|

市場調查報告書

商品編碼

1913334

食品包埋市場機會、成長要素、產業趨勢分析及預測(2026年至2035年)Food Encapsulation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

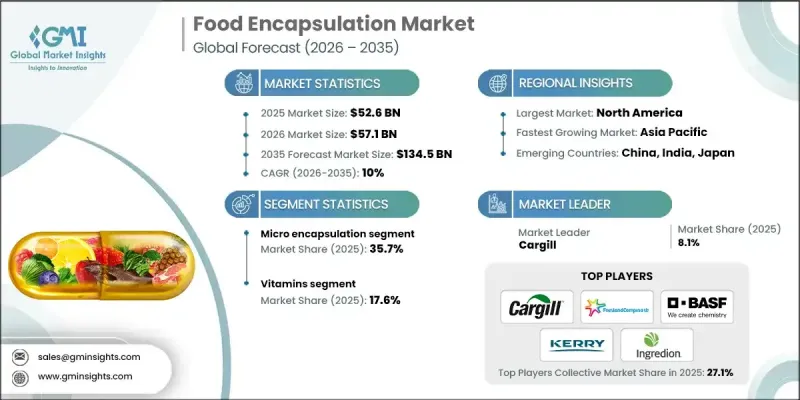

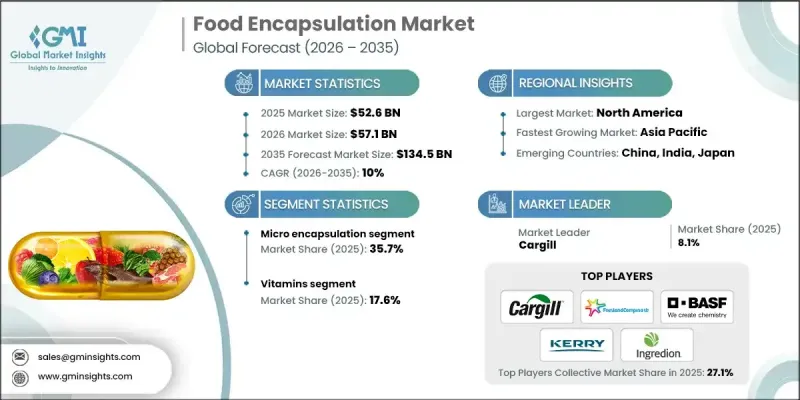

全球食品包埋市場預計到 2025 年將達到 526 億美元,預計到 2035 年將達到 1,345 億美元,年複合成長率為 10%。

市場成長主要得益於食品生產商致力於提升產品穩定性、感官品質和營養價值,從而推動了包埋技術在多個食品類別中的廣泛應用。包埋技術正日益應用於改善食品的視覺吸引力、風味保持性和口感一致性,進而提升消費者對包裝食品的接受度。甜味劑配方中包埋成分的日益普及,以及對成分創新和食品保藏研究的持續投入,都促進了包埋技術的廣泛應用。消費者營養意識的不斷提高,以及對強化食品和增值食品需求的成長,持續推動市場擴張。保護敏感和易揮發性食品成分的需求,推動了對先進包埋解決方案的需求。現代保藏技術的快速發展,進一步提升了成分保護效果和延長了保存期限。同時,緩釋機制的進步,也為那些希望透過增強產品功能和健康益處來實現差異化生產的生產商創造了極具吸引力的成長機會。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 526億美元 |

| 預測金額 | 1345億美元 |

| 複合年成長率 | 10% |

由於保護性塗層技術在保護敏感成分方面的有效性以及其在各種食品配方中的適應性,微膠囊化領域在 2025 年將佔據 35.7% 的市場佔有率。

到 2025 年,維生素細分市場將佔 17.6% 的市場佔有率,這主要得益於人們對營養強化和維生素在維持長期健康和生理功能方面的作用日益成長的興趣。

到 2025 年,北美食品封裝市場將佔據 36.6% 的市場佔有率,這得益於成熟的包裝食品行業、豐富的封裝材料供應以及先進保鮮技術的持續應用。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 產業潛在風險與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特五力分析

- PESTEL 分析

- 價格趨勢

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 專利狀態

- 貿易統計(HS編碼)

(註:貿易統計數據僅涵蓋主要國家。)

- 主要進口國

- 主要出口國

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 業務拓展計劃

第5章 按類型分類的市場估算與預測,2022-2035年

- 微膠囊化

- 奈米封裝

- 混合技術

- 大分子膠囊化

第6章 2022-2035年核心階段市場估算與預測

- 維他命

- 脂溶性維生素

- 維生素A

- 維生素D

- 維生素E

- 維生素K

- 水溶性維生素

- 維生素B族

- 維生素C

- 脂溶性維生素

- 有機酸

- 檸檬酸

- 乳酸

- 富馬酸

- 蘋果酸

- 其他

- 礦物

- 酵素

- 香精和香精

- 防腐劑

- 甜味劑

- 色素

- 益生元

- 益生菌

- 精油

- 其他

第7章 按技術分類的市場估計與預測,2022-2035年

- 物理過程

- 噴

- 噴霧乾燥

- 噴霧冷卻

- 旋轉圓盤

- 擠出法

- 流體化床技術

- 其他

- 噴

- 化學和物理化學過程

第8章 按外殼材料的市場估算與預測,2022-2035年

- 多醣

- 蛋白質

- 脂質

- 乳化劑

- 其他

第9章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

第10章:公司簡介

- Cargill

- FrieslandCampina Kievit

- Royal DSM

- BASF SE

- Kerry Group

- Ingredion Incorporated

- Lycored Group

- International Flavours &Fragrances Inc.(IFF)

- Symrise AG

- Sensient Technologies Corporation

- Balchem Corporation

- Firmenich SA

- AVEKA Group

The Global Food Encapsulation Market was valued at USD 52.6 billion in 2025 and is estimated to grow at a CAGR of 10% to reach USD 134.5 billion by 2035.

Market growth is fueled by the widening use of encapsulation across multiple food categories, as manufacturers focus on enhancing product stability, sensory quality, and nutritional value. Encapsulation technologies are increasingly applied to improve visual appeal, flavor retention, and taste consistency, which supports stronger consumer acceptance of packaged foods. Rising utilization of encapsulated ingredients in sweetener formulations is contributing to broader adoption, supported by continuous investments in ingredient innovation and food preservation research. Growing consumer awareness regarding nutrition, combined with higher demand for fortified and value-added food products, continues to support market expansion. The need to safeguard sensitive and volatile food components has strengthened demand for advanced encapsulation solutions. Rapid adoption of modern preservation techniques is further improving ingredient protection and shelf-life performance. At the same time, advancements in controlled-release mechanisms are creating attractive growth opportunities for producers seeking to differentiate their offerings through functional performance and enhanced health benefits.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $52.6 Billion |

| Forecast Value | $134.5 Billion |

| CAGR | 10% |

The microencapsulation segment accounted for 35.7% share in 2025, supported by its effectiveness in protecting sensitive ingredients through protective coating methods and its adaptability across diverse food formulations.

The vitamins segment held 17.6% share in 2025, driven by rising interest in nutritional enrichment and the role of vitamins in supporting long-term health and physiological functions.

North America Food Encapsulation Market held 36.6% share in 2025, supported by a mature packaged food industry, strong availability of encapsulation materials, and ongoing adoption of advanced preservation technologies.

Key companies operating in the Global Food Encapsulation Market include Ingredion Incorporated, Kerry Group, Symrise AG, Balchem Corporation, Cargill, Sensient Technologies Corporation, International Flavours & Fragrances Inc. (IFF), FrieslandCampina Kievit, BASF SE, Lycored Group, AVEKA Group, Royal DSM, and Firmenich SA. Companies in the Global Food Encapsulation Market are reinforcing their market position by investing heavily in research and development to improve encapsulation efficiency, stability, and controlled-release performance. Strategic partnerships with food manufacturers allow suppliers to co-develop customized solutions tailored to specific formulation needs. Expansion of production capacities and geographic presence helps companies meet rising global demand while improving supply reliability. Firms are also focusing on clean-label and health-oriented innovations to align with evolving consumer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Core phase

- 2.2.4 Technology

- 2.2.5 Shell material

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2022-2035 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Micro encapsulation

- 5.3 Nano encapsulation

- 5.4 Hybrid technology

- 5.5 Macro encapsulation

Chapter 6 Market Estimates and Forecast, By Core Phase, 2022-2035 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 Vitamins

- 6.2.1 Fat soluble vitamins

- 6.2.1.1 Vitamin A

- 6.2.1.2 Vitamin D

- 6.2.1.3 Vitamin E

- 6.2.1.4 Vitamin K

- 6.2.2 Water soluble vitamins

- 6.2.2.1 Vitamin B complex

- 6.2.2.2 Vitamin C

- 6.2.1 Fat soluble vitamins

- 6.3 Organic acids

- 6.3.1 Citric acid

- 6.3.2 Lactic acid

- 6.3.3 Fumaric acid

- 6.3.4 Malic acid

- 6.3.5 Others

- 6.4 Minerals

- 6.5 Enzymes

- 6.6 Flavors & essences

- 6.7 Preservatives

- 6.8 Sweeteners

- 6.9 Colors

- 6.10 Prebiotics

- 6.11 Probiotics

- 6.12 Essential oils

- 6.13 Others

Chapter 7 Market Estimates and Forecast, By Technology, 2022-2035 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 Physical process

- 7.2.1 Atomization

- 7.2.1.1 Spray drying

- 7.2.1.2 Spray chilling

- 7.2.1.3 Spinning disk

- 7.2.2 Extrusion

- 7.2.3 Fluid bed technique

- 7.2.4 Others

- 7.2.1 Atomization

- 7.3 Chemical & physicochemical process

Chapter 8 Market Estimates and Forecast, By Shell Material, 2022-2035 (USD Billion & Tons)

- 8.1 Key trends

- 8.2 Polysaccharides

- 8.3 Proteins

- 8.4 Lipids

- 8.5 Emulsifiers

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion & Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Cargill

- 10.2 FrieslandCampina Kievit

- 10.3 Royal DSM

- 10.4 BASF SE

- 10.5 Kerry Group

- 10.6 Ingredion Incorporated

- 10.7 Lycored Group

- 10.8 International Flavours & Fragrances Inc. (IFF)

- 10.9 Symrise AG

- 10.10 Sensient Technologies Corporation

- 10.11 Balchem Corporation

- 10.12 Firmenich SA

- 10.13 AVEKA Group