|

市場調查報告書

商品編碼

1913481

嬰兒背帶及配件市場機會、成長促進因素、產業趨勢分析及預測(2026-2035)Baby and Toddlers Carriers and Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

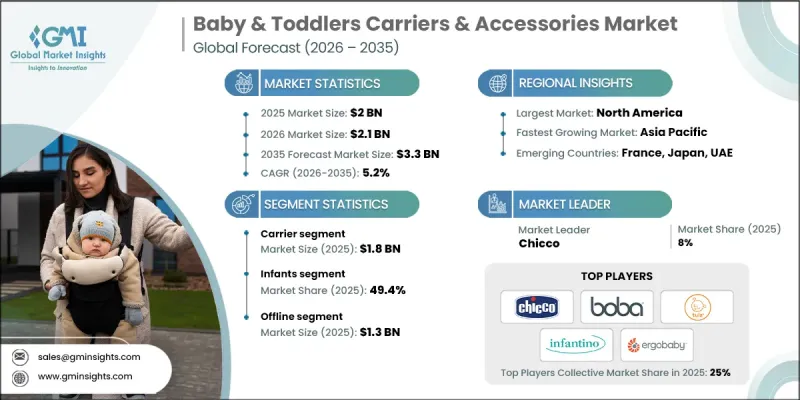

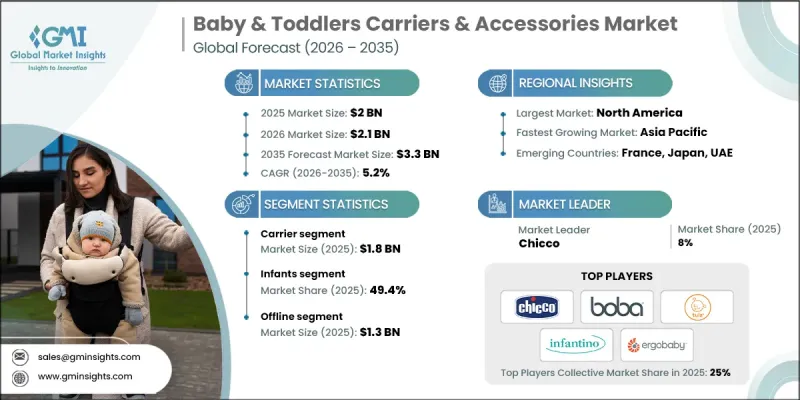

全球嬰兒背帶及配件市場預計到 2025 年將達到 20 億美元,到 2035 年將達到 33 億美元,年複合成長率為 5.2%。

市場成長正受到家庭結構變化的影響,尤其是雙薪家庭的增加和持續的都市化。現代父母越來越傾向於選擇能夠支持積極生活方式、兼顧工作、個人生活和育兒的產品。嬰兒背帶提供了一個實用的解決方案,既能解放雙手,又能與孩子保持親密的身體連結。在人口密集的都市區,由於背帶在擁擠的道路、公共交通工具和狹小的生活空間中更易於使用,因此往往比傳統嬰兒車更受歡迎。對便攜性和效率的關注正在推動產品創新,各大品牌都在設計兼具舒適性、安全性和美觀性的背帶。現代父母期望產品既能體現現代美學和功能性,又能無縫融入他們的日常生活,這促使製造商不斷擴展其多功能、符合人體工學且外觀時尚的背帶產品線。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始金額 | 20億美元 |

| 預測金額 | 33億美元 |

| 複合年成長率 | 5.2% |

預計到2025年,嬰兒背帶市場規模將達18億美元。這些產品專為照顧者設計,讓他們能夠安全地抱起嬰幼兒,同時解放雙手。嬰兒背帶款式多樣,可滿足不同發展階段、舒適度需求及抱姿偏好。父母依靠嬰兒背帶增進親子關係,確保照顧者和孩子都能保持正確的姿勢,並在日常活動中保持舒適。

預計到2025年,嬰兒用品市佔率將達到49.4%。嬰兒期,尤其是5個月至2歲這段時期,是身體和認知快速發展的階段。隨著嬰兒逐漸能夠控制頭部、頸部和身體軀幹,照顧者會逐漸過渡到使用結構更穩固的背帶,這些背帶既能提供支撐,又能讓孩子觀察周圍環境並與之互動。在這個尚未學會走路的階段,背帶在維繫照顧者與孩子之間的親密關係方面發揮著重要作用,同時也能支持孩子日益成長的好奇心以及與環境的感官互動。

預計2025年,美國嬰兒背帶及配件市場規模將達5億美元,佔78.6%的市佔率。高購買力、對安全性和人體工學標準的重視以及以兒童為中心的消費文化,是推動市場持續成長的主要因素。美國父母尤其偏好兼具舒適性、設計感、多功能性和符合健康指南的嬰兒背帶。實體店和線上平台的廣泛產品供應進一步促進了市場成長,並豐富了消費者的選擇。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 越來越多的職業父母和城市生活方式的普及

- 父母對背巾使用嬰兒的好處的看法

- 注重人體工學與舒適性

- 產業潛在風險與挑戰

- 安全和合規問題

- 品管和仿冒品措施

- 機會

- 配件創新

- 技術整合產品

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管環境

- 標準和合規要求

- 區域法規結構

- 認證標準

- 波特分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 業務拓展計劃

第5章 依產品類型分類的市場估算與預測(2022-2035 年)

- 職業

- 軟結構類型

- 包裝搬運工

- 斜背包

- 背包式背帶

- 其他(美泰航空等)

- 配件

- 食物

- 靠背

- 口水墊

- 肩帶保護套

- 其他(收納袋等)

第6章 市場估算與預測:依材料分類(2022-2035 年)

- 棉布

- 尼龍

- 亞麻布

- 聚酯纖維

- 其他(人造毛皮、氯丁橡膠等)

第7章 市場估計與預測:依年齡層分類(2022-2035 年)

- 新生兒(0-5個月)

- 嬰兒(5個月至2歲)

- 幼兒(2-4歲)

第8章 市場估算與預測:依持有類型分類(2022-2035 年)

- 積極的

- 向後

- 時髦的

第9章 市場估計與預測:依價格分類(2022-2035 年)

- 低價位

- 中價位

- 高價位範圍

第10章 按分銷管道分類的市場估計和預測(2022-2035 年)

- 線上

- 電子商務

- 公司網站

- 離線

- 超級市場/大賣場

- 專賣店

- 其他(個別門市等)

第11章 各地區市場估計與預測(2022-2035 年)

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Baby K'tan

- Baby Tula

- Be Lenka

- Boba

- Chicco

- Ergobaby

- Fidella

- Infantino

- Kinderkraft

- Kol Kol Baby Carrier

- LennyLamb

- Mabe

- MaMidea

- Tushbaby

- Wildbird

The Global Baby & Toddlers Carriers & Accessories Market was valued at USD 2 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 3.3 billion by 2035.

Market growth is shaped by changing family dynamics, particularly the rise in dual-income households and continued urbanization. Modern parents increasingly seek products that support active lifestyles while allowing them to manage childcare alongside professional and personal responsibilities. Baby carriers offer a practical solution by enabling hands-free mobility while maintaining close physical connection with children. In dense urban environments, carriers are often favored over traditional strollers due to their ease of use on crowded streets, public transport systems, and in compact living spaces. The emphasis on portability and efficiency has influenced product innovation, leading brands to design carriers that balance comfort, safety, and visual appeal. Today's parents expect products that integrate seamlessly into daily routines while reflecting modern aesthetics and functionality, which has encouraged manufacturers to expand their portfolios with versatile, ergonomic, and visually refined carrier solutions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2 Billion |

| Forecast Value | $3.3 Billion |

| CAGR | 5.2% |

The carriers segment reached USD 1.8 billion in 2025. These products are designed to be worn by caregivers, allowing infants and toddlers to be carried securely while keeping hands free. Available in a variety of designs, carriers support different developmental stages, comfort needs, and carrying preferences. Parents rely on them to promote closeness, support proper posture for both caregiver and child, and maintain comfort during everyday activities.

The infant category accounted for 49.4% share in 2025. Early childhood is marked by rapid physical and cognitive development, particularly between five months and two years of age. As infants gain better head, neck, and core control, caregivers increasingly transition to structured carriers that provide support while allowing children to observe and engage with their surroundings. During this pre-mobility phase, carriers play a key role in maintaining caregiver bonding while supporting a child's growing curiosity and sensory interaction with the environment.

United States Baby & Toddlers Carriers & Accessories Market held 78.6% share, generating USD 500 million in 2025. Strong purchasing power, high awareness of safety and ergonomic standards, and a well-established culture of child-focused consumer spending support sustained demand. Parents in the U.S. show strong preference for carriers that combine comfort, design appeal, versatility, and compliance with health guidelines. Broad product availability through both physical retail channels and online platforms further strengthens market growth and consumer choice.

Key companies active in the Global Baby & Toddlers Carriers & Accessories Market include Ergobaby, Baby K'tan, Infantino, Chicco, Boba, Tushbaby, LennyLamb, Baby Tula, Kinderkraft, Wildbird, Fidella, Be Lenka, Kol Kol Baby Carrier, MaMidea, and Mabe. Companies in the Global Baby & Toddlers Carriers & Accessories Market are reinforcing their market position through continuous product innovation, brand differentiation, and expanded distribution strategies. Many players focus on ergonomic research to improve comfort and safety for both caregivers and children. Design-led development that blends functionality with modern styling is being used to attract fashion-conscious parents. Brands are also strengthening digital presence through direct-to-consumer platforms and targeted marketing campaigns. Strategic partnerships with retailers and parenting communities help expand reach and build trust.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Material

- 2.2.4 Age

- 2.2.5 Carry positions

- 2.2.6 Price

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in working parents & urban lifestyles

- 3.2.1.2 Parental awareness of babywearing benefits

- 3.2.1.3 Focus on ergonomics & comfort

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Safety and compliance concerns

- 3.2.2.2 Quality control and counterfeit products

- 3.2.3 Opportunities

- 3.2.3.1 Accessory innovation

- 3.2.3.2 Tech-integrated products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion)

- 5.1 Key trends

- 5.2 Carrier

- 5.2.1 Soft structured

- 5.2.2 Wrap carriers

- 5.2.3 Sling carriers

- 5.2.4 Backpack carriers

- 5.2.5 Others (Mei-tai carriers etc.)

- 5.3 Accessories

- 5.3.1 Hood

- 5.3.2 Back support

- 5.3.3 Drool pads

- 5.3.4 Shoulder strap protectors

- 5.3.5 Others (storage pouch etc.)

Chapter 6 Market Estimates and Forecast, By Material, 2022 - 2035 (USD Billion)

- 6.1 Key trends

- 6.2 Cotton

- 6.3 Nylon

- 6.4 Linen

- 6.5 Polyester

- 6.6 Others (faux fur, neoprene etc.)

Chapter 7 Market Estimates and Forecast, By Age, 2022 - 2035 (USD Billion)

- 7.1 Key trends

- 7.2 Newborns (0m-5m)

- 7.3 Infants (5m-2y)

- 7.4 Toddler (2y-4y)

Chapter 8 Market Estimates and Forecast, By Carry Positions, 2022 - 2035 (USD Billion)

- 8.1 Key trends

- 8.2 Front facing

- 8.3 Back facing

- 8.4 Hip

Chapter 9 Market Estimates and Forecast, By Price, 2022 - 2035 (USD Billion)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company owned website

- 10.3 Offline

- 10.3.1 Supermarket/hypermarket

- 10.3.2 Specialty stores

- 10.3.3 Others (individual stores, etc.)

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Baby K'tan

- 12.2 Baby Tula

- 12.3 Be Lenka

- 12.4 Boba

- 12.5 Chicco

- 12.6 Ergobaby

- 12.7 Fidella

- 12.8 Infantino

- 12.9 Kinderkraft

- 12.10 Kol Kol Baby Carrier

- 12.11 LennyLamb

- 12.12 Mabe

- 12.13 MaMidea

- 12.14 Tushbaby

- 12.15 Wildbird