|

市場調查報告書

商品編碼

1913354

車載支付服務市場機會、成長要素、產業趨勢分析及2026年至2035年預測In-Vehicle Payment Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

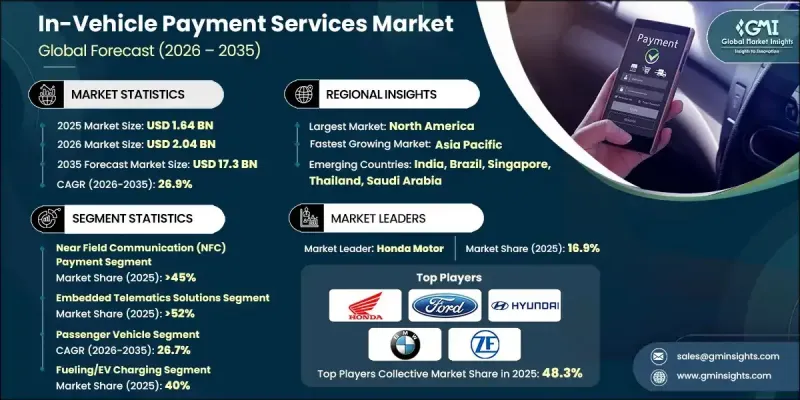

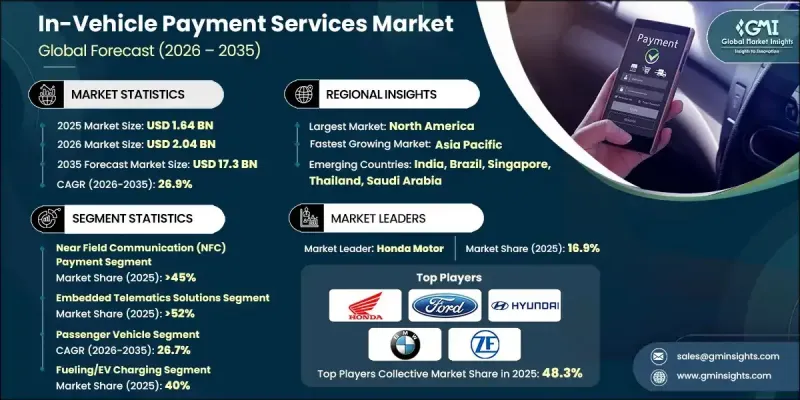

全球車載支付服務市場預計到 2025 年將達到 16.4 億美元,到 2035 年將達到 173 億美元,年複合成長率為 26.9%。

市場發展勢頭強勁,這主要得益於人們對出行相關活動中無縫、非接觸式數位交易日益成長的偏好,促使汽車製造商和出行服務供應商將安全支付功能直接嵌入車輛。聯網汽車平台憑藉先進的資訊娛樂和遠端資訊處理架構的快速發展,為整合支付功能和即時交易處理奠定了堅實的基礎。消費者對數位錢包和無現金支付解決方案的日益依賴,進一步加速了車輛系統與更廣泛的金融生態系統之間的兼容性。汽車製造商正積極與金融機構、支付處理商和科技公司合作,以簡化開發週期、滿足監管要求,並從互聯服務中挖掘新的商機。同時,物聯網、人工智慧和高速連接等先進技術的整合,正在增強車輛、支付基礎設施和服務平台之間的通訊,從而提高車載商務解決方案的可擴展性和可靠性。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 16.4億美元 |

| 預測金額 | 173億美元 |

| 複合年成長率 | 26.9% |

到 2025 年,近距離場通訊 (NFC) 支付領域將佔 45% 的佔有率,預計到 2035 年將達到 87 億美元。非接觸式支付方式的廣泛採用以及與車輛硬體生態系統日益增強的整合正在推動這一領域的發展。

預計到 2025 年,嵌入式遠端資訊處理解決方案將佔 52% 的市場佔有率,並創造 8.529 億美元的收入。這些解決方案的價值在於能夠實現安全的本地支付功能,同時還能增強資料所有權、提高系統可靠性和實現長期業務收益。

美國車載支付服務市場預計到 2025 年將達到 6.531 億美元,並預計到 2035 年將保持強勁成長。市場擴張的驅動力是聯網汽車的普及和對便利數位支付體驗的強烈需求。

目錄

第1章調查方法

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率分析

- 成本結構

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 非接觸式支付需求不斷成長

- 聯網汽車滲透率成長

- 擴展數位錢包生態系統

- OEM廠商與金融科技夥伴關係

- 擴大電動車的使用範圍並改善充電基礎設施

- 產業潛在風險與挑戰

- 網路安全和資料隱私問題

- 高昂的系統整合和合規成本

- 市場機遇

- 擴大電動車充電支付整合

- 車隊和商用車支付自動化發展

- 開發個人化的車用商務服務

- 推出生物識別和語音支付認證

- 成長潛力分析

- 監管環境

- 北美洲

- 美國:車載支付處理安全標準 (PCI DSS)

- 加拿大:《個人資訊保護和電子文件法》(PIPEDA) 規範支付和使用者資料保護。

- 歐洲

- 英國:車上數位支付符合英國GDPR和PCI DSS標準

- 德國:嵌入式支付系統的GDPR和ISO/IEC 27001資訊安全控制

- 法國:PSD2(支付服務指令),旨在保障安全的電子支付和車載支付。

- 義大利:數位和嵌入式付款管道的PSD2和GDPR合規框架

- 西班牙:車載支付資料安全方面的 GDPR 和 PCI DSS 要求

- 亞太地區

- 中國:《個人資訊保護法》規範聯網汽車與車載支付數據

- 日本:《汽車支付資料安全個人資訊保護法》(APPI)

- 印度:適用於車載支付服務的印度儲備銀行數位支付安全指南

- 拉丁美洲

- 巴西:車載和聯網支付系統中的通用資料保護法 (LGPD)

- 墨西哥:《個人資料保護法》(LFPDPPP),該法規範汽車數位支付

- 阿根廷:與車載付款管道相關的個人資料保護法(第25326號法律)

- 中東和非洲

- 阿拉伯聯合大公國:阿拉伯聯合大公國資料保護條例和嵌入式支付服務支付卡產業資料安全標準 (PCI DSS)

- 南非:《個人資訊保護法》(POPIA) 對聯網汽車支付資料的影響

- 沙烏地阿拉伯:沙烏地阿拉伯資料與人工智慧管理局 (SDAIA) 車載支付系統資料保護條例

- 北美洲

- 波特五力分析

- PESTEL 分析

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 成本細分分析

- 開發成本結構

- 研發成本分析

- 行銷和銷售成本

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 未來市場展望與機遇

- OEM貨幣化與經營模式分析

- 直接交易收入模式(收入分成,基於商家折扣率)

- 基於訂閱的車載商務模式

- 平台和生態系統貨幣化(應用商店、市場)

- 數據驅動的獲利機會(使用、行為分析)

- OEM vs. 金融科技 vs. 支付網路 所得所有權

- OEM整合與實施框架

- 生態系動態與策略控制點

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 企業擴張計畫和資金籌措

第5章 依支付方式分類的市場估算與預測,2022-2035年

- 近距離場通訊 (NFC) 支付

- 基於QR碼的支付

- 嵌入式錢包

- 其他

第6章 按技術分類的市場估計與預測,2022-2035年

- 嵌入式車載資訊服務解決方案

- 基於行動應用程式的整合

- 基於雲端的付款管道

第7章 依車輛類型分類的市場估計與預測,2022-2035年

- 搭乘用車

- SUV

- 轎車

- 掀背車

- 商用車輛

- 輕型商用車(LCV)

- MCV

- 重型商用車(HCV)

第8章 按應用領域分類的市場估算與預測,2022-2035年

- 加油/電動車充電

- 智慧停車

- 電子收費系統

- 電子商務

- 其他

第9章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 葡萄牙

- 克羅埃西亞

- 比荷盧經濟聯盟

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 泰國

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

第10章:公司簡介

- 世界玩家

- Amazon Web Services

- Ford Motor Company

- Hyundai Motor Company

- IBM

- Mastercard

- PayPal

- Shell

- Visa

- Volkswagen

- BMW

- Jaguar Land Rover Automotive

- ParkMobile

- ZF

- 區域玩家

- General Motors Company

- Honda Motor

- Daimler/Mercedes-Benz

- Toyota Motor

- Telenav

- Parkopedia

- CarPay Diem/Kwalyo

- SiriusXM Connected Vehicle

- Gentex

- Thales

- Emerging/Disruptor Players

- Car IQ Pay

- Cerence

- PayByCar

- Verra Mobility

- Apple

- Samsung Electronics

- Parkwhiz

- Xevo

The Global In-Vehicle Payment Services Market was valued at USD 1.64 billion in 2025 and is estimated to grow at a CAGR of 26.9% to reach USD 17.3 billion by 2035.

Market momentum is driven by the growing preference for seamless and contactless digital transactions across mobility-related activities, encouraging automakers and mobility service providers to embed secure payment functionality directly into vehicles. The rapid expansion of connected vehicle platforms equipped with sophisticated infotainment and telematics architectures is creating a robust base for integrated payment capabilities and real-time transaction processing. Increasing consumer reliance on digital wallets and cashless payment solutions is further accelerating compatibility between vehicle systems and broader financial ecosystems. Automakers are actively partnering with financial institutions, payment processors, and technology firms to streamline development cycles, address regulatory requirements, and unlock new revenue opportunities from connected services. In parallel, the integration of advanced technologies such as IoT, AI, and high-speed connectivity is enhancing communication between vehicles, payment infrastructure, and service platforms, reinforcing the scalability and reliability of in-vehicle commerce solutions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.64 Billion |

| Forecast Value | $17.3 Billion |

| CAGR | 26.9% |

In 2025, the near field communication payment segment held 45% share and is forecast to reach USD 8.7 billion by 2035. Adoption is supported by widespread acceptance of contactless payment methods and increasing integration within vehicle hardware ecosystems.

The embedded telematics solutions segment held 52% share in 2025 and generated USD 852.9 million. These solutions are favored for enabling secure, native payment functionality while improving data ownership, system reliability, and long-term service monetization.

U.S. In-Vehicle Payment Services Market reached USD 653.1 million in 2025 and is expected to record strong growth through 2035. Market expansion is supported by high penetration of connected vehicles and strong demand for convenience-oriented digital payment experiences.

Key companies operating in the Global In-Vehicle Payment Services Market include Volkswagen, PayPal, BMW, ZF, Ford Motor Company, Shell, Hyundai Motor, Jaguar Land Rover Automotive, Honda Motor, and ParkMobile. Companies in the In-Vehicle Payment Services Market are focusing on strategic partnerships to strengthen ecosystem integration and accelerate solution deployment. Collaboration with financial institutions, fintech providers, and mobility service platforms allows players to ensure regulatory compliance while expanding transaction coverage. Many firms are investing in cybersecurity, tokenization, and data encryption to enhance trust and protect user information. Continuous software innovation and over-the-air update capabilities are being leveraged to improve functionality and scalability. Market participants are also prioritizing user-centric interface design to improve adoption and engagement.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Payment mode

- 2.2.3 Technology

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook & strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising demand for contactless payments

- 3.2.1.3 Growth of connected vehicle penetration

- 3.2.1.4 Expansion of digital wallet ecosystems

- 3.2.1.5 OEM-fintech partnerships

- 3.2.1.6 Increase in EV adoption and charging infrastructures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Cybersecurity and data privacy concerns

- 3.2.2.2 High system integration and compliance costs

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of EV charging payment integration

- 3.2.3.2 Growth of fleet and commercial vehicle payment automation

- 3.2.3.3 Development of personalized in-car commerce services

- 3.2.3.4 Adoption of biometric and voice-enabled payment authentication

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 United States: PCI DSS (Payment Card Industry Data Security Standard) for secure in-vehicle payment processing

- 3.4.1.2 Canada: PIPEDA (Personal Information Protection and Electronic Documents Act) governing payment and user data protection

- 3.4.2 Europe

- 3.4.2.1 United Kingdom: UK GDPR and PCI DSS compliance for in-vehicle digital payments

- 3.4.2.2 Germany: GDPR and ISO/IEC 27001 information security management for embedded payment systems

- 3.4.2.3 France: PSD2 (Revised Payment Services Directive) for secure electronic and in-vehicle payments

- 3.4.2.4 Italy: PSD2 and GDPR compliance framework for digital and embedded payment platforms

- 3.4.2.5 Spain: GDPR and PCI DSS requirements for in-vehicle payment data security

- 3.4.3 Asia Pacific

- 3.4.3.1 China: PIPL (Personal Information Protection Law) regulating connected vehicle and in-vehicle payment data

- 3.4.3.2 Japan: APPI (Act on the Protection of Personal Information) for automotive payment data security

- 3.4.3.3 India: RBI digital payment security guidelines applicable to in-vehicle payment services

- 3.4.4 Latin America

- 3.4.4.1 Brazil: LGPD (Lei Geral de Protecao de Dados) for in-vehicle and connected payment systems

- 3.4.4.2 Mexico: Federal Law on Protection of Personal Data (LFPDPPP) governing automotive digital payments

- 3.4.4.3 Argentina: Personal Data Protection Law (Law No. 25,326) relevant to in-vehicle payment platforms

- 3.4.5 Middle East & Africa

- 3.4.5.1 United Arab Emirates: UAE data protection regulations and PCI DSS for embedded payment services

- 3.4.5.2 South Africa: POPIA (Protection of Personal Information Act) for connected vehicle payment data

- 3.4.5.3 Saudi Arabia: Saudi Data and AI Authority (SDAIA) data protection regulations for in-vehicle payment systems

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Development cost structure

- 3.8.2 R&D cost analysis

- 3.8.3 Marketing & sales costs

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.11 Future market outlook & opportunities

- 3.12 OEM Monetization & Business Model Analysis

- 3.12.1 Direct transaction revenue models (revenue share, MDR-based)

- 3.12.2 Subscription-based in-vehicle commerce models

- 3.12.3 Platform and ecosystem monetization (app stores, marketplaces)

- 3.12.4 Data-driven monetization opportunities (usage, behavioral insights)

- 3.12.5 OEM vs fintech vs payment network revenue ownership

- 3.13 OEM Integration & Deployment Framework

- 3.14 Ecosystem Power Dynamics & Strategic Control Points

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Payment mode, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Near Field Communication (NFC) Payments

- 5.3 QR Code-Based Payments

- 5.4 Embedded Wallets

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Embedded Telematics Solutions

- 6.3 Mobile Application-Based Integration

- 6.4 Cloud-Based Payment Platforms

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicle

- 7.2.1 SUV

- 7.2.2 Sedan

- 7.2.3 Hatchback

- 7.3 Commercial vehicle

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Fueling/EV Charging

- 8.3 Smart Parking

- 8.4 Automated Toll Payments

- 8.5 E-commerce

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Portugal

- 9.3.9 Croatia

- 9.3.10 Benelux

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Singapore

- 9.4.7 Thailand

- 9.4.8 Indonesia

- 9.4.9 Vietnam

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Turkey

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Amazon Web Services

- 10.1.2 Ford Motor Company

- 10.1.3 Hyundai Motor Company

- 10.1.4 IBM

- 10.1.5 Mastercard

- 10.1.6 PayPal

- 10.1.7 Shell

- 10.1.8 Visa

- 10.1.9 Volkswagen

- 10.1.10 BMW

- 10.1.11 Jaguar Land Rover Automotive

- 10.1.12 ParkMobile

- 10.1.13 ZF

- 10.2 Regional Players

- 10.2.1 General Motors Company

- 10.2.2 Honda Motor

- 10.2.3 Daimler / Mercedes-Benz

- 10.2.4 Toyota Motor

- 10.2.5 Telenav

- 10.2.6 Parkopedia

- 10.2.7 CarPay Diem / Kwalyo

- 10.2.8 SiriusXM Connected Vehicle

- 10.2.9 Gentex

- 10.2.10 Thales

- 10.3 Emerging / Disruptor Players

- 10.3.1 Car IQ Pay

- 10.3.2 Cerence

- 10.3.3 PayByCar

- 10.3.4 Verra Mobility

- 10.3.5 Apple

- 10.3.6 Samsung Electronics

- 10.3.7 Parkwhiz

- 10.3.8 Xevo