|

市場調查報告書

商品編碼

1891233

軟體定義車輛 (SDV) 普及率:2026 年Software-defined Vehicles Adoption Report 2026 |

|||||||

範例預覽

汽車產業正從以硬體為中心的設計轉向以軟體為先的方法,從根本上改變車輛架構和開發方式。 流程和駕駛員體驗。向軟體定義車輛 (SDV) 的轉變實現了持續的功能更新、集中式運算以及透過訂閱服務實現的新型獲利模式。然而,這也帶來了一些挑戰,例如複雜的組織結構、網路安全風險以及多系統軟體堆疊的整合。

本報告全面分析了 SDV 的現狀,並詳細介紹了主要 OEM 和一級供應商的採用策略。報告從多個技術和戰略角度審視了市場,包括電氣/電子 (E/E) 架構的演進、八層軟體棧的組成、人工智慧在開發中的作用以及車輛安全監管框架。

本報告的研究結果是基於 2025 年初對 86 位來自 OEM 和供應商的汽車行業高管進行的調查,以及對 20 多位專家的深度訪談。 它也融合了來自上海車展 (AutoShanghai 2025) 和法蘭克福國際車展 (IAA Mobility 2025) 等重要產業活動的洞見。

範例預覽

報告概述

- 140 頁報告:詳細介紹了定義 SDV 市場的採用趨勢、技術和策略。

- 市場優先級資料:45% 的 OEM 將 SDV 列為首要策略重點,超過了自動駕駛和電氣化。

- 財務分析:領先的 OEM 將 21% 的 SDV 相關支出分配給軟體,並將類似比例分配給電子電氣 (E/E) 架構。

- 按區域劃分的架構詳情分析:許多 OEM 正在採用分區式 E/E 架構,以簡化佈線並集中運算資源。

- 軟體堆疊結構分析:組織了從硬體抽象層到雲端平台的 8 層 48 個元件的結構。

- 供應商與OEM趨勢: 分析主要廠商的策略,包括特斯拉、寶馬、賓士、蔚來、日產、AWS、微軟和恩智浦。

範例預覽

關鍵分析領域

- SDV概述: 將SDV定義為採用軟體優先方法建構的車輛,涵蓋四個維度:車輛架構、雲端整合、軟體驅動工程和生命週期管理。概述了從分散式ECU到集中式計算的過渡。

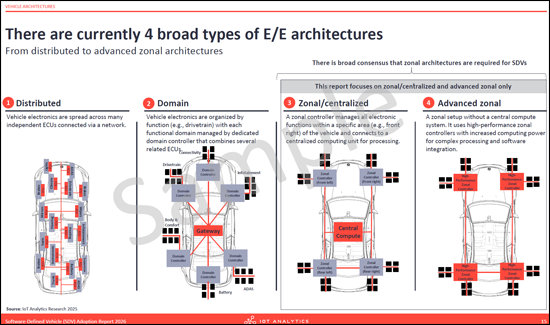

- 車輛架構: 詳細闡述從基於域的電子電氣架構向基於區域的電子電氣架構的過渡。分析區域設計的優勢,例如減輕重量和簡化佈線,同時也探討了技能差距和高昂的初始成本等障礙。

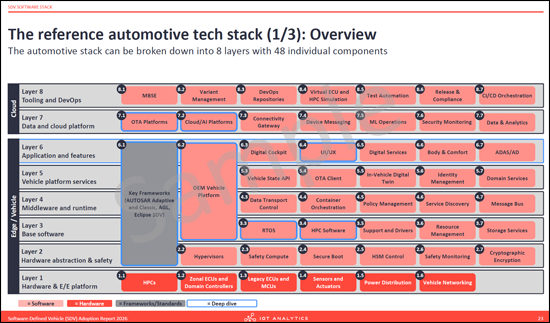

- SDV 軟體堆疊: 將參考汽車技術堆疊分解為八層,包括硬體和電子電氣平台、中介軟體和應用層。我們評估了關鍵框架,例如 AUTOSAR Adaptive 和 Eclipse SDV,並深入研究了車輛平台,例如 MB.OS 和 Tesla OS。

- 人工智慧的角色與應用: 我們分析了人工智慧在車輛模型開發過程中的價值。數據顯示,絕大多數原始設備製造商 (OEM) 認為人工智慧在軟體開發和驗證方面最有價值。我們也討論了生成式人工智慧在程式碼產生和需求工程的應用。

- 安全與監管: 我們分析了軟體定義虛擬 (SDV) 擴充功能的攻擊面,並識別出五種關鍵攻擊途徑,包括 ECU 漏洞利用和 OTA 漏洞。我們概述了符合 ISO 21434 和 UN R155/R156 等標準的合規性要求。

- OEM 和供應商採用策略: 我們將特斯拉和蔚來等科技原生公司的努力與傳統公司的努力進行比較。我們重點介紹了歐洲 OEM 如何比亞太地區的同行更積極地優先考慮 SDV。

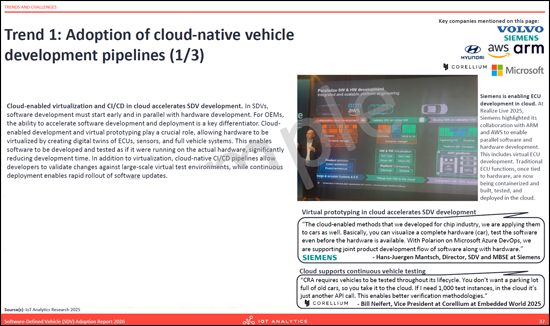

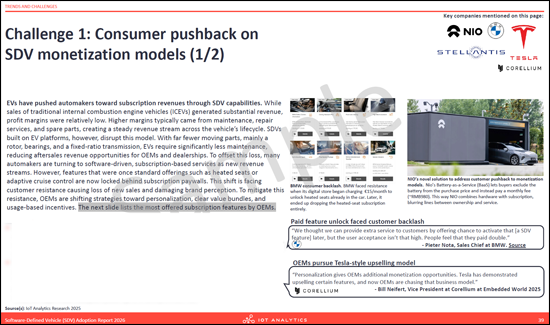

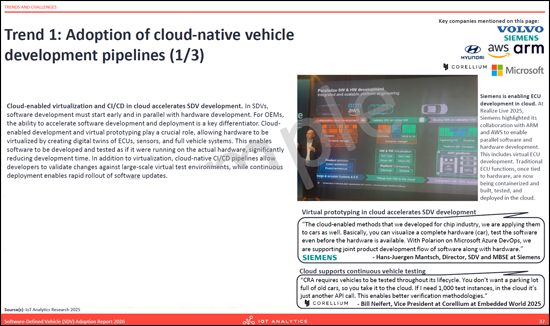

- 趨勢與挑戰: 辨識出雲端原生開發流程的採用與軟體堆疊模組化等宏觀趨勢。同時,也探討了消費者對訂閱模式的抵制以及軟體工程人才短缺等挑戰。

公司列表:

|

|

|

目錄

第一章:摘要整理

第二章:引言

- 引言:章節概述與要點

- 傳統汽車產業面臨三大壓力

- 因此,OEM廠商正在投資三大關鍵產品策略

- IoT Analytics 的 2025 年調查顯示,SDV 是首要策略問題

- 歐洲 OEM 廠商和供應商處於 SDV 革命的前沿

- SDV 的定義

- 製造商和產業協會如何定義 SDV

- SDV 有四個關鍵要素維度

- 這些維度在汽車開發的整體 V 模型中都扮演著獨特的角色。

- 為什麼軟體定義車輛 (SDV) 如此重要?關鍵引言

- SDV 的演變

- 原始設備製造商 (OEM) 每年都在 SDV 上進行投資,其中大部分投資用於軟體和電子電氣 (E/E) 架構。

- 案例研究:梅賽德斯-奔馳的軟體定義未來

- 專家市場共識:技術原生 OEM 在 SDV 方面擁有明顯的領先優勢

第三章 車輛架構

- 車輛架構:章節概要與重點

- SDV 要求將改變未來的電子電氣架構

- 目前,電子電氣架構種類繁多。

- 採用區域架構

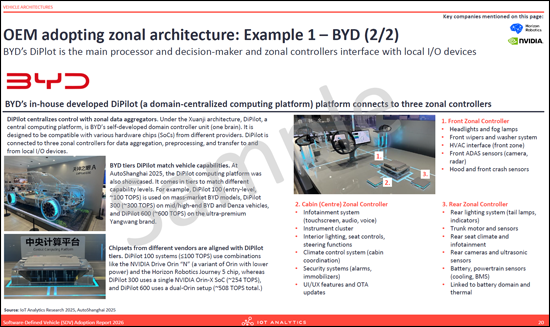

- 採用區域架構的OEM廠商:範例1 - 比亞迪

- 採用區域架構的OEM廠商:範例2 - 特斯拉

- 採用區域架構的OEM廠商:範例3 - Rivian

- 採用區域架構的供應商:範例 - NXP

- 區域架構的主要優勢

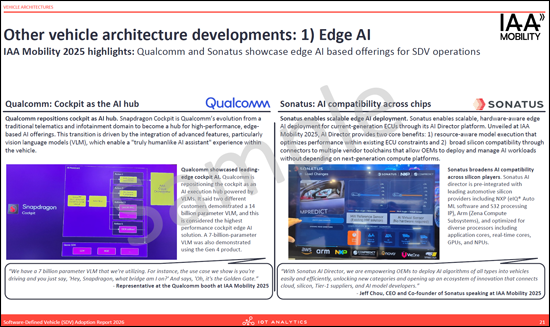

- 其他車輛架構發展:1 - 邊緣AI

- 其他車輛架構發展:2 - 硬體虛擬化

第四章 SDV軟體堆疊

- SDV軟體堆疊:章節概述與要點

- 參考汽車技術棧

- 詳細分析1:關鍵框架

- 詳細分析2:OEM車輛平台

- 詳細分析3:即時作業系統 (RTOS)

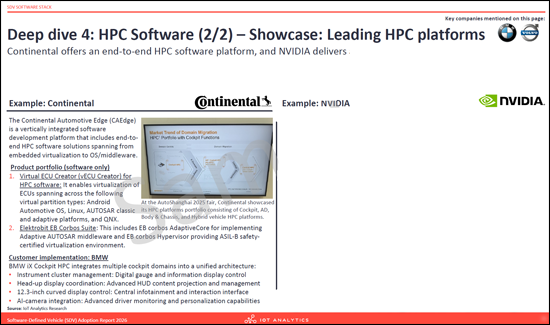

- 詳細分析4:高效能運算 (HPC) 軟體

- 詳細分析5:OTA平台

- 詳細分析 6:雲端平台

- 詳細分析 7:使用者介面/使用者體驗

- 詳細分析 8:應用與功能 - SDV 的功能

第五章:人工智慧的作用與應用

- 人工智慧的作用與應用:章節概述及要點

- 人工智慧在汽車開發中的價值創造潛力

- 詳情:人工智慧在區域架構開發中的作用

- 人工智慧在車輛設計和車輛應用中的作用

- 人工智慧在建構特定車輛系統中的作用

- 關鍵的人工智慧賦能車輛功能

- 生成式人工智慧的作用

第六章:安全與監理的作用

- 安全與監管的功能:章節概述及要點

- SDV 中的網路安全風險

- 網路安全在…中的作用SDV V 模型

- 整體網路安全成熟度

- 關鍵網路安全主題的職責

- 汽車廠商安全廠商展示 1:上游

- 汽車廠商安全廠商展示 2:關鍵軟體

- 法規

- OEM 和供應商採用策略:章節概述和要點

- OEM SDV 採用(10 個部分)

- 供應商 SDV 實施

第 7 章:趨勢與挑戰

- 趨勢與挑戰:章節概要與重點

- 趨勢

- 挑戰

- 其他見解:EW25 SDV 小組討論亮點

第 8 章:研究方法

第 9 章:物聯網分析

A report detailing the adoption of software-defined vehicles, incl. deep-dive on the software stack, specific OEM and supplier adoption strategies, and key trends and challenges.

Sample preview

The automotive industry is transitioning from hardware-centric engineering to a software-first approach, fundamentally altering vehicle architecture, development processes, and the driver experience. This shift to Software-Defined Vehicles (SDVs) enables continuous feature updates, centralized computing, and new monetization models through subscription-based services. However, it also introduces complexities in organizational structure, cybersecurity risks, and the integration of multi-system software stacks.

The "Software-Defined Vehicle (SDV) Adoption Report 2026" provides a comprehensive analysis of the SDV landscape, detailing the adoption strategies of major OEMs and Tier-1 suppliers. It examines the market through multiple technical and strategic lenses: the evolution of electrical/electronic (E/E) architectures, the composition of the 8-layer software stack, the role of Artificial Intelligence (AI) in development, and the regulatory frameworks governing vehicle security.

The findings in this report rely on a survey of 86 automotive executives from OEMs and suppliers, conducted in early 2025, alongside 20+ in-depth expert interviews. The research also incorporates insights from major industry events such as AutoShanghai 2025 and IAA Mobility 2025.

Sample preview

Report at a glance

- 140-page report: Detailing the adoption trends, technologies, and strategies defining the SDV market.

- Market prioritization data: Analysis indicates that 45% of OEMs classify SDVs as their top strategic priority, surpassing autonomous driving and electrification.

- Financial insights: Data details that leading OEMs allocate 21% of their SDV expenditure to software, with a nearly equal portion dedicated to electrical/electronic architectures.

- Deep dive into Zonal Architectures: Examines the migration status, with a vast majority of OEMs currently adopting zonal E/E architectures to reduce wiring complexity and centralize compute power.

- Software stack breakdown: A structural analysis of the SDV software stack, identifying 8 layers and 48 components, from hardware abstraction to cloud platforms.

- Vendor and OEM landscape: Profiles strategies from key players including Tesla, BMW, Mercedes-Benz, Nio, Nissan, AWS, Microsoft, and NXP.

Sample preview

Key areas of analysis

- Introduction to SDVs: Defines the SDV as a vehicle built with a software-first approach across four dimensions: vehicle architecture, cloud integration, software-driven engineering, and lifecycle management. It outlines the shift from distributed ECUs to centralized computing.

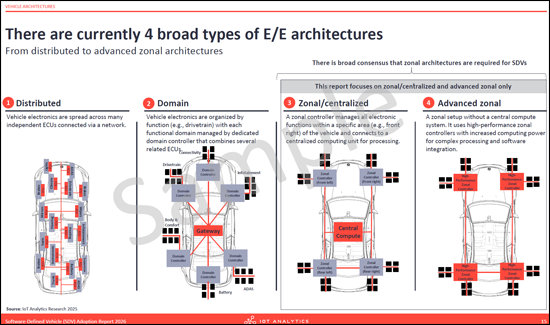

- Vehicle architectures: Details the transition from domain-based to zonal E/E architectures. The section analyzes the benefits of zonal designs, such as weight reduction and simplified wiring, while addressing barriers like skill gaps and high upfront costs.

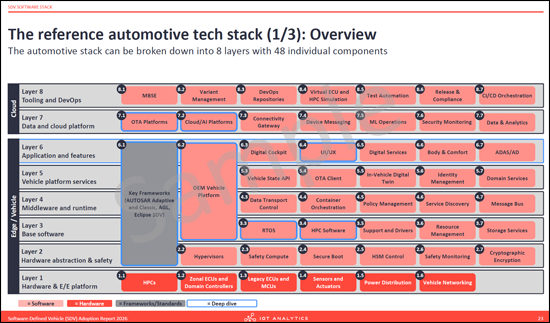

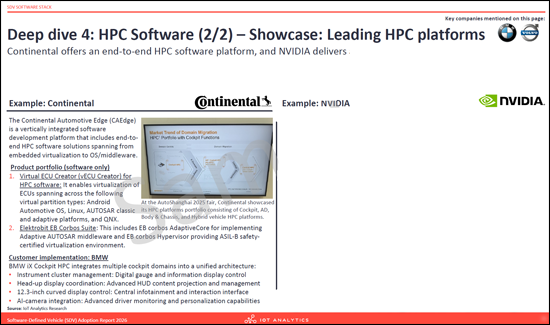

- The SDV software stack: Dissects the reference automotive tech stack into 8 layers, including the hardware & E/E platform, middleware, and application layers. It evaluates key frameworks such as AUTOSAR Adaptive and Eclipse SDV, and deep-dives into vehicle platforms like MB.OS and Tesla OS.

- Role and adoption of AI: Analyzes the value of AI across the V-model development process. Data indicates that the overwhelming majority of OEMs see the greatest value for AI in software development and validation. The section also covers Generative AI applications in code generation and requirements engineering.

- Security and regulations: Examines the expanded attack surface of SDVs, identifying five primary attack vectors including ECU exploitation and OTA vulnerabilities. It outlines compliance requirements with standards such as ISO 21434 and UN R155/R156.

- OEM and supplier adoption strategies: Contrasts the approaches of tech-native players like Tesla and Nio against traditional incumbents. It highlights that European OEMs prioritize SDVs significantly more aggressively than their APAC counterparts.

- Trends and challenges: Identifies macro trends such as the adoption of cloud-native development pipelines and the modularization of software stacks. It also addresses challenges like consumer pushback on subscription models and the shortage of software engineering talent.

A data-driven foundation for key business functions

- Strategy & corporate development: Align strategic roadmaps with the shift toward zonal architectures, which a vast majority of competitors are adopting, and assess investment priorities where 45% of OEMs classify SDVs as their top strategic goal.

- Product management: Inform feature roadmaps by analyzing the adoption of specific SDV capabilities; for instance, a significant majority of new vehicles sold in 2024 possessed Software-Over-The-Air (SOTA) capabilities.

- R&D & engineering leadership: Direct resource allocation based on industry priorities, noting that software accounts for the leading share of SDV budgets. Evaluate the utility of AI, as a clear majority of peers expect it to be critical for ADAS simulation.

- Market intelligence: Assess the competitive landscape by reviewing the platform strategies of major players like BMW, Stellantis, Nissan, and BYD, and understanding the friction points between OEMs and suppliers regarding "white-box" code sharing.

Key concepts defined

- Software-Defined Vehicle (SDV): An automobile engineered with a software-first approach, where core functions (control, connectivity, user experience) and development processes are primarily defined by software rather than hardware.

- Zonal Architecture: An E/E architecture that groups Electronic Control Units (ECUs) by their physical location (zones) within the vehicle rather than by function, connecting them to central computing units to simplify wiring and processing.

- Vehicle Platform: An end-to-end software ecosystem (e.g., MB.OS, VW.OS) that manages hardware, enables real-time control, supports OTA updates, and provides a development environment for applications.

- Over-the-Air (OTA): The capability to download and install software and firmware updates remotely, managing the lifecycle of vehicle software without physical dealership visits.

- High-Performance Computing (HPC): Centralized computing units within the vehicle that process complex, data-intensive workloads such as AI, ADAS, and cross-domain functions.

Questions answered:

- What is a software-defined vehicle (definition), and which stakeholders treat SDV as a strategic priority?

- Which components of the automotive technology stack are foundational to SDV development and operations?

- What types of zonal architecture are emerging, and what are its benefits and adoption challenges?

- How valuable is AI expected to be across SDV lifecycle?

- What are SDV cybersecurity risks and mitigation approaches?

- What are the SDV adoption strategies of OEMs and suppliers?

- What are the key trends and challenges in SDV adoption?

Companies mentioned:

A selection of companies mentioned in the report.

|

|

|

Table of Contents

1. Executive summary

- The insights in this report are based on 4 main research sources

- Executive summary (4 parts)

- Analyst opinion: 4 things that stood out in our research

2. Introduction

- Introduction: Chapter overview and key takeaways

- The traditional automotive industry is experiencing pressure on 3 fronts

- As a result, OEMs are investing in 3 key product strategies

- IoT Analytics' 2025 survey shows SDV is the top strategic priority

- European OEMs and suppliers are at the forefront of SDV revolution

- Definition of an SDV

- How manufacturers and industry associations define SDV

- There are 4 main dimensions of an SDV

- Each of the 4 dimensions plays a separate role across the automotive development V-model

- Why are SDVs so important? Key quotes

- Evolution of SDVs

- OEMs invest into SDVs each year with most spending on software and E/E architectures

- Case in point: Mercedes-Benz's software-defined future (3 parts)

- Expert market consensus: Tech-native OEMs are clearly ahead with SDVs

3. Vehicle architectures

- Vehicle architectures: Chapter overview and key takeaways

- SDV requirements change future E/E architectures

- There are currently broad types of E/E architectures

- Zonal architecture adoption (5 parts)

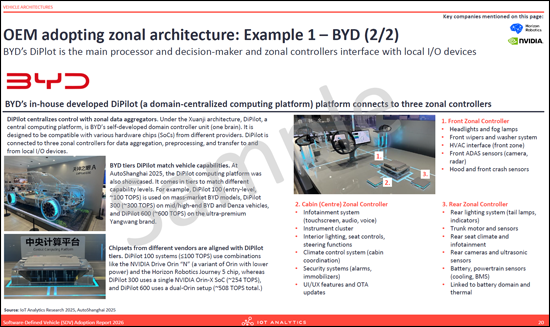

- OEM adopting zonal architecture: Example 1 - BYD (2 parts)

- OEM adopting zonal architecture: Example 2 - Tesla

- OEM adopting zonal architecture: Example 3 - Rivian

- Supplier adopting zonal architecture: Example - NXP (2 parts)

- Key benefits of zonal architecture

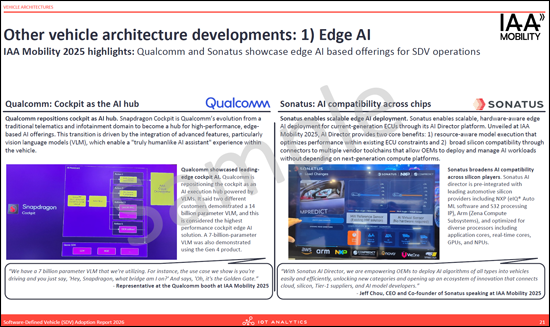

- Other vehicle architecture developments: 1 - Edge AI

- Other vehicle architecture developments: 2 - Hardware virtualization

4. The SDV software stack

- SDV Software stack: Chapter overview and key takeaways

- The reference automotive tech stack (3 parts)

- Deep dive 1: Key frameworks (2 parts)

- Deep dive 2: OEM Vehicle Platform (7 parts)

- Deep dive 3: RTOS (2 parts)

- Deep dive 4: HPC software (2 parts)

- Deep dive 5: OTA platforms (2 parts)

- Deep dive 6: Cloud platforms (6 parts)

- Deep dive 7: UI/UX (2 parts)

- Deep dive 8: Applications and features - What SDV enables

5. Role and adoption of AI

- Role and adoption of AI: Chapter overview and key takeaways

- AI's value creation potential in vehicle development

- Deep-dive: Role of AI in zonal architecture development

- The role of AI for vehicle design and vehicle applications

- Role of AI when building specific vehicle systems

- Key vehicle functions that make use of AI

- The role of generative AI

6. Role of security and regulations

- Role of security and regulations: Chapter overview and key takeaways

- Cybersecurity risks in SDVs (2 parts)

- The role of cybersecurity in the SDV V-Model

- Overall cybersecurity maturity

- Responsibility for key cybersecurity topics

- Automotive cybersecurity vendor showcase 1: Upstream

- Automotive cybersecurity vendor showcase 2: Critical Software

- Regulations (2 parts)

- OEM and supplier adoption strategies: Chapter overview and key takeaways

- OEM SDV adoption (10 parts)

- Supplier SDV adoption (4 parts)

7. Trends and challenges

- Trends and challenges: Chapter overview and key takeaways

- Trend 1 (3 parts)

- Trend 2

- Trend 3

- Trend 4

- Challenge 1 (2 parts)

- Challenge 2 (2 parts)

- Challenge 3 (3 parts)

- Other insights: Highlights from the EW25 SDV panel discussion

8. Methodology

- The insights in this report are based on 4 main research sources

- Complete list of survey questions (2 parts)

- Complete list of interview questions

- Respondent sampling overview (3 parts)

9. About IoT Analytics

- About IoT Analytics

- Other publications by IoT Analytics

- Information and contact