|

市場調查報告書

商品編碼

1717364

業者的收益策略:2025-2029年Operator Revenue Strategies: 2025-2029 |

||||||

到 2029 年,行動網路營運商的企業收入將達到 3,480 億美元

| 主要統計 | |

|---|---|

| 全球網路業者的收益 (~2029年): | 1兆美元 |

| 來自全球網路業者的企業用服務的收益 (2029年): | 3,480億美元 |

| 來自全球網路業者針對消費者服務的收益 (~2029年): | 6,830億美元 |

| 預測期間: | 2025-2029年 |

本報告研究了網路營運商的收入趨勢和策略,分析了充滿活力且競爭激烈的網路營運商市場趨勢和當前市場課題,包括收入分析、消費者市場飽和度、網路擁有成本上升以及5G貨幣化面臨的課題,數據涵蓋全球60個國家。本報告是了解產業環境的重要工具,將有助於網路營運商、營運商技術解決方案提供者、監管機構和政策制定者制定未來策略。

本報告包含策略和趨勢文檔,全面評估了市場規模、關鍵預測數據、關鍵趨勢、課題,並為 60 多個國家/地區多個細分市場的利害關係人提供了重要建議。總而言之,這些文件是了解這個快速成長的市場的重要工具,並將幫助網路營運商和技術供應商制定未來策略。

主要的特徵

- 關鍵要點和策略建議:本研究總結了我們對網路營運商市場深入分析的主要發現,並為營運商在當前和不久的將來應對市場提供了關鍵策略建議。

- 未來市場展望:本研究提供了對未來市場前景的洞察,包括全球八大主要地區、蜂窩技術以及消費者/企業細分市場的訂閱量和收入增長。它還提供了針對網路營運商的收入洞察。

- AI的發展

- 行動傳訊

- 行動漫遊

- 營運商的新機會:本研究評估了營運商應在其近期收入策略中重點關注的三個網路服務交付關鍵技術領域,包括:

- 管理&諮詢服務

- 網路API

- 旅遊eSIM解決方案

- 市場預測與關鍵要點:本報告從隨附資料集中精選了一系列關鍵預測統計數據,按 8 個主要區域細分,並分析了關鍵要點,並就網路營運商應如何應對提出了見解。

資料與互動式預測

涵蓋一系列指標的大量歷史數據和 5 年預測數據,包括用戶滲透率、網路營運商收入、網路技術、產業、8 個主要區域和 61 個國家。指標包括:

- 行動加入數

- 由於全球網路業者申請的總收益

- 全球網路業者的整體ARPU

- 蜂巢式IoT整體連線數

- 蜂巢式IoT總收益

企業,消費者,2G/3G,4G,5G,LPWA,6G的市場明細

- SMS流量總合

- 每SMS的平均收益

- SMS總收益

- RCS支援手機用戶總數

- RCS流量總合

- RCS的總收益

含P2P及A2P的各部門明細。

樣品view

市場趨勢·預測

目錄

第1章 重要點·策略性建議

- 重要點·策略性建議

- 策略性建議

第2章 未來市場預測

- 未來市場預測

- 網路收益化的未來

- 企業服務的收益化

- AI引進

- 行動傳訊

- SMS

- SMS的成本

- 對話式商務

- SMS詐騙

- 企業用雙向SMS

- 行動漫遊

第3章 對經營者來說的新機會

- 對業者來說的新機會

- 管理&諮詢服務

- 網路API

- 旅遊eSIM解決方案

- 旅遊用SIM

第4章 市場預測·重要點

- 業者的收益預測:簡介

- 預測研究方法論

- 全球網路營運商 ARPU

- 全球網路營運商帳單收入

- 網路營運商消費者服務收入

- 網路營運商企業服務收入

- 4G 網路業者帳單總收入

- 4G 網路營運商消費者服務收入

- 4G 網路營運商企業服務收入

- 5G 網路業者帳單收入

- 5G 網路營運商消費者服務收入

- 5G 網路營運商企業服務收入

'Mobile Network Operators' Enterprise Revenue to Reach $348bn by 2029'

| KEY STATISTICS | |

|---|---|

| Global network operator revenue by 2029: | $1tn |

| Global network operator enterprise revenue in 2029: | $348bn |

| Global network operator consumer revenue by 2029: | $683bn |

| Forecast period: | 2025-2029 |

Overview

Discover invaluable insights into trends and strategies for network operator revenue in our latest report, Operator Revenue Strategies. With data split across 60 countries, this extensive forecast analyses the dynamic and competitive network operator market and the current market challenges posed by slowing revenue, high market saturation in the consumer market, rising network ownership costs, and challenges in 5G monetisation. The report is a critical tool for understanding the industry environment; helping network operators, technical solutions providers for those operators, and regulatory bodies and policy makers to shape their future strategy.

The suite includes both a data deliverable, sizing the market and providing key forecast data for over 60 countries and several different segments, as well as a strategy and trends document which gives a complete assessment of the key trends, challenges and key recommendations for stakeholders. Collectively, they provide a critical tool for understanding this rapidly emerging market; allowing network operators and technology vendors to shape their future strategy.

All report content is delivered in the English language.

Key Features

- Key Takeaways & Strategic Recommendations: Key summarised findings from in-depth analysis into the network operators' market, accompanied by key strategic recommendations for operators to navigate the market at the present time and in the near future.

- Future Market Outlooks: Includes insights into the future market prospects, including the growth in mobile subscriptions and revenue, with splits for eight key world regions, by cellular technology, and by consumer and enterprise sectors. There are also insights into areas of network operator revenue including:

- AI Deployment

- Mobile Messaging

- Mobile Roaming

- Emerging Opportunities for Operators: The study assesses three key technical areas of network service provision which operators must be looking to as part of their revenue strategies going into the near future. These include:

- Managed & Consulting Services

- Network APIs

- Travel eSIM Solutions

- Market Forecasts & Key Takeaways: A selection of key forecasted statistics from the report's accompanying dataset, broken down by 8 key regions, with some accompanying analysis of key takeaways, as well as how network operators should act upon them.

Data & Interactive Forecast

Extensive historical and 5-year forecasted data on a wide array of metrics including subscriber penetration, network operator revenue, as well as breakdowns by different network technologies, sectors, and by our 8 key regions and 61 countries. Metrics include:

- Total Mobile Subscriptions

- Total Global Network Operator-billed Revenue

- Total Global Network Operator ARPU

- Total Cellular IoT Connections

- Total Cellular IoT Revenue

With market breakdowns for Enterprise, Consumer, 2G/3G, 4G, 5G, LPWA and 6G.

- Total SMS Traffic

- Average Revenue per SMS

- Total SMS Revenue

- Total RCS-capable Mobile Subscribers

- Total RCS Traffic

- Total RCS Revenue

With sector breakdowns for P2P and A2P.

SAMPLE VIEW

Market Trends & Forecasts

A comprehensive analysis of the current market landscape, alongside strategic recommendations and a walk-through of the forecasts.

Table of Contents

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways and Strategic Recommendations

- 1.1.2. Strategic Recommendations

2. Future Market Outlooks

- 2.1. Future Market Outlooks

- Figure 2.1: Total Mobile Subscriptions, Split by 8 Key Regions, 2024-2029

- Figure 2.2: Total Mobile Subscriptions, 2025, Split by Cellular Technology

- 2.2. The Future of Network Monetisation

- Figure 2.3: Consumer Operator-billed Monthly ARPU ($), Split by 8 Key Regions, 2021-2029

- 2.3. Monetising Enterprise Services

- Figure 2.4: Global Operator Revenue ($m), Split by Consumer & Enterprise, 2025-2029

- Figure 2.5: MVNO Revenue as a Proportion of Total Network Operator Revenue (%), 2020-2029, Split by 8 Key Regions

- 2.4. AI Deployment

- 2.5. Mobile Messaging

- Figure 2.6: Total Mobile Messaging Traffic (m), 2025, Split by Service

- Figure 2.7: Total Mobile Messaging Traffic in 2025 (m), Split by 8 Key Regions

- 2.6. SMS

- Figure 2.8: Total SMS Traffic (m), Split by 8 Key Regions, 2024-2029

- 2.6.1. The Cost of SMS

- Figure 2.9: Average Revenue per A2P SMS ($), Split by 8 Key Regions, 2021-2029

- 2.6.2. Conversational Commerce

- 2.6.3. SMS Fraud

- Figure 2.10: Infographic with SMS Fraud Types

- i. AIT Fraud

- Figure 2.11: AIT Fraud Infographic

- ii. Tighter Global Restrictions

- 2.6.4. Two-way SMS for Businesses

- Figure 2.12: One-way vs Two-way Business SMS Infographic

- 2.7. Mobile Roaming

- Figure 2.13: Mobile Roaming Structure

- Figure 2.14: Total Wholesale Roaming Revenue ($m), Split by 8 Key Regions, 2024-2029

3. Emerging Opportunities for Operators

- 3.1. Emerging Opportunities for Operators

- 3.1.1. Managed & Consulting Services

- i. Managed Network Services

- ii. Network Consulting Services

- 3.1.2. Network APIs

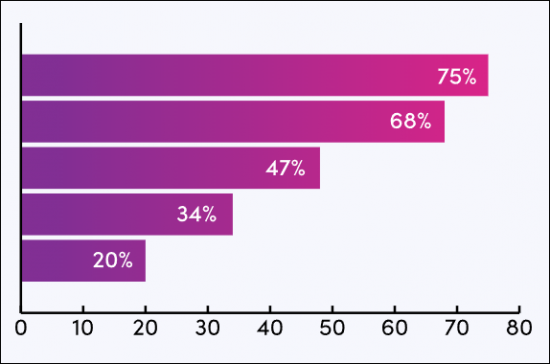

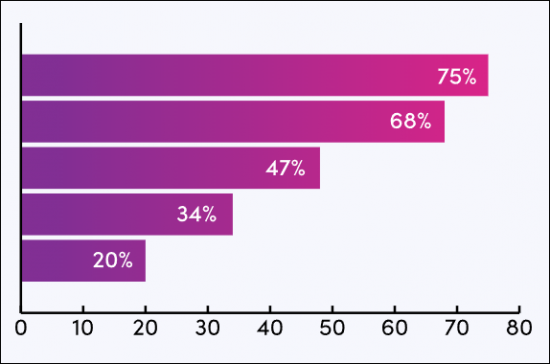

- Figure 3.1: Enterprise Adoption of APIs Without Standardised APIs

- Figure 3.2: Revenue Flow Without Telco APIs vs With

- 3.1.3. Travel eSIM Solutions

- Figure 3.3: Revenue From Travel SIMs & eSIMs ($m), Split by 8 Key Regions, 2024-2028

- Travel SIMs

- Figure 3.4: Travel SIM Packages Acquired Globally by Users (m) 2024-2028

- Figure 3.5: Proportion of Consumer Connected Devices Leveraging eSIMs for Connectivity in 2024 (%), Split by 8 Key Regions

- Figure 3.3: Revenue From Travel SIMs & eSIMs ($m), Split by 8 Key Regions, 2024-2028

- 3.1.1. Managed & Consulting Services

4. Market Forecasts & Key Takeaways

- 4.1. Introduction to Operator Revenue Forecasts

- 4.1.1. Forecast Methodology

- Figure 4.1: Operator Revenue Strategies Forecast Methodology

- 4.1.2. Global Network Operator ARPU

- Figure and Table 4.2: Global Network Operator ARPU ($), Split by 8 Key Regions, 2025-2029

- 4.1.3. Global Network Operator-billed Revenue

- Figure and Table 4.3: Global Network Operator-billed Revenue ($m), Split by 8 Key Regions, 2025-2029

- 4.1.4. Total Network Operator Consumer Revenue

- Figure and Table 4.4: Total Network Operator Consumer Revenue ($m), Split by 8 Key Regions, 2025-2029

- 4.1.5. Total Network Operator Enterprise Revenue

- Figure and Table 4.5: Total Network Operator Enterprise Revenue ($m), Split by 8 Key Regions, 2025-2029

- 4.1.6. Total 4G Network Operator-billed Revenue

- Figure and Table 4.6: Total Operator-billed Revenue ($m), Split by 8 Key Regions, 2025-2029

- 4.1.7. Total Consumer 4G Network Operator Revenue

- Figure and Table 4.7: Total Consumer 4G Network Operator Revenue ($m), Split by 8 Key Regions, 2025-2029

- 4.1.8. Total Enterprise 4G Network Operator Revenue

- Figure and Table 4.8: Total Enterprise 4G Network Operator Revenue ($m), Split by 8 Key Regions, 2025-2029

- 4.1.9. Total 5G Network Operator-billed Revenue

- Figure and Table 4.9: Total 5G Network Operator Revenue ($m), Split by 8 Key Regions, 2025-2029

- 4.1.10. Total Consumer 5G Network Operator Revenue

- Figure and Table 4.10: Total 5G Consumer Network Operator Revenue ($m), Split by 8 Key Regions, 2025-2029

- 4.1.11. Total Enterprise 5G Network Operator Revenue

- Figure and Table 4.11: Total 5G Enterprise Network Operator Revenue ($m), Split by 8 Key Regions, 2025-2029

- 4.1.1. Forecast Methodology