|

市場調查報告書

商品編碼

1889067

癌症及抗體偶聯物專利趨勢分析(2025)Cancer & Antibody Conjugates Patent Landscape Analysis 2025 |

|||||||

抗體偶聯物 (ADC) 和放射免疫偶聯物開啟癌症治療新紀元

主要特點:

- PDF>100 張投影片

- Excel 文件:3,761 個專利族

- 智慧財產權趨勢,包括專利公開隨時間的變化及申請國家/地區

- 主要專利持有人排名

- 主要參與者的智慧財產權地位及專利組合相對實力

- 細分:抗體(液態腫瘤、僅液態腫瘤、實體腫瘤、僅實體腫瘤)、依主要適應症細分、連接子(可裂解、不可裂解)、有效載荷(藥物、放射性同位素)

- 合作及新進者分析

- 包含本報告分析的所有專利的 Excel 資料庫(分段資訊 + 指向更新的線上資料庫的超連結:法律地位、文件等)

利用抗體進行標靶細胞毒性治療:癌症偶聯物的策略性洞察

癌症抗體偶聯物,包括抗體藥物偶聯物 (ADC) 和放射免疫偶聯物,透過將單株抗體的選擇性與小分子藥物或放射性核素的細胞毒性相結合,實現高度靶向的腫瘤細胞殺傷,正在重塑腫瘤學領域。最近的一項回顧報告稱,目前全球約有 15 種 ADC 獲準用於治療血液系統惡性腫瘤和實體腫瘤,另有 200 多種 ADC 正在進行臨床試驗,400 多種 ADC 正在研發中,凸顯了這種治療方式的快速發展。同時,現代免疫腫瘤學領域對放射免疫偶聯物 (RIC) 的興趣也重新燃起。儘管歷史上僅有兩種產品獲批用於治療非何杰金氏淋巴瘤,但新興的臨床和臨床前數據凸顯了它們在精準遞送治療性放射線方面的潛力,尤其是在與其他全身療法和免疫標靶療法聯合使用時。這些免疫偶聯物為難治性疾病的治療開闢了新途徑,拓展了其在早期治療階段的應用,並催生了治療性診斷策略,但它們也面臨著毒性、抗藥性機制、放射性同位素處理和複雜生產過程等挑戰。在這個高度動態的市場環境中,了解主要公司如何圍繞抗體、有效載荷、連接子、放射性核素、靶向分子和偶聯技術構建其知識產權,對於預測未來的競爭格局、確保市場自由以及指導抗體藥物偶聯物(ADC)市場的戰略決策至關重要。

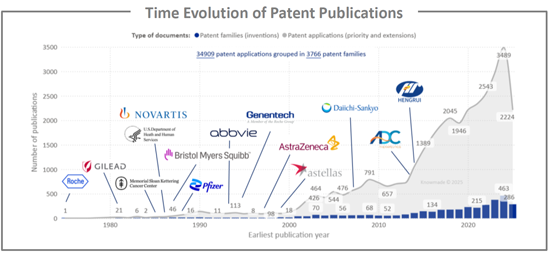

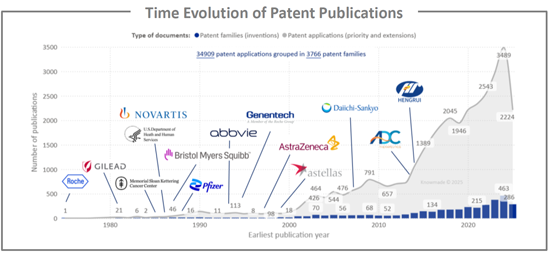

縱觀抗體偶聯藥物 (ADC) 專利揭露的歷史,我們可以清楚地看到一個趨勢:漫長的發現階段之後,一旦臨床療效得到證實,申請量就會迅速增長。從 20 世紀 70 年代末到 21 世紀初,每年只有少數專利族提交申請,主要由羅氏等早期拓荒者和學術癌症中心提交。在首批 ADC 獲準上市,且臨床探索擴展到血液系統惡性腫瘤和乳癌領域後,申請活動開始增加,自 2010 年以來呈現出明顯的陡峭成長曲線。這與進入臨床階段的 ADC 數量不斷增加以及下一代產品逐步獲批(全球已批准 15 種 ADC,開展超過 1500 項臨床試驗)相吻合。 2018 年至 2024 年間,年度申請數量翻了一番以上,達到每年約 500 個新的專利族。這主要得益於密集的研發投入,包括高效拓撲異構酶I靶向有效載荷(如deruxtecan和govitecan)、新型連接子和位點特異性偶聯技術,以及適應症從血液系統惡性腫瘤擴展到實體瘤。在此期間,除了傳統的西方製藥公司(羅氏/基因泰克、諾華、輝瑞、百時美施貴寶、艾伯維、阿斯特捷利康、吉利德)之外,專注於抗體偶聯藥物(ADC)的生物技術公司以及快速發展的亞洲公司(如第一三共和恆瑞)也進入了市場,這反映了該領域激烈的全球合作競爭以及積極的許可和全球競爭活動以及積極的許可和全球競爭的全球競爭。近年來略有波動或趨於平穩,以及每個專利家族的專利申請數量較高,表明在日趨成熟但創新迅速的ADC市場中,正從早期技術積累階段過渡到產品組合整合和地域擴張階段,這為相關抗體-放射性同位素偶聯物(ARC)的發展鋪平了道路。

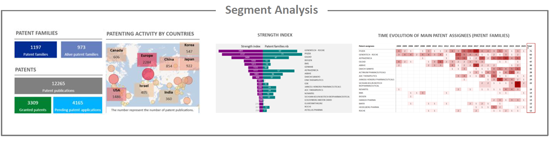

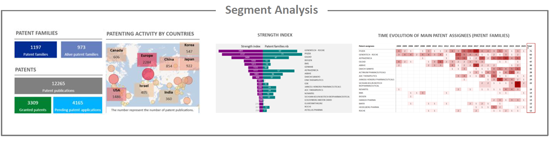

細分市場分析

為了更清楚地了解抗體藥物偶聯物 (ADC) 領域的創新趨勢和研發策略,我們將專利格局分為三大關鍵技術組成部分:抗體、連接子和有效載荷。每個組成部分在決定 ADC 的特異性、穩定性和治療特性方面都發揮著關鍵作用。此智慧財產權模式又細分為八個部分:抗體(依主要適應症劃分,包括血液腫瘤、僅用於血液腫瘤、實體腫瘤和僅用於實體腫瘤)、連接子(可裂解型和不可裂解型)以及有效載荷(藥物和放射性同位素)。

辨識智慧財產權領域的新興公司

在持有與雙特異性抗體和癌症相關的專利族的公司中,我們發現了147家新進者。這些公司既有新創企業,也有在該領域開發首創技術的成熟企業。大多數新進業者(76家公司)位於中國。在這些創新公司中,有可能出現一家成為下一代醫療保健獨角獸企業,吸引大型公司的收購。

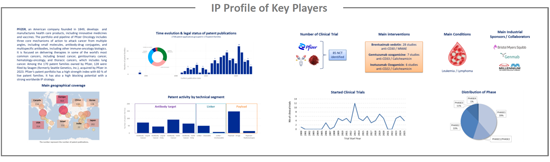

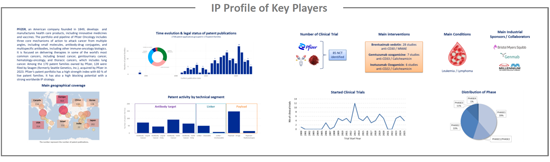

主要進入者的智慧財產權概況

本知識產權研究對主要進入者進行了選擇和概述。對主要進入者的專利組合分析包括所有權資訊、專利組合概述、專利揭露趨勢、主要地域覆蓋範圍以及依技術領域劃分的有效專利。在此智慧財產權概況概述之後,我們提供了關鍵專利的技術內容描述以及臨床試驗摘要表。

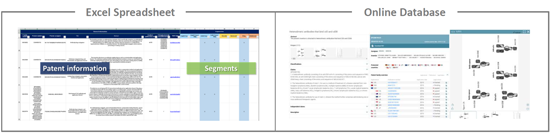

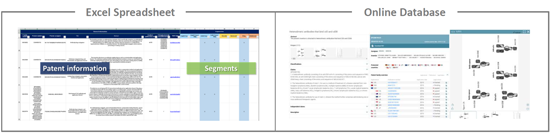

此外,本報告還包含一個Excel電子表格,其中列出了本研究分析的3,761個專利族。這個實用的專利資料庫支援多條件檢索,包括專利公開號、指向來源文件的超連結、優先權日、標題、摘要、專利權人、每項專利的當前法律狀態以及專利分割。它還包含一個“專利線上資料庫”,用於更新每份專利文件的法律狀態。

本報告中提及的部分公司名單:

|

|

|

等等

目錄

引言

- 什麼是抗體偶聯物?

- 腫瘤學領域的首批批准、機會與挑戰

- 研究範圍

- 專利檢索、篩選與分析

- 檢索策略

- Excel資料庫

- 閱讀指南

摘要整理

專利概況

- 專利公開數量隨時間的變化

- 專利申請數最多的申請人排名

- 主要參與者的當前法律地位

- 專利庫的法律地位

- 目前主要知識產權持有人分佈圖

- 主要專利受讓人隨時間的變化

新晉企業

- 中國企業

- 其他企業

主要申請人的智慧財產權地位

- 專利智慧財產權領導地位申請人

- 專利申請人知識產權現有技術阻斷潛力

- 專利引用

- 專利組合實力指數

專利分段

- 意義

- 依技術劃分的主要受讓人

- 抗體部分

- 連接子部分

- 有效載荷部分

主要參與者的智慧財產權概況

- 概述、關鍵專利和臨床試驗:

- 輝瑞

- 基因泰克

- 羅氏

- 艾伯維

- 阿斯特捷利康 吉利德

研究方法

KNOWMADE簡報

聯絡我們

ADC and Radioimmunoconjugates Ignite a New Era in Cancer Therapy

Key Features:

- PDF > 100 slides

- Excel file: 3761 patent families

- IP trends, including time evolution of published patents and countries of patent filings

- Ranking of main patent assignees

- Key players' IP position and relative strength of their patent portfolios

- Segmentation: Antibody (liquid cancer, liquid cancer only, solid cancer, solid cancer only-segmentation based on claims), Linker (cleavable, uncleavable) and Payload (drugs, radioisotopes).

- Analysis of collaborations and newcomers.

- Excel database containing all patents analyzed in the report, including segmentations + hyperlink to updated online database (legal status, documents, etc.)

Harnessing Antibodies for Targeted Cytotoxicity: Strategic Insights into Cancer Conjugates

Cancer antibody conjugates - encompassing antibody-drug conjugates (ADCs) and radioimmunoconjugates - are reshaping oncology by coupling the selectivity of monoclonal antibodies with the cytotoxic power of small-molecule drugs or radionuclides to achieve highly targeted tumor cell killing. Recent reviews report that around 15 ADCs are now approved worldwide for hematologic malignancies and solid tumors, while more than 200 additional ADCs are in clinical trials and over 400 are in development, underscoring the rapid expansion of this modality. In parallel, radioimmunoconjugates are experiencing renewed interest in the era of modern immuno-oncology: despite only two products historically approved for non-Hodgkin's lymphoma, new clinical and preclinical data highlight their potential to deliver therapeutic radiation with precision, particularly when combined with other systemic or immune-targeted therapies. Together, these immunoconjugates open avenues to treat refractory disease, expand into earlier lines of therapy and enable theragnostic strategies, while still facing challenges related to toxicity, resistance mechanisms, radioisotope handling and complex manufacturing. In this highly dynamic context, understanding how key players position their intellectual property on antibodies, payloads, linkers, radionuclides, targets and conjugation technologies is critical to anticipate future competition, secure freedom-to-operate and guide strategic decisions in the cancer antibody conjugate market.

The time evolution of ADC patent publications highlights a long exploratory phase followed by a steep acceleration once the modality was clinically validated. From the late 1970s to mid-2000s, only a handful of patent families were filed each year, mainly by early pioneers such as Roche and academic cancer centers. Activity begins to rise after the first ADC approvals and wider clinical exploration in hematologic malignancies and breast cancer, and then clearly inflects after 2010, in line with the growing number of ADCs entering the clinic and the progressive approval of next-generation products (15 approved ADCs worldwide and >1500 clinical trials). Between 2018 and 2024, annual filings more than double, reaching close to 500 new patent families per year, driven by intensive R&D on highly potent topoisomerase 1 based payloads such as deruxtecan and govitecan, new linker and site-specific conjugation technologies, and expansion from hematologic cancers into solid tumors. Over this period the landscape also broadens from traditional Western pharma (Roche/Genentech, Novartis, Pfizer, BMS, AbbVie, AstraZeneca, Gilead) to include specialized ADC biotechs and fast-growing Asian players such as Daiichi Sankyo and Hengrui, reflecting intense global competition and a strong licensing/partnering dynamic in this field. The slight peak or plateau in the most recent years, combined with the large number of patent applications per family, suggests a transition from early technology build-up to portfolio consolidation and geographic extension, in a maturing but still rapidly innovating ADC market that also paves the way for related antibody-radioisotope conjugates.

Analysis by segment

To better characterize innovation trends and R&D strategies in the ADC field, the patent landscape has been segmented into three main technological components: antibody, linker, and payload. Each component plays a crucial role in defining the specificity, stability, and therapeutic profile of an ADC. This IP landscape features the following 8 types of segmentation: Antibody (liquid cancer, liquid cancer only, solid cancer, solid cancer only - segmentation based on claims), Linker (cleavable, uncleavable) and Payload (drugs, radioisotopes).

Identifying the companies that have recently emerged in the IP landscape

Among the players owning patent families related to Bispecific Ab & cancer, 147 newcomers were identified. These companies are either start-up firms or established companies developing their first technology in the field. Most IP newcomers are based in China (76). It is possible that one of these innovative companies could become one of the next healthcare unicorns that the big corporations will be tempted to acquire.

IP profile of key players

This IP study includes a selection and description of main players. The patent portfolio analysis of main players includes a description of the assignee, patent portfolio description, time evolution of patent publication, main geographical coverage and live patents by technical segment. This IP profile overview is followed by the description of the technological content of their key patents and by a table with its clinical trials.

Moreover, the report includes an Excel spreadsheet with the 3761 patent families analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to the original documents, priority dates, titles, abstracts, patent assignees, each patent's current legal status and segmentation. The report also includes a Patent Online Database which legal status are updated for each patent document.

Companies mentioned in this report (non-exhaustive list):

|

|

|

etc.

TABLE OF CONTENTS

INTRODUCTION

- What are antibody conjugates?

- First approvals, opportunities & challenges in oncology

- Scope of the report

- Patent search, selection and analysis

- Search strategy

- Excel database

- Reading guide

EXECUTIVE SUMMARY

PATENT LANDSCAPE OVERVIEW

- Time evolution of patent publications

- Ranking of most prolific patent applicants

- Current legal status of the main players

- Patent legal status of the corpus

- Mapping of main current IP holders

- Time evolution of main patent assignees

NEWCOMERS

- Chinese companies

- Other companies

IP POSITION OF MAIN APPLICANTS

- IP leadership of patent applicants

- IP prior art blocking Potential of patent applicants

- Patent citation

- Strength index of patent portfolios

PATENT SEGMENTATION

- Definition

- Main assignees by technology

- antibody moiety

- Linker

- Payload moiety

IP PROFILE OF KEY PLAYERS

- Overview, key patents & clinical trials of:

- Pfizer

- Genentech

- Roche

- AbbVie

- AstraZeneca

- Gilead

METHODOLOGY

- Patent search

- Terminologies

- Key IP players

- Key patents

- selection and analysis