium nickel manganese cobalt oxide, and others), and region (Asia Pacific, Europe, and Americas). It also includes an in-depth competitive analysis of the major electric construction equipment manufacturers, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying this Report:

The report will assist market leaders and new entrants by providing estimates of revenue for the overall electric construction equipment market and its sub-segments. This report will help stakeholders understand the competitive landscape and gain valuable insights to better position their businesses and develop effective go-to-market strategies. Additionally, it helps stakeholders stay informed about the market's current trends and offers information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (strict vehicular emission regulations, high ventilation costs in underground mining, rising demand for low-noise construction in residential areas), restraints (higher initial costs than conventional ICE equipment, loss of productivity due to prolonged charging times, complex charging infrastructure for electric construction machinery), opportunities (development of long-range and fast-charging battery technology, increased manufacturing and testing of hybrid electric vehicles, emergence of hydrogen-powered construction equipment), and challenges (limited compatibility, interchangeability, and standardization of electric construction equipment for long-haul applications, complex thermal management of batteries, rapid transition of construction equipment toward alternative power sources) influencing the growth of the electric construction equipment market

- Product Development/Innovation: In-depth insights on upcoming technologies and new product and service launches in the electric construction equipment market

- Market Development: Comprehensive market information - the report analyses the authentication and brand protection market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the electric construction equipment market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the electric construction equipment market, such as Caterpillar Inc. (US), Komatsu Ltd. (Japan), Volvo Construction Equipment (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), and JCB (UK)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Sampling techniques and data collection methods

- 2.1.2.2 Primary interview participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN THE ELECTRIC CONSTRUCTION EQUIPMENT MARKET

- 4.2 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE

- 4.3 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY APPLICATION

- 4.4 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CHEMISTRY

- 4.5 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CAPACITY

- 4.6 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY PROPULSION

- 4.7 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY POWER OUTPUT

- 4.8 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Strict vehicular emission regulations

- 5.2.1.2 High ventilation costs in underground mining

- 5.2.1.3 Surge in demand for low-noise construction in residential areas

- 5.2.1.4 Incentives on electric tractors and finance credits

- 5.2.2 RESTRAINTS

- 5.2.2.1 Higher initial cost than conventional ICE equipment

- 5.2.2.2 Loss of productivity due to prolonged charging time

- 5.2.2.3 Complex charging infrastructure for electric construction machinery

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of long-range and fast-charging battery technology

- 5.2.3.2 Increased manufacturing and testing of hybrid electric vehicles

- 5.2.3.3 Emergence of hydrogen-powered construction equipment

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited compatibility, interchangeability, and standardization for long-haul applications

- 5.2.4.2 Complex thermal management of batteries

- 5.2.4.3 Rapid transition of construction equipment toward alternative power sources

- 5.2.1 DRIVERS

- 5.3 TRADE ANALYSIS

- 5.3.1 IMPORT SCENARIO (HS CODE 842710)

- 5.3.2 EXPORT SCENARIO (HS CODE 842710)

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 PATENT ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 PRICING ANALYSIS

- 5.8.1 BY TYPE

- 5.8.2 BY APPLICATION

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Autonomous construction equipment

- 5.9.1.2 Remote monitoring and predictive maintenance

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Grade control systems

- 5.9.2.2 Regenerative braking

- 5.9.2.3 Hydrogen fuel cells

- 5.9.2.4 Augmented reality

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Agricultural equipment automation

- 5.9.3.2 Advanced telematics

- 5.9.1 KEY TECHNOLOGIES

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 QUALITY STANDARDS

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 CATERPILLAR'S ELECTRIC MINI EXCAVATOR

- 5.12.2 HITACHI'S ZE85 ELECTRIC EXCAVATOR

- 5.12.3 KOMATSU'S ELECTRIC MINI EXCAVATORS

- 5.12.4 VOLVO CE'S MID-SIZE ELECTRIC WHEEL LOADERS

- 5.12.5 JCB'S ELECTRIC TELEHANDLERS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 TOTAL COST OF OWNERSHIP OF ELECTRIC CONSTRUCTION EQUIPMENT

- 5.15 TOTAL COST OF OWNERSHIP OF ELECTRIC TRACTORS

- 5.16 TOTAL COST OF OWNERSHIP OF LOADERS

- 5.17 FUTURE DEVELOPMENTS IN BATTERY TECHNOLOGY

- 5.17.1 SOLID-STATE BATTERIES

- 5.17.2 LITHIUM-ION BATTERIES

- 5.17.3 SODIUM-ION BATTERIES

- 5.17.4 SWAPPABLE BATTERY TECHNOLOGY

- 5.18 OEM ANALYSIS

- 5.18.1 BATTERY CAPACITY OF ELECTRIC COMPACT CONSTRUCTION EQUIPMENT OFFERED BY OEMS

- 5.18.2 BATTERY CAPACITY VS. POWER OUTPUT

6 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 ELECTRIC EXCAVATORS

- 6.2.1 EXTENSIVE USE IN CONSTRUCTION AND MINING DUE TO NOISELESS OPERATIONS

- 6.3 ELECTRIC LOADERS

- 6.3.1 INCREASED INVESTMENTS BY PROMINENT COMPANIES

- 6.4 ELECTRIC MOTOR GRADERS

- 6.4.1 RISING NEED IN US DUE TO STRINGENT EMISSION NORMS

- 6.5 ELECTRIC DOZERS

- 6.5.1 HIGH DEMAND FROM ASIA PACIFIC DUE TO STRONG PRESENCE OF CONSTRUCTION AND MINING COMPANIES

- 6.6 ELECTRIC DUMP TRUCKS/WIDE-BODIED TRUCKS

- 6.6.1 SURGE IN MINING ACTIVITIES

- 6.7 ELECTRIC LOAD HAUL DUMP LOADERS

- 6.7.1 FOCUS ON MINIMIZING UNDERGROUND VENTILATION COST

- 6.8 PRIMARY INSIGHTS

7 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CAPACITY

- 7.1 INTRODUCTION

- 7.2 <50 KWH

- 7.2.1 SUITABLE FOR PACKED CONSTRUCTION SITES AND NARROW MINING APPLICATIONS

- 7.3 50-200 KWH

- 7.3.1 HIGH DEMAND FOR SMALL AND MID-RANGE CONSTRUCTION EQUIPMENT T

- 7.4 200-500 KWH

- 7.4.1 ONGOING DEVELOPMENT OF NEWER MODELS

- 7.5 >500 KWH

- 7.5.1 UNTAPPED GROWTH POTENTIAL WITH ADVANCES IN BATTERY TECHNOLOGY

- 7.6 BATTERY CAPACITY OF OEM-LEVEL EQUIPMENT

- 7.7 PRIMARY INSIGHTS

8 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CHEMISTRY

- 8.1 INTRODUCTION

- 8.2 LITHIUM IRON PHOSPHATE

- 8.2.1 NEED FOR EFFICIENT ENERGY STORAGE DUE TO RISE IN RENEWABLE ENERGY SOURCES

- 8.3 LITHIUM NICKEL MANGANESE COBALT OXIDE

- 8.3.1 HIGHER CONSUMER ACCEPTANCE IN EUROPE AND AMERICAS

- 8.4 OTHERS

- 8.4.1 SODIUM-ION BATTERIES

- 8.4.2 SOLID-STATE BATTERIES

- 8.5 COST ANALYSIS

- 8.6 DEVELOPMENTS IN BATTERY CHEMISTRY

- 8.7 PRIMARY INSIGHTS

9 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY POWER OUTPUT

- 9.1 INTRODUCTION

- 9.2 <50 HP

- 9.2.1 LARGE-SCALE ADOPTION IN LIGHT CONSTRUCTION APPLICATIONS

- 9.3 50-150 HP

- 9.3.1 INCREASED PRODUCT DEVELOPMENT ACTIVITIES

- 9.4 150-300 HP

- 9.4.1 EXPANDING DEVELOPMENTS IN BATTERIES AND CONSTRUCTION EQUIPMENT PRODUCTS

- 9.5 >300 HP

- 9.5.1 LIMITED COMMERCIALIZATION DUE TO HIGH BATTERY COSTS

- 9.6 PRIMARY INSIGHTS

10 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY PROPULSION

- 10.1 INTRODUCTION

- 10.2 BATTERY ELECTRIC

- 10.2.1 EMPHASIS ON ENVIRONMENTAL SUSTAINABILITY

- 10.3 HYBRID ELECTRIC

- 10.3.1 LIMITATIONS ASSOCIATED WITH 100% ELECTRIFICATION

- 10.4 HYDROGEN

- 10.4.1 GROWING ADOPTION OF ENVIRONMENTALLY CONSCIOUS PRACTICES

- 10.5 PRIMARY INSIGHTS

11 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 CONSTRUCTION

- 11.2.1 COMPLIANCE WITH STRINGENT EMISSION AND NOISE REGULATIONS

- 11.3 MINING

- 11.3.1 EMERGING TREND OF ELECTRIFICATION

- 11.4 GARDENING

- 11.4.1 HIGHER RATE OF ELECTRIFICATION THAN OTHER EQUIPMENT

- 11.5 AGRICULTURE

- 11.5.1 ELEVATED DEMAND FOR FOOD PRODUCTION

- 11.6 PRIMARY INSIGHTS

12 ELECTRIC AGRICULTURE EQUIPMENT MARKET, BY TYPE

- 12.1 INTRODUCTION

- 12.2 OPERATIONAL DATA

- 12.3 ELECTRIC LAWNMOWERS

- 12.3.1 HIGH FUEL COSTS AND WORKFORCE SHORTAGES

- 12.4 ELECTRIC SELF-PROPELLED SPRAYERS

- 12.4.1 PREVENTION OF CROP WITHERING

- 12.5 ELECTRIC TRACTORS

- 12.5.1 GOVERNMENT INITIATIVES FOR BOOSTING FOOD PRODUCTIVITY

- 12.6 PRIMARY INSIGHTS

13 ELECTRIC TRACTOR MARKET, BY BATTERY CAPACITY

- 13.1 INTRODUCTION

- 13.2 <50 KWH

- 13.2.1 INCREASED PREFERENCE DUE TO ACCESSIBILITY AND LOW COST

- 13.3 50-100 KWH

- 13.3.1 LONG-TERM SAVINGS THROUGH REDUCED FUEL AND MAINTENANCE COSTS

- 13.4 >100 KWH

- 13.4.1 RIGOROUS DEVELOPMENT OF HIGH-POWERED ELECTRIC TRACTORS BY OEMS

- 13.5 ELECTRIC TRACTOR MODELS AND BATTERY CAPACITIES

- 13.6 PRIMARY INSIGHTS

14 ELECTRIC TRACTOR MARKET, BY BATTERY CHEMISTRY

- 14.1 INTRODUCTION

- 14.2 LITHIUM IRON PHOSPHATE

- 14.2.1 INCREASED INVESTMENTS BY AGRICULTURAL MACHINERY MANUFACTURERS

- 14.3 LITHIUM NICKEL MANGANESE COBALT OXIDE

- 14.3.1 HIGHER DENSITY AND FASTER CHARGING CAPABILITIES THAN OTHER CHEMISTRIES

- 14.4 OTHERS

- 14.4.1 SODIUM-ION BATTERIES

- 14.4.2 SOLID-STATE BATTERIES

- 14.5 PRIMARY INSIGHTS

15 ELECTRIC TRACTOR MARKET, BY PROPULSION

- 15.1 INTRODUCTION

- 15.2 BATTERY ELECTRIC

- 15.2.1 DECLINING COST OF LITHIUM-ION BATTERIES

- 15.3 HYBRID ELECTRIC

- 15.3.1 HIGHER POWER OUTPUT THAN BATTERY ELECTRIC TRACTORS

- 15.4 HYDROGEN

- 15.4.1 ADVANCEMENTS IN FUEL CELL TECHNOLOGY AND INFRASTRUCTURE

- 15.5 PRIMARY INSIGHTS

16 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 ASIA PACIFIC

- 16.2.1 MACROECONOMIC OUTLOOK

- 16.2.2 CHINA

- 16.2.2.1 National emission standards for mining automation to drive market

- 16.2.3 INDIA

- 16.2.3.1 Growing demand for eco-friendly, cost-effective electric construction equipment to drive market

- 16.2.4 JAPAN

- 16.2.4.1 Increasing investments in electric construction excavators and other equipment to drive market

- 16.2.5 SOUTH KOREA

- 16.2.5.1 Ongoing electrification of loaders for mining to drive market

- 16.2.6 REST OF ASIA PACIFIC

- 16.3 EUROPE

- 16.3.1 MACROECONOMIC OUTLOOK

- 16.3.2 GERMANY

- 16.3.2.1 Stringent government norms to drive market

- 16.3.3 UK

- 16.3.3.1 Rising demand for electric construction excavators to drive market

- 16.3.4 FRANCE

- 16.3.4.1 Implementation of National Low-Carbon Strategy to drive market

- 16.3.5 SPAIN

- 16.3.5.1 Emphasis on reducing carbon emissions from construction machinery to drive market

- 16.3.6 RUSSIA

- 16.3.6.1 Electric construction equipment expected to drive market

- 16.3.7 ITALY

- 16.3.7.1 Electrification of construction and mining sectors to drive market

- 16.3.8 REST OF EUROPE

- 16.4 AMERICAS

- 16.4.1 MACROECONOMIC OUTLOOK

- 16.4.2 US

- 16.4.2.1 Presence of major electric construction equipment providers to drive market

- 16.4.3 CANADA

- 16.4.3.1 Global dominance in electric construction industry to drive market

- 16.4.4 MEXICO

- 16.4.4.1 Ongoing electrification promotion programs to drive market

- 16.4.5 BRAZIL

- 16.4.5.1 Incorporation of electric excavators in construction frameworks to regularize mining to drive market

- 16.4.6 ARGENTINA

- 16.4.6.1 Commitment to sustainability and emission reductions to drive market

- 16.5 PRIMARY INSIGHTS

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 17.3 REVENUE ANALYSIS, 2020-2024

- 17.4 MARKET SHARE ANALYSIS, 2024

- 17.5 COMPANY VALUATION

- 17.6 FINANCIAL METRICS

- 17.7 BRAND/PRODUCT COMPARISON

- 17.8 COMPANY EVALUATION MATRIX: ELECTRIC CONSTRUCTION EQUIPMENT MANUFACTURERS, 2024

- 17.8.1 STARS

- 17.8.2 EMERGING LEADERS

- 17.8.3 PERVASIVE PLAYERS

- 17.8.4 PARTICIPANTS

- 17.8.5 COMPANY FOOTPRINT

- 17.8.5.1 Company footprint

- 17.8.5.2 Region footprint

- 17.8.5.3 Type footprint

- 17.8.5.4 Application footprint

- 17.9 COMPANY EVALUATION MATRIX: ELECTRIC EXCAVATOR MANUFACTURERS, 2025

- 17.9.1 STARS

- 17.9.2 EMERGING LEADERS

- 17.9.3 PERVASIVE PLAYERS

- 17.9.4 PARTICIPANTS

- 17.9.5 COMPANY FOOTPRINT

- 17.9.5.1 Company footprint

- 17.9.5.2 Region footprint

- 17.9.5.3 Propulsion footprint

- 17.9.5.4 Battery chemistry footprint

- 17.10 COMPETITIVE SCENARIO

- 17.10.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 17.10.2 DEALS

- 17.10.3 EXPANSIONS

- 17.10.4 OTHER DEVELOPMENTS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 HITACHI CONSTRUCTION MACHINERY CO., LTD.

- 18.1.1.1 Business overview

- 18.1.1.2 Products offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Product launches/developments

- 18.1.1.3.2 Deals

- 18.1.1.3.3 Expansions

- 18.1.1.3.4 Other developments

- 18.1.1.4 MnM view

- 18.1.1.4.1 Key strengths

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 CATERPILLAR INC.

- 18.1.2.1 Business overview

- 18.1.2.2 Products offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Product launches/developments

- 18.1.2.3.2 Deals

- 18.1.2.3.3 Expansions

- 18.1.2.3.4 Other developments

- 18.1.2.4 MnM view

- 18.1.2.4.1 Key strengths

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 KOMATSU LTD.

- 18.1.3.1 Business overview

- 18.1.3.2 Products offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Product launches/developments

- 18.1.3.3.2 Deals

- 18.1.3.4 MnM view

- 18.1.3.4.1 Key strengths

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 VOLVO CONSTRUCTION EQUIPMENT

- 18.1.4.1 Business overview

- 18.1.4.2 Products offered

- 18.1.4.3 Recent developments

- 18.1.4.3.1 Product launches/developments

- 18.1.4.3.2 Deals

- 18.1.4.3.3 Other developments

- 18.1.4.4 MnM view

- 18.1.4.4.1 Key strengths

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses and competitive threats

- 18.1.5 SANY HEAVY INDUSTRIES CO., LTD.

- 18.1.5.1 Business overview

- 18.1.5.2 Products offered

- 18.1.5.3 Recent developments

- 18.1.5.3.1 Product launches/developments

- 18.1.5.3.2 Other developments

- 18.1.5.4 MnM view

- 18.1.5.4.1 Key strengths

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 JCB

- 18.1.6.1 Business overview

- 18.1.6.2 Products offered

- 18.1.6.3 Recent developments

- 18.1.6.3.1 Product launches/developments

- 18.1.6.3.2 Deals

- 18.1.6.3.3 Expansions

- 18.1.6.3.4 Other developments

- 18.1.7 DEERE & COMPANY

- 18.1.7.1 Business overview

- 18.1.7.2 Products offered

- 18.1.7.3 Recent developments

- 18.1.7.3.1 Product launches/developments

- 18.1.7.3.2 Deals

- 18.1.7.3.3 Expansions

- 18.1.7.3.4 Other developments

- 18.1.8 SANDVIK AB

- 18.1.8.1 Business overview

- 18.1.8.2 Products offered

- 18.1.8.3 Recent developments

- 18.1.8.3.1 Product launches/developments

- 18.1.8.3.2 Deals

- 18.1.8.3.3 Expansions

- 18.1.8.3.4 Other developments

- 18.1.9 EPIROC AB

- 18.1.9.1 Business overview

- 18.1.9.2 Products offered

- 18.1.9.3 Recent developments

- 18.1.9.3.1 Product launches/developments

- 18.1.9.3.2 Deals

- 18.1.9.3.3 Other developments

- 18.1.10 LIEBHERR

- 18.1.10.1 Business overview

- 18.1.10.2 Products offered

- 18.1.10.3 Recent developments

- 18.1.10.3.1 Product launches/developments

- 18.1.10.3.2 Deals

- 18.1.10.3.3 Other developments

- 18.1.11 BOBCAT COMPANY

- 18.1.11.1 Business overview

- 18.1.11.2 Products offered

- 18.1.11.3 Recent developments

- 18.1.11.3.1 Product launches/developments

- 18.1.11.3.2 Other developments

- 18.1.1 HITACHI CONSTRUCTION MACHINERY CO., LTD.

- 18.2 OTHER PLAYERS

- 18.2.1 SOLETRAC INC.

- 18.2.2 FENDT

- 18.2.3 HUSQVARNA AB

- 18.2.4 XUZHOU CONSTRUCTION MACHINERY GROUP CO., LTD.

- 18.2.5 KUBOTA CORPORATION

- 18.2.6 KOBELCO CONSTRUCTION MACHINERY EUROPE BV

- 18.2.7 BHARAT EARTH MOVERS LIMITED

- 18.2.8 CNH INDUSTRIAL NV

- 18.2.9 WACKER NEUSON SE

- 18.2.10 TAKEUCHI GLOBAL

- 18.2.11 HD HYUNDAI HEAVY INDUSTRIES CO., LTD.

- 18.2.12 LUIGONG MACHINERY CO., LTD.

19 RECOMMENDATIONS FROM MARKETSANDMARKETS

- 19.1 ASIA PACIFIC TO GROW SWIFTLY IN ELECTRIC CONSTRUCTION EQUIPMENT MARKET

- 19.2 HYDROGEN-FUELED CONSTRUCTION EQUIPMENT TO CREATE LUCRATIVE OPPORTUNITIES

- 19.3 EMPHASIS ON ELECTRIFICATION OF UNDERGROUND MINING EQUIPMENT

- 19.4 INTEGRATION OF SOLID-STATE BATTERIES IN ELECTRIC TRACTORS

- 19.5 CONCLUSION

20 APPENDIX

- 20.1 INSIGHTS FROM INDUSTRY EXPERTS

- 20.2 DISCUSSION GUIDE

- 20.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.4 CUSTOMIZATION OPTIONS

- 20.4.1 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY APPLICATION

- 20.4.1.1 Construction

- 20.4.1.2 Mining

- 20.4.1.3 Agriculture

- 20.4.1.4 Gardening

- 20.4.2 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY PROPULSION

- 20.4.2.1 Electric

- 20.4.2.2 Hybrid

- 20.4.2.3 Hydrogen

- 20.4.3 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CAPACITY AND BATTERY CHEMISTRY

- 20.4.3.1 <50 kWh

- 20.4.3.2 50-200 kWh

- 20.4.3.3 200-500 kWh

- 20.4.3.4 >500 kWh

- 20.4.3.5 Lithium Iron Phosphate

- 20.4.3.6 Lithium Nickel Manganese Cobalt Oxide

- 20.4.3.7 Other Battery Chemistries

- 20.4.4 ELECTRIC MINING MACHINERY MARKET, BY BATTERY CAPACITY AND CHEMISTRY

- 20.4.4.1 <50 kWh

- 20.4.4.2 50-200 kWh

- 20.4.4.3 200-500 kWh

- 20.4.4.4 >500 kWh

- 20.4.4.5 Lithium Iron Phosphate

- 20.4.4.6 Lithium Nickel Manganese Cobalt Oxide

- 20.4.4.7 Others

- 20.4.5 ELECTRIC AGRICULTURE EQUIPMENT MARKET, BY BATTERY CAPACITY AND CHEMISTRY

- 20.4.5.1 <50 kWh

- 20.4.5.2 50-200 kWh

- 20.4.5.3 200-500 kWh

- 20.4.5.4 >500 kWh

- 20.4.5.5 Lithium Iron Phosphate

- 20.4.5.6 Lithium Nickel Manganese Cobalt Oxide

- 20.4.5.7 Others

- 20.4.6 ELECTRIC CONSTRUCTION EQUIPMENT MARKET FOR ADDITIONAL COUNTRIES

- 20.4.6.1 Australia

- 20.4.6.2 Scandinavian Countries

- 20.4.7 DETAILED ANALYSIS AND PROFILING OF UP TO FIVE ADDITIONAL MARKET PLAYERS

- 20.4.1 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY APPLICATION

- 20.5 RELATED REPORTS

- 20.6 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 COST COMPARISON BETWEEN DIESEL AND ELECTRIC MINING EQUIPMENT

- TABLE 3 NOISE CONTROL REGULATIONS FOR RESIDENTIAL AREAS

- TABLE 4 INCENTIVES AND SUBSIDIES OFFERED BY KEY COUNTRIES

- TABLE 5 ELECTRIC VS. DIESEL POWERED OFF-HIGHWAY EQUIPMENT

- TABLE 6 RANGE COMPARISON OF BATTERY ELECTRIC AND OFF-HIGHWAY DIESEL TRUCKS

- TABLE 7 WORKING TEMPERATURE COMPARISON FOR CONSTRUCTION EQUIPMENT

- TABLE 8 US: IMPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 FRANCE: IMPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 UK: IMPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 GERMANY: IMPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 ITALY: IMPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 CHINA: EXPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 GERMANY: EXPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 US: EXPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 16 SWEDEN: EXPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 17 ITALY: EXPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 18 PATENT ANALYSIS

- TABLE 19 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 20 INDICATIVE PRICING OF ELECTRIC CONSTRUCTION EQUIPMENT, BY TYPE, 2024 (USD/UNIT)

- TABLE 21 INDICATIVE PRICING OF ELECTRIC CONSTRUCTION EQUIPMENT, BY APPLICATION, 2024 (USD/UNIT)

- TABLE 22 AMERICAS: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 QUALITY STANDARDS FOR ELECTRIC CONSTRUCTION EQUIPMENT

- TABLE 26 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 28 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 29 TOTAL COST OF OWNERSHIP OF ELECTRIC EXCAVATORS

- TABLE 30 TOTAL COST OF OWNERSHIP OF LOADERS

- TABLE 31 BATTERY CHEMISTRIES

- TABLE 32 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 33 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 34 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 35 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 36 ELECTRIC EXCAVATOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 37 ELECTRIC EXCAVATOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 38 ELECTRIC EXCAVATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 ELECTRIC EXCAVATOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 40 ELECTRIC LOADER MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 41 ELECTRIC LOADER MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 42 ELECTRIC LOADER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 ELECTRIC LOADER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 44 ELECTRIC MOTOR GRADER MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 45 ELECTRIC MOTOR GRADER MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 46 ELECTRIC MOTOR GRADER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 ELECTRIC MOTOR GRADER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 48 ELECTRIC DOZER MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 49 ELECTRIC DOZER MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 50 ELECTRIC DOZER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 ELECTRIC DOZER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 52 ELECTRIC DUMP TRUCK/WIDE-B0DIED TRUCKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 53 ELECTRIC DUMP TRUCK/WIDE-B0DIED TRUCKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 54 ELECTRIC DUMP TRUCK/WIDE-B0DIED TRUCKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 ELECTRIC DUMP TRUCK/WIDE-B0DIED TRUCKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 56 ELECTRIC LOAD HAUL DUMP LOADER MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 57 ELECTRIC LOAD HAUL DUMP LOADER MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 58 ELECTRIC LOAD HAUL DUMP LOADER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 ELECTRIC LOAD HAUL DUMP LOADER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 60 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CAPACITY, 2021-2024 (UNITS)

- TABLE 61 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CAPACITY, 2025-2032 (UNITS)

- TABLE 62 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 63 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CAPACITY, 2025-2032 (USD MILLION)

- TABLE 64 <50 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 65 <50 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 66 <50 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 <50 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 68 50-200 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 69 50-200 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 70 50-200 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 50-200 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 72 200-500 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 73 200-500 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 74 200-500 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 200-500 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 76 >500 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 77 >500 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 78 >500 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 >500 KWH: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 80 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CHEMISTRY, 2021-2024 (UNITS)

- TABLE 81 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CHEMISTRY, 2025-2032 (UNITS)

- TABLE 82 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CHEMISTRY, 2021-2024 (USD MILLION)

- TABLE 83 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CHEMISTRY, 2025-2032 (USD MILLION)

- TABLE 84 LITHIUM IRON PHOSPHATE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 85 LITHIUM IRON PHOSPHATE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 86 LITHIUM IRON PHOSPHATE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 LITHIUM IRON PHOSPHATE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 88 LITHIUM NICKEL MANGANESE COBALT OXIDE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 89 LITHIUM NICKEL MANGANESE COBALT OXIDE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 90 LITHIUM NICKEL MANGANESE COBALT OXIDE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 LITHIUM NICKEL MANGANESE COBALT OXIDE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 92 ELECTRIC CONSTRUCTION EQUIPMENT MARKET: SODIUM-ION VS. LITHIUM-ION BATTERIES

- TABLE 93 OTHERS: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 94 OTHERS: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 95 GLOBAL BATTERY PRODUCTION, BY BATTERY CHEMISTRY

- TABLE 96 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY POWER OUTPUT, 2021-2024 (UNITS)

- TABLE 97 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY POWER OUTPUT, 2025-2032 (UNITS)

- TABLE 98 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY POWER OUTPUT, 2021-2024 (USD MILLION)

- TABLE 99 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY POWER OUTPUT, 2025-2032 (USD MILLION)

- TABLE 100 <50 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 101 <50 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 102 <50 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 <50 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 104 50-150 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 105 50-150 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 106 50-150 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 50-150 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 108 150-300 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 109 150-300 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 110 150-300 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 111 150-300 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 112 >300 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 113 >300 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 114 >300 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 >300 HP: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 116 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 117 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 118 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 119 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 120 BATTERY ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 121 BATTERY ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 122 BATTERY ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 123 BATTERY ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 124 HYBRID ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 125 HYBRID ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 126 HYBRID ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 HYBRID ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 128 HYDROGEN ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 129 HYDROGEN ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 130 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 131 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 132 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 133 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 134 CONSTRUCTION: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 135 CONSTRUCTION: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 136 CONSTRUCTION: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 137 CONSTRUCTION: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 138 MINING: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 139 MINING: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 140 MINING: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 141 MINING: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 142 GARDENING: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 143 GARDENING: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 144 GARDENING: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 GARDENING: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 146 AGRICULTURE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 147 AGRICULTURE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 148 AGRICULTURE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 149 AGRICULTURE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 150 ELECTRIC AGRICULTURE EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 151 ELECTRIC AGRICULTURE EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 152 ELECTRIC AGRICULTURE EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 153 ELECTRIC AGRICULTURE EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 154 ELECTRIC LAWNMOWER MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 155 ELECTRIC LAWNMOWER MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 156 ELECTRIC LAWNMOWER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 157 ELECTRIC LAWNMOWER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 158 ELECTRIC SELF-PROPELLED SPRAYER MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 159 ELECTRIC SELF-PROPELLED SPRAYER MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 160 ELECTRIC SELF-PROPELLED SPRAYER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 161 ELECTRIC SELF-PROPELLED SPRAYER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 162 ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 163 ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 164 ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 165 ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 166 ELECTRIC TRACTOR MARKET, BY BATTERY CAPACITY, 2021-2024 (UNITS)

- TABLE 167 ELECTRIC TRACTOR MARKET, BY BATTERY CAPACITY, 2025-2032 (UNITS)

- TABLE 168 ELECTRIC TRACTOR MARKET, BY BATTERY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 169 ELECTRIC TRACTOR MARKET, BY BATTERY CAPACITY, 2025-2032 (USD MILLION)

- TABLE 170 <50 KWH: ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 171 <50 KWH: ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 172 <50 KWH: ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 173 <50 KWH: ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 174 50-100 KWH: ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 175 50-100 KWH: ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 176 50-100 KWH: ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 177 50-100 KWH: ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 178 >100 KWH: ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 179 >100 KWH: ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 180 >100 KWH: ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 181 >100 KWH: ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 182 ELECTRIC TRACTOR MARKET, BY BATTERY CHEMISTRY, 2021-2024 (UNITS)

- TABLE 183 ELECTRIC TRACTOR MARKET, BY BATTERY CHEMISTRY, 2025-2032 (UNITS)

- TABLE 184 ELECTRIC TRACTOR MARKET, BY BATTERY CHEMISTRY, 2021-2024 (USD MILLION)

- TABLE 185 ELECTRIC TRACTOR MARKET, BY BATTERY CHEMISTRY, 2025-2032 (USD MILLION)

- TABLE 186 INVESTMENTS AND DEVELOPMENTS RELATED TO LFP BATTERIES

- TABLE 187 LITHIUM IRON PHOSPHATE: ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 188 LITHIUM IRON PHOSPHATE: ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 189 LITHIUM IRON PHOSPHATE: ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 190 LITHIUM IRON PHOSPHATE: ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 191 LITHIUM NICKEL MANGANESE COBALT OXIDE: ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 192 LITHIUM NICKEL MANGANESE COBALT OXIDE: ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 193 LITHIUM NICKEL MANGANESE COBALT OXIDE: ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 194 LITHIUM NICKEL MANGANESE COBALT OXIDE: ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 195 ELECTRIC TRACTOR MARKET: SODIUM-ION VS. LITHIUM-ION BATTERIES

- TABLE 196 OTHERS: ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 197 OTHERS: ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 198 ELECTRIC TRACTOR MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 199 ELECTRIC TRACTOR MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 200 ELECTRIC TRACTOR MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 201 ELECTRIC TRACTOR MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 202 OEM-WISE BATTERY CHEMISTRY AND MOTOR CAPACITY

- TABLE 203 BATTERY ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 204 BATTERY ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 205 BATTERY ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 206 BATTERY ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 207 HYBRID ELECTRIC TRACTOR SPECIFICATIONS WITH MOTOR AND ENGINE CAPACITIES

- TABLE 208 HYBRID ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 209 HYBRID ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 210 HYBRID ELECTRIC TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 211 HYBRID ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 212 HYDROGEN ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 213 HYDROGEN ELECTRIC TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 214 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 215 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 216 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 217 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 218 ASIA PACIFIC: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 219 ASIA PACIFIC: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 220 ASIA PACIFIC: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 221 ASIA PACIFIC: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 222 CHINA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 223 CHINA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 224 CHINA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 225 CHINA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 226 INDIA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 227 INDIA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 228 INDIA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 229 INDIA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 230 JAPAN: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 231 JAPAN: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 232 JAPAN: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 233 JAPAN: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 234 SOUTH KOREA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 235 SOUTH KOREA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 236 SOUTH KOREA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 237 SOUTH KOREA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 238 REST OF ASIA PACIFIC: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 239 REST OF ASIA PACIFIC: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 240 REST OF ASIA PACIFIC: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 241 REST OF ASIA PACIFIC: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 242 EUROPE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 243 EUROPE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 244 EUROPE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 245 EUROPE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 246 GERMANY: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 247 GERMANY: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 248 GERMANY: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 249 GERMANY: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 250 UK: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 251 UK: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 252 UK: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 253 UK: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 254 FRANCE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 255 FRANCE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 256 FRANCE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 257 FRANCE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 258 SPAIN: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 259 SPAIN: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 260 SPAIN: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 261 SPAIN: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 262 RUSSIA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 263 RUSSIA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 264 RUSSIA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 265 RUSSIA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 266 ITALY: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 267 ITALY: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 268 ITALY: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 269 ITALY: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 270 REST OF EUROPE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 271 REST OF EUROPE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 272 REST OF EUROPE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 273 REST OF EUROPE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 274 AMERICAS: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 275 AMERICAS: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 276 AMERICAS: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 277 AMERICAS: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 278 US: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 279 US: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 280 US: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 281 US: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 282 CANADA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 283 CANADA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 284 CANADA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 285 CANADA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 286 MEXICO: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 287 MEXICO: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 288 MEXICO: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 289 MEXICO: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 290 BRAZIL: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 291 BRAZIL: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 292 BRAZIL: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 293 BRAZIL: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 294 ARGENTINA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 295 ARGENTINA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 296 ARGENTINA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 297 ARGENTINA: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 298 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 299 ELECTRIC CONSTRUCTION EQUIPMENT MARKET: DEGREE OF COMPETITION, 2024

- TABLE 300 ELECTRIC CONSTRUCTION EQUIPMENT MANUFACTURERS: REGION FOOTPRINT

- TABLE 301 ELECTRIC CONSTRUCTION EQUIPMENT MANUFACTURERS: TYPE FOOTPRINT

- TABLE 302 ELECTRIC CONSTRUCTION EQUIPMENT MANUFACTURERS: APPLICATION FOOTPRINT

- TABLE 303 ELECTRIC EXCAVATOR MANUFACTURERS: REGION FOOTPRINT

- TABLE 304 ELECTRIC EXCAVATOR MANUFACTURERS: PROPULSION FOOTPRINT

- TABLE 305 ELECTRIC EXCAVATOR MANUFACTURERS: BATTERY CHEMISTRY FOOTPRINT

- TABLE 306 ELECTRIC CONSTRUCTION EQUIPMENT MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2022-2025

- TABLE 307 ELECTRIC CONSTRUCTION EQUIPMENT MARKET: DEALS, 2022-2025

- TABLE 308 ELECTRIC CONSTRUCTION EQUIPMENT MARKET: EXPANSIONS, 2022-2025

- TABLE 309 ELECTRIC CONSTRUCTION EQUIPMENT MARKET: OTHER DEVELOPMENTS, 2022-2025

- TABLE 310 HITACHI CONSTRUCTION MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 311 HITACHI CONSTRUCTION MACHINERY CO., LTD.: PRODUCTS OFFERED

- TABLE 312 HITACHI CONSTRUCTION MACHINERY CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 313 HITACHI CONSTRUCTION MACHINERY CO., LTD.: DEALS

- TABLE 314 HITACHI CONSTRUCTION MACHINERY CO., LTD.: EXPANSIONS

- TABLE 315 HITACHI CONSTRUCTION MACHINERY CO., LTD.: OTHER DEVELOPMENTS

- TABLE 316 CATERPILLAR INC.: COMPANY OVERVIEW

- TABLE 317 CATERPILLAR INC.: PRODUCTS OFFERED

- TABLE 318 CATERPILLAR INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 319 CATERPILLAR INC.: DEALS

- TABLE 320 CATERPILLAR INC.: EXPANSIONS

- TABLE 321 CATERPILLAR INC.: OTHER DEVELOPMENTS

- TABLE 322 KOMATSU LTD.: COMPANY OVERVIEW

- TABLE 323 KOMATSU LTD.: PRODUCTS OFFERED

- TABLE 324 KOMATSU LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 325 KOMATSU LTD.: DEALS

- TABLE 326 VOLVO CONSTRUCTION EQUIPMENT: COMPANY OVERVIEW

- TABLE 327 VOLVO CONSTRUCTION EQUIPMENT: PRODUCTS OFFERED

- TABLE 328 VOLVO CONSTRUCTION EQUIPMENT: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 329 VOLVO CONSTRUCTION EQUIPMENT: DEALS

- TABLE 330 VOLVO CONSTRUCTION EQUIPMENT: OTHER DEVELOPMENTS

- TABLE 331 SANY HEAVY INDUSTRIES CO., LTD.: COMPANY OVERVIEW

- TABLE 332 SANY HEAVY INDUSTRIES CO., LTD.: PRODUCTS OFFERED

- TABLE 333 SANY HEAVY INDUSTRIES CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 334 SANY HEAVY INDUSTRIES CO., LTD.: OTHER DEVELOPMENTS

- TABLE 335 JCB: COMPANY OVERVIEW

- TABLE 336 JCB: PRODUCTS OFFERED

- TABLE 337 JCB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 338 JCB: DEALS

- TABLE 339 JCB: EXPANSIONS

- TABLE 340 JCB: OTHER DEVELOPMENTS

- TABLE 341 DEERE & COMPANY: COMPANY OVERVIEW

- TABLE 342 DEERE & COMPANY: PRODUCTS OFFERED

- TABLE 343 DEERE & COMPANY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 344 DEERE & COMPANY: DEALS

- TABLE 345 DEERE & COMPANY: EXPANSIONS

- TABLE 346 DEERE & COMPANY: OTHER DEVELOPMENTS

- TABLE 347 SANDVIK AB: COMPANY OVERVIEW

- TABLE 348 SANDVIK AB: PRODUCTS OFFERED

- TABLE 349 SANDVIK AB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 350 SANDVIK AB: DEALS

- TABLE 351 SANDVIK AB: EXPANSIONS

- TABLE 352 SANDVIK AB: OTHER DEVELOPMENTS

- TABLE 353 EPIROC AB: COMPANY OVERVIEW

- TABLE 354 EPIROC AB: PRODUCTS OFFERED

- TABLE 355 EPIROC AB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 356 EPIROC AB: DEALS

- TABLE 357 EPIROC AB: OTHER DEVELOPMENTS

- TABLE 358 LIEBHERR: COMPANY OVERVIEW

- TABLE 359 LIEBHERR: PRODUCTS OFFERED

- TABLE 360 LIEBHERR: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 361 LIEBHERR: DEALS

- TABLE 362 LIEBHERR: OTHER DEVELOPMENTS

- TABLE 363 BOBCAT COMPANY: COMPANY OVERVIEW

- TABLE 364 BOBCAT COMPANY: PRODUCTS OFFERED

- TABLE 365 BOBCAT COMPANY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 366 BOBCAT COMPANY: OTHER DEVELOPMENTS

- TABLE 367 SOLETRAC INC.: COMPANY OVERVIEW

- TABLE 368 FENDT: COMPANY OVERVIEW

- TABLE 369 HUSQVARNA AB: COMPANY OVERVIEW

- TABLE 370 XUZHOU CONSTRUCTION MACHINERY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 371 KUBOTA CORPORATION: COMPANY OVERVIEW

- TABLE 372 KOBELCO CONSTRUCTION MACHINERY EUROPE BV: COMPANY OVERVIEW

- TABLE 373 BHARAT EARTH MOVERS LIMITED: COMPANY OVERVIEW

- TABLE 374 CNH INDUSTRIAL NV: COMPANY OVERVIEW

- TABLE 375 WACKER NEUSON SE: COMPANY OVERVIEW

- TABLE 376 TAKEUCHI GLOBAL: COMPANY OVERVIEW

- TABLE 377 HD HYUNDAI HEAVY INDUSTRIES CO., LTD.: COMPANY OVERVIEW

- TABLE 378 LIUGONG MACHINERY CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ELECTRIC CONSTRUCTION EQUIPMENT MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 MARKET SIZE ESTIMATION: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ELECTRIC CONSTRUCTION EQUIPMENT MARKET OUTLOOK

- FIGURE 9 ASIA PACIFIC TO BE SECOND-LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 10 ELEVATED DEMAND FOR LOW-NOISE CONSTRUCTION TO DRIVE THE MARKET

- FIGURE 11 ELECTRIC EXCAVATORS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 12 AGRICULTURE TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 LITHIUM IRON PHOSPHATE TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 14 50-200 KWH TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 15 BATTERY ELECTRIC SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 16 50-150 HP SEGMENT TO ACQUIRE HIGHEST SHARE DURING FORECAST PERIOD

- FIGURE 17 EUROPE TO BE LARGEST MARKET FOR ELECTRIC CONSTRUCTION EQUIPMENT IN 2025

- FIGURE 18 ELECTRIC CONSTRUCTION EQUIPMENT MARKET DYNAMICS

- FIGURE 19 NON-ROAD MOBILE MACHINERY (NRMM) EMISSION REGULATION OUTLOOK, 2019-2030

- FIGURE 20 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 PATENT ANALYSIS

- FIGURE 22 LEGAL STATUS OF PATENTS

- FIGURE 23 SUPPLY CHAIN ANALYSIS

- FIGURE 24 ECOSYSTEM MAPPING

- FIGURE 25 ECOSYSTEM ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 27 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 28 COMPARISON OF ELECTRIC VS. ICE MINI EXCAVATORS

- FIGURE 29 FACTORS INFLUENCING TOTAL COST OF OWNERSHIP OF ELECTRIC EXCAVATORS

- FIGURE 30 TOTAL COST OF OWNERSHIP OF ELECTRIC TRACTORS

- FIGURE 31 TOTAL COST OF OWNERSHIP OF ELECTRIC LOADERS

- FIGURE 32 BATTERY CAPACITY OF ELECTRIC COMPACT CONSTRUCTION EQUIPMENT OFFERED BY OEMS, 2024

- FIGURE 33 POWER OUTPUT VS. BATTERY CAPACITY

- FIGURE 34 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 35 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CAPACITY, 2025 VS. 2032 (USD MILLION)

- FIGURE 36 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY BATTERY CHEMISTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 37 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY POWER OUTPUT, 2025 VS. 2032 (USD MILLION)

- FIGURE 38 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY PROPULSION, 2025 VS. 2032 (USD MILLION)

- FIGURE 39 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 40 ELECTRIC AGRICULTURE EQUIPMENT MARKET, BY TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 41 ELECTRIC TRACTOR MARKET, BY BATTERY CAPACITY, 2025 VS. 2032 (USD MILLION)

- FIGURE 42 ELECTRIC TRACTOR MARKET, BY BATTERY CHEMISTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 43 CHARACTERISTICS OF NMC BATTERIES

- FIGURE 44 ELECTRIC TRACTOR MARKET, BY PROPULSION, 2025 VS. 2032 (USD MILLION)

- FIGURE 45 AVERAGE PACK AND CELL PRICE PER KILOWATT-HOUR, 2013-2023

- FIGURE 46 ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 47 ASIA PACIFIC: ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 48 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 49 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 50 ASIA PACIFIC: INFLATION RATE IN TERMS OF AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 51 ASIA PACIFIC: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 52 EUROPE: ELECTRIC CONSTRUCTION EQUIPMENT MARKET SNAPSHOT

- FIGURE 53 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 54 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 55 EUROPE: INFLATION RATE IN TERMS OF AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 56 EUROPE: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 57 AMERICAS: ELECTRIC CONSTRUCTION EQUIPMENT MARKET SNAPSHOT

- FIGURE 58 AMERICAS: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 59 AMERICAS: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 60 AMERICAS: INFLATION RATE IN TERMS OF AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 61 AMERICAS: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 62 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2020-2024

- FIGURE 63 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 64 COMPANY VALUATION (USD BILLION)

- FIGURE 65 FINANCIAL METRICS (EV/EBIDTA)

- FIGURE 66 BRAND/PRODUCT COMPARISON

- FIGURE 67 COMPANY EVALUATION MATRIX: ELECTRIC CONSTRUCTION EQUIPMENT MANUFACTURERS, 2024

- FIGURE 68 ELECTRIC CONSTRUCTION EQUIPMENT MANUFACTURERS: COMPANY FOOTPRINT

- FIGURE 69 COMPANY EVALUATION MATRIX: ELECTRIC EXCAVATOR MANUFACTURERS, 2024

- FIGURE 70 ELECTRIC EXCAVATOR MANUFACTURERS: COMPANY FOOTPRINT

- FIGURE 71 HITACHI CONSTRUCTION MACHINERY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 72 CATERPILLAR INC.: COMPANY SNAPSHOT

- FIGURE 73 KOMATSU LTD.: COMPANY SNAPSHOT

- FIGURE 74 VOLVO CONSTRUCTION EQUIPMENT: COMPANY SNAPSHOT

- FIGURE 75 SANY HEAVY INDUSTRIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 76 DEERE & COMPANY: COMPANY SNAPSHOT

- FIGURE 77 SANDVIK AB: COMPANY SNAPSHOT

- FIGURE 78 EPIROC AB: COMPANY SNAPSHOT

- FIGURE 79 LIEBHERR: COMPANY SNAPSHOT

- FIGURE 80 BOBCAT COMPANY: COMPANY SNAPSHOT