|

市場調查報告書

商品編碼

1913451

汽車差速器市場成長機會、成長要素、產業趨勢分析及2026年至2035年預測Automotive Differential Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

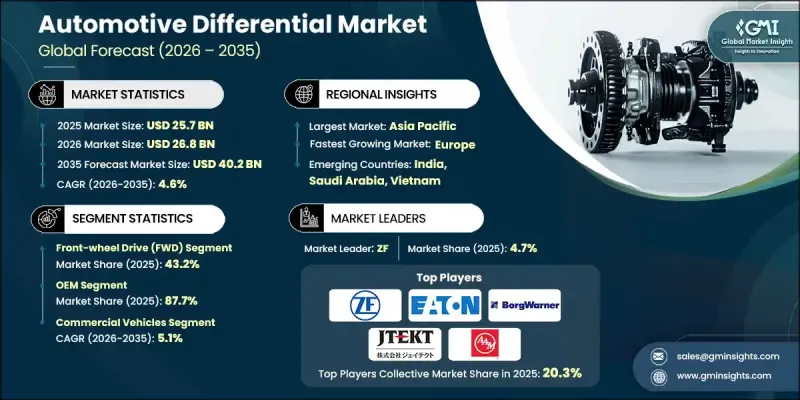

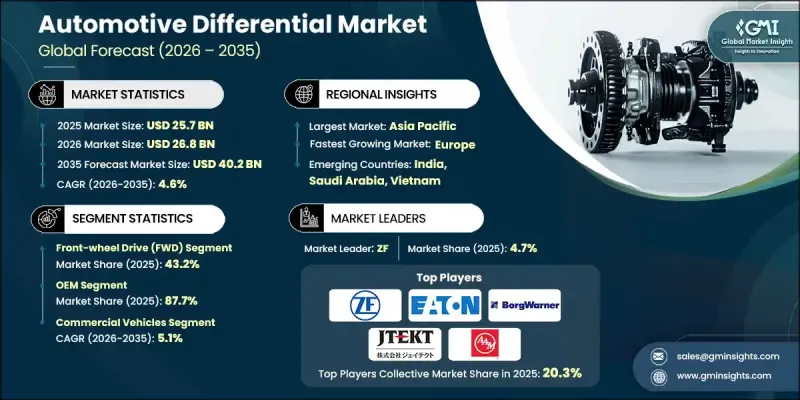

全球汽車差速器市場預計到 2025 年將達到 257 億美元,到 2035 年將達到 402 億美元,年複合成長率為 4.6%。

中產階級消費者可支配收入的增加以及全球汽車產量的成長支撐了市場成長,而這又得益於交通運輸和物流行業的持續擴張。個人出行和貨運需求的成長推動了乘用車和商用車的持續生產,從而直接支撐了對汽車差速器的需求。公共交通系統和物流業務的成長進一步加速了巴士、廂型車和卡車的生產,進一步增強了市場成長勢頭。差速器製造商正在加緊開發針對特定車型的解決方案,以適應不斷變化的動力傳動系統總成架構。電動和混合動力汽車的日益普及促使供應商重新設計和整合差速器系統,以滿足新的動力傳動系統要求。技術進步推動了對電子控制和智慧差速器的日益關注,這些系統能夠改善扭矩分配、牽引力管理和車輛穩定性。隨著車輛系統向軟體主導和感測器整合方向發展,電子控制的先進差速器在各類車輛中的重要性日益凸顯。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 257億美元 |

| 預測金額 | 402億美元 |

| 複合年成長率 | 4.6% |

截至2025年,前輪驅動車型市佔率達43.2%,營收達111億美元。前輪驅動配置因其成本效益高、結構緊湊(將動力傳動系統零件整合於單一總成中)而廣泛應用。這種結構降低了製造複雜性和整車成本,從而幫助其在全球市場廣受歡迎。

2025年,OEM細分市場佔市場佔有率的87.7%,預計到2035年將達到359億美元。由於OEM能夠提供符合整合車輛生產策略和不斷變化的性能要求的高品質、特定應用的零件,因此它們仍然是差速器供應的主要來源。

美國汽車差速器市場預計到2025年將達到38.3億美元。汽車製造業活動的增加以及汽車製造商與零件供應商之間合作的加強推動了市場成長。由於內部生產成本高昂,汽車製造商紛紛與專業的差速器製造商合作,以滿足其客製化的傳動系統需求。

目錄

第1章調查方法

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 成本結構

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 全球汽車產量增加

- 對SUV和四輪傳動車的需求不斷成長

- 越野和休閒車市場成長

- 商用車越來越受歡迎

- 產業潛在風險與挑戰

- 車輛重量和包裝限制

- 設計和維護的複雜性

- 市場機遇

- 電動車中電動差速器的普及率越來越高

- 高性能差速器的售後市場需求不斷成長

- 新興汽車市場的成長

- 開發輕巧小巧的差速器解決方案

- 促進要素

- 成長潛力分析

- 監管環境

- 北美洲

- 美國汽車工程師協會 (SAE)

- FMVSS(聯邦機動車輛安全標準 - NHTSA)

- ASTM International

- CSA集團

- 歐洲

- 聯合國歐洲經濟委員會(UNECE)條例(ECE)

- ISO(國際標準化組織)

- EN標準(CEN)

- TUV標準與認證

- 亞太地區

- JIS(日本工業標準)

- GB/T標準(中國)

- AIS(印度汽車工業標準)

- 拉丁美洲

- ABNT 標準(巴西)

- NOM標準(墨西哥)

- IRAM 標準(阿根廷)

- 中東和非洲

- 波灣合作理事會(GSO)標準

- SASO標準(沙烏地阿拉伯)

- 南非標準局 (SABS)

- 北美洲

- 波特五力分析

- PESTEL 分析

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 生產統計

- 生產基地

- 消費基礎

- 出口和進口

- 成本細分分析

- 永續性和環境影響

- 環境影響評估

- 社會影響力和社區服務

- 公司管治與企業社會責任

- 永續金融與投資趨勢

- 電氣化影響評估

- 電動車差速器的設計差異

- 電子橋接器整合趨勢

- 電動車中的扭力向量控制

- 傳統製造商轉型面臨的挑戰

- 性能和效率基準

- 按類型分類的差異化效率等級

- 耐久性和壽命分析

- 噪音、振動和聲振粗糙度 (NVH) 性能

- 溫度控管能力

- 案例研究

- 未來前景與機遇

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 企業擴張計畫和資金籌措

第5章 依車輛類型分類的市場估計與預測,2022-2035年

- 開放式差速器

- 限滑差速器(LSD)

- 電子控制限滑差速器(ELSD)

- 差速鎖

- 手動鎖(駕駛員操作)

- 自動鎖定機構(偵測車輪打滑)

- 扭力差速器

第6章 按組件分類的市場估算與預測,2022-2035年

- 差速器

- 差速器殼體

- 軸承和密封件

- 電子控制零件

第7章 依車輛類型分類的市場估計與預測,2022-2035年

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型商用車(LCV)

- MCV

- 重型商用車(HCV)

第8章 按驅動類型分類的市場估算與預測,2022-2035年

- 前輪驅動(FWD)

- 後輪驅動(RWD)

- 全輪驅動(AWD)/四輪驅動(4WD)

9. 2022-2035年按推進方式分類的市場估計與預測

- 內燃機(ICE)

- 電動車(EV)

- 混合

第10章 依銷售管道分類的市場估計與預測,2022-2035年

- OEM

- 售後市場

第11章 2022-2035年各地區市場估計與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 比荷盧經濟聯盟

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ANZ

- 新加坡

- 馬來西亞

- 印尼

- 越南

- 泰國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- 世界公司

- ZF

- American Axle &Manufacturing(AAM)

- Dana

- BorgWarner

- GKN Automotive

- Eaton

- JTEKT

- Linamar

- Schaeffler

- Magna

- Hyundai Mobis

- Meritor(Cummins)

- Continental

- NSK

- 本地公司

- Bharat Gears

- Neapco

- Huayu Automotive Systems

- Tata Motors

- Sona Comstar

- AmTech

- Univance

- 新興企業

- Auburn Gear

- Drexler Automotive

- RT Quaife

- Xtrac

The Global Automotive Differential Market was valued at USD 25.7 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 40.2 billion by 2035.

Market growth is supported by rising global vehicle production, driven by higher disposable income levels among middle-class consumers and continued expansion within the transportation and logistics sectors. Increasing demand for personal mobility and freight movement is contributing to sustained production of both passenger and commercial vehicles, which directly supports demand for automotive differentials. Growth in public transportation systems and logistics operations has further accelerated manufacturing of buses, vans, and trucks, strengthening market momentum. Differential manufacturers are increasingly developing vehicle-specific solutions to align with changing powertrain architectures. The growing presence of electric and hybrid vehicles is encouraging suppliers to redesign and integrate differential systems suited to new drivetrain requirements. Technology advancement is shifting focus toward electronically controlled and smart differential systems that enhance torque distribution, traction management, and vehicle stability. As vehicle systems become more software-driven and sensor-integrated, electronically advanced differentials are gaining greater relevance across multiple vehicle categories.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $25.7 Billion |

| Forecast Value | $40.2 Billion |

| CAGR | 4.6% |

The front-wheel drive segment held 43.2% share and generated USD 11.1 billion in 2025. Front-wheel drive configurations are widely adopted due to their cost efficiency and compact design, where power delivery components are integrated into a single assembly. This structure reduces manufacturing complexity and overall vehicle cost, supporting widespread use across global markets.

The original equipment manufacturer segment accounted for 87.7% share in 2025 and is expected to reach USD 35.9 billion by 2035. OEMs remain the primary channel for differential supply due to their ability to deliver high-quality, application-specific components that align with integrated vehicle production strategies and evolving performance requirements.

U.S. Automotive Differential Market reached USD 3.83 billion in 2025. Market growth is supported by rising vehicle production activity and increasing collaboration between automakers and component suppliers. High manufacturing costs associated with in-house production are encouraging OEMs to partner with specialized differential manufacturers to meet customized drivetrain needs.

Key companies operating in the Global Automotive Differential Market include Dana, ZF, Magna, Eaton, BorgWarner, GKN Automotive, Schaeffler, American Axle & Manufacturing, Linamar, and JTEKT. Companies active in the Global Automotive Differential Market are strengthening their market position through technology innovation, strategic partnerships, and platform-specific product development. Many manufacturers are investing in advanced differential technologies that improve efficiency, durability, and electronic control compatibility. Collaboration with vehicle OEMs is being prioritized to co-develop integrated drivetrain solutions tailored to evolving powertrain architectures. Firms are expanding their global manufacturing footprint to serve regional markets more efficiently and reduce supply chain risks. Emphasis on lightweight materials and precision engineering is helping improve performance and fuel efficiency.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Differential

- 2.2.3 Component

- 2.2.4 Vehicle

- 2.2.5 Drive

- 2.2.6 Propulsion

- 2.2.7 Sales Channel

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global vehicle production

- 3.2.1.2 Growing demand for SUVs and all-wheel drive vehicles

- 3.2.1.3 Growth in off-road and recreational vehicle segment

- 3.2.1.4 Increasing penetration of commercial vehicles

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Weight and packaging constraints in vehicles

- 3.2.2.2 Complexity in design and maintenance

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of electric differentials in EVs

- 3.2.3.2 Increasing aftermarket demand for performance differentials

- 3.2.3.3 Growth in emerging automotive markets

- 3.2.3.4 Development of lightweight and compact differential solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 SAE (Society of Automotive Engineers)

- 3.4.1.2 FMVSS (Federal Motor Vehicle Safety Standards - NHTSA)

- 3.4.1.3 ASTM International

- 3.4.1.4 CSA Group

- 3.4.2 Europe

- 3.4.2.1 UNECE Regulations (ECE)

- 3.4.2.2 ISO (International Organization for Standardization)

- 3.4.2.3 EN Standards (CEN)

- 3.4.2.4 TUV Standards/Certifications

- 3.4.3 Asia Pacific

- 3.4.3.1 JIS (Japanese Industrial Standards)

- 3.4.3.2 GB/T Standards (China)

- 3.4.3.3 AIS (Automotive Industry Standards - India)

- 3.4.4 Latin America

- 3.4.4.1 ABNT Standards (Brazil)

- 3.4.4.2 NOM Standards (Mexico)

- 3.4.4.3 IRAM Standards (Argentina)

- 3.4.5 Middle East & Africa

- 3.4.5.1 GSO Standards (Gulf Cooperation Council)

- 3.4.5.2 SASO Standards (Saudi Arabia)

- 3.4.5.3 SABS Standards (South Africa)

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Sustainability and environmental impact

- 3.11.1 Environmental impact assessment

- 3.11.2 Social impact & community benefits

- 3.11.3 Governance & corporate responsibility

- 3.11.4 Sustainable finance & investment trends

- 3.12 Electrification impact assessment

- 3.12.1 EV differential design differences

- 3.12.2 E-axle integration trends

- 3.12.3 Torque vectoring in EVs

- 3.12.4 Transition challenges for traditional manufacturers

- 3.13 Performance & efficiency benchmarking

- 3.13.1 Differential efficiency ratings by type

- 3.13.2 Durability and lifespan analysis

- 3.13.3 Noise, vibration, and harshness (NVH) performance

- 3.13.4 Thermal management capabilities

- 3.14 Case studies

- 3.15 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Differential, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Open differential

- 5.3 Limited-slip differential (LSD)

- 5.4 Electronic limited-slip differential (ELSD)

- 5.5 Locking differential

- 5.5.1 Manual Locking (Driver-activated)

- 5.5.2 Automatic Locking (Sensing wheel slip)

- 5.6 Torque differential

Chapter 6 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Differential Gears

- 6.3 Differential Case/Housing

- 6.4 Bearings & Seals

- 6.5 Electronic Control Components

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

Chapter 8 Market Estimates & Forecast, By Drive, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Front-wheel drive (FWD)

- 8.3 Rear-wheel drive (RWD)

- 8.4 All-wheel drive (AWD)/Four-wheel drive (4WD)

Chapter 9 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 ICE

- 9.3 EV

- 9.4 Hybrid

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Singapore

- 11.4.7 Malaysia

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.4.10 Thailand

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global companies

- 12.1.1 ZF

- 12.1.2 American Axle & Manufacturing (AAM)

- 12.1.3 Dana

- 12.1.4 BorgWarner

- 12.1.5 GKN Automotive

- 12.1.6 Eaton

- 12.1.7 JTEKT

- 12.1.8 Linamar

- 12.1.9 Schaeffler

- 12.1.10 Magna

- 12.1.11 Hyundai Mobis

- 12.1.12 Meritor (Cummins)

- 12.1.13 Continental

- 12.1.14 NSK

- 12.2 Regional companies

- 12.2.1 Bharat Gears

- 12.2.2 Neapco

- 12.2.3 Huayu Automotive Systems

- 12.2.4 Tata Motors

- 12.2.5 Sona Comstar

- 12.2.6 AmTech

- 12.2.7 Univance

- 12.3 Emerging companies

- 12.3.1 Auburn Gear

- 12.3.2 Drexler Automotive

- 12.3.3 RT Quaife

- 12.3.4 Xtrac