|

市場調查報告書

商品編碼

1892905

影像感測器市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Image Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

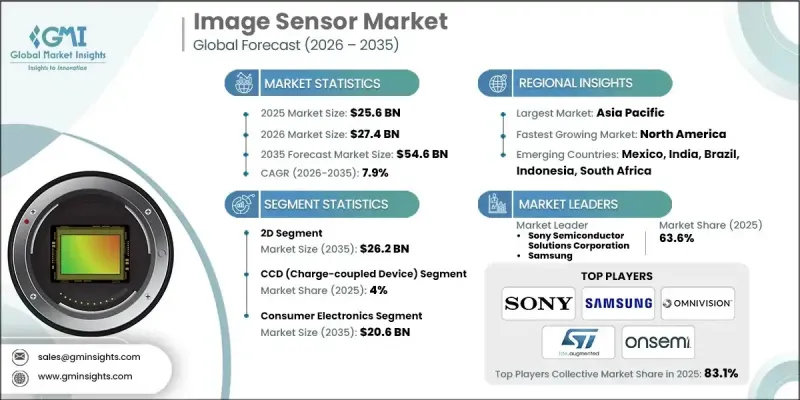

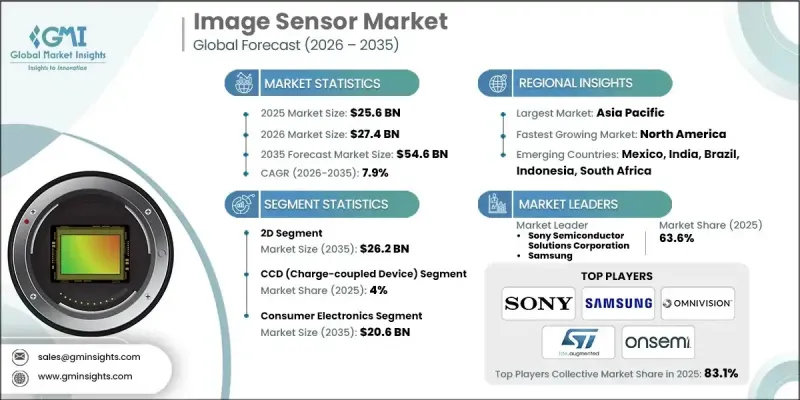

2025 年全球影像感測器市場價值為 256 億美元,預計到 2035 年將以 7.9% 的複合年成長率成長至 546 億美元。

CMOS技術的進步以及汽車、消費性電子、工業物聯網和醫療保健等領域對影像感測器的需求不斷成長,正推動市場的擴張。醫療影像透過提高診斷準確率、增強影像效果和改善病患護理,成為推動市場成長的主要動力。人工智慧與影像感測器的融合有望革新運算攝影和即時分析技術,提升低光源性能、目標偵測能力和感測器整體效率。汽車ADAS、智慧型設備和工業自動化領域對影像感測器的日益普及,進一步促進了市場成長,同時製造商也致力於研發更小巧、更強大、更具備人工智慧功能的感測器,以滿足多樣化的應用需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 256億美元 |

| 預測值 | 546億美元 |

| 複合年成長率 | 7.9% |

預計到2035年,2D影像感測器市場規模將達到262億美元。由於其成本效益高、解析度高和相容性廣,2D成像技術在監控系統、智慧型手機和車載攝影機等領域仍廣泛應用。 HDR、先進的影像處理和低光照性能的整合進一步增強了其在多個行業的適用性。

預計到2025年,CCD(電荷耦合元件)感測器市場佔有率將達到4%。由於其卓越的穩定性、低雜訊和動態範圍,CCD感測器在高精度工業、醫療和科學成像應用中仍備受青睞。儘管CMOS感測器在主流應用中佔據主導地位,但CCD感測器在一些高精度應用領域仍然至關重要。

預計到2025年,美國影像感測器市場規模將達到36億美元。汽車ADAS系統、人工智慧攝影機和工業自動化是推動市場成長的主要動力。半導體研發和製造領域的大量投資為創新提供了支持,製造商優先研發高解析度、整合人工智慧的感測器,以滿足汽車、工業和消費電子等行業的國內需求。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- CMOS技術的進步

- 汽車影像感測器需求不斷成長

- 消費性電子產品需求不斷成長

- 工業和物聯網應用的成長

- 醫療保健和醫學影像應用

- 產業陷阱與挑戰

- 成本和定價壓力

- 供應鏈中斷和半導體短缺

- 市場機遇

- 人工智慧和機器視覺整合的進展

- 新興的LiDAR與3D感測應用

- 小型化和低功耗感測器開發

- AR/VR 和元宇宙應用領域的擴展

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 新興商業模式

- 合規要求

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 對主要參與者進行競爭基準分析

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 按地區分類的市場滲透率

- 競爭定位矩陣

- 領導人

- 挑戰者

- 追蹤者

- 小眾玩家

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年主要發展動態

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 數位轉型計劃

- 新興/新創企業競爭對手格局

第5章:市場估算與預測:依感測器類型分類,2022-2035年

- CCD(電荷耦合元件)

- CMOS(互補金屬氧化物半導體)

- 其他

第6章:市場估算與預測:依解析度分類,2022-2035年

- 低解析度(<200萬像素)

- 中等解析度(2-12 MP)

- 高解析度(>1200萬像素)

第7章:市場估算與預測:依加工技術分類,2022-2035年

- QR 圖

- 3D

第8章:市場估算與預測:Spectrum公司,2022-2035年

- 可見光譜感測器

- 紅外線(IR)感測器

- 紫外線 (UV) 感測器

- 多光譜感測器

- 其他

第9章:市場估算與預測:依應用領域分類,2022-2035年

- 消費性電子產品

- 智慧型手機和平板電腦

- 數位相機和攝影機

- 穿戴式裝置

- 其他

- 汽車

- 高級駕駛輔助系統

- 車上監控系統

- LiDAR

- 其他

- 工業與製造業

- 機器視覺系統

- 機器人與自動化

- 品質控制/檢驗

- 其他

- 醫療保健與醫學影像

- 診斷影像

- 內視鏡和手術鏡頭

- 其他

- 安防監控

- 閉路電視攝影機

- 存取控制

- 其他

- 其他

第10章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- 全球關鍵參與者

- Samsung

- Sony Semiconductor Solutions Corporation

- OMNIVISION

- Onsemi

- 區域關鍵參與者

- 北美洲

- Analog Devices, Inc.

- Teledyne

- Tower Semiconductor

- 歐洲

- ams-OSRAM AG

- Infineon Technologies AG

- STMicroelectronics

- 亞太地區

- Canon Inc.

- Panasonic Corporation

- Sharp Corporation

- 北美洲

- 小眾玩家/顛覆者

- AlpsenTek

- CMOS Sensor Inc.

- GalaxyCore Shanghai Limited Corporation

- Himax Technologies

- PixArt Imaging Inc.

- Toshiba Corporation

The Global Image Sensor Market was valued at USD 25.6 billion in 2025 and is estimated to grow at a CAGR of 7.9% to reach USD 54.6 billion by 2035.

The market's expansion is being fueled by advances in CMOS technology, rising demand for image sensors across automotive applications, consumer electronics, industrial IoT, and healthcare sectors. Medical imaging is driving growth by enabling higher diagnostic accuracy, enhanced imaging, and improved patient care. The integration of artificial intelligence with image sensors is expected to revolutionize computational photography and real-time analytics, enhancing low-light performance, object detection, and overall sensor efficiency. Increasing adoption in automotive ADAS, smart devices, and industrial automation further supports market growth while manufacturers focus on creating smaller, more powerful, and AI-enabled sensors to meet diverse application requirements.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $25.6 Billion |

| Forecast Value | $54.6 Billion |

| CAGR | 7.9% |

The 2D image sensor segment is anticipated to reach USD 26.2 billion by 2035. Two-dimensional imaging remains prevalent in surveillance systems, smartphones, and automotive cameras due to its cost efficiency, high resolution, and broad compatibility. Integration of HDR, advanced image processing, and low-light capabilities enhances its applicability across multiple industries.

The CCD (charge-coupled device) segment held 4% share in 2025. CCD sensors continue to be preferred in high-precision industrial, medical, and scientific imaging applications due to their superior stability, low noise, and dynamic range. Even as CMOS dominates mainstream applications, CCD remains critical for niche high-accuracy use cases.

U.S. Image Sensor Market generated USD 3.6 billion in 2025. Growth is driven by automotive ADAS systems, AI-enabled cameras, and industrial automation. Significant investments in semiconductor R&D and fabrication support innovation, with manufacturers prioritizing high-resolution, AI-integrated sensors to meet domestic demand across automotive, industrial, and consumer electronics sectors.

Key players in the Global Image Sensor Market include Hamamatsu Photonics K.K., AlpsenTek, CMOS Sensor Inc., Canon Inc., GalaxyCore Shanghai Limited Corporation, Analog Devices, Inc., ams-OSRAM AG, Infineon Technologies AG, and Himax Technologies. Companies in the Image Sensor Market are enhancing their market presence through a combination of strategies focused on technology, partnerships, and innovation. They are investing in R&D to develop AI-enabled, high-resolution sensors for automotive, industrial, and consumer applications. Collaborations with semiconductor manufacturers and OEMs help expand reach and integrate sensors into new devices. Firms are also focusing on optimizing power efficiency, miniaturization, and low-light performance to differentiate products. Geographic expansion, targeted marketing, and after-sales support further strengthen brand presence, while strategic acquisitions and joint ventures allow them to access new technologies and markets, enhancing competitiveness globally.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Sensor type trends

- 2.2.2 Resolution trends

- 2.2.3 Processing technology trends

- 2.2.4 Spectrum trends

- 2.2.5 Application trends

- 2.2.6 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in CMOS technology

- 3.2.1.2 Rising demand for automotive image sensors

- 3.2.1.3 Increasing demand for consumer electronics

- 3.2.1.4 Growth of industrial and IoT applications

- 3.2.1.5 Healthcare and medical imaging applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Cost and pricing pressures

- 3.2.2.2 Supply chain disruptions and semiconductor shortages

- 3.2.3 Market opportunities

- 3.2.3.1 Advancements in AI and machine vision integration

- 3.2.3.2 Emerging lidar and 3D sensing applications

- 3.2.3.3 Miniaturization and low-power sensor development

- 3.2.3.4 Expansion in AR/VR and metaverse applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Patent and IP analysis

- 3.11 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Sensor Type, 2022 - 2035 (USD Million & Units)

- 5.1 Key trends

- 5.2 CCD (charge-coupled device)

- 5.3 CMOS (complementary metal-oxide-semiconductor)

- 5.4 Others

Chapter 6 Market Estimates and Forecast, By Resolution, 2022 - 2035 (USD Million & Units)

- 6.1 Key trends

- 6.2 Low resolution (<2 MP)

- 6.3 Medium resolution (2-12 MP)

- 6.4 High resolution (>12 MP)

Chapter 7 Market Estimates and Forecast, By Processing Technology, 2022 - 2035 (USD Million & Units)

- 7.1 Key trends

- 7.2 2D

- 7.3 3D

Chapter 8 Market Estimates and Forecast, By Spectrum, 2022 - 2035 (USD Million & Units)

- 8.1 Key trends

- 8.2 Visible spectrum sensors

- 8.3 Infrared (IR) sensors

- 8.4 Ultraviolet (UV) sensors

- 8.5 Multispectral sensors

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million & Units)

- 9.1 Key trends

- 9.2 Consumer electronics

- 9.2.1 Smartphones & tablets

- 9.2.2 Digital cameras & camcorders

- 9.2.3 Wearables

- 9.2.4 Others

- 9.3 Automotive

- 9.3.1 ADAS

- 9.3.2 In-vehicle monitoring systems

- 9.3.3 Lidar

- 9.3.4 Others

- 9.4 Industrial & manufacturing

- 9.4.1 Machine vision systems

- 9.4.2 Robotics & automation

- 9.4.3 Quality control / inspection

- 9.4.4 Others

- 9.5 Healthcare & medical imaging

- 9.5.1 Diagnostic imaging

- 9.5.2 Endoscopy & surgical cameras

- 9.5.3 Others

- 9.6 Security & surveillance

- 9.6.1 CCTV cameras

- 9.6.2 Access control

- 9.6.3 Others

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Key Players

- 11.1.1 Samsung

- 11.1.2 Sony Semiconductor Solutions Corporation

- 11.1.3 OMNIVISION

- 11.1.4 Onsemi

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 Analog Devices, Inc.

- 11.2.1.2 Teledyne

- 11.2.1.3 Tower Semiconductor

- 11.2.2 Europe

- 11.2.2.1 ams-OSRAM AG

- 11.2.2.2 Infineon Technologies AG

- 11.2.2.3 STMicroelectronics

- 11.2.3 APAC

- 11.2.3.1 Canon Inc.

- 11.2.3.2 Panasonic Corporation

- 11.2.3.3 Sharp Corporation

- 11.2.1 North America

- 11.3 Niche Players / Disruptors

- 11.3.1 AlpsenTek

- 11.3.2 CMOS Sensor Inc.

- 11.3.3 GalaxyCore Shanghai Limited Corporation

- 11.3.4 Himax Technologies

- 11.3.5 PixArt Imaging Inc.

- 11.3.6 Toshiba Corporation